Global Digital Publishing Market Size, Share, Statistics Analysis Report By Type (Text Content, Video Content, Audio Content), By Product (e-books, Online magazines, Newsletters, Catalogs, Podcasts, Memes, Brochures, Presentations, Newspapers, Blogs, Others), By Usage Mode (Subscription Based, One-time Pay, Others), By Application (Smartphones, Laptops, PCs, Others), By End-User (Scientific Technical, & Medical (STM), Legal & Business, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: May 2025

- Report ID: 147870

- Number of Pages: 265

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

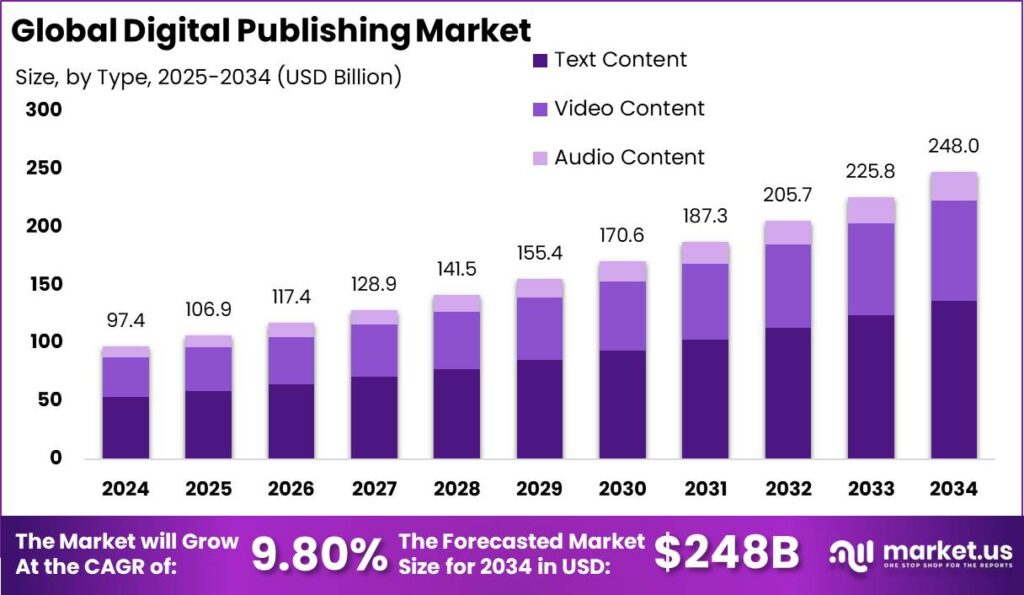

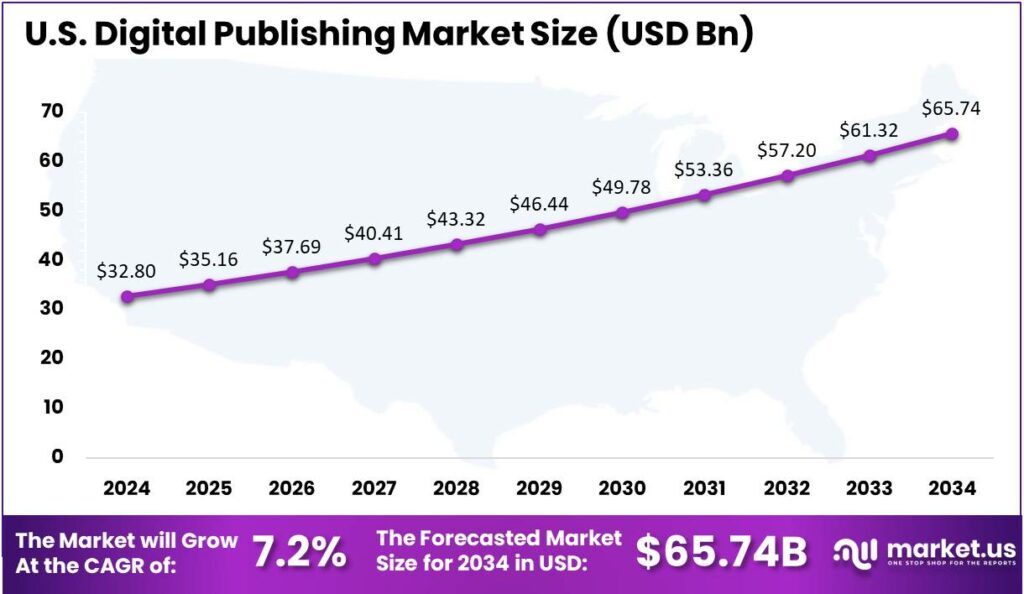

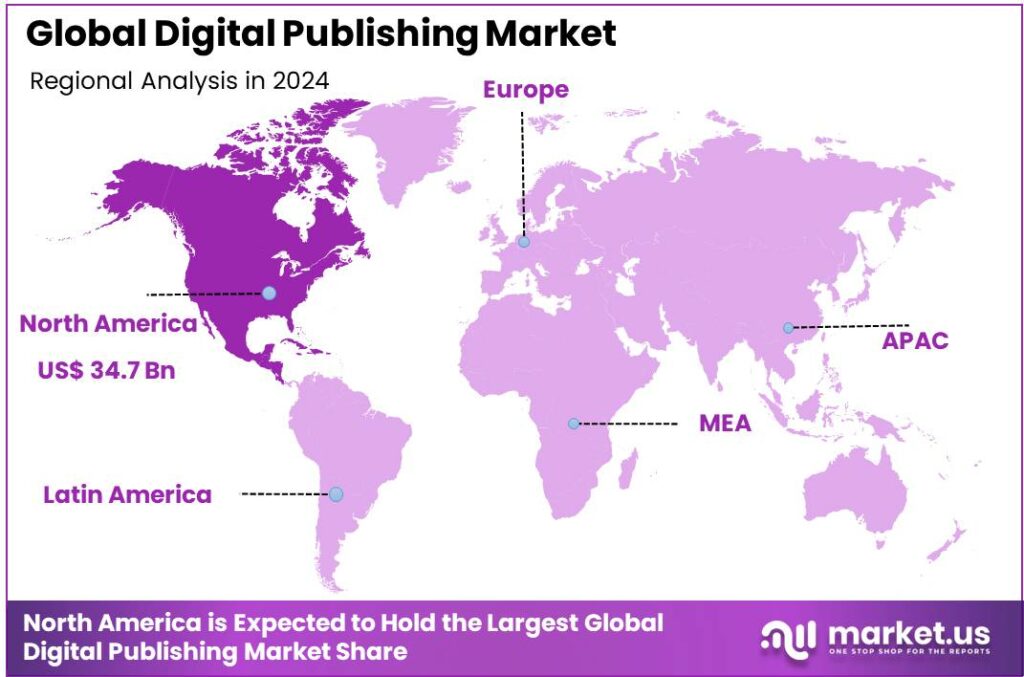

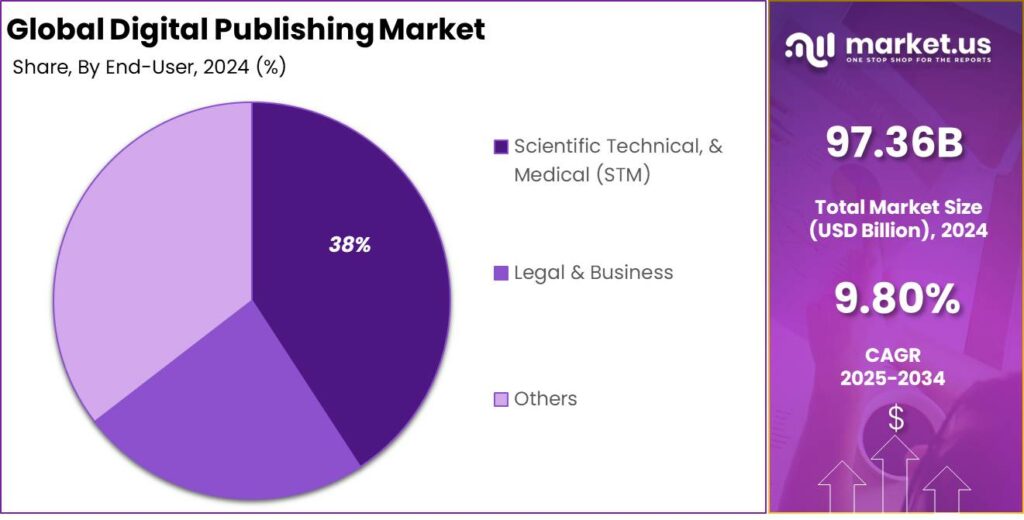

The Digital Publishing Market size is expected to be worth around USD 248 Bn By 2034, from USD 97.36 Bn in 2024, growing at a CAGR of 9.8% during the forecast period from 2025 to 2034. In 2024, North America dominated market with a 35.7% share, generating USD 34.7 bn in revenue. The U.S. market, valued at USD 32.8 bn, is expected to grow at a 7.2% CAGR, fueled by the demand for digital-first content in news, education, entertainment, and independent publishing.

Digital publishing is the distribution of content through digital platforms like websites, apps, e-books, and online magazines. It spans industries like media, education, entertainment, and corporate communication, offering benefits like flexible formats, lower production costs, and real-time distribution, making it a popular choice for publishers, authors, educators, and marketers.

Primary factors driving digital publishing include the widespread adoption of smartphones, high-speed internet, and technological innovations like AI-powered content recommendations. These changes have led to increased digital content consumption, particularly among Gen Z and millennials. Educational institutions are embracing e-learning, boosting demand for digital textbooks, while businesses invest in content marketing and digital communication tools.

Consumer preferences are increasingly shifting towards personalized, on-demand content that is accessible across multiple devices. The rise of smartphones and high-speed internet has made digital content more accessible, fueling demand for e-books, audiobooks, and interactive media. The convenience of accessing a vast library of content anytime and anywhere is a key driver of this trend.

The demand for digital content is further amplified by the increasing consumption of e-books, audiobooks, and podcasts. Consumers seek flexible and accessible content formats, leading to a surge in digital subscriptions and memberships. Publishers are responding by diversifying their offerings and exploring new revenue streams beyond traditional advertising, such as paywalls and exclusive content access.

According to Market.us, The Global Audiobooks Market size is expected to be worth around USD 39.1 Billion By 2032, from USD 5.3 Billion in 2023, growing at a CAGR of 25.7% during the forecast period from 2024 to 2033. Technological advancements play a pivotal role in shaping the digital publishing landscape.

The emergence of immersive technologies like augmented reality (AR) and virtual reality (VR) provides innovative ways to present content, enhancing reader engagement. Moreover, the implementation of responsive design ensures optimal content display across various devices, improving user experience.

The industry is set for sustained growth, driven by ongoing technological advancements and evolving consumer expectations. The emphasis will shift towards more interactive and personalized content experiences. As data analytics become increasingly sophisticated, publishers will be able to better predict trends and adapt quickly, ensuring they remain relevant in the fast-changing digital landscape.

Key Takeaways

- The Global Digital Publishing Market is expected to reach USD 248 billion by 2034, up from USD 97.36 billion in 2024, growing at a CAGR of 9.80% during the forecast period from 2025 to 2034.

- In 2024, the Text Content segment held a dominant position in the market, capturing more than 55% of the global digital publishing market share.

- The e-books segment held a significant market position in 2024, capturing over 20% of the total share.

- In 2024, the Subscription-Based segment was the dominant market player, accounting for more than 61% of the market share. This growth is attributed to its recurring revenue model, ease of access, and the growing consumer preference for bundled content services.

- The Smartphones segment held a commanding position in 2024, capturing more than 53% of the global digital publishing market share.

- In 2024, the Scientific, Technical & Medical (STM) segment held a dominant market position, capturing more than 38% of the global digital publishing market share.

- North America held a dominant position in the global digital publishing market in 2024, with a market share of over 35.7%, generating approximately USD 34.7 billion in revenue.

- In 2024, the U.S. digital publishing market was valued at USD 32.8 billion, fueled by the rise of digital-first content in news, education, entertainment, and independent publishing. This market is expected to grow at a CAGR of 7.2%, driven by increasing demand for personalized, on-demand content.

U.S. Market Size

In 2024, the U.S. digital publishing market reached a substantial valuation of USD 32.8 billion, reflecting the steady rise of digital-first content consumption across sectors such as news media, education, academic publishing, entertainment, and independent authorship.

This growth is fueled by the rising use of mobile devices, high-speed internet, and widespread adoption of e-readers and tablets, which have transformed how users consume content. The shift to digital is also driven by its cost-efficiency, convenience, and global accessibility, encouraging publishers to move away from traditional print.

The market is projected to expand at a compound annual growth rate (CAGR) of 7.2%, driven largely by the growing demand for personalized and on-demand content. Educational institutions and corporate training providers are rapidly integrating digital textbooks, interactive modules, and multimedia eLearning tools, enhancing accessibility and learner engagement.

The growth of the U.S. digital publishing market is fueled by rising use of DRM tools, cloud publishing, and monetization technologies. Self-publishing platforms like Amazon Kindle Direct Publishing and Apple Books have made it easier for independent creators to reach wide audiences. As content digitization advances and consumer preferences shift toward digital formats, the market is set to stay resilient and innovative.

In 2024, North America held a dominant position in the global digital publishing market, capturing over 35.7% share and generating approximately USD 34.7 billion in revenue. This leadership is largely driven by the region’s advanced digital infrastructure, widespread broadband penetration, and strong presence of tech giants and digital content platforms.

The U.S., in particular, has been at the forefront of digital innovation, with publishing houses, streaming platforms, academic institutions, and independent authors embracing digital-first models. The shift from print to digital has accelerated due to evolving consumer habits favoring mobile-friendly, on-demand, and multimedia-rich content formats.

North America’s strong lead in digital publishing stems from its mature e-commerce and subscription ecosystem, with platforms like Kindle, Apple Books, Scribd, and Audible offering diverse content. Widespread adoption of e-books, online journals, and e-learning tools in education and business further drives demand for digital content.

Clear digital copyright regulations, robust data protection, and a tech-savvy population make North America a strong market for digital publishing. Publishers are early adopters of AI, DRM, and analytics to enhance user engagement, while the growing popularity of audiobooks and podcasts is transforming how content is consumed, especially by millennials and Gen Z.

Type Analysis

In 2024, Text Content segment held a dominant market position, capturing more than a 55% share of the global digital publishing market. This leadership was largely attributed to the high volume of digital articles, e-books, blogs, newsletters, and academic publications being consumed across platforms. Text remains the most accessible and widely used content format, particularly for users seeking news, learning material, and long-form information.

The demand for digital newspapers, journals, and e-books has increased significantly in both developed and emerging economies, reinforcing the segment’s dominance. With traditional print media steadily declining, media houses and publishers have invested heavily in digital-first strategies that prioritize written content optimized for mobile devices and search engines.

Corporate communication and business content creation have also leaned heavily into the text content segment, using it for internal communication, whitepapers, case studies, and digital brochures. As more companies rely on content marketing and thought leadership, written formats have proven essential in engaging B2B and B2C audiences.

While video and audio formats are growing in popularity, text content remains dominant due to its efficiency, searchability, and precision. It is essential for users seeking detailed information, research, or silent consumption. Additionally, its adaptability to SEO and role in knowledge preservation ensure text’s continued prominence in the digital publishing landscape.

Product Analysis

In 2024, the e-books segment held a dominant position in the digital publishing market, capturing over 20% of the total share. This leadership is attributed to the increasing adoption of digital reading devices, such as e-readers, tablets, and smartphones, which offer readers convenient access to a vast array of content.

The e-books segment’s prominence is further reinforced by the rise of self-publishing platforms, which empower authors to distribute their work directly to readers without traditional publishing constraints. This democratization of publishing has led to a surge in diverse and niche content, catering to varied reader interests.

Technological advancements have also played a crucial role in bolstering the e-books market. Features such as adjustable fonts, integrated dictionaries, and interactive elements enhance the reading experience, making e-books more accessible to a broader audience, including individuals with visual impairments or learning disabilities.

The e-books segment is poised for sustained growth, fueled by ongoing innovations in digital publishing and changing consumer preferences for portable, customizable reading options. As global internet access expands, e-books will continue to lead the digital publishing market, providing a flexible and dynamic platform for both readers and publishers.

Usage Mode Analysis

In 2024, Subscription Based segment held a dominant market position, capturing more than a 61% share, largely due to its recurring revenue model, ease of access, and growing consumer preference for bundled content services. The shift to digital consumption, particularly among millennials and Gen Z, has driven the adoption of subscription models, offering continuous access to books, magazines, and newspapers without the need for repeated purchases.

The popularity of subscription-based services is also fueled by content personalization and algorithmic recommendations. These features enhance user engagement and satisfaction, making it more likely for subscribers to renew their plans. For publishers, this model ensures predictable income streams and helps build long-term customer relationships.

The dominance of this segment is also driven by digital bundling and cross-media integration. Subscription packages often include text, audio, and video content, appealing to a broad audience. Educational publishers and news outlets, for example, offer bundles with eBooks, podcasts, live sessions, and interactive tools, increasing retention and expanding the user base.

The growth of B2B subscription services is becoming a key revenue driver in digital publishing. Corporate libraries, academic institutions, and research organizations are investing in subscriptions for access to journals, data, and premium content. This enterprise demand, alongside consumer usage, makes the subscription model both dominant and scalable in the digital publishing landscape.

Application Analysis

In 2024, the Smartphones segment held a dominant market position, capturing more than a 53% share in the global digital publishing market. This leadership can be primarily attributed to the explosive rise in mobile internet penetration and the increasing preference for on-the-go content consumption.

The segment’s dominance is further reinforced by the large and growing global smartphone user base, providing a vast audience for digital content. In response, publishers and content creators are adopting mobile-optimized layouts, responsive designs, and app-based distribution to enhance user experience and engagement.

Another critical factor fueling this dominance is the seamless access to digital libraries, news aggregators, and real-time notifications on mobile devices. Smartphones allow immediate interaction with multimedia-rich formats combining text, audio, video, and animations which has added a dynamic layer to storytelling and academic publishing alike.

The affordability of entry-level smartphones and widespread 4G/5G coverage in emerging markets has broadened access to digital content. Regions like India, Southeast Asia, and Latin America are seeing a rise in mobile readership, fueling growth. With mobile-first strategies and mobile-native advertising, the smartphone segment is set to remain dominant.

End-User Analysis

In 2024, the Scientific, Technical & Medical (STM) segment held a dominant market position, capturing more than a 38% share of the global digital publishing market. This leadership is driven by the academic and research communities’ increasing reliance on digital platforms for sharing peer-reviewed journals, conference proceedings, and specialized technical content.

The STM segment has grown due to rising demand for timely, high-impact scientific knowledge, highlighting the need for rapid, open-access publishing. Platforms like PubMed Central and SpringerLink have expanded their digital infrastructure to serve global researchers and medical professionals. The adoption of open-access models has increased visibility and reach, boosting digital revenue in the STM space.

Technological integration in STM publishing, including AI for manuscript screening, blockchain for copyright protection, and data analytics, boosts credibility and discoverability. Digital formats also offer interactive datasets, multimedia, and real-time updates, features that print cannot replicate and are highly valued by the scientific community.

Key Market Segments

By Type

- Text Content

- Video Content

- Audio Content

By Product

- e-books

- Online magazines

- Newsletters

- Catalogs

- Podcasts

- Memes

- Brochures

- Presentations

- Newspapers

- Blogs

- Others

By Usage Mode

- Subscription Based

- One-time Pay

- Others

By Application

- Smartphones

- Laptops

- PCs

- Others

By End-User

- Scientific Technical, & Medical (STM)

- Legal & Business

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Mobile-First Consumption and On-Demand Access

The proliferation of smartphones and affordable internet access has fundamentally changed how people consume content. In emerging markets, mobile devices have become the primary means of accessing digital content, enabling users to engage with e-books, news, and multimedia on-the-go. This shift has expanded the reach of digital publishers, allowing them to tap into previously underserved demographics.

The convenience of on-demand access aligns with modern consumer expectations, fostering increased engagement and subscription rates. Moreover, the integration of digital infrastructure in these regions supports the seamless delivery of content, further propelling market growth. As a result, the digital publishing market is poised to continue its upward trajectory, driven by the mobile-first approach and the demand for instant, accessible content.

Restraint

Digital Piracy and Copyright Infringement

Despite the growth of digital publishing, piracy remains a significant challenge. Unauthorized distribution of digital content undermines revenue streams and discourages content creation. Platforms like Library Genesis and other shadow libraries facilitate the illegal sharing of copyrighted materials, impacting authors and publishers alike.

Legal actions, such as the lawsuit against Meta for using pirated books to train AI models, highlight the ongoing struggle to protect intellectual property rights. These infringements not only result in financial losses but also erode the value of original works, posing a threat to the sustainability of the digital publishing industry. Addressing piracy requires robust legal frameworks and technological solutions to safeguard content and ensure fair compensation for creators.

Opportunity

Expansion in Emerging Markets via Mobile Access

Emerging markets present a substantial opportunity for digital publishers. The widespread adoption of mobile devices in regions with limited traditional infrastructure allows publishers to reach new audiences. In areas where physical bookstores and libraries are scarce, digital platforms can provide access to a vast array of content, including educational materials and literature.

This democratization of information empowers individuals and supports literacy and education initiatives. By tailoring content to local languages and cultural contexts, publishers can enhance relevance and engagement. Investing in these markets not only drives revenue growth but also contributes to social development, positioning digital publishing as a catalyst for positive change.

Challenge

Monetization Amidst Ad-Blocking and Platform Dominance

Monetizing digital content has become increasingly complex due to the rise of ad-blocking technologies and the dominance of major platforms. Ad blockers reduce the effectiveness of traditional advertising models, leading to significant revenue losses for publishers.

Various platforms control significant digital traffic, funneling users into their ecosystems and limiting direct engagement with publisher sites. This reduces publishers’ ability to generate income and control content distribution. To adapt, publishers must explore alternative monetization strategies like subscriptions, partnerships, and diverse content to sustain operations and maintain editorial independence.

Emerging Trends

The digital publishing landscape is rapidly evolving, with AI leading the way in transforming content creation, editing, and distribution. AI tools enhance editorial workflows by generating personalized content, optimizing headlines, and tailoring materials for different platforms, boosting efficiency and audience engagement.

With more readers using smartphones and tablets, mobile optimization has become essential. Publishers are focusing on mobile-friendly designs for smooth, consistent experiences across devices. Simultaneously, the shift toward a cookieless future is driving the adoption of first-party data and privacy-focused personalization strategies.

Interactive content is on the rise, enriching storytelling and boosting engagement through videos and graphics. Niche publications are growing, targeting specific audiences with tailored content. Digital publishing also promotes sustainability by reducing paper use. Embracing these trends is vital for staying relevant in the digital age.

Business Benefits

Digital publishing significantly reduces expenses by eliminating the need for printing, paper, and physical distribution. This allows businesses to allocate resources more effectively, focusing on content quality and marketing strategies. The streamlined process not only saves money but also accelerates the time-to-market for publications.

Digital formats offer interactive features such as videos, hyperlinks, and animations, enhancing reader engagement. These interactive elements provide a dynamic user experience, encouraging readers to spend more time with the content and fostering a deeper connection with the brand.

Digital publishing platforms provide real-time data on reader behavior, including metrics like page views, time spent on content, and click-through rates. This data-driven approach enables businesses to understand their audience better and tailor content to meet their preferences effectively.

Key Player Analysis

Adobe Inc. has long been a leader in digital content creation, especially with its flagship software products like Adobe InDesign, Photoshop, and Acrobat. These tools are integral for digital publishers who create and design eBooks, magazines, and other forms of digital media. Adobe’s cloud-based solutions, including Adobe Document Cloud and Adobe Creative Cloud, make it easier for publishers to collaborate and manage their work digitally.

Amazon.com Inc. has revolutionized the digital publishing market through its Kindle platform and Kindle Direct Publishing (KDP) service. Amazon’s Kindle devices and apps have made reading digital books convenient and accessible, while KDP offers a self-publishing platform that allows authors to directly reach a global audience. Amazon continues to dominate the eBook market by offering affordable and easy-to-use services for writers and readers alike.

Apple Inc. has significantly influenced digital publishing through its iBooks platform, which allows users to purchase, read, and interact with eBooks and audiobooks across Apple devices. Apple’s iTunes store is a key distribution channel, and its ecosystem, including the iPad and iPhone, allows publishers to reach millions. Apple’s focus on design and user experience makes its digital publishing services appealing to both creators and consumers.

Top Key Players in the Market

- Adobe Inc.

- Amazon.com Inc.

- Apple Inc.

- Thomson Reuters Corp.

- Netflix Inc.

- Comcast Corp.

- RELX Group plc

- Xerox Corporation

- BuzzFeed, Inc.

- 1854 Media Limited

- 911Media

- 24Media, Inc.

- Others

Top Opportunities for Players

- AI-Powered Content Creation: Artificial Intelligence is transforming how content is produced. Publishers are utilizing AI tools to generate articles, headlines, and even entire books, enhancing efficiency and reducing costs. This technology also enables personalized content delivery, improving reader engagement. The integration of AI is becoming a competitive advantage in the industry.

- Immersive Experiences with AR/VR: Augmented and Virtual Reality are being adopted to create immersive reading experiences. These technologies allow publishers to offer interactive content, such as 3D visualizations and virtual environments, enhancing storytelling and reader engagement. This approach is particularly effective in educational and children’s publishing sectors.

- Rise of Niche Publications: There is a growing trend towards niche publications that cater to specific audiences or interests. Digital platforms make it easier to reach targeted demographics, allowing publishers to build dedicated communities and offer specialized content. This strategy can lead to higher engagement and loyalty among readers.

- Subscription-Based Models: Subscription services are becoming increasingly popular, providing a steady revenue stream for publishers. By offering exclusive content and personalized experiences, publishers can attract and retain subscribers. This model also allows for better data collection and understanding of reader preferences.

- Expansion into Emerging Markets: Digital publishing is expanding into emerging markets, where increased internet access and mobile device usage are opening new opportunities. Platforms are tailoring content to local languages and cultures, tapping into previously underserved audiences. This expansion is driving global growth in the industry.

Recent Developments

- In March 2025, Adobe enhanced its GenStudio platform to support marketing and creative teams in managing increasing content demands through AI-driven workflows.

- In January 2025, Amazon UK renewed its supply agreement with Bloomsbury Publishing, ensuring continued availability of popular titles like the ‘Harry Potter’ series.

- In August 2024, Thomson Reuters announced the acquisition of Safe Sign Technologies, a UK-based startup developing legal-specific large language models (LLMs). This acquisition aims to accelerate Thomson Reuters’ AI strategy in the legal domain.

Report Scope

Report Features Description Market Value (2024) USD 97.36 Bn Forecast Revenue (2034) USD 248 Bn CAGR (2025-2034) 9.80% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (Text Content, Video Content, Audio Content), By Product (e-books, Online magazines, Newsletters, Catalogs, Podcasts, Memes, Brochures, Presentations, Newspapers, Blogs, Others), By Usage Mode (Subscription Based, One-time Pay, Others), By Application (Smartphones, Laptops, PCs, Others), By End-User (Scientific Technical, & Medical (STM), Legal & Business, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Adobe Inc., Amazon.com Inc., Apple Inc., Thomson Reuters Corp., Netflix Inc., Comcast Corp., RELX Group plc, Xerox Corporation, BuzzFeed, Inc., 1854 Media Limited, 911Media, 24Media, Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Adobe Inc.

- Amazon.com Inc.

- Apple Inc.

- Thomson Reuters Corp.

- Netflix Inc.

- Comcast Corp.

- RELX Group plc

- Xerox Corporation

- BuzzFeed, Inc.

- 1854 Media Limited

- 911Media

- 24Media, Inc.

- Others