Global PU Sole Market By Raw Material(Methylene Diphenyl Diisocyanate (MDI), Toluene Diphenyl Diisocyanate (TDI), Polyols, Others), By Product Type(Single Density PU Sole, Double Density PU Sole, Compact PU Sole, Others), By Application(Casuals, Boots, Slippers and Sandals, Sports, Formals, Other), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 132618

- Number of Pages: 218

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

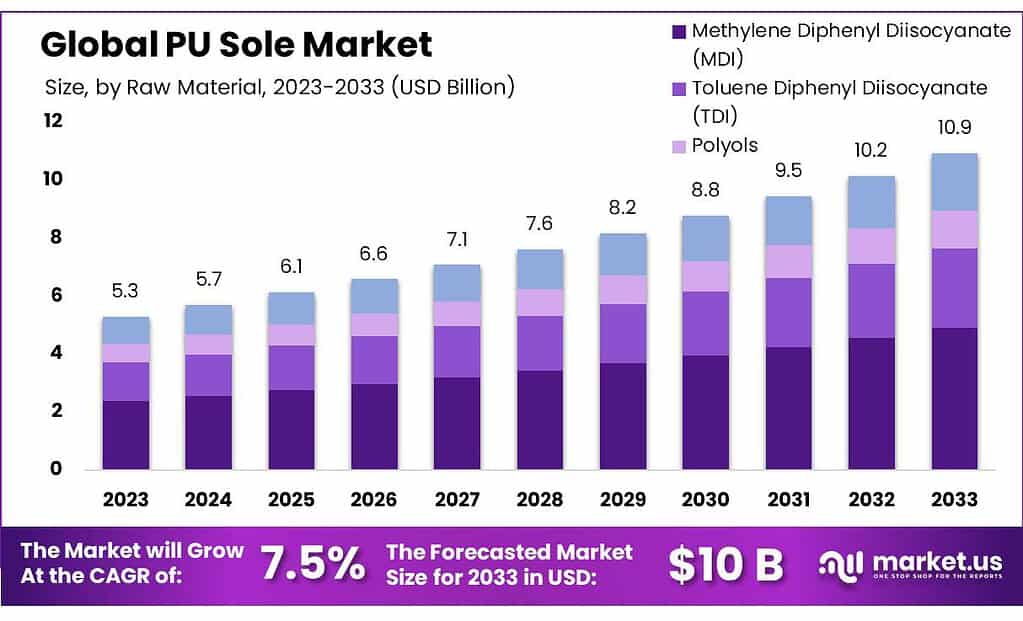

The Global PU Sole Market size is expected to be worth around USD 10.9 Bn by 2033, from USD 5.3 Bn in 2023, growing at a CAGR of 7.5% during the forecast period from 2024 to 2033.

Polyurethane (PU) soles are synthetic materials widely used in the footwear industry due to their durability, comfort, and resistance to water and chemicals. Their versatility makes them suitable for various applications, including trekking and sports, as well as for protective footwear in industries like mining and oil. As such, PU soles are increasingly replacing traditional materials like leather and rubber, especially in demanding environments.

The economic impact of the polyurethanes sector is substantial, particularly in the United States. In 2022, this industry alone was responsible for supporting approximately 332,200 jobs and generating an economic output of $118.6 billion. This contribution is spread across direct, indirect, and induced activities, underscoring the sector’s vital role in the national economy.

Within the footwear market, athletic shoes are a significant segment driving demand for PU soles. This trend is buoyed by an increase in sports participation, with 67.4% of Americans aged six and older engaging in fitness activities as of 2022. Such growth in sports participation suggests a robust market for athletic footwear, which in turn benefits the PU sole market.

Investment trends also reflect the economic climate and its influence on the polyurethanes sector. In fiscal year 2023, private sector investment levels returned to those seen during the pandemic, indicating a cautious stance among investors due to ongoing economic uncertainties.

The share of private non-financial corporations in gross fixed capital formation stood at 36.2%, showing a slight decrease from prior years. Conversely, public sector investment experienced a modest rise to 13% of gross fixed capital formation, pointing to an increased emphasis on public expenditure during times of economic uncertainty.

These dynamics highlight the interconnectedness of market trends and economic conditions, influencing investment decisions and sector growth. The ongoing development and application of PU soles in the footwear industry are likely to continue, supported by both consumer demand and industrial requirements.

Key Takeaways

- PU Sole Market size is expected to be worth around USD 10.9 Bn by 2033, from USD 5.3 Bn in 2023, growing at a CAGR of 7.5%.

- Methylene Diphenyl Diisocyanate (MDI) held a dominant market position, capturing more than a 45.2% share.

- Single Density PU Sole held a dominant market position, capturing more than a 37.4% share of the PU sole market.

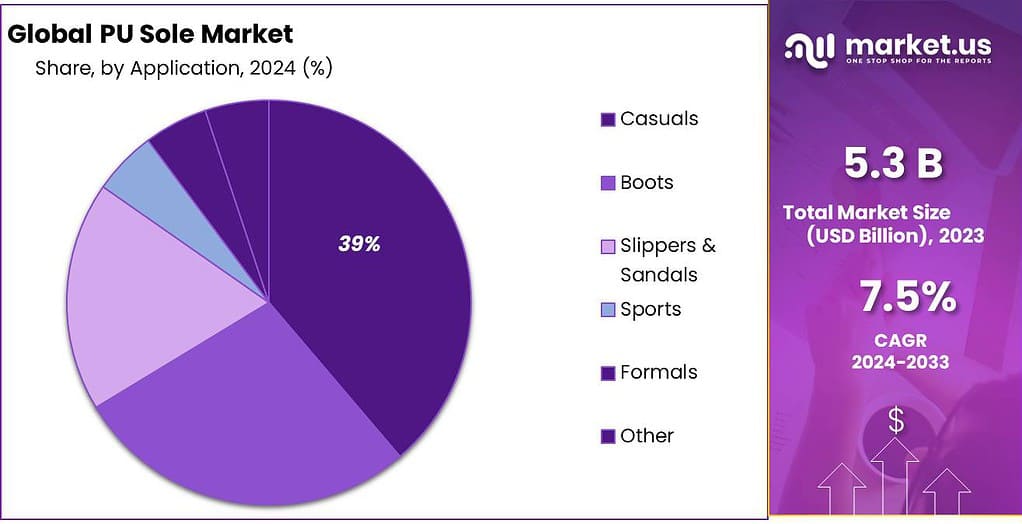

- Casuals held a dominant market position in the PU sole market, capturing more than a 38.2% share.

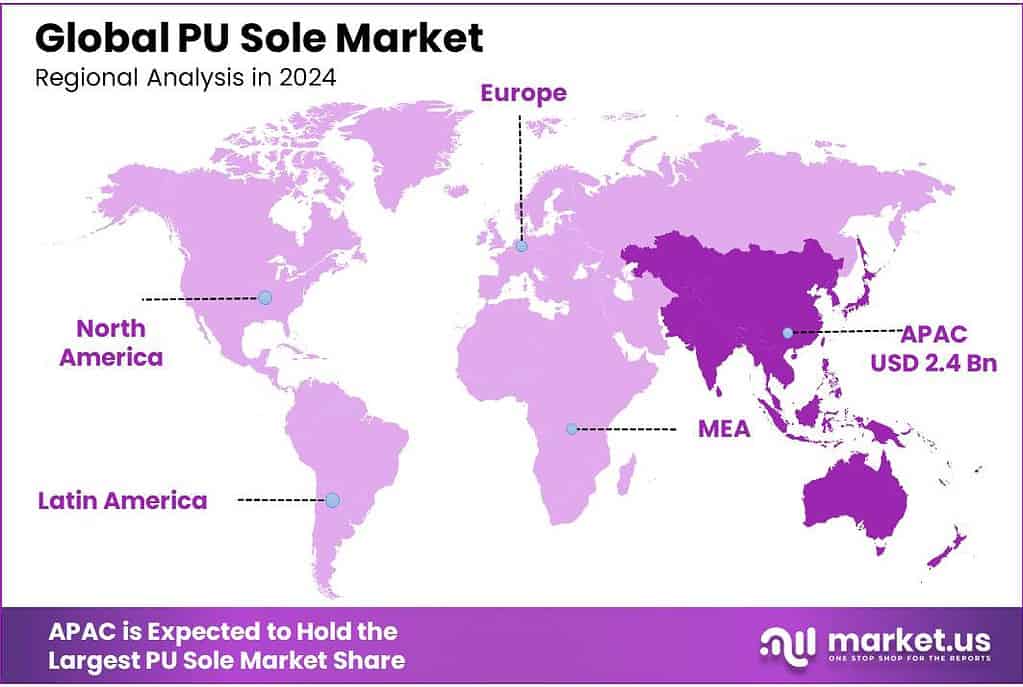

- Asia Pacific (APAC) dominates with a 46.1% market share, valued at USD 2.4 billion.

By Raw Material

In 2023, Methylene Diphenyl Diisocyanate (MDI) held a dominant market position, capturing more than a 45.2% share of the PU sole market. MDI is preferred for its robust performance characteristics in footwear, offering superior durability and flexibility. This raw material is crucial for producing rigid and flexible foams that are integral to the construction of comfortable and resilient shoe soles.

Toluene Diphenyl Diisocyanate (TDI) also plays a significant role, though it holds a smaller segment of the market. TDI is known for its faster reaction times, making it suitable for applications requiring quicker production cycles. Its use in PU soles contributes to enhanced comfort and lighter weight footwear, aligning with consumer demands for high-comfort, low-burden shoes.

Polyols are another critical raw material, serving as the backbone for polyurethane production. They are utilized to balance the mechanical properties and enhance the comfort level of PU soles. Polyols contribute to the PU sole’s elasticity and contribute significantly to the overall performance of the end product.

By Product Type

In 2023, Single Density PU Sole held a dominant market position, capturing more than a 37.4% share of the PU sole market. This type of sole is favored for its balance of cost and performance, providing sufficient comfort and durability for everyday footwear. It’s commonly used in casual and formal shoes due to its straightforward production process and overall reliability.

Double Density PU Sole, characterized by its two layers of PU – a softer one for comfort and a denser one for durability – also plays a significant role in the market. These soles are particularly appreciated in safety and outdoor footwear, where additional protection and extended wear resistance are crucial. The added layer enhances the sole’s shock absorption and longevity, making it ideal for more demanding applications.

Compact PU Sole is noted for its dense and solid structure, offering exceptional wear resistance. It is often selected for high-performance footwear where rigorous use is expected, such as in heavy-duty work boots and specialized sports shoes. This sole type provides stability and substantial support, important for both safety and performance activities.

By Application

In 2023, Casuals held a dominant market position in the PU sole market, capturing more than a 38.2% share. This segment benefits from the widespread consumer preference for comfortable, versatile footwear suitable for everyday use. Casual shoes with PU soles offer a blend of comfort, durability, and style that appeals to a broad customer base, making them a staple in consumer footwear choices.

Boots, equipped with PU soles, are also significant in the market due to their need for robustness and longevity. PU soles provide the necessary toughness and weather resistance required for boots, which are often used in harsher environments or where additional foot protection is needed.

Slippers & Sandals with PU soles cater to the demand for lighter, comfortable, and durable summer footwear. The PU material in these applications offers excellent water resistance and a soft, comfortable fit, making it ideal for both indoor and outdoor use.

Sports footwear represents another key application of PU soles, driven by the need for performance-oriented features such as shock absorption, flexibility, and lightweight design. PU soles in sports shoes enhance athletic performance and comfort, which is crucial for both professional athletes and casual sports enthusiasts.

Formals, which include dress shoes and business footwear, also utilize PU soles to provide a sleek, polished look without sacrificing comfort. The material’s adaptability allows for refined finishes that complement formal attire while ensuring wearer comfort throughout long periods of use.

Key Market Segments

By Raw Material

- Methylene Diphenyl Diisocyanate (MDI)

- Toluene Diphenyl Diisocyanate (TDI)

- Polyols

- Others

By Product Type

- Single Density PU Sole

- Double Density PU Sole

- Compact PU Sole

- Others

By Application

- Casuals

- Boots

- Slippers & Sandals

- Sports

- Formals

- Other

Driving Factors

Sustainability Initiatives and Market Growth

The push towards sustainability and the adoption of energy-efficient practices are significant drivers in the polyurethane (PU) sole market. Increasing environmental awareness and regulatory pressures are compelling PU manufacturers to innovate with eco-friendly products and processes. This shift not only aligns with global sustainability goals but also meets consumer demand for ‘greener’ footwear options.

For instance, the development of lightweight and durable PU soles contributes to reduced material use and energy consumption in the footwear industry, enhancing the product’s lifecycle and reducing its carbon footprint.

Government Policies and Economic Incentives

Government initiatives play a pivotal role in promoting sustainable materials, as seen in policies that encourage the reduction of emissions and the use of environmentally friendly materials across industries, including footwear manufacturing. Programs like the Thailand Investment Promotion Act and India’s Make in India initiative have been instrumental in supporting domestic production capabilities, which in turn boosts the demand for innovative and sustainable materials such as PU.

Investment in Renewable Energy and Technology Innovations

The transition to a new energy economy highlights the increasing investment in renewable energy sources, which indirectly supports industries involved in producing energy-efficient materials, including the PU market. The International Energy Agency outlines a future where clean technologies, driven by policy support and technological innovation, become the most cost-effective choice. This economic shift not only fosters a competitive market for renewables but also for industries adapting to these cleaner, more efficient technologies.

Energy Efficiency in Production

The PU industry has also seen advancements in production processes that emphasize energy conservation. For example, novel production methods that minimize energy and material use contribute significantly to the industry’s ability to meet both market demand and environmental regulations efficiently. Such innovations are crucial for maintaining competitiveness in a rapidly evolving market focused on sustainability

Restraining Factors

Volatile Raw Material Costs

One of the primary restraining factors for the growth of the PU sole market is the volatility in the prices of key raw materials such as methylene diphenyl diisocyanate (MDI) and toluene diphenyl diisocyanate (TDI). These chemicals are crucial for the production of polyurethane soles, and their prices can fluctuate widely due to changes in the petroleum market, which is their base source. As petroleum prices are influenced by global geopolitical and economic factors, any instability leads directly to cost pressures on PU sole manufacturers.

Impact of Energy Transition on Chemical Industry

The ongoing global shift towards renewable energy and the decarbonization of industries can indirectly affect the PU sole market. As the energy sector moves away from fossil fuels, the chemical industry, including polyurethane production, faces transitional challenges. For instance, there is a push for cleaner production processes and the use of sustainable materials, which might increase production costs or require significant investment in new technologies. This transition is driven by both government policies and market demand for more sustainable products.

Regulatory and Environmental Challenges

Environmental regulations are increasingly stringent on the production of chemicals used in PU soles. Regulations aimed at reducing carbon footprints and improving sustainability are forcing manufacturers to rethink materials and methods, potentially increasing costs and impacting production efficiency. Moreover, the production process for PU involves isocyanates, which are toxic and require careful handling and disposal, adding to compliance costs.

Supply Chain Constraints

The chemical industry is also experiencing supply chain constraints that affect the availability and cost of raw materials. These challenges are exacerbated by geopolitical tensions and global economic pressures, which can lead to delays and increased prices for raw materials necessary for PU sole production

Growth Opportunity

Rise of Clean Energy Technologies The global clean energy sector’s rapid expansion presents substantial opportunities for the PU sole market, particularly through the integration of sustainable practices and materials in production processes.

The clean technology market is projected to triple to over $2 trillion by 2035, driven by significant investments in technologies like solar PV, wind turbines, and electric cars. This surge underscores a broader industrial shift towards sustainability, aligning with the increasing demand for environmentally friendly materials across various industries, including footwear.

Government Initiatives and Funding Government policies and funding are crucial in shaping the growth trajectory of sustainable materials like PU soles. In the United States, investment in clean energy is anticipated to rise substantially, influenced by legislative actions such as the Inflation Reduction Act and Bipartisan Infrastructure Law, fostering a conducive environment for sustainable practices and materials.

Similarly, in China, there is a strong governmental push towards clean energy, evidenced by substantial investments aimed at bolstering the country’s energy security and economic competitiveness.

Corporate Sustainability Commitments Corporate commitments to sustainability also offer growth opportunities for the PU sole market. Many companies, particularly those in the RE100 initiative, are committing to renewable energy, which is likely to include sustainable material use in their products and supply chains. This trend is expected to increase demand for materials that contribute to lower carbon footprints, such as PU soles designed with eco-friendly technologies.

Strategic Industrial Developments The strategic development of industries related to clean energy and sustainability practices opens additional markets for PU soles.

For example, the increased use of PU in lightweight and energy-efficient automotive applications aligns with broader industry trends towards electric vehicles and energy efficiency. As these sectors grow, they drive further innovation and demand for advanced materials that meet new energy and sustainability standards

Latest Trends

Sustainability and Clean Energy Integration

A significant trend shaping the PU sole market is the integration of sustainability practices and clean energy technologies. As the global focus shifts towards reducing carbon footprints, the footwear industry, including PU sole manufacturing, is increasingly adopting more sustainable materials and methods.

This includes utilizing bio-based polyurethanes and recycling processes to minimize environmental impact. The clean energy sector’s growth, with a projected increase in clean energy technology deployment reaching $1.8 trillion by 2023, underscores the industry-wide shift towards more sustainable production practices.

Government Incentives and Regulatory Support

Government policies play a pivotal role in promoting environmentally friendly manufacturing practices. Initiatives like the Infrastructure Investment and Jobs Act (IIJA) in the U.S. are injecting substantial funds into enhancing grid reliability and fostering the development of battery supply chains and energy-efficient programs. These initiatives not only support the broader energy sector but also provide a conducive environment for industries, including footwear manufacturing, to innovate towards greener practices.

Corporate Environmental Commitments

Corporate responsibility towards environmental sustainability is another driving trend. Companies across various sectors are pledging to reduce their carbon emissions and increase their use of renewable energy. For instance, the RE100 initiative, which commits companies to use 100% renewable energy, has seen significant participation, indicating a shift towards sustainability that is likely to influence supply chain decisions, including materials like PU soles.

Technological Advancements in Production

Advancements in technology are also defining the future of PU soles. The footwear industry is increasingly leveraging digital and manufacturing innovations to improve efficiency and sustainability. This includes the adoption of AI for better resource management and automation technologies that minimize waste during production. The push towards more energy-efficient and cleaner production methods is aligned with the global momentum towards energy transitions and reducing industrial carbon emissions

Regional Analysis

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The PU sole market is characterized by a diverse range of key players spanning various regions and specializing in multiple aspects of polyurethane production, processing, and product innovations.

Among these, BASF SE, Covestro AG, Dow, and Huntsman International LLC are notable for their significant impact on global supply chains, largely due to their comprehensive portfolios that include advanced polyurethane solutions for footwear applications.

These companies are at the forefront of developing new formulations that offer enhanced comfort, durability, and environmental sustainability.

Asian companies such as Asahi Kasei Corporation, Wanhua, and Manali Petrochemicals also play critical roles, especially in the rapidly growing markets of the Asia Pacific region. These companies benefit from localized manufacturing and the growing footwear industries in their respective countries.

In Europe, LANXESS and the recently merged Lanxess Aktiengesellschaft are pivotal, leveraging advanced chemical engineering to produce high-quality materials that meet stringent EU regulations regarding environmental impact and consumer safety.

Top Key Players in the Market

- Airysole Footwear Pvt Ltd

- Asahi Kasei Corporation

- BASF SE

- CELLULAR MOULDINGS

- Coim Group

- Covestro AG

- Dow

- Era Polymers Pty Ltd.

- Eurofoam Group

- Headway Group

- Huntsman International LLC

- INOAC CORPORATION

- LANXESS

- Lanxess Aktiengesellschaft

- Manali Petrochemicals

- MarvelVinyls

- NEVEON Holding GmbH

- Perstorp

- Rogers Corporation

- The Lubrizol Corporation

- Trelleborg AB.

- Unisol India

- VCM Polyurethanes Pvt. Ltd.

- Wanhua

Recent Developments

In 2023, Asahi Kasei continued to strengthen its market presence by leveraging its technological expertise to produce advanced polyurethane solutions that cater to the growing demands of the footwear industry.

In 2023, Airysole Footwear Pvt Ltd is a prominent manufacturer in the PU sole market, specializing in lightweight polyurethane soles for a diverse range of footwear.

Report Scope

Report Features Description Market Value (2023) USD 5.3 Bn Forecast Revenue (2033) USD 10.9 Bn CAGR (2024-2033) 7.5% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Raw Material(Methylene Diphenyl Diisocyanate (MDI), Toluene Diphenyl Diisocyanate (TDI), Polyols, Others), By Product Type(Single Density PU Sole, Double Density PU Sole, Compact PU Sole, Others), By Application(Casuals, Boots, Slippers and Sandals, Sports, Formals, Other) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Airysole Footwear Pvt Ltd, Asahi Kasei Corporation, BASF SE, CELLULAR MOULDINGS, Coim Group, Covestro AG, Dow, Era Polymers Pty Ltd., Eurofoam Group, Headway Group, Huntsman International LLC, INOAC CORPORATION, LANXESS, Lanxess Aktiengesellschaft, Manali Petrochemicals, MarvelVinyls, NEVEON Holding GmbH, Perstorp, Rogers Corporation, The Lubrizol Corporation, Trelleborg AB., Unisol India, VCM Polyurethanes Pvt. Ltd., Wanhua Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Airysole Footwear Pvt Ltd

- Asahi Kasei Corporation

- BASF SE

- CELLULAR MOULDINGS

- Coim Group

- Covestro AG

- Dow

- Era Polymers Pty Ltd.

- Eurofoam Group

- Headway Group

- Huntsman International LLC

- INOAC CORPORATION

- LANXESS

- Lanxess Aktiengesellschaft

- Manali Petrochemicals

- MarvelVinyls

- NEVEON Holding GmbH

- Perstorp

- Rogers Corporation

- The Lubrizol Corporation

- Trelleborg AB.

- Unisol India

- VCM Polyurethanes Pvt. Ltd.

- Wanhua