Global Perovskite Solar Cells Module Market By Structure Type (Mesoscopic, and Planar), By Product Type (Rigid, and Flexible), By Type (Single Junction, and Multi Junction) By Technology (Solution Method, Vapor-Assisted Solution Method, and Vapor-Deposition Method) By Application (Smart Glass, Building-Integrated Photovoltaics, Solar Panel, and Others), By End-Use (Residential, Commercial, Industrial, and Utility), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 15931

- Number of Pages: 392

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

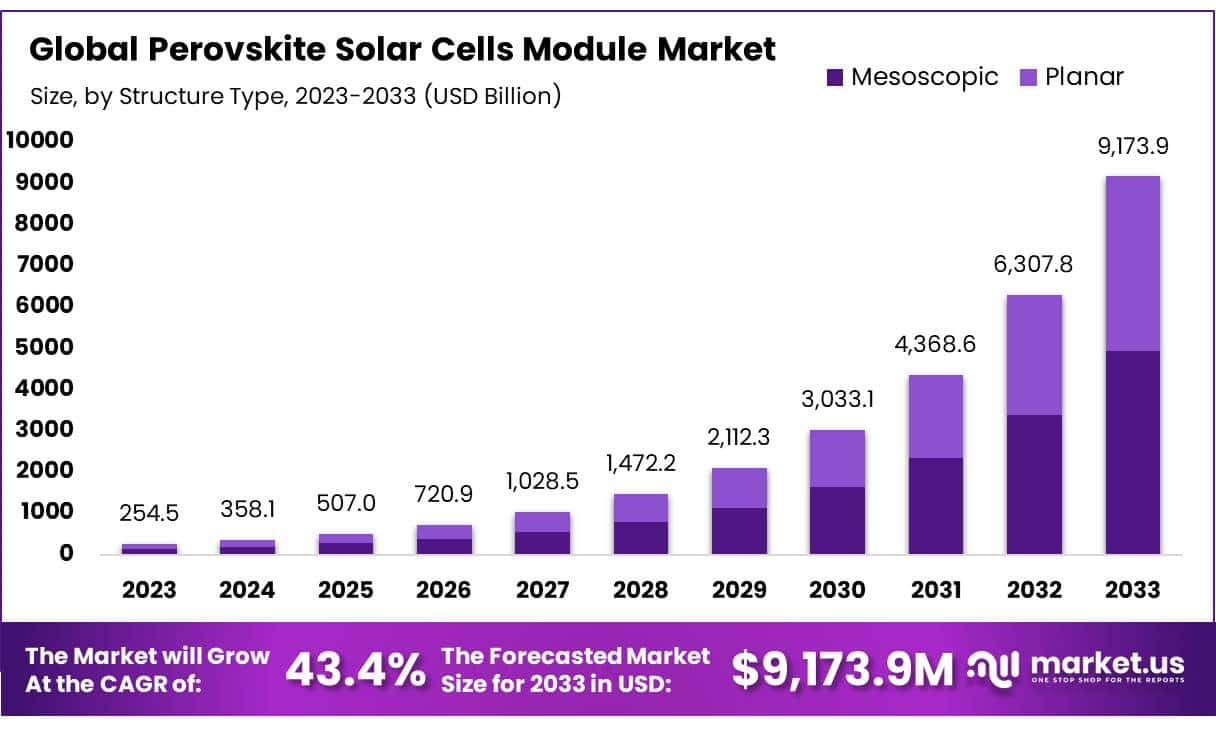

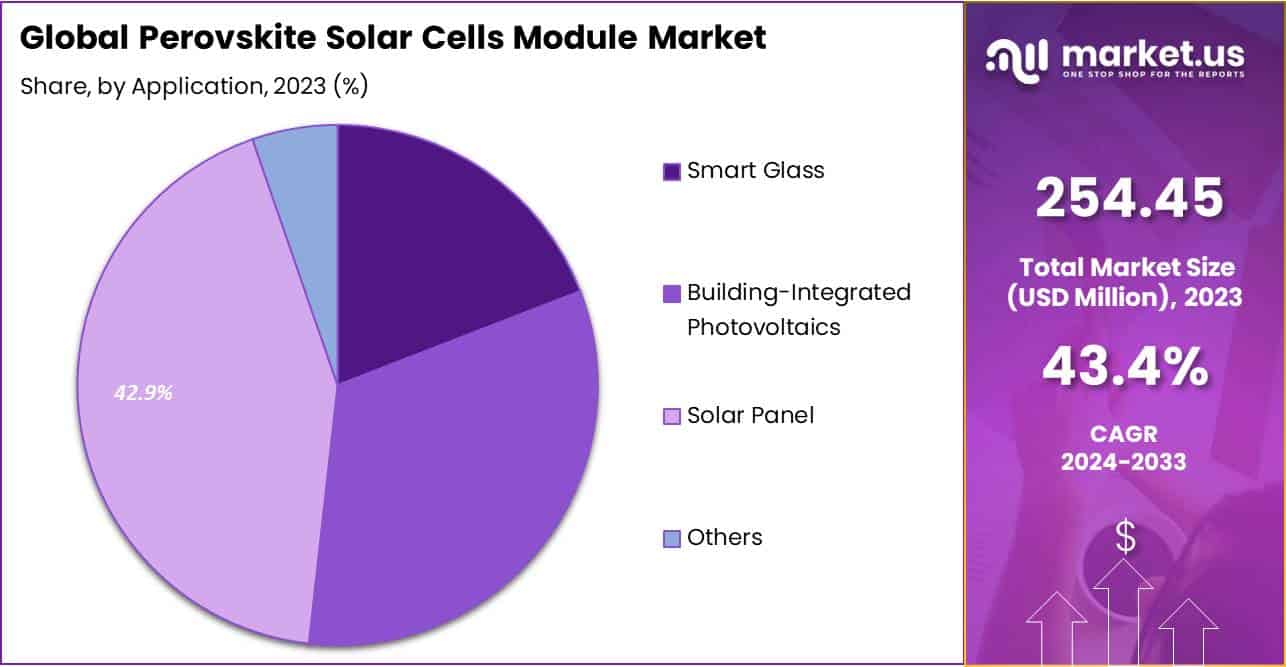

The Global Perovskite Solar Cells Module Market size is expected to be worth around USD 9,173.94 Mn by 2033, from USD 254.45 Mn in 2023, growing at a CAGR of 43.4% during the forecast period from 2024 to 2033.

The perovskite solar cell module industry holds substantial potential to impact the renewable energy landscape significantly. Continued research and development are critical as the industry strives to overcome existing challenges and move towards commercialization and large-scale deployment.

Perovskite materials utilized in the solar power sector have excellent optical and electrical charge characteristics, making solar cells suitable for a wide range of applications. Perovskite was developed by IBM in the 1990s and first used in the solar power business in 2012.

In response to the significant climate change driven by the extensive use of non-renewable energy sources, the role of renewable energy in meeting global energy demands has grown substantially in recent years.

Key Takeaways

- The global perovskite solar cells module market was valued at US$ 254.45 million in 2023.

- The global perovskite solar cells module market is projected to reach US$ 9,173.94 million by 2033.

- Among structure type, the mesoscopic held the majority of the revenue share at 53.9%.

- Based on product types, flexible accounted for the largest market share with 61.8%.

- Among types, single junction accounted for the majority of the perovskite solar cells module market share with 62.9%.

- Among technologies, solution method accounted for the majority of the perovskite solar cells module market share with 59.2%.

- Among applications, solar panel accounted for the majority of the perovskite solar cells module market share with 42.9%.

- Based on end-uses, the utility dominated the market with a share of 42.0%.

Structure Type Analysis

Offset Structure Type Held the Major Share Owing To Their High-Quality Output

The perovskite solar cells module market is segmented based on structure types into mesoscopic and planar. Among these, the mesoscopic held the majority of revenue share in 2023, with a market share of 53.9% due to their robustness in performance and manufacturing benefits over planar types.

Mesoscopic PSCs have shown higher power conversion efficiencies due to their effective light harvesting and charge collection capabilities. The mesoporous layer enhances the internal surface area, which facilitates more extensive interfaces for electron transport and collection, boosting the overall efficiency of the solar cell.

Additionally, the structured framework of mesoporous materials provides better stability under different environmental conditions, which is crucial for the practical application of perovskite solar cells.

Product Type Analysis

Plastic Product Types Accounted for a Major Share in the Perovskite Solar Cells Module Market

Based on product types, the market is segmented into rigid and flexible. Among these, flexible type accounted for the majority of the market share, at 61.8%, primarily due to its versatility, lightweight design, and adaptability for a range of applications.

Flexible PSCs are manufactured on substrates like plastic, metal foil, or flexible glass, which allow them to be lightweight and bendable, making them ideal for portable electronics, wearable devices, and integration with unconventional surfaces such as vehicle roofs, building facades, and even textiles. This adaptability opens up possibilities for their use in diverse applications beyond traditional rigid solar panels.

Additionally, the lightweight nature of flexible PSCs reduces installation complexity and cost, especially in locations where weight constraints are a concern, such as in rooftop applications or in structures with limited load-bearing capacity. This portability makes them appealing for applications in remote areas or temporary setups where conventional, rigid panels would be impractical.

Type Analysis

Being an Efficient and Cost Effective, Gloss Varnish is the Best Choice for Packaging Applications.

The perovskite solar cells module market was further categorized based on types such as single junction and multi junction. Among these applications, single junction accounted for a major market share of 63.3% as of 2023 due to several advantages associated with their simpler design, cost-effectiveness, and relatively high efficiency.

Single-junction PSCs consist of a single active layer of perovskite material that absorbs sunlight and converts it into electricity, making their structure less complex compared to multi-junction cells. This simplicity in design contributes to lower production costs and easier scalability, making single-junction cells more economically viable for mass production and commercial applications.

The efficiency of single-junction perovskite cells has also improved significantly in recent years, reaching levels comparable to or even surpassing some traditional solar technologies, such as amorphous silicon. These advancements have made single-junction PSCs an attractive option for manufacturers looking to optimize cost-to-efficiency ratios without the need for additional layers or complex configurations required by multi-junction cells.

Furthermore, single-junction cells are easier to integrate into various applications, from small-scale portable devices to larger power installations, without the technical challenges associated with aligning multiple junctions to maximize absorption across different wavelengths. As a result, they are well-suited for the current demands of the solar market, which prioritizes both cost-efficiency and adaptability.

Technology Analysis

The perovskite solar cells module market was further divided based on technologies such as solution method, vapor-assisted solution method and vapor-deposition method. Among these applications, solution method dominated the market with a major market share of 47.6% as of 2023 due to its cost-effectiveness, simplicity, and scalability.

The solution method involves dissolving perovskite precursor materials in a solvent and then depositing this solution onto a substrate. This approach is relatively straightforward and does not require complex or costly equipment, making it an economically viable choice for large-scale manufacturing.

Compared to vapor-assisted solution and vapor-deposition methods, the solution process is highly adaptable and can be performed at lower temperatures, reducing energy costs and allowing compatibility with flexible substrates, which are increasingly popular in the market.

This versatility has broadened the solution method’s application scope, as it can be used on various materials, including plastics, metals, and glass, making it well-suited for both rigid and flexible PSC modules.

The solution method also supports rapid prototyping and continuous processing, which is appealing to manufacturers focused on scaling production to meet growing market demand. Furthermore, advances in solution chemistry and coating techniques have enabled significant improvements in film uniformity, quality, and efficiency for PSCs fabricated via the solution method

Application Analysis

Owing to High Demand For Efficient Energy Generation, Solar Panels Are The Major End-Users Of Perovskite Solar Cells Module

The perovskite solar cells module market was classified based on applications such as smart glass, building-integrated photovoltaics, solar panel and others. Among these applications, solar panel accounted for a major market share of 42.9% as of 2023 due to its alignment with mainstream energy production needs, high demand for efficient energy generation, and scalability.

Perovskite solar panels offer significant advantages over traditional silicon-based solar panels, including potentially lower production costs, ease of manufacturing, and comparable or even superior efficiency improvements in certain conditions. These attributes make PSCs highly attractive for utility-scale and residential solar panel applications, where there is a strong emphasis on cost-effectiveness and energy efficiency.

Additionally, solar panels are essential for large-scale renewable energy projects, which are experiencing rapid growth globally due to increasing clean energy targets and supportive governmental policies aimed at reducing carbon emissions.

The adaptability of PSC technology for integration into traditional solar panel designs has made it easier for manufacturers to incorporate perovskites into existing infrastructure. This is especially important as demand for renewable energy sources intensifies across residential, commercial, and industrial sectors, where solar panels remain one of the most widely accepted and deployed solutions.

End-Use Analysis

By end-users, the market was divided into residential, commercial, industrial and utility. The utility sector accounted for 54.1% of the market share in the perovskite solar cells (PSCs) module market among end-users in previous years due to the sector’s large-scale energy requirements, focus on high-efficiency renewable energy solutions, and the cost advantages associated with PSC technology.

Utility-scale solar projects demand high-output, cost-effective, and scalable solar solutions, and PSCs are increasingly meeting these needs through their promising efficiency improvements, lower production costs compared to silicon-based photovoltaics, and ease of manufacturing.

Perovskite solar technology also aligns with the utility sector’s goal to maximize energy generation capacity on a large scale. PSCs can be produced with a range of deposition techniques, which can be scaled up for mass production. This makes them suitable for expansive solar farms and large energy facilities that supply power to broad regional grids, where both efficiency and installation speed are critical.

Key Market Segments

By Structure Type

- Mesoscopic

- Planar

By Product Type

- Rigid

- Flexible

By Type

- Single Junction

- Multi Junction

By Technology

- Solution Method

- One-step

- Two-step

- Vapor-Assisted Solution Method

- Vapor-Deposition Method

By Application

- Smart Glass

- Building-Integrated Photovoltaics

- Solar Panel

- Others

By End-User

- Residential

- Commercial

- Industrial

- Utility

Drivers

Increased Adoption of Residential Solar is Estimated to Boost the Perovskite Solar Cells Module Market

The increased adoption of residential solar energy systems is expected to significantly boost the perovskite solar cells (PSCs) module market due to several factors that align with the unique advantages of PSC technology.

Homeowners and residential developers are increasingly opting for solar energy to reduce reliance on traditional energy sources, lower electricity bills, and contribute to environmental sustainability. As residential solar adoption grows, demand is rising for efficient, cost-effective, and versatile solar technology options, which PSCs are well-positioned to fulfill.

Perovskite solar cells offer several advantages over traditional silicon-based panels, including potentially lower production costs, lightweight properties, and the ability to perform efficiently even in low-light conditions. This adaptability is especially attractive in residential settings where installation ease, aesthetic appeal, and performance under varied lighting conditions are essential.

Perovskite modules can be manufactured in both rigid and flexible forms, making them suitable for diverse residential applications, from traditional rooftop installations to integration with unconventional surfaces, such as facades or windows.

This versatility is particularly advantageous in urban residential areas where space is limited, as PSCs can be incorporated into building-integrated photovoltaics (BIPV) and smart glass solutions, enhancing the overall energy-generating surface area without requiring additional land.

The production of PSCs is also inherently less energy-intensive than that of traditional silicon cells, reducing their carbon footprint and making them an appealing choice for environmentally conscious homeowners.

The scalability of PSC production methods, such as solution processing, allows manufacturers to produce residential solar modules at lower costs, making solar more accessible for a wider demographic of homeowners. Moreover, with continuous improvements in stability, durability, and efficiency, PSC technology is increasingly meeting the quality and longevity standards required in residential settings.

Restraints

Longevity and Stability Issues May Hinder the Growth of the Market for A Certain Extent

Longevity and stability issues represent significant challenges that may hinder the growth of the perovskite solar cells (PSCs) module market to a certain extent. While perovskite solar cells are known for their high efficiency and potential for cost-effective production, their long-term stability and durability under real-world conditions remain areas of concern.

The stability of PSCs can be affected by environmental factors such as moisture, heat, and exposure to ultraviolet (UV) light, which degrade the perovskite material over time. This degradation impacts the lifespan and performance of PSC modules, creating reliability concerns that could slow their adoption, especially for large-scale commercial and residential applications where durability is paramount.

One of the key challenges is moisture sensitivity. Perovskite materials are highly susceptible to degradation when exposed to moisture, which can lead to a rapid decline in efficiency and even complete failure. This sensitivity necessitates the development of effective encapsulation techniques to protect the cells from humidity, but advanced encapsulation methods can add complexity and cost to the manufacturing process, partially offsetting the cost advantages of perovskites.

Opportunity

Emerging Markets Are Anticipated to Create Major Opportunities for Perovskite Solar Cells Module Market

Emerging markets are expected to present substantial growth opportunities for the Perovskite Solar Cells (PSC) Module Market. These regions, including parts of Asia, Latin America, Africa, and Eastern Europe, are experiencing rapid industrialization, urbanization, and a rising demand for energy, making them attractive markets for renewable energy solutions such as PSCs.

Emerging markets are increasingly committed to renewable energy goals as they aim to reduce reliance on fossil fuels, lower carbon emissions, and meet international environmental commitments.

Perovskite solar technology, with its high potential for efficiency and lower production costs compared to traditional silicon-based photovoltaics, aligns well with these sustainability initiatives. By offering a cost-effective way to expand renewable energy capacity, PSCs can help emerging markets achieve their renewable energy targets, making them an attractive solution for government-backed projects.

Numerous emerging economies have introduced policies and incentives to promote renewable energy adoption, and international funding organizations, including the World Bank and various development agencies, are offering financial support for green energy projects in these regions.

These favorable policy environments and funding resources can boost investment in PSC technology, as governments and investors recognize the role of affordable solar solutions in driving sustainable economic growth.

Emerging markets present significant opportunities for the PSC market due to the rising demand for affordable, reliable energy solutions, supportive government policies, and a growing commitment to sustainability.

As these economies continue to develop and prioritize green energy, PSC technology has the potential to meet diverse energy needs across both urban and rural areas, positioning it as a transformative force in the global renewable energy landscape.

Trends

Integration with Energy Storage

The integration of energy storage with perovskite solar cells (PSCs) represents a significant advancement for enhancing the efficiency and reliability of solar power systems. Energy storage is crucial in solar power applications, as it addresses the intermittent nature of solar energy due to weather conditions and daily sunlight cycles.

By combining PSCs with energy storage solutions, such as lithium-ion batteries or other advanced storage technologies, solar power systems can provide a more consistent and stable power output, even when sunlight is unavailable. This integration is particularly beneficial for grid applications, residential use, and off-grid systems, as it allows excess energy generated during peak sunlight hours to be stored and used later.

Perovskite solar cells are especially well-suited for integration with energy storage due to their lightweight nature, flexibility, and potential for high efficiency. Their adaptability in design allows them to be paired effectively with various types of storage solutions, whether in compact residential systems or larger commercial and industrial applications.

For instance, PSCs can be incorporated into building-integrated photovoltaics (BIPVs) and flexible panels for residential use, with stored energy available for nighttime or cloudy periods, reducing dependency on grid electricity and improving energy security for users.

Another advantage of integrating energy storage with PSCs is the potential to balance energy load and demand on power grids. In utility-scale applications, PSC modules paired with energy storage systems can help stabilize the grid by storing energy during periods of low demand and releasing it during peak times.

This load-balancing capability is critical for supporting renewable energy penetration in grid infrastructure, helping to mitigate fluctuations in power supply and demand, and reducing the need for backup fossil fuel-based power sources.

Geopolitical Impact Analysis

Geopolitical Tensions Significantly Impacted the Growth of the Perovskite Solar Cells Module Market

Geopolitical tensions often lead to trade restrictions, tariffs, and embargos, which can disrupt global supply chains for essential materials used in the production of perovskite solar cells. Perovskite solar cell production relies on specific raw materials, such as lead and other rare elements, that are often sourced from countries impacted by geopolitical challenges.

Trade conflicts or sanctions on key material-supplying countries can cause significant delays and cost increases in material procurement, affecting manufacturers’ ability to produce PSC modules at competitive costs and scales. For instance, restrictions on exports or import tariffs between major players in the renewable energy sector such as the U.S., China, and Europe can make accessing critical components more challenging and costly.

The perovskite solar cell industry is still in a developing phase, with significant research and development (R&D) efforts needed to improve cell efficiency, durability, and scalability.

Geopolitical tensions can restrict collaboration between international research institutions, particularly when these tensions lead to reduced scientific exchange or joint funding constraints. For example, restrictions on international partnerships may limit access to innovative technologies or expert knowledge, especially from leading research hubs in Europe, North America, and Asia.

This lack of cooperation slows the rate of innovation and hinders the rapid technological advancements needed for PSCs to reach commercialization and widespread adoption. Trade barriers, tariffs, and sanctions resulting from geopolitical tensions can directly impact the PSC market by raising the cost of imported components and equipment. Several countries rely on imported machinery, chemicals, and equipment for the manufacturing of PSC modules.

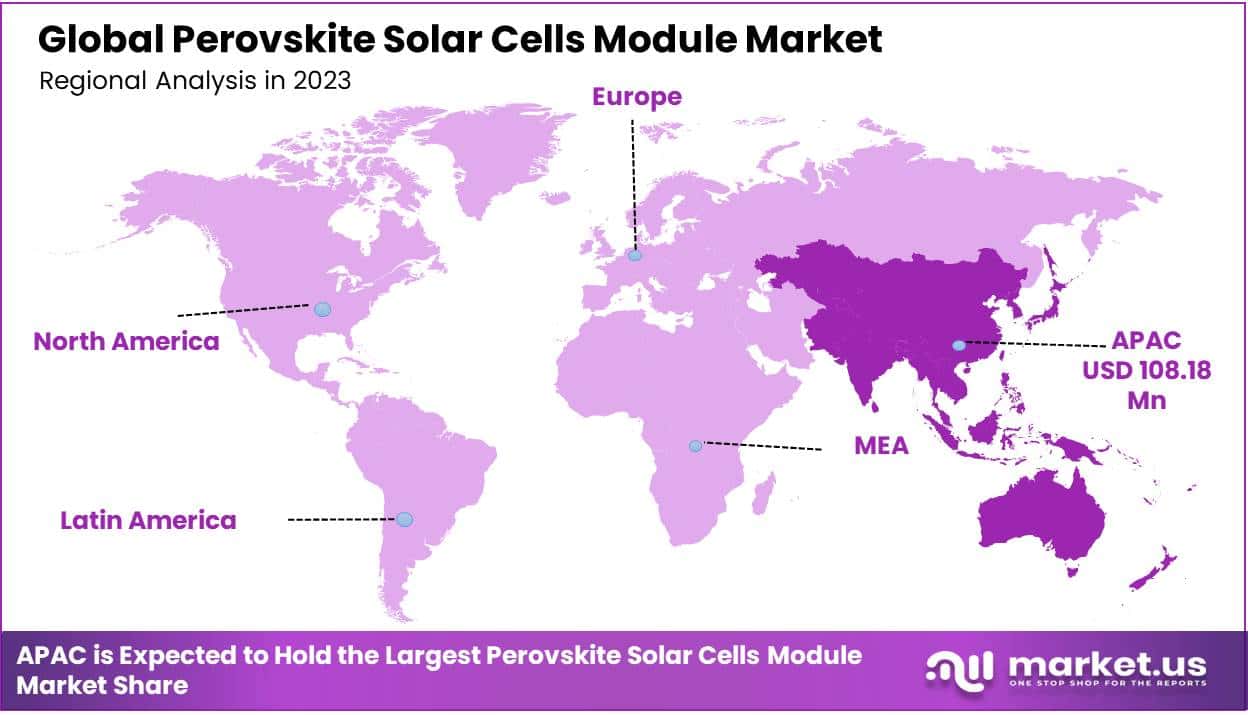

Regional Analysis

Asia-Pacific Dominated the Market Owing to The Rapid Growth of Industries

In 2023, Asia-Pacific held the largest market share of Perovskite Solar Cells Module with 59.5%. The region’s dominance can be attributed primarily to the rapid growth of industries such as packaging, commercial printing, and labels and stickers, which are the primary end-users of Perovskite Solar Cells Module.

As the region’s economies, particularly China, India, and Southeast Asian countries, experience robust industrialization and urbanization, the demand for high-quality packaging has surged. This increase is particularly prominent in consumer goods, food and beverage, pharmaceuticals, and e-commerce sectors, where premium packaging with varnishing enhances product appeal and durability.

China, being the largest manufacturer and exporter of consumer goods globally, has significantly driven the demand for perovskite solar cells module.

Its large-scale production capacities, coupled with the increasing need for attractive and protective packaging solutions, have fueled market growth. Additionally, the rise in e-commerce has created a higher demand for packaging materials, which often require high-quality varnishing to ensure product safety and brand differentiation.

Japan and South Korea, with their advanced printing technologies and high-tech industries, further contribute to the region’s leading market position. These countries emphasize innovation in printing techniques, including the use of varnish to create aesthetically appealing and durable packaging.

The cost advantages of production in Asia-Pacific, alongside the availability of raw materials and a well-established manufacturing infrastructure, also make the region attractive for printing plate manufacturing.

Additionally, increasing investments in technology and machinery upgrades have enhanced production efficiency, further boosting the region’s market share. As a result, Asia-Pacific’s expanding industrial base, combined with rising consumer demand, has cemented its position as the leading market for perovskite solar cells module in 2023.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Market Players In The Perovskite Solar Cells Module Industry Are Developing Through Various Strategies.

In the perovskite solar cells (PSC) module industry, market players are actively implementing a range of strategic initiatives to sustain and enhance e their competitive positions. Industry leaders are focusing on research and development (R&D) to improve the efficiency, stability, and scalability of perovskite technology, which is crucial for maintaining a technological edge.

Investments in R&D help companies address challenges related to long-term stability, enhancing the commercial viability of PSC modules in comparison to traditional photovoltaic technologies.

Partnerships and collaborations are another prominent strategy, with companies forming alliances with research institutions, government bodies, and other firms to accelerate innovation and bring new products to market faster. Such collaborations allow access to a broader pool of expertise, enabling advancements in material science and production methods that are essential for overcoming technical limitations in perovskite solar technology.

Acquisitions of specialized firms, for example, help integrate new capabilities and technologies, such as encapsulation techniques or hybrid tandem cell technologies, which improve module efficiency and durability. Vertical integration also enables greater control over the supply chain, helping to reduce costs and mitigate risks associated with material sourcing.

Market Key Players

- Hanwha Group

- Toshiba Corporation

- CubicPV

- Greatcell Energy

- Oxford Photovoltaics Ltd

- EneCoat Technologies Co., Ltd

- Swift Solar

- Solaronix SA

- Saule Technologies

- Tandem PV, Inc.

- Hangzhou Microquanta Co. Ltd.

- Perovskia Solar AG

- Front Materials Co. Ltd

- P3C Technology and Solutions Pvt. Ltd.

- Other Key Players

Recent Development

- On July, 2024, Oxford PV, a leading innovator in next-generation solar technology, has set a new world record for solar module efficiency. Their 60-cell residential-sized module, utilizing perovskite-on-silicon tandem solar cells, reached an exceptional efficiency of 26.9%. This surpasses the current top-performing silicon modules, which have an efficiency of around 25% with a comparable module area.

- On April, 2024, CubicPV has developed mini solar modules utilizing perovskite cells enhanced with zinc trifluoromethane sulfonate [Zn(OOSCF3)2].

Report Scope

Report Features Description Market Value (2023) US$ 254.45 Mn Forecast Revenue (2033) US$ 9,173.94 Mn CAGR (2024-2033) 43.4% Base Year for Estimation 2023 Historic Period 2020-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered Global Perovskite Solar Cells Module Market By Structure Type (Mesoscopic , and Planar), By Product Type (Rigid, and Flexible), By Type (Single Junction, and Multi Junction) By Technology (Solution Method, Vapor-Assisted Solution Method, and Vapor-Deposition Method) By Application (Smart Glass, Building-Integrated Photovoltaics, Solar Panel, and Others), By End-Use (Residential, Commercial, Industrial, and Utility) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Hanwha Group, Toshiba Corporation, CubicPV, Greatcell Energy, Oxford Photovoltaics Ltd., EneCoat Technologies Co., Ltd., Swift Solar, Solaronix SA, Saule Technologies, Tandem PV, Inc., Hangzhou Microquanta Co. Ltd., Perovskia Solar AG, Front Materials Co. Ltd., P3C Technology and Solutions Pvt. Ltd. Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate User License (Unlimited User and Printable PDF)  Perovskite Solar Cells Module MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample

Perovskite Solar Cells Module MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Hanwha Group

- Toshiba Corporation

- CubicPV

- Greatcell Energy

- Oxford Photovoltaics Ltd

- EneCoat Technologies Co., Ltd

- Swift Solar

- Solaronix SA

- Saule Technologies

- Tandem PV, Inc.

- Hangzhou Microquanta Co. Ltd.

- Perovskia Solar AG

- Front Materials Co. Ltd

- P3C Technology and Solutions Pvt. Ltd.

- Other Key Players