Global Private Jet Manufacturers Market Size, Share Analysis Report By Aircraft Type (Very Light Jets, Light Jets, Mid-Size Jets, Large Jets), By Ownership (Full Ownership, Fractional Ownership, Charter Services, Jet Cards), By End-User: Corporate, Individuals/HNWIs, Government/Military, Charter Operators), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: May 2025

- Report ID: 148028

- Number of Pages: 210

- Format:

-

keyboard_arrow_up

Quick Navigation

- Private Jet Manufacturers Market Size

- Key Takeaways

- Analysts’ Viewpoint

- AI in Private Jet Manufacturing

- Expansion of the US Market

- North America Growth Trajectory

- By Aircraft Type Analysis

- By Ownership Analysis

- By End-User Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Growth Factors

- Emerging Trends

- Business Benefits

- Key Player Analysis

- Recent Developments

- Report Scope

Private Jet Manufacturers Market Size

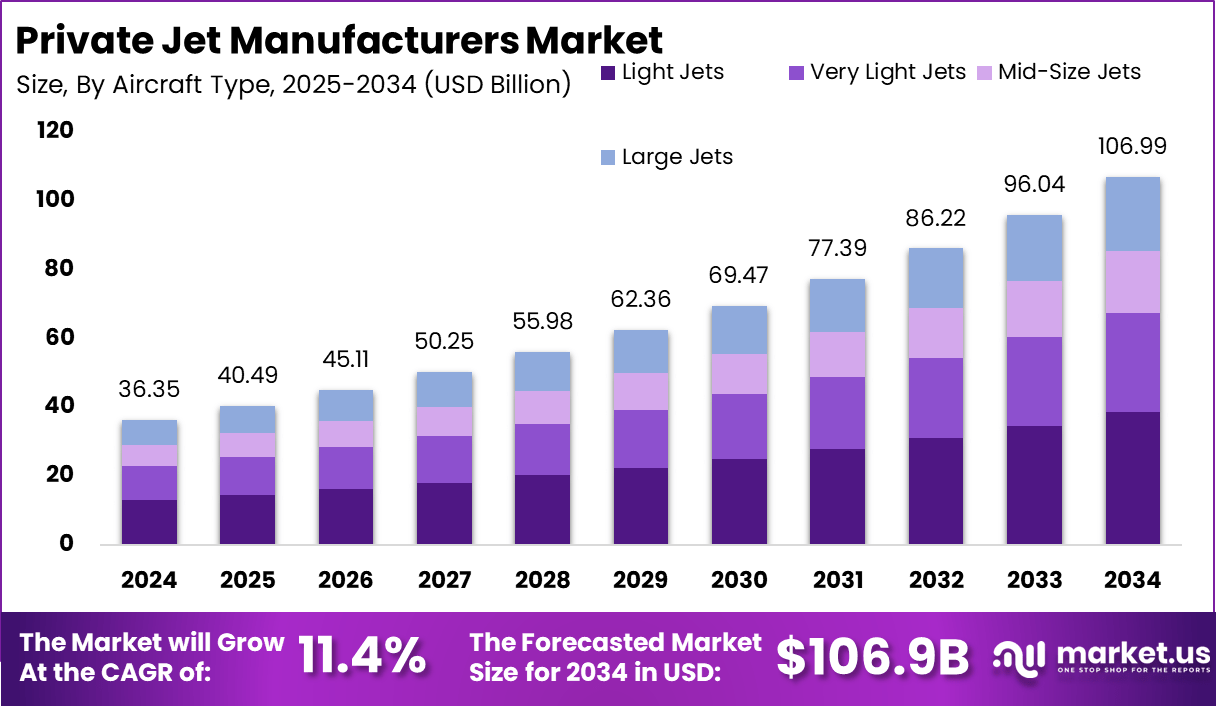

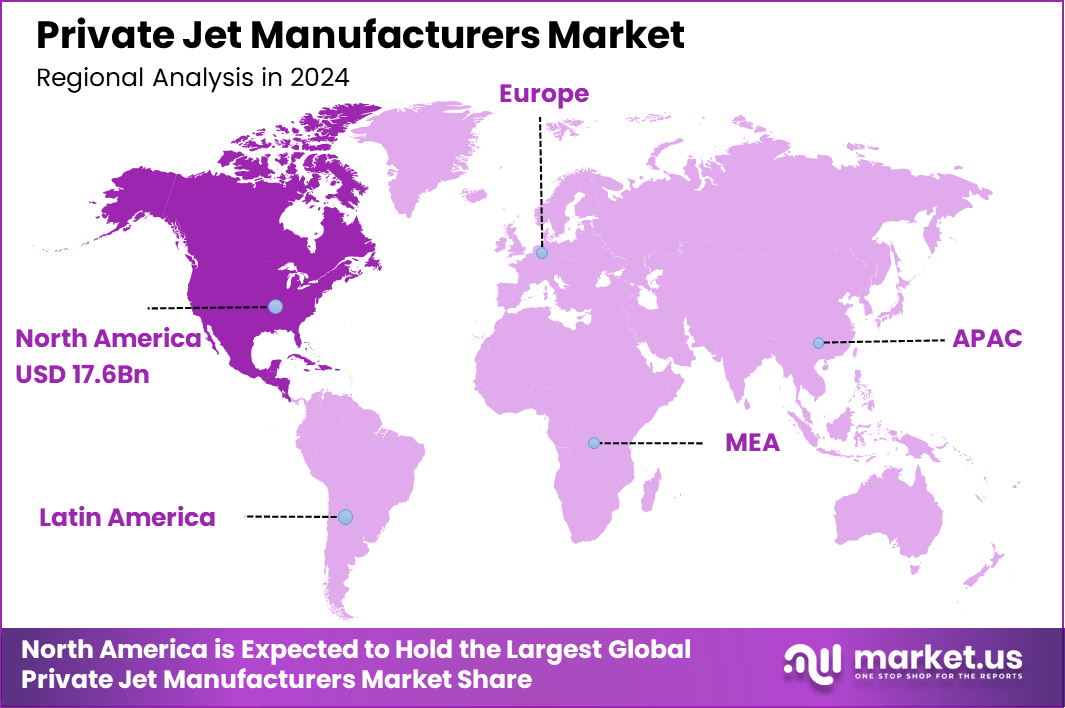

The Global Private Jet Manufacturers Market size is expected to be worth around USD 106.99 Billion By 2034, from USD 36.35 billion in 2024, growing at a CAGR of 11.4% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 48.5% share, holding USD 17.6 Billion revenue.

Private jet manufacturers are specialized aerospace companies that design, engineer, and produce aircraft tailored for private, corporate, and charter use. Leading firms in this sector include Gulfstream Aerospace, Bombardier, Dassault Aviation, Embraer, Textron Aviation, and Airbus Corporate Jets. These manufacturers offer a diverse range of models, from light jets suitable for regional travel to ultra-long-range jets capable of intercontinental flights.

Several key factors are propelling the growth of the private jet market. The increasing need for time-efficient travel solutions among corporate executives and high-net-worth individuals has heightened demand. Additionally, the limitations and unpredictability of commercial air travel have made private aviation an attractive alternative. The growth of emerging markets, particularly in Asia-Pacific, is also contributing to increased demand for private jets .

Key Takeaways

- The global private jet market is poised for significant growth, projected to rise from USD 36.35 billion in 2024 to approximately USD 106.99 billion by 2034, reflecting a compound annual growth rate (CAGR) of 11.4% over the forecast period.

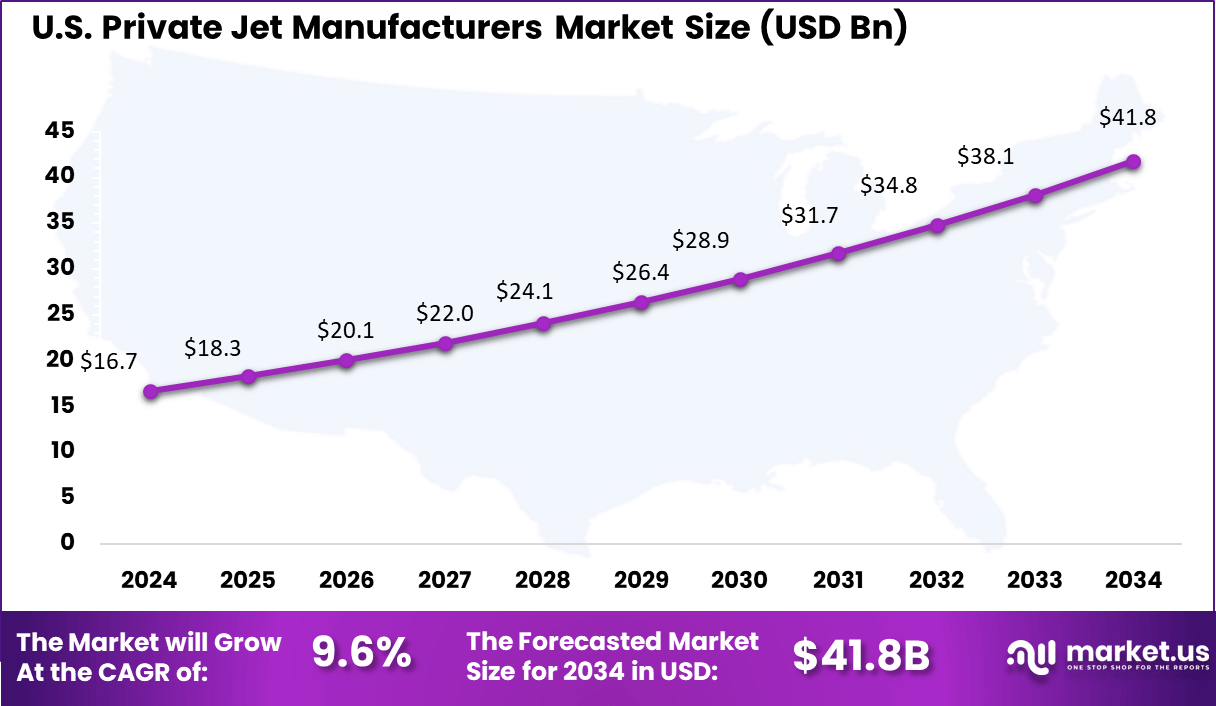

- In 2024, North America held a dominant position in the market, accounting for over 48.5% of global revenue, with the United States contributing approximately USD 16.7 billion.

- Large jets emerged as the most prominent segment, capturing a 36% market share. Their popularity stems from their superior range capabilities and ability to accommodate more passengers, making them ideal for long-haul corporate travel.

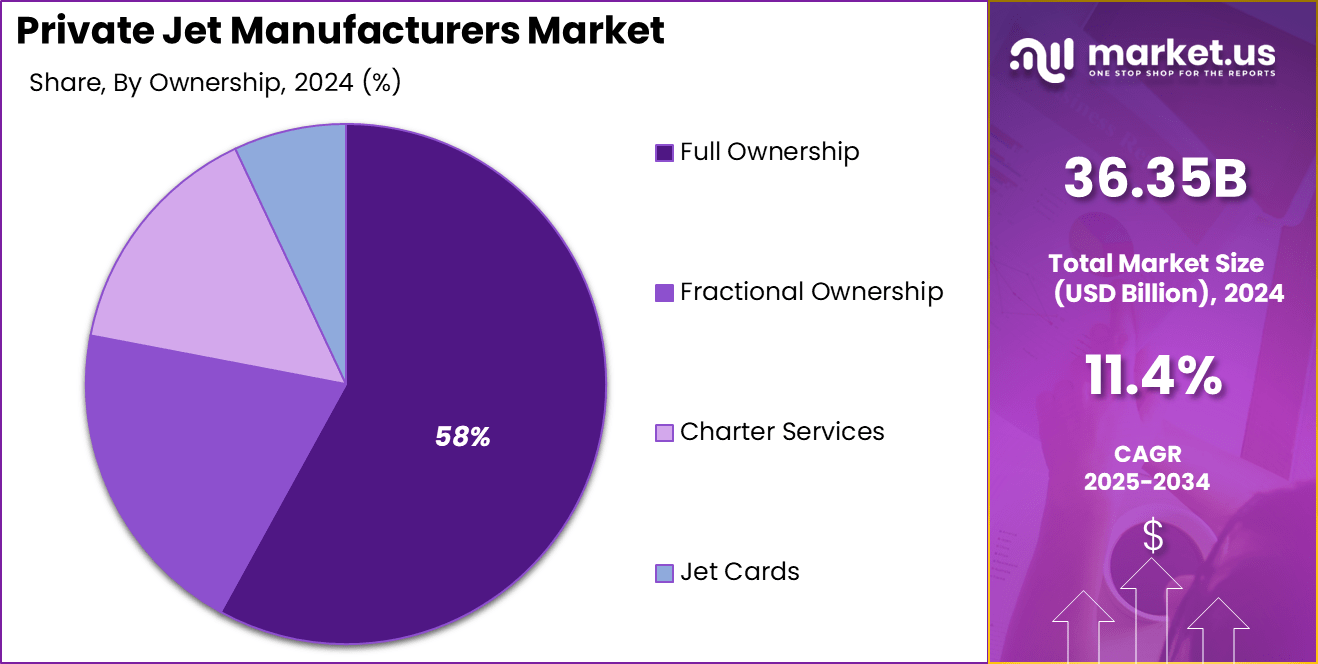

- Full ownership remains the preferred model among private jet users, representing 58% of the market. This preference indicates a strong inclination towards complete asset control and personalized usage.

- Corporate entities constitute a significant portion of the end-user segment, accounting for 45%. This highlights the critical role of business aviation in facilitating corporate travel and operational efficiency.

Analysts’ Viewpoint

Technological advancements are playing a pivotal role in the private jet industry. Manufacturers are integrating cutting-edge technologies such as fly-by-wire systems, advanced avionics, and sustainable aviation fuels (SAFs) to enhance performance and reduce environmental impact. For example, Embraer’s Praetor 600 features full fly-by-wire controls, improving fuel efficiency and simplifying maintenance.

The adoption of advanced technologies in private jets is driven by the need to improve operational efficiency, enhance passenger comfort, and meet stringent environmental regulations. Innovations such as predictive maintenance using AI and the integration of SAFs are not only reducing operational costs but also aligning with global sustainability goals.

The private jet manufacturing market presents lucrative investment opportunities. The projected growth of the market, coupled with increasing demand for private air travel, makes it an attractive sector for investors. Companies that focus on innovation, sustainability, and meeting customer needs are well-positioned to capitalize on these opportunities and achieve substantial returns on investment.

AI in Private Jet Manufacturing

In the design phase, AI enables engineers to simulate and test various configurations rapidly, leading to optimized aerodynamics and fuel efficiency. This approach reduces the time and cost associated with traditional prototyping methods. For instance, AI-driven simulations can predict the performance of new materials under different conditions, ensuring reliability and safety.

During manufacturing, AI-powered robotics and automation streamline assembly lines, ensuring precision and consistency. Machine learning algorithms monitor production processes in real-time, identifying anomalies and predicting maintenance needs, which minimizes downtime and enhances productivity. This predictive maintenance approach is crucial for maintaining the high safety standards required in aviation.

In operations, AI assists in flight scheduling and route optimization, considering factors such as weather conditions, air traffic, and fuel consumption. This leads to more efficient flight plans, reduced operational costs, and improved punctuality. Moreover, AI enhances customer experience by personalizing services based on passenger preferences, thereby increasing satisfaction and loyalty.

Expansion of the US Market

The US Private Jet Manufacturers Market is valued at approximately USD 16.7 Billion in 2024 and is predicted to increase from USD 18.3 Billion in 2025 to approximately USD 41.8 Billion by 2034, projected at a CAGR of 9.6% from 2025 to 2034.

North America Growth Trajectory

In 2024, North America held a dominant market position in the private jet manufacturing sector, capturing more than a 48.5% share and generating approximately USD 17.6 billion in revenue. This leadership is primarily attributed to the region’s robust infrastructure, a high concentration of high-net-worth individuals, and the presence of major private jet manufacturers.

The dominance of North America in this market is also supported by a well-established ecosystem that includes advanced manufacturing facilities, a skilled workforce, and favorable regulatory frameworks that encourage innovation and investment in the aerospace sector.

Additionally, the prevalence of corporate headquarters and financial institutions in the region has led to a sustained demand for business aviation services, reinforcing North America’s leading position in the global private jet market.

By Aircraft Type Analysis

Large jets accounted for 36% of the market share, underscoring their prominence in the private aviation sector. These aircraft are favored for their extended range, spacious cabins, and advanced amenities, making them suitable for long-haul travel and international operations.

The preference for large jets is driven by the increasing demand from high-net-worth individuals and corporations seeking enhanced comfort and efficiency in air travel. This trend reflects a broader shift towards aircraft that can accommodate longer distances without compromising on luxury and performance.

By Ownership Analysis

Full ownership emerged as the dominant model, representing 58% of the market. This preference indicates a strong inclination among buyers towards complete control over their aircraft, allowing for personalized customization and flexible scheduling.

Full ownership is particularly appealing to individuals and organizations with frequent travel needs, as it offers the convenience of on-demand availability and the potential for asset appreciation. The sustained interest in full ownership suggests confidence in the long-term value and utility of private jets.

By End-User Analysis

Corporate entities constituted 45% of the end-user segment, highlighting the significant role of business aviation in facilitating corporate travel. Companies are increasingly investing in private jets to enhance executive mobility, reduce travel time, and improve operational efficiency.

The use of private aircraft enables businesses to access remote locations, conduct multiple meetings across different cities in a single day, and maintain confidentiality during travel. This corporate demand is a testament to the strategic value that private aviation brings to modern business operations.

Key Market Segments

By Aircraft Type

- Very Light Jets

- Light Jets

- Mid-Size Jets

- Large Jets

By Ownership

- Full Ownership

- Fractional Ownership

- Charter Services

- Jet Cards

By End-User

- Corporate

- Individuals/HNWIs

- Government/Military

- Charter Operators

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Rising Demand for Personalized and Time-Efficient Travel

The increasing demand for personalized, flexible, and time-efficient travel experiences is a significant driver in the private jet manufacturing industry. High-net-worth individuals and business travelers are seeking alternatives to commercial flights, valuing the convenience and efficiency that private jets offer. This trend is fueled by the desire to avoid crowded airports, adhere to personalized schedules, and access remote destinations with ease.

Restraint

High Maintenance and Operational Costs

Despite the growing demand, the private jet industry faces significant restraints due to high maintenance and operational costs. Owning and operating a private jet involves substantial expenses, including regular maintenance, fuel, crew salaries, insurance, and hangar fees. These costs can be prohibitive, especially for new entrants and small operators, limiting market expansion.

Opportunity

Expansion in Emerging Markets

Emerging markets present a substantial opportunity for private jet manufacturers. Regions such as Southeast Asia, India, and parts of Africa are experiencing economic growth, leading to an increase in the number of high-net-worth individuals and a burgeoning middle class. This demographic shift is creating a new customer base seeking the convenience and prestige associated with private air travel.

Challenge

Navigating Regulatory Compliance

Navigating the complex landscape of regulatory compliance remains a significant challenge for private jet manufacturers and operators. The industry is subject to stringent regulations concerning safety standards, environmental impact, and airspace management. Compliance with evolving aviation regulations and safety standards demands continuous vigilance and investment in compliance measures.

Furthermore, the increasing focus on environmental sustainability is leading to stricter emissions regulations, compelling manufacturers to innovate and develop more eco-friendly aircraft. Adapting to these regulatory changes requires substantial investment in research and development, as well as modifications to existing manufacturing processes, posing both financial and operational challenges.

Growth Factors

Post-Pandemic Demand and Market Expansion

The private jet manufacturing sector is experiencing significant growth, primarily driven by the increased demand for personalized and time-efficient travel options. High-net-worth individuals and business travelers are seeking alternatives to commercial flights, valuing the convenience and efficiency that private jets offer. This trend is further amplified by the desire to avoid crowded airports and adhere to personalized schedules.

Emerging Trends

Sustainability and Technological Advancements

Sustainability is becoming a central focus in the private aviation industry. Manufacturers are investing in the development of sustainable aviation fuels (SAF) and exploring hybrid or electric propulsion systems to reduce carbon emissions. The use of lightweight materials, such as carbon fiber composites, is also being adopted to improve fuel efficiency.

Technological advancements are transforming private jets into airborne offices, equipped with high-speed internet and advanced communication tools, allowing business travelers to remain productive while in transit. Artificial intelligence is also playing an increasing role in predictive maintenance, helping operators anticipate service needs, minimize downtime, and reduce long-term maintenance costs.

Business Benefits

Enhanced Productivity and Flexibility

Private jet travel offers significant benefits for business executives, including enhanced productivity and flexibility. With the ability to create customized travel itineraries, executives can align their schedules with business demands, avoiding the constraints of commercial flight timetables.

The privacy and comfort of private jets provide an environment conducive to conducting meetings, strategizing, and working without distractions. This level of control over travel arrangements enables businesses to respond swiftly to opportunities and challenges, maintaining a competitive edge in the market.

Key Player Analysis

The private jet manufacturing industry in 2025 is characterized by innovation and strategic growth. Leading companies are focusing on advanced aircraft development, expanding their service offerings, and forming strategic partnerships to meet the evolving demands of global clientele.

Gulfstream Aerospace continues to set industry standards with its commitment to innovation and customer satisfaction. In 2025, the company is advancing its G700 and G800 models, emphasizing enhanced performance and cabin comfort. The G700, in particular, offers a range of 7,500 nautical miles and features the most spacious cabin in its class.

Bombardier Inc. is focusing on expanding its market presence through strategic initiatives. The company is emphasizing its Global 7500 and upcoming Global 8000 aircraft, which offer unparalleled range and comfort. Additionally, Bombardier is investing in aftermarket services and certified pre-owned aircraft programs to provide comprehensive solutions to its clients.

Dassault Aviation is strengthening its position in the private jet market with the development of the Falcon 10X, scheduled for entry into service in the coming years. This aircraft is designed to offer exceptional range and comfort, featuring a spacious cabin and advanced technology. Dassault’s focus on innovation and quality ensures that it remains a preferred choice for discerning customers seeking high-performance business jets.

Top Key Players in the Market

- Bombardier Inc.

- Gulfstream Aerospace

- Dassault Aviation

- Embraer S.A.

- Cessna

- Airbus SE

- Boeing Business Jets

- Pilatus

- Textron Aviation

- Others

Recent Developments

- In April 2025, the Gulfstream G800 received certifications from both the U.S. Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA). With a maximum range of 8,200 nautical miles, it stands as one of the longest-range business jets available.

- In October 2024, Textron Aviation unveiled the Citation CJ4 Gen3, featuring next-generation Garmin G3000 PRIME avionics and enhanced design elements. The aircraft is expected to enter service in 2026.

Report Scope

Report Features Description Market Value (2024) USD 36.35 Bn Forecast Revenue (2034) USD 106.99 Bn CAGR (2025-2034) 11.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Aircraft Type (Very Light Jets, Light Jets, Mid-Size Jets, Large Jets), By Ownership (Full Ownership, Fractional Ownership, Charter Services, Jet Cards), By End-User: Corporate, Individuals/HNWIs, Government/Military, Charter Operators) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Bombardier Inc., Gulfstream Aerospace, Dassault Aviation, Embraer S.A., Cessna, Airbus SE, Boeing Business Jets, Pilatus, Textron Aviation, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Private Jet Manufacturers MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample

Private Jet Manufacturers MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Bombardier Inc.

- Gulfstream Aerospace

- Dassault Aviation

- Embraer S.A.

- Cessna

- Airbus SE

- Boeing Business Jets

- Pilatus

- Textron Aviation

- Others