Global Polyvinylidene Fluoride Market Size, Share Analysis Report By Process (Injection Molding, Extraction, Others), By Product Type (Pellets, Powder, Latex Emulsions, Films, Others), By Application (Piping and Tubing, Plumbing and Fitting, Membranes, Chemical Processing, Semiconductors, Wire and Cable, Lithium-ion Batteries, Valves, Architectural Coating, Nuclear Waste Processing, Others), By End-Use (Electrical and Electronics, Oil and Gas, Food and Beverage, Pharmaceutical, Building and Construction, Automotive, Aerospace and Defense, Metallurgical, Paper and Textile, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153256

- Number of Pages: 343

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

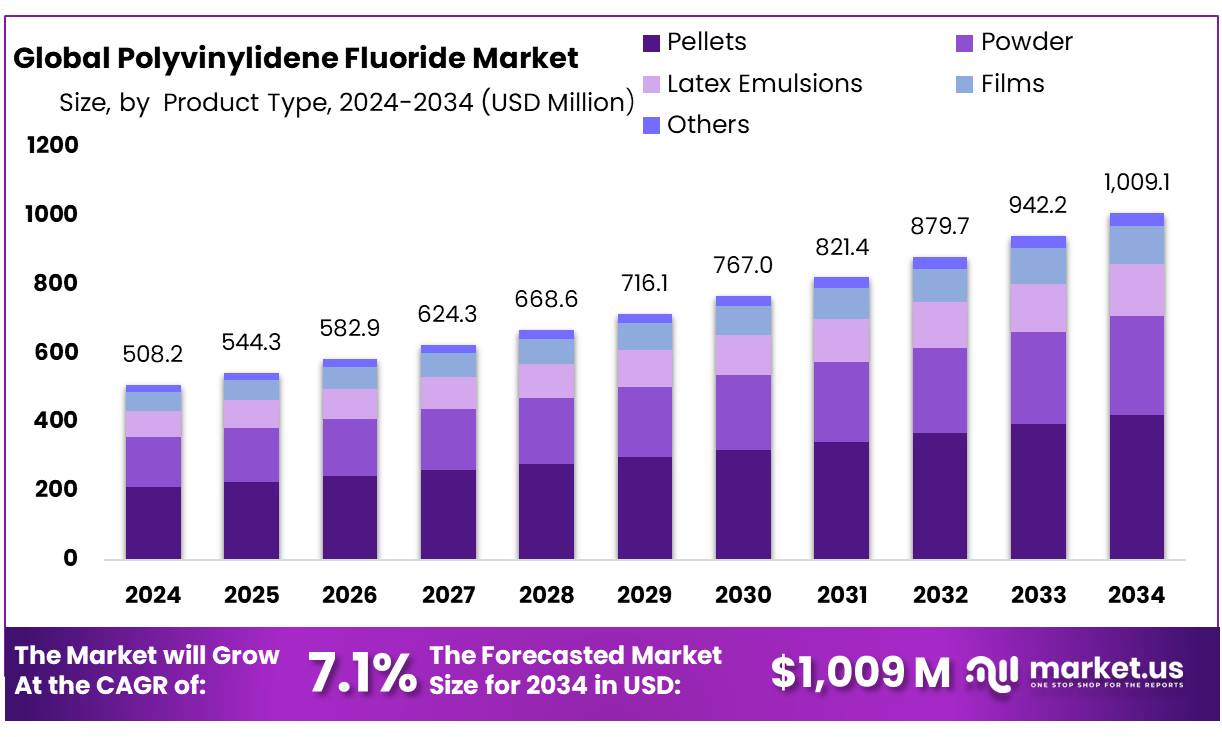

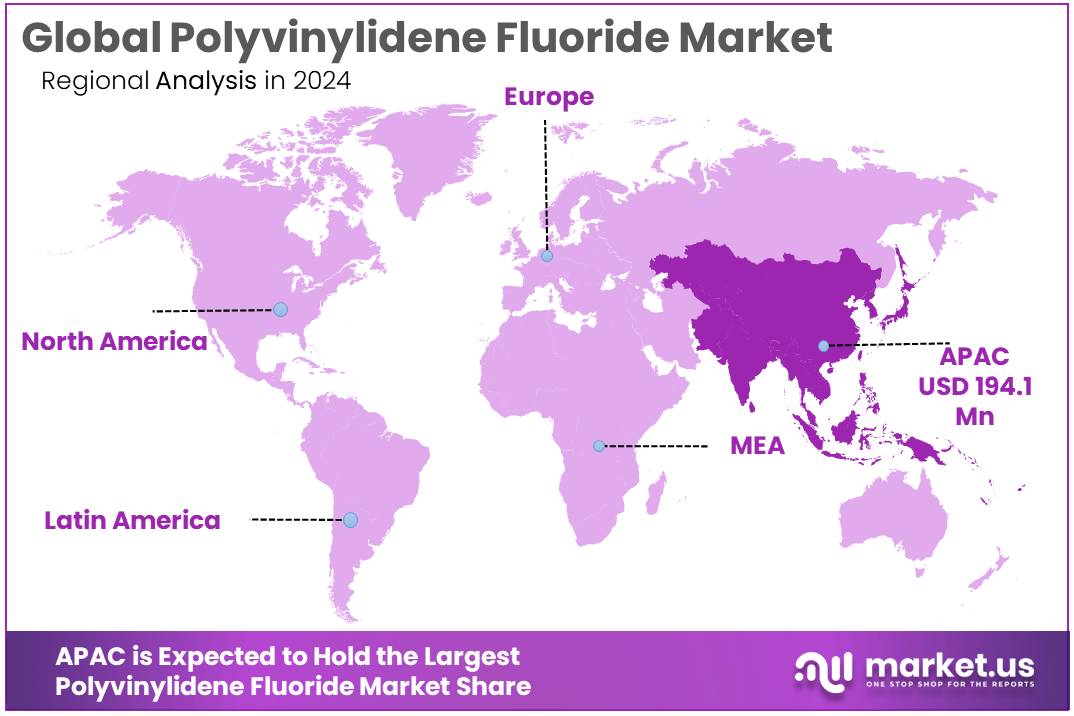

The Global Polyvinylidene Fluoride Market size is expected to be worth around USD 1009.1 Million by 2034, from USD 508.2 Million in 2024, growing at a CAGR of 7.1% during the forecast period from 2025 to 2034. In 2024, Asia-Pacific (APAC) held a dominant market position, capturing more than a 38.2% share, holding USD 194.1 Million revenue.

The global polyvinylidene fluoride (PVDF) concentrate industry is characterized by its robust growth, underpinned by rising demand in energy storage, coatings, and high-purity applications. PVDF—a semi‑crystalline thermoplastic fluoropolymer—is prized for its chemical inertness, thermal stability (melting point ~177 °C), and piezoelectric properties. These attributes underpin its expanded use across lithium-ion battery binders, high-performance membranes, architectural coatings, and advanced electronic components.

Driving factors include increasing government support for clean energy technologies. In the U.S., the Inflation Reduction Act and CHIPS & Science Act have facilitated over USD 150 billion in announced investments for battery supply chain development since 2021, supporting PVDF usage in separators and binders for EV battery manufacturing. The 45X advanced manufacturing production tax credit and 48C energy tax incentives under these programs further incentivize domestic production of PVDF-intensive battery components.

In the US and EU, water-quality regulations (e.g., Safe Drinking Water Act in the US and the EU’s Water Framework Directive) are fostering adoption of PVDF-based filtration. At the company level, Arkema is investing USD 20 million to expand PVDF production capacity by 15% in Kentucky by mid 2026, to meet rising demand in EV batteries, semiconductors, and cable insulation

Government initiatives are supporting PVDF market expansion indirectly by strengthening supply chains for critical materials, such as in the U.S. DOE’s four-year review (2021–2024), which explicitly highlights PVDF’s role in advanced battery sectors. Those federal strategies—bolstered by investments via the Department of Energy Loan Programs Office and U.S. International Development Finance Corporation—are aimed at securing domestic and global clean-energy supply chains, with at least USD 55 million allocated for related raw material sourcing.

Key Takeaways

- The Polyvinylidene Fluoride (PVDF) Market is projected to grow from USD 508.2 million in 2024 to approximately USD 1009.1 million by 2034, registering a CAGR of 7.1% during the forecast period.

- Injection molding emerged as the leading processing technology, accounting for over 48.7% of the global PVDF market share.

- Pellets dominated the form segment, capturing more than 41.8% of the overall market.

- Within the application segment, piping and tubing held a significant position, contributing to over 19.2% of the global PVDF market.

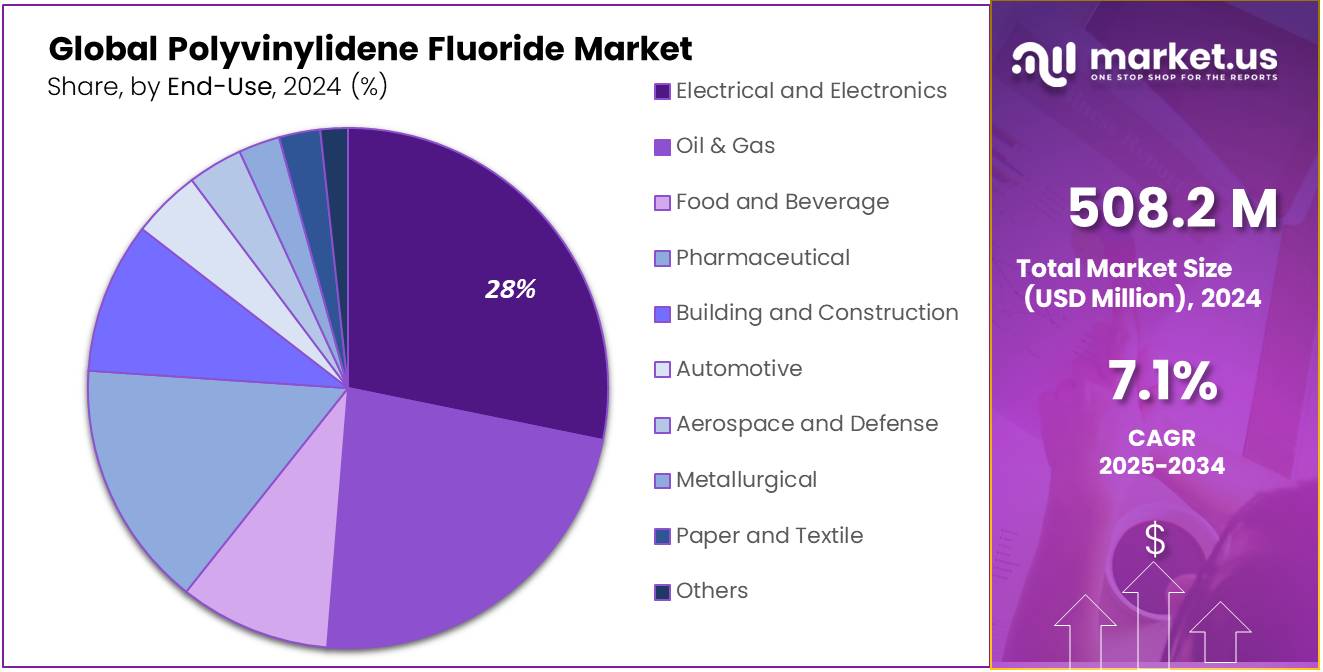

- The electrical and electronics sector led the end-use segment, representing more than 28.3% of the total market share.

- The Asia-Pacific (APAC) region was the dominant regional market, holding a 38.2% share, which translates to an estimated market value of USD 194.1 million in 2024.

By Process Analysis

Injection Molding dominates with 48.7% share due to its precision and compatibility with mass production.

In 2024, Injection Molding held a dominant market position, capturing more than a 48.7% share in the global Polyvinylidene Fluoride (PVDF) market by process. This leading position can be linked to the method’s ability to produce high-precision parts with minimal waste, making it ideal for large-scale production in automotive, electrical, and chemical handling industries.

Injection molding supports the complex geometries and tight tolerances required in PVDF applications, especially where chemical resistance and mechanical strength are critical. The growing demand for lightweight, durable components in electric vehicles and clean energy infrastructure has also favored this process. In 2025, this segment is expected to maintain its strong hold, supported by continued industrial investments and the expansion of end-use sectors across Asia-Pacific and North America.

By Product Type Analysis

Pellets dominate with 41.8% share due to their ease of processing and wide industrial compatibility.

In 2024, Pellets held a dominant market position, capturing more than a 41.8% share in the global Polyvinylidene Fluoride (PVDF) market by product type. Their widespread use is mainly driven by the simplicity they offer during processing, especially in applications like extrusion, injection molding, and compounding. Pellets are preferred by manufacturers for their uniform shape and consistent melting behavior, which allows better control in high-volume production lines.

Industries such as automotive, electronics, and chemical processing continue to rely on PVDF pellets for producing durable and chemically resistant components. As the demand for electric vehicle battery binders, protective coatings, and high-performance pipes rises, pellets are expected to remain a key material. Moving into 2025, their market position is likely to hold strong, with steady adoption across both established and emerging industrial sectors.

By Application Analysis

Piping and Tubing leads with 19.2% share as industries prefer it for chemical resistance and long-term durability.

In 2024, Piping and Tubing held a dominant market position, capturing more than a 19.2% share in the global Polyvinylidene Fluoride (PVDF) market by application. This strong presence comes from PVDF’s excellent resistance to chemicals, high temperatures, and corrosion, making it highly suitable for fluid handling systems in chemical processing plants, water treatment facilities, and semiconductor manufacturing.

PVDF pipes and tubes are often chosen for applications where metal alternatives would corrode or degrade over time. The demand is also growing in pharmaceutical and food industries, where hygienic and non-reactive materials are critical. In 2025, the segment is expected to maintain steady growth as industrial operations expand and stricter environmental and safety standards push for more durable and low-maintenance piping solutions.

By End-Use Analysis

Electrical and Electronics dominates with 28.3% share due to rising demand for high-performance insulation and components.

In 2024, Electrical and Electronics held a dominant market position, capturing more than a 28.3% share in the global Polyvinylidene Fluoride (PVDF) market by end-use. This strong performance is driven by PVDF’s excellent electrical insulation, high thermal stability, and flame resistance, making it an ideal material for wire and cable coatings, connectors, and film capacitors.

As the electronics industry continues to push toward miniaturization and reliability, PVDF is widely chosen for use in both consumer electronics and industrial control systems. Its application in lithium-ion battery binders and photovoltaic backsheets has further increased its relevance, especially with the global shift toward renewable energy and electric mobility.

Key Market Segments

By Process

- Injection Molding

- Extraction

- Others

By Product Type

- Pellets

- Powder

- Latex Emulsions

- Films

- Others

By Application

- Piping and Tubing

- Plumbing and Fitting

- Membranes

- Chemical Processing

- Semiconductors

- Wire and Cable

- Lithium-ion Batteries

- Valves

- Architectural Coating

- Nuclear Waste Processing

- Others

By End-Use

- Electrical and Electronics

- Oil & Gas

- Food and Beverage

- Pharmaceutical

- Building and Construction

- Automotive

- Aerospace and Defense

- Metallurgical

- Paper and Textile

- Others

Emerging Trends

Regulatory Support for Safer Food Packaging Materials

Polyvinylidene fluoride (PVDF) is gaining recognition as a safer alternative to traditional fluorinated compounds in food packaging. Governments worldwide are implementing regulations to phase out harmful substances like per- and polyfluoroalkyl substances (PFAS) from food contact materials, creating opportunities for PVDF adoption.

In the United States, the Food Packaging Forum (FPF) submitted comments to the U.S. Food and Drug Administration (FDA) in 2024, supporting a petition to remove authorization for fluorinated polyethylene in food packaging. The petition highlights concerns about the migration of perfluoroalkyl carboxylic acids (PFCAs) from fluorinated plastics into food, posing potential health risks. This move aligns with the FDA’s broader efforts to regulate food contact materials and ensure consumer safety.

Similarly, in Canada, Health Canada maintains a list of acceptable polymers for use in food packaging applications. While PVDF is not explicitly listed, its chemical composition and properties may allow for its inclusion upon evaluation. Health Canada’s guidelines ensure that all materials used in food packaging are safe and do not impart harmful substances to food.

Drivers

Enhanced Shelf Life and Food Safety

Polyvinylidene fluoride (PVDF) has become a cornerstone in modern food packaging due to its remarkable ability to preserve food quality and ensure safety. The material’s exceptional barrier properties—particularly its low permeability to oxygen and water vapor—play a crucial role in extending the shelf life of perishable items. This capability is especially beneficial for products like dairy, beverages, and ready-to-eat meals, which are susceptible to spoilage and contamination.

A study highlighted in Eureka notes that PVDF’s resistance to moisture and gases helps maintain the freshness and quality of packaged foods for longer periods. This is particularly important as consumer demand for longer shelf life continues to rise, driven by the need for convenience and reduced food waste.

Moreover, PVDF’s compliance with stringent food safety standards, including approvals from the U.S. Food and Drug Administration (FDA) and the European Union (EU), underscores its suitability for direct food contact applications. These certifications provide assurance to both manufacturers and consumers about the material’s safety and non-toxicity under normal usage conditions.

The adoption of PVDF in food packaging aligns with global initiatives aimed at reducing food waste and enhancing food safety. By improving the durability and effectiveness of packaging materials, PVDF contributes to more sustainable food systems and supports the broader goals of food security and environmental responsibility.

Restraints

High Production Costs Hindering Widespread Adoption

Polyvinylidene fluoride (PVDF) is celebrated for its exceptional performance in food packaging, offering superior barrier properties, chemical resistance, and compliance with food safety standards. However, its widespread adoption is significantly constrained by its high production costs.

The complex manufacturing process of PVDF, which involves high temperatures and specialized equipment, contributes to its elevated cost. Additionally, the raw materials required for PVDF production are more expensive compared to those used for conventional packaging materials. This results in PVDF-based food packaging being approximately 11% to 32% more expensive than alternatives utilizing short-chain per- and polyfluoroalkyl substances (PFAS) .

This cost disparity poses a significant barrier, particularly for small and medium-sized enterprises (SMEs) in the food industry, which may find it challenging to justify the higher expenses associated with PVDF packaging. The economic feasibility of adopting PVDF is further complicated by the lack of widespread recycling infrastructure and the potential environmental concerns associated with fluorinated compounds.

Opportunity

Government Support for Sustainable Food Packaging

Polyvinylidene fluoride (PVDF) is gaining traction in the food packaging industry, thanks to its exceptional barrier properties and compliance with food safety standards. Governments worldwide are recognizing the importance of sustainable packaging solutions and are implementing policies to encourage their adoption.

In the United States, the Environmental Protection Agency (EPA) has been actively involved in regulating per- and polyfluoroalkyl substances (PFAS) in food packaging. While PVDF is distinct from traditional PFAS, its use in food packaging is being closely monitored. The EPA’s focus on reducing harmful substances in food packaging materials indirectly supports the adoption of safer alternatives like PVDF.

These government initiatives not only foster innovation in the packaging industry but also create a conducive environment for the adoption of PVDF as a sustainable alternative. As regulations tighten and consumer demand for eco-friendly products increases, PVDF’s role in food packaging is expected to expand, offering a safer and more sustainable option for preserving food quality and safety.

Regional Insights

Asia-Pacific (APAC) dominates the Polyvinylidene Fluoride market with 38.2% share, valued at USD 194.1 million in 2024.

In 2024, the Asia-Pacific (APAC) region emerged as the dominant force in the global Polyvinylidene Fluoride (PVDF) market, capturing a substantial 38.2% market share, equivalent to a valuation of USD 194.1 million. This strong regional leadership is driven by the rapid expansion of key end-use industries such as electronics, automotive, chemicals, and renewable energy across China, Japan, South Korea, and India.

China leads the regional consumption due to its large-scale investments in clean energy, semiconductor manufacturing, and industrial infrastructure. The country’s “Made in China 2025” initiative and its dominance in battery-grade PVDF production have reinforced its supply chain position. Meanwhile, India’s Production-Linked Incentive (PLI) schemes supporting chemical and advanced material manufacturing have also encouraged domestic PVDF output and downstream utilization in sectors like pharmaceuticals and water treatment.

Japan and South Korea continue to play key roles through their innovation in electronics and high-performance polymers. These countries are witnessing rising PVDF usage in wire insulation, photovoltaic backsheets, and membranes for industrial filtration, supported by stringent environmental and safety regulations.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

3M is a leading global player in the PVDF market, known for its innovative materials and advanced technology solutions. The company manufactures high-performance PVDF products used in various industries, including electronics, healthcare, and food packaging. With a commitment to sustainability and product development, 3M focuses on offering solutions that enhance performance while minimizing environmental impact, ensuring growth in the PVDF market.

Arkema SA is a major player in the PVDF market, offering a wide range of high-performance thermoplastic materials. With a strong focus on innovation and sustainability, Arkema develops PVDF products used in energy storage, automotive, and chemical processing industries. Their commitment to research and development drives the continuous improvement of PVDF solutions, supporting the growing demand for efficient, high-quality materials in various sectors globally.

Ensinger is a global leader in producing high-performance plastic materials, including PVDF, for applications in industries such as food processing, chemical engineering, and pharmaceuticals. Known for its strong engineering expertise, Ensinger provides customized solutions that meet stringent quality standards. The company’s focus on innovation and maintaining a diverse product portfolio helps ensure its leadership in the PVDF market, offering robust and reliable solutions for demanding industrial applications.

Top Key Players Outlook

- 3M

- Aetna Plastics Corp.

- Arkema SA

- Daikin Industries, Ltd

- Ensinger

- Gujarat Fluorochemicals Ltd.

- Kureha Corporation

- Nanoshel LLC

- Ofluorine Chemical Technology Co., Ltd.

- Rochling SE and Co. KG

- RTP Co.

- Shanghai Huayi 3F New Materials Co. Ltd.

- Simtech Process Systems

- Solvay SA

- Swami Plast Industries

Recent Industry Developments

In 2024, Arkema reported stable sales of €9.5 billion, with volumes up 2.4%, driven by growth in Specialty Materials in Asia and favorable dynamics in markets such as batteries and energy.

In 2024, 3M sustained its investment in PVDF R&D and commercial supply, with flagship copolymer 11010/0000 optimized for extrusion and injection molding and copolymer 31008/0003 tailored for flame‑resistant cable jacketing.

Report Scope

Report Features Description Market Value (2024) USD 508.2 Mn Forecast Revenue (2034) USD 1009.1 Mn CAGR (2025-2034) 7.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Process (Injection Molding, Extraction, Others), By Product Type (Pellets, Powder, Latex Emulsions, Films, Others), By Application (Piping and Tubing, Plumbing and Fitting, Membranes, Chemical Processing, Semiconductors, Wire and Cable, Lithium-ion Batteries, Valves, Architectural Coating, Nuclear Waste Processing, Others), By End-Use (Electrical and Electronics, Oil and Gas, Food and Beverage, Pharmaceutical, Building and Construction, Automotive, Aerospace and Defense, Metallurgical, Paper and Textile, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape 3M, Aetna Plastics Corp., Arkema SA, Daikin Industries, Ltd, Ensinger, Gujarat Fluorochemicals Ltd., Kureha Corporation, Nanoshel LLC, Ofluorine Chemical Technology Co., Ltd., Rochling SE and Co. KG, RTP Co., Shanghai Huayi 3F New Materials Co. Ltd., Simtech Process Systems, Solvay SA, Swami Plast Industries Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Polyvinylidene Fluoride MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Polyvinylidene Fluoride MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- 3M

- Aetna Plastics Corp.

- Arkema SA

- Daikin Industries, Ltd

- Ensinger

- Gujarat Fluorochemicals Ltd.

- Kureha Corporation

- Nanoshel LLC

- Ofluorine Chemical Technology Co., Ltd.

- Rochling SE and Co. KG

- RTP Co.

- Shanghai Huayi 3F New Materials Co. Ltd.

- Simtech Process Systems

- Solvay SA

- Swami Plast Industries