Global Precision Oncology Market, By Product (Diagnostics and Therapeutics), By Cancer Type (Breast Cancer, Colorectal Cancer, Cervical Cancer, Prostate Cancer, and Other Cancer Types), By End, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2032

- Published date: Oct 2023

- Report ID: 99438

- Number of Pages: 324

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

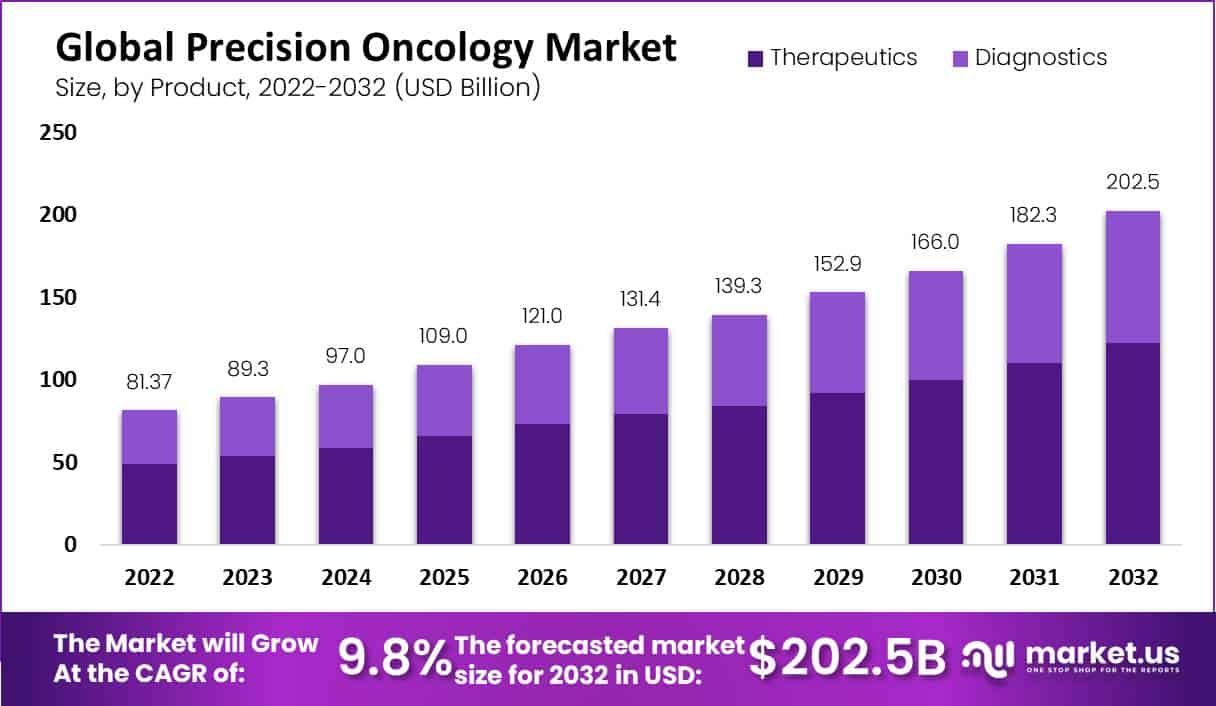

Global Precision Oncology Market size is expected to be worth around USD 202.5 Billion by 2032 from USD 89.3 Billion in 2023, growing at a CAGR of 9.8% during the forecast period from 2024 to 2032.

Precision oncology is the application of advanced technology and methods to individualize cancer treatment based on the genetic composition of a patient’s tumor. The rising incidence of cancer, the rising use of precision medicine, and technological improvements are some of the factors driving the growth of the global precision oncology market.

The growing use of liquid biopsies, which can identify cancer at an earlier stage than conventional tissue biopsies, is another aspect driving the market. Liquid biopsies are non-invasive and can reveal a lot of information about a patient’s cancer, including its genetic makeup and probable response to treatment.

Key Takeaways

- Market Size: Global Precision Oncology Market size is expected to be worth around USD 202.5 Billion by 2032 from USD 89.3 Billion in 2023.

- Market Growth: The market growing at a CAGR of 9.8% during the forecast period from 2024 to 2032.

- Product Analysis: The therapeutics sector dominated the market with a market share of 71.7% in 2022.

- Cancer Type Analysis: The breast cancer segment is estimated to be the most lucrative segment in the global precision oncology market, with a market share of 41.6% in 2022.

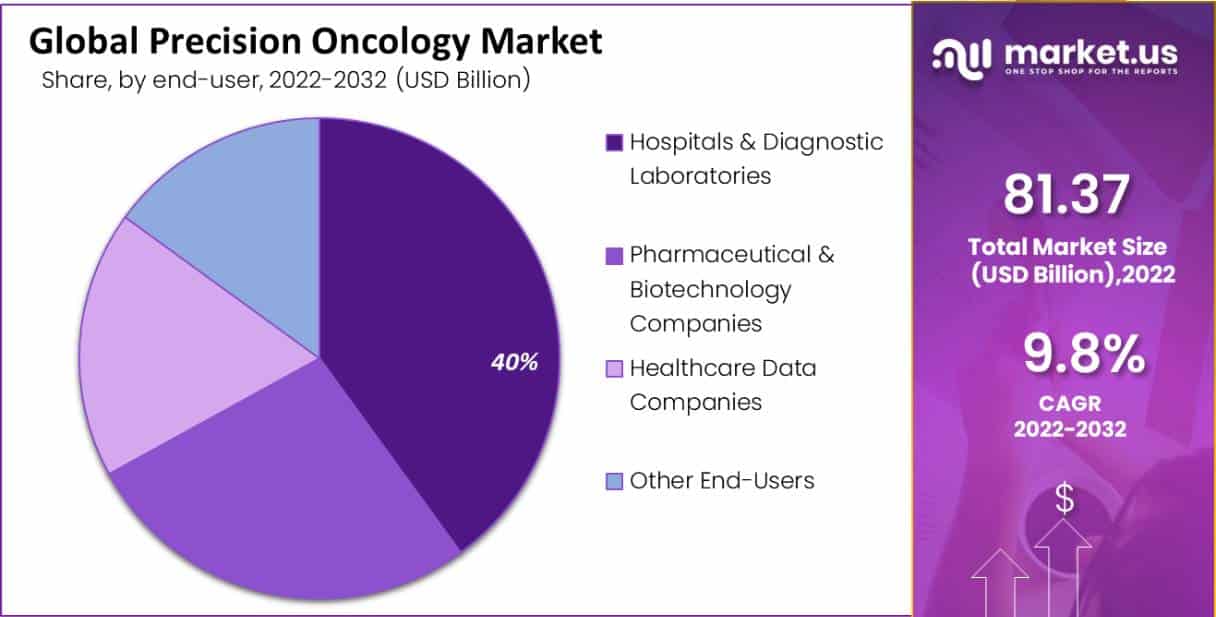

- End-User Analysis: The diagnostic laboratories &hospitals segment is estimated to be the most lucrative segment in the global precision oncology market, with the largest revenue share of 40%.

- Companion Diagnostics: Companion diagnostics play an integral part in precision oncology by helping identify patients most likely to respond positively to specific therapies thereby eliminating ineffective ones.

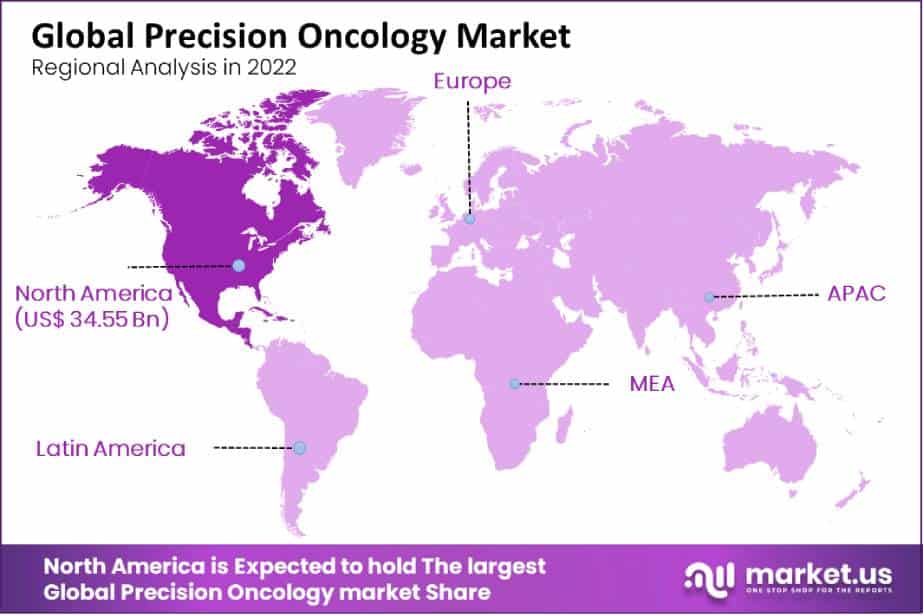

- North American Dominance: North America dominates the global precision oncology market in 2022, generating 42.5% of total revenue.

- Emerging Markets in Asia-Pacific: China, India and Japan have experienced an explosion in precision oncology demand over recent years due to factors like increasing incidence rates for cancer diagnosis as well as improving healthcare infrastructure and rising awareness regarding personalized cancer treatments.

Driving Factors

The identification of genetic changes and biomarkers that can be utilized to personalize cancer treatments has become common due to the development of genomics, proteomics, and other molecular diagnostic tools. These advancements have also made it possible to develop targeted therapies that can selectively kill cancer cells while sparing healthy cells.

The prevalence of cancer is rising worldwide, with an estimated 10.3 million cancer-related deaths and 19.3 million new cases expected. Traditional chemotherapy and radiation treatments may not be beneficial for all patients and can have serious adverse effects. As a result, there is a rising need for targeted medicines that are made to target cancer cells directly while causing the least amount of harm to healthy cells.

Restraining Factors

High cost of precision oncology therapies

This treatment is more expensive than traditional chemotherapy and radiation treatments. Patients who cannot afford these medicines may find them less accessible because precision oncology therapies are frequently more costly. This may limit the market growth and adoption of precision oncology.

Limited availability of diagnostic tests

Precision oncology depends on reliable diagnostic testing to locate the genetic alterations and biomarkers that can inform therapy choices. Precision oncology may not be widely used if any of these tests are not generally accessible or reimbursed by insurance.

Product Analysis

The precision oncology market is divided into diagnostics and therapeutics segments based on product type. The therapeutics sector dominated the market with a market share of 71.7% in 2022. The need for therapeutics is driven by a variety of factors, including the rise in tumor-agnostic therapy approvals and the distinctive characteristics of treatments based on the particular proteins or mutations that fuel the development of cancer. Based on the DNA fingerprint of each patient’s illness, precision oncology-based medicines offer personalized treatment to the individual patient.

The diagnostic tools market, on the other hand, is projected to expand rapidly between 2023 and 2030, with a CAGR of 10.4%. As the findings ideally depend on the tests run, the diagnosis products in this market play a critical role in verification and validation operations. The technological advancements and diagnostics products have accounted for successful decisions that have further optimized clinical outcomes, eliminated needless therapies, reduced side effects, and prevented drug resistance.

Cancer Type Analysis

By cancer type, the market is further divided into lung cancer, prostate cancer, breast cancer, colorectal cancer, cervical cancer, and other cancer types. The breast cancer segment is estimated to be the most lucrative segment in the global precision oncology market, with a market share of 41.6% in 2022. This can be attributed to increasing awareness of breast cancer screening, diagnosis, and treatment options such as surgery and radiation.

Similarly, increasing research efforts, early breast cancer detection, and patient prognosis are expected to encourage the development of advanced treatment methods such as precision oncology. Due to expanding research initiatives, funding, and product innovations that have driven market growth in the cervical cancer category with a CAGR of 10.5%. Cervical cancer is the fastest-growing segment in cancer type in the forecasted period.

End-User Analysis

By end-user, the market is segmented into diagnostic laboratories & hospitals, healthcare data companies, pharmaceutical & biotechnology companies, and other end-users. Among these end-users, the diagnostic laboratories &hospitals segment is estimated to be the most lucrative segment in the global precision oncology market, with the largest revenue share of 40%.

Precision oncology products are becoming increasingly popular in the medical and diagnostic sector as they are used for molecular profiling of malignancies to detect gene changes. In hospitals and diagnostics laboratories, the market has grown as a consequence of its focused-on elements such as precision planning, precision diagnosis, monitoring, and expertise.

Key Market Segments

Based on product

- Diagnostics

- Therapeutics

Based on Cancer Type

- Breast Cancer

- Colorectal Cancer

- Cervical Cancer

- Prostate Cancer

- Lung Cancer

- Other Cancer Type

Based on End-User

- Hospitals & Diagnostic Laboratories

- Pharmaceutical & Biotechnology Companies

- Healthcare Data Companies

- Other End-Users

Opportunity

Precision oncology is projected to become more widely used in cancer therapy as increasing cancer patients across the world. For businesses that can create opportunities to expand their business. Outside cancer, a variety of diseases, including genetic abnormalities and autoimmune diseases, have the potential to be treated more effectively due to precision medicine.

Companies that can create precision medicine solutions for these disorders will have a lot of opportunities as a result. There will be a rising need for companion diagnostics that can help to identify patients who are most likely to benefit from targeted therapy as precision oncology spreads. Increasing research and development spending on precision oncology is significant from all sources, including governments, pharmaceutical firms, and venture capitalists. This is a chance for businesses that can create advanced precision oncology therapies and technologies.

Trends

A type of cancer treatment termed immunotherapy utilizes the patient’s immune system to attack the disease. Precision oncology has seen a rise in the use of immunotherapy, notably for the treatment of advanced malignancies. centered therapy, which involves customizing a patient’s course of treatment based on their particular genomic and proteomic profiles.

This paradigm highlights the importance of collaborative decision-making between patients and healthcare providers. Proteomics, metabolomics, and epigenomics are some of the other omics data that precision oncology is incorporating. This has the potential to improve the accuracy and effectiveness of precision oncology treatments.

Regional Analysis

North America dominates the global precision oncology market in 2022, generating 42.5% of total revenue. The market in this region is highly competitive since the bulk of the major market competitors, including Invitae Corporation, Thermo Fisher Scientific Inc., Illumina, Inc., and Laboratory Corporation of America Holding, operate in.

A number of research activities, the development of a product diagnostic software platform, the rising cost of healthcare, and the rising cancer rate in the population have opened fresh prospects for the precision oncology industry. With a robust high-tech industry, growing healthcare facilities, and rising awareness of precision oncology, the Asia-Pacific region is projected to generate the fastest Growth of 10.9% all through the projected timeframe.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Precision oncology is a new area of cancer treatment that uses genomic data to customize medicines for specific individuals. The market for precision oncology is expected to grow rapidly in the coming years, driven by genomics advancements, personalized medicine, and targeted therapies.

To raise their market value, the companies in the precision oncology market are implementing a variety of innovations, including contracts, new products, and growth. For instance, ConcertAI, LLC, and LabCorp declare their partnership in December 2021 to advance precision oncology research. The industries are attempting to get clinical research studies, which will support lightening the load on medical practices.

Market Key Players

Listed below are some of the most prominent precision oncology industry players.

- Thermo Fisher Scientific Inc.

- Invitae Corporation

- Qiagen N.V.

- Illumina, Inc.

- Laboratory Corporation Of America Holding

- Exact Sciences Corporation

- Rain Oncology Inc.

- Strata Oncology, Inc.

- Xilis, Inc.

- Variantyx, Inc.

- Bioserve

- Relay Therapeutics

- Acrivon Therapeutics

- Other Key Market Players

Recent Developments

- Thermo Fisher Scientific Inc. (July 2024): Partnered with the National Cancer Institute for the myeloMATCH trial, leveraging next-generation sequencing to match patients with appropriate clinical trials for Acute Myeloid Leukemia (AML) and Myelodysplastic Syndrome (MDS) based on specific genetic biomarkers

- Laboratory Corporation Of America Holding (April 2024): Laboratory Corporation of America Holdings expanded its precision oncology portfolio to enhance drug development programs. This initiative underscores Labcorp’s commitment to advancing cancer research and patient care globally

- Rain Oncology Inc.(January 2024): Rain Oncology Inc. was acquired by Pathos AI in a deal that concluded with a tender offer successfully acquiring approximately 77% of Rain’s outstanding shares.

- Strata Oncology, Inc. (September 2023): Strata Oncology revealed new data supporting the utility of its Immunotherapy Response Score (IRS) for guiding first-line treatment decisions in non-small cell lung cancer (NSCLC).

Report Scope

Report Features Description Market Value (2023) USD 89.3 Billion Forecast Revenue (2032) USD 202.5 Billion CAGR (2023-2032) 9.8% Base Year for Estimation 2022 Historic Period 2016-2021 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Product (Diagnostics, Therapeutics) Cancer Type (Breast Cancer, Colorectal Cancer, Cervical Cancer, Prostate Cancer, Lung Cancer, Other Cancer Type) End-User (Hospitals & Diagnostic Laboratories, Pharmaceutical & Biotechnology Companies, Healthcare Data Companies, Other End-Users) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Thermo Fisher Scientific Inc., Invitae Corporation, Qiagen N.V., Illumina, Inc., Laboratory Corporation Of America Holding, Exact Sciences Corporation, Rain Oncology Inc., Strata Oncology, Inc., Xilis, Inc., Variantyx, Inc., Bioserve, Relay Therapeutics, Acrivon Therapeutics, Other Key Market Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Thermo Fisher Scientific Inc.

- Invitae Corporation

- Qiagen N.V.

- Illumina, Inc.

- Laboratory Corporation Of America Holding

- Exact Sciences Corporation

- Rain Oncology Inc.

- Strata Oncology, Inc.

- Xilis, Inc.

- Variantyx, Inc.

- Bioserve

- Relay Therapeutics

- Acrivon Therapeutics

- Other Key Market Players