Global Power Device Analyzer Market By Type (Both AC & DC, AC, and DC), By Current (Below 1000A and Above 1000A), By End-User (Automotive, Energy, Telecommunication, Consumer Electronics & Appliances, Medical, Other End-users), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: June 2024

- Report ID: 101699

- Number of Pages: 208

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

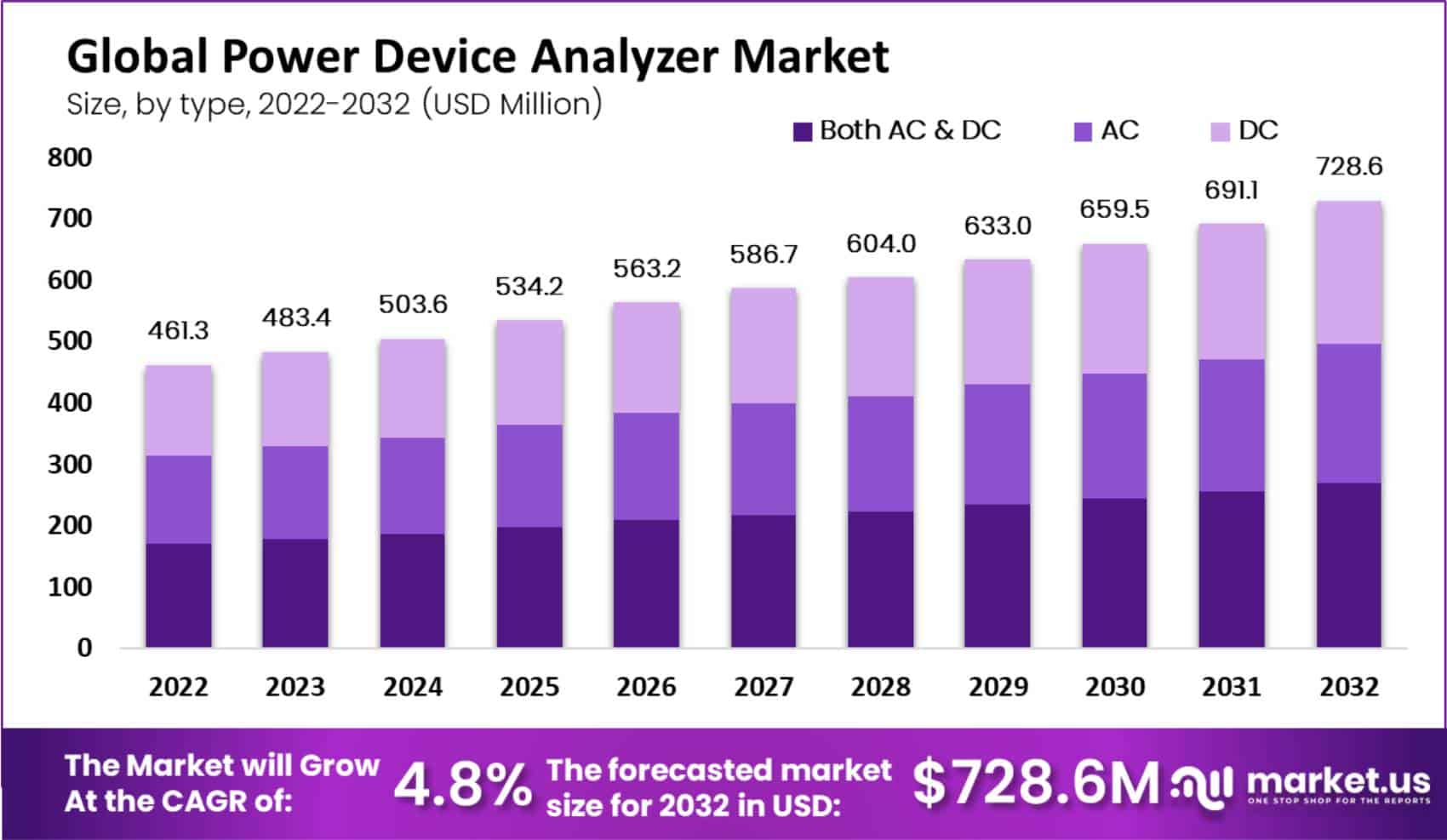

The Global Power Device Analyzer Market size is expected to be worth around USD 728.6 Million By 2032, from USD 483.4 Million in 2023, growing at a CAGR of 4.8% during the forecast period from 2024 to 2033.

The Power Device Analyzer market is witnessing significant growth due to various factors. One of the key growth factors is the increasing demand for power electronic devices in various industries such as automotive, consumer electronics, and energy. Power device analyzers play a crucial role in testing and analyzing the performance of power devices, ensuring their optimal functioning and reliability.

Moreover, the rising adoption of renewable energy sources like solar and wind power is driving the demand for power device analyzers. These analyzers assist in evaluating the efficiency and performance of power devices used in renewable energy systems, enabling the industry to enhance energy conversion and utilization.

Furthermore, the emergence of electric vehicles (EVs) is creating immense opportunities for the power device analyzer market. With the growing popularity of EVs, there is a need for efficient power devices to manage the electric power flow and ensure safe and reliable operation. Power device analyzers enable manufacturers to test and validate the performance of power devices used in EVs, contributing to the overall development and advancement of the electric vehicle industry.

However, the market faces several challenges. High costs associated with advanced power device analyzers and the complexity of integrating these devices into existing systems can hinder market growth. Additionally, the rapid pace of technological advancements requires continuous innovation, which can be a barrier for smaller companies.

Despite these challenges, there are ample opportunities for new entrants in the market. The growing emphasis on renewable energy sources and the increasing implementation of smart grids offer new players a chance to introduce innovative solutions. Additionally, as industries seek more efficient power management systems, new companies can capitalize on this demand by providing cost-effective and advanced power device analyzers.

Key Takeaways

- The Power Device Analyzer Market size is projected to reach USD 728.6 Million by 2032, growing from USD 483.4 Million in 2023, at a CAGR of 4.8% during the forecast period from 2024 to 2033.

- In 2022, the “Both AC & DC” segment held a dominant position in the Power Device Analyzer market, capturing more than a 37% share of the global market.

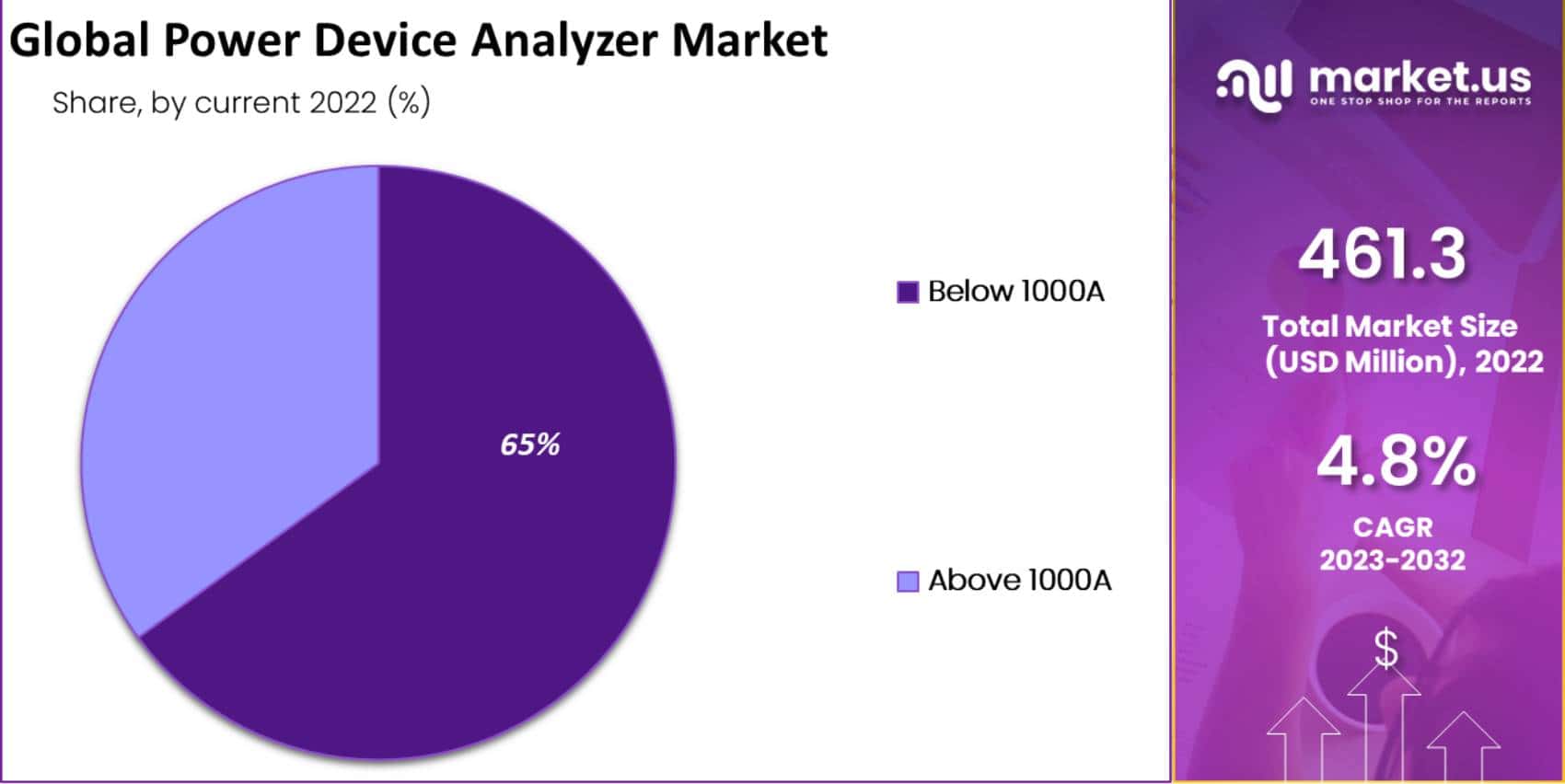

- In 2022, the “Below 1000A” segment held a dominant market position, capturing more than a 65% share of the global Power Device Analyzer market.

- In 2022, the Consumer Electronics & Appliances segment held a dominant position in the Power Device Analyzer market, capturing more than a 32% share.

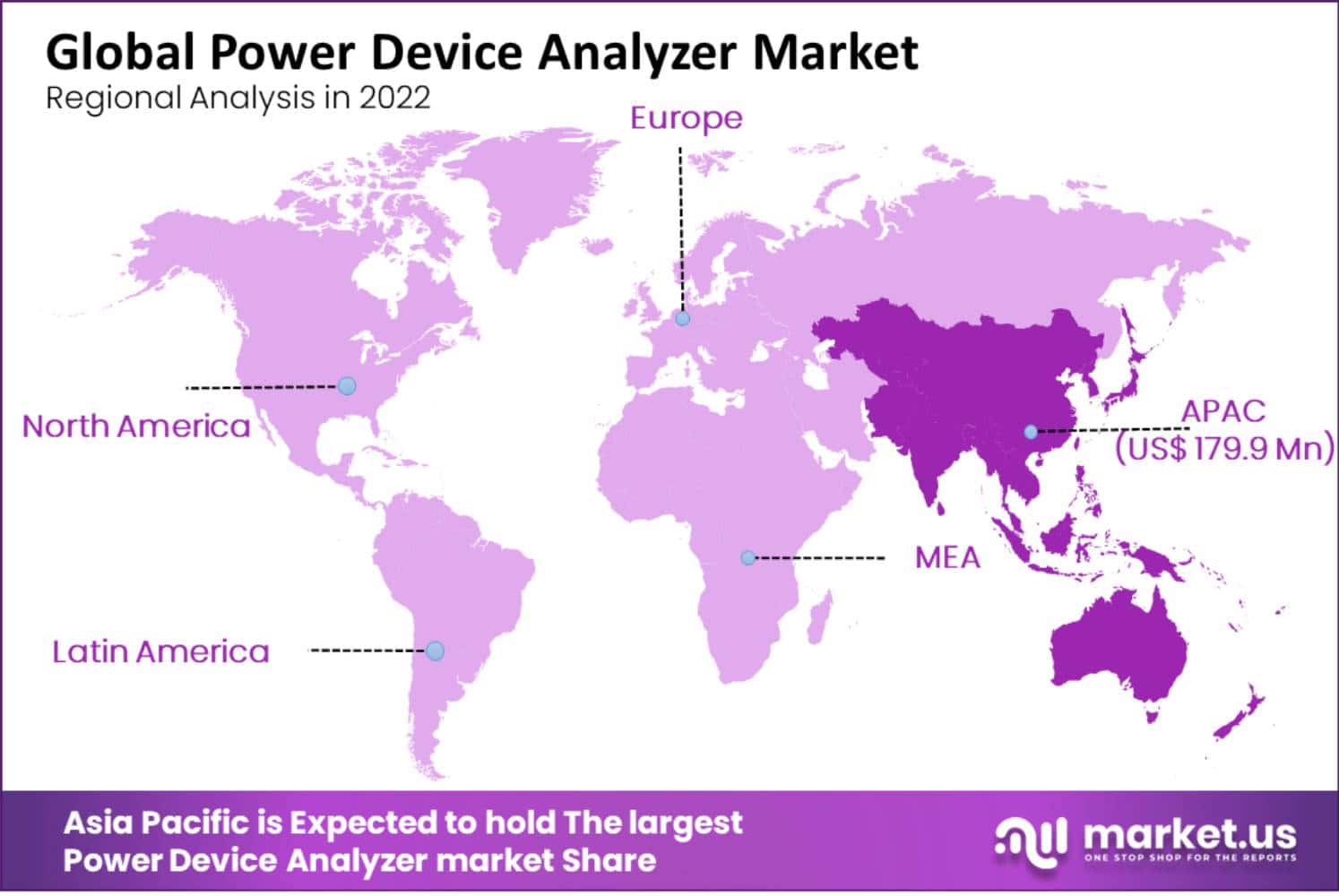

- In 2022, Asia Pacific held a dominant market position in the Power Device Analyzer market, capturing more than a 39% share, with revenue amounting to USD 179.9 million.

Type Analysis

In 2022, the “Both AC & DC” segment of the Power Device Analyzer market held a dominant position, capturing more than a 37% share of the global market. This segment leads primarily because of its versatility and comprehensive applicability across various industries, including automotive, consumer electronics, and renewable energy systems.

The ability to analyze both alternating current (AC) and direct current (DC) makes these analyzers particularly valuable in sectors that require rigorous testing of electronic components and systems that operate under both types of currents.

The prominence of the “Both AC & DC” segment is further bolstered by the ongoing advancements in power electronics and the increasing integration of renewable energy sources, which often utilize both AC and DC systems. For example, solar power systems convert DC generated by solar panels into AC for home and business use, necessitating tools that can analyze both current types for efficiency and safety checks.

The demand for dual-capability analyzers is expected to grow as technologies that require complex and hybrid electrical solutions become more widespread. Additionally, this segment’s leading position is supported by the surge in electric vehicle (EV) production and the development of smart grids, both of which rely heavily on AC and DC systems.

As these industries continue to expand, the need for robust testing and analysis equipment capable of handling both AC and DC becomes more critical, further driving the demand for “Both AC & DC” power device analyzers. The versatility and enhanced functionality of these analyzers not only simplify operational processes but also ensure a higher standard of safety and efficiency, making them a preferred choice for businesses aiming to keep pace with technological advancements.

Current Analysis

In 2022, the “Below 1000A” segment held a dominant market position in the Power Device Analyzer market, capturing more than a 65% share. This segment’s leadership is largely due to its widespread application across a multitude of industries that require moderate to low current analysis for device testing and quality assurance.

Industries such as consumer electronics, automotive components, and small-scale renewable energy systems predominantly use devices that operate within this current range, making the “Below 1000A” analyzers essential for ensuring product safety and efficiency. The predominance of the “Below 1000A” segment is also supported by the growth of smart electronic devices, which include smartphones, laptops, and home appliances.

These devices typically operate at lower current levels, thus necessitating the need for analyzers that can accurately assess and monitor electrical performance without exceeding the required capacity. Moreover, the ongoing advancements in circuit design and the miniaturization of electronic components further drive the demand for analyzers capable of handling finer, more precise measurements, which are characteristic of the “Below 1000A” segment.

Furthermore, the increasing emphasis on energy efficiency and safety standards in electronic manufacturing pushes the need for rigorous testing, particularly in the lower current range, to prevent malfunction and ensure compliance with international standards. This not only enhances the reliability of electrical products but also aligns with global efforts to enhance sustainability in technology. As a result, the “Below 1000A” power device analyzers continue to be instrumental in maintaining the high quality and performance of a vast array of electronic products.

End-User Analysis

In 2022, the Consumer Electronics & Appliances segment of the Power Device Analyzer market held a dominant position, capturing more than a 32% share. This segment leads primarily due to the constant demand for quality assurance and safety testing in the production of consumer electronics and household appliances.

As these products are integral to daily life and operate under rigorous usage conditions, manufacturers are compelled to ensure high standards of electrical safety and efficiency, thus heavily relying on power device analyzers. The burgeoning growth in smart home devices and the continuous innovation in personal electronics, such as smartphones, tablets, and wearable technology, further propel the demand within this segment.

Consumer electronics manufacturers are continuously upgrading their product offerings with new features that often require intricate power management solutions, necessitating precise analysis to optimize energy consumption and prolong battery life.

Moreover, the rise in consumer awareness regarding energy-efficient and environmentally sustainable products has influenced the market dynamics. Consumers are increasingly favoring appliances and electronics that are not only powerful but also energy-efficient, driving companies to invest in rigorous testing procedures during the design and manufacturing stages to meet these expectations. This trend significantly contributes to the sustained leadership of the Consumer Electronics & Appliances segment in the Power Device Analyzer market.

Key Market Segments

By Type

- Both AC & DC

- AC

- DC

By Current

- Below 1000A

- Above 1000A

By End-User

- Automotive

- Energy

- Telecommunication

- Consumer Electronics & Appliances

- Medical

- Other End-users

Driver

Increasing Demand for Energy-Efficient Devices

The Power Device Analyzer market is driven significantly by the rising global emphasis on energy efficiency. With increasing regulatory pressures and market demand for power-efficient products across various industries, including automotive, consumer electronics, and industrial applications, the need for effective power device analysis has become crucial.

This trend is underscored by a growing demand for electric vehicles and the expansion of renewable energy infrastructure, which require rigorous testing and optimization of power components to ensure efficiency and reliability. The widespread adoption of these technologies is expected to continue pushing the demand for power device analyzers.

Restraint

High Initial Costs

One of the primary restraints in the Power Device Analyzer market is the high initial cost associated with advanced power device analyzers. These devices are essential for ensuring the performance and efficiency of electrical components, but their high upfront cost can be a significant barrier for small and medium-sized enterprises (SMEs). This financial barrier can limit the market’s growth, particularly in developing regions where budget constraints are more pronounced.

Opportunity

Expansion in Emerging Markets

Emerging markets present significant growth opportunities for the Power Device Analyzer sector due to increasing industrialization, urbanization, and the rising adoption of technologically advanced systems. Countries in Asia Pacific, for example, are experiencing rapid growth in industries such as automotive, consumer electronics, and renewable energy, all of which require extensive power device analysis. The region’s strong push towards modernizing infrastructure and increasing energy efficiency also opens up new avenues for market expansion.

Challenge

Technological Complexities

The technological complexity of power device analyzers poses a considerable challenge. As power systems and devices become more advanced, the need for equally sophisticated analyzers increases. These analyzers must not only provide accurate and reliable data but also be compatible with the latest technologies. Staying ahead in technological advancements, including integration with IoT and real-time data analysis capabilities, requires ongoing research and development, which can be resource-intensive.

Growth Factors

- Increasing Demand for Electric Vehicles: The surge in electric vehicle production globally drives the need for advanced power device analyzers to ensure the efficiency and safety of EV components.

- Expansion of Renewable Energy Projects: As renewable energy sources like solar and wind become more prevalent, there is a growing need for power device analyzers to optimize and maintain the performance of these energy systems.

- Advancements in Power Semiconductor Technology: The development of sophisticated semiconductor devices necessitates precise testing tools, bolstering the demand for power device analyzers.

- Regulatory Push for Energy Efficiency: Governments worldwide are implementing stricter regulations on energy consumption and efficiency, prompting industries to adopt power device analyzers for compliance and performance optimization.

- Growth in Industrial Automation: As industries increasingly adopt automated systems, the requirement for monitoring and optimizing power usage in these systems enhances the market for power device analyzers.

Emerging Trends

- Integration with IoT Technologies: Power device analyzers are increasingly being integrated with the Internet of Things (IoT), allowing for real-time monitoring and data analysis, which enhances operational efficiency.

- Development of Portable and Wireless Analyzers: There is a growing trend towards the development of handheld and wireless power device analyzers, which provide greater convenience and flexibility for on-site testing.

- Increased Use in Consumer Electronics: As consumer electronics become more power-intensive and complex, the use of power device analyzers to ensure device safety and efficiency is becoming more common.

- Adoption of Artificial Intelligence and Machine Learning: AI and ML are being incorporated into power device analyzers to predict failures and optimize power usage without human intervention.

- Expansion in Emerging Markets: The Asia-Pacific region, in particular, is seeing rapid growth in the use of power device analyzers due to its booming electronics manufacturing sector and increasing industrialization.

Regional Analysis

In 2022, Asia Pacific held a dominant market position in the Power Device Analyzer market, capturing more than a 39% share, with revenue amounting to USD 179.9 million. This region’s leadership is driven by the rapid expansion of industries such as consumer electronics, automotive, and renewable energy, particularly in countries like China, India, and Japan. The presence of major manufacturing hubs and the increasing adoption of advanced technology in these sectors contribute significantly to the demand for power device analyzers.

Meanwhile, North America also presents a robust market for Power Device Analyzers, driven by advanced technological infrastructure and stringent regulations regarding energy efficiency and device safety. The region’s emphasis on innovating automotive and renewable energy sectors, coupled with substantial investments in industrial automation, positions it as a critical market. The presence of key industry players and technological innovators in the United States and Canada enhances North America’s capacity to integrate and leverage new technologies in power device analysis, further promoting growth in this market.

Europe, Latin America, the Middle East, and Africa also contribute to the global landscape, each with unique growth catalysts and challenges influenced by regional economic, technological, and regulatory dynamics. Europe’s focus on renewable energy and energy-efficient devices, Latin America’s growing industrial base, and the Middle East and Africa’s increasing infrastructure development are pivotal to understanding the global distribution and future potential of the Power Device Analyzer market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the power device analyzer market, several key players are pivotal in shaping industry trends and technology advancements. Keysight Technologies, Inc. leads with its comprehensive range of testing and measurement solutions that cater to various sectors including automotive, consumer electronics, and renewable energy. Yokogawa Electric Corporation is renowned for its precision and reliability in the manufacturing of testing instruments, significantly contributing to the market with innovations tailored for power analysis.

Advantest Corporation, another major contender, specializes in semiconductor testing devices, which are crucial for ensuring device efficiency and performance in high-stake industries like telecommunications and consumer electronics. Chroma ATE Inc. offers specialized testing solutions that support the development of battery and power electronics, positioning them as a leader in both the automotive and energy sectors.

Tektronix Inc. and B&K Precision Corporation are well-recognized for their robust and user-friendly devices, making complex measurements accessible to a broader range of professionals and industries. Rohde & Schwarz GmbH & Co KG, with its focus on precision and adaptability, supports industries in navigating rapidly evolving technological landscapes, especially in telecommunications and defense.

Top Key Players in Power Device Analyzer Market

- Keysight Technologies, Inc.

- Yokogawa Electric Corporation

- Advantest Corporation

- Chroma ATE Inc.

- Tektronix Inc.

- B&K Precision Corporation

- Rohde & Schwarz GmbH & Co KG

- National Instruments Corporation

- Keithley Instruments, Inc.

- Fortive Corporation

- Other key Players

Recent Developments

- In January 2024, Keysight launched the PD1000A Power Device Measurement System for Advanced Modeling. This system aims to streamline design cycles by enabling accurate, real-world simulations for power devices.

- In January 2024, Chroma ATE launched a new power analyzer, the 66204, designed for high-precision measurement in power electronics applications.

- In March 2023, Yokogawa released the WT5000 Precision Power Analyzer. This product is designed for applications requiring high accuracy and stability, with features to measure electrical and mechanical efficiency in EV and HEV inverters and motors.

Report Scope

Report Features Description Market Value (2023) US$ 483.4 Mn Forecast Revenue (2032) US$ 728.6 Mn CAGR (2023-2032) 4.8% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Both AC & DC, AC, and DC), By Current (Below 1000A and Above 1000A), By End-User (Automotive, Energy, Telecommunication, Consumer Electronics & Appliances, Medical, Other End-users) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Keysight Technologies, Inc., Yokogawa Electric Corporation, Advantest Corporation, Chroma ATE Inc., Tektronix Inc., B&K Precision Corporation, Rohde & Schwarz GmbH & Co KG, National Instruments Corporation, Keithley Instruments, Inc., Fortive Corporation, Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the estimated valuation of the power device analyzer market in 2032?The power device analyzer market is estimated to reach a valuation of US$ 728.6 million by 2032.

What applications do power devices play a role in?Power devices play an important role in power electronics applications such as power supplies, motor drives, and inverters.

What are the driving factors for the growth of the power device analyzer market?The rising adoption of electronic devices and increasing demand for electric vehicles (EVs) and the increasing trend towards renewable energy are driving factors for the growth of the power device analyzer market.

What is the dominant type of power device analyzer in the market?Both AC & DC segments dominated the power device analyzer market with the largest market revenue share of 37% in 2022.

Which region dominated the power device analyzer market?The Asia Pacific region dominates the market with the largest market share of 39% in 2022 and is expected to remain dominant during the forecast period.

Which companies are the key players in the power device analyzer market?The top key players in the power device analyzer market are Keysight Technologies, Yokogawa Electric Corporation, Advantest Corporation, Chroma ATE Inc., Tektronix Inc., B&K Precision Corporation, Rohde & Schwarz GmbH & Co KG, National Instruments Corporation, Keithley Instruments, Inc., and Fortive Corporation.

What are the benefits of using a power device analyzer in the manufacturing industry?The benefits of using a power device analyzer in the manufacturing industry include improved efficiency, reduced energy costs, and improved product quality.

Power Device Analyzer MarketPublished date: June 2024add_shopping_cartBuy Now get_appDownload Sample

Power Device Analyzer MarketPublished date: June 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Keysight Technologies, Inc.

- Yokogawa Electric Corporation

- Advantest Corporation

- Chroma ATE Inc.

- Tektronix Inc.

- B&K Precision Corporation

- Rohde & Schwarz GmbH & Co KG

- National Instruments Corporation

- Keithley Instruments, Inc.

- Fortive Corporation

- Other key Players