Refurbished Medical Equipment Market By Product Type (Patient Monitors, Defibrillators, Operating Room Equipment & Surgical Equipment, Medical Imaging Equipment, and Others), By Application (Hospitals, Clinics, Ambulatory Surgical Center, Diagnostic Centers, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 139133

- Number of Pages: 295

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

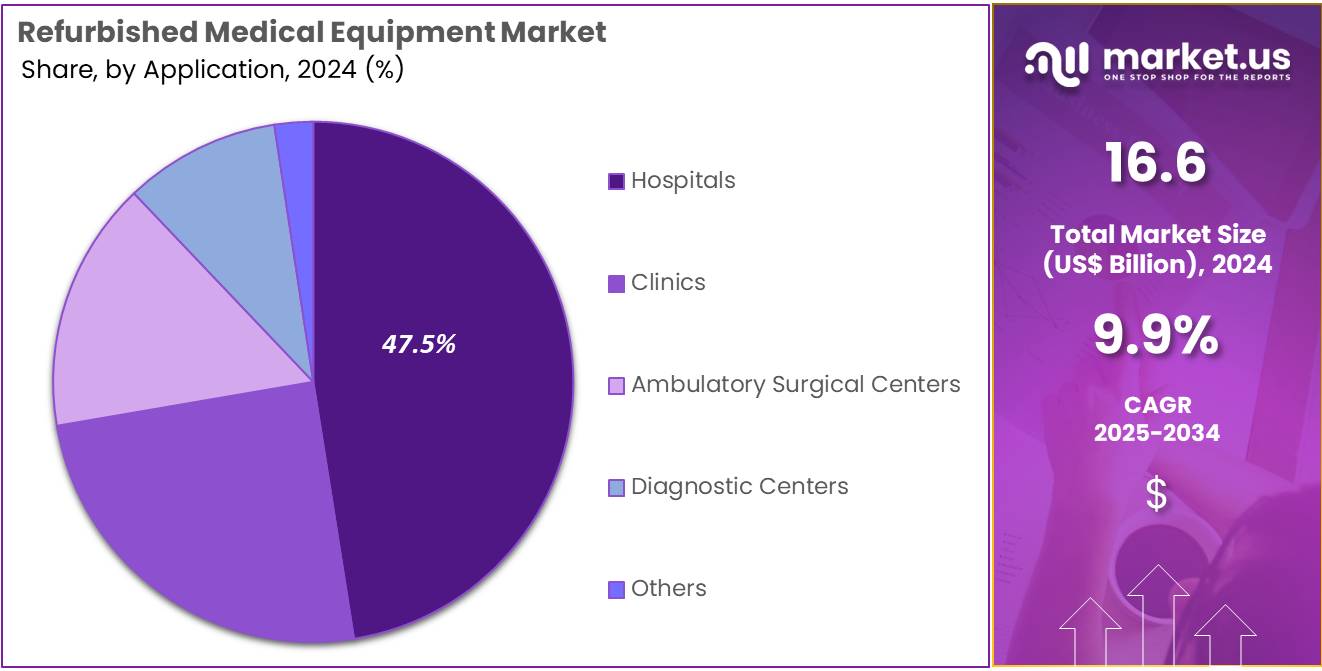

The Global Refurbished Medical Equipment Market Size is expected to be worth around US$ 42.7 Billion by 2034, from US$ 16.6 Billion in 2024, growing at a CAGR of 9.9% during the forecast period from 2025 to 2034.

The refurbished medical equipment market is driven by a growing demand for cost-effective healthcare solutions and the need to alleviate equipment shortages. Devices such as MRI machines, ultrasound equipment, CT scanners, and X-ray machines are offered as high-quality, affordable alternatives, appealing particularly to budget-conscious healthcare settings. This approach not only extends the lifecycle of medical devices but also reduces operational costs significantly for hospitals, clinics, and diagnostic centers.

Rising healthcare expenses and an increased adoption of refurbished devices across both developed and developing healthcare systems are fueling market growth. In December 2021, Block Imaging enhanced its market presence by acquiring Reliable Healthcare Imaging. This strategic move led to the establishment of a dedicated facility focused on the repair and reprocessing of CT scanner tubes and HV tanks, aligning with the increasing demand for refurbished medical equipment.

The market is witnessing a shift towards certified pre-owned medical equipment, characterized by rigorous testing and certification processes. These standards ensure that refurbished devices meet strict safety and performance criteria, thereby building trust and reliability among healthcare providers. This trend underscores a growing reliance on refurbished equipment, which combines cost-effectiveness with high performance.

Furthermore, the integration of advanced technologies such as AI-based diagnostics and real-time monitoring systems into the refurbishment process presents substantial opportunities for market expansion. Healthcare providers are increasingly opting for solutions that deliver quality without compromising cost-effectiveness. With the continuous advancement of technology and rising healthcare needs, the refurbished medical equipment market is poised for significant growth.

Key Takeaways

- In 2024, the market for Refurbished Medical Equipment generated a revenue of US$ 16.6 billion, with a CAGR of 9.9%, and is expected to reach US$ 42.7 billion by the year 2033.

- The product type segment is divided into patient monitors, defibrillators, operating room equipment & surgical equipment, medical imaging equipment, and others, with medical imaging equipment taking the lead in 2024 with a market share of 38.6%.

- Considering application, the market is divided into hospitals, clinics, ambulatory surgical center, diagnostic centers, and others. Among these, hospitals held a significant share of 47.5%.

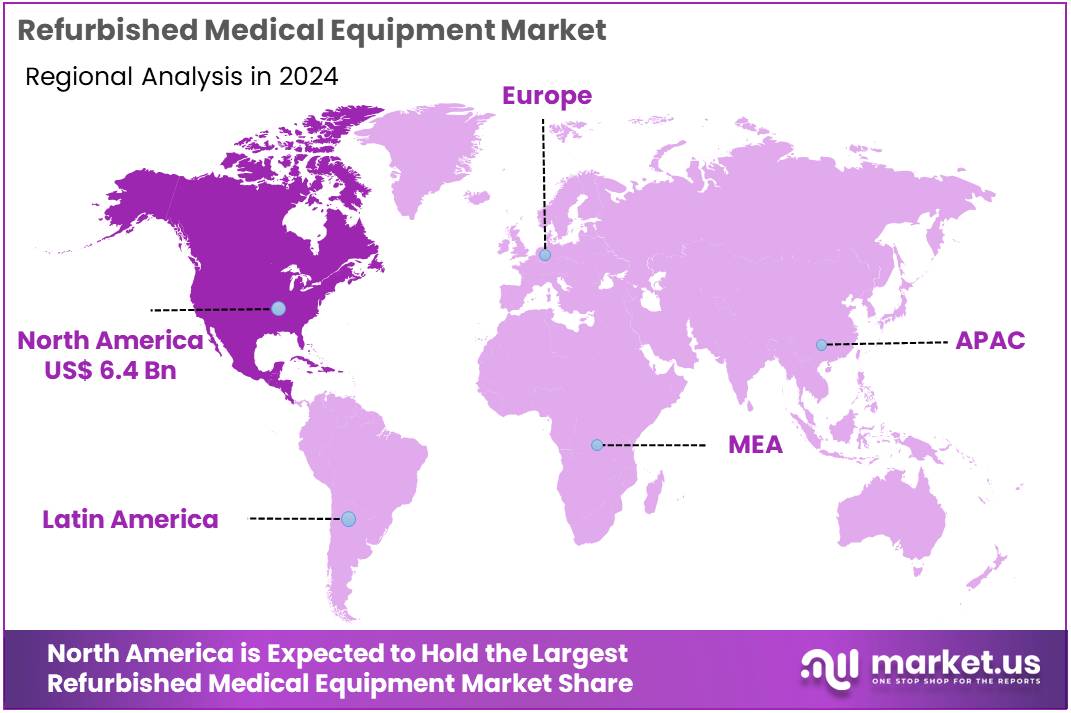

- North America led the market by securing a market share of 38.5% in 2024.

Product Type Analysis

The medical imaging equipment segment led in 2024, claiming a market share of 38.6% owing to increasing demand for cost-effective alternatives to new medical imaging devices. With healthcare providers looking to reduce operational costs while maintaining high-quality diagnostic capabilities, refurbished medical imaging equipment, such as MRI machines, CT scanners, and X-ray machines, are becoming increasingly popular.

This segment’s growth is also fueled by advancements in refurbishing technologies, which enhance the performance and reliability of refurbished equipment. Additionally, as healthcare systems in emerging markets expand and adopt advanced diagnostic technologies, the demand for affordable, high-quality refurbished imaging equipment is anticipated to rise.

Application Analysis

The hospitals held a significant share of 47.5% due to as hospitals seek to optimize their budgets while maintaining the quality of care. Many hospitals are turning to refurbished equipment to meet the growing demand for medical devices without compromising on financial sustainability. Refurbished devices, such as diagnostic imaging machines and surgical equipment, offer hospitals an affordable solution without sacrificing performance.

As hospitals continue to expand and upgrade their facilities, they are likely to increase their reliance on refurbished equipment to support both routine and specialized procedures. Furthermore, the increased focus on reducing healthcare costs, particularly in developing economies, is anticipated to drive the growth of refurbished medical equipment in hospital settings.

Key Market Segments

By Product Type

- Patient Monitors

- Defibrillators

- Operating Room Equipment & Surgical Equipment

- Medical Imaging Equipment

- Others

By Application

- Hospitals

- Clinics

- Ambulatory Surgical Center

- Diagnostic Centers

- Others

Drivers

Use of AI-Integrated Machinery Driving the Refurbished Medical Equipment Market

The use of AI-integrated machinery is anticipated to drive the refurbished medical equipment market significantly. In March 2023, Apex Medical Equipment introduced a range of refurbished surgical robots equipped with advanced AI capabilities. These systems enhance precision in minimally invasive surgeries, reduce procedural risks, and improve patient outcomes.

Healthcare providers are increasingly adopting AI-enabled refurbished equipment to access cutting-edge technologies at lower costs. Such integration ensures efficient diagnosis, faster treatment processes, and optimized healthcare delivery. Refurbished AI-enabled machinery supports data-driven insights, enabling predictive maintenance and reducing equipment downtime. This trend aligns with the rising demand for cost-effective yet advanced medical solutions in both developed and emerging economies.

Collaborations between AI technology providers and refurbishment companies accelerate the introduction of innovative products, bolstering the adoption of AI-integrated medical equipment. These factors underscore the significant role of AI-enhanced refurbished medical devices in addressing the growing demand for quality healthcare.

Restraints

High Regulatory Barriers Are Restraining the Refurbished Medical Equipment Market

High regulatory barriers are restraining the refurbished medical equipment market. Government regulations impose strict standards on the refurbishment, testing, and certification of medical devices. These requirements increase compliance costs for refurbishment companies, reducing their profit margins. Smaller players face challenges in meeting stringent guidelines, limiting their market participation.

Variations in regulatory frameworks across different countries create additional complexity, restricting international trade in refurbished equipment. Concerns about patient safety and equipment reliability often lead to increased scrutiny, further delaying the approval process. Limited awareness among healthcare providers about regulatory compliance for refurbished devices adds to the market’s challenges. Addressing these barriers requires harmonization of regulations, industry-standard certifications, and initiatives to educate healthcare providers about the safety and efficacy of refurbished equipment.

Opportunities

Increasing Availability of Affordable and Innovative Solutions

Increasing availability of affordable and innovative solutions creates a significant opportunity for the refurbished medical equipment market. In May 2021, Hermes Medical Solutions partnered with Radiology Oncology Systems to provide cost-effective refurbished devices to imaging and radiotherapy departments across the United States. These solutions offer hospitals and clinics access to high-quality equipment at a fraction of the cost of new devices, enabling improved resource allocation.

Technological advancements in refurbishment processes ensure that devices meet stringent performance and safety standards. Partnerships between refurbishment companies and healthcare institutions expand the availability of innovative medical technologies to underserved regions. Growing investments in refurbishment infrastructure enhance the quality and reliability of used medical equipment.

Rising healthcare demand in low- and middle-income countries further boosts the market as facilities seek affordable options without compromising functionality. These developments position refurbished medical equipment as a sustainable and efficient solution for global healthcare challenges.

Impact of Macroeconomic / Geopolitical Factors

The refurbished medical equipment market is significantly influenced by macroeconomic and geopolitical factors. The rising focus on cost-effective healthcare solutions boosts demand for refurbished devices. This trend is particularly evident in regions with limited resources, where new equipment may be too costly. Additionally, the growth in healthcare expenditures in emerging markets supports this demand as providers seek affordable options to meet increasing patient needs.

However, economic downturns and financial constraints in developed countries can restrict funding for new equipment purchases. This limits opportunities within the refurbished market. Moreover, there is a stigma associated with using refurbished devices, posing challenges in some markets where they are less accepted.

Geopolitical factors also play a crucial role in this market. Trade restrictions, import/export regulations, and political instability can disrupt supply chains. These disruptions can delay equipment delivery and increase costs, hindering market growth. Such factors need careful navigation to maintain steady market progress.

Despite these challenges, the refurbished medical equipment market has a positive outlook. The emphasis on sustainability and cost efficiency continues to drive demand. Moreover, the global need for accessible healthcare solutions is growing, which further supports the market’s expansion. This fosters a promising environment for the continued demand for refurbished medical equipment.

Latest Trends

Surge in Mergers and Acquisitions Driving the Refurbished Medical Equipment Market

Rising mergers and acquisitions have become a significant trend driving growth in the refurbished medical equipment market. High demand for affordable healthcare solutions and the growing focus on sustainability are expected to push companies in the healthcare equipment sector to consolidate and expand their portfolios. By joining forces, companies can improve their operational efficiencies, streamline repair and refurbishing processes, and increase market reach. The increased access to refurbished equipment in both developed and emerging markets is likely to foster further growth in this sector.

In December 2021, Block Imaging expanded its operations by acquiring Reliable Healthcare Imaging. This acquisition enabled the establishment of a new facility dedicated to the repair and reprocessing of CT scanner tubes and HV tanks. As mergers and acquisitions continue to rise, the market is expected to benefit from enhanced capabilities, technological advancements, and improved service offerings, thereby driving innovation and accessibility in the refurbished medical equipment market.

Regional Analysis

North America is leading the Refurbished Medical Equipment Market

North America dominated the market with the highest revenue share of 38.5% owing to the region’s increasing focus on cost-effective healthcare solutions and rising demand for advanced medical technologies. Canada’s approximately 1,265 hospitals, as reported by Canada.ca in 2022, contributed significantly to the demand for refurbished devices to meet growing healthcare needs without overstretching budgets.

Refurbished equipment, offering high-quality performance at reduced costs, became a preferred choice for small and mid-sized healthcare facilities. The growing emphasis on sustainability in healthcare practices further boosted the market, as refurbished equipment aligns with eco-friendly initiatives by reducing electronic waste. Technological advancements in refurbishment processes, ensuring compliance with regulatory standards and enhanced reliability, played a critical role in increasing adoption.

Additionally, collaborations between refurbished equipment providers and hospitals ensured seamless installation, maintenance, and after-sales support, further driving demand. Government initiatives promoting healthcare access in rural and underserved areas also bolstered the adoption of affordable refurbished equipment. Increased awareness among healthcare providers about the economic and environmental benefits of refurbished devices solidified the market’s growth in North America.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is projected to experience the fastest growth in the refurbished medical devices market. This surge is driven by the region’s rapidly expanding healthcare infrastructure and a rising demand for affordable medical solutions. According to China’s National Health Commission, the number of medical and health facilities reached 1.037 million by September 2021, indicating significant growth in healthcare capacity. This expansion is expected to increase the demand for cost-effective refurbished devices, especially in smaller hospitals and clinics.

Government initiatives are enhancing healthcare accessibility in rural areas, promoting the adoption of refurbished equipment. Such policies are particularly influential in countries like India, Thailand, and Malaysia, where healthcare expenditure is increasing and medical tourism is growing. These factors are anticipated to further boost the market for refurbished medical devices. Additionally, local companies are likely to form partnerships with global players to improve product availability and quality.

The market is also benefiting from a growing awareness of sustainable healthcare practices and the cost benefits of refurbished equipment. These factors are making refurbished solutions more appealing to smaller healthcare providers. Technological advancements in refurbishment processes are enhancing the quality and reliability of these devices. This progress is building trust among healthcare professionals and accelerating market growth in the Asia Pacific region.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the refurbished medical equipment market focus on providing high-quality, cost-effective alternatives to new devices by implementing advanced reconditioning processes and strict quality control measures. Companies invest in expanding their service networks to ensure efficient maintenance and customer support. Collaborations with hospitals and diagnostic centers help drive adoption, particularly in regions with constrained healthcare budgets.

Geographic expansion into emerging markets with rising demand for affordable medical solutions supports growth. Many players also emphasize sustainability by reducing electronic waste through the refurbishment of used equipment. GE Healthcare is a prominent company in this market, offering a wide range of refurbished medical devices, including imaging systems and patient monitors.

The company combines rigorous quality standards with innovative reconditioning techniques to deliver reliable and affordable solutions. GE Healthcare’s strong global presence and commitment to sustainability position it as a key player in the refurbished medical equipment industry.

Recent Developments

- In May 2023, Siemens Healthineers and CommonSpirit Health announced the acquisition of Block Imaging to leverage its expertise in refurbished medical equipment. This strategic partnership focuses on improving access to sustainable medical solutions by enhancing the lifecycle of devices, reducing waste, and providing more cost-effective options for healthcare providers.

- In January 2023, Meditech Solutions revolutionized diagnostic imaging with the launch of next-generation MRI machines. These devices feature advanced technology for quicker scan times and superior imaging quality, offering enhanced accuracy in medical diagnostics.

Top Key Players in the Refurbished Medical Equipment Market

- Siemens Healthineers

- Meditech Solutions

- Koninklijke Philips NV

- GE Healthcare

- Everx Pvt. Ltd

- Block Imaging International Inc.

- Avante Health Solutions

- Agito Medical AS

Report Scope

Report Features Description Market Value (2024) US$ 16.6 billion Forecast Revenue (2034) US$ 42.7 billion CAGR (2025-2034) 9.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Patient Monitors, Defibrillators, Operating Room Equipment & Surgical Equipment, Medical Imaging Equipment, and Others), By Application (Hospitals, Clinics, Ambulatory Surgical Center, Diagnostic Centers, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Siemens Healthineers , Meditech Solutions, Koninklijke Philips NV, GE Healthcare, Everx Pvt. Ltd, Block Imaging International Inc., Avante Health Solutions, and Agito Medical AS. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Refurbished Medical Equipment MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample

Refurbished Medical Equipment MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Siemens Healthineers

- Meditech Solutions

- Koninklijke Philips NV

- GE Healthcare

- Everx Pvt. Ltd

- Block Imaging International Inc.

- Avante Health Solutions

- Agito Medical AS