Global Protein Crisps Market Size, Share, Growth Analysis By Product (Pea Protein Crisps, Soy Protein Crisps, Milk Protein Crisps, Whey Protein Crisps, Others), By Flavour (Vanilla, Chocolate, Peanut Butter, Mocha, Others), By Application (Sports Nutrition, Weight Management, Others), By Distribution Channel (Hypermarkets/Supermarkets, Grocery Stores, Convenience Stores, Specialty Stores, Online Stores, Others) - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 157447

- Number of Pages: 216

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

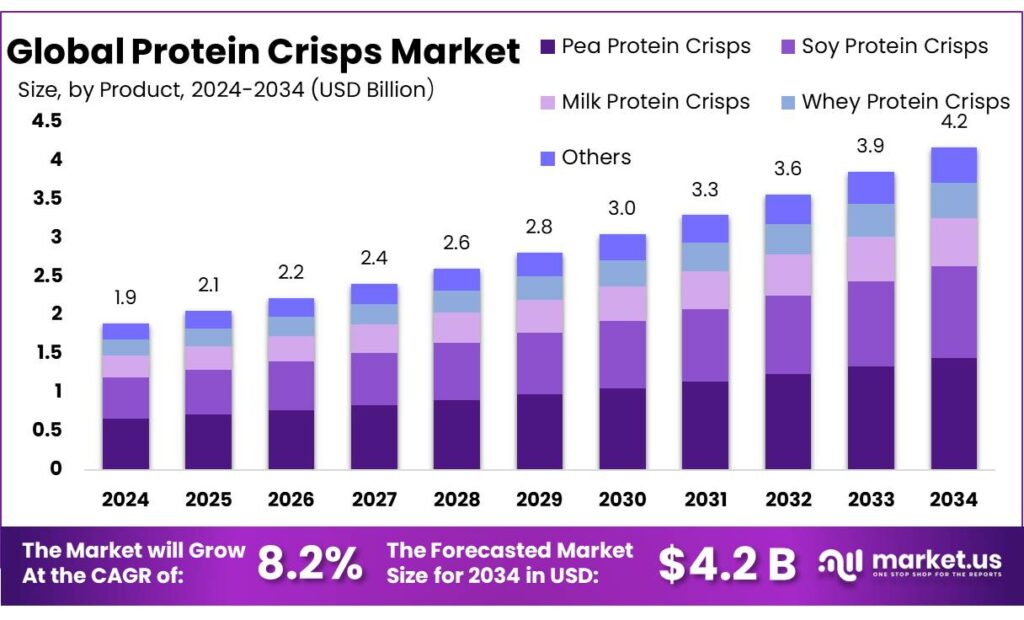

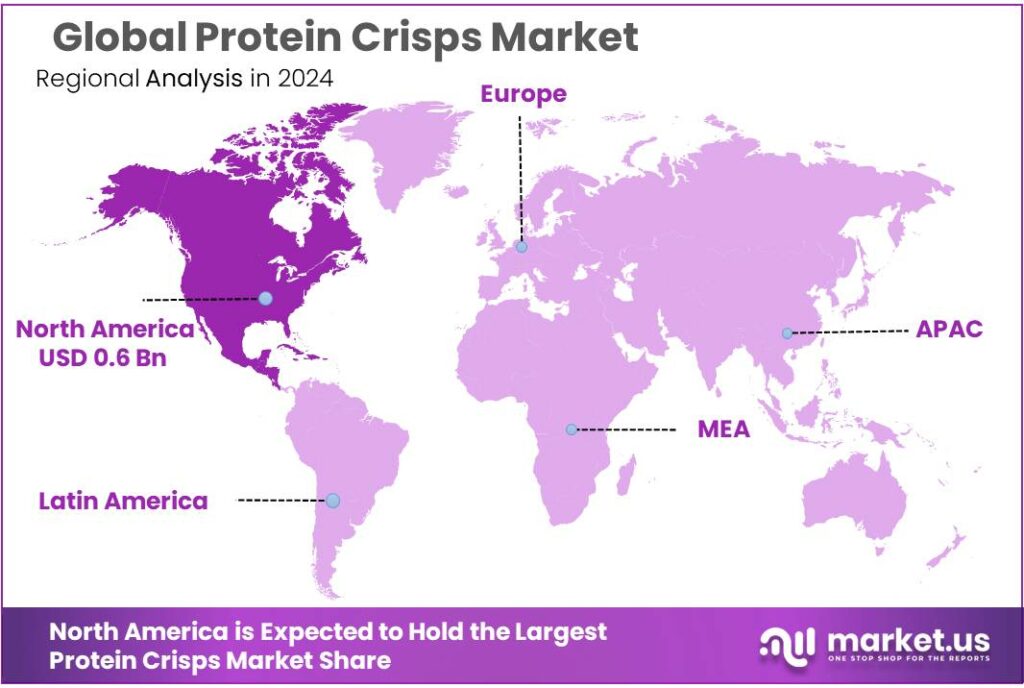

The Global Protein Crisps Market size is expected to be worth around USD 4.2 Billion by 2034, from USD 1.9 Billion in 2024, growing at a CAGR of 8.2% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 34.8% share, holding USD 0.6 Billion in revenue.

A pivotal factor contributing to this surge is the growing awareness of protein’s essential role in nutrition. In India, where approximately 73% of the population is estimated to be protein-deficient, especially in rural regions, there is a concerted effort to integrate protein into everyday foods. Initiatives by major brands and government-backed collaborations are facilitating this shift.

- For instance, McDonald’s, in partnership with Indian government food scientists, launched a vegetarian protein slice that sold 32,000 units in South India within 24 hours, highlighting the market’s readiness for such innovations.

This diversification is further supported by the rise of startups like SuperYou, backed by Bollywood actor Ranveer Singh, which have sold over 10 million protein wafers since November 2024, tapping into the urban consumer base’s preference for innovative and health-oriented snacks.

Government initiatives play a crucial role in fostering this growth. The Central Food Technological Research Institute (CFTRI), under the Ministry of Food Processing Industries, has been instrumental in developing protein-enriched food products tailored to Indian tastes. Collaborations with industry players aim to create affordable and culturally acceptable protein-rich foods, addressing both urban and rural nutritional gaps.

Key Takeaways

- Protein Crisps Market size is expected to be worth around USD 4.2 Billion by 2034, from USD 1.9 Billion in 2024, growing at a CAGR of 8.2%.

- Pea Protein Crisps held a dominant market position, capturing more than a 34.7% share of the Indian protein crisps market.

- Chocolate-flavored protein crisps held a dominant market position, capturing more than a 36.4% share of the Indian protein crisps market.

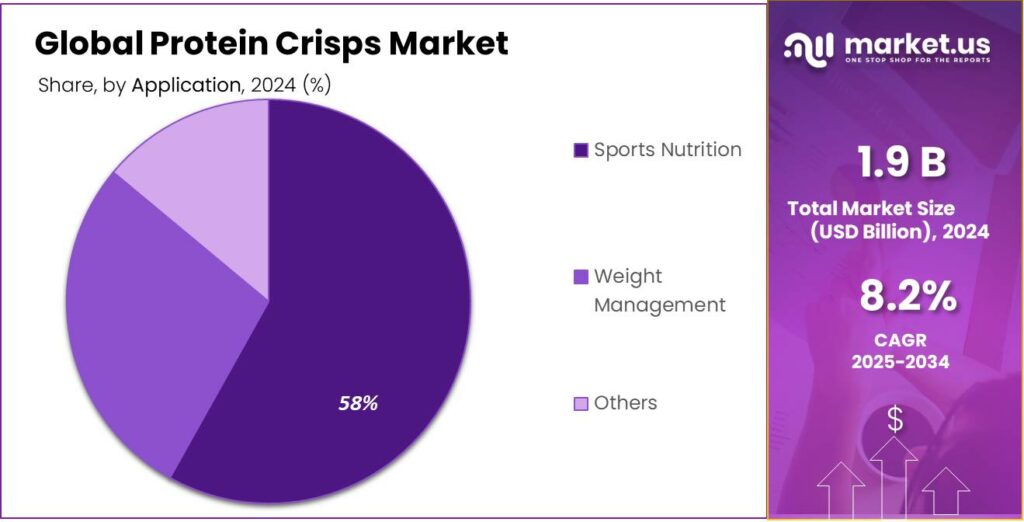

- Sports nutrition application led the Indian protein crisps market, capturing more than a 58.3% share.

- Hypermarkets and supermarkets emerged as the leading distribution channels for protein crisps in India, capturing a substantial 41.52% share of the market.

- North America emerged as the dominant region in the global protein crisps market, capturing a substantial 34.8% share, equivalent to approximately USD 0.6 billion.

By Product Analysis

Pea Protein Crisps Lead with 34.7% Market Share in 2024

In 2024, Pea Protein Crisps held a dominant market position, capturing more than a 34.7% share of the Indian protein crisps market. This significant share underscores the growing consumer preference for plant-based, allergen-friendly, and sustainable snack options. The surge in demand for pea protein crisps is attributed to their neutral taste, complete amino acid profile, and suitability for various dietary preferences, including vegan and gluten-free diets.

The popularity of pea protein crisps is further bolstered by increasing health consciousness among consumers, a shift towards plant-based diets, and the growing trend of functional snacking. These crisps offer a convenient and nutritious alternative to traditional snacks, aligning with the evolving dietary habits of the Indian population. The market is expected to continue its upward trajectory, driven by innovations in flavor, texture, and packaging, catering to the diverse tastes and preferences of Indian consumers.

By Flavour Analysis

Chocolate Protein Crisps Lead with 36.4% Market Share in 2024

In 2024, Chocolate-flavored protein crisps held a dominant market position, capturing more than a 36.4% share of the Indian protein crisps market. This significant share underscores the growing consumer preference for indulgent yet health-conscious snack options. The combination of rich chocolate flavor with the nutritional benefits of protein appeals to a broad demographic, including fitness enthusiasts, health-conscious individuals, and those seeking convenient on-the-go snacks.

The popularity of chocolate-flavored protein crisps is further bolstered by the increasing demand for functional snacks that do not compromise on taste. Manufacturers are innovating to offer products that cater to this demand, ensuring that the crisps provide a satisfying chocolate taste while delivering the desired protein content. This innovation is crucial in attracting consumers who are accustomed to traditional snacks and are looking for healthier alternatives without sacrificing flavor.

By Application Analysis

Sports Nutrition Dominates Protein Crisps Market with 58.3% Share in 2024

In 2024, the sports nutrition application led the Indian protein crisps market, capturing more than a 58.3% share. This dominance reflects the growing demand among athletes, fitness enthusiasts, and active individuals for convenient, high-protein snacks that support muscle recovery, endurance, and overall performance. The increasing awareness of the importance of protein in the diet, coupled with the rise in fitness culture across India, has significantly contributed to this trend.

The sports nutrition segment’s prominence is further evidenced by the expansion of protein crisps into mainstream retail channels, including gyms, health stores, and online platforms. Brands are increasingly targeting this segment by offering products that align with the nutritional needs of active consumers, ensuring that protein crisps are not only a convenient snack but also a functional food choice.

By Distribution Channel Analysis

Hypermarkets & Supermarkets Dominate Protein Crisps Distribution with 41.52% Share in 2024

In 2024, hypermarkets and supermarkets emerged as the leading distribution channels for protein crisps in India, capturing a substantial 41.52% share of the market. This dominance can be attributed to the widespread presence of large retail chains such as Reliance Retail, D-Mart, and MORE, which offer consumers a diverse range of protein crisp products under one roof. These retail giants provide convenience, competitive pricing, and the opportunity for consumers to compare various brands and flavors, thereby enhancing the shopping experience.

The strategic placement of protein crisps in high-traffic areas within these stores, such as endcaps and checkout aisles, has further contributed to their visibility and impulse purchases. Additionally, the availability of both single-serving and multi-pack options caters to different consumer needs, from casual snackers to fitness enthusiasts seeking bulk purchases. This accessibility and variety have solidified hypermarkets and supermarkets as the preferred shopping destinations for protein crisps in India.

Key Market Segments

By Product

- Pea Protein Crisps

- Soy Protein Crisps

- Milk Protein Crisps

- Whey Protein Crisps

- Others

By Flavour

- Vanilla

- Chocolate

- Peanut Butter

- Mocha

- Others

By Application

- Sports Nutrition

- Weight Management

- Others

By Distribution Channel

- Hypermarkets/Supermarkets

- Grocery Stores

- Convenience Stores

- Specialty Stores

- Online Stores

- Others

Emerging Trends

Government Initiatives in India to Address Food Insecurity

In India, one of the major driving factors influencing the development and adoption of feeding systems is the government’s commitment to eradicating hunger and malnutrition. Despite being the world’s largest producer of several food items, India continues to face significant challenges related to food insecurity. According to the Food and Agriculture Organization (FAO), India is home to over 190 million undernourished people, accounting for a quarter of the world’s hungry population.

Recognizing the urgency of this issue, the Indian government has implemented various initiatives aimed at improving food security and nutrition. One of the most notable programs is the Public Distribution System (PDS), which provides subsidized food grains to low-income households. Additionally, the National Food Security Act (NFSA) was enacted to ensure access to adequate quantities of quality food at affordable prices to people, thereby promoting nutritional security.

These efforts are complemented by initiatives aimed at improving nutrition awareness and dietary habits among the population. The Poshan Abhiyaan (National Nutrition Mission) focuses on reducing malnutrition through community-based interventions, including promoting the consumption of diverse and nutritious foods. Additionally, the government collaborates with international organizations to implement programs that address food security challenges, such as the FAO’s support for improved monitoring of sustainable agriculture in India.

Drivers

Government Initiatives and Public Health Campaigns

A significant driving factor behind the growth of the protein crisps market is the increasing emphasis on protein intake, particularly in regions with notable nutritional deficiencies. In India, for instance, approximately 73% of the population is estimated to be protein-deficient, especially in rural areas. This widespread deficiency has prompted both governmental and private sector initiatives to promote protein-rich diets.

In response to this challenge, McDonald’s India, in collaboration with Indian government food scientists, launched its first-ever vegetarian protein slice. The product was met with overwhelming consumer interest, selling 32,000 units in South India within just 24 hours. This rapid uptake underscores the public’s growing awareness and demand for protein-enriched foods.

Additionally, companies like Amul are leveraging their daily surplus of whey to create protein-enhanced versions of regular consumer products. These initiatives aim to integrate seamlessly into the Indian vegetarian diet, offering protein in forms like enriched cottage cheese, ice cream, milkshakes, chips, and even flatbreads. Celebrity endorsements and social media campaigns are accelerating demand, especially in urban centers, turning what was once a gym-focused supplement into a nationwide nutritional movement.

Restraints

High Production Costs: A Barrier to Widespread Adoption of Protein Crisps in India

One of the significant challenges hindering the growth of the protein crisps market in India is the high production cost, which translates to premium pricing. This pricing barrier limits accessibility for price-sensitive consumers, particularly in rural areas where income levels are lower, and purchasing power is constrained.

For instance, in 2023, Quest Nutrition faced criticism for the steep pricing of its protein crisps, despite their popularity among fitness enthusiasts. This pricing barrier is particularly pronounced in emerging markets like India, where consumers are more sensitive to price fluctuations and may opt for cheaper alternatives

The high cost of production also affects the affordability of protein crisps for low-income households. In India, food inflation has been a significant concern, with lower-income groups spending a substantial portion of their income on food. For example, a study shows that these lower-income groups spend more than 66% of their income on food, and the average share is 58–59%. This financial strain makes it challenging for these households to afford premium-priced products like protein crisps.

To address these challenges, the Indian government has been focusing on improving food security and nutrition through various initiatives. Programs such as the Public Distribution System (PDS) and the National Food Security Act (NFSA) aim to provide subsidized food grains to low-income households. However, these programs primarily focus on staple foods like rice and wheat, often neglecting the inclusion of diverse and nutrient-rich foods essential for a balanced diet.

Opportunity

Government Schemes and Policy Support

A significant growth opportunity for the protein crisps market in India lies in leveraging various government schemes and policy support aimed at enhancing food processing capabilities and promoting nutritional security. The Indian government has introduced several initiatives to bolster the food processing industry, which indirectly benefits sectors like protein crisps.

The Ministry of Food Processing Industries (MoFPI) has been instrumental in developing infrastructure and providing technical support to food processing enterprises. Over the past nine years, government projects have impacted approximately 32 lakh farmers and generated around 9.75 lakh direct and indirect employment opportunities. These initiatives have empowered more than 56,000 food processing enterprises through various schemes, facilitating the growth of the food processing industry in India.

Additionally, the government has introduced schemes like the Pradhan Mantri Kisan Sampada Yojana (PMKSY) and the Pradhan Mantri Formalization of Micro Food Processing Enterprises (PMFME) scheme. These programs aim to enhance the competitiveness of the food processing sector by providing financial assistance for the establishment and modernization of food processing units. Such support is crucial for the development of protein crisps and other value-added food products.

Furthermore, the government has recognized the importance of alternative proteins in ensuring nutritional security. The Good Food Institute India (GFI India) has highlighted the need for policy support to promote the growth of the alternative protein sector. This includes advocating for regulations and financial incentives that can help scale up production and make alternative protein products, including protein crisps, more accessible to consumers.

Regional Insights

North America Leads Global Protein Crisps Market with 34.8% Share in 2024

In 2024, North America emerged as the dominant region in the global protein crisps market, capturing a substantial 34.8% share, equivalent to approximately USD 0.6 billion in market value. This leadership is primarily attributed to the region’s robust health and wellness trends, widespread adoption of high-protein diets, and a well-established fitness culture. The United States, in particular, accounted for a significant portion of this market share, driven by increasing consumer demand for convenient, nutritious snacks that align with active lifestyles.

The growth of the protein crisps market in North America is further supported by the presence of major food manufacturers and a diverse range of product offerings. Companies are innovating to meet consumer preferences, introducing various flavors and formulations that cater to dietary needs such as gluten-free, vegan, and keto-friendly options. Additionally, the expansion of distribution channels, including supermarkets, health food stores, and online platforms, has enhanced product accessibility for consumers across the region.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

WK Kellogg Co is actively involved in the protein crisps market, leveraging its strong brand reputation and expertise in snack food products. Known for its commitment to health and wellness, Kellogg has introduced a range of protein crisps aimed at consumers seeking balanced, high-protein snacks. The company continues to expand its product lines by introducing new flavors and formulations to meet the evolving preferences of health-conscious individuals across different regions.

PepsiCo, a global leader in the food and beverage industry, has expanded into the protein crisps market with its portfolio of nutritious snack options. Through its subsidiary brands like Quaker, PepsiCo aims to tap into the growing demand for protein-based products by offering high-protein crisps. With a focus on convenience and healthy eating, PepsiCo continues to innovate and offer consumers a variety of protein-enriched snacks that cater to a wide range of dietary needs and preferences.

Post Holdings, Inc. is a key player in the protein crisps market, known for its broad portfolio of food products, including high-protein snack options. The company focuses on meeting the needs of the growing health-conscious consumer base by offering protein-enriched snacks that provide both nutrition and convenience. Post Holdings has strategically expanded its presence in the protein crisps segment, with products designed to cater to the increasing demand for plant-based and high-protein snacks.

Top Key Players Outlook

- General Mills Inc.

- WK Kellogg Co

- PepsiCo

- Post Holdings, Inc.

- Quest Nutrition & WorldPantry.com LLC

- Premier Nutrition Company, LLC

- Power Crunch

- MYPROTEIN (The Hut Group)

- Nestle

Recent Industry Developments

In 2024, Quest Nutrition, a subsidiary of The Simply Good Foods Company, solidified its leadership in the protein crisps market by capturing a significant 20–25% share.

In 2024, PepsiCo made significant strides in the protein crisps market, reflecting its commitment to innovation and consumer demand for healthier snack options. The company introduced Cheerios Protein, offering 8 grams of protein per serving in flavors like Cinnamon and Strawberry.

Report Scope

Report Features Description Market Value (2024) USD 1.9 Bn Forecast Revenue (2034) USD 4.2 Bn CAGR (2025-2034) 8.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Pea Protein Crisps, Soy Protein Crisps, Milk Protein Crisps, Whey Protein Crisps, Others), By Flavour (Vanilla, Chocolate, Peanut Butter, Mocha, Others), By Application (Sports Nutrition, Weight Management, Others), By Distribution Channel (Hypermarkets/Supermarkets, Grocery Stores, Convenience Stores, Specialty Stores, Online Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape General Mills Inc., WK Kellogg Co, PepsiCo, Post Holdings, Inc., Quest Nutrition & WorldPantry.com LLC, Premier Nutrition Company, LLC, Power Crunch, MYPROTEIN (The Hut Group), Nestle Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- General Mills Inc.

- WK Kellogg Co

- PepsiCo

- Post Holdings, Inc.

- Quest Nutrition & WorldPantry.com LLC

- Premier Nutrition Company, LLC

- Power Crunch

- MYPROTEIN (The Hut Group)

- Nestle