Global Paint Protection Film Market By Material (Polyvinyl Chloride, Thermoplastic Polyurethane, and Others); By Application (Automotive & Transportation, Aerospace & Defense, and Others); By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast: 2023-2033

- Published date: Nov 2023

- Report ID: 18095

- Number of Pages: 387

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

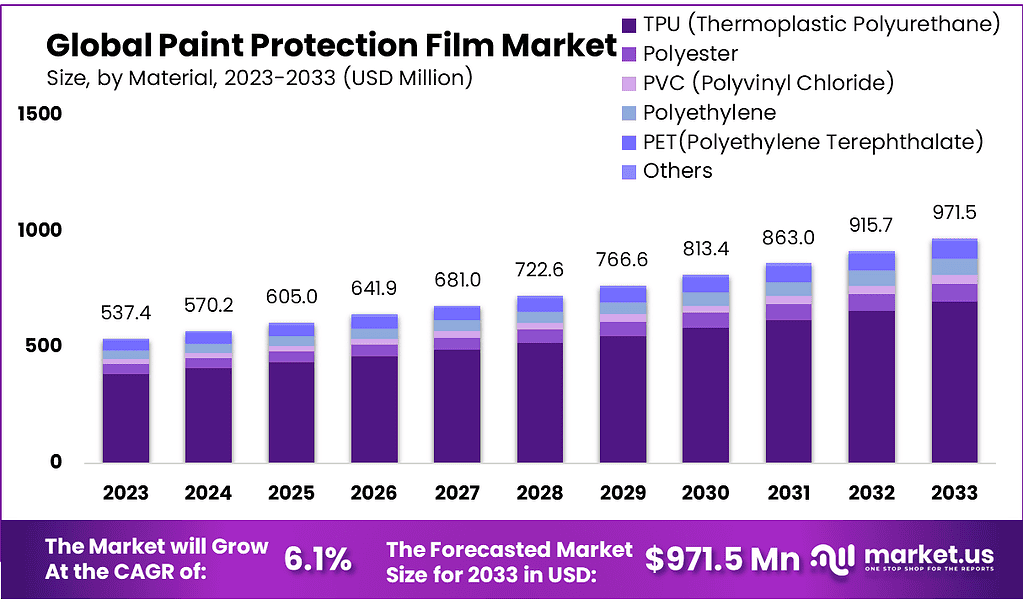

The Global Paint Protection Film Market size is expected to be worth around USD 971.5 Million by 2033, from USD 537.4 Million in 2023, growing at a CAGR of 6.1% during the forecast period from 2023 to 2033.

Over the next few years, paint protection film’s increasing application and the development of high-performance films are expected to drive product demand.

In the global paint protection film market report, the forecast period will also register an increase in demand due to technological advances that promise sustainable products with low environmental impact.

Variations in product performance and quality to resist stains and scratches will also be key factors in determining the demand for paint protection films.

Note: Actual Numbers Might Vary In the Final Report

Key Takeaways

- Market Growth Projection: The paint protection film market is projected to witness significant growth, reaching around USD 971.5 million by 2033 from USD 537.4 million in 2023, with a calculated CAGR of 6.1%.

- Material Dynamics: Thermoplastic Polyurethane (TPU) dominates the market (71.7%) due to its versatility in various industries like automotive, electronics, and medical devices. Polyvinyl Chloride (PVC) holds 25.4% of the market, primarily in electronic industries.

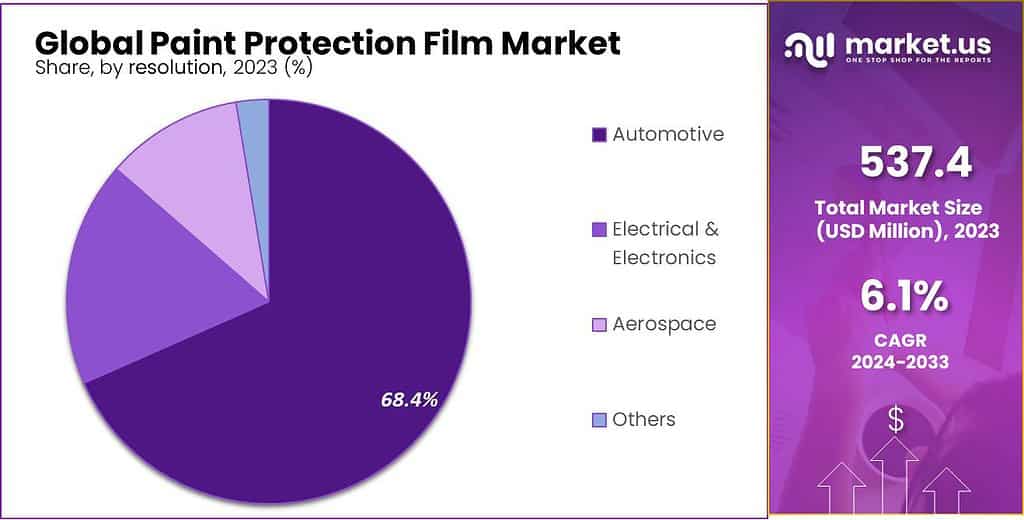

- Application Dominance: Automotive and transportation accounted for over 68.4% of the market in 2023. Aerospace and defense is expected to witness the fastest CAGR (7.8%), driven by increased air travel and defense needs.

- Global Trends: The demand for paint protection films is expanding beyond traditional automotive applications. It’s seeing increased interest in electronic devices, marine applications, and industries like medicine, construction, and energy.

- Market Drivers: The burgeoning automotive industry, rapid industrialization, increased air travel, and rising consumer awareness about vehicle maintenance are significant growth drivers.

- Challenges: High installation costs, limitations in lifespan, and issues like UV degradation and color dulling pose challenges to market growth.

- Opportunities: Ongoing developments in recyclable raw materials and technology innovations create potential growth avenues. Increased consumer awareness regarding vehicle protection also fuels demand.

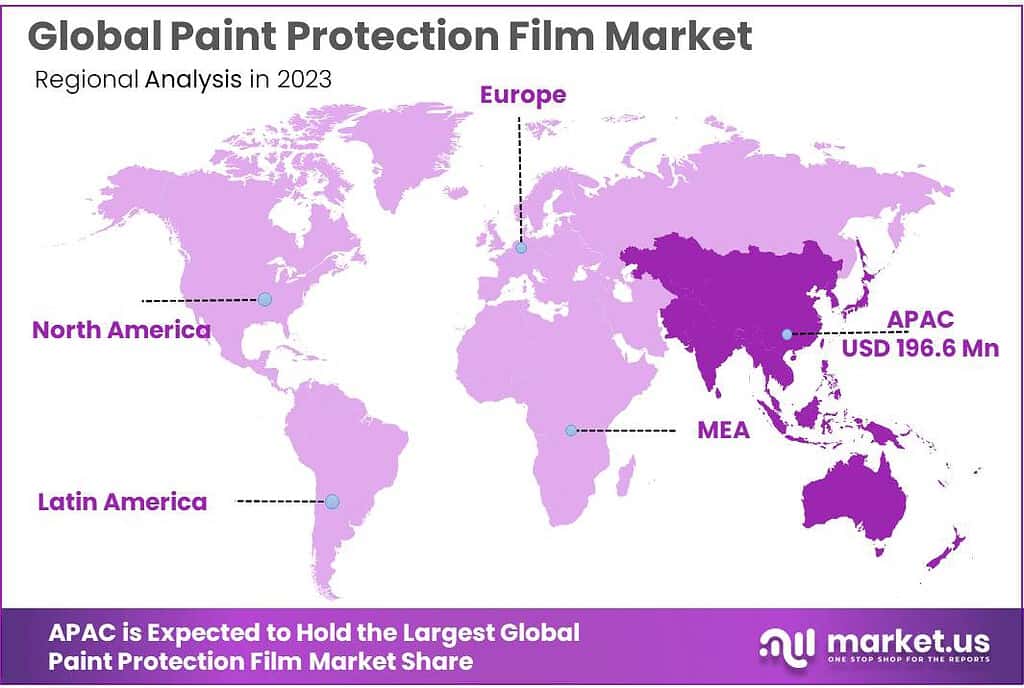

- Regional Analysis: Asia Pacific accounted for a significant revenue share (36.6% in 2023) due to high automobile production and adoption. North America and Europe showcase steady growth prospects as well.

- Competitive Landscape: The market is highly competitive with major players like 3M Company, Saint-Gobain, AVERY DENNISON CORPORATION, and others. Strategies like acquisitions, mergers, and partnerships are common for market players.

Material Analysis

In 2023, TPU (Thermoplastic Polyurethane) was the big player, owning over 71.7% of the market. It’s a sought-after material used in various industries due to its flexibility and durability. TPU finds its place in footwear, automotive parts, electronics, and even medical devices, making it a versatile favorite.

Thermoplastic Polyurethane is a high-performance polymer with superior properties, such as transparency and elasticity, chemical and abrasion resistance, and low-temperature flexibility. These films are often used in the automotive end-use industry because they have a high degree of durability.

Polyvinyl Chloride (PVC), accounts for 25.4% of the PPF market. PVC protective films are widely used in electronic industries due to their hardness and mechanical properties. They also have optimal insulation properties. These major factors are key market drivers for the growth of this segment.

Application Analysis

In the paint protection film market in terms of Application or the end-use industry, the market was dominated by the Automotive and Transport segment in 2023, accounting for more than 68.4% of total revenues.

It is expected that this segment will continue to dominate this market in the coming years. Market growth has been fueled by rapid industrialization and a growing need for transport in the end-use industry. It is also expected that the automotive sector will expand further in the near future due to an increased level of awareness concerning vehicle maintenance.

The fastest CAGR is expected to be indexed by the Aerospace and Defense segment (7.8%). This is due to increased air travel as well as the intensive defense practices of many countries. The demand for paint protection films to protect vessels against oxidation and corrosion in the end-use industry is expected to grow rapidly.

Global consumers are buying paint protection products to protect their electronic devices, including laptops, tablets, and televisions. Major players are expecting an increase in product demand from the Electronic and Electrical segment due to improving living standards and the increasing demand for smaller electronic gadgets.

The market demand for paint protection film is expected to grow due to the increasing need from the medical, construction, and energy industries. This product can also be used in many marine applications like offshore oil & gas production, as well as maritime safety and security. The market for paint protection films is in demand. This is due to the need to protect boats, yachts, and ships from UV rays, wear & tear, pollution, and scratches.

Globally, according to the detailed analysis, this segment has been relatively inaccessible. However, it is expected that this will expand significantly over the forecast period due to rising disposable income. It is used for protecting painted surfaces susceptible to damage from elements like sand, gravel, and slurry.

Note: Actual Numbers Might Vary In the Final Report

Key Market Segments

Material

- TPU (Thermoplastic Polyurethane)

- Polyester

- PVC (Polyvinyl Chloride)

- Polyethylene

- PET(Polyethylene Terephthalate)

- Others

Application

- Automotive & Transportation

- Aerospace & Defense

- Electrical & Electronics

- Others

Drivers

Increasing Demand from Several End-use Industries is expected to Drive the Market

Paint Protection Films (PPFs) serve as a shield against scratches, chips, and damage to vehicle paint, preserving its surface. These applications are crucial for maintaining the look and integrity of vehicle exteriors. The booming global automotive and transportation sector plays a pivotal role in propelling this market. This industry holds substantial weight in the world’s GDP, contributing around 3%, with developing markets like India and China accounting for 7%.

PPFs, transparent or colored, are made from an elastic polymer, allowing them to retain their form when stretched. High-quality PPFs not only enhance a car’s appearance but also safeguard it from scratches and debris, offering realistic colors that mimic original automotive paint.

These films ensure both interior and exterior vehicle longevity. Their increasing use in luxury cars significantly influences resale value, as a well-maintained appearance holds substantial importance. PPFs promise to retain a car’s shine and gloss, adding assurance to vehicle owners.

Furthermore, the rising demand for electronic devices, including smartphones, laptops, tablets, and computers, contributes to the market’s growth. In 2021 alone, 1.37 billion cell phones were shipped worldwide, indicating a continuous upward trend in electronic device demand. PPFs play a crucial role in safeguarding these sensitive devices from accidental damage, spills, and abrasion, further driving their installation.

Restraining Factors

High Installation Costs and Temporary Life Span are Anticipated to Limit the Market Growth

Paint protection film might seem like a one-time investment, but its installation cost remains high due to the need for skilled handling. Experts ensure flawless application without causing any damage to the surface. Customers opting for short-term vehicle ownership might refrain from installing protective films due to their longevity.

An inherent issue with protective films is their tendency to degrade and yellow under excessive UV exposure, primarily seen in outdoor vehicles. However, modern urethane films maintain their transparency over extended periods, often backed by warranties ranging from five to twelve years. Beyond this period, the film’s integrity isn’t assured, posing a potential cost for manufacturers or installers if replacements are needed within the warranty duration.

It’s important to note that while PPFs shield painted surfaces once they’re cured, they don’t eliminate the need for expensive and labor-intensive repainting processes. Moreover, applying PPFs involves a considerable amount of time for cutting, pasting, and installation. Vehicle owners concerned about waiting times might consider paint replacement films as an alternative.

Opportunities

Growing Developments

Moreover, market players’ ongoing developments and innovations in recyclable raw materials and production technologies create lucrative opportunities in the forecast period from 2023 to 2033.

Increased Awareness Regarding Vehicle Protection

Increased consumer awareness regarding the advantages of using paint protection films to safeguard painted surfaces from stone chips, bug splatters, and minor abrasions is projected to drive market demand. These coatings act as a shield, defending a car’s paint from scratches, dents, and environmental damage caused by road debris.

The utilization of PPF not only maintains a vehicle’s showroom-quality finish but also extends its youthful appearance by safeguarding vulnerable areas, subsequently enhancing its resale value. This appeal to customers leads to a heightened demand for paint protection films.

Challenges

Drawbacks of Paint Protection Films

Additionally, paint protection films often have the drawback of dulling a vehicle’s color and may lack efficient water repellency. However, skilled PPF installers often offer ceramic coating treatments on top of these films, providing enhanced paint protection. These limitations pose challenges to the growth rate of the paint protection film market.

This paint protection film market report encompasses recent developments, trade regulations, import-export analyses, production insights, value chain optimization, market shares, impacts from local players, opportunities in emerging revenue pockets, regulatory changes, strategic growth analyses, market sizes, category expansions, application niches, product approvals, launches, geographic expansions, and technological innovations.

Regional Analysis

The Asia Pacific accounted for a 36.6% revenue share in 2023. This region is projected to continue to grow at an estimated 196.5, between 2023 and 2032. This is due to high levels of automobile production and adoption.

This region has registered an increase in transportation activities, as well as possesses low labor costs, easy access to raw materials, and high customer demand. This has led to vehicle producers setting up new facilities, in turn triggering increased product demand.

The North American automotive industry is expected to index a 5.4% increase in product demand due to increased automobile sales and aging fleets. Favorable government regulations and a matured manufacturing sector are also expected to aid in sustaining this region’s growth in the coming years.

Europe has been a major revenue contributor in the past, due to high passenger car and aircraft production. The growing defense industries budgets of Germany, Britain, and France will further expand this regional market, along with the growing product demand from the electronic sectors.

International trade policies that encourage countries in South America like Brazil and Mexico to open up for investments are encouraged by supportive government regulations. Growth of this regional market is also encouraged by increasing Foreign Direct Investments (FDIs), in Central America and South America.

Note: Actual Numbers Might Vary In the Final Report

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Hong Kong

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- GCC

- South Africa

- Israel

- Saudi Arabia

- Rest of the Middle East & Africa

High product volumes and variations from many international and local players make the paint protection film market highly competitive. To reduce product costs and remain competitive, market players often resort to acquisitions, mergers, and joint ventures. Several players in this industry form partnerships with third-party installers and suppliers of raw materials to ensure that they have access and are able to provide easy installation services.

Manufacturers seek to grow their businesses and strengthen their market position by using various strategies like integration through acquisitions, joint ventures, and the expansion of production capacities. These are the prime factors for the considerable growth in the market.

A majority of industry experts also produce exclusive paint protection film made of Thermoplastic Polyurethane, or TPU-based, which is widely accepted in the end-use industry, especially aerospace and automotive. They offer products that can be used in a variety of applications and are standardized.

Covestro AG reported an increase in domestic investments to produce paint protection films in April 2022. This protective film protects automobiles and is very popular in Asia. XPEL made multiple acquisitions in North America, including automotive paint protection films, vehicle protection films, and porcelain coatings for architectural windows. 3M Company opened installation centers around the globe equipped with tools that allow for easy application of film on vehicles. The company also purchased many individual service stations in order to expand its services segment.

Key Market Players

- 3M Company

- Saint-Gobain

- AVERY DENNISON CORPORATION

- Eastman Chemical Company

- XPEL, Inc.

- Hexis S.A.

- PremiumShield Limited

- STEK-USA

- Reflek Technologies Corporation

- GRAFITYP Selfadhesive Products NV

- ORAFOL Europe GmbH

- OPTICSHIELD

- SCHWEITZER-MAUDUIT INTERNATIONAL, INC.

- Dow

Recent Development

- August 2022: BASF introduced thermoplastic polyurethane paint protection film from its brand RODIM for improved car paint protection.

- April 2022: IVIOS launched Kaizer paint protection film, which provides protection and stain resistance to the car’s painted surface.

Report Scope

Report Features Description Market Value (2023) USD 537.4 Million Forecast Revenue (2033) USD 971.5 Million CAGR (2023-2032) 6.1% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material (Polyvinyl Chloride, Thermoplastic Polyurethane, and Others); By Application (Automotive & Transportation, Aerospace & Defense, and Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape 3M, Saint-Gobain, AVERY DENNISON CORPORATION, Eastman Chemical Company, XPEL, Inc., Hexis S.A., PremiumShield Limited, STEK-USA, Reflek Technologies Corporation, GRAFITYP Selfadhesive Products NV, ORAFOL Europe GmbH, OPTICSHIELD, SCHWEITZER-MAUDUIT INTERNATIONAL, INC., Dow. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Paint Protection Film MarketPublished date: Nov 2023add_shopping_cartBuy Now get_appDownload Sample

Paint Protection Film MarketPublished date: Nov 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- 3M Company

- Saint-Gobain

- AVERY DENNISON CORPORATION

- Eastman Chemical Company

- XPEL, Inc.

- Hexis S.A.

- PremiumShield Limited

- STEK-USA

- Reflek Technologies Corporation

- GRAFITYP Selfadhesive Products NV

- ORAFOL Europe GmbH

- OPTICSHIELD

- SCHWEITZER-MAUDUIT INTERNATIONAL, INC.

- Dow