Oncology Market Size By Cancer Diagnostics (Cancer Diagnostics, Tumor Biomarker Test, Imaging, Biopsy), and Cancer Treatment (Chemotherapy, Targeted Therapy, Immunotherapy), By End-use (Hospitals, Diagnostic Laboratories, Diagnostic Imaging Centers), COVID-19 Impact Analysis, Regional Outlook, Application Potential, Price Trends, Competitive Market Share & Forecast, 2023 – 2032

- Published date: Sep 2024

- Report ID: 96666

- Number of Pages: 394

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

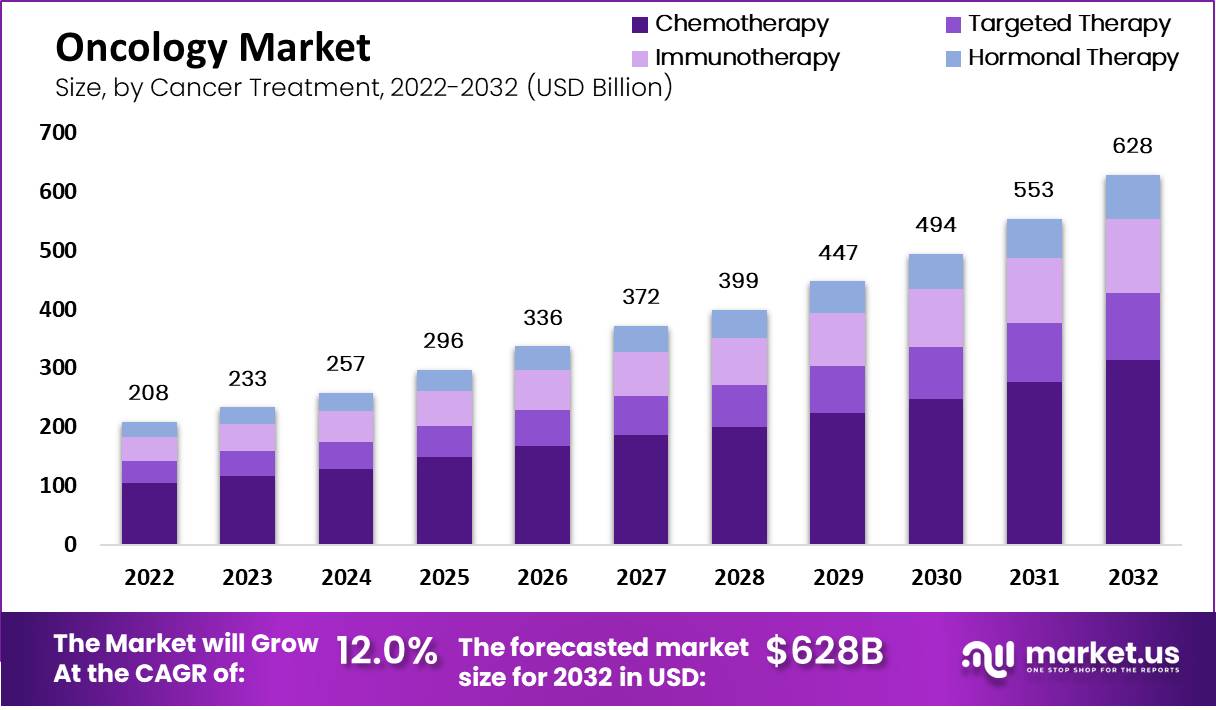

The Oncology Market size is expected to be worth around USD 628 Billion by 2032 from USD 208 Billion in 2022, growing at a CAGR of 12% during the forecast period from 2022 to 2032.

During the forecast period, major factors such as an increase in healthcare expenditure, an increase in cancer prevalence and incidence, a surge in technological advancements in cancer treatment, and the introduction of novel products are anticipated to boost the market growth.

Key Takeaways

- The global oncology market was valued at USD 208 billion in 2022.

- It is projected to reach USD 628 billion by 2032.

- The oncology market is expected to grow at a CAGR of 12% over the next decade.

- Europe held a 24.1% revenue share in the oncology market in 2022.

- In 2022, the North America region dominated the oncology market.

- The prevalence of cancer is increasing worldwide due to population growth and lifestyle changes.

- Technological advancements like AI detectors and liquid biopsy techniques are contributing to market growth.

- Pharmaceutical and biotechnology companies are investing heavily in research and development for cancer treatments.

- Governments are providing financial support for cancer immunotherapy research.

- High treatment costs are a barrier to cancer care in developing countries.

- AI-based cancer detection systems are a recent trend in the oncology market.

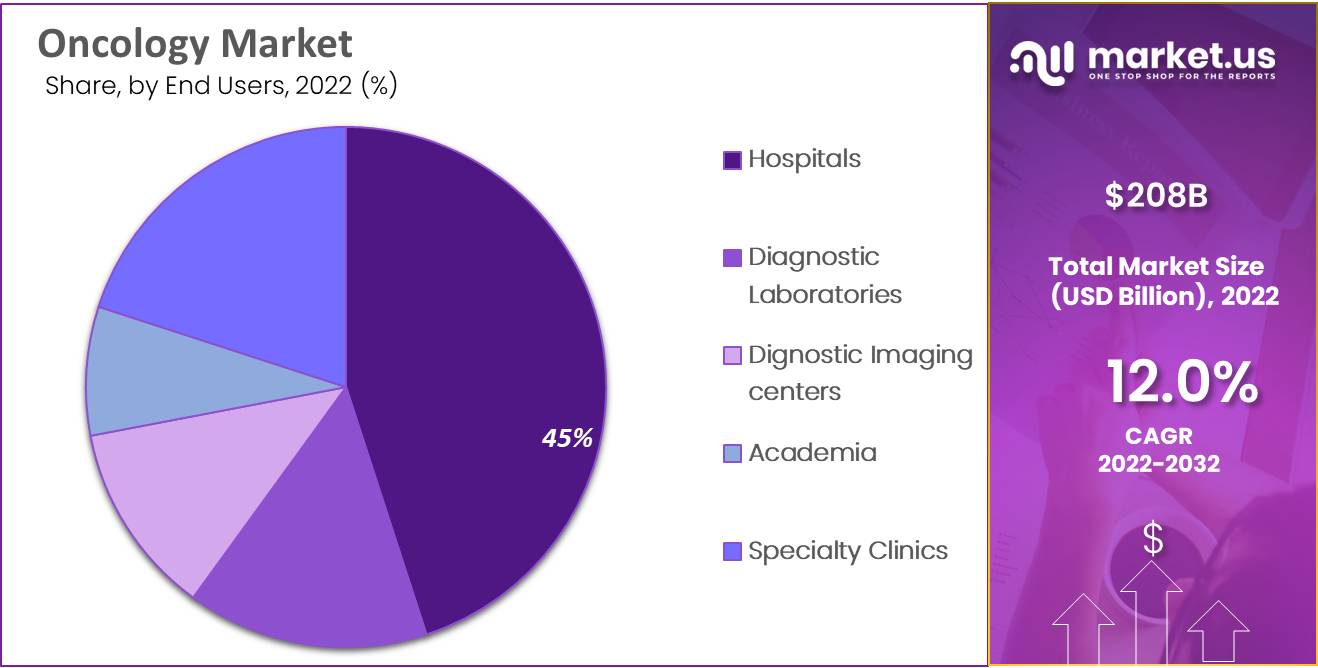

- Hospitals hold the majority share of the global oncology market among end-users.

- The oncology market in North America is driven by advanced healthcare infrastructure and awareness.

- Latin America and MEA have moderate growth rates in the global oncology market.

Cancer Diagnostics & Treatment

The use of in vitro diagnostic testing segment is growing at the fastest rate.

Imaging Testing, Biomarkers Testing, In Vitro Diagnostic Testing, and Biopsy, among other types, have been included in the cancer diagnostics segment market by type.

Due to factors such as the growing use of in-vitro diagnostics, the in vitro diagnostic testing segment is anticipated to grow at the fastest rate during the forecast period of 2022-2030 and this segment dominated market growth.

The key players in the industry are introducing an increasing number of in vitro diagnostics products, which are expanding the market. This market is divided into instrument-based tests, laboratory tests, and liquid biopsies according to the type of test.

Cancer Treatment

Targeted therapy is being replaced by traditional chemotherapy because of its low toxicity and ability to specifically target cancer cells without harming normal cells.

The cancer treatment segment sector held a rough share of the oncology market. This is because more and more people around the world are using traditional chemotherapy and immunotherapy to treat cancer.

When compared to conventional chemotherapy, targeted therapy and immunotherapy are more convenient, more effective, and have fewer side effects. As a result, more people are turning to them for treatment.

The cancer treatment market is experiencing significant expansion due to the targeted therapy’s low toxicity and its ability to specifically target cancer cells without harming normal cells.

In addition, the global demand for these cancer treatments is being fueled by the growing public’s awareness of the advantages of targeted therapy, hormonal therapy, and immunotherapy.

End-User Analysis

The hospital segment holds the majority of the global market for cancer diagnostics.

Cancer diagnostics market data segment the market into Diagnostic Centers, Hospitals and Clinics, Research Institutes, and others based on end-users. the hospitals and clinics sector dominated the market and is anticipated to expand at a faster annual growth rate during the forecast period of 2022-2030.

Increased awareness of personalized medicine, an increase in readily available healthcare services, and strategic initiatives are all contributing to the segment’s expansion. For instance, in order to establish a nationwide, integrated cancer research and treatment system, the City of Hope purchased Cancer Treatment Centers of America in December 2021 for USD 390 million.

The market is divided into hospitals, diagnostic laboratories, and other end users based on end-users. It is anticipated that hospitals will continue to hold the largest revenue share of the global market for the cancer diagnostics segment.

Because of their superior staff and cutting-edge technology, hospitals are widely regarded as the preferred choice for cancer diagnostics. Hospitals have the expertise to carry out the most precise tests because cancer diagnosis is a highly specialized field.

Hospitals are where the majority of cancer treatments are performed, and patients frequently seek treatment there first. Hospitals can provide comprehensive care for patients and have the resources to deal with any kind of cancer. In addition, rising costs associated with cancer in developed nations like the United States and the United Kingdom are enhancing market expansion.

Key Market Segments

Based on Cancer Diagnostics

- Tumor Biomarker Test

- Imaging

- Biopsy

- Liquid Biopsy

- Immunohistochemistry

- In situ Hybridization

Based on Cancer Treatment

- Chemotherapy

- Targeted Therapy

- Immunotherapy

- Hormonal Therapy

Based on End-User

- Hospitals

- Diagnostic Laboratories

- Diagnostic Imaging Centers

- Academia

- Specialty Clinics

Drivers

Rising prevalence of cancer

Cancer has a significant social impact all over the world. One of the leading causes of death worldwide, it is more common in developed than in developing markets. The alarming pattern of rising cancer rates is urging healthcare providers for innovative oncology diagnostics and to place a greater emphasis on prevention.

This would necessitate cancer diagnostics that are not only specific and sensitive but also capable of early detection and treatment. Due to the rising incidence of various cancers worldwide, it is anticipated that the global market for cancer diagnostics will expand rapidly during the forecast period.

Restraints

Lack of cancer awareness

Lack of cancer awareness leads to late detection of cancer which results in late diagnosis of cancer. When symptoms first appear, people are more likely to seek treatment, making early detection of cancer challenging. Most of the time, cancer doesn’t show any symptoms until it has spread far enough to cause infectious diseases and health issues.

As a result, many cancer patients are diagnosed too late, when it is already too late to treat them. The majority of people in developing countries find that the method of diagnosing cancer is expensive, so they try to avoid getting it early to save money.

The diagnosis can cost as much as $25,000 annually on average Opportunity. It takes a long time for advanced cancer drugs to be approved and the high capital costs associated with R&D are the primary barriers to entry and long-term development in the market.

Trends

The Liquid Biopsies segment propels the market growth for cancer diagnostics.

The introduction of liquid biopsies, one of the most significant market trend analyses for cancer diagnostics, is anticipated to drive market expansion during the forecast period.

Liquid biopsy techniques are frequently substituted for surgical biopsy procedures because they are non-invasive. Liquid biopsy is now possible because advances in genome sequencing have made it possible for scientists to detect changes in the genetic structure of cancer using blood samples.

Lung, prostate, and breast cancers currently comprise the majority of early liquid biopsy research. However, it is anticipated that the expanding reach of technology will also have a significant impact on other types of cancer.

Another recent addition to the cancer diagnostics market is the AI-based cancer detection system. By identifying tumors in their earliest stages, AI contributes to improving the accuracy of image identification in diagnostic procedures like the diagnosis of breast cancer and lung cancer.

Additionally, AI improves the accuracy of lung cancer detection by reducing false positives during screening. A reliable method for self-assessing lymph node biopsies was developed by researchers at the Naval Medical Centre San Diego and Google AI, the company’s AI research arm, using cancer-detecting algorithms.

The use of AI resulted in a 99 percent increase in metastatic breast cancer detection accuracy. However, in the not-too-distant future, a market expansion for cancer diagnostics will be sparked by expanding government efforts to raise awareness of the benefits of early diagnosis.

In developing and underdeveloped regions, cancer diagnostics products are less widely available and less well-known. In an effort to improve this, both government and non-governmental organizations are conducting cancer awareness campaigns to educate the public about the significance of early diagnosis.

As a result, it is anticipated that this aspect will accelerate the revenue growth of the cancer diagnostics market and cancer drugs market growth.

Regional Analysis

North America holds the highest share of the oncology market.

In 2022, North America held a dominant market position, capturing more than a 40.5% share and holds US$ 84.2 Billion market value for the year. The increased cancer incidence in major markets like the United States is to blame for this.

Over 1.8 million new cases of cancer and 6,06,520 deaths were reported in the United States in 2020, according to the American Cancer Society. Lung cancer, colorectal cancer, breast cancer, and prostate cancer are the most common types of cancer in North America.

Due to the presence of established healthcare infrastructure and rising healthcare expenditure, it is anticipated that the North American oncology market will maintain its significance. Since 1991, approximately 29% fewer people have died from cancer as a result of the increased use of oncology treatments in the United States.

During the forecast period, Europe is anticipated to be the most opportunistic market. The increasing technological advancements in the diagnosis of various cancer conditions are to blame for this. In addition, it is anticipated that the rising incidence of cancer and the rising number of cancer-related deaths will support the expansion of the European oncology market in the coming years.

The European Commission estimates that there were approximately 2.7 million new cases of cancer and approximately 1.3 million deaths from cancer in 2022. Asia Pacific is expected to see the fastest CAGR at 7.4% over the forecast period. This is due to an increasing patient pool that allows for easy recruitment.

Asia Pacific’s most experienced biotech CRO, “Novotech”, says that the region is a popular destination for clinical trials due to its lower trial density and a large number of active investigators. This region is increasingly being sought after by biotechnology companies looking for CRO services in oncology.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The innovative product offerings of major key players and the entry of new players have both contributed to the rapid cancer drugs market growth. IBM, Azra AI, Siemens Healthineers, GE Healthcare, Intel, NVIDIA, Digital Diagnostics Inc., and Concert are some of the leading players in the global market for artificial intelligence in the oncology field.

AI, Path AI, and Median Technologies Intel and the University of Pennsylvania’s Perelman School of Medicine collaborated to develop an AI model that aids in the identification of brain tumors.

This tool will be developed by Penn Medicine and 29 international organizations using the privacy-preserving method of federated learning. All organizations will be able to work with the AI model and train it without having to share sensitive patient data thanks to this tool.

To increase their market share and provide users with cutting-edge AI solutions, major market players have joined forces. Over the forecast period, it is anticipated that this will boost growth.

Imagia Cybernetics, a provider of AI-based healthcare, and Canexia Health, a pioneer in oncology that simplifies cancer genomic information, announced their merger.

The market’s expansion is significantly aided by various development strategies like mergers, partnerships, acquisitions, and collaborations.

The major players in the market are working together for research and development and investing a lot of money in oncology to develop cutting-edge oncology diagnostics and treatments.

By introducing cutting-edge oncology solutions, these market players are working hard to take advantage of the current market opportunities.

Market Key Players

- Aegerion Pharmaceuticals Inc.

- Abbvie Inc.

- Aslan Pharmaceuticals Ltd.

- Amgen Inc.

- Acadia Pharmaceuticals Inc.

- Astrazeneca

- Athenex Inc.

- Takeda Oncology

- Aspen Pharmacare Holdings Limited.

- Ability Pharma

- Other key players

Recent Developments

- In November 2023: AbbVie announced the acquisition of ImmunoGen, including its flagship cancer therapy, ELAHERE® (mirvetuximab soravtansine-gynx). This acquisition aims to expand AbbVie’s portfolio in solid tumors and specifically targets folate receptor-alpha positive, platinum-resistant epithelial ovarian, fallopian tube, or primary peritoneal cancer. The financial terms of the deal were not disclosed, but the acquisition is expected to enhance AbbVie’s oncology pipeline significantly.

- In June 2023: Aslan Pharmaceuticals entered into a strategic licensing agreement with Zenyaku Kogyo, a Japanese pharmaceutical company, for the development and commercialization of eblasakimab in Japan. This agreement includes an upfront payment of $12 million to Aslan, with the potential to receive up to an additional $123.5 million based on achieving certain development and commercial milestones. Zenyaku Kogyo will initiate a Phase 1 study of eblasakimab in Japan in the first half of 2024, targeting atopic dermatitis and other indications.

- In May 2023: Aegerion Pharmaceuticals was acquired by Amryt Pharma in a transaction valued at $190.7 million. This acquisition was part of a strategic move by Amryt to broaden its portfolio in the rare disease and oncology sectors, particularly incorporating Aegerion’s product, Myalept, used for generalized lipodystrophy. This condition is relevant in oncology due to its implications in metabolic disorders associated with cancer.

Report Scope

Report Features Description Market Value (2022) USD 208 Billion Forecast Revenue (2032) USD 628 Billion CAGR (2023-2032) 12% Base Year for Estimation 2022 Historic Period 2019-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Cancer Diagnostic Type-Tumor Biomarker Test, Imaging, Biopsy, Liquid Biopsy, Immunohistochemistry, In Situ Hybridization and others; By Cancer Treatment Type- Chemotherapy, Targeted Therapy, Immunotherapy, Hormonal Therapy and others; By End-User- Hospitals, Diagnostic Laboratories, Diagnostic Imaging Centers, Academia, Specialty Clinics and others. Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Aegerion Pharmaceuticals Inc., Abbvie Inc., Ability Pharma, Acadia Pharmaceuticals Inc., Amgen Inc.,Takeda Oncology, Aslan Pharmaceuticals Ltd.,Aspen Pharmacare Holdings Limited, Astrazeneca, Athenex Inc and Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Aegerion Pharmaceuticals Inc.

- Abbvie Inc.

- Aslan Pharmaceuticals Ltd.

- Amgen Inc.

- Acadia Pharmaceuticals Inc.

- Astrazeneca

- Athenex Inc.

- Takeda Oncology

- Aspen Pharmacare Holdings Limited.

- Ability Pharma

- Other key players