Global Phytopathological Disease Diagnostics Market By Product Type (ELISA Kits, Protein-Based Diagnostics Kits, Lateral Flow Devices, DNA-Based Diagnostics Kits and DNA/RNA Probes), By Test Type (PCR-Based Assays, Serological Tests, Microarray Assays, Isothermal Amplification Assays and Electronic Technology-Based Tests), By Sample Type (Plants, Seeds, Grains and Fruits), By End-user (Agricultural Laboratories, Food Processing Laboratories, Contract Research Organizations, Academic and Research Institutes and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 171062

- Number of Pages: 279

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

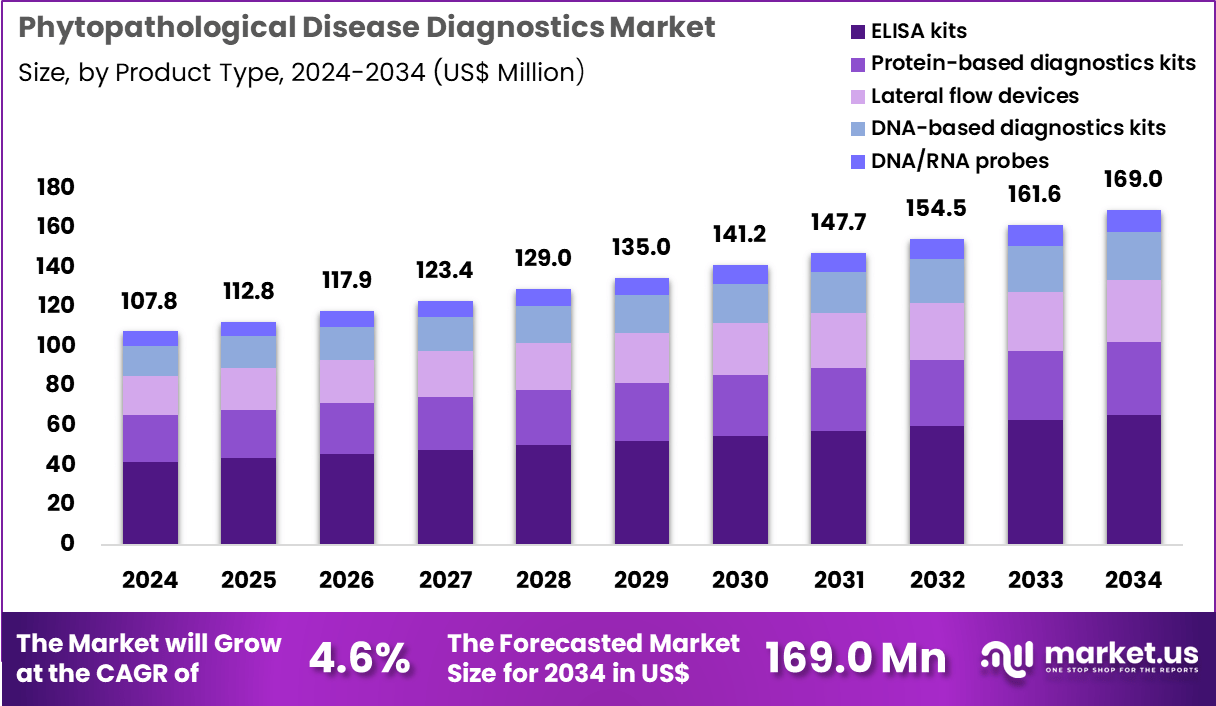

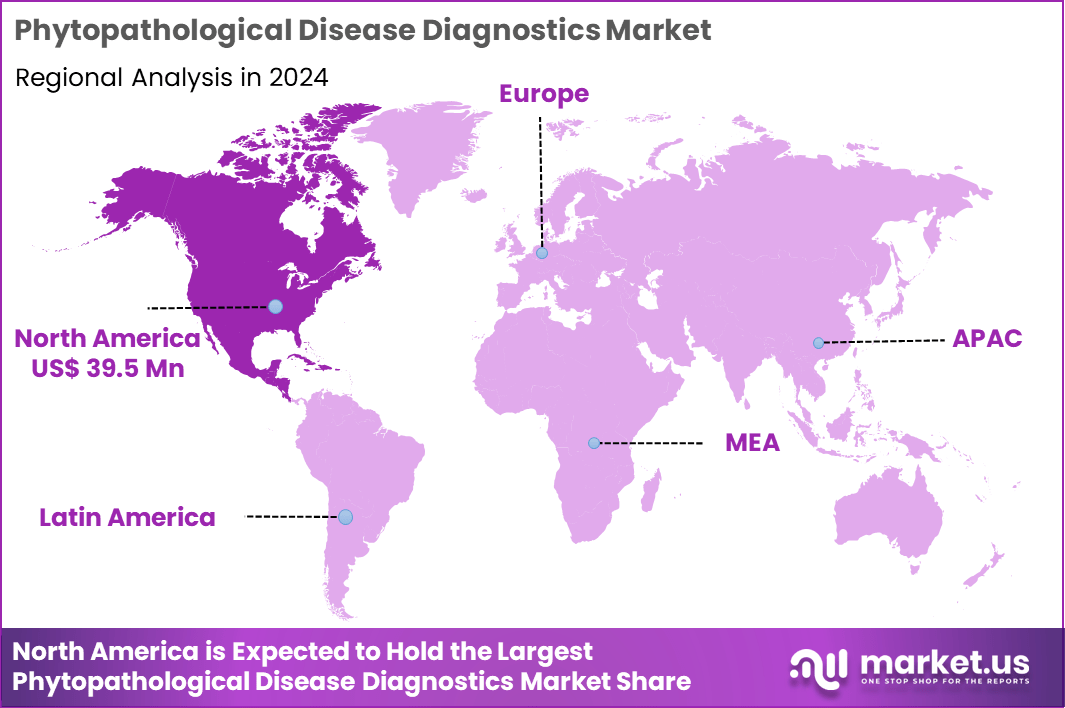

The Global Phytopathological Disease Diagnostics Market size is expected to be worth around US$ 169.0 Million by 2034 from US$ 107.8 Million in 2024, growing at a CAGR of 4.6% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 36.6% share with a revenue of US$ 39.5 Million.

Increasing pressure to minimize crop losses from phytopathological threats propels the Phytopathological Disease Diagnostics market, as agricultural stakeholders invest in tools that enable swift pathogen identification to safeguard yields and economic stability. Diagnostic firms advance serological assays and molecular kits that detect fungal spores, bacterial toxins, and viral genomes from leaf, root, or soil samples with high specificity.

These technologies support early intervention in vineyards for downy mildew control, grain storage monitoring to prevent Fusarium head blight outbreaks, orchard management against fire blight in apple trees, and greenhouse surveillance for powdery mildew on cucumbers. Collaborative academic efforts create opportunities for field-deployable diagnostics that integrate with precision agriculture platforms for real-time alerts.

In 2025, Michigan State University’s Plant & Pest Diagnostics team, working closely with the Michigan Department of Agriculture and Rural Development’s Plant Pathology Laboratory, continued advancing modern agricultural diagnostics to improve crop health monitoring and pathogen detection across the state. This partnership exemplifies the role of institutional innovation in scaling reliable testing solutions.

Growing adoption of molecular techniques accelerates the Phytopathological Disease Diagnostics market, as growers leverage PCR-based panels to differentiate symptomatic diseases and implement targeted fungicide applications efficiently. Biotechnology companies refine loop-mediated isothermal amplification kits that operate without thermal cyclers, ideal for on-site use in remote farming operations.

Applications encompass soil-borne pathogen detection in potato fields to combat Rhizoctonia solani, viral screening in tomato greenhouses for tomato spotted wilt virus, bacterial wilt confirmation in tobacco crops, and nematode quantification in turfgrass for integrated pest management. Point-of-care advancements open avenues for subscription-based testing services that pair diagnostics with advisory analytics for optimized crop rotation. Research institutions increasingly validate these tools against traditional culturing methods, fostering trust and regulatory acceptance.

Rising integration of digital and AI-driven tools invigorates the Phytopathological Disease Diagnostics market, as agribusinesses deploy smartphone-linked sensors and image recognition apps to automate disease scoring and prediction models. Technology providers develop hyperspectral imaging kits that analyze reflectance patterns for non-destructive field assessments.

These innovations facilitate precision spraying in citrus groves to target Huanglongbing vectors, yield forecasting in wheat fields by tracking rust progression, quarantine compliance in exported fruits through automated lesion detection, and biodiversity preservation in wild plant populations against invasive pathogens. AI enhancements create opportunities for predictive epidemiology platforms that forecast outbreak risks based on weather data integration. Collaborative consortia actively standardize digital outputs to enable seamless data sharing across supply chains.

Key Takeaways

- In 2024, the market generated a revenue of US$ 107.8 Million, with a CAGR of 4.6%, and is expected to reach US$ 169.0 Million by the year 2034.

- The product type segment is divided into ELISA kits, protein-based diagnostics kits, lateral flow devices, dna-based diagnostics kits and dna/rna probes, with ELISA kits taking the lead in 2024 with a market share of 38.9%.

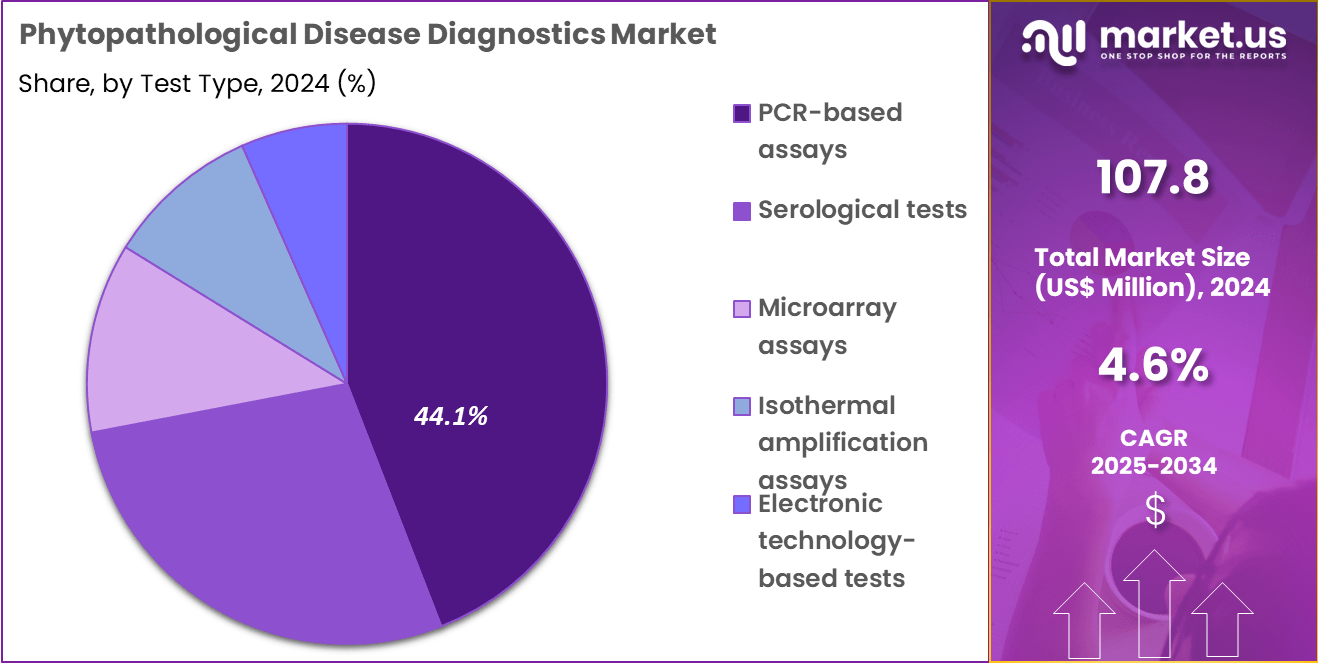

- Considering test type, the market is divided into PCR-based assays, serological tests, microarray assays, isothermal amplification assays and electronic technology-based tests. Among these, PCR-based assays held a significant share of 44.1%.

- Furthermore, concerning the sample type segment, the market is segregated into plants, seeds, grains and fruits. The plants sector stands out as the dominant player, holding the largest revenue share of 53.4% in the market.

- The end-user segment is segregated into agricultural laboratories, food processing laboratories, contract research organizations, academic and research institutes and others, with the agricultural laboratories segment leading the market, holding a revenue share of 47.5%.

- North America led the market by securing a market share of 36.6% in 2024.

Product Type Analysis

ELISA kits, holding 38.9%, are expected to dominate because they provide an efficient and cost-effective approach for detecting a wide spectrum of plant pathogens before crop damage escalates. Farmers and agribusiness operators rely strongly on these kits for screening at greenhouse and field levels to ensure early intervention. ELISA is favored due to simplified workflows that do not require advanced molecular equipment, making adoption easier in developing agricultural economies. Increasing global crop production intensifies the demand for monitoring bacterial, viral, and fungal infections that threaten food supply.

Rapid result turnaround supports informed decisions regarding pesticide application and crop isolation. Government-led disease surveillance programs strengthen the deployment of ELISA kits in rural areas. The growing focus on sustainable agriculture promotes early disease control over chemical-heavy treatments. Research labs continue to use ELISA platforms to validate epidemiological data. These drivers keep ELISA kits anticipated to remain the leading product type in this market.

Test Type Analysis

PCR-based assays, holding 44.1%, are projected to dominate due to their superior ability to detect minute pathogen loads in the early infection phase. Molecular genetic identification improves accuracy in distinguishing species and strains linked with varying virulence, which is crucial for outbreak containment. Expanding concerns related to invasive pests and emerging plant diseases increase the need for PCR-based quarantine testing.

Field-deployable PCR instruments support rapid farm-level decision-making during crop health emergencies. Export-oriented agriculture relies heavily on PCR testing for phytosanitary certification to comply with international standards. Growing investment in advanced agri-biotech accelerates the integration of PCR in crop protection programs. Data from PCR assays guide targeted treatment strategies, reducing yield losses. Continuous innovation in reagent chemistry enhances reaction speed and reliability. These dynamics keep PCR-based assays expected to remain the dominant testing approach.

Sample Type Analysis

Plants, holding 53.4%, are expected to remain the primary sample category because direct analysis of plant tissue helps identify infection spread at its source. Agricultural operations depend on timely detection within crops to prevent full-field contamination and economic loss. Rising disease severity associated with climate fluctuations pushes agronomists to frequently test symptomatic and asymptomatic plants. High-value crops such as grains, vegetables, and fruits require stricter health surveillance during all cultivation stages.

Plant genomic research accelerates the use of testing for resistance breeding programs. Increased focus on sustainable farming encourages preventive disease monitoring rather than depending solely on chemical interventions. Agricultural regulations require monitoring of plants to avoid trade disruptions from contaminated shipments. The segment is projected to expand as global crop demand continues climbing. These factors keep plants expected to remain the dominant sample type.

End-User Analysis

Agricultural laboratories, holding 47.5%, are anticipated to dominate because they conduct the majority of regulated crop health investigations and official certification procedures. Governments depend on these facilities to track and contain diseases that threaten national food security. Adoption of automated molecular testing systems enhances laboratory processing capacity and diagnostic accuracy.

Commercial growers submit routine samples to laboratories to verify crop safety before market entry. Increasing global trade drives the need for validated lab results to meet stringent import standards. Agricultural laboratories also collaborate with research institutes to detect newly emerging phytopathogens. They provide expert interpretation of complex results that guide local farm management practices.

The rise in precision agriculture strengthens partnerships with labs for data-driven disease analytics. These factors keep agricultural laboratories expected to remain the dominant end-user segment in this market.

Key Market Segments

By Product Type

- ELISA Kits

- Protein-Based Diagnostics Kits

- Lateral Flow Devices

- DNA-Based Diagnostics Kits

- DNA/RNA Probes

By Test Type

- PCR-Based Assays

- Serological Tests

- Microarray Assays

- Isothermal Amplification Assays

- Electronic Technology-Based Tests

By Sample Type

- Plants

- Seeds

- Grains

- Fruits

By End-user

- Agricultural Laboratories

- Food Processing Laboratories

- Contract Research Organizations

- Academic and Research Institutes

- Others

Drivers

Escalating global crop losses from phytopathogens is driving the market

The intensification of phytopathological threats worldwide has heightened the imperative for sophisticated diagnostic capabilities to safeguard agricultural yields and food security. Annual losses attributable to plant pests and diseases compel governments and agribusinesses to invest in proactive detection systems for timely mitigation. This urgency is amplified by the interconnectedness of global supply chains, where outbreaks can cascade into widespread economic disruptions.

Regulatory bodies like the Food and Agriculture Organization emphasize diagnostics as foundational to integrated pest management frameworks. The economic toll prompts fiscal allocations toward research and development of field-applicable tools, fostering innovation in molecular and serological assays. Climate variability exacerbates pathogen emergence, necessitating adaptive diagnostic strategies across diverse cropping systems.

Collaborative international surveillance networks rely on standardized testing to preempt transboundary incursions. Enhanced diagnostic precision enables precision agriculture practices, optimizing input use and minimizing environmental impacts. As production demands rise to feed growing populations, diagnostics become integral to sustainable intensification efforts. Collectively, this driver accelerates the deployment of cutting-edge technologies, ensuring resilience in phytopathological disease management.

Restraints

Standardization challenges for high-throughput sequencing is restraining the market

The complexity of validating and harmonizing high-throughput sequencing protocols across laboratories impedes seamless integration into routine phytopathological diagnostics. Disparities in bioinformatics pipelines and data interpretation criteria lead to inconsistencies in results, undermining regulatory confidence. Resource-intensive validation processes, including interlaboratory trials, strain budgets in underfunded agricultural extensions.

Variability in sample preparation and sequencing platforms complicates scalability for widespread adoption. The absence of universal reference databases for emerging pathogens prolongs assay development timelines. Training deficiencies among field technicians exacerbate errors in pre-analytical phases, compromising overall reliability. Intellectual property constraints on proprietary algorithms limit collaborative standardization efforts.

Inconsistent performance metrics across jurisdictions hinder cross-border trade certifications. These hurdles result in prolonged reliance on legacy methods, delaying transitions to genomics-based diagnostics. Ultimately, this restraint curtails efficiency gains, perpetuating vulnerabilities in plant health monitoring.

Opportunities

Adoption of high-throughput sequencing in quarantine programs is creating growth opportunities

The endorsement of high-throughput sequencing by regulatory agencies streamlines pathogen detection in importation and certification workflows, unlocking efficiencies for clean plant propagation. This technology surpasses traditional indexing by identifying a broader spectrum of agents, including latent infections, in a single run. Reduced testing durations from years to months accelerate material release, benefiting nurseries and exporters.

Bioinformatics advancements enable automated variant calling, enhancing traceability for outbreak investigations. Integration with national networks facilitates real-time data sharing, bolstering predictive modeling for risk assessment. Cost reductions per sample through economies of scale make it viable for smallholder surveillance programs.

Partnerships between federal laboratories and state entities amplify capacity building in underrepresented regions. The versatility of sequencing supports multiplex applications, extending to non-regulated diagnostics. As global trade volumes expand, compliant systems gain premium market access. In essence, this opportunity redefines phytopathological diagnostics as a strategic enabler for resilient agroecosystems.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic forces propel the phytopathological disease diagnostics market forward as expanding agricultural investments and escalating crop losses from climate change drive farmers and researchers to adopt advanced kits for pathogen detection in fruits, vegetables, and grains. Manufacturers actively launch molecular tools like PCR assays and serological tests, capitalizing on the global emphasis on food security and sustainable farming to enhance early intervention strategies.

Persistent inflation and uneven economic recoveries, however, constrict budgets for agribusinesses and public labs, compelling operators to postpone equipment acquisitions and reduce testing frequencies in developing regions. Geopolitical tensions, including U.S.-China trade disputes and export restrictions tied to disease outbreaks, frequently disrupt supplies of essential reagents and biosensors, leading to production halts and heightened uncertainty for international suppliers.

Current U.S. tariffs impose a ten percent baseline on most imported diagnostic components alongside up to twenty-five percent duties on Chinese-origin lab equipment, elevating procurement costs and challenging affordability for American growers and diagnostic firms. These tariffs trigger retaliatory measures in foreign markets that limit U.S. exports of innovative plant health tools and strain collaborative research on emerging pathogens. Nevertheless, the policies accelerate investments in domestic production facilities and localized innovation hubs, building more resilient supply chains that will foster greater market stability and long-term expansion.

Latest Trends

Development of multiplex PCR assays for emerging pathogens is a recent trend

In 2024, the U.S. Department of Agriculture’s Animal and Plant Health Inspection Service advanced multiplex PCR capabilities for detecting strains within the Ralstonia solanacearum species complex, including race 3 biovar 2. This innovation enables simultaneous identification of multiple biovars in a single reaction, streamlining quarantine evaluations.

Concurrently, real-time multiplex PCR protocols for Phytoplasma species were finalized, incorporating ABI QuantStudio 7 Flex systems for enhanced throughput. These assays address gaps in distinguishing invasive variants, critical for potato and solanaceous crop protections. The trend reflects a pivot toward consolidated testing panels, reducing reagent demands and turnaround times. Validation against international standards ensures interoperability in global surveillance.

Field deployments in high-risk zones demonstrate robustness under variable conditions. Regulatory updates incorporate these methods into official work instructions, promoting uniform application. Early outcomes include fewer false positives in import inspections. This 2024 progression signifies a maturation in molecular tools, fortifying defenses against evolving phytopathological threats.

Regional Analysis

North America is leading the Phytopathological Disease Diagnostics Market

In 2024, North America held a 36.6% portion of the global phytopathological disease diagnostics market, fueled by intensifying agricultural vulnerabilities and sophisticated technological integrations. Climate variability exacerbates pathogen proliferation in staple crops like corn and soybeans, prompting farmers to adopt molecular assays for swift identification of fungal and bacterial threats. Federal programs through the U.S. Department of Agriculture allocate resources for surveillance networks, enhancing predictive modeling to preempt outbreaks in vast farmlands.

Biotechnology firms innovate portable spectrometers and drone-based sampling, streamlining field-level diagnostics for resource-limited growers. Collaborative research consortia validate genomic markers for resistance breeding, reducing reliance on chemical interventions amid sustainability mandates. Export-oriented producers invest in certified testing protocols to meet stringent international phytosanitary standards, safeguarding trade volumes.

Educational outreach by extension services empowers rural communities with user-friendly kits, bridging gaps in early intervention. These multifaceted advancements reflect a proactive stance against escalating biotic stresses, bolstering food security foundations. The U.S. Department of Agriculture estimates that crop losses due to plant pathogens not originating in the United States cost $21 billion annually, as detailed in its 2022 annual report on science accomplishments.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Authorities foresee vigorous expansion of the phytopathological disease diagnostics sector in Asia Pacific over the forecast period, as nations confront mounting crop threats through strategic enhancements. Regional governments in India and Indonesia channel funds into biosensor development, enabling real-time detection of rice blast and citrus greening in humid tropics. Agritech startups deploy AI-driven image recognition apps, allowing smallholders to diagnose viral infections via smartphones without lab access.

Bilateral agreements facilitate technology transfers, equipping border surveillance teams with PCR kits to curb transboundary incursions like wheat rust. Universities pioneer affordable ELISA tests tailored to local strains, integrating them into cooperative farming models for equitable distribution. Export hubs in Vietnam and Thailand enforce rigorous pre-shipment screenings, aligning with global compliance to sustain horticultural revenues.

Community cooperatives train extension agents on metagenomic sequencing, fostering resilience in polyculture systems vulnerable to emerging pathogens. These initiatives harness innovation and collaboration, fortifying agricultural productivity against environmental pressures. The Food and Agriculture Organization reports that transboundary plant diseases inflict annual losses of USD 43.8 billion across the Asia-Pacific region, according to its 2022 plant protection outlook publication.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Major companies in phytopathological disease diagnostics accelerate growth by launching rapid molecular and immunoassay-based test kits that detect multiple crop pathogens at early stages, helping farmers and agribusinesses prevent large-scale yield losses. They expand their reach by partnering with agricultural extension networks, seed companies, and food-producers to embed routine plant-health surveillance across supply chains.

Automation and portable field-testing solutions improve decision-making speed for growers, especially in regions with limited laboratory access. They differentiate by integrating results with digital crop-monitoring platforms, enabling disease-forecasting models that support precision agriculture. Strategic investments in R&D and global distribution pipelines allow faster response to emerging plant diseases driven by climate change and international trade.

Agdia Inc. represents this strategic approach with a strong portfolio of plant pathogen diagnostics, a global customer base across agriculture and horticulture, and continuous innovation in field-ready assays that help producers protect crop quality and productivity.

Top Key Players

- Neogen Corporation

- Eurofins Scientific SE

- Intertek Group PLC

- Bureau Veritas SA

- SGS SA

- ALS Limited

- Bio-Rad Laboratories, Inc.

- Romer Labs Division Holding GmbH

Recent Developments

- In 2025, Agdia Inc., located in Wilmington, Delaware, introduced the Thrips Spot Viruses ImmunoComb. This new solution provides growers with a compact and easy-to-use tool for rapid identification of plant viruses transmitted by thrips, helping support better disease control decisions.

- In 2025, Abingdon Health plc in York, United Kingdom, partnered with Morrama Ltd to create Eco-Flo Innovations Ltd. The new venture focuses on developing environmentally friendly housings for lateral flow tests, supporting growing sustainability initiatives within the diagnostics industry.

- In 2025, Planet Labs PBC of San Francisco expanded its advanced analytics capabilities by acquiring Sinergise. This acquisition is expected to enhance precision agriculture and plant disease surveillance through improved geospatial data insights and monitoring tools.

Report Scope

Report Features Description Market Value (2024) US$ 107.8 Million Forecast Revenue (2034) US$ 169.0 Million CAGR (2025-2034) 4.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (ELISA Kits, Protein-Based Diagnostics Kits, Lateral Flow Devices, DNA-Based Diagnostics Kits and DNA/RNA Probes), By Test Type (PCR-Based Assays, Serological Tests, Microarray Assays, Isothermal Amplification Assays and Electronic Technology-Based Tests), By Sample Type (Plants, Seeds, Grains and Fruits), By End-user (Agricultural Laboratories, Food Processing Laboratories, Contract Research Organizations, Academic and Research Institutes and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Neogen Corporation, Eurofins Scientific SE, Intertek Group PLC, Bureau Veritas SA, SGS SA, ALS Limited, Bio-Rad Laboratories, Inc., Romer Labs Division Holding GmbH Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Phytopathological Disease Diagnostics MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Phytopathological Disease Diagnostics MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Neogen Corporation

- Eurofins Scientific SE

- Intertek Group PLC

- Bureau Veritas SA

- SGS SA

- ALS Limited

- Bio-Rad Laboratories, Inc.

- Romer Labs Division Holding GmbH