Global Optical Design Software Market Size, Share Analysis Report By Component (Software, Services), By Deployment (On-premise, Cloud-based), By Application (Imaging Systems Design, Illumination Design, Laser Systems & Beam Propagation, Fiber Optic & Photonic Devices, Optomechanical Design, Display Systems), By End-Use Industry (Consumer Electronics, Automotive & Transportation, Healthcare & Medical Devices, Aerospace & Defense, Telecommunications, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152099

- Number of Pages: 392

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

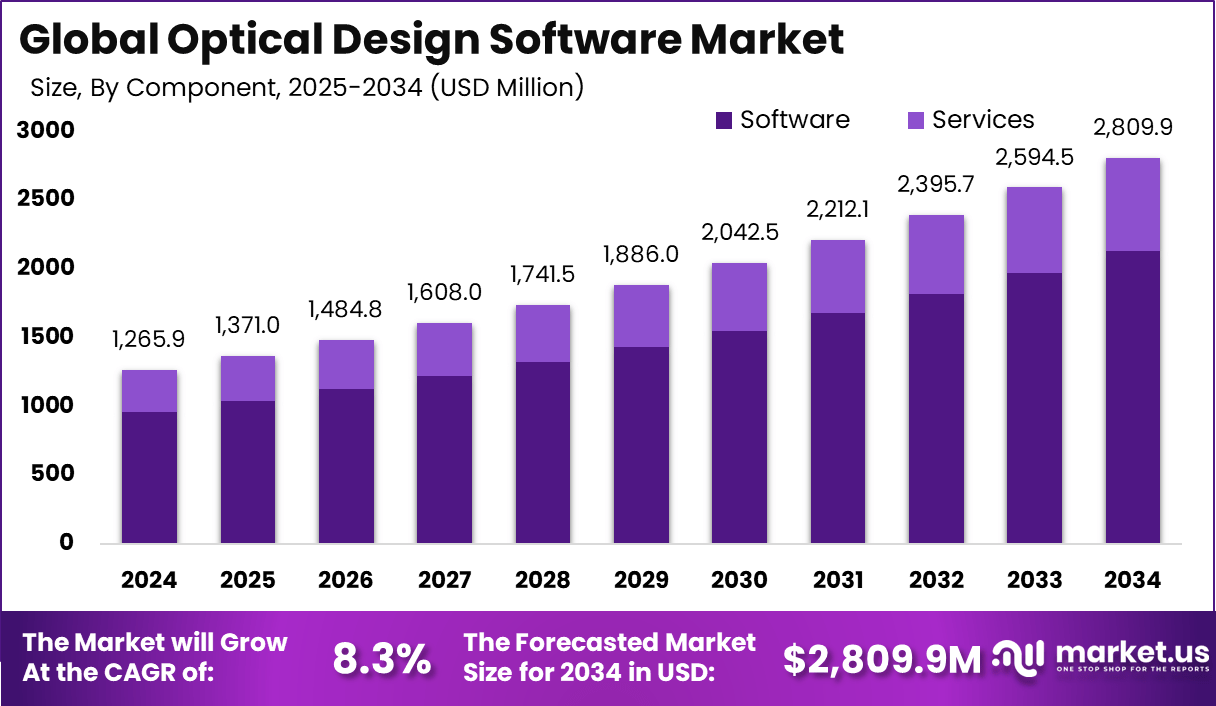

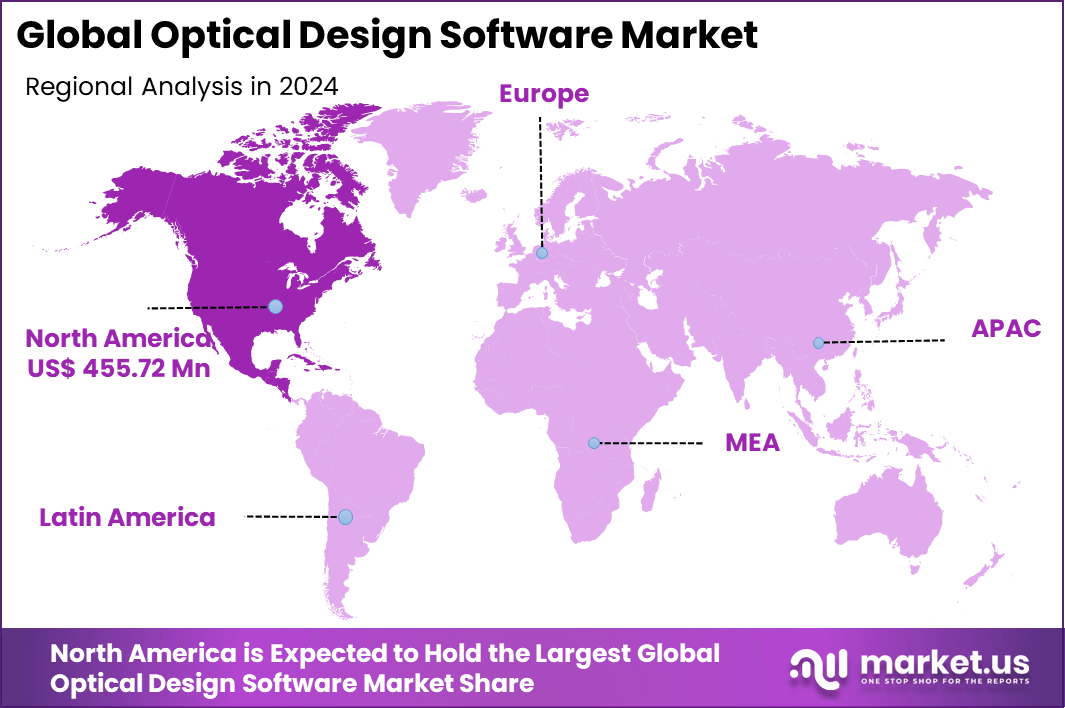

The Global Optical Design Software Market size is expected to be worth around USD 2,809.9 million by 2034, from USD 1,265.9 million in 2024, growing at a CAGR of 8.3% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 36% share, holding USD 455.72 million in revenue.

The global optical design software market is undergoing a period of notable transformation, propelled by increasing demand for precision optical systems across high‑technology sectors. The leading segment, cloud‑based platforms, has been adopted rapidly due to its scalability and accessibility. These platforms enable real‑time collaboration among distributed engineering teams and reduce barriers to entry for smaller enterprises.

Top driving factors in the market include the urgent need for optimized optical systems in telecom, consumer electronics, autonomous vehicles, and healthcare. The proliferation of technologies such as AR/VR headsets, LiDAR, and photonic sensors creates strong impetus for software that can model complex light‑matter interactions with high fidelity. The rise of AI and machine‑learning‐enabled optimization tools further accelerates product cycles while reducing development costs.

For instance, in June 2025, Lambda Research Corporation launched an update to its TracePro optical design software, enhancing its capabilities for simulation and optimization of illumination and optical systems. The update introduces new features designed to improve accuracy and efficiency, catering to industries such as aerospace, automotive, and telecommunications.

Technological adoption is increasing for cloud‑native design suites and AI‑augmented simulation. Firms are increasingly embracing subscription‑based licensing models, which reduce upfront costs and improve flexibility for research labs, startups, and SMEs. This shift enables seamless integration with Industry 4.0 systems and supports virtual prototyping on scalable infrastructure.

Key reasons for adopting these technologies lie in faster design cycles, improved precision, and the ability to collaborate globally. Automated parameter optimization reduces manual effort, while cloud infrastructure allows real‑time feedback and remote computing power. This leads to enhanced time‑to‑market and reduced iteration costs.

Business benefits from adopting advanced optical design software include improved prototype accuracy, reduced need for costly physical testing, and better compliance with performance standards. Firms can optimize thin‑film coatings, lens systems, and detector arrays at early stages, leading to lower development risk and higher yield.

Key Takeaway

- The market is projected to grow from USD 1,265.9 million in 2024 to approximately USD 2,809.9 million by 2034, reflecting a steady CAGR of 8.3%, driven by increasing demand for precision optical systems across industries.

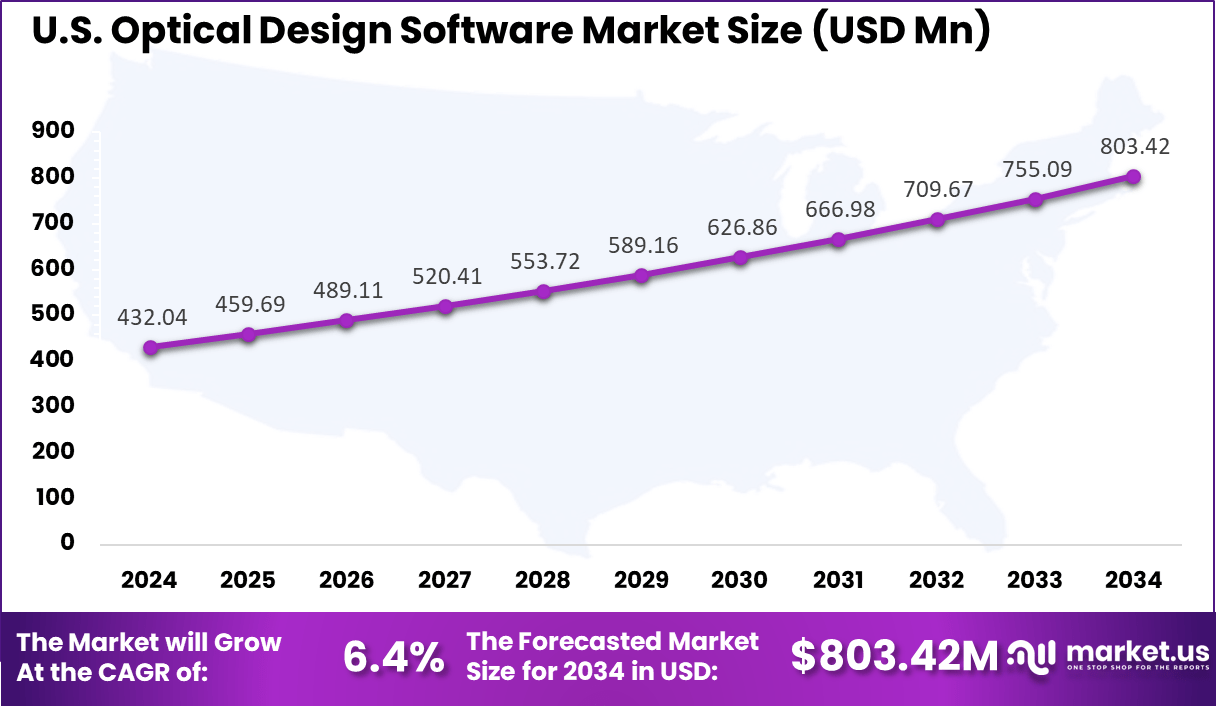

- The U.S. market contributed around USD 432.04 million in 2024, and is expected to expand at a CAGR of 6.4%, supported by strong innovation in imaging technologies, AR/VR devices, and photonics research.

- North America maintained market leadership in 2024, capturing over 36% share with revenue of about USD 455.72 million, fueled by advanced R&D infrastructure and high adoption of simulation tools.

- By component, the Software segment dominated with a commanding 76% share, reflecting its central role in designing, testing, and optimizing optical systems digitally.

- In terms of deployment, On-Premise solutions led with 63% share, as industries with sensitive IP continue to prefer localized, secure computing environments for design activities.

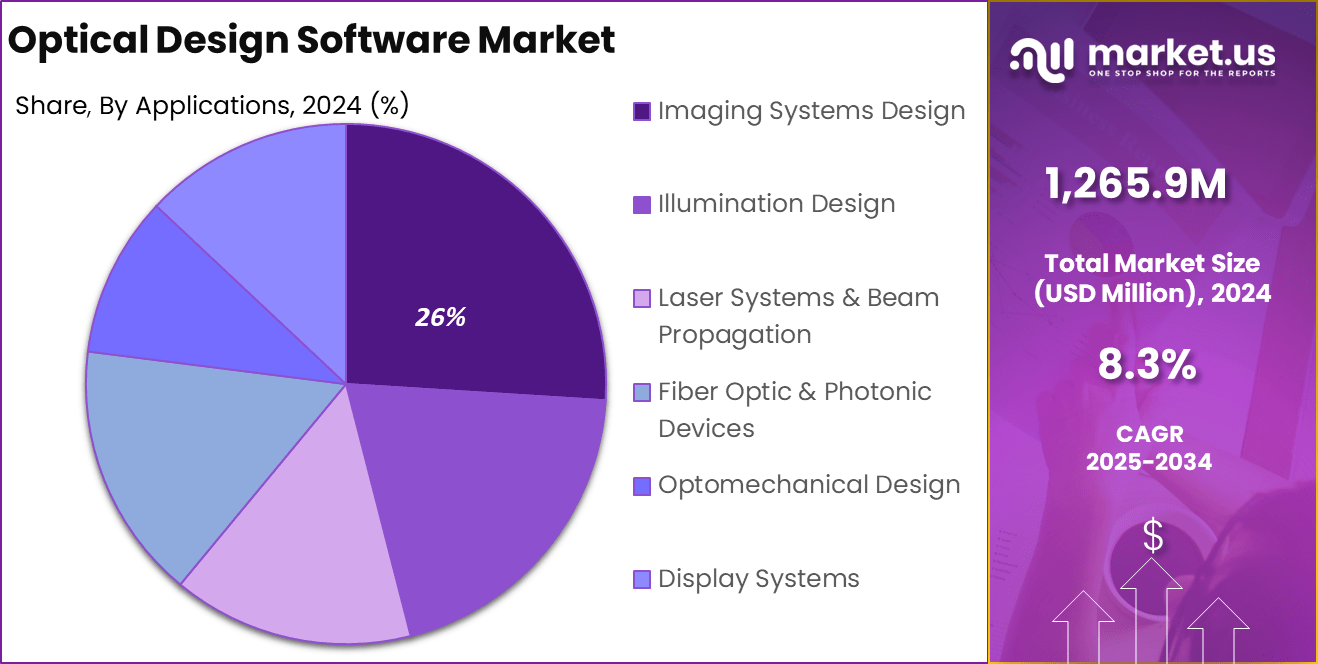

- By application, Imaging Systems Design accounted for 26% share, driven by growing use in cameras, microscopes, and medical imaging systems demanding high-precision optical performance.

- The Consumer Electronics sector was the leading end-use industry, holding 23% share, as demand rises for compact, high-quality optics in smartphones, wearables, and AR/VR headsets.

U.S. Market Size

The market for Optical Design Software within the U.S. is growing tremendously and is currently valued at USD 432.04 million, the market has a projected CAGR of 6.4%. The U.S. optical design software market is expanding rapidly due to high demand from industries like aerospace, defense, healthcare, and automotive, all of which require precise optical systems.

The presence of leading tech companies and significant R&D investments fosters innovation and accelerates the adoption of advanced software tools. In addition, with the increasing use of optical elements in newer technologies such as autonomous vehicles, AR (augmented reality), and VR, there is a need for advanced design solutions that can manage complex simulations and improve performance.

For instance, In December 2022, Hamamatsu Photonics and Siemens launched the MPower digital platform in the U.S. to improve how photonic systems are designed and optimized. By combining advanced optical design tools with high-speed simulations, the platform supports faster and more accurate development. It is especially valuable for sectors like telecommunications, healthcare, and semiconductors, where high-performance optics are critical.

In 2024, North America held a dominant market position in the Global Optical Design Software Market, capturing more than a 36% share, holding USD 455.72 million in revenue. Due to North America’s advanced technological infrastructure, large numbers of major technology firms, and demand coming from major industrial sectors such as aerospace engineering, defense, healthcare, or automotive, the world market for optical design software was one of the largest ever recorded.

With a strong presence of top-tier institutions and research facilities, the area is known for its innovation and rapid software iteration. Furthermore, North America’s industry dominance is bolstered by significant government investments in quantum computing, photonics research, and the integration of high-precision optical systems into business and scientific applications.

For instance, in August 2021, Ansys announced its acquisition of Zemax, a leading provider of optical design software, under a definitive acquisition agreement. This acquisition is expected to drive significant growth in North America, where the demand for advanced optical design solutions is rapidly increasing across key industries such as aerospace, healthcare, automotive, and consumer electronics.

Component Analysis

In 2024, the Software segment held a dominant market position in the Optical Design Software market, capturing more than 76% of the overall share. This dominance can be attributed to the increasing demand for advanced simulation tools that allow designers to model, optimize, and test optical systems with precision.

The Software component provides comprehensive toolkits that support real-time analysis, enabling engineers to reduce design iterations and cut down development time. These capabilities are particularly crucial for sectors such as telecommunications, medical imaging, consumer electronics, and aerospace, where optical accuracy and performance are mission-critical.

For Instance, in December 2023, Synopsys announced the latest release of CODE V optical design software, offering significant updates to enhance the design and optimization of advanced optical systems. The new version provides improved capabilities for simulating complex optical systems with higher precision and efficiency, particularly for industries like aerospace, defense, and consumer electronics.

The Software segment continues to lead as it integrates intelligent technologies like artificial intelligence and computational optics, which enhance automation and predictive design capabilities. Compared to services, software solutions offer scalability and flexibility that align with the growing shift toward digital prototyping. Additionally, the availability of cloud-based platforms enables remote collaboration and real-time design updates, further strengthening adoption.

Deployment Analysis

In 2024, On‑Premise segment held a dominant market position in the Optical Design Software market, capturing more than 63% share. This leadership is primarily attributed to its alignment with stringent security and data control requirements.

Organizations operating in defense, aerospace, and healthcare sectors prefer On‑Premise deployments, which provide enhanced governance over sensitive design files and intellectual property. Direct infrastructure control enables consistent performance for computation‑intensive simulations, avoiding latency complications that can occur in remote environments

For instance, In March 2025, Ansys introduced its 2025 R1 update for Ansys Optics, bringing major enhancements to its photonics design and simulation tools. The update strengthens on-premise optical design capabilities, offering more accurate and faster simulations for complex optical systems. This is especially useful for telecommunications, aerospace, and automotive industries, where secure environments and tailored solutions are critical.

Furthermore, the On‑Premise model offers robust customization capabilities, enabling organizations to tailor software configurations to specific hardware environments and internal workflows. This flexibility allows engineering teams to integrate optical design tools with proprietary systems and legacy processes, creating a cohesive ecosystem.

Application Analysis

In 2024, Imaging Systems Design segment held a dominant market position in the Optical Design Software market, capturing more than 26% share. This segment’s leadership is primarily driven by the rising demand for precision optics in applications such as medical diagnostics, surveillance, aerospace imaging, and industrial inspection.

These systems require advanced modeling tools to simulate and optimize complex lens assemblies, ensuring minimal distortion, high resolution, and reliable image output under varying operational conditions. Optical design software tailored for imaging enables engineers to accelerate development while maintaining strict quality standards.

For Instance, in September 2024, Synopsys announced a major advancement in imaging system development with the introduction of the industry’s first complete virtual prototyping platform for optical design. This platform integrates advanced imaging simulation tools, allowing engineers to design and optimize imaging systems with unprecedented accuracy and efficiency.

The segment also benefits from its role in next-generation technologies such as autonomous vehicles and augmented reality devices, where real-time imaging accuracy is essential. Designers are increasingly adopting simulation tools to develop compact optical systems capable of meeting high-speed processing requirements. With the growing emphasis on miniaturized, lightweight, and high-performance imaging modules, the Imaging Systems Design segment continues to lead the market.

End-Use Industry Analysis

In 2024, Consumer Electronics segment held a dominant market position in the Optical Design Software market, capturing more than 23%. This leadership is largely driven by the relentless growth in smartphone camera systems, wearable sensors, and display modules across global markets.

Optical design tools tailored for consumer electronics enable detailed simulation of multi-lens arrays, sensor integration, and compact form factors, thereby reducing dependence on costly physical prototypes. Such precision technology is fundamental as product designers strive to maximize performance within tight spatial constraints.

The segment’s strength is further reinforced by its alignment with immersive technologies such as augmented reality (AR) glasses and virtual reality (VR) headsets, which demand ultra-compact and high-fidelity optical systems. As reported, the explosion in consumer electronics demand has been a potent catalyst for the market’s growth, underscoring its importance in driving adoption of advanced design solutions.

For Instance, in August 2024, a Rock Health report highlighted a significant rise in the adoption of wearable technology, particularly in the form of smart rings and other personal devices. As consumer interest in wearable electronics continues to grow, optical design software plays a crucial role in optimizing the optical components used in these devices, such as sensors, displays, and cameras.

Key Market Segments

By Component

- Software

- Services

By Deployment

- On-premise

- Cloud-based

By Application

- Imaging Systems Design

- Illumination Design

- Laser Systems & Beam Propagation

- Fiber Optic & Photonic Devices

- Optomechanical Design

- Display Systems

By End-Use Industry

- Consumer Electronics

- Automotive & Transportation

- Healthcare & Medical Devices

- Aerospace & Defense

- Telecommunications

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Rising R&D Investments

The growing investment in research and development by leading companies and research institutes is significantly advancing the development of optical design software. Funding for innovation is fostering the creation of more efficient and user-friendly solutions that address the diverse needs of various industries.

This rise in R&D efforts leads to the development of advanced capabilities, including sophisticated simulations and integration with new technologies, which is driving market growth. For instance, in July 2024, Zeiss Group India announced plans to invest ₹2,500 crore in a new facility in Bangalore, aiming to strengthen its manufacturing and R&D capabilities.

This investment underscores Zeiss’s commitment to expanding its footprint in the optical and precision technology sectors. The new facility will focus on the development and production of cutting-edge optical systems, including those for industrial and consumer applications.

Restraint

High Cost and Technical Skill Barrier

Despite strong demand, one of the most persistent restraints in the market is the high cost of licensing advanced optical design software. These tools often require substantial investment not only in software but also in supporting infrastructure such as high-performance computing systems.

This restricts adoption among smaller companies, academic institutions, and startups, who may lack the capital or justification for such expenditure in early-stage development. Additionally, the steep learning curve associated with using professional-grade optical design software creates another hurdle.

These tools are complex and require a deep understanding of optical physics, system modeling, and engineering principles. Without skilled personnel, organizations cannot fully leverage the software’s capabilities, often leading to underutilization or inefficient design cycles. This barrier delays adoption and limits broader industry participation.

Opportunities

Expanding Accessibility through Cloud-Based Platforms

A key opportunity in the market lies in the growing availability of cloud-based optical design platforms. These systems offer scalable computing resources, flexible subscription models, and easy collaboration tools, making high-end optical simulation accessible to a wider range of users. By reducing the need for upfront hardware investments and providing access to remote teams, cloud platforms are opening new pathways for innovation in both established firms and emerging startups.

Moreover, cloud-based platforms often come integrated with updates, AI enhancements, and libraries of pre-built design modules. This improves ease of use and reduces onboarding time for new users. As industries seek faster and more collaborative design environments, cloud solutions offer a low-barrier alternative to traditional desktop applications.

For instance, in June 2025, 3YOURMIND’s founders introduced a new AI co-pilot for optical system design through their OPDO platform. This innovative tool leverages artificial intelligence to assist engineers in designing and optimizing optical systems more efficiently. The AI co-pilot is designed to streamline the design process, providing real-time suggestions and improving decision-making by analyzing vast datasets.

Challenges

Interoperability Between Design Tools and Manufacturing Systems

One of the ongoing challenges in the optical design software space is achieving seamless interoperability with other design and manufacturing systems. Optical design often needs to be integrated with mechanical CAD tools, electronics simulation software, and prototyping environments. However, limited compatibility, data conversion issues, and lack of standard file formats often lead to inefficiencies in handoffs between teams and departments.

This disconnect can introduce delays and errors during product development, especially when transitioning from design to production. Engineers frequently have to rework files or perform manual data translation, which adds time and complexity. As industries push toward tighter integration and digital thread continuity, resolving these interoperability issues will be critical to achieving faster, more efficient product development pipelines.

Latest Trends

Rise of AI‑Powered Optical Simulation

One of the most prominent emerging trends in the optical design software market is the increasing use of artificial intelligence and machine learning to enhance simulation accuracy and speed. AI algorithms are being integrated to automatically optimize design parameters, predict aberrations, and improve the precision of multi-element lens systems.

This trend is gaining attention as industries continue to demand more from optical systems, such as in AR/VR, LiDAR, and biomedical imaging. AI-enabled optical design software reduces time-to-market and supports real-time corrections during modeling. This approach also opens doors to generative design techniques, where the system proposes novel designs that may not have been discovered through conventional methods.

Key Players Analysis

In the Optical Design Software market, Synopsys, Inc. and Ansys (Zemax LLC) hold strong leadership due to their advanced simulation capabilities and extensive customer base. These companies are known for offering integrated photonics design environments and supporting both imaging and illumination optics. Their solutions are widely used across industries such as semiconductor manufacturing, telecommunications, and aerospace.

Lambda Research Corporation, LightTrans International, and Breault Research Organization (BRO) are recognized for their specialized tools that cater to niche segments such as non-sequential ray tracing, holographic systems, and polarization analysis. These players are gaining traction among researchers and small-to-medium enterprises that require flexible and cost-efficient optical design tools.

Optiwave Systems Inc., Photon Engineering LLC, and COMSOL Inc. contribute to the diversity of the market with their unique offerings in photonic integrated circuits, diffractive optics, and multiphysics modeling. These firms focus on interoperability with other engineering platforms and expanding cloud-based capabilities.

Top Key Players in the Market

- Synopsys, Inc.

- Zemax LLC (Ansys)

- Lambda Research Corporation

- LightTrans International

- Breault Research Organization (BRO)

- Optiwave Systems Inc.

- Ansys, Inc.

- Photon Engineering LLC

- COMSOL Inc.

- Others

Recent Developments

- In July 2024, Ansys released the 2024 R2 update for Zemax OpticStudio, introducing several enhancements designed to improve optical system design and simulation. Key features include improved performance for FFT MTF analysis, expanded support for new surfaces and objects in the Export Optical Design to Speos tool, and enhancements that streamline the workflow for optical engineers.

- In January 2024, Lambda Research Corporation introduced the latest version of TracePro, offering advanced features designed to enhance the design and simulation of optical systems. The update includes improved illumination modeling capabilities and more efficient workflows for optical engineers, allowing for faster and more accurate system optimization.

Report Scope

Report Features Description Market Value (2024) USD 1,265.9 Mn Forecast Revenue (2034) USD 2,809.9 Mn CAGR (2025-2034) 8.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Software, Services), By Deployment (On-premise, Cloud-based), By Application (Imaging Systems Design, Illumination Design, Laser Systems & Beam Propagation, Fiber Optic & Photonic Devices, Optomechanical Design, Display Systems), By End-Use Industry (Consumer Electronics, Automotive & Transportation, Healthcare & Medical Devices, Aerospace & Defense, Telecommunications, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Synopsys, Inc., Zemax LLC (Ansys), Lambda Research Corporation, LightTrans International, Breault Research Organization (BRO), Optiwave Systems Inc., Ansys, Inc., Photon Engineering LLC, COMSOL Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Optical Design Software MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Optical Design Software MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Synopsys, Inc.

- Zemax LLC (Ansys)

- Lambda Research Corporation

- LightTrans International

- Breault Research Organization (BRO)

- Optiwave Systems Inc.

- Ansys, Inc.

- Photon Engineering LLC

- COMSOL Inc.

- Others