Global Protein Engineering Market By Product Type (Instruments, Reagents, and Software & Services), By Technology (Rational Protein Design, Directed Evolution, Hybrid Approach, De Novo Protein Design, and Others), By Protein Type (Monoclonal Antibodies, Insulin, Vaccines, Growth Factors, Colony Stimulating Factors, and Others), By End-users (Pharmaceutical & Biotechnology Companies, Academic Research Institutes, Contract Research Organizations (CROs)), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 101541

- Number of Pages: 264

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

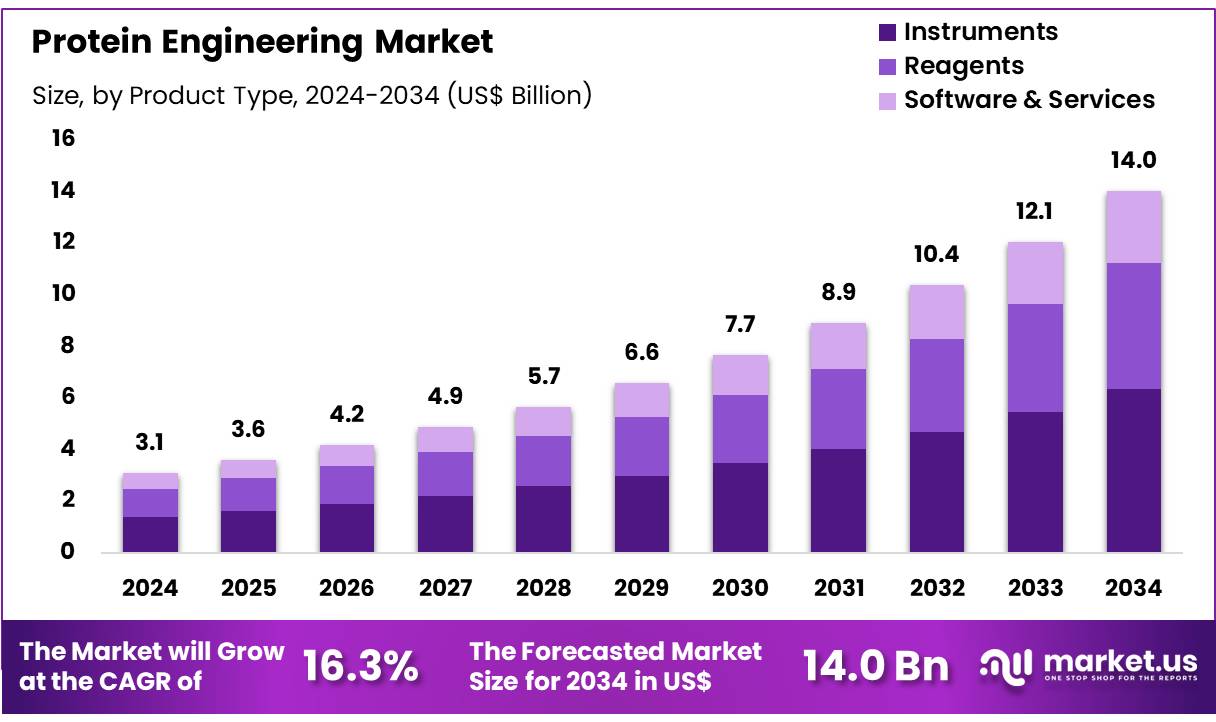

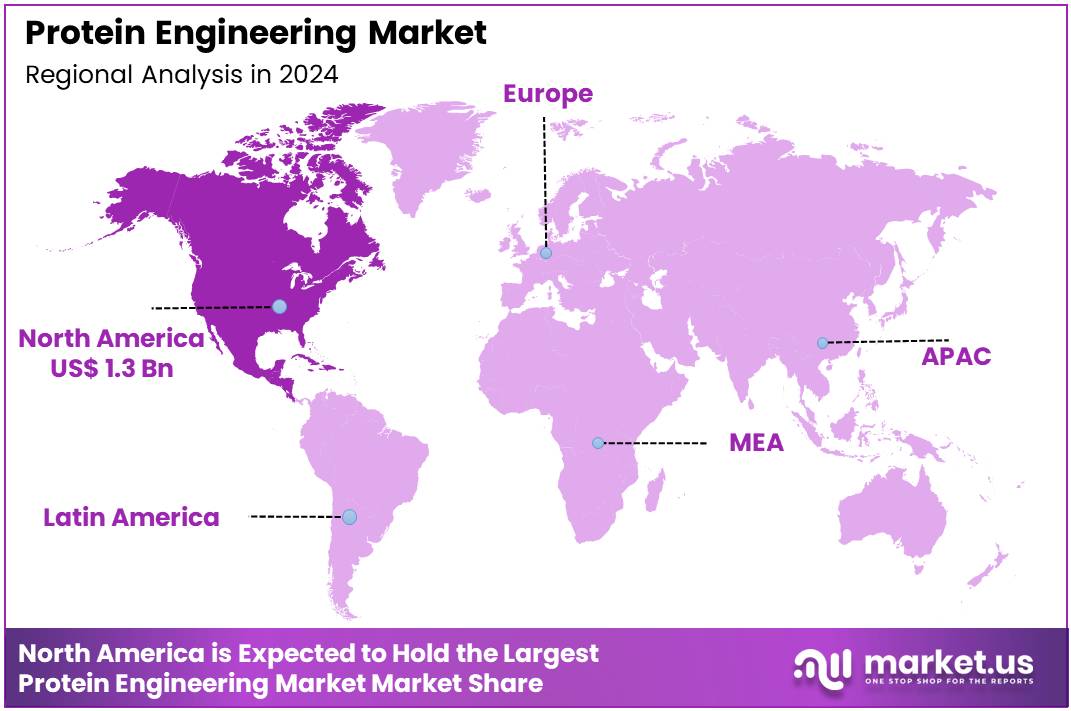

Global Protein Engineering Market size is expected to be worth around US$ 14.0 Billion by 2034 from US$ 3.1 Billion in 2024, growing at a CAGR of 16.3% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 40.9% share with a revenue of US$ 1.3 Billion.

Rising demand for novel therapeutic solutions is a key driver for the protein engineering market. This field involves the design and modification of proteins to create new functionalities or improve existing ones, addressing the limitations of traditional small-molecule and antibody-based drugs.

The increasing prevalence of chronic and lifestyle disorders, such as diabetes and cardiovascular conditions, is creating an immense and ongoing need for more effective and targeted treatments. Protein engineering is central to this effort, as it enables the development of tailored protein-based drugs that can perform highly specific and complex functions with reduced toxicity and side effects.

Growing investment and strategic collaborations are shaping a significant trend in the market, accelerating the pace of drug discovery and development. Major pharmaceutical and biotechnology companies are forming multi-billion-dollar partnerships to leverage advanced protein engineering platforms.

For example, in January 2022, Generate Biomedicines and Amgen announced a research collaboration to develop protein therapies for five clinical targets. This type of collaboration is becoming more common as companies seek to harness the power of artificial intelligence and machine learning to design novel proteins. This is complemented by continuous advancements in computational protein design, which allows for the rapid generation and optimization of new therapeutic candidates.

Increasing accessibility to advanced technologies and a focus on personalized medicine are creating new opportunities for market expansion. The development of automated and high-throughput screening technologies is making protein engineering more accessible to smaller research laboratories and academic institutions. This is further supported by collaborations that expand the reach of advanced lab instruments and software.

For instance, in December 2023, Thermo Fisher Scientific partnered with AESKU.GROUP GmbH to distribute and support its suite of FDA-cleared automated lab instruments, IFA products, and software solutions throughout the U.S., expanding accessibility for clinical and research laboratories. This trend is crucial for driving innovation and facilitating the discovery of personalized protein-based therapies that can address unique patient needs.

Key Takeaways

- In 2024, the market for protein engineering generated a revenue of US$ 3.1 billion, with a CAGR of 16.3%, and is expected to reach US$ 14.0 billion by the year 2034.

- The product type segment is divided into instruments, reagents, and software & services, with instruments taking the lead in 2023 with a market share of 45.3%.

- Considering technology, the market is divided into rational protein design, directed evolution, hybrid approach, de novo protein design, and others. Among these, rational protein design held a significant share of 38.2%.

- Furthermore, concerning the protein type segment, the market is segregated into monoclonal antibodies, insulin, vaccines, growth factors, colony stimulating factors, and others. The monoclonal antibodies sector stands out as the dominant player, holding the largest revenue share of 41.9% in the protein engineering market.

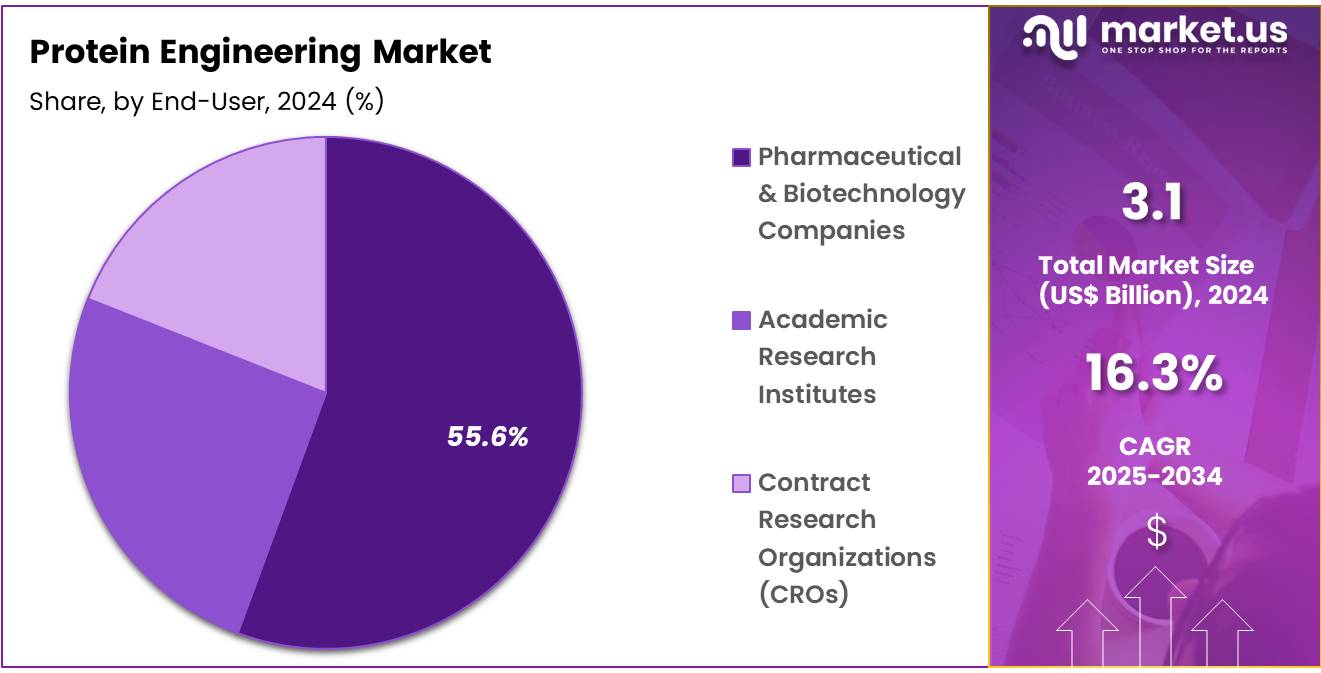

- The end-users segment is segregated into pharmaceutical & biotechnology companies, academic research institutes, contract research organizations (CROs), with the pharmaceutical & biotechnology companies segment leading the market, holding a revenue share of 55.6%.

- North America led the market by securing a market share of 40.9% in 2023.

Product Type Analysis

Instruments hold the largest share of 45.3% in the protein engineering market. This segment’s growth is expected to continue as technological advancements in protein analysis tools drive increased demand. Instruments are integral to the protein engineering process, from protein expression and purification to structural analysis and characterization. The increasing need for precision in protein modification and optimization is anticipated to raise the demand for high-end instruments.

Research in biotechnology, particularly in biologics, fuels the growth of sophisticated instruments capable of high-throughput screening, real-time monitoring, and data analysis. Pharmaceutical and biotechnology companies are projected to heavily invest in advanced instruments to accelerate drug discovery and development. The integration of instruments with automation, artificial intelligence, and machine learning is expected to further streamline processes, enhancing their attractiveness.

Moreover, the growing number of protein-based therapies entering clinical trials, including monoclonal antibodies and vaccines, will likely drive the adoption of state-of-the-art instruments. Regulatory standards pushing for higher quality in protein engineering also contribute to instrument demand.

Universities and research institutions are expected to increase their investments in these instruments to support academic studies in protein biology. Additionally, instruments capable of precise protein characterization will be crucial for optimizing biologics. Over time, the increasing sophistication of protein engineering techniques will continue to support the expansion of this segment.

Technology Analysis

Rational protein design dominates the technology segment with 38.2% market share. This approach is expected to drive substantial growth due to its precise and systematic method of engineering proteins based on detailed structural data. Rational protein design uses computational modeling to predict protein structures and functions, enabling the creation of proteins with specific, desired properties.

Pharmaceutical companies are projected to increase their investments in rational protein design to enhance the efficiency of drug development, particularly in the biologics space. This technique allows for the creation of highly specific monoclonal antibodies and other biologics, improving therapeutic outcomes and minimizing side effects. As the need for personalized medicine grows, rational protein design’s ability to create targeted treatments is likely to gain further traction. Moreover, advancements in computational tools and algorithms are expected to enhance the capabilities of rational protein design.

The demand for more precise and effective therapies in oncology, immunology, and rare diseases will increase the use of this approach. The ability to engineer proteins with specific characteristics, such as binding affinity or stability, positions rational protein design as a critical tool in the development of next-generation therapeutics. This segment’s growth is also supported by expanding research in structural biology, which feeds into more refined computational models. Industry players focusing on collaborations to integrate rational protein design into drug discovery workflows will likely boost its market share.

Protein Type Analysis

Monoclonal antibodies (mAbs) represent the largest protein type segment, with a 41.9% share. The continued expansion of monoclonal antibody therapies in oncology, immunology, and autoimmune diseases is expected to fuel growth in this segment. Monoclonal antibodies are among the most successful biologic treatments, providing highly specific targeting of disease-causing cells with minimal off-target effects. As the demand for targeted therapies increases, particularly in cancer and autoimmune conditions, the adoption of monoclonal antibodies is anticipated to grow.

The increasing number of mAb-based treatments being approved by regulatory agencies will likely contribute to market growth. R&D investments from pharmaceutical companies focusing on mAb development are expected to further drive the segment’s expansion. Advances in protein engineering technologies, such as rational protein design and directed evolution, will enhance the development of next-generation monoclonal antibodies with improved efficacy and safety profiles.

Partnerships between biotechnology firms and pharmaceutical companies will also support growth by speeding up the development and commercialization of new mAb therapies. The rise in chronic diseases and the growing aging population, who are more prone to conditions like cancer and arthritis, will continue to propel the demand for monoclonal antibody treatments. Additionally, regulatory incentives for orphan drugs and breakthrough therapies will further accelerate mAb development. The use of mAbs in combination therapies, particularly in oncology, will contribute to their dominance in the market.

End-User Analysis

Pharmaceutical and biotechnology companies dominate the end-user segment with a 55.6% share. This growth is expected to continue as these companies play a critical role in the development and commercialization of protein-based therapies, including monoclonal antibodies and vaccines. Increased investment in biologics research, particularly protein engineering, is likely to fuel market expansion. As the pharmaceutical industry shifts toward precision medicine, the demand for highly specific, engineered proteins will grow, making protein engineering technologies increasingly important.

Pharmaceutical and biotechnology companies are expected to invest heavily in R&D to develop innovative therapies for complex diseases, including cancer, autoimmune disorders, and genetic conditions. Strategic partnerships and licensing agreements are likely to further drive the development of protein-based drugs. The need for high-quality protein production platforms, including the use of recombinant DNA technology, will bolster the demand for protein engineering solutions. With the increasing approval of protein therapeutics, especially in oncology, these companies will continue to dominate the market.

Additionally, growing regulatory support for the development of biologics and protein-based therapies will provide further momentum for this segment. The ability to scale up production while maintaining product quality will be a critical factor for the continued success of pharmaceutical and biotechnology companies in this market. Furthermore, the rise of personalized and targeted therapies will lead to an increase in demand for protein engineering technologies, strengthening the position of pharmaceutical and biotechnology companies in the market.

Key Market Segments

By Product Type

- Instruments

- Reagents

- Software & Services

By Technology

- Rational Protein Design

- Directed Evolution

- Hybrid Approach

- De Novo Protein Design

- Others

By Protein Type

- Monoclonal Antibodies

- Insulin

- Vaccines

- Growth Factors

- Colony Stimulating Factors

- Others

By End-users

- Pharmaceutical & Biotechnology Companies

- Academic Research Institutes

- Contract Research Organizations (CROs)

Drivers

The rising demand for biologics is driving the market.

The protein engineering market is experiencing significant growth, primarily driven by the escalating demand for biologics, a class of drugs derived from living organisms. These therapies, which include monoclonal antibodies, vaccines, and therapeutic enzymes, are increasingly preferred for treating a wide range of complex diseases, including cancer, autoimmune disorders, and genetic conditions. Their high specificity and efficacy compared to traditional small-molecule drugs make them a cornerstone of modern medicine.

The US Food and Drug Administration (FDA) is consistently approving a growing number of these therapies, reflecting a robust pipeline. For instance, in 2023, the FDA approved 17 novel biologics, and by May 2024, it had already approved 8 additional biologics, a pace that suggests continued momentum. This constant need for new and improved biologics, many of which require advanced engineering to optimize their function, stability, and delivery, directly fuels the demand for innovative protein engineering technologies.

Restraints

The high cost and complexity of the regulatory approval process are restraining the market.

A significant restraint on the market is the substantial financial investment and the intricate, time-consuming regulatory pathway required to bring an engineered protein to market. Unlike small-molecule drugs, biologics are complex and large, making their development, manufacturing, and quality control extremely challenging. This complexity translates directly into high costs for research and clinical trials, which often span many years.

According to a 2024 analysis, the average cost to complete a Phase III clinical trial for a biologic can exceed $100 million. Furthermore, the regulatory scrutiny is immense, with agencies demanding extensive data to prove not only the safety and efficacy of the protein but also the consistency of the manufacturing process itself. This high cost of entry and the prolonged development timelines can deter smaller companies and investors, slowing the overall rate of innovation and product commercialization, particularly for therapies targeting smaller patient populations.

Opportunities

The expansion of applications into industrial and non-clinical fields is creating growth opportunities.

The protein engineering market is presented with significant opportunities from the accelerating trend of applying engineered proteins to industrial and non-clinical sectors. While the therapeutic applications in healthcare are well-established, there is vast, untapped potential for modified enzymes to improve processes in areas like sustainable energy, food and beverage, and diagnostics. For example, in the biofuel industry, engineered enzymes are used to more efficiently break down biomass into fermentable sugars, which increases the yield of bioethanol.

According to the US Energy Information Administration (EIA), the capacity of US to produce biofuels increased 7% in 2023, a gain largely led by a 44% increase in the renewable diesel and other biofuels category, a sector that relies heavily on advanced enzymatic processes. This expansion into diverse industries offers new revenue streams and reduces the market’s dependence on the highly regulated and capital-intensive pharmaceutical sector, providing a robust pathway for sustained growth.

Impact of Macroeconomic / Geopolitical Factors

The global pharmaceutical market faces significant geopolitical and macroeconomic headwinds, largely driven by US-China trade tensions and supply chain vulnerabilities. As per a testimony submitted to the US-China Economic and Security Review Commission, the US is heavily reliant on China and India for generic drugs, which account for about 90% of US prescriptions.

A major geopolitical factor is the ongoing Section 232 investigation by the US Department of Commerce, which is examining whether pharmaceutical imports threaten national security. While this investigation could pave the way for future tariffs, pharmaceuticals have been largely exempted from recent, broader US tariffs, such as the 50% tariff recently imposed on many Indian goods.

However, if new tariffs are implemented, a report from the Yale Budget Lab suggests that a 25% ad valorem tariff could increase medication costs for American households, and potentially lead to shortages by disrupting a supply chain heavily reliant on these key exporting nations. This highlights the dual challenge of national security and public health, where the drive to re-shore production must be balanced against the immediate risk of increasing drug costs and limiting patient access.

Latest Trends

The integration of artificial intelligence and machine learning is a recent trend.

A significant trend in 2024 is the accelerating adoption of artificial intelligence (AI) and machine learning (ML) platforms for protein design and optimization. The traditional process of engineering proteins is time-consuming and relies on a trial-and-error approach, limiting the number of variants that can be tested. AI and ML are revolutionizing this process by analyzing vast datasets of protein structures and sequences to predict and design novel proteins with desired properties, such as enhanced stability, binding affinity, and function. This technology dramatically reduces the time and resources required for R&D.

According to a 2024 report on generative AI patents from the World Intellectual Property Organization (WIPO), patent filings using molecule, gene, and protein-based data are growing rapidly. This trend signifies a shift toward a more data-driven and efficient approach to protein engineering, which is poised to accelerate the discovery and development of new therapeutic and industrial products.

Regional Analysis

North America is leading the Protein Engineering Market

The North American market for protein engineering held a substantial 40.9% share of the global market in 2024. This leadership is directly attributed to a highly developed biopharmaceutical industry, significant public and private investment in life sciences research, and a strategic focus on developing advanced protein-based therapeutics.

The US National Institutes of Health (NIH) plays a crucial role, with a total budget of $47.68 billion in 2023, a significant portion of which is allocated to grants and research programs that drive innovation in protein engineering. Furthermore, the US Food and Drug Administration (FDA) is actively approving new protein-based drugs, with 13 monoclonal antibodies approved in 2024 alone, setting a new record for this class of drugs. This high rate of regulatory approval provides a clear pathway for commercialization and encourages ongoing investment from pharmaceutical and biotechnology companies.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The Asia Pacific region is experiencing significant expansion in biomanufacturing, driven by government initiatives and rising healthcare demands. Several countries in the region are heavily investing in the life sciences and biotechnology sectors. For example, the Japanese government, through an initiative from the Ministry of Economy, Trade and Industry (METI), has supported the development of biopharmaceutical manufacturing to enhance vaccine production.

A notable instance of this initiative was the January 2024 announcement by AGC Biologics of a new manufacturing facility in Yokohama, with an estimated investment of US$350.5 million, funded in part by a METI grant. This capital inflow is expected to spur the demand for sophisticated technologies for protein design and optimization.

In addition, the Singapore government committed to its Research, Innovation and Enterprise (RIE) 2025 plan with an investment of S$25 billion (approximately US$18.5 billion). This funding is designed to enhance the nation’s research capabilities and infrastructure, which is crucial for advancing biopharmaceutical innovation. As these strategic investments and private sector developments take root, the Asia Pacific market is projected to solidify its position as a major hub for biologics development and production, boosting the region’s capacity for advanced protein research and manufacturing.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the protein engineering market are primarily focused on leveraging technological advancements like machine learning and artificial intelligence to accelerate the design and discovery of novel proteins with enhanced functions. They are also heavily engaged in strategic collaborations, mergers, and acquisitions to expand their portfolios and gain access to new therapeutic applications, such as biopharmaceuticals and gene therapies.

Companies also invest in expanding their service offerings to contract research organizations and academic institutions, aiming to streamline the research-to-development pipeline. This multifaceted approach, combining innovation with strategic partnerships, is essential for maintaining a competitive edge and driving market growth in this dynamic field.

Twist Bioscience, a synthetic biology company, has established a groundbreaking DNA synthesis platform built on proprietary silicon-based technology. This platform allows for the high-throughput, parallel manufacturing of synthetic DNA, dramatically reducing costs and accelerating development timelines for its customers.

The company provides a range of products, including synthetic genes, oligo pools, and next-generation sequencing tools. Twist Bioscience’s business model centers on enabling its customers in diverse fields, from medicine to agriculture and data storage, to design and create a wide array of new proteins and nucleic acids, solidifying its position as a foundational partner in the life sciences sector.

Top Key Players

- Waters Corp

- Thermo Fisher Scientific, Inc

- PerkinElmer, Inc

- Merck KGaA

- Genscript Biotech Corp

- Danaher Corp

- Bruker Corp

- Bio-Rad Laboratories

- Amgen, Inc

- Agilent Technologies

Recent Developments

- In January 2024, Agilent Technologies rolled out a next-generation capillary electrophoresis system capable of running multiple protein analyses simultaneously, aiming to accelerate research workflows and improve data precision.

- In January 2024, Biognosys strengthened its footprint in the United States by opening a dedicated proteomics CRO in Massachusetts, enabling closer collaboration with US-based biopharma companies. The company became part of Bruker Corporation in early 2023, enhancing its global service capabilities.

Report Scope

Report Features Description Market Value (2024) US$ 3.1 Billion Forecast Revenue (2034) US$ 14.0 Billion CAGR (2025-2034) 16.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Instruments, Reagents, and Software & Services), By Technology (Rational Protein Design, Directed Evolution, Hybrid Approach, De Novo Protein Design, and Others), By Protein Type (Monoclonal Antibodies, Insulin, Vaccines, Growth Factors, Colony Stimulating Factors, and Others), By End-users (Pharmaceutical & Biotechnology Companies, Academic Research Institutes, Contract Research Organizations (CROs)) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Waters Corp, Thermo Fisher Scientific, Inc, PerkinElmer, Inc, Merck KGaA, Genscript Biotech Corp, Danaher Corp, Bruker Corp, Bio-Rad Laboratories, Amgen, Inc, Agilent Technologies. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Waters Corp

- Thermo Fisher Scientific, Inc

- PerkinElmer, Inc

- Merck KGaA

- Genscript Biotech Corp

- Danaher Corp

- Bruker Corp

- Bio-Rad Laboratories

- Amgen, Inc

- Agilent Technologies