Global Party Supplies Market Report By Product Type (Balloons, Tableware/Disposable Supplies, Banners & Decorations, Pinatas & Games, Invitations, Party Favors, Candles & Cake Toppers), By Material, By Application, By Distribution Channel, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 132110

- Number of Pages: 342

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

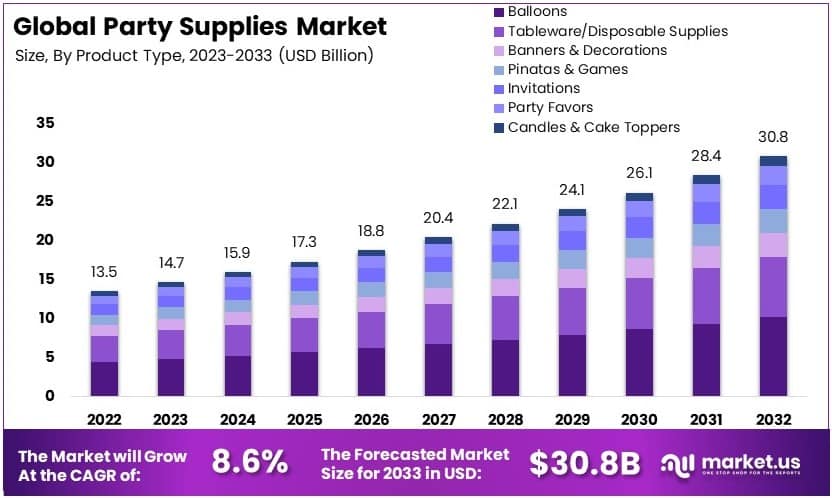

The Global Party Supplies Market size is expected to be worth around USD 30.8 Billion by 2033, from USD 13.5 Billion in 2023, growing at a CAGR of 8.6% during the forecast period from 2024 to 2033.

Party supplies are products and materials used to enhance and decorate events like birthdays, weddings, corporate events, and other celebrations. They include items such as balloons, banners, tableware, party favors, and themed decorations. These items help create a festive atmosphere and enhance the event’s overall experience.

The party supplies market is the commercial space that encompasses the production, distribution, and sale of products used for event decoration and celebration. It includes various product categories, including decorations, tableware, and disposable items, tailored for different events.

The party supplies market involves the production, distribution, and sale of decorations and materials for various events. It caters to both individual and corporate clients. According to Pinterest’s Summer Trends Report, searches for “dinner party” surged by over 6,000%, highlighting the market’s broad reach and diverse consumer interests.

The market is growing due to the rise in themed parties and DIY trends. A 2022 survey by The Knot revealed that 78% of couples use social media for wedding ideas. Additionally, Venveo reports that 47% of DIY enthusiasts start projects after seeing content from influencers or blogs.

The party supplies market is moderately saturated with many established brands. However, there is still room for niche players who offer unique and customizable products. For example, themed decorations like “fairy dinner party” saw a 150% increase, indicating opportunities for specialized products.

Globally, social media drives the adoption of international party themes. Locally, small businesses thrive by providing customized and culturally relevant decorations. This dual impact supports both large-scale and community-based market growth.

Key Takeaways

- Party Supplies Market was valued at USD 13.5 Billion in 2023 and is expected to reach USD 30.8 Billion by 2033, with a CAGR of 8.6%.

- In 2023, Balloons dominated the product type segment with 33% share, attributed to their high demand for various celebrations.

- In 2023, Paper-based materials led the market by material with 35.5%, driven by increasing environmental awareness and sustainability preferences.

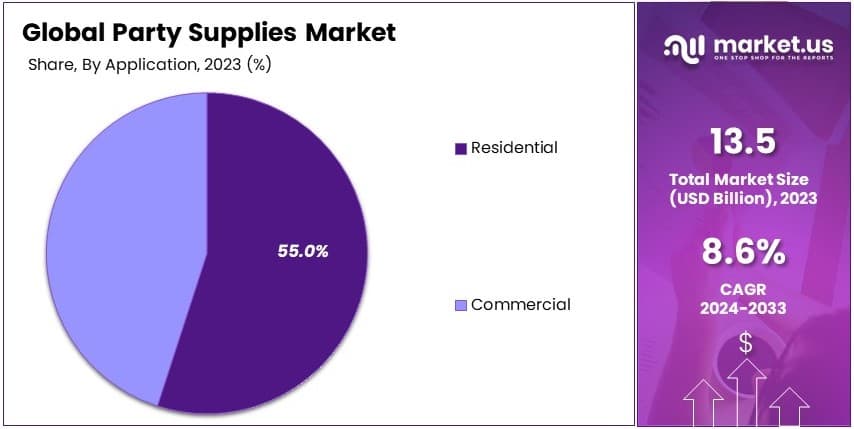

- In 2023, Residential applications accounted for 55% of the market, highlighting strong demand for party supplies in personal gatherings and events.

- In 2023, Offline retail channels held 35.5% share in distribution, reflecting consumer preference for in-person shopping for party supplies.

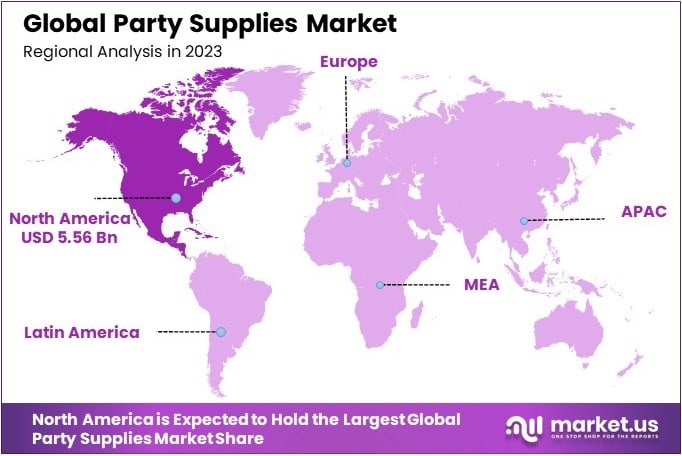

- In 2023, North America was the dominant region, capturing 41.2% market share, owing to high spending on events and celebrations.

Product Type Analysis

In the Party Supplies Market, balloons dominate the product type segment, accounting for approximately 33% of the market. This popularity is primarily due to their versatility and affordability, making them ideal for a wide range of events, from birthdays and weddings to corporate gatherings.

Balloons are available in various shapes, colors, and materials, including latex, foil, and mylar. They are easy to customize, which enhances their appeal for both private consumers and event organizers looking to create memorable, themed environments.

Tableware/Disposable Supplies represent a significant portion of the party supplies market as well. Given the growing consumer preference for eco-friendly products, suppliers are increasingly offering biodegradable plastics and compostable options, particularly in paper-based or bamboo materials.

Banners & Decorations are also essential in setting the theme and tone of any event, making them indispensable for themed parties and personalized celebrations. The demand for unique and customized decorations continues to grow, especially in commercial and corporate events, where companies often use branded decorations.

Pinatas & Games, although more niche, are consistently popular for children’s events. Also, invitations play a vital role in setting the tone for the event, and although digital invitations are on the rise, there remains a substantial market for printed, customized invitations.

Party Favors provide guests with a lasting memory of the celebration. They continue to be popular in both residential and commercial applications, with a growing trend toward personalized and themed favors.

Candles & Cake Toppers complete the setup for many events, especially birthdays and weddings. These items, while small, are essential in adding a final, decorative touch to cakes and desserts, increasing their popularity across various types of gatherings.

Material Analysis

The paper-based sub-segment leads the material category with approximately 35.5% market share. Its dominance is due to the rising environmental concerns among consumers and increasing regulatory pressures to reduce plastic waste. Paper-based products are preferred as they are biodegradable and offer a sustainable alternative to traditional plastic supplies.

In addition, they are versatile and can be used for multiple products, including tableware, banners, and invitations. As the market shifts toward eco-friendly solutions, paper-based party supplies are expected to maintain and even expand their market share.

Plastic-based materials remain a significant segment despite environmental concerns, as they offer durability and cost-effectiveness. Many consumers continue to opt for plastic-based products, especially when organizing large events on a budget. However, this segment is under pressure from shifting regulations and changing consumer preferences.

Metallic materials cater to a smaller but distinct market segment. These products are mainly used in premium decorations and party favors, particularly for formal or high-end events. Metallic decorations add a luxury goods feel and are often chosen for weddings, corporate gatherings, and milestone celebrations.

Fabric materials are primarily used in reusable decorations, banners, and tablecloths. With a rising interest in sustainable, reusable options, fabric-based party supplies are gaining traction among eco-conscious consumers.

Application Analysis

In the application segment, residential use leads with approximately 55% of the market share. This is driven by the increasing number of home-based celebrations, such as birthdays, anniversaries, and holidays. With more consumers opting to host events at home, the demand for residential party supplies remains high.

Products tailored to individual themes, personalization options, and affordability are particularly attractive to residential users. The rise of social media has also amplified this trend, with people seeking Instagram-worthy setups for their gatherings. As a result, suppliers continue to focus on offering a broad array of residential party supplies to meet diverse customer preferences.

Commercial applications, while smaller in market share, are integral to corporate and event planning services. Businesses hosting branded or theme-specific events represent a steady demand for customized and premium supplies. This segment also includes products used by event planners and caterers, where consistency in quality and durability is essential.

Distribution Channel Analysis

Offline retail channels dominate the distribution channel segment with approximately 35.5% market share. The prominence of brick-and-mortar stores is attributed to consumer preferences for physically browsing products, especially for customizable and theme-based items.

Many customers prefer to see and feel party supplies in person to assess quality and compatibility with their event needs. Additionally, last-minute purchases are common in this segment, further supporting the importance of offline retail in the market. Offline retailers often provide a variety of options and instant availability, making them a preferred choice for customers.

Online retail has rapidly gained traction as consumers increasingly favor the convenience and variety offered by digital platforms. The availability of reviews, detailed descriptions, and custom-order capabilities make online retail attractive, especially to tech-savvy consumers.

Direct sales primarily serve commercial customers, such as event planners and corporate clients who require large volumes of supplies. This channel enables suppliers to establish long-term relationships with bulk buyers, providing customized services and bulk discounts.

Key Market Segments

Product Type

- Balloons

- Tableware/Disposable Supplies

- Banners & Decorations

- Pinatas & Games

- Invitations

- Party Favors

- Candles & Cake Toppers

Material

- Paper-based

- Plastic-based

- Metallic

- Fabric

Application

- Commercial

- Residential

Distribution Channel

- Online Retail

- Offline Retail

- Direct Sales

Drivers

Increasing Celebrations and Events Drive Market Growth

The Party Supplies Market is thriving, propelled by a surge in celebrations and events, the rising popularity of DIY party products, the growth of online retailing, and an expanding middle-class population.

As global cultures embrace more celebratory events, both traditional and modern, there is a heightened demand for diverse party supplies. Moreover, the DIY trend has gained traction through platforms like Pinterest and YouTube, encouraging consumers to personalize their events in unique and affordable ways.

Additionally, online retail platforms have expanded the accessibility of party supplies, offering a wide range of products at competitive prices, which caters to an increasingly broad consumer base.

In particular, the expansion of the middle class, especially in emerging economies, has introduced a new demographic of consumers eager to invest in celebrations, thus broadening the market’s reach and driving growth in the party supplies sector.

Restraints

High Competition Restrains Market Growth

Despite this growth, the Party Supplies Market faces significant constraints due to high competition, fluctuations in raw material prices, stringent environmental regulations, and the inherent seasonality of the business.

The market is saturated with established players and new entrants, resulting in intense competition and frequent price wars, which often reduce profit margins.

Furthermore, raw material price volatility complicates financial forecasting and pricing strategies, directly impacting profitability. Additionally, the growing regulatory focus on environmental conservation compels manufacturers to invest in sustainable, but often more costly, production processes, thereby inflating costs.

In addition, the seasonal nature of party supplies, with peaks around specific festivals or holidays, challenges consistent sales throughout the year, affecting stable growth and market stability.

Opportunity

Innovation in Eco-Friendly Products Offers Growth Opportunities

The Party Supplies Market presents numerous growth opportunities through innovation in eco-friendly products, penetration into new geographical markets, partnerships with event planners, and adoption of advanced manufacturing technologies.

Hence, as consumer awareness regarding sustainability increases, there is a notable shift towards eco-friendly party products, opening new avenues for companies that invest in green solutions.

Moreover, expanding into untapped geographical areas provides substantial growth prospects, especially in regions undergoing rapid urbanization and economic development. Furthermore, collaborations with event planners offer direct access to end-users, facilitating customized and large-scale supply opportunities.

Additionally, leveraging advanced technologies in manufacturing can enhance efficiency and product variety, helping businesses scale effectively to meet diverse consumer demands.

Challenges

Logistic and Supply Chain Disruptions Challenge Market Growth

Logistic and supply chain disruptions, changing consumer spending patterns, intense pricing pressure, and regulatory compliance costs present significant challenges to the Party Supplies Market.

Supply chain inefficiencies, exacerbated by global disruptions such as pandemics or political unrest, can lead to stock shortages or delays, frustrating customers and potentially diverting them to competitors.

In addition, consumer spending patterns are increasingly unpredictable, influenced by economic factors and shifting preferences toward more sustainable or innovative products. Consequently, pricing pressure remains high due to the competitive nature of the market, pushing companies to find cost-effective solutions without compromising quality.

Additionally, the financial burden of adhering to increasingly stringent regulations can stifle innovation and responsiveness in product development and marketing strategies.

Growth Factors

Technological Advancements and E-commerce Expansion Fuel Market Growth

The growth of the Party Supplies Market is significantly fueled by technological advancements in product design, the expansion of consumer bases through e-commerce, strategic marketing initiatives, and the diversification of product ranges.

First, the advanced technologies facilitate the creation of innovative products that meet the current demand for customization and efficiency.

Moreover, e-commerce platforms extend the market’s reach globally, enabling suppliers to tap into new demographics and regions with minimal overhead. Furthermore, strategic marketing initiatives, particularly through digital channels, enhance brand visibility and consumer engagement, driving sales and customer loyalty.

Finally, diversifying product offerings to include various themes, materials, and price points ensures that companies can cater to a broad spectrum of consumer needs, sustaining growth in a competitive market landscape.

Emerging Trends

Personalization and Social Media Trends Influence Market Growth

The trend toward personalized and customizable products, amplified by the growing influence of social media management, an increase in corporate and government events, and an enhanced focus on sustainability, is shaping the Party Supplies Market dynamically.

Specifically, personalization allows consumers to differentiate their events, driving demand for customized supplies that cater to individual tastes and themes.

Furthermore, social media platforms influence consumer preferences and serve as powerful marketing tools, enabling suppliers to reach a broader audience with visually appealing offerings.

Additionally, the rise in corporate and governmental events has expanded the market, as these sectors seek professional, themed, and high-quality supplies for their events. Finally, the industry’s shift toward sustainability resonates well with the global consumer movement towards environmentally friendly products, further influencing market trends and opportunities.

Regional Analysis

North America Dominates with 41.2% Market Share

North America leads the Party Supplies Market, holding a 41.2% share and valued at USD 5.56 billion. This strong market position is fueled by high disposable incomes, a growing culture of themed celebrations, and extensive e-commerce presence. Additionally, the market benefits from increasing demand for customizable and premium party supplies.

The region’s vibrant economy and consumer enthusiasm for celebrations drive steady growth. Furthermore, North America’s robust digital infrastructure supports the rise of online retail, making party supplies readily accessible to a large consumer base. Moreover, trends like DIY and personalized parties contribute significantly to the demand for unique party products.

Looking ahead, North America’s influence in the Party Supplies Market is expected to remain high. As e-commerce continues to grow and more people seek innovative, personalized products, the region’s market share may even increase.

Regional Mentions:

- Europe: Europe maintains a strong presence in the Party Supplies Market with its emphasis on eco-friendly products. The region’s commitment to sustainability and recycling regulations drives demand for biodegradable party supplies, encouraging market growth.

- Asia Pacific: Asia Pacific is expanding rapidly in the Party Supplies Market, driven by population growth and increasing urbanization. Countries like China and India are adopting Western-style celebrations, fueling demand for party supplies.

- Middle East & Africa: The Middle East and Africa see rising interest in party supplies, particularly for weddings and cultural events. Increasing disposable incomes and the growth of online retail in urban areas support market growth.

- Latin America: Latin America is steadily embracing party supplies, spurred by a strong cultural focus on celebrations. Countries such as Brazil and Mexico drive demand through festive traditions, contributing to steady market growth in the region.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Party Supplies Market is dominated by several key players. Party City Holdco Inc., Oriental Trading Company, Unique Industries, Inc., and Shindigz lead the industry by leveraging strong brand identities and broad product ranges to capture various customer segments. Additionally, these companies offer extensive selections of balloons, decorations, tableware, and customizable products, positioning them well to cater to both residential and commercial customers.

Party City Holdco Inc. stands out due to its large physical retail presence, which consequently allows it to reach customers across multiple regions and cater to last-minute, in-store purchases. Moreover, its online shopping option increases accessibility and convenience for customers.

Furthermore, Oriental Trading Company and Unique Industries, Inc. have a strong foothold in e-commerce, providing a wide range of affordable and customizable products. Both companies are known for their extensive selections, making them go-to options for themed parties and bulk purchases. As a result, their strong online presence and competitive pricing enable them to serve a broad consumer base, from casual buyers to event planners.

In contrast, Shindigz focuses on unique and premium party items, appealing to consumers seeking distinctive or high-quality products for special events. Its emphasis on creative and customizable products helps capture niche markets and high-end customers, which sets it apart within the competitive landscape.

Collectively, these top players drive market trends by focusing on a mix of affordability, variety, and customization, effectively meeting the demands of today’s party supply consumers. Through diverse offerings and solid distribution channels, these companies remain influential in shaping the Party Supplies Market.

Top Key Players in the Market

- Party City Holdco Inc.

- Oriental Trading Company

- Unique Industries, Inc.

- Shindigz

- The Party People

- Party America

- The Party Darling

- Coterie

- For Your Party

- Bonjour Fête

Recent Developments

- On April 2024, Champion Party Supply, a family-owned business in Seattle, announced its relocation from Interbay to Georgetown due to increased rent following the expiration of its lease. The new store, located at 6516 Fifth Place S., spans 11,000 square feet, approximately 2,000 square feet smaller than the previous location.

- On July 2024, The Wonder Group, an international wholesaler and retailer of costume and party products headquartered in Milton Keynes, was acquired by Baaj Capital after entering administration earlier that month. The acquisition secured the futures of associated companies, including Ginger Ray and Christy’s by Design.

- On March 2024, Michaels, a leading arts and crafts retailer, launched birthday party services and enhanced classes to provide customers with more creative experiences. The birthday parties are designed for children aged 4 to 13. Additionally, Michaels expanded its class offerings to include a variety of creative activities for all ages and skill levels.

Report Scope

Report Features Description Market Value (2023) USD 13.5 Billion Forecast Revenue (2033) USD 30.8 Billion CAGR (2024-2033) 8.6% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Balloons, Tableware/Disposable Supplies, Banners & Decorations, Pinatas & Games, Invitations, Party Favors, Candles & Cake Toppers), By Material (Paper-based, Plastic-based, Metallic, Fabric), By Application (Commercial, Residential), By Distribution Channel (Online Retail, Offline Retail, Direct Sales) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Party City Holdco Inc., Oriental Trading Company, Unique Industries, Inc., Shindigz, The Party People, Party America, The Party Darling, Coterie, For Your Party, Bonjour Fête Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Party City Holdco Inc.

- Oriental Trading Company

- Unique Industries, Inc.

- Shindigz

- The Party People

- Party America

- The Party Darling

- Coterie

- For Your Party

- Bonjour Fête