Global Oral Solid Dosage Pharmaceutical Formulation Market By Product Type (Tablets, Capsules, Powders and Granules, Lozenges and Pastilles, Others) By Drug Release Mechanism (Immediate Release, Delayed Release, Modified Release) By Type (Generic, Branded) By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Pharmacies), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario,Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 166806

- Number of Pages: 214

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

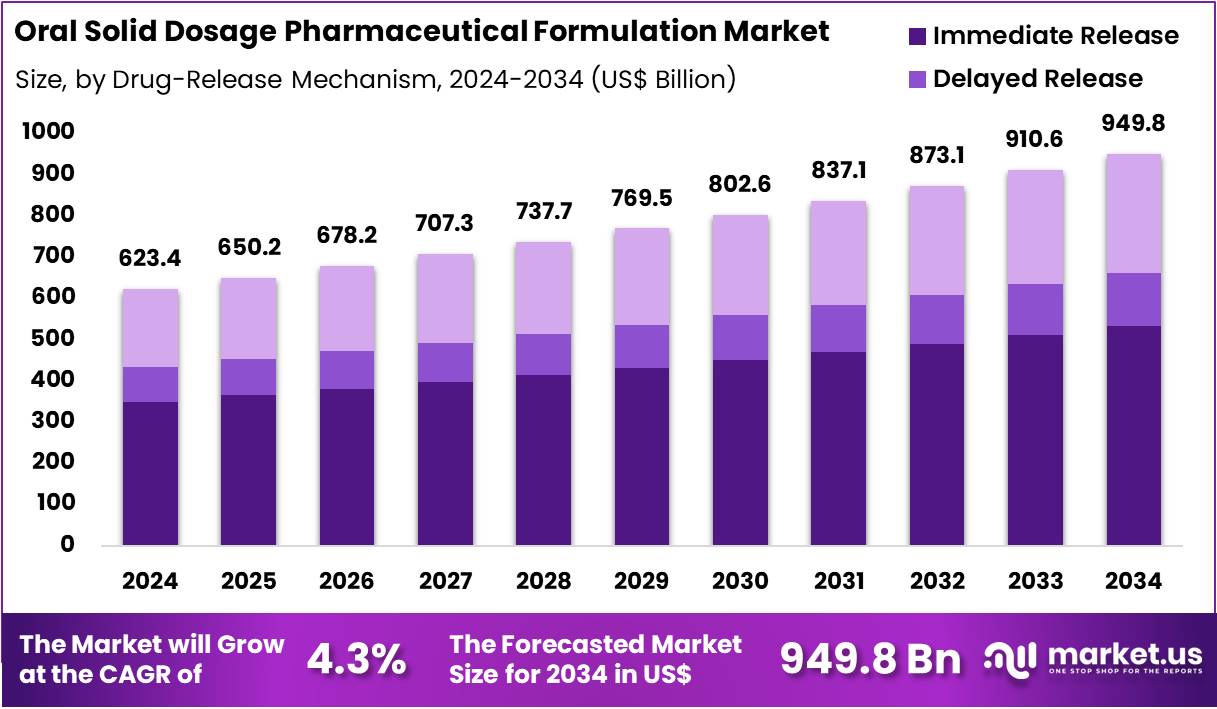

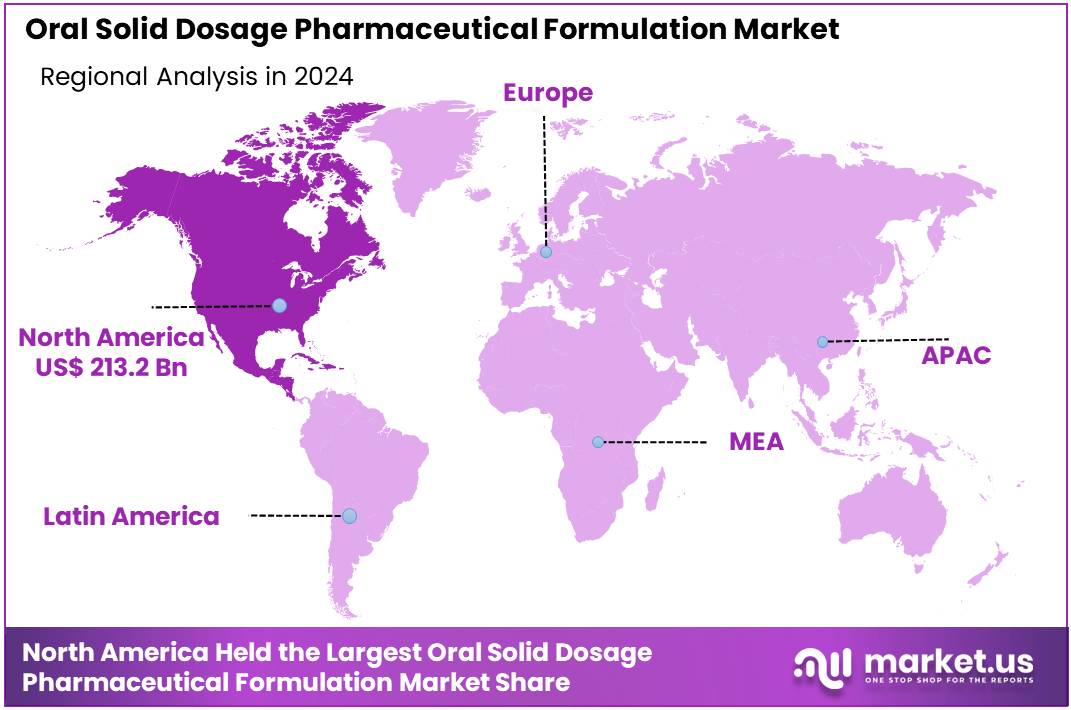

Global Oral Solid Dosage Pharmaceutical Formulation Market size is expected to be worth around US$ 949.8 Billion by 2034 from US$ 623.4 Billion in 2024, growing at a CAGR of 4.3% during the forecast period from 2025 to 2034. In 2024, North America led the market, achieving over 34.2% share with a revenue of US$ 213.2 Billion.

The growth of the market can be attributed largely to demographic ageing and the rising burden of chronic diseases. The World Health Organization (WHO) reports that the global population aged 60 years and older will increase from 1.1 billion in 2023 to 1.4 billion by 2030, while the proportion of older persons is expected to almost double between 2015 and 2050.

Older adults show high medicine utilization, with 85–90% reporting prescription use within 12 months. As chronic non-communicable diseases such as diabetes, cardiovascular disease, cancer, and respiratory illness expand in prevalence, demand for long-term oral solid therapies continues to rise.

A strong preference for oral administration reinforces market expansion, as tablets and capsules offer convenience, stability, and lower handling costs. Industry findings indicate that approximately 84% of best-selling pharmaceuticals are administered orally, and oral formats dominate small-molecule development pipelines. At the policy level, WHO’s essential medicines framework and countries’ commitments to universal health coverage are increasing procurement of cost-effective oral solids.

Technological advances such as orally disintegrating tablets, multiparticulate systems, mini-tablets, and modified-release profiles are supporting improved bioavailability and adherence. Supply-side growth is further strengthened by CDMO expansion, with oral solids accounting for about 60% of the contract manufacturing market, and India producing around 60% of solid oral dosage volume for the U.S. market.

Overall, demographic trends, cost pressures, regulatory harmonization, and continuous innovation are expected to maintain oral solid dosage formulations as the backbone of global pharmacotherapy over the coming decade.

Key Takeaways

- Market Size: Global Oral Solid Dosage Pharmaceutical Formulation Market size is expected to be worth around US$ 949.8 Billion by 2034 from US$ 623.4 Billion in 2024.

- Market Growth: The market growing at a CAGR of 4.3% during the forecast period from 2025 to 2034.

- Product Type Analysis: Tablets accounted for 39.7% of the global market share in 2024, and their leadership can be attributed to high patient compliance, dose accuracy, and extensive adoption across therapeutic classes.

- Application Analysis: Immediate-release products accounted for 56.1% of the global market share in 2024, and this dominance can be attributed to simple manufacturing processes, lower production costs, and strong physician preference.

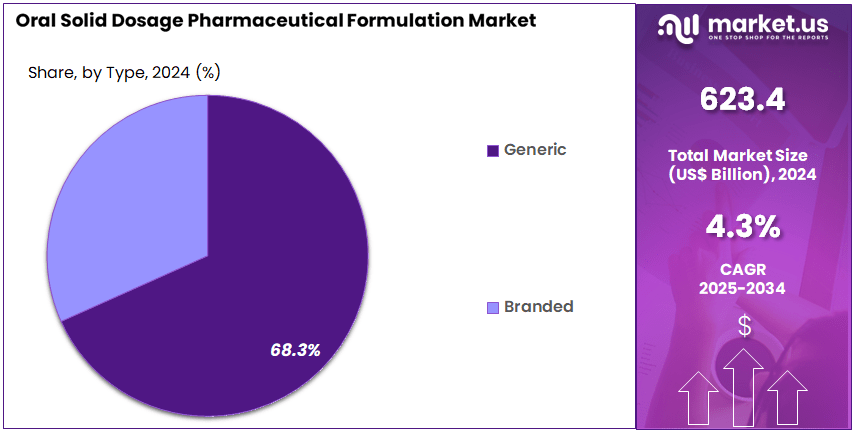

- End-Use Analysis: In 2024, generic oral solid dosages accounted for an estimated 68.3% of total market share, indicating significant penetration across both developed and emerging healthcare systems.

- Regional Analysis: In 2024, North America led the market, achieving over 34.2% share with a revenue of US$ 213.2 Billion.

Product Type Analysis

The oral solid dosage pharmaceutical formulation market is characterized by a diverse product landscape, with tablets retaining a dominant position due to broad clinical applicability and cost-efficient production. Tablets accounted for 39.7% of the global market share in 2024, and their leadership can be attributed to high patient compliance, dose accuracy, and extensive adoption across therapeutic classes. The segment continues to benefit from sustained innovation in controlled-release systems and fixed-dose combinations, which has reinforced its commercial relevance.

Capsules represent another significant segment, supported by their suitability for moisture-sensitive active ingredients and their ability to enhance bioavailability through specialized fill technologies. Demand for capsules has been influenced by premium positioning in nutraceuticals and prescription drugs. Powders and granules are utilized extensively in pediatric and geriatric populations where swallowing difficulties are prevalent. Growth in this category has been driven by flexible dosing benefits and the rising focus on fast-dissolving oral therapies.

Lozenges and pastilles maintain steady usage in the treatment of throat and oral cavity conditions, with demand supported by the expansion of over-the-counter healthcare products. The “Others” segment, comprising effervescent tablets, dispersible formats, and orally disintegrating systems, has observed increasing adoption as patient-centric drug delivery continues to gain importance across global markets.

Drug Release Mechanism Analysis

Based on drug release mechanisms, with immediate-release (IR) formulations holding a significant share due to their widespread therapeutic use and efficient onset of action. Immediate-release products accounted for 56.1% of the global market share in 2024, and this dominance can be attributed to simple manufacturing processes, lower production costs, and strong physician preference in acute and chronic disease management. The continued expansion of generic drugs further supports the prominence of this segment.

Delayed-release formulations constitute an important category, particularly for drugs requiring protection from acidic gastric environments or those intended for targeted intestinal absorption. Their adoption is influenced by the growing demand for optimized pharmacokinetic profiles and improved gastrointestinal tolerability.

The modified-release (MR) segment, comprising sustained-release, controlled-release, and extended-release systems, has gained momentum as patient-centric drug delivery solutions become more essential. Sustained-release and controlled-release formats are used to maintain consistent plasma concentrations and reduce dosing frequency, thereby enhancing adherence. Extended-release technologies have been increasingly integrated into chronic care therapies where long-term, stable drug exposure is required. Overall, modified-release systems are expected to observe steady growth as innovation in polymer science and formulation engineering continues to advance.

Type Analysis

The market is characterized by a strong presence of generic and branded products, with generics holding a dominant position in 2024. The expansion of generic formulations can be attributed to patent expiries, increasing demand for cost-effective therapies, and favorable government policies that encourage the adoption of affordable medications.

In 2024, generic oral solid dosages accounted for an estimated 68.3% of total market share, indicating significant penetration across both developed and emerging healthcare systems. Their widespread availability and lower development costs have further supported sustained uptake.

Branded oral solid dosage products continue to represent an important segment within the market, driven by ongoing innovation in drug delivery technologies, the introduction of novel therapeutics, and strong brand loyalty in critical therapeutic classes. Although the share of branded products is smaller relative to generics, this segment benefits from premium pricing and consistent investment in R&D activities.

Growth within the branded category is expected to be supported by advancements in controlled-release formulations, targeted delivery systems, and lifecycle management strategies implemented by major pharmaceutical manufacturers. Collectively, both segments contribute to a stable and expanding OSD market landscape.

Distribution Channel Analysis

The distribution channel structure for oral solid dosage formulations has been shaped by strong retail penetration and expanding patient access. Retail pharmacies were observed to dominate the market in 2024, accounting for an estimated 53.4% share. The prominence of this channel can be attributed to broad geographic coverage, consistent product availability, and high patient reliance on community pharmacy services. The segment has also benefited from the increasing use of generic tablets and capsules, which are commonly dispensed through retail outlets.

Hospital pharmacies represented another significant distribution route. Demand in this channel has been supported by rising inpatient admissions, greater adoption of high-potency and controlled-release formulations in clinical settings, and the emphasis on standardized medication management within hospitals. Growth in this segment has been further reinforced by expanding pharmaceutical procurement programs and the rising burden of chronic disease requiring supervised therapy.

Online pharmacies continued to gain traction, driven by increasing digital adoption, improved e-commerce logistics, and the growing preference for home delivery of prescription medicines. The expansion of telehealth services and electronic prescriptions has supported steady uptake. Although the market share remains lower than traditional channels, sustained investment in digital health platforms is expected to enhance long-term growth prospects for online distribution.

Key Market Segments

By Product Type

- Tablets

- Capsules

- Powders and Granules

- Lozenges and Pastilles

- Others

By Drug Release Mechanism

- Immediate Release

- Delayed Release

- Modified Release

- Sustained Release

- Controlled Release

- Extended Release

By Type

- Generic

- Branded

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Driving Factors

The growth of the global oral solid dosage (OSD) pharmaceutical-formulation market is strongly driven by rising chronic disease prevalence and the consequent long-term therapeutic demand. For example, treatment adherence remains a major challenge in chronic diseases, with research indicating that about half of all patients do not follow prescribed regimens in long-term therapy.Solid oral dosage forms—such as tablets and capsules—are typically the preferred modality for chronic treatment due to ease of administration, established manufacturing frameworks, and patient familiarity.

Regulatory frameworks further support OSD formats: for instance, the Food and Drug Administration (FDA)’s “M13A Bioequivalence for Immediate-Release Solid Oral Dosage Forms” guidance underscores the regulatory clarity available for such formulations. These factors combine to create a reliable demand base and facilitate manufacturing scalability, thus acting as a key driver for market expansion.

Trending Factors

A prominent trend in the oral solid dosage sector is the shift toward patient-centric formulation and advanced delivery technologies within solid oral formats. Studies on patient acceptability highlight that preferences and ease of swallowing significantly influence dosage-form choice, with solid forms remaining dominant but evolving in design. Concurrently, regulatory bodies emphasize process robustness and manufacturing consistency in OSD production.

For example, the FDA’s inspection guide for OSD forms details validation of manufacturing processes and quality controls. Moreover, incremental regulatory refinements—such as the June 2025 FDA draft guidance on “Minor Changes to Solid Oral Dosage Forms for Certain OTC Drugs” —highlight industry adaptation toward agile reformulations and lifecycle management. These developments signal the trend of leveraging improved formulation science, enhanced patient adherence features, and regulatory flexibility within the solid oral segment.

Restraining Factors

Despite favourable market dynamics, the oral solid dosage segment faces meaningful restraints originating from formulation complexity and patient-specific challenges. For instance, although many patients prefer tablets and capsules, studies show that swallowing difficulties and physical attributes of OSDs (size, shape, texture) can impair acceptability, especially in elderly or paediatric populations.

Additionally, regulatory requirements for OSD products remain stringent: the FDA mandates imprinting of solid oral dosage forms under 21 CFR Part 206 to ensure unique product identification and traceability. This regulatory burden, combined with the need for rigorous process validation and stability testing (as per FDA quality guidelines), increases formulation cost and complexity, thereby restraining some manufacturers from aggressively pursuing the OSD segment.

Opportunity

An important opportunity for the oral solid dosage pharmaceutical-formulation market lies in the increasing outsourcing of development and manufacturing via contract manufacturing organisations (CMOs/CDMOs) and growth in emerging markets. The contract manufacturing market for OSD forms, for example, is forecast to grow significantly, indicating that smaller and specialty players may access formulation expertise without the capital burden of full-scale manufacturing.

Furthermore, the demographic shift in developing regions, alongside expanding healthcare access and generic-drug penetration, presents a strong growth runway for OSD formats. Improvements in formulation technology (e.g., orally disintegrating tablets, fixed-dose combinations) aimed at enhancing patient adherence also create opportunity. Collectively, these drivers generate favourable conditions for market entrants and incumbent firms to expand their OSD portfolio in both developed and emerging geographies.

Regional Analysis

The leadership of North America in the oral solid dosage (OSD) pharmaceutical formulation market can be attributed to several structural strengths. The region has a well-established pharmaceutical manufacturing base. Strong regulatory frameworks have supported consistent investments in research, formulation development, and quality standards. This environment has enabled steady adoption of advanced manufacturing technologies for tablets, capsules, and powders.

Demand for OSD products has remained stable due to the high prevalence of chronic diseases. Aging demographics have also expanded the patient pool. As a result, consumption of prescription and over-the-counter solid oral medicines has continued to increase. The growth of generic drug utilization has further strengthened the region’s output.

The presence of skilled scientific talent has supported a robust formulation pipeline. Universities and research institutes have contributed to continuous innovation. Contract development and manufacturing organizations have played a major role as well. Their capabilities have widened access to specialized formulation technologies, including modified-release systems and high-potency oral solids.

Healthcare spending in the region has remained among the highest globally. This has ensured consistent adoption of new therapies and rapid commercialization of reformulated oral dosage products. Reimbursement structures and insurance penetration improved market access and helped maintain high consumption levels across therapeutic categories.

Supply chain reliability has been another key factor. Integrated distribution networks have ensured broad availability of oral solid medicines through hospital pharmacies, retail chains, and online platforms. This stability has strengthened the commercial performance of OSD products.

Overall, the region’s dominance has been supported by strong infrastructure, sustained R&D activity, and high therapeutic demand. These conditions are expected to maintain North America’s leading position over the forecast horizon.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The competitive landscape in the oral solid dosage formulation market is shaped by organizations that demonstrate strong capabilities in large-scale production, advanced formulation science, and global regulatory compliance. Growth has been driven by entities that invest in continuous manufacturing, modular production lines, and process analytical technologies.

Significant emphasis has been placed on expanding capabilities in modified-release systems, high-potency drug handling, and bioavailability-enhancing techniques. Market participants with extensive portfolios in generics and contract development services have strengthened their positions through strategic capacity expansion and technology upgrades.

Innovation in tablet compression, coating systems, and quality-by-design frameworks has supported product differentiation. The market has also been influenced by firms that integrate digital quality management and data-driven process optimization. Competitive advantage has increasingly been associated with flexible manufacturing models, rapid technology transfer, and strong compliance records across regulated markets.

Market Key Players

- Pfizer Inc.

- Novartis AG

- Merck & Co., Inc.

- AstraZeneca plc

- Takeda Pharmaceutical Company Limited

- Bayer AG

- Teva Pharmaceutical Industries Ltd.

- Otsuka Pharmaceutical Co., Ltd.

- Aspen Pharmacare Holdings Ltd.

- Bristol-Myers Squibb Company

- Eli Lilly and Company

- Gilead Sciences

- AbbVie Inc.

- Boehringer Ingelheim GmbH

- F. Hoffman-La-Roche Ltd.

- Johnson and Johnson

- GSK plc.

- Sun Pharmaceutical Industries Ltd

Recent Developments

- Pfizer Inc. (Nov 2025) – Pfizer secured shareholder approval to acquire Metsera Inc. for up to US$10 billion, including a cash component and contingent payments. The takeover adds oral and injectable incretin/amylin programmes to strengthen Pfizer’s pipeline and expand into obesity and cardiometabolic disease.

- AstraZeneca plc (Mar 2025) – AstraZeneca disclosed positive Phase IIb data for its investigational once-daily oral PCSK9 inhibitor (AZD0780) showing >50 % LDL-C reduction when added to statin therapy. This underscores the emphasis on novel oral solid formulations in cardiovascular/ lipid-lowering therapy.

Report Scope

Report Features Description Market Value (2024) US$ 623.4 Billion Forecast Revenue (2034) US$ 949.8 Billion CAGR (2025-2034) 4.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Tablets, Capsules, Powders and Granules, Lozenges and Pastilles, Others) By Drug Release Mechanism (Immediate Release, Delayed Release, Modified Release, Sustained Release, Controlled Release, Extended Release) By Type (Generic, Branded) By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Pharmacies) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Pfizer Inc., Novartis AG, Merck & Co., Inc., AstraZeneca plc, Takeda Pharmaceutical Company Limited, Bayer AG, Teva Pharmaceutical Industries Ltd., Otsuka Pharmaceutical Co., Ltd., Aspen Pharmacare Holdings Ltd., Bristol-Myers Squibb Company, Eli Lilly and Company, Gilead Sciences, AbbVie Inc., Boehringer Ingelheim GmbH, F. Hoffman-La-Roche Ltd., Johnson and Johnson, GSK plc., Sun Pharmaceutical Industries Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Oral Solid Dosage Pharmaceutical Formulation MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Oral Solid Dosage Pharmaceutical Formulation MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Pfizer Inc.

- Novartis AG

- Merck & Co., Inc.

- AstraZeneca plc

- Takeda Pharmaceutical Company Limited

- Bayer AG

- Teva Pharmaceutical Industries Ltd.

- Otsuka Pharmaceutical Co., Ltd.

- Aspen Pharmacare Holdings Ltd.

- Bristol-Myers Squibb Company

- Eli Lilly and Company

- Gilead Sciences

- AbbVie Inc.

- Boehringer Ingelheim GmbH

- F. Hoffman-La-Roche Ltd.

- Johnson and Johnson

- GSK plc.

- Sun Pharmaceutical Industries Ltd