Global Ortho Xylene Market Size, Share, And Business Benefits By Type (Ortho-xylene, Meta-xylene, Para-xylene), By Application (Phthalic Anhydride, Bactericides, Herbicides, Lube Oil Additives), By End Use (Automotive, Building and Construction, Paints and Coatings, Aerospace and Defence, Electrical and Electronics), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 167013

- Number of Pages: 204

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

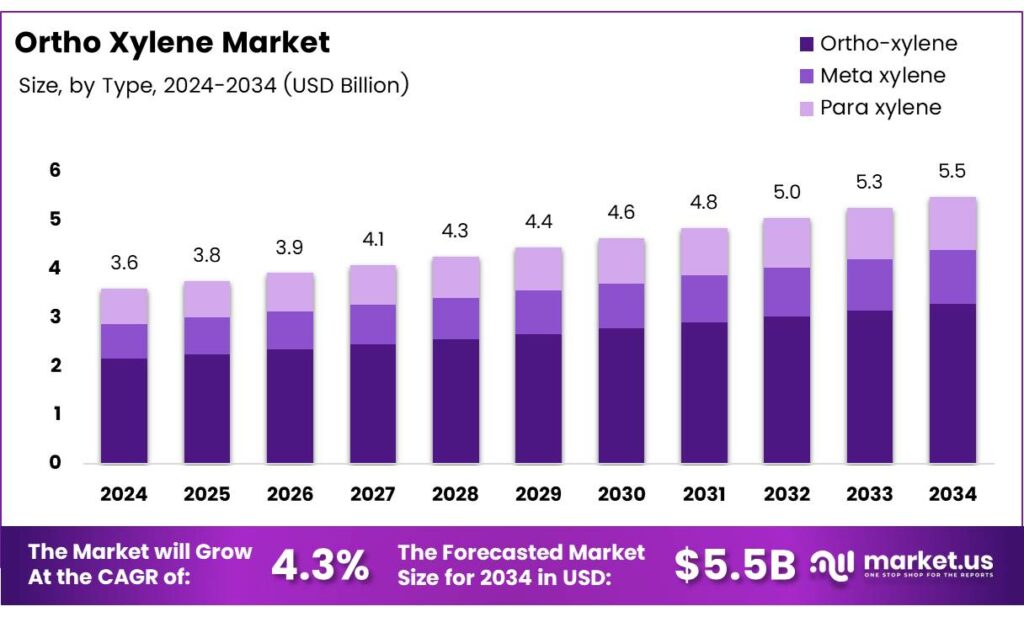

The Global Ortho Xylene Market size is expected to be worth around USD 5.5 billion by 2034, from USD 3.6 billion in 2024, growing at a CAGR of 4.3% during the forecast period from 2025 to 2034.

The Ortho Xylene Market continues to grow steadily as industries increase their consumption of phthalic anhydride, plasticisers, and speciality solvents. Manufacturers benefit from stable demand in coatings, automotive components, and flexible packaging. As economies expand, downstream chemical producers seek reliable aromatic intermediates that support consistent production efficiency and chemical performance.

Additionally, rising demand for speciality polymers and insulation materials adds new opportunity layers. Industries prefer ortho-based intermediates for their compatibility and structural properties. As manufacturers diversify end-use segments such as adhesives, dyes, and surfactants, Ortho Xylene becomes a key raw material supporting innovation and production optimisation.

- In broader chemical behaviour, Ortho Xylene exhibits distinct sensory and metabolic characteristics relevant for environmental and occupational assessments. The U.S. National Institute for Occupational Safety and Health (NIOSH), the odour threshold of o-xylene is 0.17 ppm, lower than m-xylene at 3.7 ppm and p-xylene at 0.47 ppm, indicating higher odour detectability.

Moreover, as reported by the U.S. Agency for Toxic Substances and Disease Registry (ATSDR), methylbenzoic acids formed during xylene metabolism conjugate with glycine to produce methyl hippuric acids. A 1–4% minor pathway forms xylenol. Joint exposure to methyl ethyl ketone can cause a 50% rise in blood xylene levels, influencing workplace monitoring.

Stricter air-quality standards push companies to adopt cleaner processing technologies and improve solvent-handling systems. While compliance raises operational costs, it also encourages technology upgrades that enhance energy efficiency and reduce hazardous emissions, building long-term market resilience. ATSDR also notes that 36% of xylene is excreted by the end of a working day, while 70–80% is cleared within 24 hours, primarily through the kidneys. Fat-stored residues take several days to be eliminated.

Key Takeaways

- The Global Ortho Xylene Market is valued at USD 3.6 billion in 2024 and expected to reach USD 5.5 billion by 2034, at a CAGR of 4.3% from 2025–2034.

- Ortho-xylene leads the Type segment with a 57.9% share in 2024.

- Phthalic Anhydride dominates the Application segment with a 72.3% share.

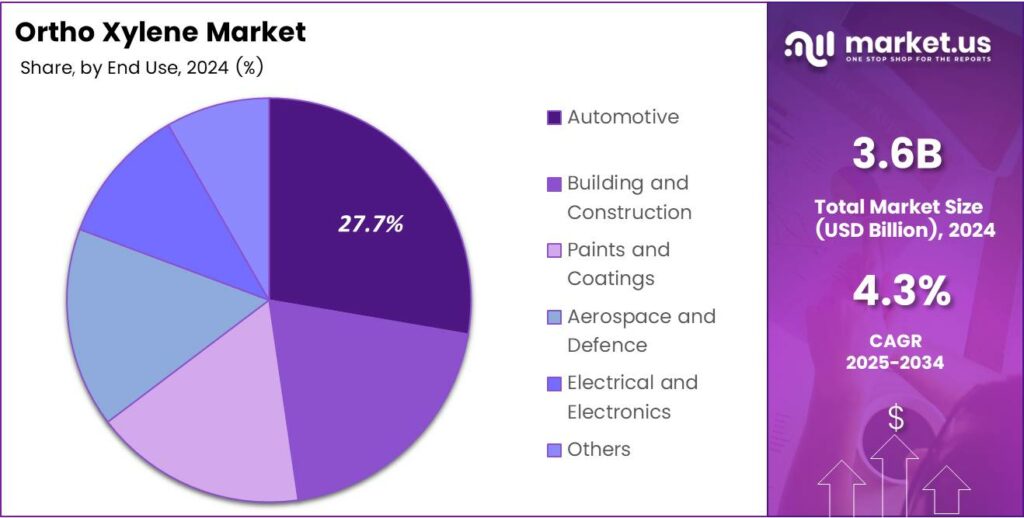

- Automotive is the leading End-Use segment with a 27.7% market share.

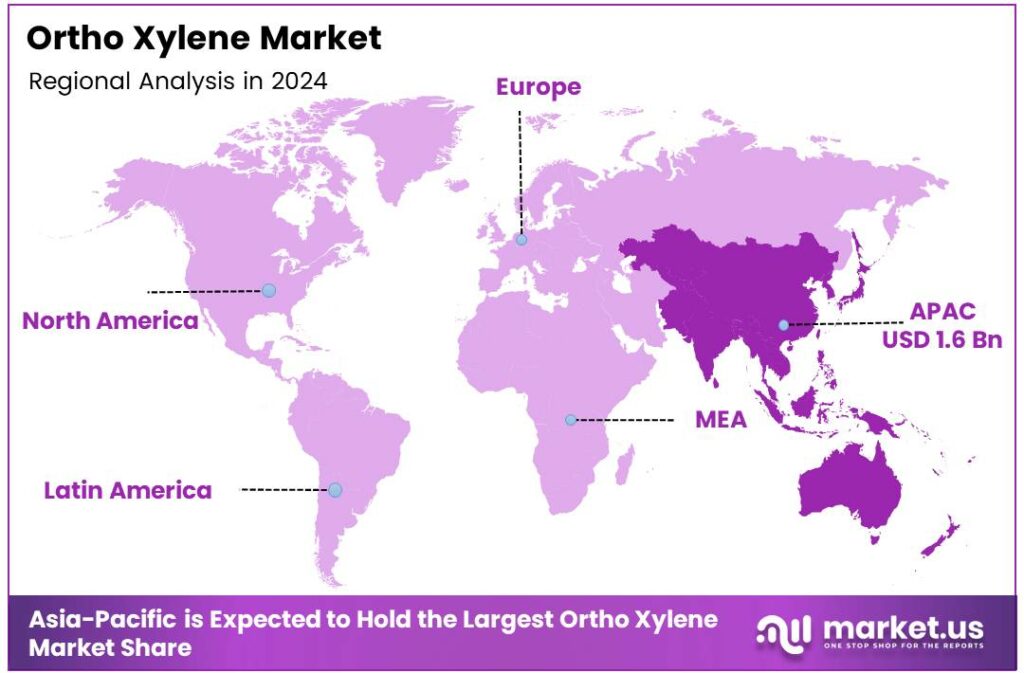

- Asia Pacific dominates the market with a 45.9% share worth USD 1.6 billion.

By Type Analysis

Ortho-xylene dominates with 57.9% due to its widespread industrial demand.

In 2024, Ortho-xylene held a dominant market position in the By Type Analysis segment of the Ortho Xylene Market, with a 57.9% share. This segment grew steadily as industries relied on ortho-xylene for phthalic anhydride production. Its strong chemical stability supported higher consumption, driving consistent growth across manufacturing applications.

Meta xylene maintained a moderate position in the By Type Analysis segment of the Ortho Xylene Market. This sub-segment benefited from increased use in solvent blending and chemical intermediates. Its steady adoption across coatings and speciality chemicals allowed stable demand, despite a lower share compared to the leading type.

Para-xylene secured a notable place in the By Type Analysis segment of the Ortho Xylene Market. This segment found traction through rising usage in polyester and PET resin applications. Its role in packaging and textile value chains supported expanding opportunities, although it remained behind the dominant ortho-xylene segment.

By Application Analysis

Phthalic Anhydride dominates with 72.3% due to its extensive industrial usage.

In 2024, Phthalic Anhydride held a dominant market position in the By Application Analysis segment of the Ortho Xylene Market, with a 72.3% share. Strong demand in plasticisers, resins, and speciality chemicals boosted its market lead. Manufacturers continued prioritising ortho-xylene for high-volume conversions in industrial operations.

Bactericides held a supportive position in the By Application Analysis segment of the Ortho Xylene Market. This sub-segment advanced due to rising hygiene demand across urban regions. Its adoption in disinfectants and microbial control applications helped maintain stable usage levels, complementing the larger phthalic anhydride segment.

Herbicides exhibited steady progress in the By Application Analysis segment of the Ortho Xylene Market. Expanding agricultural activity encouraged greater herbicide consumption. Ortho-xylene’s reliability as a carrier solvent enabled consistent adoption, especially within crop protection formulations that required strong solubilising properties.

Lube Oil Additives recorded measured growth in the By Application Analysis segment of the Ortho Xylene Market. Its usage in enhancing lubricant stability supported demand. Industries focused on equipment maintenance continued to integrate additives to improve operational performance, creating incremental consumption of ortho-xylene-based formulations.

By End Use Analysis

Automotive dominates with 27.7% driven by rising manufacturing and chemical usage.

In 2024, Automotive held a dominant market position in the By End Use Analysis segment of the Ortho Xylene Market, with a 27.7% share. Its strong role in coatings, plasticisers, and performance materials supported rising adoption. Growing vehicle production helped strengthen consumption across global automotive manufacturing hubs.

Building and Construction maintained a solid position in the By End Use Analysis segment of the Ortho Xylene Market. Its usage in sealants, paints, and insulation materials enabled steady growth. Rising infrastructure development across emerging economies supported broader demand for chemically enhanced building products.

Paints and Coatings secured a key place in the By End Use Analysis segment of the Ortho Xylene Market. Strong demand for durable and high-performance coatings supported rising consumption. Industrial, commercial, and decorative applications all contributed to expanding adoption throughout the coatings value chain.

Aerospace and Defence achieved stable momentum in the By End Use Analysis segment of the Ortho Xylene Market. Rising production of specialised coatings and engineered materials supported demand. Its application in protective and corrosion-resistant formulations encouraged steady integration across defence manufacturing.

Key Market Segments

By Type

- Ortho-xylene

- Meta xylene

- Para xylene

By Application

- Phthalic Anhydride

- Bactericides

- Herbicides

- Lube Oil Additives

- Others

By End Use

- Automotive

- Building and Construction

- Paints and Coatings

- Aerospace and Defence

- Electrical and Electronics

- Others

Emerging Trends

Rising Use of Phthalic Anhydride in Industrial Applications Drives Market Growth

The Ortho Xylene market is witnessing strong momentum as industries increasingly use it to manufacture phthalic anhydride. This chemical plays a key role in producing plasticisers, resins, and coatings, which are widely needed in construction, automotive, and packaging activities. As these sectors expand, demand for Ortho Xylene continues to rise.

- A clear emerging trend for ortho xylene is that it sits at the crossroads of two big forces: rising long-term demand for petrochemicals and much stricter rules on air emissions. Petrochemical feedstocks already account for about 12% of global oil demand, and their role is expected to grow further as plastics and fertiliser consumption rise.

The chemical industry is investing in cleaner production technologies. Many manufacturers are upgrading aromatics units to improve yield and reduce emissions. This shift not only boosts supply stability but also aligns with sustainability goals, strengthening the market’s long-term outlook.

The packaging sector is also influencing market trends. Plasticisers derived from phthalic anhydride are heavily used in flexible packaging. As consumer goods, e-commerce shipments, and food packaging continue to increase, the demand for Ortho Xylene is rising accordingly.

Drivers

Growing Use of Phthalic Anhydride Boosts Ortho Xylene Demand

The Ortho Xylene Market is expanding steadily as industries rely more on phthalic anhydride production. This chemical is essential for making plasticisers, which improve the flexibility and durability of PVC products. Growing construction and automotive activities create a strong demand for PVC, indirectly supporting higher consumption of ortho-xylene.

Another major driver is the rising need for solvents in paints and coatings. Ortho xylene offers strong solvency and fast drying, making it suitable for industrial coatings, automotive refinishing, and protective paints. As infrastructure projects rise across the Asia-Pacific and the Middle East, coating manufacturers use more ortho-xylene to meet quality and performance standards.

Additionally, advancements in petrochemical processing technologies improve production efficiency and product purity. Modern refineries and aromatics complexes are optimising output to meet growing demand from end-user sectors. These technological investments, along with expanding industrial activity in emerging economies, continue to strengthen overall market growth for ortho-xylene.

Restraints

Strict Environmental Regulations Limit Market Expansion

Tightening environmental rules remain one of the biggest barriers for the Ortho Xylene market. Since ortho-xylene is a volatile aromatic compound, regulators often impose strict limits on emissions to protect air quality. These rules increase compliance costs for manufacturers and make production more complicated.

Additionally, several industries that use Ortho Xylene—such as paints, coatings, and plastics—are shifting toward low-VOC and eco-friendly formulations. This transition reduces dependency on traditional aromatic solvents and creates long-term pressure on demand. End-users increasingly prefer alternatives that meet sustainability targets.

Furthermore, fluctuations in crude oil prices add uncertainties to the cost structure of Ortho Xylene. Since it is derived from petroleum-based feedstocks, any instability in global oil markets affects production costs. This volatility makes long-term planning challenging for manufacturers and buyers.

Growth Factors

Rising Adoption of High-Performance Chemicals Creates New Market Opportunities

Growing demand for advanced chemicals in coatings, plastics, and automotive sectors is opening strong opportunities for the ortho-xylene market. Industries are shifting toward high-performance materials, and ortho xylene plays an essential role in producing phthalic anhydride, which is widely used across these applications. This shift allows manufacturers to capture new revenue streams.

- In India, industry analyses point to a plastic pipes market growing around 10–12% in the medium term, driven by government spending on infrastructure, real estate and irrigation. Alongside this, the Indian paint and coatings sector is estimated at about USD 9.6 billion in 2024, supported by urban housing programs and road-building schemes.

Ongoing technological improvements in petrochemical plants are helping producers reduce costs and improve process efficiency. Companies adopting energy-efficient technologies or upgrading catalytic processes can enhance output. This creates opportunities to meet rising global demand while improving competitiveness and maintaining better margins in a rapidly evolving market.

Regional Analysis

Asia Pacific Dominates the Ortho Xylene Market with a Market Share of 45.9%, Valued at USD 1.6 Billion

The Asia Pacific region leads the global Ortho Xylene market due to strong chemical manufacturing capacities and expanding end-use industries. With a dominant share of 45.9% and a market value of USD 1.6 billion, the region benefits from rising infrastructure spending and a growing automotive sector. Additionally, government-backed industrial expansion programs enhance the demand for ortho-xylene across coatings, plastics, and chemical intermediates.

North America shows steady growth driven by mature petrochemical infrastructure and technological advancements in solvent processing. The region benefits from strong demand in construction chemicals and speciality coatings. Moreover, rising investments in industrial modernisation and strict quality standards continue to support market growth across key downstream sectors.

Europe’s market performance is shaped by stringent environmental regulations and increasing innovation in eco-friendly chemical formulations. Growth is supported by robust demand in automotive coatings, high-grade plastics, and industrial solvents. Additionally, the region’s circular-economy initiatives encourage the development of cleaner aromatic derivatives, gradually influencing product preferences.

The Middle East & Africa region benefits from expanding petrochemical complexes and rising investments in industrial diversification. Strong feedstock availability and large-scale refinery upgrades strengthen supply capabilities. Demand grows gradually across construction, packaging, and chemical manufacturing sectors, supported by improving trade flows and regional economic reforms.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, the global Ortho Xylene market reflects steady momentum, supported by diverse production capacities and evolving downstream demand.

China Petroleum and Chemical Corporation continues to influence regional pricing and supply stability through its large-scale aromatics operations. The company’s integrated refining-to-chemicals approach strengthens its ability to balance feedstock availability with rising demand for phthalic anhydride and derivative applications.

Exxon Mobil Corporation remains a key contributor through its advanced process technologies and steady output across major petrochemical hubs. Its focus on operational efficiency and optimised aromatics integration ensures a reliable supply, particularly for markets that require high-purity ortho-xylene grades for coatings, plasticisers, and industrial chemicals.

Flint Hills Resources maintains a consistent position in North America with its emphasis on feedstock optimisation and stable production of xylenes. The company benefits from strong access to refinery streams, supporting predictable supply to downstream producers in coatings, resins, and polyester intermediates, which helps reduce regional supply volatility.

Formosa Chemicals and Fibre Corporation adds significant value to the East Asian market through its balanced mix of aromatics capacity and speciality chemical integration. Its strong foothold in Taiwan and strategic presence across Asia support reliable output for producers of phthalic anhydride, plasticisers, and high-performance polymers, contributing to regional supply resilience.

Top Key Players in the Market

- China Petroleum and Chemical Corporation

- Exxon Mobil Corporation

- Flint Hills Resources

- Formosa Chemicals and Fibre Corporation

- Nouri Petrochemical Company

- Reliance Industries Ltd

- Royal Dutch Shell PLC

- SK Global Chemical Co. Ltd

Recent Developments

- In 2025, ExxonMobil, a global leader in xylene production (including ortho-xylene for phthalates and resins), reported robust chemical segment performance, driven by high-value products amid volatile feedstock costs. Planned maintenance and 2025 project startups (China Chemical Complex) offset structural savings.

- In 2025, the U.S. EPA reviewed Flint Hills’ AMEL for Leak Detection and Repair (LDAR) under SOCMI and Petroleum Refining standards. It applies to the Mid-crude and Meta-Xylene units at Corpus Christi’s West Refinery, aiming to minimise fugitive emissions from xylene handling while maintaining compliance.

Report Scope

Report Features Description Market Value (2024) USD 3.6 billion Forecast Revenue (2034) USD 5.5 billion CAGR (2025-2034) 4.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Ortho-xylene, Meta-xylene, Para-xylene), By Application (Phthalic Anhydride, Bactericides, Herbicides, Lube Oil Additives, Others), By End Use (Automotive, Building and Construction, Paints and Coatings, Aerospace and Defence, Electrical and Electronics, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape China Petroleum and Chemical Corporation, Exxon Mobil Corporation, Flint Hills Resources, Formosa Chemicals and Fibre Corporation, Nouri Petrochemical Company, Reliance Industries Ltd, Royal Dutch Shell PLC, SK Global Chemical Co. Ltd Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- China Petroleum and Chemical Corporation

- Exxon Mobil Corporation

- Flint Hills Resources

- Formosa Chemicals and Fibre Corporation

- Nouri Petrochemical Company

- Reliance Industries Ltd

- Royal Dutch Shell PLC

- SK Global Chemical Co. Ltd