Global Phenolic Boards Market By Thickness (≤ 40 mm, >40 mm), By Type (Plain, Sandwich), By Phenolic Board (Standard Grade, High-Performance Grade, Flame Retardant Grade), By Resin Type (Phenol-Formaldehyde, Phenol-Furfural, Phenol-Resorcinol), By Form (Sheets, Rods, Tubes, Laminates), By Application ( Electrical Insulation, Mechanical Components, Automotive and Aerospace, Construction and Building, Others), By End Use (Residential, Commercial, Industrial) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 133993

- Number of Pages: 346

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

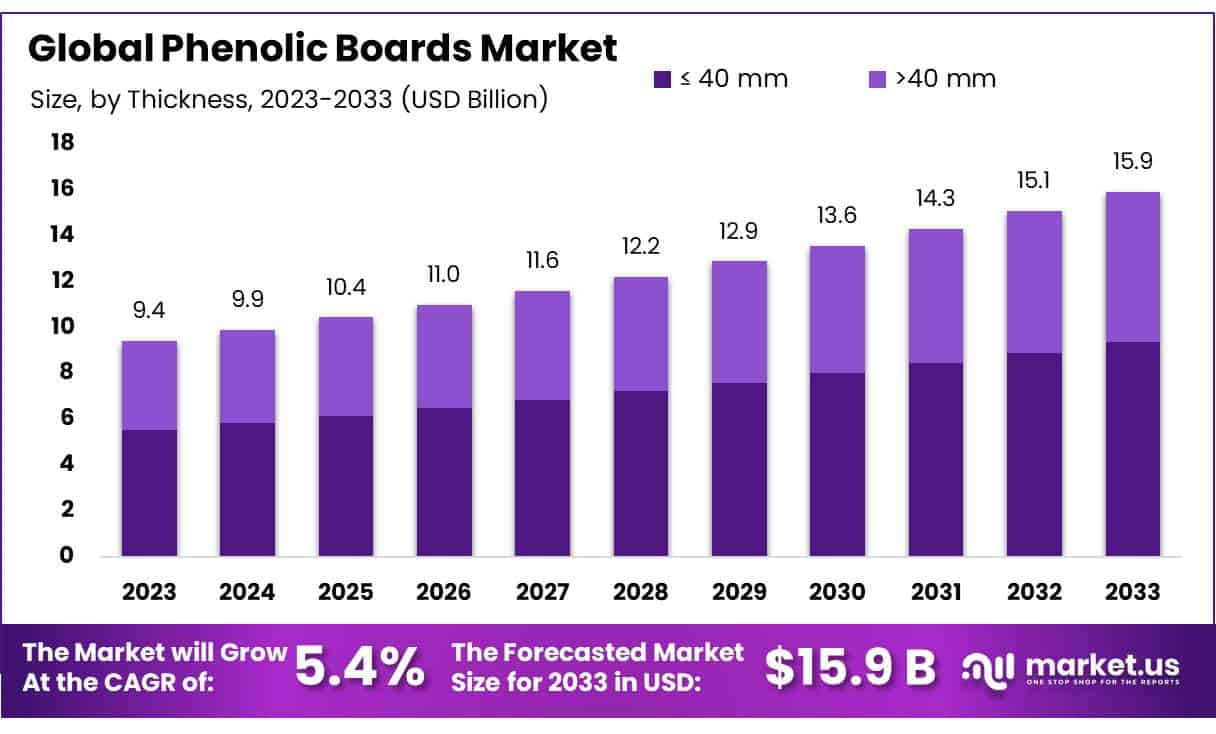

The Global Phenolic Boards Market size is expected to be worth around USD 15.9 Bn by 2033, from USD 9.4 Bn in 2023, growing at a CAGR of 5.4% during the forecast period from 2024 to 2033.

Phenolic boards, also known as phenolic resin boards, are durable, moisture-resistant composite materials made by bonding layers of fiber, paper, or wood veneers using phenolic resin. The resin is cured under heat and pressure to create a strong, dense material, making it ideal for a variety of industrial and commercial uses, including construction, transportation, and furniture manufacturing.

Government regulations significantly influence the market for phenolic boards, particularly in construction. In the European Union, the Construction Products Regulation (CPR) mandates that building materials, including phenolic boards, meet strict fire safety and environmental standards.

Similarly, in the U.S., the National Fire Protection Association (NFPA) provides guidelines on fire-resistant materials for both residential and commercial buildings. These regulations drive the demand for phenolic products that comply with high safety and performance standards.

The global trade in phenolic boards shows positive growth. In 2022, the global export value of phenolic resins, which includes phenolic boards, was estimated at $5.2 billion. Key exporters include China, the United States, and Germany, while major importers are found in the Asia-Pacific region, particularly in India, Japan, and South Korea. This growth is largely attributed to the increasing demand for high-performance materials in the construction and automotive industries.

Investment in phenolic board production technologies is also driving market expansion. In 2023, Hexion Inc., a leading producer of phenolic resins, announced a $200 million investment to increase its production capacity in North America.

Additionally, BASF partnered with Kraton Polymers in 2022 to develop advanced phenolic materials for the automotive and construction sectors, signaling ongoing innovation and growth in the industry.

Urbanization, especially in regions like Asia-Pacific, where 61% of the population lives in urban areas, is expected to further boost the demand for phenolic boards. With significant government spending on infrastructure projects and the construction industry’s contribution to economic growth, phenolic boards will continue to see strong demand in the coming years.

Additionally, the global export of furniture, a major user of phenolic boards, reached approximately USD 190 billion in 2021, supporting the international trade of this material.

Key Takeaways

- Phenolic Boards Market size is expected to be worth around USD 15.9 Bn by 2033, from USD 9.4 Bn in 2023, growing at a CAGR of 5.4%.

- ≤ 40 mm phenolic boards held a dominant market position, capturing more than a 59.3% share.

- Plain phenolic boards held a dominant market position, capturing more than a 64.3% share.

- Standard Grade phenolic boards held a dominant market position, capturing more than a 54.3% share.

- Phenol-Formaldehyde held a dominant market position, capturing more than a 64.3% share.

- Sheets held a dominant market position, capturing more than a 48.2% share.

- Electrical Insulation held a dominant market position, capturing more than a 38.3% share.

- Residential held a dominant market position, capturing more than a 47.1% share.

- APAC held a substantial share of the market, accounting for 37.9% of the total market value, which was approximately USD 4.4 billion.

By Thickness

In 2023, ≤ 40 mm phenolic boards held a dominant market position, capturing more than a 59.3% share. This segment is widely favored due to its versatility, cost-effectiveness, and suitability for a range of applications.

The thinner boards are commonly used in construction, interior design, and industrial applications where lightweight materials are preferred. Their ease of handling and installation further contribute to their strong market presence.

On the other hand, phenolic boards with thicknesses greater than 40 mm accounted for the remaining share of the market. These thicker boards are typically utilized in applications requiring enhanced durability, thermal insulation, and structural strength.

They are often used in environments such as industrial settings, where higher resistance to wear and impact is essential. Despite their smaller market share, the demand for >40 mm boards is expected to grow steadily due to increasing use in specialized construction and manufacturing sectors.

By Type

In 2023, Plain phenolic boards held a dominant market position, capturing more than a 64.3% share. This segment is the most widely used due to its simple design, cost-effectiveness, and broad application range.

Plain phenolic boards are favored in industries such as construction, interior design, and furniture manufacturing, where basic functionality and ease of use are key considerations. Their popularity is also driven by their excellent fire resistance and environmental sustainability.

The Sandwich type phenolic boards, while accounting for a smaller share of the market, are gaining attention. These boards are constructed with a core material sandwiched between two phenolic layers, offering enhanced strength, insulation, and soundproofing properties.

They are commonly used in applications that require better thermal performance, such as in the automotive and transportation industries. As demand for energy-efficient and high-performance materials rises, the Sandwich type segment is expected to see steady growth.

By Phenolic Board

In 2023, Standard Grade phenolic boards held a dominant market position, capturing more than a 54.3% share. This segment is the most widely used due to its cost-effectiveness and sufficient performance for general applications.

Standard Grade phenolic boards are commonly employed in construction, furniture, and interior design, offering a balance of strength, durability, and fire resistance. Their broad usability and lower cost contribute to their leading market share.

High-Performance Grade phenolic boards, though accounting for a smaller portion of the market, are increasingly in demand. These boards offer superior mechanical properties, enhanced thermal stability, and greater resistance to chemicals and moisture. As industries such as aerospace, automotive, and high-end construction look for advanced materials, the demand for High-Performance Grade phenolic boards is expected to rise.

Flame Retardant Grade phenolic boards also represent a specialized segment, focusing on safety and fire resistance. These boards are specifically designed for applications where fire resistance is critical, such as in electrical systems, transportation, and high-risk industrial environments. While this segment holds a niche share, the growing emphasis on safety regulations and fire prevention is driving steady growth.

By Resin Type

In 2023, Phenol-Formaldehyde held a dominant market position, capturing more than a 64.3% share. This resin type is the most commonly used in the production of phenolic boards due to its excellent mechanical properties, durability, and cost-effectiveness. Phenol-Formaldehyde resins offer high strength, good resistance to heat, and strong bonding, making them suitable for a wide range of applications in industries such as construction, automotive, and furniture manufacturing.

Phenol-Furfural resin-based phenolic boards represent a smaller, but growing segment of the market. These boards are valued for their enhanced thermal stability and resistance to chemical degradation. Phenol-Furfural resins are often used in specialized applications, such as in the oil and gas industry, where high resistance to moisture and chemicals is required. While their market share is currently limited, demand is expected to rise as industries seek more environmentally friendly and sustainable alternatives.

Phenol-Resorcinol resin-based phenolic boards are the least common in the market but are gaining interest in high-performance applications. These resins provide superior adhesion, moisture resistance, and heat resistance, making them ideal for critical applications in the aerospace, automotive, and military sectors. As demand for advanced, high-strength materials grows, the Phenol-Resorcinol segment is expected to see steady growth, driven by its specialized properties.

By Form

In 2023, Sheets held a dominant market position, capturing more than a 48.2% share. This form of phenolic board is the most widely used due to its versatility, ease of fabrication, and broad range of applications. Sheets are commonly utilized in construction, furniture, and electrical industries, where they provide excellent strength, durability, and fire resistance. Their availability in various sizes and thicknesses contributes to their leading position in the market.

Rods, while accounting for a smaller share, are increasingly being used in specialized industrial applications. These phenolic rods offer high mechanical strength and resistance to wear and corrosion, making them suitable for use in machinery, gears, and bushings. As industries such as automotive and manufacturing demand stronger, more durable components, the rod segment is expected to experience moderate growth.

Tubes are also a niche segment in the phenolic boards market. They are valued for their strength, heat resistance, and chemical stability. Phenolic tubes are commonly used in applications requiring high performance, such as in electrical insulation and fluid handling systems. Though the segment remains small, the growing demand for advanced materials in technical applications is likely to drive gradual expansion.

Laminates, made by bonding thin layers of phenolic resin, hold a key position in sectors like interior design, packaging, and furniture. Their resistance to heat, moisture, and chemicals makes them ideal for use in high-impact environments. Although laminates make up a smaller market share compared to sheets, they are increasingly favored in applications requiring decorative finishes and enhanced durability.

By Application

In 2023, Electrical Insulation held a dominant market position, capturing more than a 38.3% share. Phenolic boards are widely used in electrical insulation due to their excellent dielectric properties, high heat resistance, and flame retardancy. These characteristics make them ideal for use in electrical panels, transformers, and circuit boards, where reliable insulation is crucial. The demand for phenolic boards in electrical applications is driven by increasing needs for safer and more efficient electrical systems.

The Mechanical Components segment, while smaller in comparison, is growing steadily. Phenolic boards used in this sector are valued for their durability, wear resistance, and strength. They are commonly used in applications such as gears, bearings, bushings, and structural components. As industries seek materials that offer both performance and cost-efficiency, the demand for phenolic boards in mechanical components is expected to rise.

In the Automotive & Aerospace sectors, phenolic boards are used for their lightweight, heat-resistant, and fire-retardant properties. These applications require materials that can withstand extreme conditions, and phenolic boards meet these demands effectively. While this segment holds a smaller share of the market, the increasing focus on lightweight and high-performance materials in both automotive and aerospace industries is driving growth.

The Construction & Building segment also plays a significant role in the phenolic boards market. Phenolic boards are used in construction for applications such as wall panels, flooring, and insulation, where their durability, fire resistance, and thermal insulation properties are highly valued. As the construction industry increasingly prioritizes energy efficiency and fire safety, the demand for phenolic boards in this sector is anticipated to grow.

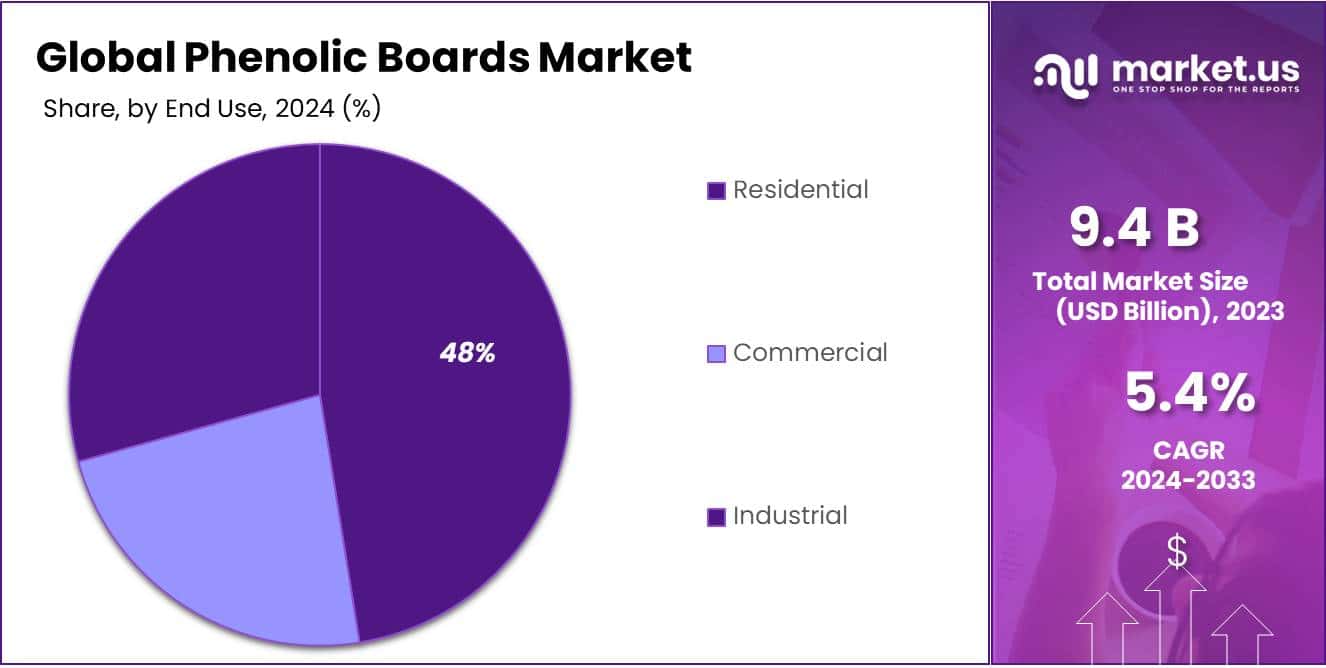

By End Use

In 2023, Residential held a dominant market position, capturing more than a 47.1% share. Phenolic boards are widely used in residential applications due to their excellent durability, fire resistance, and thermal insulation properties.

They are commonly used for flooring, wall panels, countertops, and insulation in homes and apartments. The demand for phenolic boards in the residential sector is driven by the increasing emphasis on energy efficiency, safety, and the need for long-lasting, low-maintenance materials.

The Commercial segment, while accounting for a smaller share, is steadily growing. Phenolic boards are used in commercial buildings for applications such as office partitions, flooring, and decorative wall panels. Their ability to withstand high traffic, resist moisture, and provide thermal and sound insulation makes them ideal for office buildings, retail spaces, and hospitality venues. As businesses prioritize durability and sustainability in building materials, the demand for phenolic boards in the commercial sector is expected to rise.

In the Industrial sector, phenolic boards are highly valued for their strength, resistance to heat and chemicals, and versatility. They are used in various applications such as machinery parts, equipment panels, and industrial insulation.

The Industrial segment benefits from the growing need for reliable, high-performance materials in manufacturing, energy, and heavy industries. While this segment holds a smaller market share compared to residential, its growth is driven by increasing industrial activity and the need for more durable and efficient materials.

Key Market Segments

By Thickness

- ≤ 40 mm

- >40 mm

By Type

- Plain

- Sandwich

By Phenolic Board

- Standard Grade

- High-Performance Grade

- Flame Retardant Grade

By Resin Type

- Phenol-Formaldehyde

- Phenol-Furfural

- Phenol-Resorcinol

By Form

- Sheets

- Rods

- Tubes

- Laminates

By Application

- Electrical Insulation

- Mechanical Components

- Automotive & Aerospace

- Construction & Building

- Others

By End Use

- Residential

- Commercial

- Industrial

Drivers

Increasing Demand for Fire-Resistant Materials in Construction and Infrastructure

One of the major driving factors behind the growing demand for phenolic boards is the increasing emphasis on fire safety in construction and infrastructure. As urbanization and industrialization accelerate globally, building safety standards have become more stringent, particularly in fire resistance. Phenolic boards, known for their superior fire-retardant properties, are widely used in construction materials such as wall panels, floors, and insulation.

According to the National Fire Protection Association (NFPA), in the United States alone, there were an estimated 1.3 million fires reported in 2022, with a direct property loss of $15.9 billion. This highlights the importance of fire-resistant building materials in reducing fire-related damages and protecting human lives. The global construction industry is increasingly adopting materials like phenolic boards to meet fire safety standards.

In the European Union, the construction sector accounted for 30% of the region’s total energy consumption and 36% of CO2 emissions, according to the European Commission. As part of efforts to improve safety and sustainability, the EU’s “Energy Performance of Buildings Directive” mandates higher fire safety and energy efficiency standards in new and existing buildings, thereby boosting the adoption of fire-resistant materials like phenolic boards.

Government Regulations and Sustainability Initiatives

Government regulations and sustainability initiatives are another significant factor driving the adoption of phenolic boards. Governments around the world are introducing policies that encourage the use of eco-friendly, energy-efficient, and fire-resistant materials in various sectors, particularly in construction.

For example, the U.S. Green Building Council’s LEED (Leadership in Energy and Environmental Design) certification program is widely adopted in the construction industry, promoting the use of materials that meet specific sustainability and fire safety standards. In line with these sustainability goals, the adoption of phenolic boards is growing due to their environmental benefits.

Phenolic boards are made from phenolic resins, which are produced using renewable resources, reducing their environmental impact compared to many traditional materials. The boards are also durable and require minimal maintenance, contributing to lower life-cycle costs and reducing environmental waste. The European Union’s “Green Deal,” aimed at making Europe climate-neutral by 2050, is encouraging the use of sustainable materials in construction.

Rising Demand for Durable and Low-Maintenance Materials

Phenolic boards are also gaining traction due to their durability and low-maintenance qualities, particularly in industries where long-term performance and cost-effectiveness are critical. The durability of phenolic boards makes them ideal for applications that require resistance to wear, impact, and environmental conditions, such as in industrial settings and commercial buildings.

According to the U.S. Department of Energy, the commercial and industrial sectors account for nearly 50% of total energy consumption in the United States, with significant energy usage in HVAC systems, lighting, and construction materials. Phenolic boards, due to their excellent insulation properties, contribute to reducing energy consumption by providing better thermal insulation and reducing heating and cooling costs.

In the commercial and industrial sectors, this can lead to significant long-term savings. The automotive industry, for instance, increasingly uses phenolic boards in parts like door panels, dashboards, and interior linings. According to the International Organization of Motor Vehicle Manufacturers (OICA), in 2022, global automobile production was over 80 million vehicles, with increasing demand for lightweight and durable materials.

Phenolic boards meet these demands by providing strength without adding excessive weight, making them ideal for the automotive sector. Additionally, phenolic boards require minimal maintenance over their lifespan, which lowers the total cost of ownership, making them an attractive option for industries looking for durable materials that offer both performance and cost savings.

Restraints

High Cost of Raw Materials and Production

A significant restraining factor for the phenolic boards market is the high cost of raw materials and the production process. Phenolic boards are manufactured using phenolic resins, which are derived from phenol and formaldehyde. These raw materials are relatively expensive, and fluctuations in their prices can have a substantial impact on the overall production cost.

The price of phenol, for instance, has been volatile in recent years due to supply chain disruptions, increasing demand, and rising production costs. According to the U.S. Energy Information Administration (EIA), the price of phenol in the U.S. surged by approximately 15% from 2021 to 2022. As phenolic boards are dependent on these raw materials, any increase in their price directly raises the cost of production, which in turn can limit the affordability and accessibility of phenolic boards for certain industries.

Additionally, the manufacturing process of phenolic boards is energy-intensive, requiring significant amounts of energy for curing and shaping the resins. The global energy crisis and rising electricity prices, particularly in countries like the United States and European Union, contribute to the increased production costs.

For example, according to the International Energy Agency (IEA), global energy prices saw an increase of 26% in 2022, which was the highest in over a decade. As energy costs climb, the cost of manufacturing phenolic boards also rises, making it a less competitive alternative to other materials like plywood, which is cheaper and easier to produce.

Limited Availability of Sustainable and Cost-Effective Raw Materials

Sustainability is another challenge facing the phenolic boards market. While phenolic resins offer excellent properties such as fire resistance and mechanical strength, the raw materials used in their production are derived from fossil-based chemicals, raising concerns about their environmental impact.

The need for more sustainable and cost-effective alternatives is becoming more urgent as industries shift towards greener production practices. According to the European Commission, the chemical industry in Europe is the second-largest industrial emitter of CO2, contributing to around 15% of the region’s total emissions. With global sustainability targets, including the EU’s Green Deal, pressing for lower carbon footprints, many manufacturers are seeking alternatives to phenolic resins that are both environmentally friendly and affordable.

In response, some companies are researching bio-based phenolic resins made from renewable resources such as biomass or plant-based compounds. However, these alternatives are still in the early stages of development, and their production is more expensive compared to conventional phenolic resins.

For example, a study published by the American Chemical Society found that bio-based phenolic resins can cost up to 30% more than traditional resins due to the high costs associated with raw material sourcing and the development of new production technologies. As a result, the limited availability of sustainable and cost-effective alternatives to fossil-based raw materials is a barrier to the broader adoption of phenolic boards in environmentally conscious sectors.

Health and Environmental Concerns with Formaldehyde

Formaldehyde, one of the key components in the production of phenolic resins, has raised health and environmental concerns, especially in relation to its use in indoor applications such as furniture and flooring. Formaldehyde is a volatile organic compound (VOC) that can off-gas into the air, posing health risks such as respiratory issues, allergic reactions, and even cancer when exposed to high concentrations.

The U.S. Environmental Protection Agency (EPA) classifies formaldehyde as a known human carcinogen, and various regulations have been introduced globally to limit its presence in consumer products. For instance, the California Air Resources Board (CARB) has established strict standards for formaldehyde emissions in wood products, including phenolic boards, which must meet the California Air Toxic Emissions Standards (CATE). The implementation of such regulations increases the cost and complexity of producing phenolic boards that meet these stringent standards.

Opportunity

Growing Demand for Fire-Resistant and Insulating Materials in Construction

One of the major growth opportunities for phenolic boards lies in the increasing demand for fire-resistant and insulating materials in the global construction industry. As urbanization continues to rise, there is growing pressure on construction projects to meet stricter safety standards and environmental regulations.

Fire-resistant materials, such as phenolic boards, are gaining popularity due to their excellent flame-retardant properties and ability to provide high thermal insulation. According to the U.S. Census Bureau, the value of new privately owned residential construction in the United States alone was estimated at $912 billion in 2022, and this is expected to continue growing. The construction sector is prioritizing the use of safer and more energy-efficient materials, making phenolic boards an attractive option.

In Europe, building safety regulations are increasingly focusing on fire protection in high-rise buildings and other commercial structures. The European Union has introduced the “Energy Performance of Buildings Directive” (EPBD), which mandates higher energy efficiency and fire safety standards in buildings.

These initiatives are pushing construction companies toward materials that provide both fire resistance and insulation. In this context, phenolic boards, known for their superior fire resistance and thermal properties, are poised to benefit from these regulatory trends. The growing focus on sustainable building practices and energy-efficient solutions further amplifies the demand for phenolic boards in the construction industry.

Rising Focus on Sustainability and Eco-Friendly Materials

Sustainability is becoming a driving force behind innovation and material selection across industries, including construction and manufacturing. Governments worldwide are introducing policies to reduce carbon emissions and encourage the use of eco-friendly materials.

In line with these initiatives, phenolic boards are gaining traction due to their relatively lower environmental impact compared to many conventional materials. Phenolic boards can be produced with bio-based phenolic resins, reducing reliance on fossil fuels and contributing to a lower carbon footprint.

The European Green Deal, aimed at making Europe carbon-neutral by 2050, encourages the use of sustainable materials in construction and industrial sectors. According to the European Commission, the construction industry accounts for 36% of the EU’s carbon emissions.

As a result, building regulations are shifting towards the use of materials that not only meet safety and performance standards but also adhere to sustainability goals. Phenolic boards, due to their long lifespan, durability, and energy-efficient properties, are well-suited for this trend. Moreover, these boards can be produced using renewable resources such as lignin, which is derived from biomass, offering an eco-friendly alternative to traditional petrochemical-based products.

Technological Advancements and Customization Opportunities

Technological advancements in manufacturing processes and resin formulations are opening new growth opportunities for phenolic boards. Manufacturers are continuously innovating to improve the properties of phenolic boards, making them more versatile and suitable for a wider range of applications.

For example, improvements in resin technology have led to the development of phenolic boards with enhanced resistance to moisture, chemicals, and high temperatures. This makes phenolic boards ideal for use in specialized industries such as automotive, aerospace, and electronics.

Trends

Increased Adoption of Bio-Based Phenolic Resins

A major emerging trend in the phenolic boards market is the growing shift towards bio-based phenolic resins, driven by both environmental concerns and regulatory pressure for sustainability. Traditional phenolic resins are derived from petrochemical sources, which have significant environmental impacts due to their extraction and carbon footprint.

However, bio-based phenolic resins are derived from renewable resources such as biomass or plant-based materials, offering a more sustainable alternative. This trend is gaining traction as industries and governments push for more sustainable practices.

According to the European Commission, the European Union’s “Green Deal” aims for a 55% reduction in greenhouse gas emissions by 2030 and carbon neutrality by 2050. As part of this initiative, the construction and manufacturing sectors are encouraged to adopt sustainable materials, which directly benefits the use of bio-based phenolic resins.

The bio-based resin market is experiencing significant growth, with the global bio-based chemicals market projected to reach $91 billion by 2025, growing at a compound annual growth rate (CAGR) of 13.1%. Bio-based phenolic resins are seen as a viable alternative that can help industries meet sustainability targets without compromising performance.

Additionally, bio-based phenolic resins can reduce reliance on fossil fuels and lower carbon emissions in production processes. Companies in the phenolic boards industry are increasingly exploring bio-based formulations to cater to the rising demand for environmentally friendly solutions, especially in the construction and automotive sectors.

Focus on Fire Safety Regulations in Construction

The increasing adoption of fire safety regulations in the construction sector is a significant trend that is driving demand for phenolic boards. Fire-resistant materials are becoming a key requirement for buildings, particularly in commercial and residential high-rise buildings, where the risk of fire spreading can have catastrophic consequences.

In response to high-profile fires, such as the Grenfell Tower fire in the UK, many countries have strengthened fire safety codes. According to the National Fire Protection Association (NFPA), in 2022, there were over 1.3 million fires reported in the U.S., resulting in nearly $15.9 billion in property damage. This highlights the ongoing need for fire-resistant building materials, creating a favorable environment for phenolic boards due to their exceptional flame-retardant properties.

In the European Union, building regulations are becoming increasingly stringent regarding fire safety. The EU’s “Construction Products Regulation” (CPR) outlines the need for construction products to meet specific fire performance standards. Phenolic boards, which are inherently fire-resistant, are gaining traction in construction as they help meet these stricter fire safety standards.

Similarly, in the U.S., the International Building Code (IBC) has implemented fire safety provisions that require materials used in buildings to meet specific fire-resistance ratings. As a result, the construction sector’s growing emphasis on fire safety is expected to continue driving the demand for phenolic boards in applications such as wall panels, flooring, and insulation.

Integration of Phenolic Boards in High-Performance Applications

The trend toward using phenolic boards in high-performance applications is also on the rise, particularly in industries like aerospace, automotive, and electronics. Phenolic boards offer a unique combination of strength, fire resistance, and thermal insulation, making them suitable for demanding applications where other materials may not perform as well.

In the automotive industry, for example, phenolic boards are increasingly used for components such as dashboards, door panels, and interior parts. According to the International Organization of Motor Vehicle Manufacturers (OICA), the global automotive industry produced over 80 million vehicles in 2022, with increasing demand for lightweight, durable, and fire-resistant materials.

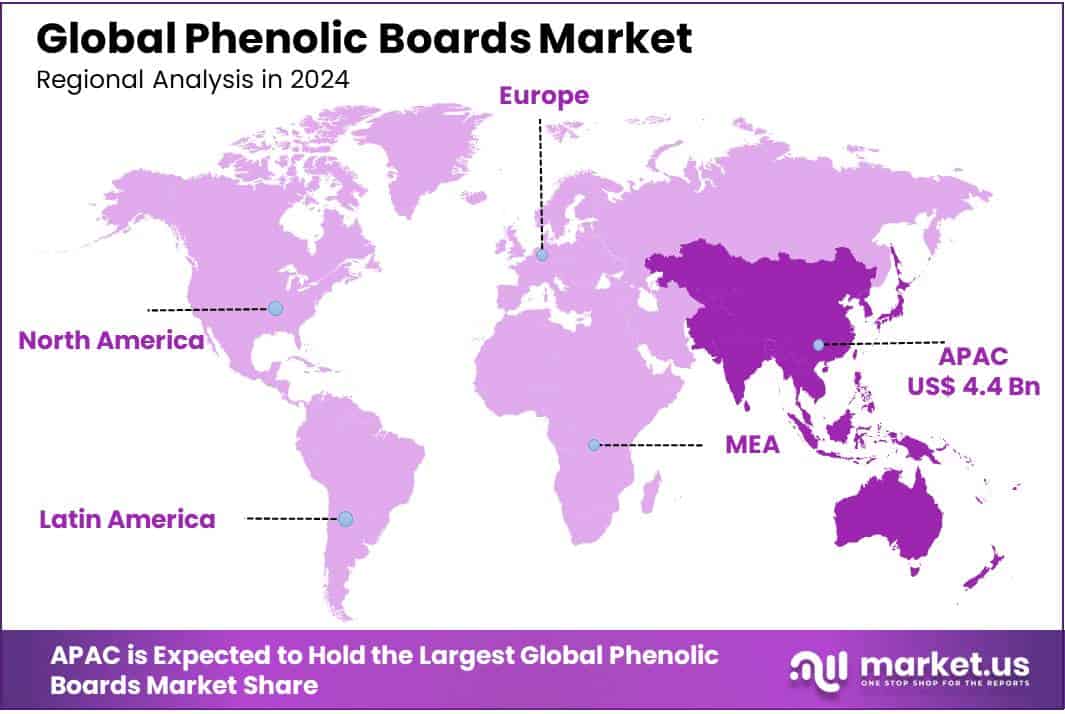

Regional Analysis

The global phenolic boards market is experiencing varied growth across different regions, with Asia Pacific (APAC) being the dominant market. In 2023, APAC held a substantial share of the market, accounting for 37.9% of the total market value, which was approximately USD 4.4 billion.

This growth can be attributed to the rapid industrialization and urbanization in key countries like China, India, and Japan, where the demand for advanced construction and automotive materials is increasing. The construction boom in urban areas and the rise of high-rise buildings in countries like China are key drivers of phenolic boards adoption, particularly due to their superior fire resistance and thermal insulation properties.

The region’s burgeoning automotive industry, with over 40 million vehicles produced in 2022 according to the International Organization of Motor Vehicle Manufacturers (OICA), further bolsters the demand for phenolic boards in interior automotive applications.

Europe follows APAC as a key market, driven by stringent building regulations focused on fire safety and sustainability. The European Union’s Green Deal and rising demand for eco-friendly materials in construction have spurred the adoption of phenolic boards. The region is expected to maintain a steady growth rate due to increasing government investments in sustainable building practices and energy-efficient solutions.

North America is also a significant market, primarily driven by demand from the construction and automotive sectors. The United States, with its large infrastructure projects and automotive industry, continues to represent a strong market for phenolic boards. Growth in Latin America and the Middle East & Africa is relatively slower but shows potential due to expanding infrastructure and construction activities in regions like the GCC countries.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The phenolic boards market is highly competitive, with several key players operating globally across various sectors, including construction, automotive, and industrial manufacturing. Asahi Kasei Corporation, a leading player based in Japan, is known for its innovative production of phenolic resins and boards used in high-performance applications.

Other notable manufacturers include Changzhou Zhongtian Fireproof Decorative Sheets Co., Ltd., and Fiberesin Industries, both of which specialize in providing fire-resistant and durable phenolic board solutions for the construction and interior design industries. Kingspan Group, renowned for its energy-efficient building materials, has also strengthened its presence in the phenolic boards market, leveraging its expertise in thermal insulation and sustainability-focused products.

In Asia, Guangdong Yuhua Building Materials Co., Ltd., Jialifu Panel Industry (Guangzhou) Co., Ltd., and SAVI Co., Ltd. play prominent roles in supplying phenolic boards for the growing construction and infrastructure sectors.

Companies such as Shandong Green Plastic Co., Ltd. and Shouguang Fuji Wood Industry Co., Ltd. contribute to the market’s expansion in China, where demand for phenolic boards is driven by both domestic industrial growth and export opportunities. In North America, Phenolam India Pvt. Ltd. and Unitech Enterprise Private Limited are expanding their reach, providing customized phenolic board solutions for various industrial applications.

Further enhancing the market’s growth are companies like SEKISUI Chemical Co., Ltd., LG Hausys, Stonewood Architectural Panel, and UNILIN, all of which are innovating in product development, including sustainable, fire-resistant, and high-strength phenolic boards.

The competition is further intensifying with the presence of Sourci and OKCHEM, which focus on global trade and supply chain solutions, expanding the accessibility of phenolic boards across emerging markets. The continued innovation and geographic expansion of these companies are expected to fuel the market’s growth, particularly in regions such as Asia Pacific and Europe.

Top Key Players in the Market

- Asahi Kasei Corporation

- Changzhou Zhongtian Fireproof Decorative Sheets Co., Ltd.

- Fiberesin Industries

- Fiberesin Industries, Inc.

- Guangdong Yuhua Building Materials Co., Ltd.

- Jialifu Panel Industry (Guangzhou) Co., Ltd.

- Kingspan Group

- LINYI CONSMOS WOOD INDUSTRY CO., LTD.

- Phenolam India Pvt. Ltd.

- SAVI CO., LTD

- SEKISUI CHEMICAL CO., LTD.

- Shallin Electronics Co., Ltd.

- Shandong Green Plastic Co., Ltd.

- Shouguang Fuji Wood Industry Co., Ltd.

- Sourci, OKCHEM, LG HAUSYS

- Spigo Group

- Stonewood Architectural Panel

- UNILIN

- Kingspan Group

- Unitech Enterprise Private Limited

Recent Developments

In 2023, Asahi Kasei reported sales of ¥2.4 trillion (approximately USD 16.3 billion), with its Performance Polymers Division, which includes phenolic resins, contributing significantly to the company’s overall revenue.

In 2023, Fiberesin Industries reported a revenue of approximately USD 200 million, driven in part by its strong product offerings in phenolic boards, which contribute significantly to its overall sales.

Report Scope

Report Features Description Market Value (2023) USD 9.4 Bn Forecast Revenue (2033) USD 15.9 Bn CAGR (2024-2033) 5.4% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Thickness (≤ 40 mm, >40 mm), By Type (Plain, Sandwich), By Phenolic Board (Standard Grade, High-Performance Grade, Flame Retardant Grade), By Resin Type (Phenol-Formaldehyde, Phenol-Furfural, Phenol-Resorcinol), By Form (Sheets, Rods, Tubes, Laminates), By Application ( Electrical Insulation, Mechanical Components, Automotive and Aerospace, Construction and Building, Others), By End Use (Residential, Commercial, Industrial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Asahi Kasei Corporation, Changzhou Zhongtian Fireproof Decorative Sheets Co., Ltd., Fiberesin Industries, Fiberesin Industries, Inc., Guangdong Yuhua Building Materials Co., Ltd., Jialifu Panel Industry (Guangzhou) Co., Ltd., Kingspan Group, LINYI CONSMOS WOOD INDUSTRY CO., LTD., Phenolam India Pvt. Ltd., SAVI CO., LTD, SEKISUI CHEMICAL CO., LTD., Shallin Electronics Co., Ltd., Shandong Green Plastic Co., Ltd., Shouguang Fuji Wood Industry Co., Ltd., Sourci, OKCHEM, LG HAUSYS, Spigo Group, Stonewood Architectural Panel, UNILIN, Kingspan Group, Unitech Enterprise Private Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Asahi Kasei Corporation

- Changzhou Zhongtian Fireproof Decorative Sheets Co., Ltd.

- Fiberesin Industries

- Fiberesin Industries, Inc.

- Guangdong Yuhua Building Materials Co., Ltd.

- Jialifu Panel Industry (Guangzhou) Co., Ltd.

- Kingspan Group

- LINYI CONSMOS WOOD INDUSTRY CO., LTD.

- Phenolam India Pvt. Ltd.

- SAVI CO., LTD

- SEKISUI CHEMICAL CO., LTD.

- Shallin Electronics Co., Ltd.

- Shandong Green Plastic Co., Ltd.

- Shouguang Fuji Wood Industry Co., Ltd.

- Sourci, OKCHEM, LG HAUSYS

- Spigo Group

- Stonewood Architectural Panel

- UNILIN

- Kingspan Group

- Unitech Enterprise Private Limited