Global Oral Proteins and Peptides Market By Product Type (Ferric Gluconate, Low Molecular Weight Iron Dextran, Iron Sucrose, and Ferric Carboxyl Maltose), By Application (Diabetes, Gastric & Digestive Disorders, Bone Diseases, and Hormonal Disorders), By Drug Type (Linaclotide, Calcitonin, Insulin, Plecanatide, and Octreotide), By End-user (Hospitals, Pharmaceutical Companies, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 132664

- Number of Pages: 356

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

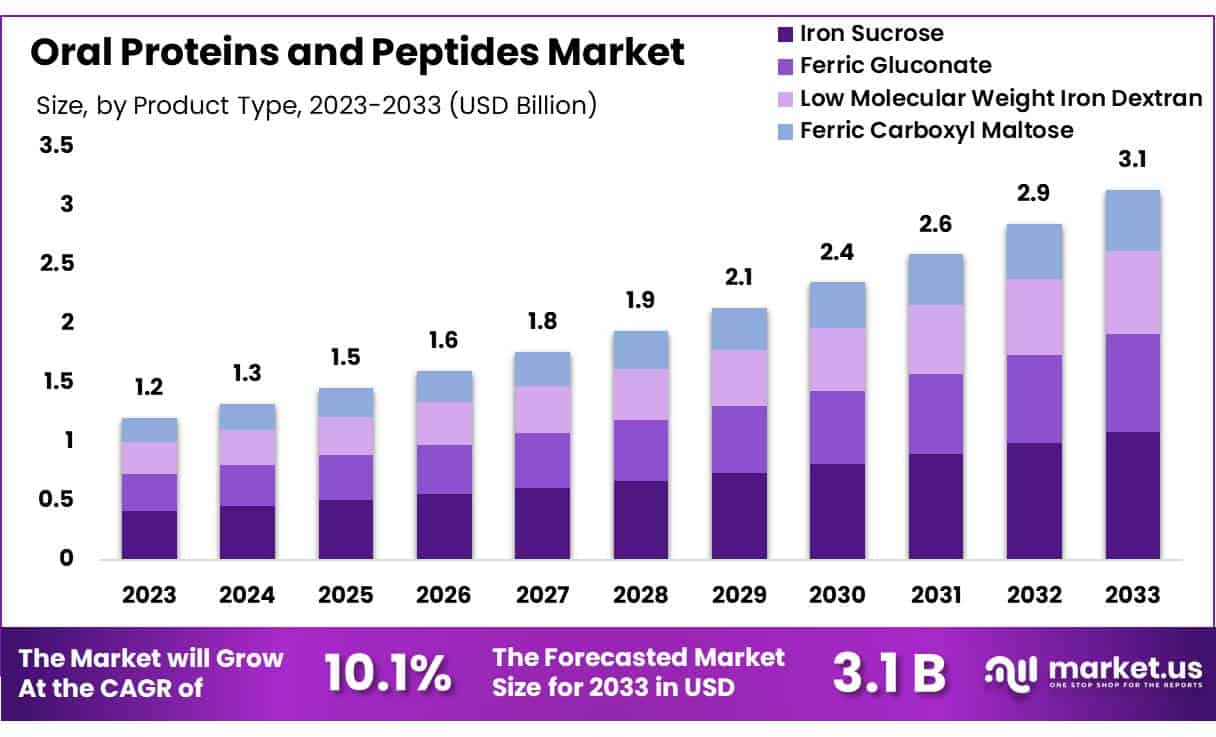

Global Oral Proteins and Peptides Market size is expected to be worth around US$ 3.1 billion by 2033 from US$ 1.2 billion in 2023, growing at a CAGR of 10.1% during the forecast period 2024 to 2033.

Increasing demand for effective, non-invasive therapies drives the oral proteins and peptides market, as patients and healthcare providers seek alternatives to injectable treatments. Oral proteins and peptides offer significant potential across therapeutic areas, including metabolic disorders, oncology, and immunology, as they target specific cellular pathways with high precision.

The U.S. Food and Drug Administration’s implementation of the 21st Century Cures Act, designed to streamline the approval process for innovative drug delivery technologies, has accelerated the development of advanced oral formulations for proteins and peptides. This regulatory support encourages pharmaceutical companies to invest in research, fueling rapid advancements in bioavailability and stability technologies critical for oral delivery.

Recent innovations, such as enteric coatings and absorption enhancers, address the challenges of delivering biologically active proteins through the digestive tract, opening new possibilities in treatment protocols. The market for oral proteins and peptides also benefits from the rising prevalence of chronic diseases, where patients require long-term, convenient therapeutic options.

With growing interest in peptide-based therapeutics, manufacturers find substantial opportunities to expand pipelines and introduce targeted treatments. The focus on patient-centric solutions continues to drive research efforts, leading to next-generation formulations that promise increased efficacy, ease of use, and patient compliance.

Key Takeaways

- In 2023, the market for oral proteins and peptides generated a revenue of US$ 2 billion, with a CAGR of 10.1%, and is expected to reach US$ 3.1 billion by the year 2033.

- The product type segment is divided into ferric gluconate, low molecular weight iron dextran, iron sucrose, and ferric carboxyl maltose, with iron sucrose taking the lead in 2023 with a market share of 34.6%.

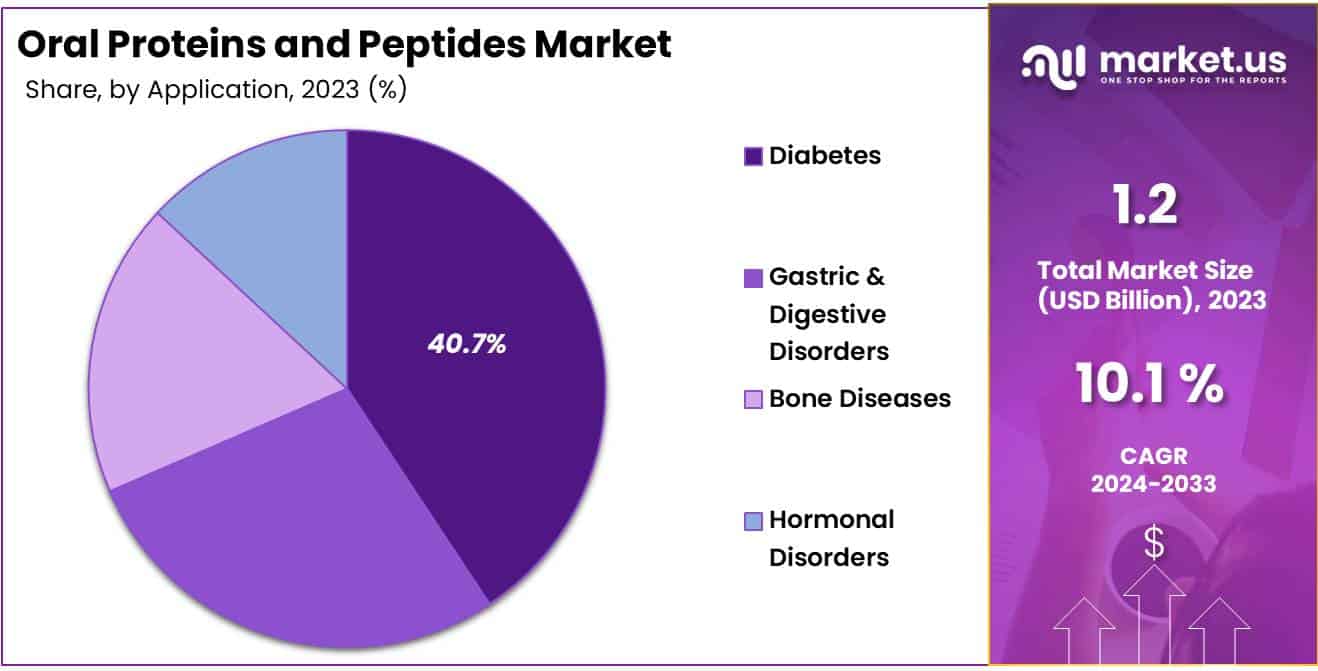

- Considering application, the market is divided into diabetes, gastric & digestive disorders, bone diseases, and hormonal disorders. Among these, diabetes held a significant share of 40.7%.

- Furthermore, concerning the drug type segment, the market is segregated into linaclotide, calcitonin, insulin, plecanatide, and octreotide. The insulin sector stands out as the dominant player, holding the largest revenue share of 38.5% in the oral proteins and peptides market.

- The end-user segment is segregated into hospitals, pharmaceutical companies, and others, with the hospitals segment leading the market, holding a revenue share of 52.3%.

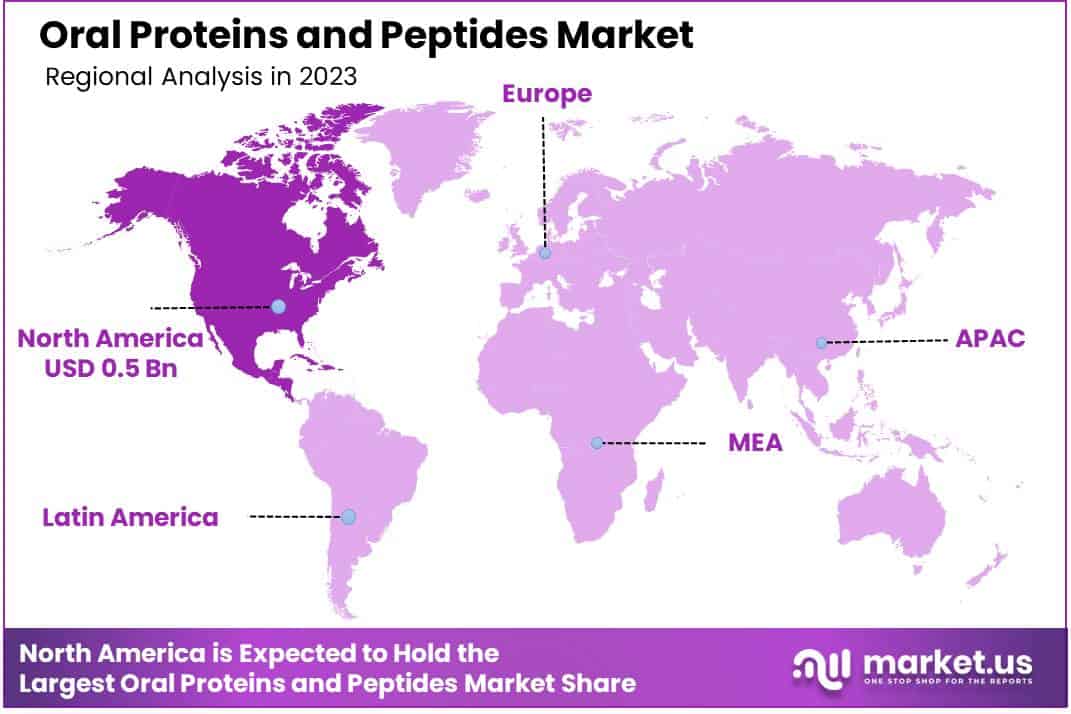

- North America led the market by securing a market share of 38.2% in 2023.

By Product Type Analysis

The iron sucrose segment led in 2023, claiming a market share of 34.6% owing to iron sucrose’s effectiveness in managing iron deficiency anemia, particularly among patients with chronic kidney disease and pregnant women. Rising incidences of anemia and the demand for effective iron supplementation fuel the preference for iron sucrose, known for its favorable safety profile and ease of absorption. With healthcare providers increasingly favoring iron sucrose due to fewer side effects compared to other iron formulations, demand continues to increase.

Ongoing advancements in delivery systems for oral proteins and peptides have made iron sucrose an increasingly viable option for efficient nutrient absorption. As awareness about anemia treatment grows globally, the iron sucrose segment in the oral proteins and peptides market is projected to expand significantly.

By Application Analysis

The diabetes held a significant share of 40.7% due to the rising prevalence of diabetes worldwide and the growing demand for non-invasive therapeutic options for glycemic control. Oral proteins and peptides provide a promising alternative for diabetes management, especially as patient adherence to oral treatments is generally higher than for injectables. Innovations in oral peptide formulations that protect active ingredients from digestive breakdown are anticipated to drive demand in this segment.

With healthcare providers focusing on improving patient quality of life and managing complications related to diabetes, this segment is likely to see increased attention. Expanding diabetes management programs, coupled with technological advancements in peptide drug delivery, further support the growth of this segment within the oral proteins and peptides market.

By Drug Type Analysis

The insulin segment had a tremendous growth rate, with a revenue share of 38.5% owing to the increasing prevalence of diabetes and the high demand for alternative insulin delivery methods that avoid injections. Oral insulin formulations offer a more convenient option for patients, likely to improve compliance and quality of life. Recent advancements in peptide technology have enhanced insulin’s stability and bioavailability in the digestive tract, making oral insulin a viable treatment option.

Rising awareness about non-invasive insulin delivery and the potential to reduce needle-related complications further support demand in this segment. With continued investment in research to optimize oral insulin formulations, the insulin segment in the oral proteins and peptides market is anticipated to expand significantly in the coming years.

By End-user Analysis

The hospitals segment grew at a substantial rate, generating a revenue portion of 52.3% due to the rising demand for advanced protein and peptide therapies that address chronic conditions like diabetes and gastrointestinal disorders. Hospitals increasingly adopt these therapies due to the growing prevalence of chronic diseases and the need for effective management options.

Moreover, the hospital setting provides an ideal environment for monitoring and administering complex treatments, ensuring better patient outcomes. As regulatory bodies approve more peptide-based oral drugs, hospitals are expected to increase adoption rates.

The expansion of healthcare infrastructure, particularly in emerging economies, also fuels demand in this segment, as more hospitals integrate innovative treatments. With growing awareness of oral protein and peptide therapies, the hospitals segment is likely to contribute significantly to the market’s growth trajectory.

Key Market Segments

By Product Type

- Ferric Gluconate

- Low Molecular Weight Iron Dextran

- Iron Sucrose

- Ferric Carboxyl Maltose

By Application

- Diabetes

- Gastric & Digestive Disorders

- Bone Diseases

- Hormonal Disorders

By Drug Type

- Linaclotide

- Calcitonin

- Insulin

- Plecanatide

- Octreotide

By End-user

- Hospitals

- Pharmaceutical Companies

- Others

Drivers

Growing Efforts in Clinical Trials

Increasing investments in clinical trials drive the expansion of the oral proteins and peptides market, as pharmaceutical companies actively explore innovative formulations to treat a range of chronic conditions. By focusing on enhancing the bioavailability and stability of these oral treatments, research teams aim to provide effective alternatives to traditional injections, thus improving patient compliance.

In 2024, Johnson & Johnson presented promising Phase II trial results for JNJ-2113, the first oral peptide under development for treating moderate-to-severe plaque psoriasis, highlighting advancements in this therapeutic area. Clinical trials investigating various oral proteins and peptides for diseases such as diabetes, gastrointestinal disorders, and autoimmune conditions emphasize the market’s potential. With regulatory agencies increasingly supporting such trials, the industry anticipates more breakthroughs in oral delivery systems.

Additionally, clinical trials provide valuable data on safety and efficacy, encouraging both developers and investors to expand their commitment to this sector. As clinical trial efforts intensify, the demand for robust oral protein and peptide therapies is projected to grow, particularly in markets focused on patient-friendly treatments.

Restraints

Rising Challenges in Formulation Stability

High challenges in maintaining formulation stability restrain the growth of the oral proteins and peptides market, as these molecules are inherently sensitive to environmental conditions and the digestive system. Unlike other drug forms, proteins and peptides face rapid degradation in the acidic stomach environment, making their effective delivery through oral formulations complex and costly.

This degradation necessitates additional encapsulation technologies or modifications, which significantly raise production costs and may impact the final product’s bioavailability. Frequent reformulations and stability testing add to developmental timelines, further delaying market entry for new treatments. These technical obstacles increase manufacturing costs and complexity, hampering market growth as only a limited number of companies can afford the extensive R&D required.

Furthermore, the need for specialized storage and handling protocols increases distribution expenses, limiting the accessibility of these therapies. Such challenges create barriers to broader adoption, particularly in markets with limited healthcare budgets, restraining the overall potential for oral proteins and peptides.

Opportunities

Advancements in Regulatory Framework

Growing advancements in the regulatory framework present a significant opportunity for the oral proteins and peptides market, as regulatory bodies increasingly recognize the potential of these therapies in addressing unmet medical needs.

In 2023, the FDA granted Fast Track Designation to Oramed Pharmaceuticals’ oral insulin capsule, facilitating faster review processes and allowing for more frequent interactions with regulatory reviewers to accelerate its development timeline. This type of regulatory support reflects a commitment to advancing innovative treatments and encourages other companies to explore similar solutions.

Streamlined approval processes and incentives for expedited development provide a favorable environment for new entrants in the market. With increasing regulatory collaboration, developers of oral proteins and peptides anticipate fewer administrative hurdles, creating a faster path to market.

These advancements in regulatory practices are expected to benefit patients by enabling quicker access to novel treatments, fostering innovation, and supporting industry growth. As agencies prioritize therapies that offer non-invasive delivery methods, the oral proteins and peptides market is projected to expand substantially.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors exert substantial influence on the growth and stability of the oral proteins and peptides market. Strong economic performance in developed regions supports healthcare investments, enhancing access to innovative therapies and fueling demand.

However, economic volatility in emerging markets constrains healthcare budgets, limiting accessibility to high-cost treatments, including oral protein and peptide-based drugs. Inflation and currency fluctuations elevate production costs, affecting affordability and profitability for manufacturers. Geopolitical tensions and trade restrictions disrupt supply chains, delaying the availability of essential raw materials and impacting research and development timelines.

Stringent regulatory environments in key markets like the U.S. and Europe impose compliance burdens, raising operational costs for companies entering these regions. Nonetheless, increasing awareness of advanced therapies and supportive government initiatives aimed at improving patient outcomes offer positive growth prospects for the industry.

Latest Trends

Impact of Surge in Business Agreements and Partnerships on the Oral Proteins and Peptides Market:

Increasing business agreements and partnerships are anticipated to drive the oral proteins and peptides market. Strategic collaborations enable companies to expand market reach and share technological expertise, enhancing product development and accelerating commercialization.In May 2024, Biocon Limited entered into an exclusive licensing and supply agreement with Handok, a South Korean specialty pharmaceutical firm, to commercialize Synthetic Liraglutide. Under this agreement, Biocon will manage the drug’s development, manufacturing, and supply, while Handok will focus on regulatory approval and commercialization within South Korea.

This collaboration reflects a growing trend where partnerships streamline market entry and compliance in new regions. High demand for innovative treatments and supportive government policies worldwide encourage companies to forge alliances, fostering advancements in oral protein and peptide therapies.

Regional Analysis

North America is leading the Oral Proteins and Peptides Market

North America dominated the market with the highest revenue share of 38.2% owing to advancements in drug delivery technologies and rising demand for innovative therapeutic options for chronic diseases. This market expansion reflects a shift toward non-invasive treatment options that enhance patient compliance, especially for conditions like diabetes and inflammatory disorders.

A key development came from Biora Therapeutics, a U.S.-based company, which announced plans to present preclinical trial results of its BioJet Systemic Oral Delivery Platform at the Next Gen Peptide Formulation & Delivery Summit in June 2024. This technology aims to improve the systemic absorption of therapeutic proteins and peptides, addressing one of the primary challenges in oral peptide delivery.

The market’s growth has also been supported by increasing healthcare investments and a strong focus on biotechnology research across North America, along with regulatory support for novel drug delivery systems. Additionally, collaborations between biotech firms and research institutions have accelerated the development and commercialization of oral protein therapeutics, meeting the demand for more convenient, patient-friendly treatments.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to the increasing prevalence of chronic diseases and improvements in healthcare infrastructure. Countries like China and India are experiencing a rise in diabetes and cardiovascular conditions, leading to greater demand for innovative therapeutic approaches, including oral proteins and peptides. Growing healthcare expenditure and government initiatives to foster biotech research are likely to support this trend.

Additionally, partnerships between regional pharmaceutical companies and international biotech firms are expected to facilitate technology transfer, accelerating the development of effective oral formulations. Advances in encapsulation and drug delivery technologies tailored to meet diverse market needs are projected to enhance the availability of these therapeutics.

As awareness about non-invasive treatment options grows in Asia Pacific, the market is likely to benefit from both increased patient acceptance and strong regulatory frameworks that support drug innovation.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The major players in the oral proteins and peptides market are actively engaged in the development and introduction of innovative products, as well as implementing strategic initiatives aimed at enhancing their competitive positioning. Leading companies in the oral proteins and peptides market focus on advancing drug delivery technologies to improve bioavailability and therapeutic efficacy.

Many invest in research collaborations with biotechnology firms and academic institutions to accelerate innovation and optimize formulations. Strategic partnerships allow these companies to access specialized expertise and streamline clinical trials, speeding up time-to-market.

Additionally, businesses expand their geographical presence, especially in regions with growing healthcare demands and supportive regulatory frameworks. Enhanced marketing efforts and educational outreach help increase awareness among healthcare providers and encourage adoption of these advanced therapies.

Top Key Players

- Tarsa Therapeutics Inc.

- Synergy Pharmaceuticals Inc.

- Oramed Pharmaceuticals Inc.

- Novo Nordisk A/S

- Generex Biotechnology Corp.

- Chiasma Inc.

- Biocon Limited

- AstraZeneca PLC

- Allergan Plc.

Recent Developments

- In August 2023, Entera Bio presented an abstract at the American Society for Bone and Mineral Research (ASBMR) annual meeting on its pioneering once-daily oral hPTH (1-34) peptide tablets (EB613). These tablets are designed to treat post-menopausal women at high risk of fractures. This breakthrough demonstrates significant progress in developing effective oral peptide treatments, contributing to the growth of the oral proteins and peptides market as the demand for convenient, non-invasive treatment options rises.

- In February 2023, Biora Therapeutics announced promising bioavailability results for its oral delivery of GLP-1 receptor agonists. This achievement highlights the potential for oral administration of traditionally injectable peptide drugs, marking a critical advancement for the market as it responds to the need for patient-friendly alternatives in metabolic treatments.

- In February 2023, Entera Bio reported the FDA’s acceptance of a Type D meeting review to confirm the design of the pivotal phase 3 protocol for EB613 PTH mini tablets, poised to become the first oral osteoanabolic treatment for post-menopausal osteoporosis. This regulatory progress underscores the growing focus on oral protein and peptide treatments in the bone health sector, supporting further growth in the market as clinical developments advance toward providing more accessible therapeutic options for patients.

Report Scope

Report Features Description Market Value (2023) US$ 1.2 billion Forecast Revenue (2033) US$ 3.1 billion CAGR (2024-2033) 10.1% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Ferric Gluconate, Low Molecular Weight Iron Dextran, Iron Sucrose, and Ferric Carboxyl Maltose), By Application (Diabetes, Gastric & Digestive Disorders, Bone Diseases, and Hormonal Disorders), By Drug Type (Linaclotide, Calcitonin, Insulin, Plecanatide, and Octreotide), By End-user (Hospitals, Pharmaceutical Companies, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Tarsa Therapeutics Inc., Synergy Pharmaceuticals Inc., Oramed Pharmaceuticals Inc., Novo Nordisk A/S, Generex Biotechnology Corp., Chiasma Inc., Biocon Limited, AstraZeneca PLC, and Allergan Plc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Oral Proteins and Peptides MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample

Oral Proteins and Peptides MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Tarsa Therapeutics Inc.

- Synergy Pharmaceuticals Inc.

- Oramed Pharmaceuticals Inc.

- Novo Nordisk A/S

- Generex Biotechnology Corp.

- Chiasma Inc.

- Biocon Limited

- AstraZeneca PLC

- Allergan Plc.