Global Privacy Management Software Market By Deployment Mode (Cloud-Based, On-Premise), By Application (Data Discovery and Mapping, Risk Management, Privacy Impact Assessments, Reporting and Analytics, Consent and Preference Management, Incident and Breach Management, Other Applications), By Organization Size (Small and Medium-Sized Enterprises (SMEs), Large Enterprises), By Industry Vertical (BFSI, IT & Telecommunications, Government & Public Sector, Healthcare, Manufacturing, Retail and E-commerce, Other Industry Verticals), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 133267

- Number of Pages: 334

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Deployment Mode

- Application Analysis

- Organization Size

- Industry Vertical

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunities

- Challenging Factors

- Growth Factors

- Emerging Trends

- Business Benefits

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

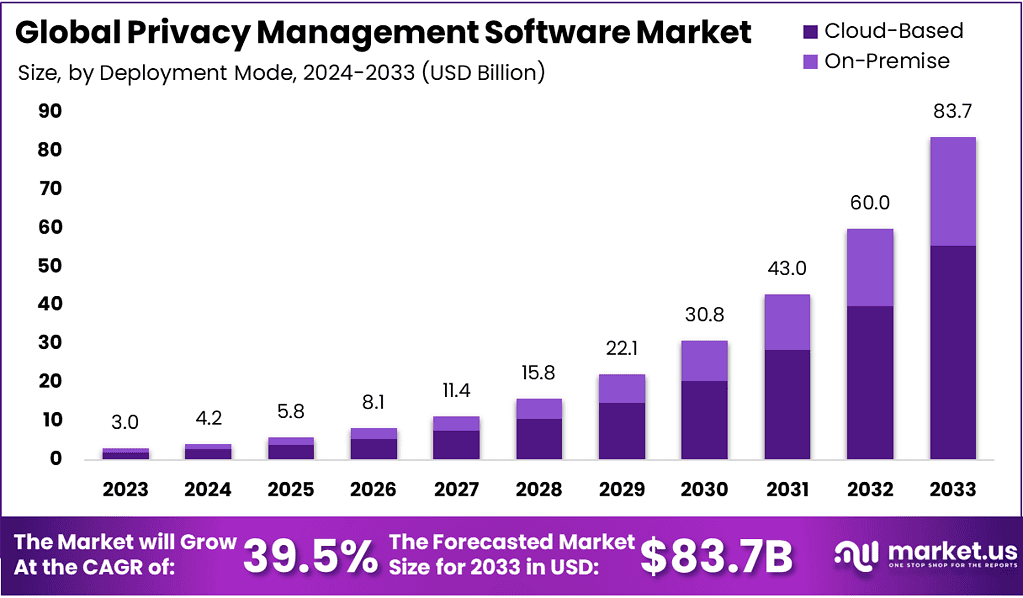

The Global Privacy Management Software Market size is expected to be worth around USD 83.7 Billion By 2033, from USD 3.0 billion in 2023, growing at a CAGR of 39.50% during the forecast period from 2024 to 2033.

Privacy Management Software (PMS) refers to specialized tools designed to help organizations manage and protect personal data in compliance with various data protection regulations. These solutions facilitate tasks such as data mapping, consent management, incident response, and compliance reporting, ensuring that personal information is handled responsibly and transparently. By automating privacy-related processes, PMS enables businesses to mitigate data breaches and non-compliance risks, thereby safeguarding consumer trust and organizational reputation.

The Privacy Management Software market has experienced significant growth, driven by the increasing complexity of data privacy regulations and the rising volume of personal data processed by organizations. This expansion reflects the escalating demand for robust privacy solutions across various industries.

Several factors contribute to the growth of the PMS market. The proliferation of stringent data protection laws, such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States, has compelled organizations to adopt comprehensive privacy management solutions. Additionally, the increasing frequency of data breaches and cyber security threats has heightened the need for effective privacy management to protect sensitive information and maintain consumer trust.

The demand for Privacy Management Software is further amplified by the growing consumer awareness regarding data privacy rights. Individuals are increasingly concerned about how their personal information is collected, used, and shared, prompting organizations to implement transparent and accountable data-handling practices. This shift necessitates the adoption of PMS to manage consent, respond to data subject access requests, and ensure compliance with evolving privacy regulations.

Opportunities within the PMS market are abundant, particularly in sectors such as healthcare, finance, and retail, where large volumes of personal data are processed. The integration of artificial intelligence (AI) and machine learning (ML) into privacy management solutions presents significant potential for enhancing data discovery, risk assessment, and compliance monitoring. Furthermore, the expansion of digital services and the Internet of Things (IoT) ecosystem creates a growing need for advanced privacy management tools to address complex data flows and regulatory requirements.

Technological advancements are pivotal in shaping the evolution of Privacy Management Software. The incorporation of AI and ML enables more sophisticated data analysis, facilitating proactive identification of privacy risks and automated compliance processes. Cloud-based PMS solutions offer scalability and flexibility, allowing organizations to adapt to changing regulatory landscapes efficiently. Additionally, the development of user-friendly interfaces and integration capabilities with existing IT systems enhances the accessibility and effectiveness of privacy management tools.

Privacy Management Software (PMS) plays a critical role in helping organizations navigate the complexities of data privacy in today’s digital age. This growth reflects the increasing emphasis on regulatory compliance and the rising consumer demand for transparent and secure data management practices.

Data privacy awareness is at an all-time high, with 86% of the U.S. population expressing growing concerns about how their data is handled. Regulatory requirements are also intensifying; by the end of 2024, it is anticipated that 75% of the global population’s data will fall under privacy regulations such as GDPR and CCPA. Organizations are recognizing the necessity of robust privacy management, with surveys revealing that 94% of businesses believe customers would not purchase from them if they failed to protect personal information.

From a financial perspective, privacy compliance is becoming increasingly critical. The average cost of manually processing a single data subject request is estimated at USD 1,524, highlighting the economic inefficiencies of traditional methods. PMS solutions streamline these processes, significantly reducing costs while enhancing accuracy and compliance. These factors collectively underscore the indispensable role of PMS in maintaining consumer trust and meeting regulatory standards in an evolving digital landscape.

Key Takeaways

- The global Privacy Management Software market is forecasted to achieve exponential growth, surging from USD 3.0 billion in 2023 to an impressive USD 83.7 billion by 2033, at a robust CAGR of 39.5% over the decade.

- The cloud-based deployment mode dominated the market, accounting for 66.4% of the total share in 2023, reflecting the industry’s shift towards scalable and flexible privacy solutions.

- Data discovery and mapping emerged as a leading application, contributing 24.1% to the market share in 2023, underlining its critical role in privacy compliance and risk mitigation.

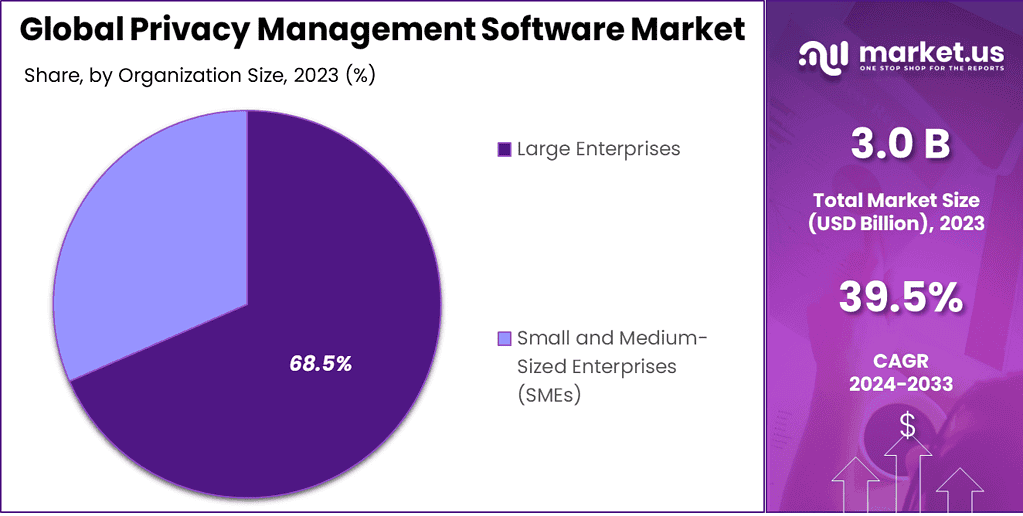

- Large enterprises represented the largest organizational segment, holding 68.5% of the market share, driven by their significant compliance requirements and higher investment capacities.

- The BFSI (Banking, Financial Services, and Insurance) sector led among industry verticals, capturing 23.0% of the market share in 2023, driven by the industry’s need to safeguard sensitive customer data.

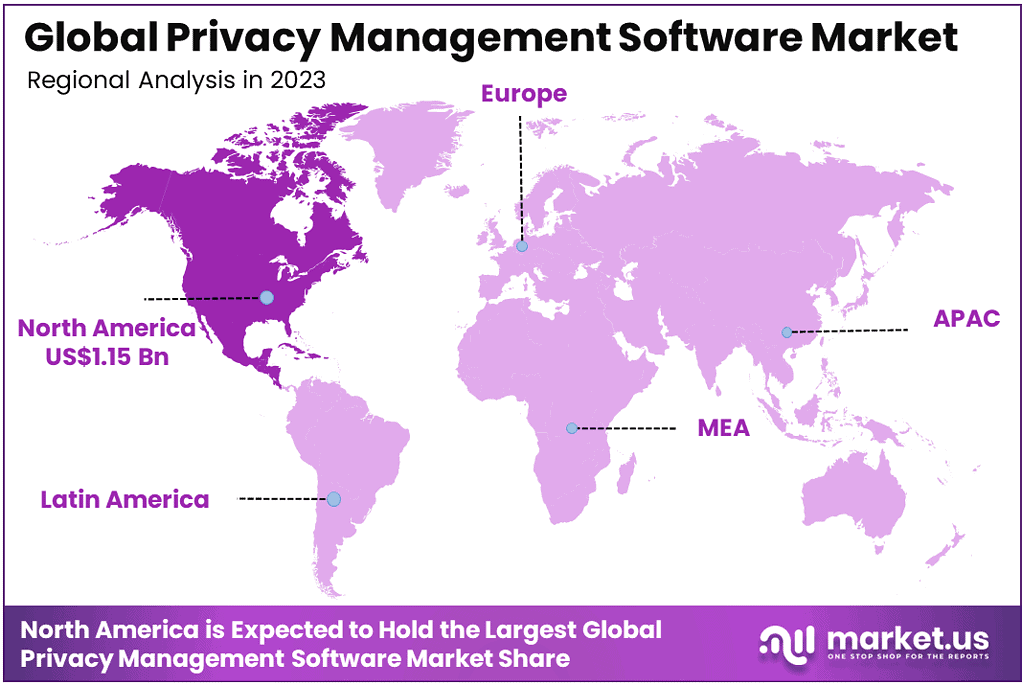

- North America maintained its position as the dominant regional market, contributing 38.4% to the global market share in 2023, owing to stringent data privacy regulations and advanced technological adoption.

Deployment Mode

In 2023, the Cloud-Based segment held a dominant position in the Privacy Management Software market, accounting for more than 66.4% of the total market share. This dominance can be attributed to the rising demand for scalable and flexible solutions that align with modern business needs. Cloud-based privacy management tools offer seamless accessibility, enabling organizations to manage privacy compliance across multiple locations without the need for extensive on-site infrastructure. Their cost-effectiveness, combined with quick deployment capabilities, makes them the preferred choice for businesses of all sizes, especially in industries dealing with dynamic regulatory environments.

The adoption of cloud-based solutions is further fueled by their ability to integrate with existing IT systems and support advanced features such as real-time data monitoring, automated compliance checks, and AI-driven insights. Organizations increasingly favor these solutions for their ability to ensure high levels of data security while maintaining compliance with complex data protection laws. Moreover, as companies expand globally, the cloud-based approach offers the agility needed to address region-specific privacy requirements, enhancing their appeal.

On the other hand, the On-Premise segment, while not as dominant, continues to attract organizations that prioritize complete control over their data. This deployment mode is particularly prevalent in sectors like government and defense, where sensitive information and stringent security protocols necessitate in-house management. Despite its smaller market share, on-premise solutions remain relevant for businesses with specific privacy needs that require bespoke configurations or those operating in regions with less-developed cloud infrastructure.

The cloud-based segment’s lead is expected to grow further as businesses increasingly transition toward digital-first strategies and remote work environments. With advancements in cloud security and privacy-enhancing technologies, more organizations are likely to migrate their privacy management systems to cloud platforms, solidifying this segment’s market leadership in the coming years.

Application Analysis

In 2023, the Data Discovery and Mapping segment held a dominant position in the Privacy Management Software market, capturing over 24.1% of the total market share. This leadership stems from the critical role this application plays in helping organizations identify, catalog, and monitor personal data across their systems. As privacy regulations like GDPR and CCPA emphasize transparency and accountability in data handling, data discovery and mapping solutions have become indispensable for ensuring compliance. Businesses rely on these tools to gain a clear understanding of where sensitive data resides and how it flows within their ecosystems.

The prominence of this segment is further driven by its ability to empower organizations to address key privacy challenges effectively. By automating the process of data inventory and classification, data discovery and mapping tools enable companies to respond swiftly to data subject access requests (DSARs), minimize the risk of non-compliance, and mitigate potential security breaches. These capabilities are particularly crucial for industries such as healthcare, BFSI, and retail, where managing large volumes of sensitive customer data is a priority.

Other applications, such as Risk Management and Incident and Breach Management, also hold significant importance, but they primarily serve as complementary functions to data discovery and mapping. While these applications address specific aspects of privacy compliance, their effectiveness often hinges on the foundational insights provided by comprehensive data mapping. This dependency underscores why data discovery and mapping remain central to most privacy management strategies.

Looking ahead, the demand for data discovery and mapping solutions is expected to grow as organizations increasingly adopt proactive privacy management practices. With the proliferation of AI-driven tools and advanced analytics, this segment is poised to maintain its leadership position, helping businesses navigate the complexities of evolving privacy regulations while safeguarding their reputations.

Organization Size

In 2023, the Large Enterprises segment held a dominant position in the Privacy Management Software market, capturing over 68.5% of the total market share. This leadership can be attributed to the significant data privacy and compliance needs of large organizations, which often deal with vast amounts of sensitive customer and employee information. Large enterprises are subject to stringent regulatory requirements across multiple jurisdictions, necessitating robust and comprehensive privacy management solutions to ensure adherence to evolving global data protection standards.

The dominance of this segment is further driven by the financial and operational resources available to large enterprises, enabling them to invest in advanced privacy management tools and technologies. These organizations prioritize integrated solutions that offer features such as automated compliance reporting, data discovery, and incident management to manage complex privacy challenges effectively. Additionally, the reputational risks associated with data breaches and non-compliance are more pronounced for large enterprises, making privacy management a critical strategic focus.

While the Small and Medium-Sized Enterprises (SMEs) segment is gaining traction, its adoption of privacy management software is comparatively limited due to budget constraints and a lower perceived urgency of compliance needs. However, as data privacy regulations increasingly target businesses of all sizes, SMEs are beginning to recognize the importance of adopting scalable and affordable privacy management solutions. Cloud-based offerings and modular tools are emerging as attractive options for this segment.

Looking forward, the Large Enterprises segment is expected to maintain its leadership position as these organizations continue to invest heavily in privacy management to safeguard their operations and maintain customer trust. With ongoing advancements in AI and machine learning, large enterprises are likely to leverage these technologies to enhance their privacy management capabilities further, ensuring their compliance strategies remain both proactive and effective.

Industry Vertical

In 2023, the BFSI (Banking, Financial Services, and Insurance) segment held a dominant position in the Privacy Management Software market, capturing over 23.0% of the total market share. This dominance is primarily driven by the sector’s reliance on handling sensitive customer data, including financial transactions, account details, and personally identifiable information (PII). The BFSI industry’s strict regulatory environment, with mandates like GDPR, CCPA, and PCI DSS, necessitates advanced privacy management tools to ensure compliance and safeguard against data breaches.

The BFSI sector’s leadership in the market is further reinforced by the high costs associated with data breaches in financial services. Financial institutions face significant reputational and operational risks in the event of non-compliance or a privacy lapse, making robust privacy management solutions a critical investment. Features such as data mapping, incident and breach management, and real-time risk monitoring are particularly valued in this segment, ensuring the proactive management of data privacy concerns.

Other sectors, such as Healthcare, Retail, and E-commerce, also experience growing adoption of privacy management software but do not match BFSI’s share due to the comparatively lower volume of regulated data or less immediate regulatory pressure. However, these sectors are steadily gaining importance as regulatory landscapes tighten and digital transformation accelerates their reliance on consumer data.

Looking ahead, the BFSI segment is expected to retain its leading position as financial institutions continue to embrace digitalization, increasing the volume and complexity of data to manage. With advancements in privacy-enhancing technologies like artificial intelligence and encryption, the BFSI industry will likely further strengthen its compliance frameworks, cementing its reliance on privacy management software solutions.

Key Market Segments

Deployment Mode:

- Cloud-Based

- On-Premise

Application:

- Data Discovery and Mapping

- Risk Management

- Privacy Impact Assessments

- Reporting and Analytics

- Consent and Preference Management

- Incident and Breach Management

- Other Applications

Organization Size:

- Small and Medium-Sized Enterprises (SMEs)

- Large Enterprises

Industry Vertical:

- BFSI

- IT & Telecommunications

- Government & Public Sector

- Healthcare

- Manufacturing

- Retail and E-commerce

- Other Industry Verticals

Driving Factors

Proliferation of Data Privacy Regulations

The rapid expansion of data privacy regulations worldwide serves as a significant driver for the Privacy Management Software (PMS) market. Legislations such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States have established stringent guidelines for data protection, compelling organizations to adopt comprehensive privacy management solutions. These regulations mandate strict compliance measures, including data subject rights management, breach notification protocols, and accountability frameworks, necessitating the implementation of robust PMS tools to ensure adherence.

The enforcement of these laws has heightened organizational awareness regarding data privacy, leading to increased investments in privacy management technologies. Companies are now required to demonstrate compliance through detailed documentation and regular audits, tasks that are efficiently managed by advanced PMS solutions. The complexity and variability of global data protection laws further amplify the need for adaptable and scalable privacy management systems capable of navigating diverse regulatory landscapes.

Moreover, the financial and reputational risks associated with non-compliance have escalated, with penalties reaching substantial amounts. For instance, under the GDPR, organizations can face fines of up to €20 million or 4% of their annual global turnover, whichever is higher. Such significant repercussions underscore the critical importance of implementing effective privacy management strategies, thereby driving the demand for PMS in the market.

Restraining Factors

High Implementation Costs

Despite the clear benefits, the adoption of Privacy Management Software is often hindered by high implementation costs. Developing and deploying comprehensive PMS solutions require substantial financial investment, encompassing software acquisition, integration with existing systems, and ongoing maintenance expenses. These costs can be particularly burdensome for small and medium-sized enterprises (SMEs) with limited budgets, deterring them from adopting such technologies.

Additionally, the complexity of integrating PMS with legacy systems poses technical challenges that may necessitate specialized expertise, further escalating costs. Organizations may also need to invest in employee training to effectively utilize these systems, adding to the overall expenditure. The perception of PMS as a non-revenue-generating investment can lead to deprioritization, especially in industries where immediate financial returns are a primary focus.

Furthermore, the rapid evolution of data privacy regulations requires continuous updates and enhancements to PMS solutions, leading to recurring costs. This ongoing financial commitment can be a significant deterrent for organizations, particularly those operating in highly competitive markets with tight profit margins.

Growth Opportunities

Integration of Artificial Intelligence and Machine Learning

The integration of Artificial Intelligence (AI) and Machine Learning (ML) into Privacy Management Software presents a substantial opportunity for market growth. AI and ML technologies can enhance data discovery processes, enabling organizations to efficiently identify and classify personal data across complex systems. These technologies facilitate real-time monitoring and predictive analytics, allowing for proactive identification of potential privacy risks and swift response to incidents.

Moreover, AI-driven automation can streamline compliance workflows, reducing manual efforts and minimizing human errors. For instance, AI can automate the processing of data subject access requests, ensuring timely and accurate responses in compliance with regulatory requirements. The scalability of AI and ML solutions also allows organizations to adapt to increasing data volumes and evolving regulatory landscapes effectively.

The adoption of AI and ML in PMS can lead to cost efficiencies by optimizing resource allocation and reducing the need for extensive manual oversight. As organizations seek to enhance their privacy management capabilities while controlling costs, the demand for AI-integrated PMS solutions is expected to rise, presenting a lucrative opportunity for market expansion.

Challenging Factors

Evolving Cybersecurity Threats

The dynamic nature of cybersecurity threats poses a significant challenge to the Privacy Management Software market. As cyber-attacks become more sophisticated, PMS solutions must continuously evolve to effectively protect sensitive data. The emergence of advanced persistent threats, ransomware, and zero-day vulnerabilities requires PMS providers to implement robust security measures and maintain vigilance against potential breaches.

Additionally, the increasing use of cloud services and remote work arrangements has expanded the attack surface, complicating data protection efforts. Ensuring the security of data across diverse environments necessitates comprehensive and adaptable PMS solutions capable of addressing a wide range of threat vectors.

The challenge is further compounded by the need to balance stringent data protection measures with user accessibility and operational efficiency. Overly restrictive security protocols can hinder business processes, while lax measures can expose organizations to significant risks. Developing PMS solutions that effectively navigate this balance is crucial yet challenging, requiring continuous innovation and collaboration between privacy management and cybersecurity experts.

Growth Factors

The Privacy Management Software (PMS) market is experiencing significant growth, driven by several key factors. Foremost among these is the escalating complexity and stringency of data protection regulations worldwide. Legislations such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States have established rigorous standards for data privacy, compelling organizations to adopt comprehensive PMS solutions to ensure compliance and avoid substantial penalties.

Additionally, the increasing frequency and sophistication of data breaches have heightened organizational awareness regarding the importance of robust privacy management. High-profile incidents have underscored the potential financial and reputational damages associated with inadequate data protection measures, prompting businesses to invest in advanced PMS tools to safeguard sensitive information and maintain consumer trust.

The rapid digital transformation across industries further contributes to the demand for effective privacy management solutions. As companies expand their digital footprints, the volume of personal data collected and processed has surged, necessitating efficient systems to manage privacy concerns. The integration of technologies such as Artificial Intelligence (AI) and Machine Learning (ML) into PMS has enhanced capabilities in data discovery, risk assessment, and compliance monitoring, making these solutions more appealing to organizations seeking to navigate the complexities of modern data privacy landscapes.

Emerging Trends

Several emerging trends are shaping the evolution of the Privacy Management Software market. A notable development is the increasing adoption of cloud-based PMS solutions. These platforms offer scalability, flexibility, and cost-effectiveness, enabling organizations to manage privacy compliance across diverse and distributed environments efficiently. The shift towards remote work and global operations has further accelerated the preference for cloud-based solutions, as they facilitate seamless access and integration across various locations and systems.

Another significant trend is the incorporation of AI and ML technologies into privacy management. These advancements enable more sophisticated data analysis, allowing for the proactive identification of privacy risks and automated compliance processes. AI-driven tools can enhance data mapping, consent management, and incident response, providing organizations with more robust and responsive privacy management capabilities.

Furthermore, there is a growing emphasis on user-centric design in PMS solutions. Developers are focusing on creating intuitive interfaces and user-friendly features to facilitate easier adoption and operation by non-technical staff. This approach aims to democratize privacy management within organizations, ensuring that privacy considerations are integrated seamlessly into daily operations and decision-making processes.

Business Benefits

Implementing Privacy Management Software offers numerous benefits to businesses. Primarily, it ensures compliance with data protection regulations, thereby mitigating the risk of legal penalties and associated financial losses. By automating compliance processes, PMS reduces the administrative burden on organizations, allowing them to allocate resources more efficiently.

Moreover, robust privacy management enhances consumer trust and brand reputation. Demonstrating a commitment to protecting personal data can differentiate a company in a competitive market, attracting privacy-conscious customers and fostering loyalty. Effective privacy management also minimizes the risk of data breaches, which can have devastating financial and reputational consequences.

Additionally, PMS provides valuable insights into data flows and usage within an organization, enabling better data governance and informed decision-making. By understanding how data is collected, stored, and processed, businesses can optimize their operations, identify potential efficiencies, and develop strategies that align with both regulatory requirements and organizational objectives.

Regional Analysis

In 2023, North America held a dominant position in the Privacy Management Software market, capturing more than 38.4% of the global market share, with a revenue contribution of approximately USD 1.15 billion. This leadership can be attributed to the region’s stringent regulatory framework and heightened awareness of data privacy among organizations and consumers. Regulations such as the California Consumer Privacy Act (CCPA) and the Health Insurance Portability and Accountability Act (HIPAA) have set strict standards for data protection, compelling businesses to adopt robust privacy management solutions to ensure compliance.

North America’s dominance is further reinforced by the presence of a highly developed technological infrastructure and a significant concentration of leading privacy software providers. The United States, in particular, serves as a hub for innovation in data privacy technologies, with numerous companies investing in advanced features such as AI-driven analytics, real-time monitoring, and automated compliance reporting. The region’s emphasis on digital transformation and data-driven decision-making across industries, including finance, healthcare, and retail, has also driven demand for comprehensive privacy management solutions.

The region’s robust adoption of cloud-based technologies is another critical factor contributing to its leadership. With organizations increasingly relying on cloud infrastructure to manage data, the integration of privacy management software into these systems has become essential. This shift is especially relevant in industries with complex data ecosystems, where real-time compliance monitoring and scalable solutions are paramount.

Looking ahead, North America is expected to maintain its leading position, driven by the continuous evolution of data privacy regulations and the growing emphasis on consumer data protection. As new legislation, such as federal privacy laws, gains traction in the United States, the demand for privacy management solutions is likely to accelerate further. Additionally, the increasing frequency of cyberattacks in the region underscores the need for advanced privacy technologies to safeguard sensitive information, ensuring that North America remains at the forefront of the global Privacy Management Software market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

OneTrust has solidified its leadership in the privacy management software market through strategic acquisitions and innovative product developments. In May 2024, the company announced it expects to surpass $500 million in Annual Recurring Revenue (ARR) later this year while maintaining positive free cash flow. This growth is driven by its expanding customer base, which has reached more than 14,000 customers, including 75% of the Fortune 100. Additionally, OneTrust has formed partnerships with major technology providers, including Microsoft, to enhance its data subject access request automation and overall trust management capabilities.

TrustArc has been proactive in expanding its service offerings through acquisitions and product innovations. In November 2019, TrustArc acquired Nymity, a Toronto-based privacy compliance software company, to broaden its expertise and market reach. This strategic move enabled TrustArc to offer a more comprehensive suite of privacy management solutions tailored to various industries. Furthermore, TrustArc has introduced new products focusing on risk assessments, data flow mapping, and compliance reporting, addressing the evolving needs of businesses in managing complex privacy workflows.

BigID has distinguished itself by integrating advanced technologies into its privacy management solutions. The company has developed AI-driven tools that enhance data discovery and classification processes, allowing organizations to identify and manage sensitive information more efficiently. BigID’s focus on innovation is evident in its continuous development of features that proactively identify privacy risks and automate compliance tasks. These advancements have positioned BigID as a preferred choice for businesses seeking next-generation privacy management capabilities.

These companies’ strategic initiatives in acquisitions, product launches, and technological advancements have significantly contributed to their leadership in the privacy management software market. Their efforts reflect a commitment to addressing the complex and evolving challenges of data privacy in today’s digital landscape.

Top Key Players in the Market

- TrustArc Inc.

- OneTrust, LLC

- IBM Corporation

- Informatica Inc.

- Securiti.ai

- BigID

- Exterro

- 2B Advice GmbH

- Sprinto

- MineOS

- Collibra

- LogicGate, Inc.

- DPOrganizer

- Other Key Players

Recent Developments

- In April 2024, Microsoft expanded its Priva suite by introducing a new Consent Management solution. This addition aims to streamline the handling of user-consented data, enabling organizations to comply more effectively with evolving data privacy regulations. The solution offers simplified consent collection and management processes, enhancing transparency and trust between businesses and their customers.

- In November 2024, Proton AG updated Proton Drive to include an end-to-end encrypted suggesting mode, which significantly advances secure document collaboration. This feature allows users to propose edits without altering the original document, maintaining data integrity and confidentiality. The update also introduced password-protected, read-only public links with expiration dates, giving users greater control over shared documents.

Report Scope

Report Features Description Market Value (2023) USD 3.0 Bn Forecast Revenue (2033) USD 83.7 Bn CAGR (2024-2033) 39.50% Largest Market North America Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Deployment Mode(Cloud-Based, On-Premise), By Application(Data Discovery and Mapping, Risk Management, Privacy Impact Assessments, Reporting and Analytics, Consent and Preference Management, Incident and Breach Management, Other Applications), By Organization Size(Small and Medium-Sized Enterprises (SMEs), Large Enterprises), By Industry Vertical(BFSI, IT & Telecommunications, Government & Public Sector, Healthcare, Manufacturing, Retail and E-commerce, Other Industry Verticals) Regional Analysis North America (US, Canada), Europe (Germany, UK, Spain, Austria, Rest of Europe), Asia-Pacific (China, Japan, South Korea, India, Australia, Thailand, Rest of Asia-Pacific), Latin America (Brazil), Middle East & Africa(South Africa, Saudi Arabia, United Arab Emirates) Competitive Landscape TrustArc Inc., OneTrust, LLC, IBM Corporation, Informatica Inc., Securiti.ai, BigID, Exterro, 2B Advice GmbH, Sprinto, MineOS, Collibra, LogicGate, Inc., DPOrganizer, Other Key Players Customization Scope We will provide customization for segments and at the region/country level. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Privacy Management Software MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample

Privacy Management Software MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- TrustArc Inc.

- OneTrust, LLC

- IBM Corporation

- Informatica Inc.

- Securiti.ai

- BigID

- Exterro

- 2B Advice GmbH

- Sprinto

- MineOS

- Collibra

- LogicGate, Inc.

- DPOrganizer

- Other Key Players