Global Renewable Drone Market Size, Share, Statistics Analysis Report By Type (Fixed-Wing, Multi-Rotor), By Propulsion System (Solar, Wind, Hybrid (Solar and Wind)), By Payload Capacity (5 kg, 5-15 kg, 15-25 kg, >25 kg), By Range (50 km, 50-100 km, 100-200 km, >200 km), By Application (Aerial Surveying and Mapping, Delivery and Logistics, Inspection and Monitoring, Agriculture, Security and Surveillance), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: May 2025

- Report ID: 147775

- Number of Pages: 396

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- U.S. Renewable Drone Market

- Type Analysis

- Propulsion System Analysis

- Payload Capacity Analysis

- Range Analysis

- Application Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Key Features

- Emerging Trends

- Business Benefits

- Key Player Analysis

- Top Opportunities for Players

- Recent Developments

- Report Scope

Report Overview

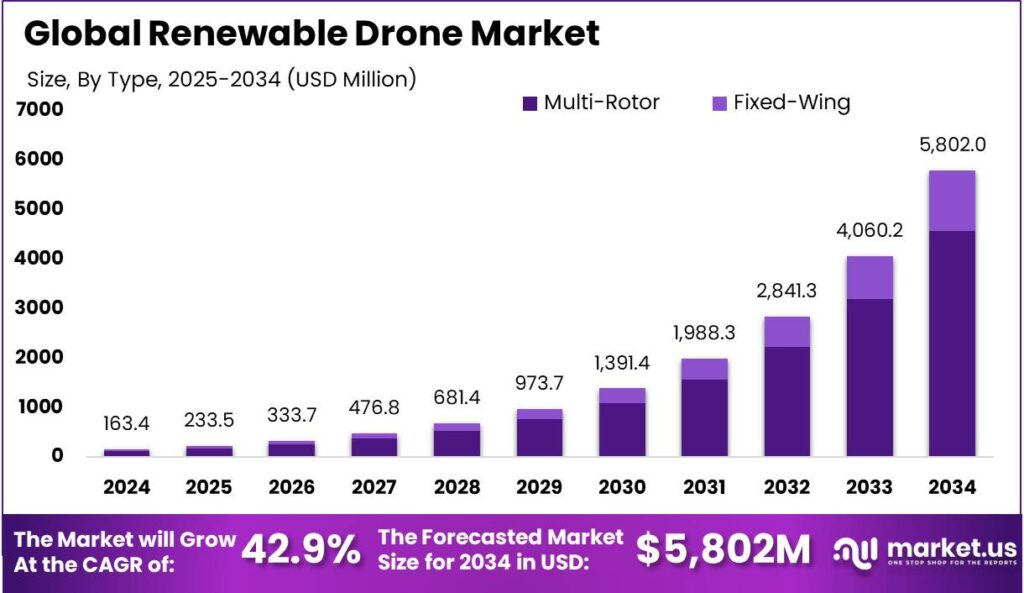

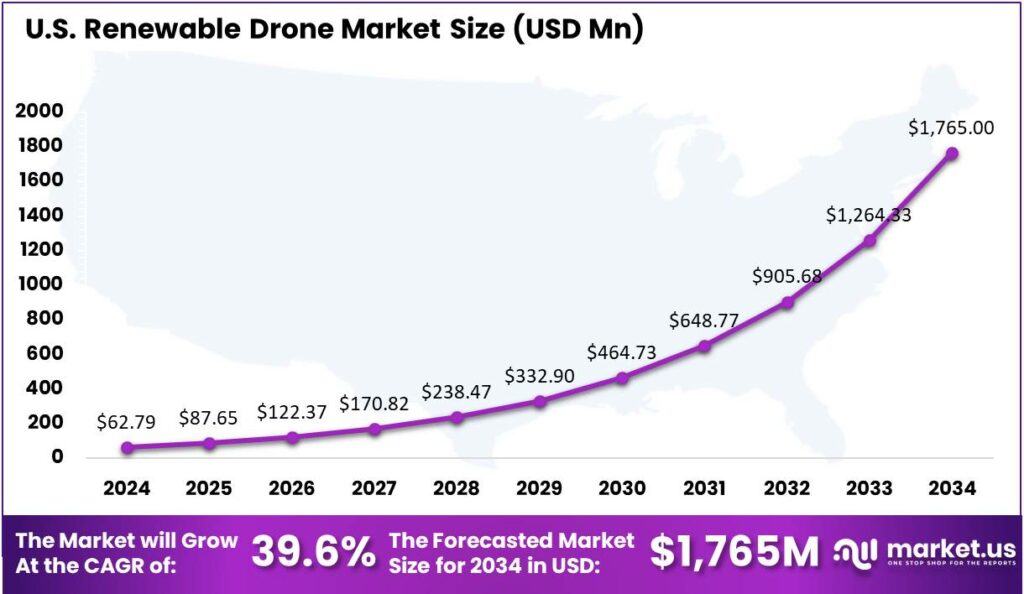

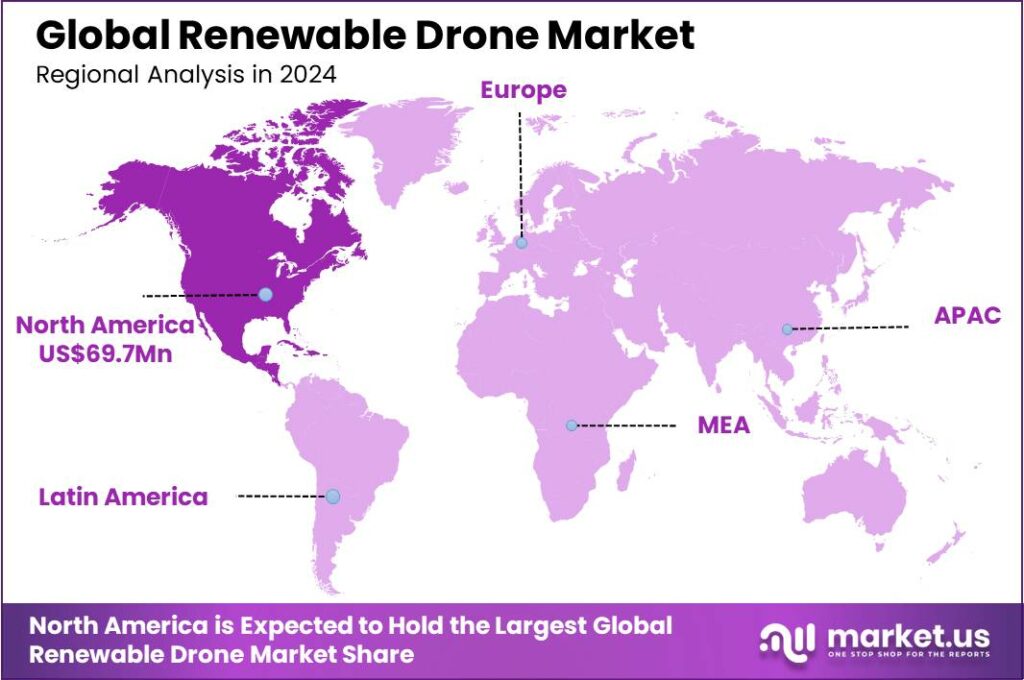

The Renewable Drone Market size is expected to be worth around USD 5,802 Mn By 2034, from USD 163.4 Mn in 2024, growing at a CAGR of 42.9% during the forecast period from 2025 to 2034. In 2024, North America led the global renewable drone market with over 42.7% market share, generating around USD 69.7 Mn. The U.S. market alone was valued at USD 62.79 Mn, with a strong 39.6% CAGR, driven by the growing adoption of sustainable drones.

The renewable drone market is experiencing significant growth, driven by the increasing adoption of renewable energy sources and the need for efficient infrastructure monitoring. This growth is attributed to the enhanced monitoring capabilities of renewable drones, which offer cost-effective solutions for inspecting large-scale renewable energy installations.

The integration of artificial intelligence and machine learning further augments their efficiency, allowing for real-time data analysis and predictive maintenance. As the renewable energy sector continues to expand, the demand for renewable drones is expected to rise, offering substantial investment opportunities and business benefits.

The demand for renewable drones is further amplified by the need for real-time data collection and analysis. These drones can quickly identify issues such as equipment malfunctions or energy losses, allowing for prompt corrective actions. This capability is particularly valuable in remote or hard-to-reach areas where traditional inspection methods are challenging.

The rise in renewable drone adoption is driven by the need to cut operational costs and improve safety in energy infrastructure maintenance. Drones replace risky, expensive manual inspections, accessing hard-to-reach areas without disrupting operations. This enables more frequent, thorough inspections, enhancing asset management and reducing the risk of unexpected failures.

According to Market.us, The global drone market is set for considerable expansion, with its valuation expected to reach approximately USD 95.4 billion by 2034, rising from USD 36.4 billion in 2024. This projected growth reflects a steady CAGR of 10.1% between 2025 and 2034, supported by increasing demand across sectors such as agriculture, logistics, surveillance, and infrastructure monitoring.

As per the report from Gitnux, sustainability has become a major focus across the drone ecosystem, with over 60% of manufacturers integrating eco-friendly materials into their product lines by 2023. In agriculture, drones are helping reduce pesticide use by around 25%, offering a cleaner and safer approach to crop management. In battery innovations, energy consumption in drone operations has dropped by 15% over the last five years.

About 45% of drone firms are actively exploring solar-powered or hybrid propulsion systems to enhance energy efficiency. Meanwhile, 85% of service providers globally have started adopting sustainable practices in their operations. Electric drones are gaining traction in delivery services, expected to capture 80% of the market by 2025, significantly lowering dependence on fuel.

Key Takeaways

- The Global Renewable Drone Market is expected to reach USD 5,802 Million by 2034, growing from USD 163.4 Million in 2024, with a CAGR of 42.90% during the forecast period from 2025 to 2034.

- In 2024, the Multi-Rotor segment held a dominant market share, capturing more than 78.7% of the global renewable drone market.

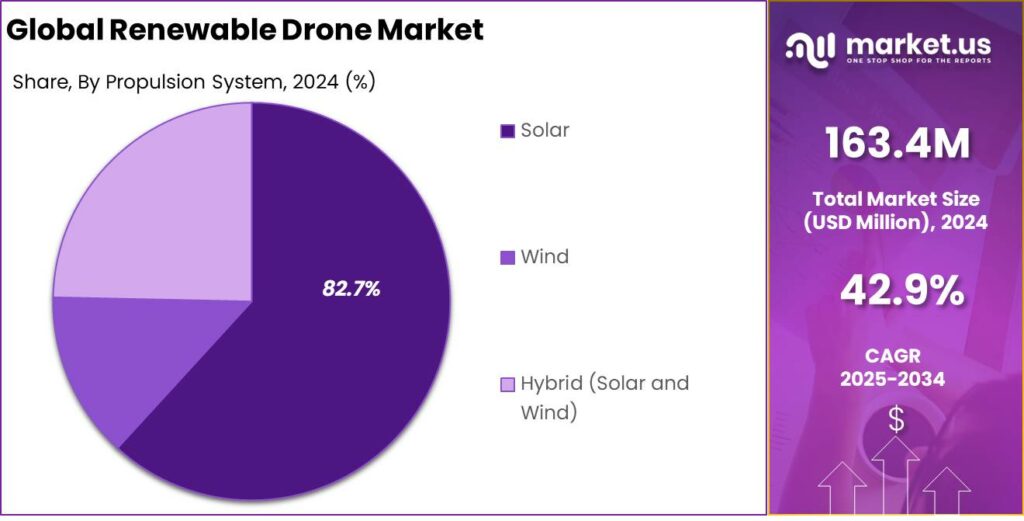

- The solar segment also had a dominant market position in 2024, holding more than 82.7% of the global renewable drone market.

- The 5–15 kg payload capacity segment led the market in 2024, capturing more than 38.4% of the global renewable drone market.

- The 50 km range segment dominated in 2024, with a share of more than 41.9% in the global renewable drone market.

- The Aerial Surveying and Mapping segment also held a significant market share, capturing more than 41.3% of the global renewable drone market in 2024.

- North America was the leading region in the global renewable drone market in 2024, holding more than 42.7% of the market share, generating approximately USD 69.7 million in revenue.

- In 2024, the U.S. renewable drone market was valued at USD 62.79 million, with a strong projected growth rate of 39.6% CAGR, reflecting the rapid adoption of sustainable unmanned aerial systems.

U.S. Renewable Drone Market

In 2024, the U.S. Renewable Drone Market was valued at USD 62.79 million, reflecting the early but accelerating adoption of sustainable unmanned aerial systems across various industrial sectors. Solar-powered and renewable energy drones are increasingly used for eco-friendly data collection, surveying, monitoring, and logistics.

The renewable drone market is expected to grow at a 39.6% CAGR, making it one of the fastest-growing segments in the drone and green-tech space. Growth is fueled by demand in agriculture, energy, forestry, and disaster management, with solar-powered drones gaining popularity for surveillance, communication, and eco-friendly operations like grid inspection and smart farming.

Government incentives and stricter emissions regulations are accelerating the development of renewable drones, with support from both public grants and private investment in clean tech startups. As states push for carbon neutrality, innovations in lightweight materials, solar panels, and hybrid propulsion are driving growth and enhancing drone performance for sustainable operations across industries.

In 2024, North America held a dominant market position, capturing more than a 42.7% share in the global renewable drone market and generating approximately USD 69.7 million in revenue. This regional leadership can be attributed to the early adoption of advanced drone technologies, robust funding for clean energy research, and a strong ecosystem of drone manufacturers and tech startups.

North America’s leadership in the renewable drone market stems from strong integration of clean energy with UAVs, heavy investment in solar and hybrid systems, and growing demand from defense, public safety, and utility sectors. Collaborations between research institutions and tech firms further drive innovation in solar and energy storage solutions, reinforcing long-term market dominance.

The Federal Aviation Administration (FAA) has been actively updating drone flight rules, paving the way for beyond visual line of sight (BVLOS) operations, which is a critical factor for solar-powered long-endurance drones. Increasing climate awareness and sustainability mandates from U.S. corporations are boosting the adoption of renewable drone technologies in logistics, inspection, and remote sensing. Additionally, North America’s supportive airspace regulations make it more favorable for drone operations than other regions.

Although other regions are catching up, North America’s strength lies in its robust technological infrastructure, clear regulations, innovation funding, and readiness for large-scale commercialization. This positions the region as both a revenue leader and a key innovation hub in the global renewable drone ecosystem.

Type Analysis

In 2024, the Multi-Rotor segment held a dominant market position, capturing more than a 78.7% share of the global renewable drone market. This dominance can be primarily attributed to the segment’s flexibility, cost-efficiency, and ease of use in vertical inspections.

Multi-rotor drones are extensively deployed for tasks such as solar panel monitoring, wind turbine inspection, and site mapping especially in tight or complex environments where maneuverability is essential. Their ability to hover steadily and operate in confined areas has made them highly suitable for renewable energy applications that require precision and proximity.

Another critical reason behind the growth of the multi-rotor segment is its compatibility with high-resolution cameras, thermal imaging sensors, and LiDAR systems. These capabilities enable comprehensive data capture, which is vital for predictive maintenance and real-time fault detection in wind and solar energy systems.

The decreasing prices of commercial-grade multi-rotor drones and the growing availability of software-integrated solutions have expanded their use in both small and utility-scale renewable energy projects. Short operator training times and easy deployment further improve their practicality in daily maintenance, resulting in cost savings and increased system uptime for energy companies.

Propulsion System Analysis

In 2024, the solar segment held a dominant market position, capturing more than a 82.7% share in the global renewable drone market. This significant lead is primarily attributed to the increasing deployment of drones in large-scale solar farms for inspection, fault detection, and thermal imaging analysis.

Solar-powered drones, with their extended flight endurance and low environmental impact, have become a preferred solution in areas with high solar irradiance, especially across regions like North America, India, and the Middle East. These drones are particularly useful for monitoring photovoltaic panels spread over vast terrains, reducing the need for manual labor and improving operational productivity.

The dominance of the solar segment is further strengthened by rapid advancements in photovoltaic efficiency and ultra-lightweight solar cells, which are enabling drones to fly longer without needing external charging infrastructure. This self-sustaining feature drastically cuts down on maintenance costs and enhances reliability, especially in remote or off-grid areas.

The hybrid solar-wind energy systems show potential but face challenges like integration complexities, higher costs, and weight constraints. While ongoing research may unlock future potential, solar-powered drones are expected to lead due to their proven performance, environmental compatibility, and growing role in global clean energy infrastructure.

Payload Capacity Analysis

In 2024, the 5–15 kg payload capacity segment held a dominant market position, capturing more than a 38.4% share of the global renewable drone market. This segment has emerged as the preferred choice among industrial users due to its optimal balance between endurance, functionality, and payload flexibility.

Drones in this weight category can carry medium-sized sensors, high-resolution cameras, and small cargo, making them ideal for agriculture, energy, and infrastructure. Their efficient use of renewable energy, like lightweight solar panels or hybrid systems, enhances their appeal for long flight times and low carbon emissions.

The growth of the 5–15 kg drone segment is driven by its versatility in both commercial and public service applications. In agriculture, they are used for crop monitoring, irrigation, and pesticide spraying, offering precise maneuverability and balanced payloads. In the utility and energy sectors, they support tasks like thermal imaging and power grid inspection, particularly in remote areas where solar-powered drones ensure long, uninterrupted operation.

Technological innovations in drone frames and materials have also contributed to the growth of this segment. The use of lightweight composites allows drones in the 5–15 kg range to accommodate more onboard equipment without compromising flight performance. Combined with efficient renewable energy integration, these drones achieve longer missions and improved cost-effectiveness.

Range Analysis

In 2024, 50 km segment held a dominant market position, capturing more than a 41.9% share in the global renewable drone market. This leadership is primarily driven by the growing demand for short-range surveillance, environmental monitoring, and agricultural inspections that typically do not require long-distance travel.

Most commercial and governmental drone applications in renewable energy, like wind farm inspection and solar panel maintenance, are confined to areas under 50 kilometers. This suits the strengths of this range category cost-effective deployment, lightweight design, and energy efficiency particularly in rural and semi-urban regions.

The 50 km range drones are popular due to their low operational complexity and battery consumption, making them ideal for short-duration missions. They are easy to launch, maintain, and recharge, especially in regions with developing drone infrastructure. With smaller solar or hybrid power systems, these drones offer greater payload flexibility and lower costs, making them the most commercially viable option for routine inspections.

AI-powered automation and smart flight controllers have made 50 km drones more intelligent and autonomous, enabling them to perform scheduled missions, capture high-resolution imagery, and transmit real-time data without human intervention. Their affordability and high ROI for small to mid-sized operations ensure that this range will remain dominant, even as drone technology advances.

Application Analysis

In 2024, Aerial Surveying and Mapping segment held a dominant market position, capturing more than a 41.3% share in the global renewable drone market. This stronghold is largely attributed to the critical role that drones play in mapping large-scale renewable energy installations such as solar farms, wind turbine sites, and hydroelectric terrains.

Renewable energy developers heavily depend on accurate geospatial data to evaluate site suitability, assess terrain elevation, and plan infrastructure layouts. Drones equipped with high-resolution cameras, LiDAR, and GPS capabilities can generate precise 2D and 3D maps far more efficiently and cost-effectively than traditional land surveying methods.

The demand for aerial surveying and mapping is further fueled by the increasing complexity and geographic spread of renewable energy projects. As solar parks and wind farms expand across diverse terrains including deserts, mountainous zones, and offshore areas the ability to capture real-time spatial data from the air has become essential.

Moreover, the integration of AI and machine learning algorithms into drone-based mapping solutions has amplified their value proposition. Drones used for aerial surveying are now capable of detecting surface irregularities, calculating optimal panel orientations, and even predicting erosion or vegetation growth that may affect infrastructure performance.

Key Market Segments

By Type

- Fixed-Wing

- Multi-Rotor

By Propulsion System

- Solar

- Wind

- Hybrid (Solar and Wind)

By Payload Capacity

- 5 kg

- 5-15 kg

- 15-25 kg

- >25 kg

By Range

- 50 km

- 50-100 km

- 100-200 km

- >200 km

By Application

- Aerial Surveying and Mapping

- Delivery and Logistics

- Inspection and Monitoring

- Agriculture

- Security and Surveillance

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Enhancing Operational Efficiency and Cost Reduction

The adoption of drones in the renewable energy sector is primarily driven by their ability to significantly enhance operational efficiency and reduce costs. Traditional inspection methods for solar panels and wind turbines often involve manual labor, which is time-consuming, costly, and sometimes hazardous.

Drones equipped with high-resolution cameras and thermal sensors can perform inspections more quickly and safely, identifying issues such as faulty panels or turbine blade damage without the need for physical access. This not only reduces downtime but also minimizes the risk to human workers.

Moreover, drones can cover large areas in a fraction of the time it would take ground crews, leading to substantial cost savings in maintenance and monitoring operations. The integration of drones into renewable energy operations exemplifies how technology can drive efficiency and safety, making renewable energy sources more competitive and reliable.

Restraint

Regulatory and Airspace Limitations

The deployment of drones in renewable energy projects faces regulatory challenges, as airspace regulations differ across countries. Strict limitations, such as restrictions on beyond visual line of sight (BVLOS) flights and operating near airports or populated areas, can hinder their use. These constraints may reduce the effectiveness of drones, especially in large-scale, remote renewable energy installations.

Additionally, obtaining the necessary permits and ensuring compliance with aviation authorities can be a complex and time-consuming process, potentially delaying project timelines. The lack of standardized regulations across different jurisdictions further complicates international operations for companies looking to deploy drone technology globally. Addressing these regulatory challenges is crucial for the widespread adoption of drones in the renewable energy sector.

Opportunity

Expansion in Emerging Markets

Emerging markets offer significant growth potential for drone applications in renewable energy. Countries in Asia, Africa, and Latin America are investing heavily in renewable energy to meet rising demand and sustainability targets. These regions often feature vast, challenging terrains where traditional inspection and maintenance methods are less practical, making drones an ideal solution.

Drones provide an efficient and cost-effective solution for monitoring and maintaining renewable energy assets in emerging markets. Lower regulatory barriers in some regions can enable faster adoption of drone technology. As these countries expand their renewable energy sectors, the demand for innovative solutions like drones is expected to grow, presenting significant opportunities for drone service providers and manufacturers.

Challenge

Technical Limitations and Data Management

A major challenge in integrating drones into renewable energy operations is their technical limitations, including flight endurance, payload capacity, and data management. Drones often have limited battery life, restricting their ability to cover large areas or perform extended inspections, particularly in remote locations.

The payload capacity of drones limits the number and types of sensors they can carry, which can affect the quality and scope of the data collected. Additionally, managing and analyzing the large volumes of data from drone inspections is a challenge, requiring efficient data processing systems and skilled personnel. Overcoming these technical and data management hurdles is crucial to maximizing the benefits of drone technology in the renewable energy sector.

Key Features

- High-Precision Imaging: These drones come equipped with high-resolution cameras and thermal sensors. Drones can detect hidden issues like overheating solar panels or damaged wind turbine blades, enabling early detection and timely maintenance for optimal energy system performance.

- Enhanced Safety: By using drones, technicians can avoid risky manual inspections. Drones can access hard-to-reach areas, improving safety and speeding up inspections by eliminating the need for workers to climb tall structures or navigate hazardous terrains.

- Automated Flight Paths: Modern drones can be programmed to follow specific flight paths automatically. This ensures comprehensive coverage of inspection areas without missing any spots, leading to more thorough and reliable assessments.

- Cost-Effective Operations: Using drones for inspections reduces the need for manual labor and expensive equipment like helicopters. This leads to significant cost savings in the long run, making renewable energy projects more economically viable.

- Real-Time Data Collection: Drones can transmit data in real-time, allowing for immediate analysis and quicker decision-making. This rapid feedback loop helps in promptly addressing issues, minimizing downtime, and maintaining consistent energy production.

Emerging Trends

One significant trend is the use of solar-powered drones for inspecting solar panels. These drones can fly for extended periods, capturing detailed images to identify issues like dirt or damage on panels. This helps in maintaining the efficiency of solar farms.

In the wind energy sector, drones are being used to inspect turbines. They can access hard-to-reach areas, capturing high-resolution images to detect problems like blade cracks or corrosion. This reduces the need for manual inspections, which can be risky and time-consuming.

Agriculture is also benefiting from renewable drones. Drones equipped with sensors can monitor crop health, soil conditions, and irrigation systems. This data helps farmers make informed decisions, leading to better yields and resource management.

Business Benefits

Regular drone inspections help in early detection of problems, preventing costly repairs down the line. By identifying issues like overheating panels or structural weaknesses early, businesses can address them before they escalate. This proactive approach leads to significant savings in maintenance costs over time.

Drones equipped with advanced sensors can collect a wealth of data, from thermal readings to high-resolution images. This information helps in monitoring the performance of renewable energy installations and making informed decisions. Accurate data ensures that energy systems operate at optimal efficiency.

Using drones reduces the need for heavy machinery and vehicles, lowering carbon emissions. They offer a cleaner alternative for inspections and monitoring, aligning with the eco-friendly goals of renewable energy businesses. This contributes to a smaller environmental footprint and promotes sustainability.

Key Player Analysis

Three key players in the Renewable Drone Market stand out for their innovation, market presence, and tailored solutions for renewable energy.

DJI is the global leader in drone technology and continues to dominate the market with its wide range of products. Known for its advanced flight stability and camera systems, DJI drones are widely used in solar farm inspections and wind turbine assessments. Its drones like the Matrice series come equipped with thermal imaging and AI-powered tracking, ideal for detecting faults in renewable infrastructure.

Autel Robotics is gaining attention with its high-performance drones that balance affordability and professional features. The company stands out for its compact designs and powerful sensors. Autel’s EVO series is often used in field surveys and energy plant inspections. One key advantage is its strong data security focus, which appeals to energy firms needing secure and reliable data collection.

Parrot is a European drone company known for its smart, lightweight drones with strong imaging capabilities. Parrot’s Anafi drone is designed for detailed inspections of solar arrays and wind turbines, providing high-resolution imagery and 3D mapping. Its modular, user-driven design makes it well-suited for specialized energy projects.

Top Key Players in the Market

- Autel Robotics

- DJI

- Parrot

- Mapware Technologies

- Skydio Technologies

- DroneDeploy

- PrecisionHawk

- Aerobotics

- DroneBase

- Delair

- Yuneec

- Teal Drones

- senseFly

- Others

Top Opportunities for Players

- Advanced Inspection and Maintenance: Drones equipped with high-resolution cameras and thermal sensors are revolutionizing the inspection of solar panels and wind turbines. They enable rapid detection of faults, reducing downtime and maintenance costs. This approach minimizes human risk and enhances the longevity of renewable energy assets.

- Optimized Site Planning and Construction: During the planning and construction phases of renewable energy projects, drones provide detailed aerial surveys and 3D mapping. This data aids in accurate site assessments, efficient resource allocation, and streamlined project timelines.

- Integration with AI and IoT for Predictive Analytics: Combining drone technology with artificial intelligence and Internet of Things (IoT) devices allows for real-time data analysis and predictive maintenance. This integration enhances operational efficiency and supports proactive decision-making in energy management.

- Environmental Monitoring and Compliance: Drones play a crucial role in monitoring the environmental impact of renewable energy installations. They assist in assessing wildlife habitats, vegetation changes, and other ecological factors, ensuring compliance with environmental regulations and promoting sustainable practices.

- Expansion into Emerging Markets: The growing demand for renewable energy in emerging markets presents opportunities for drone companies to offer tailored solutions. Adapting drone technology to meet the specific needs of these regions can lead to significant market expansion and contribution to global sustainability goals.

Recent Developments

- In February 2023, building on its stronghold in advanced inspection software for energy and infrastructure, DroneBase has reemerged as Zeitview, fueled by a $55 million investment to drive its next wave of innovation.

Report Scope

Report Features Description Market Value (2024) USD 163.4 Mn Forecast Revenue (2034) USD 5,802 Mn CAGR (2025-2034) 42.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (Fixed-Wing, Multi-Rotor), By Propulsion System (Solar, Wind, Hybrid (Solar and Wind)), By Payload Capacity (5 kg, 5-15 kg, 15-25 kg, >25 kg), By Range (50 km, 50-100 km, 100-200 km, >200 km), By Application (Aerial Surveying and Mapping, Delivery and Logistics, Inspection and Monitoring, Agriculture, Security and Surveillance) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Autel Robotics, DJI, Parrot, Mapware Technologies, Skydio Technologies, DroneDeploy, PrecisionHawk, Aerobotics, DroneBase, Delair, Yuneec, Teal Drones, senseFly, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Autel Robotics

- DJI

- Parrot

- Mapware Technologies

- Skydio Technologies

- DroneDeploy

- PrecisionHawk

- Aerobotics

- DroneBase

- Delair

- Yuneec

- Teal Drones

- senseFly

- Others