Global Pressure Infusion Bags Market By Product Type (Disposable, Reusable) By Material (Nylon, Polyurethane (PU)/TPU, PVC/Medical-grade plastic) By Capacity (500 ml, 1,000 ml, 3,000 ml and above) By Sterility (Sterile, Non-sterile) By Age Group (Adult, Pediatric, Neonatal) By Application (Blood and drug infusion, Invasive pressure monitoring and fluid pressurised irrigation) By End-User (Hospitals and clinics, Outpatient & Ambulatory care centers, Blood Banks and Transfusion Labs, Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 165335

- Number of Pages: 332

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Product type Analysis

- Material Analysis

- Capacity Analysis

- Sterility Analysis

- Age Group Analysis

- Application Analysis

- End-user Analysis

- Key Market Segments

- Driving Factors

- Trending Factors

- Restraining Factors

- Opportunity

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

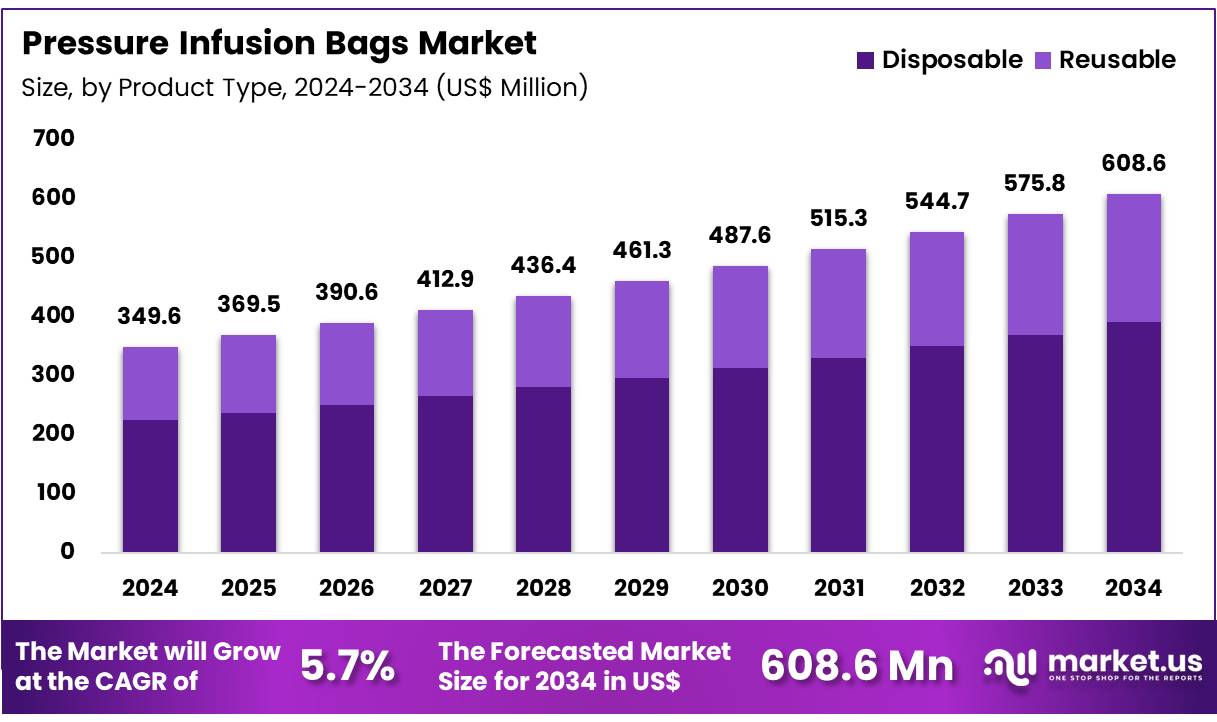

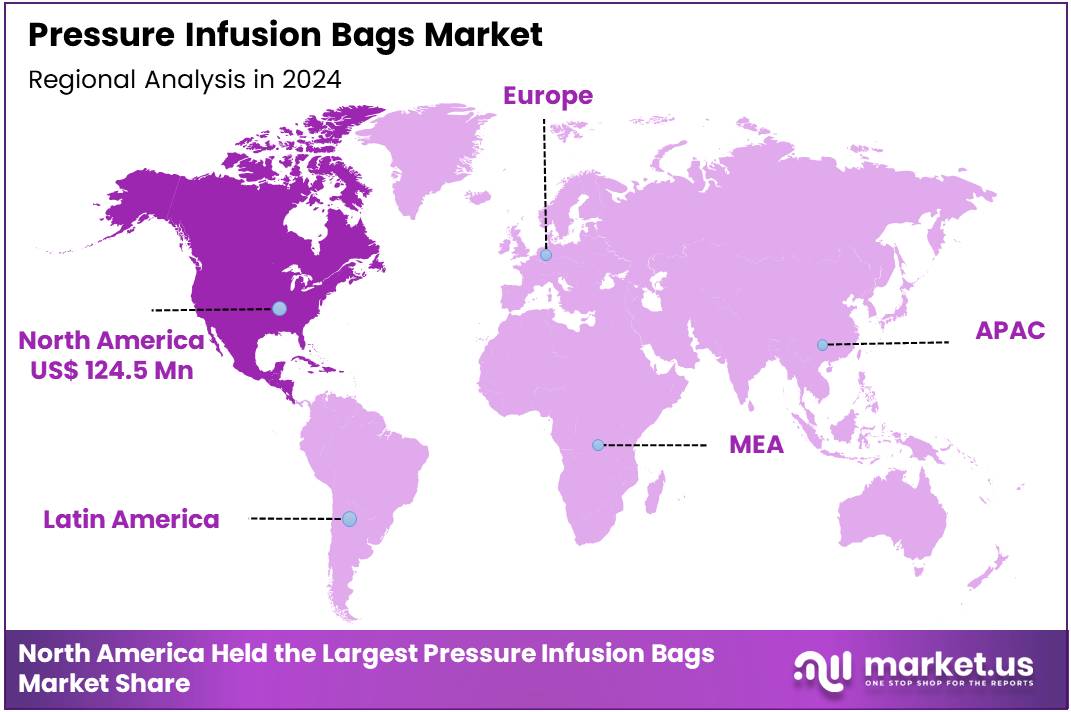

Global Pressure Infusion Bags Market size is expected to be worth around US$ 608.6 Million by 2034 from US$ 349.6 Million in 2024, growing at a CAGR of 5.7% during the forecast period from 2025 to 2034. In 2024, North America led the market, achieving over 35.6% share with a revenue of US$ 124.5 Million.

The global market for pressure infusion bags is benefiting from multiple robust growth drivers. First, surgical activity remains high: according to the World Health Organization (WHO), surgical interventions account for about 13 % of total global disability-adjusted life years (DALYs). One estimate indicates approximately 313 million surgical procedures per year worldwide. As surgical services expand, demand for equipment such as pressure infusion bags increases, because they enable rapid delivery of fluids and blood products and maintain pressure in invasive monitoring systems.

Second, the blood-transfusion sector is a major driver. WHO reports that around 118.5 million blood donations are collected annually worldwide, with high-income countries accounting for 40 % of those donations. The demand for transfusions especially in ageing populations and trauma settings supports use of pressure infusion bags to expedite delivery and flow control.

Third, demographic ageing further reinforces demand. The WHO projects that by 2030, one in six people globally will be aged 60 years or older. By 2050, the population aged 60+ is expected to reach about 2.1 billion people. Older patients undergo more surgeries, more transfusions and more invasive monitoring, all of which increase baseline demand for pressure infusion solutions.

Fourth, trauma and emergency medicine volumes remain substantial. For example, WHO estimates about 1.19 million deaths annually from road-traffic crashes and tens of millions of injuries. Such cases often require rapid fluid resuscitation and transfusion applications for which pressure infusion bags are used.

Fifth, regulatory and systems factors are favourable. For instance, in the U.S., the Food and Drug Administration (FDA) classifies “pressure infusor for an I.V. bag” as a distinct regulated device category (Product Code KZD, 21 CFR 880.5420), which helps facilitate clear device pathways and adoption by health-care providers. Together, these five factors high surgical volume, growing transfusion activity, ageing populations, trauma/emergency care pressures, and supportive regulatory frameworks create a positive foundation for steady growth in the pressure infusion bags market across both developed and emerging markets.

Key Takeaways

- Market Size: Global Pressure Infusion Bags Market size is expected to be worth around US$ 608.6 Million by 2034 from US$ 349.6 Million in 2024.

- Market Growth: The market growing at a CAGR of 5.7% during the forecast period from 2025 to 2034

- Product type Analysis: The disposable segment dominates the global market, accounting for 64.3% of the total share in 2024.

- Material Analysis: The nylon segment dominates the market, holding a 46.1% share in 2024.

- Capacity Analysis: The 500 ml pressure infusion bags segment accounts for the largest market share of approximately 48.9% in 2024.

- Sterility Analysis: The non-sterile segment accounted for the dominant share of 61.1% in 2024.

- Age Group Analysis: The adult segment accounted for the dominant share of 76.4% in 2024

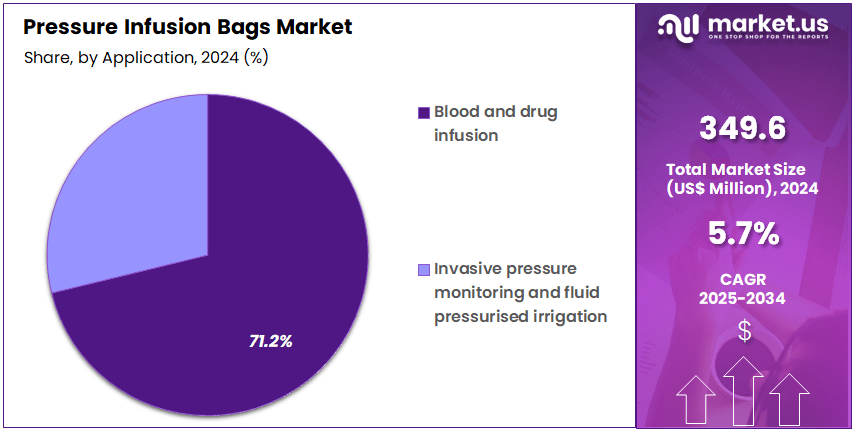

- Application Analysis: The blood and drug infusion segment dominates the market, accounting for 71.2% of the global share in 2024.

- End-Use Analysis: Hospitals and clinics hold a dominant position, accounting for approximately 59.0% of the global market share in 2024.

- Regional Analysis: In 2024, North America led the market, achieving over 35.6% share with a revenue of US$ 124.5 Million.

Product type Analysis

The pressure infusion bags market is segmented into two major product types: disposable and reusable infusion bags. The disposable segment dominates the global market, accounting for 64.3% of the total share in 2024. The dominance of disposable infusion bags is attributed to their superior infection control, ease of use, and cost-effectiveness in clinical settings.

These bags eliminate the need for sterilization and reduce the risk of cross-contamination, making them highly preferred in hospitals and emergency care units. Furthermore, the increasing adoption of single-use medical products and strict hygiene standards in healthcare facilities have accelerated the demand for disposable pressure infusion bags.

The reusable segment, although smaller, is witnessing gradual adoption in certain healthcare environments where long-term cost efficiency is prioritized. These products are typically made from durable materials suitable for multiple uses. However, concerns regarding sterilization and infection prevention limit their broader acceptance compared to disposable alternatives.

Material Analysis

Based on material divided into nylon, polyurethane (PU)/thermoplastic polyurethane (TPU), and polyvinyl chloride (PVC)/medical-grade plastic. Among these, the nylon segment dominates the market, holding a 46.1% share in 2024.

The growth of this segment is attributed to nylon’s high tensile strength, lightweight structure, and excellent resistance to wear, chemicals, and punctures. These properties ensure durability and reliability during high-pressure applications, making nylon the preferred material for medical-grade pressure infusion bags used in hospitals and emergency care.

The PU/TPU segment is gaining traction due to its flexibility, superior elasticity, and resistance to abrasion, offering an alternative for advanced medical applications requiring enhanced adaptability and patient comfort. Meanwhile, PVC and other medical-grade plastics continue to serve as cost-effective options in regions with price-sensitive markets, though their use is gradually declining due to environmental concerns and the healthcare industry’s shift toward more sustainable and durable materials.

Capacity Analysis

Based on the current market assessment, the 500 ml pressure infusion bags segment accounts for the largest market share of approximately 48.9% in 2024. The dominance of this segment is attributed to its widespread use in emergency care, operating rooms, and critical care units, where rapid fluid or medication infusion is required in controlled volumes. Its compact size, ease of handling, and suitability for single-patient use make it the preferred choice across healthcare facilities globally.

The 1,000 ml segment follows, driven by applications requiring moderate fluid delivery during surgeries or intensive care treatments. These bags are favored in situations demanding slightly higher infusion volumes without compromising portability.

The 3,000 ml and above segment, although smaller, is gaining traction in specialized medical procedures and field emergency setups that require large-volume fluid administration. Growing demand from military medical units and trauma centers is expected to gradually enhance the adoption of higher-capacity infusion bags over the forecast period.

Sterility Analysis

Based on sterility, the pressure infusion bags market is segmented into non-sterile and sterile types. The non-sterile segment accounted for the dominant share of 61.1% in 2024. This dominance can be attributed to its extensive use in general medical and emergency applications where sterility is not a critical requirement, such as fluid administration and blood transfusion procedures in emergency and field settings.

Non-sterile bags are also preferred due to their lower cost, easy availability, and suitability for single-use or short-duration procedures, which enhance their adoption in healthcare facilities and pre-hospital care environments.

The sterile segment, though smaller, is expected to exhibit steady growth over the forecast period. Increasing demand for infection control and sterile environments in operating rooms, intensive care units, and specialized medical procedures is projected to support its expansion. Rising emphasis on patient safety and infection prevention protocols continues to drive gradual adoption of sterile pressure infusion bags.

Age Group Analysis

Age group devided into adult, pediatric, and neonatal categories. The adult segment accounted for the dominant share of 76.4% in 2024, primarily due to the higher incidence of chronic diseases, trauma cases, and surgical procedures among adults that require rapid fluid or blood administration.

The widespread adoption of pressure infusion systems in emergency and critical care units further strengthens the demand in this segment. The pediatric segment represents a smaller share, driven by increasing cases of congenital disorders and the need for controlled infusion in child patients.

The neonatal segment, though limited, is gaining gradual traction owing to the growing focus on neonatal intensive care and advancements in precision infusion technology. Overall, the adult population continues to be the major consumer base, supported by extensive hospital usage and growing emergency healthcare infrastructure worldwide.

Application Analysis

By application devided into blood and drug infusion, invasive pressure monitoring, and fluid pressurised irrigation. Among these, the blood and drug infusion segment dominates the market, accounting for 71.2% of the global share in 2024. This dominance can be attributed to the extensive use of pressure infusion bags in operating rooms, emergency care, and intensive care units for rapid blood transfusion and controlled drug delivery. The growing prevalence of trauma cases, surgical procedures, and critical care treatments continues to drive demand within this segment.

The invasive pressure monitoring segment represents a significant secondary application, supported by the increasing need for real-time hemodynamic monitoring in patients with cardiovascular and respiratory complications. Meanwhile, the fluid pressurised irrigation segment is primarily driven by orthopedic and urological surgical procedures, where continuous irrigation under pressure is essential for optimal visibility and tissue management. Together, these segments contribute to the market’s steady growth trajectory.

End-user Analysis

The pressure infusion bags market is segmented based on end-users into hospitals and clinics, outpatient and ambulatory care centers, blood banks and transfusion laboratories, and others. Among these, hospitals and clinics hold a dominant position, accounting for approximately 59.0% of the global market share in 2024.

This dominance is driven by the increasing prevalence of surgical procedures, trauma cases, and critical care admissions that demand rapid and controlled infusion of fluids, medications, or blood products. The extensive presence of advanced medical infrastructure and skilled healthcare professionals further supports the widespread adoption of pressure infusion systems in hospital environments.

The outpatient and ambulatory care centers segment is projected to exhibit steady growth, supported by the rise in minimally invasive and same-day surgical procedures. Blood banks and transfusion laboratories represent another significant segment, where these devices are crucial for blood component transfusion and plasma administration. The others category, including home healthcare and military medical units, is anticipated to witness gradual growth owing to the increasing need for portable and efficient infusion solutions.

Key Market Segments

By Product Type

- Disposable

- Reusable

By Material

- Nylon

- Polyurethane (PU)/TPU

- PVC/Medical-grade plastic

By Capacity

- 500 ml

- 1,000 ml

- 3,000 ml and above

By Sterility

- Sterile

- Non-sterile

By Age Group

- Adult

- Pediatric

- Neonatal

By Application

- Blood and drug infusion

- Invasive pressure monitoring and fluid pressurised irrigation

By End-User

- Hospitals and clinics

- Outpatient & Ambulatory care centers

- Blood Banks and Transfusion Labs

- Others

Driving Factors

The market for pressure infusion bags is significantly driven by the global burden of traumatic injuries. According to the World Health Organization (WHO), over 5 million people die annually as a result of injuries, accounting for approximately 9 % of global deaths. In trauma settings, rapid infusion of fluids or blood is critical for resuscitation, leading to increased demand for devices that enable efficient delivery.

Similarly, the safe transfusion of blood and components is a priority: the WHO notes that blood transfusion is needed for trauma, surgical procedures and other critical conditions. Thus, the rising incidence of emergency surgeries and trauma-care cases supports growth in pressure infusion bag usage.

Trending Factors

A key trend in this market is the heightened emphasis on patient safety and infection control in infusion systems. The WHO’s patient safety fact sheet indicates that approximately 1 in 10 patients is harmed while receiving hospital care and up to 50 % of this harm is preventable. In this context, single-use or disposable pressure infusion bags and designs that reduce contamination risk are gaining priority.

Moreover, studies on infusion device safety highlight that intravenous infusions are associated with significant risk: one review found that IV medication errors accounted for 54 % of all adverse drug events and 61 % of serious errors. These data indicate an increasing clinical and regulatory push toward safer infusion technologies, including improved pressure infusion bags.

Restraining Factors

A major restraint stems from the safety-risk profile and regulatory burden associated with infusion devices. For instance, the WHO reports that unsafe transfusion practices including improper handling of blood products and devices can result in serious adverse events (12.2 serious reactions per 100 000 units) and contribute to patient-harm globally.

Furthermore, intravenous infusion devices involve complex administration steps; a systematic review noted that the majority of infusion-associated medication errors stem from user or device-related failures. These safety and regulatory factors constrain uptake, particularly in resource-limited settings where training and compliance may be weaker.

Opportunity

Significant opportunity exists in expanding emergency care capacity and bolstering trauma-resuscitation infrastructure, particularly in low- and middle-income countries (LMICs) where over 90 % of injury-related deaths occur.As hospitals in these regions upgrade acute-care systems and invest in critical-care equipment, devices that support rapid fluid delivery including advanced pressure infusion bags—can gain traction.

In addition, the rising global prevalence of chronic conditions requiring continual intravenous therapy supports an expansion of infusion-device usage beyond acute trauma settings. Combined, these trends offer manufacturers and health-care systems a pathway to deploy enhanced infusion-bag solutions across both emergency and routine care environments.

Regional Analysis

In 2024, North America held a dominant market position, capturing more than a 35.6% share and holding a market value of US$ 124.5 million. The region’s leadership in the Pressure Infusion Bags market can be attributed to the strong presence of advanced healthcare infrastructure and high adoption of innovative medical devices. The growing number of surgical procedures, coupled with a rising prevalence of chronic diseases, has significantly increased the demand for efficient fluid and blood administration systems.

Hospitals and emergency medical services in the United States and Canada have shown a steady increase in the use of pressure infusion bags to improve patient outcomes in trauma and critical care. The high level of awareness among healthcare professionals regarding infection control and precise fluid management has further contributed to market growth. Additionally, favorable reimbursement policies and strong government support for healthcare modernization have accelerated the adoption of these devices across hospitals and ambulatory care centers.

The growing geriatric population and the surge in critical care admissions have further reinforced regional dominance. Technological advancements, such as disposable and reusable pressure infusion bags with enhanced durability and pressure control features, have also strengthened the market outlook. The increasing presence of key manufacturers and distributors in the region ensures product availability and faster adoption of next-generation infusion technologies.

Overall, North America’s dominance is expected to continue over the coming years. The combination of advanced healthcare systems, technological innovation, and a well-established regulatory framework will sustain its leading position in the global Pressure Infusion Bags market.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Pressure Infusion Bags market focus on expanding product portfolios and strengthening global distribution networks. These companies emphasize product innovation through advanced materials that ensure durability and precise pressure control. Continuous improvement in design enhances clinical efficiency and patient safety.

Strategic collaborations with hospitals and emergency care providers are common to increase product penetration. Manufacturers also invest in regulatory approvals and certifications to ensure compliance with international healthcare standards. The adoption of automation in production processes improves consistency and reduces manufacturing costs.

Many players focus on disposable bag variants due to rising infection control concerns. Expansion into emerging markets and sustained investment in research and development remain central to maintaining competitiveness and meeting the evolving demands of healthcare facilities worldwide.

Market Key Players

- Merit Medical Systems, Inc.

- VBM Medizintechnik GmbH

- ASP Global LLC

- AirLife (Ethox Medical)

- Astromed Health Care India Pvt Ltd

- Dosani Healthcare

- Onyx Medicare Technologies LLP

- ICU Medical Inc.

- Biegler GmbH

- SunMed

- Vyaire Medical Inc.

- Salter Labs

- Smiths Medical, Inc.

- Statcorp Medical

- Spengler SAS

- Rudolf Riester GmbH

- Friedrich Bosch GmbH & Co. KG

Recent Developments

- Merit Medical Systems, Inc. (Feb 2024): Launched an advanced version of its pressure infusor bag featuring an ergonomic inflation bulb and improved gauge visibility, aiming to enhance clinician ease-of-use in high-acuity settings.

- VBM Medizintechnik GmbH (Apr 2023): Received CE-marking for a novel biodegradable pressure infusion bag, reflecting a sustainability-driven innovation in the cuff/infusor segment.

- SunMed (Aug 2024): Introduced or made available its “Infu-Surg Pressure Infusion Bag” 1000 mL model with features: hook, one-hand inflation, color-coded gauge and MRI-conditional design.

- Vyaire Medical Inc. (Aug 2024): Agreed to sell its RDx business unit to Trudell Medical Limited, following Chapter 11 filing, signalling portfolio refocus which may affect infusion-related product lines.

Report Scope

Report Features Description Market Value (2024) US$ 349.6 Million Forecast Revenue (2034) US$ 608.6 Million CAGR (2025-2034) 5.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Disposable, Reusable) By Material (Nylon, Polyurethane (PU)/TPU, PVC/Medical-grade plastic) By Capacity (500 ml, 1,000 ml, 3,000 ml and above) By Sterility (Sterile, Non-sterile) By Age Group (Adult, Pediatric, Neonatal) By Application (Blood and drug infusion, Invasive pressure monitoring and fluid pressurised irrigation) By End-User (Hospitals and clinics, Outpatient & Ambulatory care centers, Blood Banks and Transfusion Labs, Others) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape Merit Medical Systems, Inc., VBM Medizintechnik GmbH, ASP Global LLC, AirLife (Ethox Medical), Astromed Health Care India Pvt Ltd, Dosani Healthcare, Onyx Medicare Technologies LLP, ICU Medical Inc., Biegler GmbH, SunMed, Vyaire Medical Inc., Salter Labs, Smiths Medical, Inc., Statcorp Medical, Spengler SAS, Rudolf Riester GmbH, Friedrich Bosch GmbH & Co. KG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Pressure Infusion Bags MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Pressure Infusion Bags MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Merit Medical Systems, Inc.

- VBM Medizintechnik GmbH

- ASP Global LLC

- AirLife (Ethox Medical)

- Astromed Health Care India Pvt Ltd

- Dosani Healthcare

- Onyx Medicare Technologies LLP

- ICU Medical Inc.

- Biegler GmbH

- SunMed

- Vyaire Medical Inc.

- Salter Labs

- Smiths Medical, Inc.

- Statcorp Medical

- Spengler SAS

- Rudolf Riester GmbH

- Friedrich Bosch GmbH & Co. KG