Global PACS and RIS Market By Product (PACS and RIS), By Component (Software, Hardware, and Services), By Deployment Mode (On-premise, Cloud Based, Web-based), By Platform (Standalone and Integrated), By Application (Cardiology, Orthopedics, Ophthalmology, Oncology, Veterinary Medicine, and Others), By End-user (Hospitals, Diagnostic Imaging Centers, Research & Academic Institutes, and Ambulatory Surgical Centers), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 74678

- Number of Pages: 398

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Product Analysis

- Deployment Mode Analysis

- Component Analysis

- Platform Analysis

- Application Analysis

- End-user Analysis

- Key Segments Analysis

- Market Dynamics

- Market Restraints

- Market Opportunities

- Impact of macroeconomic factors / Geopolitical factors

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

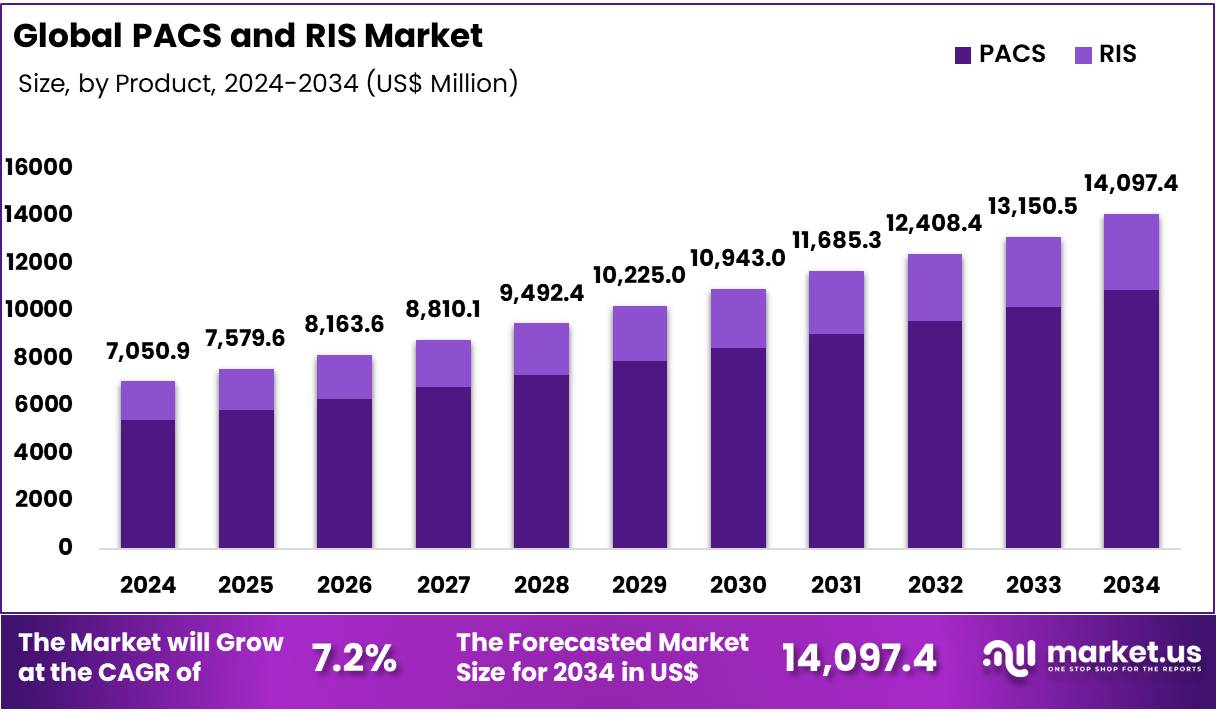

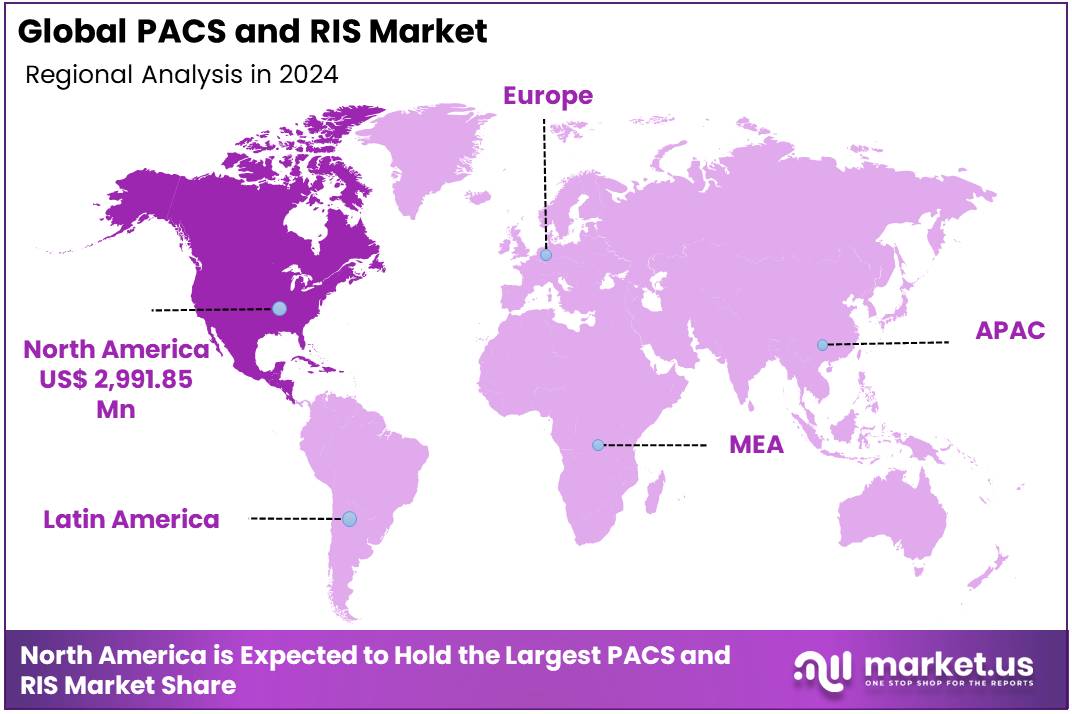

Global PACS and RIS Market was valued at US$ 6,579.46 Million in 2024 and is expected to grow at a CAGR of 7.2% from 2024 to 2034. In 2024, North America led the market, achieving over 42.4% share with a revenue of US$ 2991.85 Million.

PACS and RIS Market, Global Analysis, 2020-2024 (US$ Million)

Global 2020 2021 2022 2023 2024 CAGR Revenue 6,097.85 6,074.78 6,220.57 6,579.46 7,050.93 7.2% The healthcare industry is undergoing a transformation, where digital technologies are becoming integral to the way patient data is handled, analyzed, and shared. The adoption of PACS and RIS systems has been a major part of this transformation, especially in radiology departments, where imaging and diagnostics are a central aspect of patient care.

These systems are critical in managing large volumes of medical images and associated data, facilitating collaboration between healthcare providers, and ensuring efficient care delivery. With the advancement in imaging technology and the growing complexity of medical diagnoses, the integration of PACS and RIS systems is expected to continue playing a vital role in enhancing diagnostic accuracy, reducing operational costs, and improving patient outcomes.

- According to industry reports, almost two-thirds of the organizations surveyed either already use the cloud for image viewing and storage or plan to adopt it within the next three years. Additionally, 63% of organizations currently using cloud software intend to increase its usage in the future. This trend is particularly prevalent among larger organizations, with 75% planning to expand their cloud adoption for diagnostic viewing.

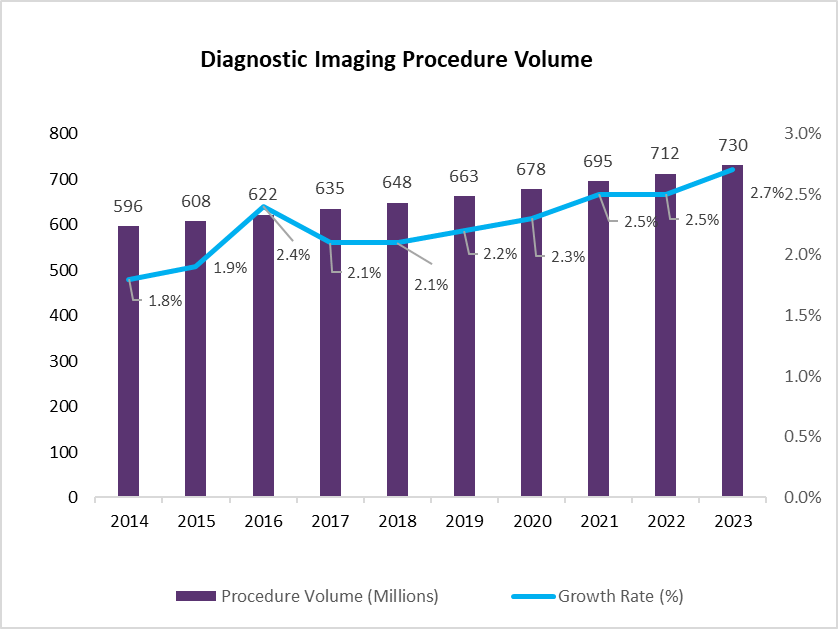

This graph illustrates the diagnostic imaging procedure volume from 2014 to 2023, highlighting both the volume of procedures in millions and the annual growth rate. From 2014 to 2023, there is a steady increase in the number of diagnostic imaging procedures performed, rising from 596 million in 2014 to 730 million in 2023. The growth rate fluctuates slightly, but it remains relatively stable, peaking at 2.4% in 2016 and gradually decreasing to 2.7% in 2023. The trend reflects consistent growth, indicating a steady demand for diagnostic imaging over this period, with a slight deceleration in the growth rate towards the later years.

Key Takeaways

- The global PACS and RIS market was valued at USD 6,579.46 Million in 2024 and is anticipated to register substantial growth of USD 13,150.51 Million by 2034, with 7.2% CAGR.

- In 2024, the PACS segment took the lead in the global market, securing 77.3% of the total revenue share.

- The oncology segment took the lead in the global market, securing 29.9% of the total revenue share.

- The software segment took the lead in the global market, securing 46.8% of the total revenue share.

- The on-premise segment took the lead in the global market, securing b of the total revenue share.

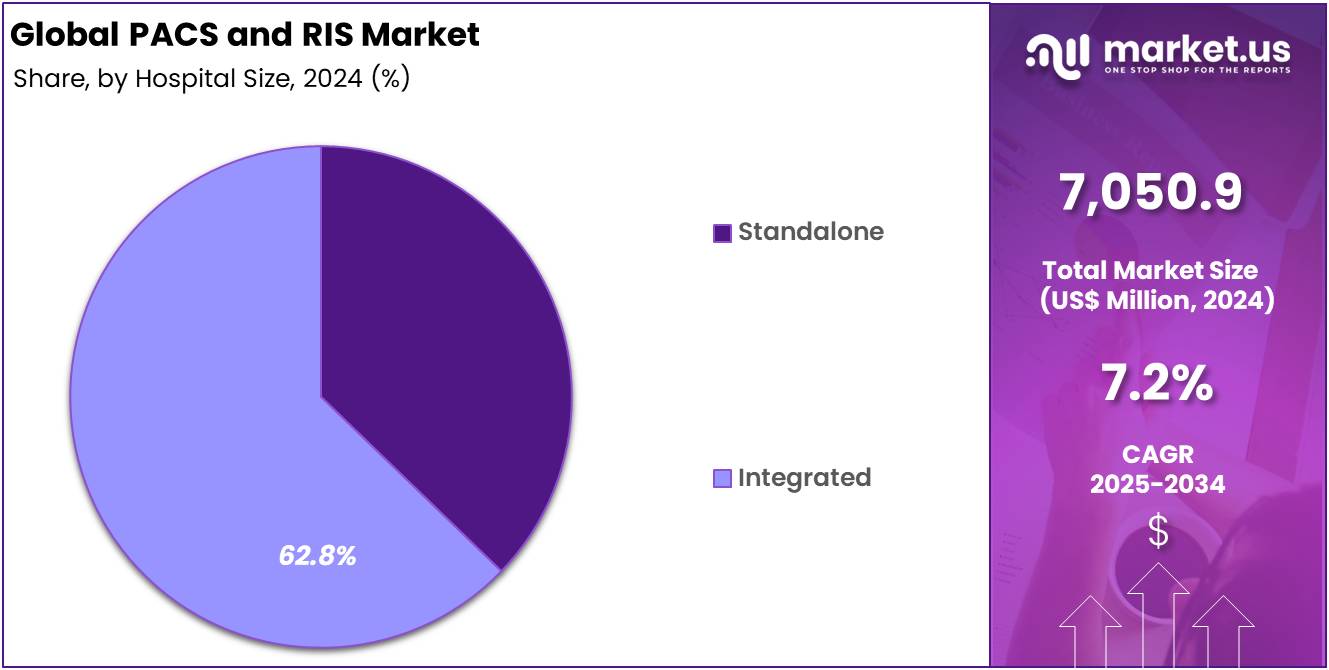

- The integrated segment took the lead in the global market, securing 62.8% of the total revenue share.

- The hospitals segment took the lead in the global market, securing 45.4% of the total revenue share.

- North America maintained its leading position in the global market with a share of 42.4% of the total revenue.

Product Analysis

Based on product the market is fragmented into PACS and RIS. Amongst these, PACS segment dominated the global PACS and RIS market capturing a significant market share of 77.3% in 2024.

The PACS segment held a dominated share in the PACS and RIS market due to its critical role in the management, storage, and retrieval of medical imaging data. PACS is central to modern radiology departments and healthcare facilities, as it allows for the digital storage of medical images such as X-rays, MRIs, CT scans, and ultrasounds. By eliminating the need for traditional film-based methods, PACS has revolutionized the way medical images are stored, accessed, and shared, offering substantial benefits in terms of efficiency, cost savings, and data accessibility.

As healthcare providers continue to seek more efficient and accurate diagnostic solutions, the PACS segment is poised for continued growth, driven by innovations in data accessibility, workflow efficiency, and clinical decision support. These advancements are accelerating the adoption of PACS systems across global healthcare systems.

- In February 2025, Sectra, an international medical imaging IT and cybersecurity company, announced a collaboration with Siemens Healthineers to enhance radiologists’ diagnostic capabilities and patient care. The partnership aims to integrate Siemens Healthineers’ NAEOTOM Alpha photon-counting CT (PCCT) images into Sectra’s diagnostic application, providing seamless access and post-processing tools for radiologists.

- In November 2023, Philips launched its new and enhanced PACS solution, Philips HealthSuite Imaging, built on AWS’ cloud infrastructure. This next-generation version of Philips’ Vue PACS introduces new features such as integrated reporting, remote access for diagnostic reading, and AI tools to streamline clinical workflows.

The PACS segment is gaining traction in emerging markets like Brazil, India, and China, where the demand for efficient, cost-effective imaging solutions is growing. As healthcare infrastructure improves, PACS solutions are being deployed to support scalable, flexible imaging across diverse healthcare settings, from small clinics to large hospitals.

PACS and RIS Market, Product Analysis, 2020-2024 (US$ Million)

Product 2020 2021 2022 2023 2024 PACS 4,704.8 4,686.5 4,797.6 5,079.3 5,450.4 RIS 1,392.9 1,388.1 1,422.8 1,500.1 1,600.5 Deployment Mode Analysis

The market is fragmented by deployment mode into on-premise, cloud based, web-based. On-premise dominated the global PACS and RIS market capturing a significant market share of 42.6% in 2024.

The on-premise segment held a significant share in the PACS and RIS markets due to its established presence in healthcare facilities and the control it offers over data management. On-premise PACS and RIS systems are typically installed and managed within a healthcare provider’s own infrastructure, which provides greater control over data security, system maintenance, and integration with existing healthcare IT infrastructure. This is particularly important in healthcare environments where data privacy and compliance with regulations like HIPAA (Health Insurance Portability and Accountability Act) in the U.S. are crucial.

Many hospitals, diagnostic centers, and healthcare organizations prefer on-premise solutions because they offer direct access to imaging data, faster processing speeds, and reduced dependency on external cloud services. Additionally, on-premise solutions can be customized to meet the specific needs of healthcare providers, ensuring better integration with other in-house systems such as Electronic Health Records (EHR) and Hospital Information Systems (HIS).

PACS and RIS Market, Deployment Mode Analysis, 2020-2024 (US$ Million)

Deployment Mode 2020 2021 2022 2023 2024 On-premise 2,636.7 2,626.0 2,682.9 2,822.7 3,005.7 Cloud Based 2,079.7 2,072.7 2,133.7 2,284.6 2,485.1 Web-based 1,381.3 1,375.9 1,403.8 1,472.1 1,560.0 Component Analysis

The market is fragmented by component into software, hardware, and services. Software dominated the global PACS and RIS market capturing a significant market share of 46.8% in 2024. The software segment held a significant share in the PACS and RIS markets due to its critical role in managing, processing, and analyzing medical imaging data.

Software solutions in these markets enable healthcare providers to store, retrieve, and share medical images seamlessly, improving operational efficiency, diagnostic accuracy, and overall patient care. The growing adoption of software-based PACS and RIS is largely driven by the demand for systems that enhance workflow efficiency, integrate with other healthcare IT systems, and improve the accessibility of diagnostic imaging data.

Cloud-based PACS and RIS solutions have also contributed to the expansion of the software segment. Cloud-based solutions offer significant advantages, including lower upfront costs, scalability, and remote access. Healthcare providers can store and access medical images without the need for extensive on-premise infrastructure, making it easier for them to scale their operations as demand grows.

Cloud-based software solutions are also highly flexible, allowing healthcare institutions to adopt pay-as-you-go models that reduce financial burden and make it easier to upgrade to the latest technologies. As healthcare organizations increasingly adopt cloud technologies, the software segment in the PACS and RIS markets is set to continue growing.

- For example, RamSoft has made significant strides in offering cloud-based and on-premise software solutions. Its RIS/PACS software is widely adopted by imaging centers, providing advanced image processing and secure data sharing features. This widespread adoption highlights the growing demand for software that can meet the needs of modern healthcare providers.

- GE Healthcare’s Centricity PACS software has gained widespread use in hospitals and diagnostic centers due to its ability to store, manage, and share imaging data efficiently. GE’s focus on integrating AI and machine learning into their PACS software has further solidified its position in the market.

PACS and RIS Market, Component Analysis, 2020-2024 (US$ Million)

Component 2020 2021 2022 2023 2024 Software 2,808.2 2,797.3 2,872.0 3,056.1 3,299.6 Hardware 1,247.1 1,242.1 1,264.8 1,320.3 1,392.2 Services 2,042.4 2,035.2 2,083.7 2,202.9 2,359.0 Platform Analysis

The market is fragmented by platform into standalone and integrated. Standalone dominated the global PACS and RIS market capturing a significant market share of 42.6% in 2024. The standalone segment held a substantial share in the PACS and RIS markets due to its flexibility, simplicity, and cost-effectiveness, particularly in smaller or less complex healthcare settings.

Standalone PACS and RIS solutions are typically designed to function independently, providing all the necessary features for managing and storing medical imaging data without the need for integration with other systems like Electronic Health Records (EHR) or Hospital Information Systems (HIS). This makes them particularly attractive to imaging centers, outpatient clinics, and smaller hospitals that require a more focused and straightforward solution for managing diagnostic imaging data.

The standalone segment is popular among healthcare providers who prioritize ease of implementation and reduced operational complexity. These systems are self-contained, i.e., they do not require the complex infrastructure or extensive IT support needed for integrated solutions. For example, smaller hospitals or imaging centers may find standalone PACS and RIS systems to be an affordable and efficient option, as they can provide the essential capabilities needed for storing, retrieving, and sharing medical images, without the additional overhead of complex integrations with multiple other healthcare systems.

PACS and RIS Market, Platform Analysis, 2020-2024 (US$ Million)

Platform 2020 2021 2022 2023 2024 Standalone 2,305.8 2,296.4 2,345.9 2,467.3 2,625.9 Integrated 3,792.0 3,778.3 3,874.6 4,112.1 4,425.0

Application Analysis

The market is fragmented by application into cardiology, orthopedics, ophthalmology, oncology, veterinary medicine, and others. Oncology dominated the global PACS and RIS market capturing a significant market share of 29.9% in 2024.

The oncology segment is expected to capture a high share of the PACS and RIS market due to the increasing need for advanced imaging technologies in the diagnosis, treatment, and monitoring of cancer. Oncology involves the use of various imaging techniques, including CT scans, MRIs, PET scans, and X-rays, to detect, stage, and monitor tumors.

As the incidence of cancer continues to rise globally, the demand for high-quality imaging solutions becomes even more critical for oncologists and radiologists. PACS and RIS play a pivotal role in managing the massive volumes of imaging data generated in cancer care, facilitating the timely and accurate assessment of tumors and treatment outcomes.

- Recent studies suggest that India is emerging as the “cancer capital of the world,” with projections indicating an increase in cancer cases from 1.39 million in 2020 to 1.57 million by 2025. Common cancers include those of the breast, cervix, and oral cavity.

- In the U.S., cancer remains a leading cause of morbidity and mortality. In 2024, it was estimated that there would be 2,001,140 new cancer cases and 611,720 cancer-related deaths. Notably, certain states exhibit higher incidence rates, influenced by factors such as tobacco use, obesity, and environmental exposures. For example, Kentucky has one of the highest cancer rates in the country, while New Mexico has one of the lowest.

PACS and RIS Market, Application Analysis, 2020-2024 (US$ Million)

Application 2020 2021 2022 2023 2024 Cardiology 1,305.0 1,300.2 1,333.2 1,414.5 1,521.8 Orthopedics 1,580.6 1,574.4 1,608.1 1,690.9 1,799.0 Ophthalmology 293.3 292.2 299.0 315.8 337.8 Oncology 1,784.4 1,778.1 1,826.9 1,947.5 2,107.2 Veterinary Medicine 250.0 249.0 253.1 263.1 276.1 Others 884.2 880.6 900.0 947.4 1,008.9 End-user Analysis

The market is fragmented by end-user hospitals, diagnostic imaging centers, research & academic institutes, and ambulatory surgical centers. Hospitals dominated the global PACS and RIS market capturing a significant market share of 45.4% in 2024. Due to the evolving demands of healthcare institutions for more efficient, accurate, and scalable solutions for managing diagnostic imaging and patient data. Hospitals, particularly large ones with high patient volumes, require sophisticated systems to handle vast amounts of medical imaging data, such as X-rays, MRIs, CT scans, and ultrasounds. PACS enables the digital storage, retrieval, and sharing of these images, which significantly reduces the dependency on physical films, thus streamlining the entire workflow.

- Specific usage statistics for these imaging modalities in 2023 highlight their widespread application. For instance, in England, there were 1.65 million X-ray procedures performed in January 2023, followed by 0.81 million ultrasound examinations, 0.52 million CT scans, and 0.31 million MRIs.

This transition to digital systems not only increases the speed of image retrieval but also enhances the quality of care by allowing healthcare professionals to access images and reports from any connected device, fostering quicker decision-making.

PACS and RIS Market, End-user Analysis, 2020-2024 (US$ Million)

End-user 2020 2021 2022 2023 2024 Hospitals 2,766.9 2,756.2 2,822.8 2,986.7 3,202.1 Diagnostic Imaging Centers 1,892.1 1,885.2 1,936.3 2,062.5 2,229.6 Research & Academic Institutes 858.1 854.6 872.3 915.5 972.0 Ambulatory Surgical Centers 580.6 578.5 589.0 614.5 647.1 Key Segments Analysis

By Product

- PACS

- RIS

By Component

- Software

- Hardware

- Services

By Deployment Mode

- On-premise

- Cloud Based

- Web-based

By Platform

- Standalone

- Integrated

By Application

- Cardiology

- Orthopedics

- Ophthalmology

- Oncology

- Veterinary Medicine

- Others

By End-user

- Hospitals

- Diagnostic Imaging Centers

- Research & Academic Institutes

- Ambulatory Surgical Centers

Market Dynamics

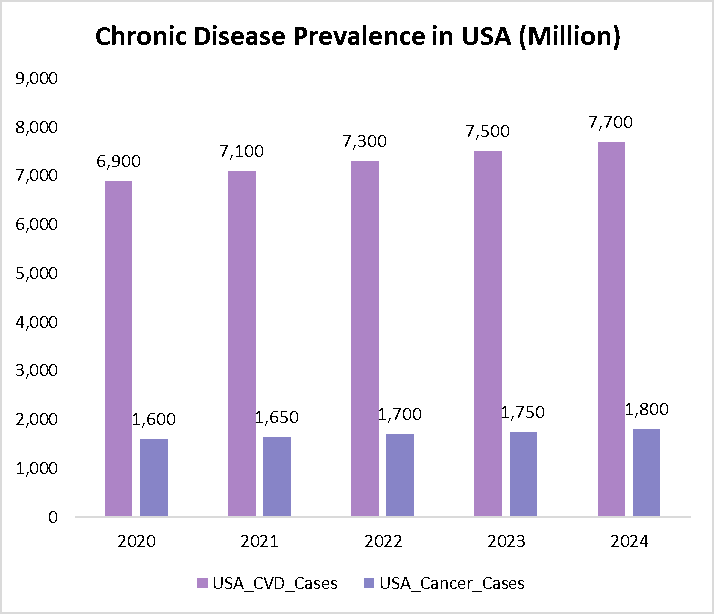

Rising Prevalence of Chronic Diseases

The growing prevalence of chronic diseases, particularly cancer, is significantly driving the demand for PACS and RIS. As chronic diseases such as cancer increasingly require extensive medical imaging for diagnosis, treatment planning, and ongoing monitoring, the need for sophisticated image management systems becomes critical. Radiology plays a central role in the management of cancer, as imaging technologies such as CT scans, MRIs, and PET scans are essential for detecting tumors, assessing their size, location, and stage, as well as tracking the progress of treatments like chemotherapy or radiation therapy.

- The Centers for Disease Control and Prevention (CDC) reported that in 2020, there were 1,603,844 new cancer cases and 602,347 cancer-related deaths in the United States. In 2024, an estimated 2,001,140 new cases of cancer will be diagnosed in the US, and 611,720 people will die from the disease.

This growing cancer burden underscores the increasing demand for imaging services and the need for efficient systems to store, manage, and retrieve medical images. PACS provides a digital platform for storing and accessing high-resolution imaging data, while RIS is used to manage the clinical workflow, including radiology imaging orders, patient records, and billing information. The integration of RIS with PACS and Vendor Neutral Archives (VNAs) helps healthcare providers streamline the management of radiology data and ensures seamless access to images for clinicians.

In addition to general cancer prevalence, the increasing incidence of specific types of cancer, such as brain cancer, is contributing to the demand for imaging solutions.

- For instance, according to the American Cancer Society, it was estimated that about 24,810 new cases of malignant tumors in the brain or spinal cord would be diagnosed in 2023, with a higher incidence in males.

These cancers require frequent imaging to monitor disease progression, and radiology departments must manage and store large volumes of imaging data efficiently. RIS, which helps track radiology orders and billing, is often paired with PACS to provide comprehensive solutions for imaging data storage, record-keeping, and archiving.

As cancer rates continue to rise, particularly with the increasing prevalence of chronic conditions requiring ongoing monitoring, the need for PACS and RIS systems will continue to grow. These systems enable healthcare organizations to handle large volumes of medical imaging data, improve the accuracy of diagnoses, reduce human error, and enhance the overall efficiency of radiology departments. Therefore, the ongoing rise in chronic diseases, particularly cancer, is expected to drive substantial growth in the PACS and RIS market as healthcare providers adopt these solutions to meet the rising demand for medical imaging services and improve patient care.

Market Restraints

High Implementation Cost

One of the major restraints hindering the growth of the PACS and RIS market is the high implementation cost associated with these systems. The upfront expenses related to purchasing, installing, and maintaining PACS and RIS systems can be significant, especially for smaller healthcare facilities such as community hospitals, outpatient clinics, and imaging centers. These costs can be prohibitively high, limiting the ability of these smaller institutions to adopt the technology.

In addition to the hardware and software costs, healthcare organizations must also account for expenses related to training staff, ensuring proper system integration, and maintaining ongoing updates, software upgrades, and robust data security measures. Staff training alone can incur substantial costs, as personnel need to become proficient in operating the new systems. Furthermore, integrating PACS and RIS with existing IT infrastructure in hospitals and clinics adds complexity and further increases costs. The effort and time required for a smooth integration process can make the overall investment even more challenging for smaller providers who already operate with tight budgets.

- For example, while the cost of PACS software for a practice generating 1,000 studies per month may be under US$ 10,000, the total cost of ownership can quickly rise to around US$ 40,000 when considering all associated expenses.

This high total cost of ownership can discourage smaller healthcare providers from adopting these systems, thus slowing the overall adoption rate and limiting the market’s growth potential. The need for significant financial investment is a barrier that many healthcare organizations, particularly in developing regions, find difficult to overcome, hindering the widespread use of PACS and RIS.

Market Opportunities

Favorable Government Policies and Funding

Favorable government funding have opened up significant new growth opportunities for the PACS and RIS market. Governments worldwide are increasingly recognizing the importance of digital health solutions, including imaging technologies, in improving healthcare delivery and reducing costs. As a result, they are introducing policies and allocating funding to support the adoption of advanced medical technologies such as PACS and RIS. These efforts not only encourage healthcare institutions to upgrade their systems but also stimulate innovation within the sector.

A notable example is INOVAIT, a pan-Canadian innovation network that supports advancements in image-guided therapy (IGT) and artificial intelligence (AI).

- In September 2024, INOVAIT announced the latest recipients of its Pilot Fund, which awards competitive funding to promising medical technology projects. This funding, totaling just under US$ 730,000, is directed toward initiatives that leverage AI, machine learning, and big data analytics to enhance medical imaging and streamline patient care.

The support fosters collaborations between small- and medium-sized enterprises, hospital research centers, and academic institutions, helping to drive innovation and job creation within the healthcare sector.

Such government-backed funding programs are crucial in accelerating the development and commercialization of cutting-edge imaging technologies. They provide the necessary resources for research, product development, and the integration of new technologies into healthcare systems. With continued government support, the PACS and RIS markets are expected to grow significantly, as these policies help to drive the adoption of digital imaging solutions and further transform healthcare delivery.

Favorable government policies have significantly contributed to the growth of the PACS and RIS market.

- In the Union Budget for 2024-25, the Indian government introduced measures aimed at bolstering the domestic manufacturing of medical devices, which directly impact the affordability and accessibility of imaging technologies. One notable initiative is the provision of a 20% capital subsidy to companies investing in the production of components essential for digital X-ray, CT scan, and MRI machines.

Impact of macroeconomic factors / Geopolitical factors

The picture archiving and communication system and radiology information system markets are influenced significantly by broader macroeconomic and geopolitical factors, which affect investment levels, healthcare infrastructure development, supply chain continuity, and technology adoption worldwide.

One of the key macroeconomic factors is economic slowdown or inflation, which impacts healthcare budgets and capital expenditure, especially in developing regions. When national economies experience instability or currency devaluation, hospitals and imaging centers may delay or scale back purchases of PACS/RIS systems due to high initial investment and operational costs. Similarly, interest rate hikes can make financing large-scale IT infrastructure projects more challenging for public and private providers.

Geopolitical tensions, such as conflicts or strained international relations, can disrupt the global supply chain of medical imaging components and IT hardware required for PACS and RIS. For instance, instability in key supplier regions or sanctions on major technology exporters may lead to delays in product availability and higher input costs, affecting system deployment timelines and increasing operational expenses.

A specific geopolitical-economic factor affecting the PACS and RIS market is the United States’ tariff policies on imported technology goods, particularly from countries such as China. U.S. tariffs imposed on medical imaging components, servers, and electronic hardware have increased costs for vendors sourcing internationally. These cost hikes are often passed on to healthcare providers, making it more expensive to acquire or upgrade PACS and RIS systems.

The Trump administration announced plans to impose a 10% universal tariff on goods from all countries starting April 5, 2025. Additionally, government officials intend to implement further reciprocal tariffs on nations with which the U.S. has significant trade deficits, according to the American Hospital Association. AdvaMed, which represents over 50 imaging manufacturers, including Bayer, Canon, GE HealthCare, Philips, Siemens Healthineers, and others, criticized the move. The medical technology association has called for radiological devices to be exempt from tariffs, expressing concerns that these tariffs will drive up prices while limiting patient access to essential healthcare services.

Latest Trends

The global picture archiving and communication system and radiology information system markets are experiencing significant transformation driven by several key trends. Foremost among these is the integration of artificial intelligence (AI) into radiology workflows, enhancing diagnostic accuracy and streamlining image analysis. AI-powered PACS and RIS solutions are increasingly employed to automate routine tasks, reduce radiologist workload, and improve patient outcomes.

Additionally, the shift toward cloud-based deployments is gaining momentum, offering scalable, cost-effective, and accessible solutions, particularly beneficial for smaller healthcare facilities and those in remote locations. The adoption of vendor-neutral archives (VNAs) is also on the rise, facilitating interoperability among diverse imaging systems and enabling seamless data sharing across departments and institutions.

Furthermore, the growing emphasis on cybersecurity is prompting vendors to implement robust security measures to protect sensitive patient data from potential breaches. Collectively, these trends are reshaping the PACS and RIS landscape, fostering innovation, and driving the adoption of advanced imaging technologies worldwide.

Regional Analysis

The Picture Archiving and Communication Systems (PACS) and Radiology Information Systems (RIS) markets in North America are experiencing significant growth, driven by technological advancements, increased healthcare digitization, and substantial investments in healthcare IT infrastructure.

The market is increasingly being shaped by the integration of Artificial Intelligence (AI) technologies. AI-powered tools within PACS systems, such as automated image analysis, lesion detection, and predictive analytics, are helping radiologists make faster, more accurate diagnoses. AI also aids in reducing repetitive manual tasks, freeing up radiologists’ time to focus on complex cases.

For example, AI can automatically prioritize images based on severity, helping to streamline workflows. This shift not only improves diagnostic accuracy but also enhances patient outcomes by enabling earlier intervention and personalized care. As a result, the demand for AI-enhanced PACS and RIS solutions is growing rapidly in North America.

- According to data from Healthcare Business International, updated in 2023, the US has nearly seven times the CT capacity per capita compared to Mexico, and almost 14 times the MRI capacity per capita.

Chronic diseases such as diabetes, cardiovascular conditions, and cancer are major contributors to the growing demand for advanced medical imaging systems in North America. These diseases require frequent monitoring, diagnostic imaging, and long-term care, placing significant pressure on healthcare systems to adopt efficient PACS and RIS solutions.

As the number of patients with chronic diseases rises, healthcare providers are increasingly relying on digital imaging technologies to detect, monitor, and manage these conditions. PACS and RIS platforms facilitate faster image retrieval, easier diagnosis, and the ability to track disease progression over time, which improves patient care and reduces the cost of long-term treatment. PACS systems are essential for storing and sharing large imaging files that are critical for cancer diagnosis and treatment planning.

- The Canadian Cancer Society reports that 2 in 5 Canadians are expected to be diagnosed with cancer during their lifetime.

- According to the American Cancer Society, the average risk of a woman in the US developing breast cancer at some point in her life is approximately 13%. The National Breast Cancer Foundation, Inc. estimates that in 2025, around 316,950 women and 2,800 men will be diagnosed with invasive breast cancer, alongside 59,080 new cases of non-invasive (in situ) breast cancer.

PACS and RIS Market, Region Analysis, 2020-2024 (US$ Million)

Region 2020 2021 2022 2023 2024 North America 2,637.3 2,625.7 2,680.8 2,816.0 2,991.8 Europe 1,602.0 1,596.4 1,635.1 1,730.4 1,855.2 Asia-Pacific 1,269.9 1,265.8 1,306.7 1,408.0 1,543.4

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The competitive landscape for the PACS and RIS market is dynamic and continuously evolving, driven by rapid advancements in healthcare technology and the increasing adoption of digital solutions across healthcare facilities. The market is populated by a blend of multinational corporations and specialized firms, each vying to offer solutions that improve imaging workflows, diagnostic accuracy, and operational efficiency.

Key players in the PACS and RIS market include global giants like GE Healthcare, Philips Healthcare, Agfa-Gevaert Group, and Fujifilm Holdings, alongside specialized companies such as Carestream Health and Siemens Healthineers. These companies dominate the market by offering comprehensive solutions that cater to the needs of hospitals, imaging centers, and diagnostic labs, with a focus on integrating sophisticated imaging hardware with software systems for seamless data management and enhanced patient care.

Acquisitions and strategic partnerships are also a common strategy in this market to expand product portfolios, enhance technological capabilities, and gain access to new regional markets. For example, companies may acquire smaller, specialized firms with expertise in AI or cloud-based solutions to stay ahead of technological trends.

GE Healthcare is a leading global medical technology and digital solutions innovator, headquartered in Chicago, Illinois. A subsidiary of General Electric, the company provides a broad range of healthcare technologies, including medical imaging, monitoring, diagnostics, and digital health solutions.

In addition, Koninklijke Philips N.V., commonly known as Philips, is a Dutch multinational company headquartered in Amsterdam, primarily focused on health technology. With a strong presence in diagnostic imaging, patient monitoring, and health informatics, Philips delivers integrated solutions that span the health continuum—from healthy living and prevention to diagnosis, treatment, and home care.

Top Key Players

- GE Healthcare

- Koninnklijke Philips NV

- Fujifilm Holdings Corporation

- Siemens healthineers

- Oracle Corporation

- MedInformatix, Inc.

- RadNet, Inc.

- RamSoft

- Agfa-Gevaert Group

- Merative

Recent Developments

- In October 2024, GE HealthCare partnered with Blackford to integrate artificial intelligence (AI)-enabled application orchestration feature into its True PACS and Centricity PACS. The new AI-enabled offerings help radiologists with their workload which could help lead to quicker diagnosis and treatment for patients.

- In November 2023, Philips launched HealthSuite Imaging, a cloud-based next generation of Vue PACS, with new AI-enabled clinical and operational workflows. HealthSuite Imaging on Amazon Web Services (AWS) offers new capabilities such as high-speed remote access for diagnostic reading, integrated reporting and AI-enabled workflow orchestration, all delivered securely via the cloud to ease IT management burden.

- In March 2025, Fujifilm partnered with Amazon Web Services for expanding and strengthening cloud hosting capabilities for Fujifilm’s North American Synapse Enterprise Imaging customer base. AWS cloud services allow Fujifilm to offer its customers industry leading cloud security and the ability to scale to any size Synapse organization, supporting the Synapse customer community as they look to transition from legacy data centers to public cloud infrastructure.

Report Scope

Report Features Description Market Value (2024) US$ 7,050.9 Million Forecast Revenue (2034) US$ 13,150.51 Million CAGR (2025-2034) 7.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (PACS and RIS), By Component (Software, Hardware, and Services), By Deployment Mode (On-premise, Cloud Based, Web-based), By Platform (Standalone and Integrated), By Application (Cardiology, Orthopedics, Ophthalmology, Oncology, Veterinary Medicine, and Others), By End-user (Hospitals, Diagnostic Imaging Centers, Research & Academic Institutes, and Ambulatory Surgical Centers) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape GE Healthcare, Koninnklijke Philips NV, Fujifilm Holdings Corporation, Siemens healthineers, Oracle Corporation, MedInformatix, Inc., RadNet, Inc., RamSoft, Agfa-Gevaert Group, and Merative Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- GE Healthcare

- Koninnklijke Philips NV

- Fujifilm Holdings Corporation

- Siemens healthineers

- Oracle Corporation

- MedInformatix, Inc.

- RadNet, Inc.

- RamSoft

- Agfa-Gevaert Group

- Merative