Pharmaceutical Filtration Market By Product (Membrane Filters, Prefilters & Depth Media, Single-use Systems, Cartridges & Capsules, Filter Holders, Filtration Accessories and Other Products), By Technique (Microfiltration, Ultrafiltration, Cross Flow Filtration, Nanofiltration and Other Techniques), By Type (Sterile and Non-sterile), By Application (Final Product Processing, Raw Material Filtration, Cell Separation, Water Purification and Air Purification), By Scale of Operation (Manufacturing Scale, Pilot Scale and Research & Development Scale) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2032

- Published date: Nov 2024

- Report ID: 27308

- Number of Pages: 215

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

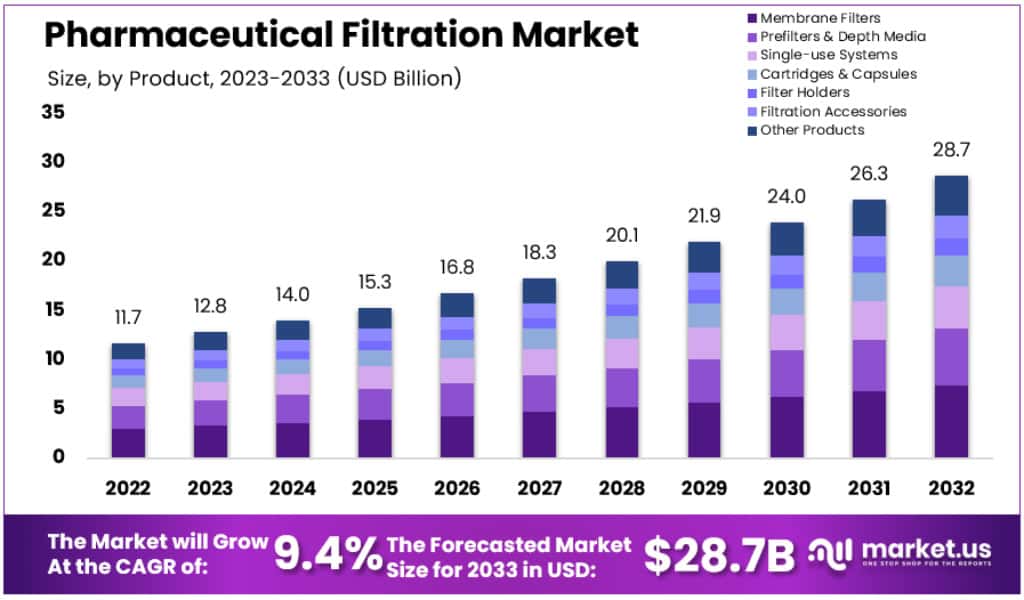

The Global Pharmaceutical Filtration Market size is expected to be worth around USD 28.7 billion by 2032, from USD 12.8 billion in 2023, growing at a CAGR of 9.4% during the forecast period from 2023 to 2032.

Pharmaceutical filtration is a crucial process in the pharmaceutical industry, involving the removal of solid particulate matter from fluids, which can be either liquid or gas, using a porous medium. This process is essential for ensuring the safety and quality of pharmaceutical products, as it helps to remove contaminants from liquids, such as particles, bacteria, mycoplasma, and endotoxins, at multiple points in the manufacturing process.

Key Takeaways

- Market Size: The pharmaceutical filtration market is valued at USD 12.8 billion in 2023.

- Projected Market Size: The market is expected to grow to USD 28.7 billion by 2032.

- Compound Annual Growth Rate (CAGR): The market is projected to grow at a CAGR of 9.4% from 2023 to 2032.

- Membrane Filters: Membrane filters hold a 25.8% share of the pharmaceutical filtration market in 2023.

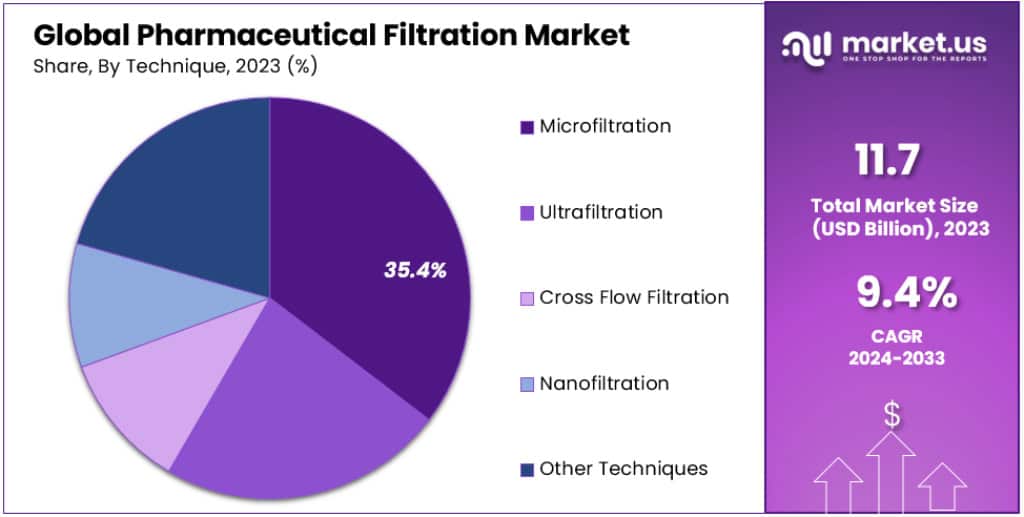

- Microfiltration Technique: Microfiltration captures more than 35.4% of the market share in 2023.

- Sterile Filtration Type: Sterile filtration dominates the market with a share of over 53.2% in 2023.

- Final Product Processing: This segment holds a 42.6% share of the market in 2023.

- Manufacturing Scale of Operation: The manufacturing scale operations dominate with a 62.6% market share in 2023.

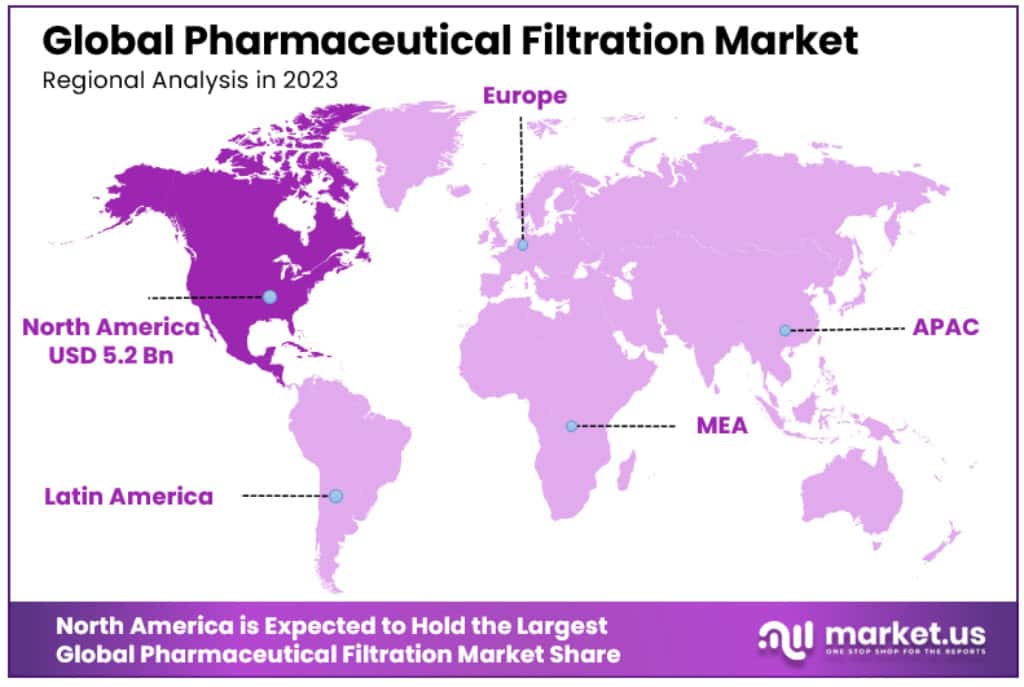

- North American Market Share: North America leads the market with a 44.5% share, amounting to USD 5.2 billion.

- European Market Overview: Europe is a major market due to its advanced healthcare infrastructure and the presence of key market players.

- Demand for Advanced Membranes: There is a growing demand for ultrafiltration track-etched membranes and nanofiltration technology.

- Rise of Single-Use Technology: The market is driven by the increasing adoption of single-use technologies in the pharmaceutical and biopharmaceutical industries.

Product Analysis

In 2023, membrane filters held a dominant market position in the pharmaceutical filtration market, capturing more than a 25.8% share. This segment is diverse, each type addressing specific filtration needs.

MCE Membrane Filters are a key player, valued for their effectiveness in microbial removal, crucial in sterile pharmaceutical processes.

Coated Cellulose Acetate Membrane Filters stand out for their low protein binding, making them ideal for sensitive applications where maintaining product integrity is essential.

PTFE Membrane Filters are recognized for their robust chemical resistance. They are preferred for filtering harsh solvents and acids, providing reliability in aggressive environments.

Nylon Membrane Filters are chosen for their versatility and strength, suitable for a wide range of solutions, both aqueous and solvent-based.

PVDF Membrane Filters are noted for their high flow rates and thermal stability, an excellent choice for applications involving high temperatures.

Lastly, Other Membrane Filters cater to specialized needs, offering tailored solutions for unique filtration requirements in the pharmaceutical industry. This diversity ensures comprehensive coverage across various pharmaceutical processes.

Under the Prefilters & Depth Media subsegment, Glass Fiber Filters and PTFE Fiber Filters are notable categories.

Glass Fiber Filters are known for their high dirt-holding capacity. They effectively pre-filter particles, extending the lifespan of more refined downstream filters. Their use is crucial in protecting final membrane filters from rapid clogging, enhancing overall efficiency.

PTFE Fiber Filters, on the other hand, are prized for their chemical inertness and broad thermal stability. They are especially suited for filtering harsh chemicals and solvents, maintaining performance even under extreme conditions. This makes them a reliable choice in pharmaceutical processes involving aggressive substances.

Single-use Systems are gaining popularity for their convenience and efficiency. They eliminate the need for cleaning and sterilization, significantly reducing downtime and enhancing productivity in pharmaceutical manufacturing.

Cartridges & Capsules are versatile components, widely used due to their adaptability to different filtration media. Their ease of installation and replacement makes them ideal for various scales of production, from small-scale labs to large-scale industrial processes.

Filter Holders are crucial for securing the filtration setup. Their design ensures that filters are properly seated, thereby optimizing filtration efficiency and preventing leaks or contaminations.

Filtration Accessories encompass a range of supplementary items, from sealing gaskets to adapters, which are essential for the smooth operation of filtration systems. They ensure the compatibility and functionality of the main filtration components.

Finally, the ‘Others’ category includes specialized products that cater to niche requirements in the pharmaceutical industry. This segment allows for tailored solutions, addressing specific filtration needs that are not covered by the standard products.

Technique Analysis

In 2023, Microfiltration held a dominant market position in the pharmaceutical filtration market, capturing more than a 35.4% share. This technique is favored for its ability to efficiently remove small particles and microorganisms, making it essential in sterilization and clarification processes.

Ultrafiltration follows, known for its precision in separating molecules based on size. It’s particularly useful in concentrating and purifying proteins and enzymes, playing a vital role in the production of biopharmaceuticals.

Crossflow Filtration stands out for its unique mechanism where the feed stream flows tangentially across the filter surface. This method is effective in reducing fouling, making it ideal for continuous processing in pharmaceutical manufacturing.

Nanofiltration, with its ability to filter even smaller particles, is crucial for purifying water and removing contaminants like viruses and endotoxins. Its high selectivity makes it a key technique in producing highly purified end products.

The ‘Others’ category includes various emerging and specialized filtration techniques. These methods address specific needs in pharmaceutical production, offering innovative solutions for complex filtration requirements.

Type Analysis

In 2023, sterile filtration commanded a dominant market position, capturing more than a 53.2% share. This segment’s dominance is attributed to its crucial role in ensuring the purity and safety of pharmaceutical products. Sterile filtration is essential in processes like drug formulation and biologics production, where the removal of bacteria and other microorganisms is mandatory. The demand for sterile filtration solutions is bolstered by strict regulatory requirements and the need for high-quality pharmaceuticals.

On the other side, the non-sterile filtration segment also plays a significant role in the pharmaceutical filtration market. Although it holds a smaller market share compared to sterile filtration, its importance cannot be overlooked. Non-sterile filtration is primarily used in applications where sterility is not a critical requirement, such as in certain bulk chemicals and early-stage drug manufacturing processes. This type of filtration is crucial for removing particulates and impurities, thereby ensuring the consistency and quality of pharmaceutical products.

Application Analysis

Final product processing held a dominant market position in the pharmaceutical filtration market, capturing more than a 42.6% share, in 2023. This segment includes several critical processes.

Active Pharmaceutical Ingredient (API) Filtration is key in purifying and isolating the active ingredients in drugs. This step ensures the potency and safety of pharmaceutical products.

Sterile Filtration is crucial for removing microbial contamination from products, especially those that cannot be sterilized by heat. This process is essential for ensuring the sterility of injectables and other sensitive pharmaceuticals.

Protein Purification involves separating proteins from complex mixtures, a vital step in producing biopharmaceuticals. This process requires precise filtration techniques to maintain the integrity and functionality of the proteins.

Vaccines and Antibody Processing rely heavily on filtration for separating and purifying these critical components. The process ensures the effectiveness and safety of vaccines and antibody-based therapies.

Formulation and Filling Solutions involve the filtration of the final drug formulations before packaging. This step is crucial for ensuring that the final product is free from particulates and meets regulatory standards.

Lastly, Viral Clearance is an essential process to ensure biopharmaceutical products are free from viral contamination. This filtration step is critical for patient safety and meeting stringent regulatory requirements.

In the pharmaceutical filtration market, the Raw Material Filtration segment is essential, encompassing Media Buffer Filtration, Pre-filtration, and Bioburden Testing.

Media Buffer Filtration focuses on purifying the media and buffers used in pharmaceutical manufacturing. This step is crucial to ensure that these foundational components are free from contaminants, thus safeguarding the integrity of the final product.

Pre-filtration is a vital preliminary process. It primarily targets the removal of larger particulates from raw materials. This not only protects the more delicate final filters from clogging but also enhances the overall efficiency and longevity of the filtration system.

Bioburden Testing involves assessing the microbial load present in raw materials. This critical process helps in identifying potential contamination risks early on, ensuring the raw materials meet stringent safety standards before they proceed further in the pharmaceutical production process.

Scale of Operation Analysis

The manufacturing scale of operations held a dominant market position in the pharmaceutical filtration market, capturing more than a 62.6% share in 2023. This segment is crucial as it deals with large-scale production of pharmaceutical products, requiring robust and efficient filtration systems to ensure product purity and compliance with regulatory standards.

Pilot-scale operations serve as a bridge between small-scale research and full-scale manufacturing. This segment is essential for scaling up processes developed in research and development. Filtration at this scale demands flexibility and scalability, allowing for the optimization of processes before they are implemented on a larger scale.

Research & Development scale operations, while smaller in volume, are vital for innovation in pharmaceutical filtration. This segment focuses on experimenting with new filtration techniques and materials. The filtration systems used at this scale are often more specialized, catering to unique and complex research needs.

Key Market Segments

By Product

- Membrane filters

- MCE membrane filters

- Coated cellulose acetate membrane filters

- PTFE membrane filters

- Nylon membrane filters

- PVDF membrane filters

- Other membrane filters

- Prefilters & depth media

- Glass fiber filters

- PTFE fiber filters

- Single-use systems

- Cartridges & capsules

- Filter holders

- Filtration accessories

- Others

By Technique

- Microfiltration

- Ultrafiltration

- Crossflow filtration

- Nanofiltration

- Others

By Type

- Sterile

- Non-sterile

By Application

- Final product processing

- Active pharmaceutical ingredient filtration

- Sterile filtration

- Protein purification

- Vaccines and antibody processing

- Formulation and filling solutions

- Viral clearance

- Raw material filtration

- Media buffer

- Pre-filtration

- Bioburden testing

- Cell separation

- Water purification

- Air purification

By Scale of Operation

- Manufacturing scale

- Pilot-scale

- Research & development scale

Drivers

- Rising Demand for Advanced Membranes: The pharmaceutical membrane filtration market is seeing growth due to the increasing demand for ultrafiltration track-etched membranes and nano filtration technology. These advanced technologies are highly efficient in filtration processes, making them desirable in emerging economies.

- Growth of Single-Use Technology: The market is also driven by the growing acceptance of single-use technologies. These are popular in the pharmaceutical and biopharmaceutical industries for reducing cross-contamination, lowering costs, and improving production efficiency.

- Increased R&D Spending: There’s a noticeable surge in research and development expenditures within the pharmaceutical and biotechnology sectors. This investment in R&D is pushing the demand for various pharmaceutical filtration products, as they are crucial in the development and production stages.

Restraints

- High Capital Investment: Setting up production facilities for filtration systems demands substantial financial resources. The costs involved in acquiring technical expertise and sophisticated equipment act as a barrier, especially for smaller companies.

Opportunities

- Emerging Markets: Countries like China, India, and Brazil present significant growth opportunities. Their expanding biopharmaceutical sectors, combined with favorable manufacturing costs and less stringent regulations, make these markets attractive for pharmaceutical filtration companies.

Challenges

- Competition and Market Entry: The market is highly consolidated, with a few major players dominating. This scenario creates a challenging environment for new entrants who need to compete with established brands and innovate to gain a foothold.

- Stringent Regulations: The pharmaceutical industry faces strict regulatory standards, making drug production complex and expensive. These regulations, while ensuring quality and safety, pose challenges for the adoption of new filtration technologies.

Regional Analysis

North America is dominating Pharmaceutical Filtration Market with 44.5% share, and USD 5.2 Billion in 2023. Large pharmaceutical and biopharmaceutical corporations such as Merck KGaA and Hoffmann-La Roche Ltd., in the North American region, contributed the most to this region’s share. The region’s market has grown because of its well-developed healthcare infrastructure, and easy access to high-quality products.

Because of its advanced healthcare infrastructure and availability of high-tech products, the European region is another major market. This region is expected to see an increase in demand for biopharmaceuticals. The region is home to many European-based market leaders like Sartorius Stedim Biotech S.A. and Merck KGaA. The development of new devices and systems allows Europe to grab a significant share.

Due to the untapped potential of the market, the Asia Pacific pharmaceutical filter market will experience the highest CAGR over the forecast period. This region has seen tremendous growth due to the proliferation of biopharmaceutical and pharmaceutical companies. These companies are able to benefit from the increased market growth due to their heavy investments in CMOs (Contract Manufacturer Organizations) as well as CROs (Contract Research Organizations). The market’s growth is largely due to the development of healthcare infrastructure and large genome pools.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

The major players have a broad product range and are always expanding their portfolios. Most of these players have a wide-ranging distribution network. Due to the strong distribution channels and large product portfolios, vendors are facing intense competition. This has created high pressure on pricing strategies, which can impact the vendors’ profit margins.

In order to increase their market share, top players participate in collaborations, new product developments, mergers &acquisitions, and regional expansions. The companies can increase their product portfolio and geographic reach through acquisitions. Some key players are:

Маrkеt Кеу Рlауеrѕ

- Eaton Corporation Plc

- Merck KGaA

- Amazon Filters Ltd

- GE Healthcare

- Thermo Fisher Scientific Inc.

- Parker Hannifin Corp.

- 3M

- Sartorius AG.

- Graver Technologies

- Danaher.

- Meissner Filtration Products, Inc

- and Other Players

Recent Development

- October 2023: Sartorius AG (Germany) and RoosterBio, Inc. (US) announce a collaboration to provide purification solutions and establish scalable downstream manufacturing processes for exosome-based therapies.

- October 2023: Pall Corporation (US) launches a new line of membrane filters for biopharmaceutical applications, featuring a proprietary hydrophilic surface coating that reduces protein adsorption and fouling.

- September 2023: 3M (US) acquires Avectra Ltd. (UK), a provider of single-use filtration systems for the pharmaceutical industry.

Report Scope

Report Features Description Market Value (2023) USD 12.8 Billion Forecast Revenue (2032) USD 28.7 Billion CAGR (2023-2032) 9.4% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product [Membrane Filters (MCE Membrane Filters, Coated Cellulose Acetate Membrane Filters, PTFE Membrane Filters, Nylon Membrane Filters, PVDF Membrane Filters, Other Membrane Filters) Prefilters & Depth Media (Glass Fiber Filters and PTFE Fiber Filters) Single-use Systems, Cartridges & Capsules, Filter Holders, Filtration Accessories and Other Products] By Technique (Microfiltration, Ultrafiltration, Cross Flow Filtration, Nanofiltration and Other Techniques) By Type (Sterile and Non-sterile) By Application [Final Product Processing (Active Pharmaceutical Ingredient Filtration Sterile Filtration, Protein Purification, Vaccines And Antibody Processing, Formulation And Filling Solutions, Viral Clearance) By Raw Material Filtration (Media Buffer, Pre-filtration, Bioburden Testing) Cell Separation, Water Purification and Air Purification)] By Scale of Operation (Manufacturing Scale, Pilot Scale and Research & Development Scale) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Eaton., Merck KGaA, Amazon Filters Ltd., Thermo Fisher Scientific Inc., Parker Hannifin Corp., 3M, Sartorius AG., Graver Technologies, Danaher. , Meissner Filtration Products, Inc and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Pharmaceutical Filtration MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample

Pharmaceutical Filtration MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Eaton Corporation Plc

- Merck KGaA

- Amazon Filters Ltd

- GE Healthcare

- Thermo Fisher Scientific Inc.

- Parker Hannifin Corp.

- 3M

- Sartorius AG.

- Graver Technologies

- Danaher.

- Meissner Filtration Products, Inc

- and Other Players