Global Probiotic Cosmetics Market Size, Share, Growth Analysis By Product Type (Skincare, Haircare, Other Cosmetics), By Application (Anti-aging, Acne Treatment, Skin Hydration, Sensitive Skin Care, Other Applications), By Distribution Channel (Online Retail, Offline Retail), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 145265

- Number of Pages: 310

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

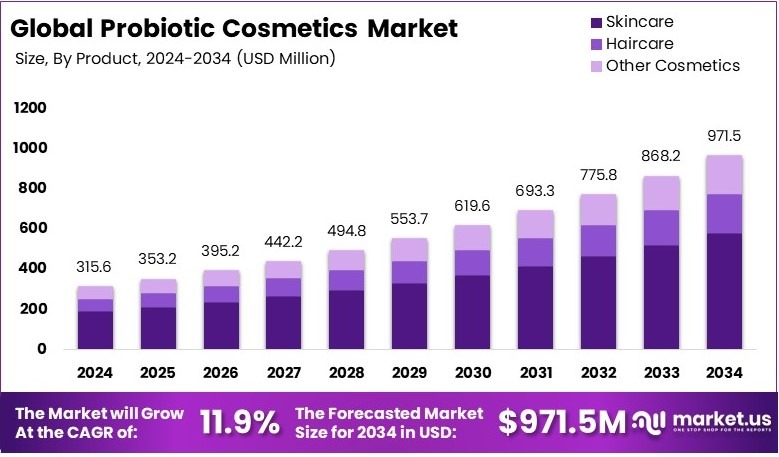

The Global Probiotic Cosmetics Market size is expected to be worth around USD 971.5 Million by 2034, from USD 315.6 Million in 2024, growing at a CAGR of 11.9% during the forecast period from 2025 to 2034.

Probiotic cosmetics are skin‑care formulations that include live or lysed beneficial bacteria or their ferments. These microbes support the skin’s microbiome. They help balance pH, strengthen barrier function, and reduce irritation. Products include creams, serums, and cleansers designed for sensitive, acne‑prone, or aging skin. They align with clean beauty demand.

The probiotic cosmetics market comprises manufacturers, suppliers, and retailers offering skincare products infused with beneficial bacteria. Demand is driven by consumer interest in microbiome health, natural ingredients, and preventive skincare.

Probiotic cosmetics are becoming increasingly popular as consumers focus on skin health and natural ingredients. These products aim to balance the skin’s microbiome, which helps reduce inflammation and strengthen the skin barrier. This trend is driven by growing awareness of microbiome health and its role in skincare.

For instance, a clinical trial involving 38 women demonstrated that using a formulation containing probiotics alongside tretinoin improved skin hydration and decreased inflammation. Consequently, consumers perceive probiotic cosmetics as both innovative and beneficial.

The global market for probiotic cosmetics is witnessing rapid growth, largely due to rising disposable incomes and the increasing demand for natural skincare solutions. Consumers are drawn to products that promote skin health without harsh chemicals. Additionally, companies are investing significantly in research and development to offer unique formulations.

For example, collaborations between researchers from Canada, Brazil, Mauritius, and France led to the development of Mineral 89 Probiotic Fractions, a product aimed at reducing retinoid-induced irritation and improving aging skin health. As a result, brands that focus on innovative solutions are more likely to capture market share.

According to data, South Korea remains a key player in the cosmetics industry. In 2022, skincare cosmetics (HS code 3304.99.1000) accounted for 41.8% of total cosmetic imports, amounting to $711 million. This highlights the country’s robust import activity within the skincare sector.

Furthermore, local brands are increasingly incorporating probiotics into their products, aligning with the global trend of microbiome-friendly skincare. Consequently, South Korea’s proactive approach to integrating new formulations strengthens its position in the global market.

The market is not yet saturated, providing ample opportunities for new and established brands alike. In developed regions, the demand for probiotic cosmetics is high, while emerging markets are gradually catching up.

As consumer awareness grows, more companies are expected to enter the market. However, early adopters may benefit from higher brand loyalty as consumers develop trust in their products. As a result, being among the first to offer proven probiotic solutions can yield a competitive advantage.

Furthermore, smaller brands are entering the market with niche formulations, creating a dynamic competitive environment. Consequently, continuous innovation and strategic partnerships are crucial for maintaining relevance.

Key Takeaways

- The Probiotic Cosmetics Market was valued at USD 315.6 million in 2024 and is expected to reach USD 971.5 million by 2034, with a CAGR of 11.9%.

- In 2024, Skincare dominates the product type segment with 62.3%, attributed to rising demand for microbiome-supportive facial products.

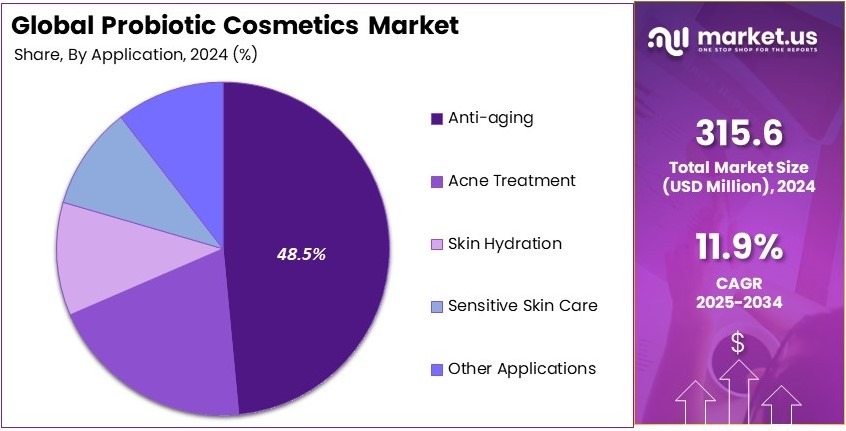

- In 2024, Anti-aging leads the application segment with 48.5%, driven by increasing consumer focus on youthful appearance.

- In 2024, Online Retail holds the largest share at 57.2%, reflecting the convenience and variety offered by e-commerce platforms.

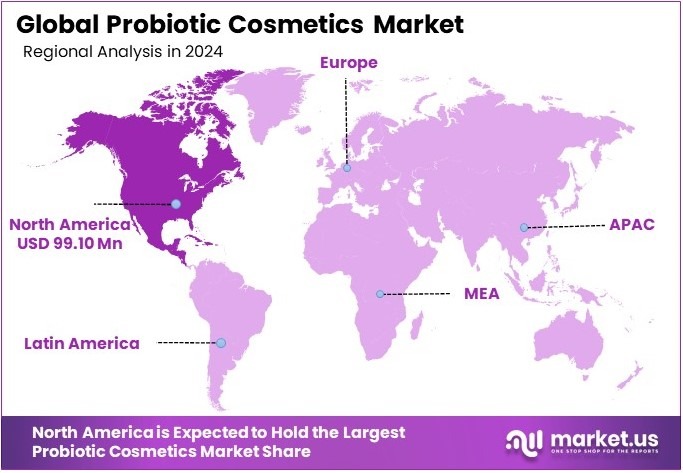

- In 2024, North America accounts for 31.4% + USD 99.10 million, supported by high consumer awareness and premium product adoption.

Type Analysis

Skincare sub-segment dominates with 62.3% due to its wide acceptance and innovative product launches.

The skincare segment in the Probiotic Cosmetics Market leads with a substantial share of approximately 62.3%. This dominance is primarily driven by increasing consumer awareness of the benefits probiotics offer, such as enhancing skin’s natural barrier and reducing inflammatory responses.

Major brands are continuously introducing innovative products that integrate probiotics, appealing to health-conscious consumers and driving the segment’s growth. The widespread acceptance of these skincare products underscores their significant role in the market’s dynamics.

Haircare, holding about 21.4%, and other cosmetics, with around 16.3%, are other vital sub-segments within this market. Haircare products infused with probiotics are gaining popularity for their benefits to scalp health and hair vitality. Meanwhile, other cosmetics, including probiotic-infused makeup items, represent a smaller but growing niche that contributes to the market’s innovation and diversity.

Application Analysis

Anti-aging sub-segment dominates with 48.5% due to its effectiveness in reducing signs of aging and promoting skin health.

In the application segment of the Probiotic Cosmetics Market, anti-aging products hold the largest share at 48.5%. These products are highly sought after for their proven effectiveness in reducing the visible signs of aging such as wrinkles and fine lines. They work by restoring the natural balance of skin microbiota and enhancing skin barrier functions, appealing to an aging demographic that prefers natural and non-invasive beauty solutions.

Other applications including acne treatment (20.1%), skin hydration (17.7%), and sensitive skin care (13.7%) also significantly contribute to the market. Acne treatment products are particularly popular among the younger demographic, while hydration and sensitive skin care products address the needs of a broader consumer base looking for gentle yet effective skincare options.

Distribution Channel Analysis

Online Retail sub-segment dominates with 57.2% due to the convenience and wide range of products available.

The distribution channel of the Probiotic Cosmetics Market is predominantly led by online retail, capturing about 57.2% of the market. This dominance is due to the convenience it offers, along with the ability to browse a vast array of products.

Consumers prefer online shopping as it allows for easy comparison, access to customer reviews, and the comfort of home delivery. The growth of this segment is further supported by exclusive online discounts and the continued expansion of e-commerce platforms.

Offline retail holds approximately 42.8%, playing an essential role particularly in areas with lower internet penetration or where consumers favor physical store experiences. These outlets provide direct customer interaction and the opportunity to test products firsthand, factors that are crucial for many buyers.

Key Market Segments

By Product Type

- Skincare

- Haircare

- Other Cosmetics

By Application

- Anti-aging

- Acne Treatment

- Skin Hydration

- Sensitive Skin Care

- Other Applications

By Distribution Channel

- Online Retail

- Offline Retail

Driving Factors

Microbiome Balance Awareness Drives Market Growth

The growing awareness of the importance of maintaining the skin’s microbiome balance is a key driver of the probiotic cosmetics market. Consumers increasingly recognize that a balanced skin microbiome contributes to healthier and more resilient skin.

As people become more conscious of long-term skin health, they seek products that support this natural balance. This demand has led to a surge in products containing natural and non-sensitizing ingredients, as these are perceived to be gentler on the skin’s delicate microbiome.

In addition, there is a rising preference for dermatologically tested formulations, particularly in acne and sensitive skincare. Such products assure consumers of their safety and effectiveness, especially when dealing with skin issues that can disrupt microbiome harmony.

Furthermore, investments in R&D have increased significantly, focusing on developing next-generation bioengineered probiotics that offer enhanced stability and targeted benefits. Brands are actively collaborating with dermatologists and biotechnologists to create innovative probiotic solutions, aiming to address diverse skin concerns.

Restraining Factors

Regulatory and Production Complexities Restrain Market Growth

Despite its potential, the probiotic cosmetics market faces significant challenges that limit its expansion. One of the main issues is the regulatory uncertainty surrounding live bacterial formulations in cosmetics. Authorities often lack clear guidelines, making it difficult for companies to confidently develop and market probiotic products. This ambiguity can slow innovation and delay product launches.

Another challenge is the high cost associated with production. Maintaining the stability and preservation of live probiotics requires advanced formulations and specialized packaging, driving up costs. This can make probiotic cosmetics less accessible to a broader consumer base.

Additionally, there is limited consumer understanding regarding the benefits of probiotics when applied topically. Many still associate probiotics solely with gut health, leading to skepticism about their effectiveness on the skin.

Finally, the diverse nature of skin types complicates standardizing efficacy claims. What works well for one individual might not yield the same results for another, making it challenging to create universally effective formulations.

Growth Opportunities

Hybrid Formulations and Personalization Provide Opportunities

The probiotic cosmetics market presents promising opportunities through innovative formulations and personalized skincare solutions. One significant area of growth is the development of hybrid products that combine prebiotics, probiotics, and postbiotics. These multifunctional formulations cater to consumers seeking comprehensive skin health solutions, leveraging the synergistic effects of these ingredients.

Additionally, advancements in AI-driven skin microbiome analysis enable brands to offer customized probiotic skincare tailored to individual needs. This personalized approach enhances consumer satisfaction and fosters brand loyalty.

Collaboration with biotech startups is another promising avenue. By integrating strain-specific innovations, companies can develop targeted solutions that address particular skin concerns, such as acne or eczema.

Furthermore, the market is expanding into pediatric and infant skincare, where the demand for gentle, microbiome-supportive products is rising. These product lines cater to parents looking for safe and effective solutions for their children’s delicate skin.

Trending Factors

Advanced Delivery Systems Are Latest Trending Factor

Emerging trends in the probiotic cosmetics market highlight the use of advanced delivery systems and minimalist skincare routines. Spore-based and encapsulated probiotic formulations are gaining traction, as they enhance stability and ensure the delivery of live cultures to the skin. These innovative delivery methods address a key challenge in probiotic cosmetics, making the formulations more effective and longer-lasting.

Additionally, the trend of “skinimalism” is influencing consumer choices. As more individuals opt for simplified skincare routines, products that support the skin’s microbiome naturally fit into these streamlined regimens. Facial mists and setting sprays enriched with probiotics are becoming popular as they provide a quick, lightweight way to incorporate microbiome care into daily routines.

Another notable trend is the integration of gut–skin axis concepts into product marketing. Brands are increasingly promoting dual supplement-cosmetic offerings, emphasizing holistic wellness. For instance, a probiotic cream might be paired with an ingestible supplement to address skin health from the inside out.

Regional Analysis

North America Dominates with 31.4% Market Share

North America leads the Probiotic Cosmetics Market with a 31.4% share, amounting to USD 99.10 million. This significant market presence is driven by heightened consumer awareness about skincare health, robust investment in biotechnology, and substantial consumer spending power.

The region’s dominance is bolstered by an advanced retail infrastructure and a strong trend towards organic and natural beauty products. The presence of major industry players who continually innovate and expand their product lines also significantly contributes to market growth.

The influence of North America on the global Probiotic Cosmetics Market is expected to continue growing. This trend is supported by ongoing innovations in product formulations and marketing strategies that appeal to a health-conscious population. The region’s focus on sustainable and ethical beauty products is likely to attract more consumers, potentially increasing North America’s market share.

Regional Mentions:

- Europe: Europe holds a prominent position in the Probiotic Cosmetics Market, driven by stringent regulations regarding cosmetic ingredients and a high consumer preference for probiotic-based products. The region’s market is supported by a strong tradition of skincare innovation.

- Asia Pacific: Asia Pacific is witnessing rapid growth in the Probiotic Cosmetics Market due to rising disposable income and increasing consumer awareness about skin health. Countries like South Korea and Japan are pioneering in skincare innovation, particularly with probiotics.

- Middle East & Africa: The Middle East and Africa are gradually advancing in the Probiotic Cosmetics Market. The growth is driven by increasing urbanization and changing consumer lifestyles, particularly in major cities that are becoming more open to modern cosmetic solutions.

- Latin America: Latin America is showing a growing interest in Probiotic Cosmetics, propelled by increasing economic development and a rising beauty-conscious population. The market is expanding particularly in countries like Brazil and Mexico, where beauty and personal care products are highly valued.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

The Probiotic Cosmetics Market is characterized by a competitive landscape with several prominent companies driving innovation and growth. Among these, L’Oréal S.A., Unilever PLC, The Estée Lauder Companies Inc., and Johnson & Johnson are the top players, each holding significant influence due to their extensive product portfolios, global presence, and strong brand recognition.

L’Oréal S.A. is a leader in the beauty industry, and its foray into probiotic cosmetics underscores its commitment to innovation. The company leverages its substantial R&D capabilities to develop probiotic-infused products that cater to a diverse consumer base looking for skincare benefits such as enhanced hydration and reduced inflammation.

Unilever PLC has also made significant strides in incorporating probiotics into its skincare lines, focusing on creating products that balance skin’s natural flora to improve skin health. Unilever’s global distribution network allows it to effectively market and sell these innovative products across various regions, making it a formidable player in the market.

The Estée Lauder Companies Inc. is renowned for its premium skincare products, and its probiotic cosmetics range is no exception. By integrating probiotics into its high-end skincare products, Estée Lauder appeals to luxury consumers seeking advanced skincare solutions that combine efficacy with natural ingredients.

Johnson & Johnson, with its broad healthcare and consumer goods portfolio, utilizes its expertise in science-based formulations to develop probiotic products that support skin health. The company focuses on gentle skincare formulations that are suitable for all skin types, including sensitive skin, thus addressing a wide market segment.

These top companies not only contribute to the market through their innovative products but also drive competitive dynamics by setting high standards in product efficacy and safety. Their ongoing research into probiotics and skin health is likely to influence future trends in the Probiotic Cosmetics Market, ensuring that the sector continues to evolve and expand, meeting the growing consumer demand for natural and effective skincare solutions.

Major Companies in the Market

- L’Oréal S.A.

- Unilever PLC

- The Estée Lauder Companies Inc.

- Johnson & Johnson

- TULA Life, Inc.

- Aurelia Skincare Ltd.

- Glowbiotics Inc.

- ESSE Skincare

- Eminence Organic Skin Care

- Gallinée Ltd.

Recent Developments

- TULA Life, Inc.: On July 2024, TULA Life, Inc. launched a new line of probiotic-infused serums and moisturizers targeting specific skin concerns such as redness and uneven texture. This launch reflects TULA’s ongoing innovation in the probiotic skincare segment.

- L’Oréal: On December 2023, L’Oréal acquired Lactobio, a Denmark-based company specializing in precision probiotics and microbiome research. This acquisition strengthens L’Oréal’s research in the skin microbiome and allows for the development of new cosmetic solutions using live bacteria. L’Oréal’s 2022 sales amounted to 38.26 billion euros.

Report Scope

Report Features Description Market Value (2024) USD 315.6 Million Forecast Revenue (2034) USD 971.5 Million CAGR (2025-2034) 11.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Skincare, Haircare, Other Cosmetics), By Application (Anti-aging, Acne Treatment, Skin Hydration, Sensitive Skin Care, Other Applications), By Distribution Channel (Online Retail, Offline Retail) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape L’Oréal S.A., Unilever PLC, The Estée Lauder Companies Inc., Johnson & Johnson, TULA Life, Inc., Aurelia Skincare Ltd., Glowbiotics Inc., ESSE Skincare, Eminence Organic Skin Care, Gallinée Ltd., Marie Veronique, LaFlore Probiotic Skincare, Mother Dirt Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Probiotic Cosmetics MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Probiotic Cosmetics MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- L'Oréal S.A.

- Unilever PLC

- The Estée Lauder Companies Inc.

- Johnson & Johnson

- TULA Life, Inc.

- Aurelia Skincare Ltd.

- Glowbiotics Inc.

- ESSE Skincare

- Eminence Organic Skin Care

- Gallinée Ltd.