Kaolin Market By Grade (Calcined, Hydrous, Delaminated, Surface Treated, Structured), By Application (Paper, Ceramics, Paint & Coatings, Fiberglass, Plastic, Rubber, Pharmaceuticals & Medical, Cosmetics, Others), By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 28707

- Number of Pages: 359

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

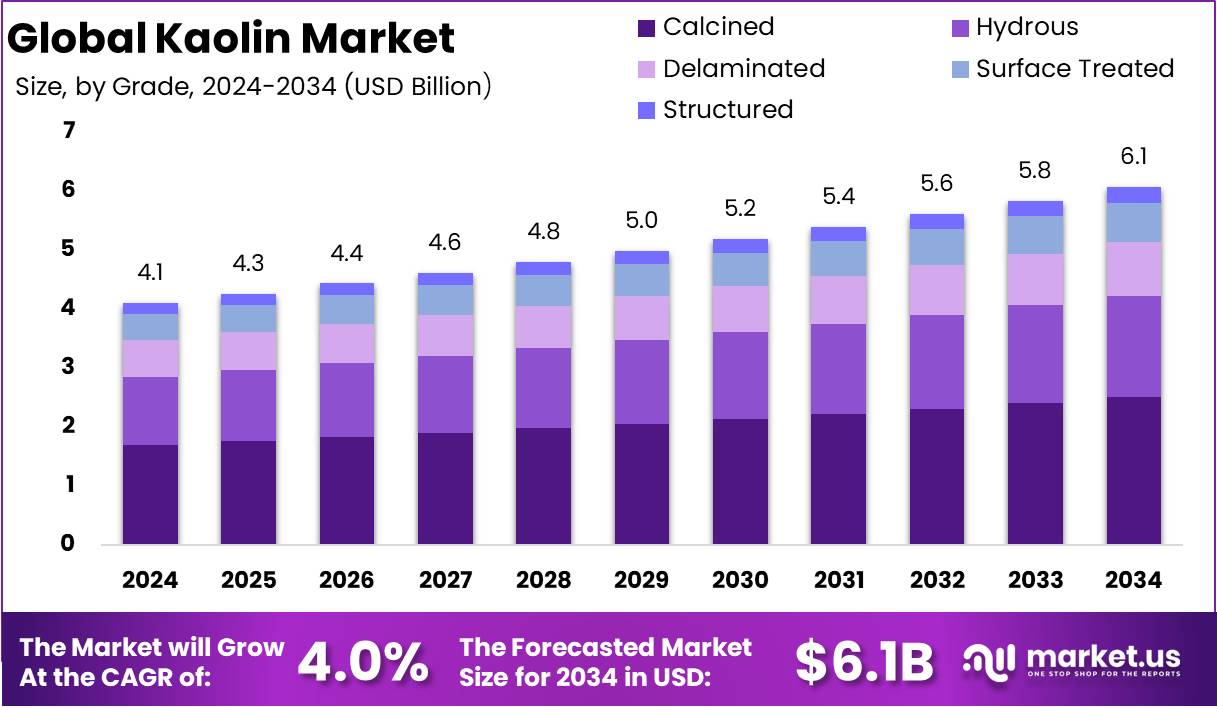

The Global Kaolin Market size is expected to be worth around USD 6.1 Billion by 2034 from USD 4.1 Billion in 2024, growing at a CAGR of 4.0% during the forecast period from 2025 to 2034.

Kaolin, also known as china clay, is a naturally occurring mineral primarily composed of kaolinite, a type of clay mineral rich in silica and alumina. It is widely recognized for its fine particle size, high brightness, and ability to enhance the physical and chemical properties of various industrial applications. Kaolin is extensively used in ceramics, paper manufacturing, rubber, paints, coatings, and pharmaceuticals, offering unique benefits such as improved opacity, strength, and thermal resistance.

The Kaolin market encompasses the global production, distribution, and consumption of kaolin across diverse industries. Driven by its extensive applications, the market is segmented based on product type (calcined, hydrous, delaminated, surface-modified, and structured) and end-use industries such as ceramics, paper, paints & coatings, rubber, plastics, and pharmaceuticals.

The market is shaped by evolving industrial needs, sustainability trends, and technological advancements in refining and processing techniques, enhancing kaolin’s performance and usability across sectors.

The growth of the kaolin market is fueled by the increasing demand for high-quality ceramics, the expanding paper and packaging industry, and advancements in coating technologies. The rising emphasis on lightweight materials in the automotive and aerospace industries is also a crucial driver, as kaolin-based composites contribute to weight reduction while maintaining durability.

Kaolin demand is witnessing steady growth, driven by its indispensable role in manufacturing and industrial processes. The ceramics sector remains one of the largest consumers, leveraging kaolin for its superior whiteness and plasticity in porcelain and sanitaryware. In the paper industry, kaolin’s ability to enhance paper opacity and printability sustains its high demand despite the rise of digitalization.

Emerging applications and technological innovations present significant opportunities for kaolin market expansion. The growing emphasis on sustainable and bio-based materials opens new avenues in green coatings, packaging, and advanced ceramics. The rapid development of 3D printing technology also fosters demand for refined kaolin formulations with enhanced performance characteristics.

Kaolin accounts for about 7% of global demand in plastics as a filler and 5-6% in cosmetics for its absorbent and skin-soothing properties.

According to IBM.gov, Ball clay, which commonly consists of 20-80% kaolinite, 10-25% mica, and 6-65% quartz, highlights the diverse mineral composition that supports kaolin’s widespread industrial use. Ball clay is notably more plastic than China clay, which impacts its applications and performance across various sectors.

Key Takeaways

- The Global Kaolin Market is projected to grow from USD 4.1 Billion in 2024 to USD 6.1 Billion by 2034, at a CAGR of 4.0%.

- Calcined Kaolin leads the market with a dominant share of 41.2% in 2024 due to its superior physical properties and widespread use in various industries.

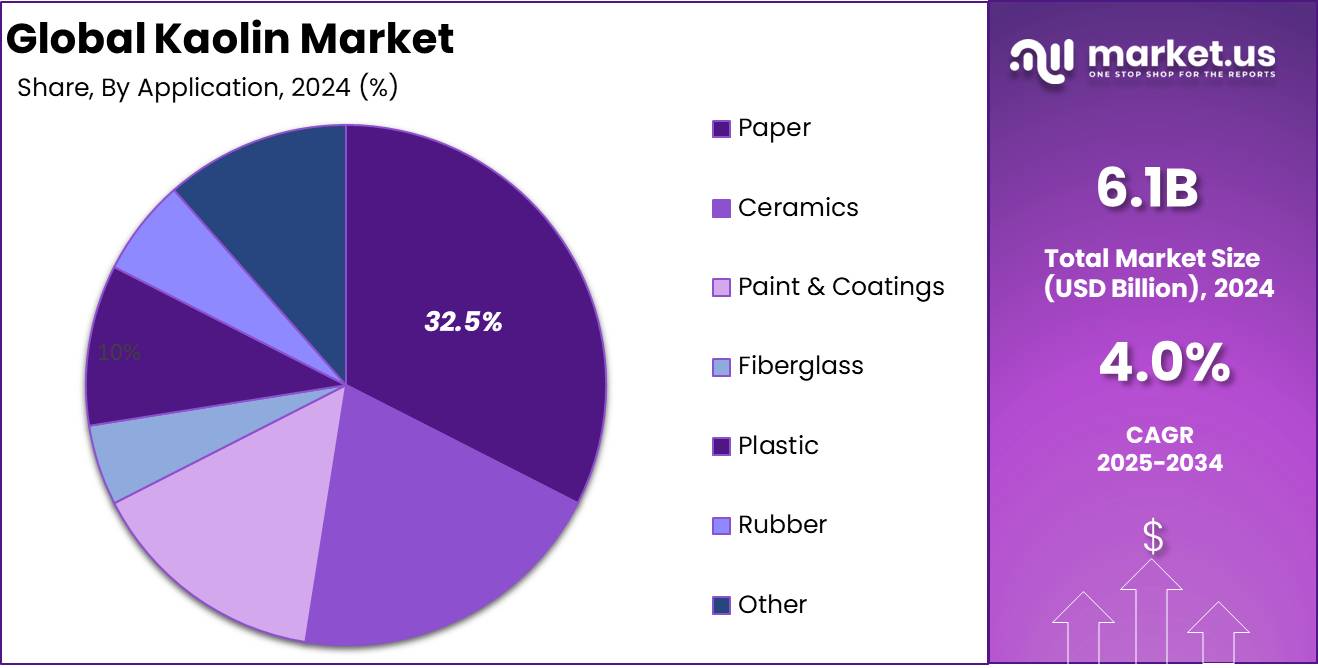

- The Paper segment holds the largest market share, accounting for 32.5% in 2024, driven by its critical role in enhancing paper brightness, smoothness, and printability.

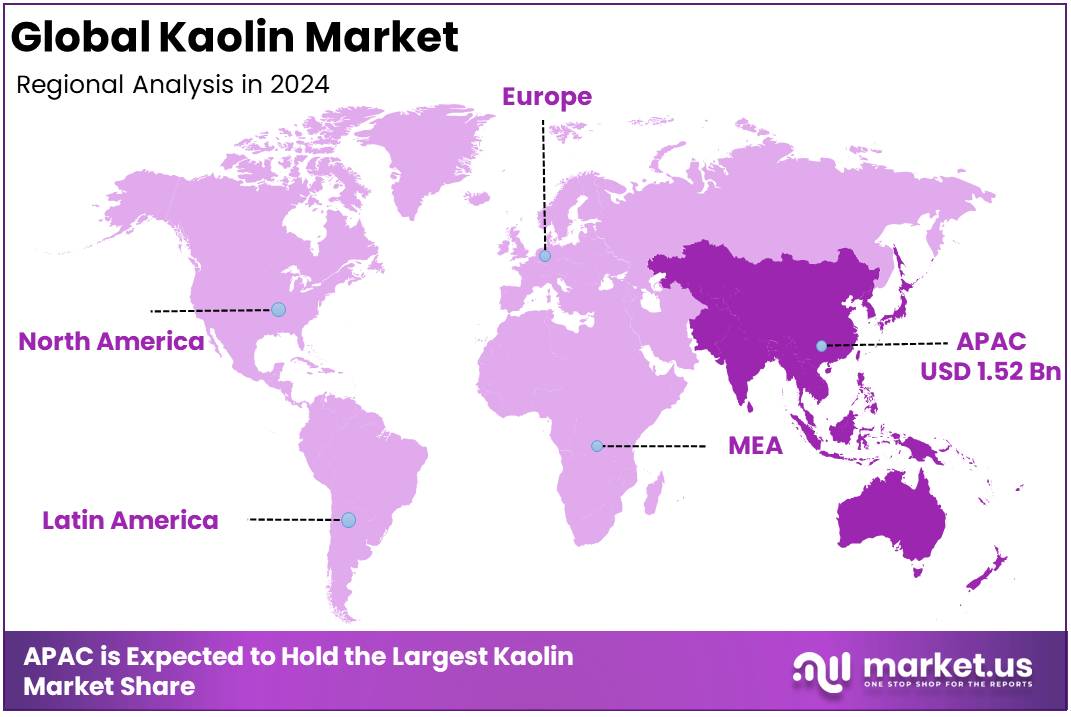

- The APAC region dominates the global Kaolin market with a 37.1% market share in 2024, driven by industrial growth and demand in countries like China and India.

By Grade Analysis

Calcined Kaolin Dominates the Market with 41.2% Market Share

In 2024, Calcined Kaolin held a dominant market position in the Kaolin segment by grade, capturing more than 41.2% of the total market share. Calcined Kaolin is widely preferred due to its superior physical properties, such as higher brightness, lower viscosity, and improved rheological properties, making it ideal for use in ceramics, paints, rubber, and plastics industries.

Hydrous Kaolin is widely used in applications that require finer particle sizes and improved dispersion properties. It maintains a significant share of the market, particularly in industries such as paper, paints, and adhesives.

Delaminated Kaolin is characterized by its unique properties, including its high level of fineness and exceptional whiteness. It is typically used in high-end applications such as coatings and specialty paper products.

Surface Treated Kaolin has a strong presence in markets that require enhanced performance characteristics, including improved compatibility with other materials. It is used in a variety of applications such as paints, coatings, and rubber.

Structured Kaolin finds its applications in areas where improved rheological properties and structured design are required, particularly in coatings and paints, offering smooth finishes and durability in end products.

By Application Analysis

In 2024, the Paper segment holds a dominant market position in the Kaolin industry, capturing more than 32.5% of the total market share. This is largely due to the extensive use of kaolin as a filler and coating material in paper production. Kaolin enhances the brightness, smoothness, and printability of paper products, which is essential for high-quality printing and packaging. The growing demand for high-quality paper products in industries such as publishing, packaging, and stationery further solidifies kaolin’s significant role in this segment.

Kaolin is a crucial raw material in the ceramics industry, where it is used to produce fine china, tiles, and sanitary ware. Its role in providing smoothness, whiteness, and high resistance to heat makes it a preferred choice for ceramic products. The demand for high-end ceramics, driven by architectural and interior design trends, continues to support the growth of kaolin in this sector.

In the Paint & Coatings segment, kaolin is widely utilized for its opacity, smooth texture, and ability to improve the durability and wear resistance of paints. The demand for high-quality paints, especially in automotive and construction sectors, contributes to the rising demand for kaolin. Its low abrasiveness and non-toxic properties further make it suitable for various coating applications.

Kaolin is used in the production of fiberglass to enhance its strength and resistance to heat. The increasing need for lightweight, durable materials in automotive, construction, and aerospace industries is expected to boost the use of kaolin in fiberglass production. Its ability to improve the material properties of fiberglass makes it an essential component in these sectors.

The use of kaolin in plastic manufacturing is mainly driven by its ability to improve the physical properties of plastics, such as dimensional stability, rigidity, and chemical resistance. As demand grows for high-performance plastics in the automotive, packaging, and consumer goods sectors, kaolin’s role as an additive in plastics continues to expand.

Kaolin is increasingly used in rubber production to enhance the strength, durability, and heat resistance of rubber products. It also acts as a reinforcing filler in tires and industrial rubber goods. The rising demand for rubber in automotive and industrial applications ensures a steady market for kaolin in this segment.

In the Pharmaceuticals & Medical segment, kaolin is valued for its adsorbent properties, particularly in the production of antidiarrheal medications and other healthcare products. Its use in medical applications is driven by its non-toxicity and ability to absorb moisture and impurities, making it an important ingredient in pharmaceutical formulations.

Kaolin is used in the cosmetics industry due to its soothing and absorbent properties. It is often found in facial masks, powders, and other skin care products. The growing consumer demand for natural and non-irritating ingredients in personal care products helps support the use of kaolin in this sector.

Kaolin also finds use in various other applications, including agriculture, adhesives, and paperboard manufacturing. While these segments are relatively smaller in comparison to the major markets, they still contribute to the overall demand for kaolin due to its versatility and unique properties.

Key Market Segments

By Grade

- Calcined

- Hydrous

- Delaminated

- Surface Treated

- Structured

By Application

- Paper

- Ceramics

- Paint & Coatings

- Fiberglass

- Plastic

- Rubber

- Pharmaceuticals & Medical

- Cosmetics

- Others

Driver

Rising Demand in the Paper Industry

The global kaolin market is experiencing significant growth, primarily driven by its extensive application in the paper industry. Kaolin serves as a crucial component in paper manufacturing, where it is utilized as a coating and filler material to enhance the paper’s quality, brightness, and printability.

The mineral’s fine particle size and white color contribute to improved opacity and surface smoothness, making it indispensable for producing high-grade paper products. As the demand for premium paper continues to rise, especially in emerging economies, the consumption of kaolin in this sector is expected to increase substantially.

In addition to its traditional applications, kaolin’s role in the paper industry has expanded with the growing emphasis on sustainable and recyclable materials. Paper manufacturers are increasingly adopting kaolin to produce eco-friendly products, aligning with global environmental initiatives.

This shift not only bolsters the demand for kaolin but also underscores its importance in developing sustainable solutions within the paper industry. Consequently, the rising demand for high-quality, sustainable paper products is a significant driver propelling the growth of the global kaolin market.

Restraint

Availability of Substitutes in the Paper Industry

While kaolin has been a staple in paper manufacturing, the market faces challenges due to the availability of alternative materials. Substitutes such as ground calcium carbonate (GCC) and precipitated calcium carbonate (PCC) have gained traction as cost-effective alternatives to kaolin.

These materials offer comparable properties, such as brightness and opacity, which are essential in paper production. The abundance and lower cost of GCC and PCC make them attractive options for paper manufacturers aiming to reduce production expenses. This shift towards alternative fillers poses a significant restraint on the kaolin market, potentially limiting its growth in the paper industry.

Moreover, advancements in paper recycling technologies have reduced the reliance on virgin materials, including kaolin. Recycled paper often requires fewer additives, further diminishing the demand for kaolin in this sector. As environmental concerns drive the increase in paper recycling rates, the need for traditional fillers like kaolin may continue to decline. Therefore, the availability and adoption of substitutes, coupled with the rise in paper recycling, present notable challenges to the expansion of the kaolin market.

Opportunity

Growing Applications in the Ceramics Industry

The ceramics industry presents a significant opportunity for the kaolin market’s expansion. Kaolin’s unique properties, such as high purity, fine particle size, and excellent dispersion, make it an ideal material for ceramic applications.

It is extensively used in the production of whiteware ceramics, including porcelain, sanitaryware, and tableware, where it imparts whiteness, strength, and dimensional stability. As the global construction industry experiences growth, particularly in emerging economies, the demand for ceramic products is on the rise, thereby increasing the consumption of kaolin.

Additionally, the trend towards aesthetic interiors and the increasing use of ceramic tiles in residential and commercial buildings further fuel the demand for kaolin. Innovations in ceramic manufacturing, such as the development of advanced ceramics for electronic applications, also open new avenues for kaolin utilization. These factors collectively create a promising opportunity for the kaolin market to expand its footprint in the ceramics industry, capitalizing on the material’s inherent advantages and the sector’s growth trajectory.

Trends

Rising Use of Kaolin in Paints and Coatings

A notable trend in the kaolin market is its increasing application in the paints and coatings industry. Kaolin acts as a functional extender, enhancing the performance and durability of paints. Its fine particle size and platy structure contribute to improved opacity, better suspension properties, and reduced cracking in the dried film.

Moreover, kaolin’s chemical inertness and non-toxicity make it suitable for both interior and exterior paint formulations. As the global construction and automotive industries expand, the demand for high-quality paints and coatings rises, subsequently driving the consumption of kaolin in this sector.

Furthermore, the shift towards eco-friendly and sustainable products has led to the development of water-based paints, where kaolin plays a crucial role. Its ability to improve rheology and provide a matte finish aligns with the requirements of modern paint formulations aimed at reducing volatile organic compound (VOC) emissions.

This trend not only boosts the demand for kaolin but also underscores its adaptability to evolving industry standards and consumer preferences. Consequently, the rising use of kaolin in paints and coatings represents a significant trend contributing to the growth of the global kaolin market.

Regional Analysis

APAC Region Leads the Kaolin Market with the Largest Market Share of 37.1% in 2024

The global kaolin market is experiencing significant growth, with the Asia Pacific (APAC) region emerging as the dominant market, accounting for 37.1% of the market share in 2024. Valued at approximately USD 1.52 billion, the APAC kaolin market is fueled by robust industrial growth, particularly in China, India, and Southeast Asia.

The region’s expanding demand for kaolin in various applications, such as ceramics, paints & coatings, rubber, and plastics, drives this dominance. The increasing construction activities and rapid urbanization in key countries further contribute to the strong demand for kaolin in the region.

In North America, the market is projected to hold a significant share as well, though it remains smaller compared to APAC, with the U.S. being the key contributor. The kaolin market in North America is benefiting from strong demand in the paper & pulp industry, where kaolin is used as a coating material for paper production. Europe is another important region, with countries like Germany and the U.K. showing consistent demand for kaolin in industrial applications.

The Middle East & Africa and Latin America, while growing, hold comparatively smaller shares of the market, driven mainly by emerging industries and increasing infrastructural investments in these regions. However, the overall demand for kaolin in these areas is expected to grow steadily, albeit at a slower pace than APAC and North America.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

The Global Kaolin Market in 2024 is shaped by the strategic initiatives and competitive positioning of key players such as BASF SE, EICL Ltd, Imerys S.A., I-Minerals Inc., KaMin LLC, LB Minerals Ltd., Maoming Xingli Kaolin Co. Ltd., Quarzwerke GmbH, Sibelco, and Thiele Kaolin Company. These companies play a pivotal role in driving market growth through advancements in kaolin processing technologies, expanding product portfolios, and strengthening supply chain networks.

BASF SE remains a dominant player with its strong focus on high-quality kaolin products for applications in coatings, ceramics, and rubber industries. Imerys S.A., a global leader in mineral-based solutions, leverages its vast mining operations and advanced processing capabilities to maintain a strong foothold in the market. EICL Ltd., a major player in India, continues to expand its presence by catering to the growing demand for kaolin in paper and ceramics manufacturing.

I-Minerals Inc. specializes in high-purity kaolin production, positioning itself in niche applications such as high-end ceramics and paints. KaMin LLC and Thiele Kaolin Company remain key suppliers in North America, focusing on customized kaolin solutions for industrial and commercial applications.

LB Minerals Ltd. and Quarzwerke GmbH emphasize sustainability and efficient mining practices to enhance their competitive edge. Sibelco, a global mining powerhouse, strengthens its market share with diversified kaolin applications, including pharmaceuticals and plastics. Meanwhile, Maoming Xingli Kaolin Co. Ltd., based in China, plays a crucial role in meeting Asia-Pacific’s rising demand for kaolin in construction and paper industries.

Top Key Players in the Market

- BASF SE

- EICL Ltd

- Imerys S.A.

- I-Minerals Inc.

- KaMin LLC

- LB Minerals Ltd.

- Maoming Xingli Kaolin Co. Ltd.

- Quazwerke GmbH

- Sibelco

- Thiele Kaolin Company

Recent Developments

- In 2025, PQ, a global leader in silicates, silicas, and related products, announced the successful acquisition of Sibelco Group’s specialty silicate business, which operates from the Lödöse plant in Sweden. This strategic move enhances PQ’s ability to serve new customers in the Nordic region, leveraging its extensive European network and expertise in specialty silicates, according to CEO Al Beninati.

- In 2025, Imerys expanded its portfolio by acquiring Chemviron’s European diatomite and perlite assets. This acquisition, which covers sites in France and Italy, strengthens Imerys’ capabilities in the filtration and life sciences markets. The deal includes three facilities and a workforce of 130 employees, bolstering Imerys’ position in key European regions.

Report Scope

Report Features Description Market Value (2024) USD 4.1 Billion Forecast Revenue (2034) USD 6.1 Billion CAGR (2025-2034) 4.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Grade (Calcined, Hydrous, Delaminated, Surface Treated, Structured), By Application (Paper, Ceramics, Paint & Coatings, Fiberglass, Plastic, Rubber, Pharmaceuticals & Medical, Cosmetics, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape BASF SE, EICL Ltd, Imerys S.A., I-Minerals Inc., KaMin LLC, LB Minerals Ltd., Maoming Xingli Kaolin Co. Ltd., Quazwerke GmbH, Sibelco, Thiele Kaolin Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- BASF SE

- EICL Ltd

- Imerys S.A.

- I-Minerals Inc.

- KaMin LLC

- LB Minerals Ltd.

- Maoming Xingli Kaolin Co. Ltd.

- Quazwerke GmbH

- Sibelco

- Thiele Kaolin Company