Global Oilseeds Processing Market Size, Share, And Industry Analysis Report By Type (Soybean Processing, Rapeseed and Canola Processing, Sunflower Seed Processing, Palm Kernel Processing, Cottonseed Processing), By Process Type (Solvent Extraction, Mechanical Pressing, Hydraulic Pressing, Enzyme-Assisted Extraction), By Application (Food Industry, Feed Industry, Biofuel Industry), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 174309

- Number of Pages: 237

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

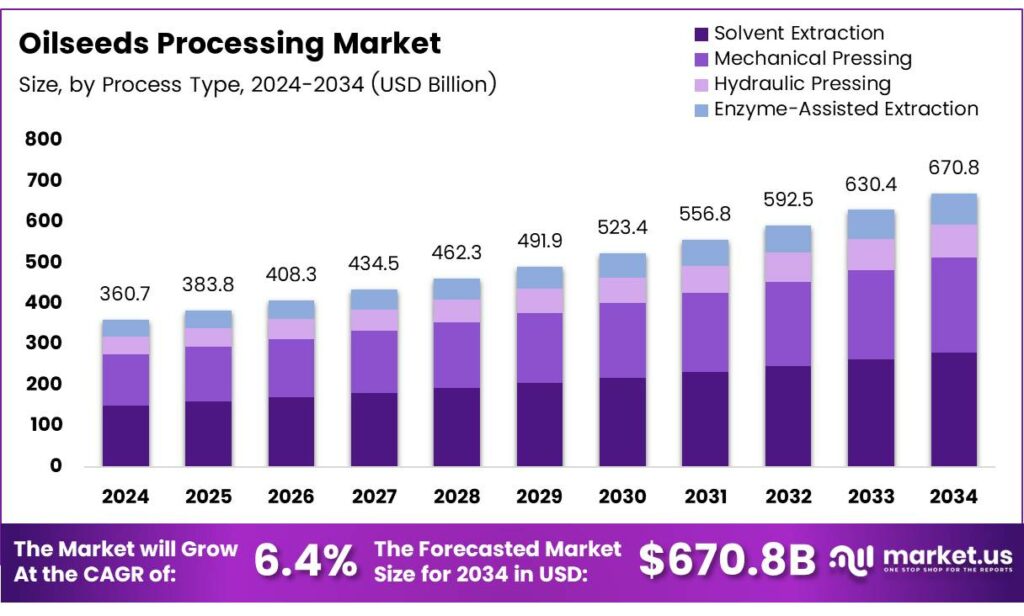

The Global Oilseeds Processing Market size is expected to be worth around USD 670.8 billion by 2034, from USD 360.7 billion in 2024, growing at a CAGR of 6.4% during the forecast period from 2025 to 2034.

The Oilseeds Processing Market can be clearly defined as the organized system that converts raw oilseeds into edible oils, industrial oils, and protein-rich meals. This market includes cleaning, drying, storage, crushing, solvent extraction, and refining. Importantly, it supports food security, feed demand, biofuel blending, and value-added agri-processing across global agricultural economies.

Oilseed processing has benefited from rising edible oil consumption, expanding livestock feed demand, and increasing use of oilseed derivatives in food ingredients and biodiesel. The global oilseeds sector has expanded at 4.1% annually over the past three decades, outpacing overall agriculture and livestock growth, reflecting structural demand resilience and processing investments.

- Oilseeds remain the backbone of rain-fed agriculture, cultivated across nearly 26 million hectares. Efficient processing is critical to reduce post-harvest losses, especially as soybean contributes 34%, groundnut 27%, and rapeseed & mustard 27%, together accounting for over 88% of total oilseed output.

Processing efficiency strongly affects oil recovery and meal quality. Oilseeds stored at 8–10% moisture retain quality for longer periods, while poor handling accelerates oxidation, respiration, and heat buildup, raising economic losses for processors and cooperatives. Damaged or high-moisture seeds deteriorate faster and reduce overall processing yields.

Quality deterioration is measurable through carbon dioxide release. Sound seeds emit under 10 cc/g/day, whereas damaged seeds release 50 cc/g/day or more. Moisture levels above 14–15% speed microbial activity and oil splitting, increasing free fatty acids beyond the natural 0.5%. Governments and processors increasingly invest in modern storage, drying, aeration, and rapid crushing infrastructure to protect value.

Key Takeaways

- The Global Oilseeds Processing Market is projected to grow from USD 360.7 billion in 2024 to USD 670.8 billion by 2034, registering a 6.4% CAGR during 2025–2034.

- Soybean Processing dominates the By Type segment with a leading market share of 54.2%, supported by strong edible oil and protein meal demand.

- Solvent Extraction leads the By Process Type segment, accounting for a dominant 61.8% share due to higher oil recovery efficiency.

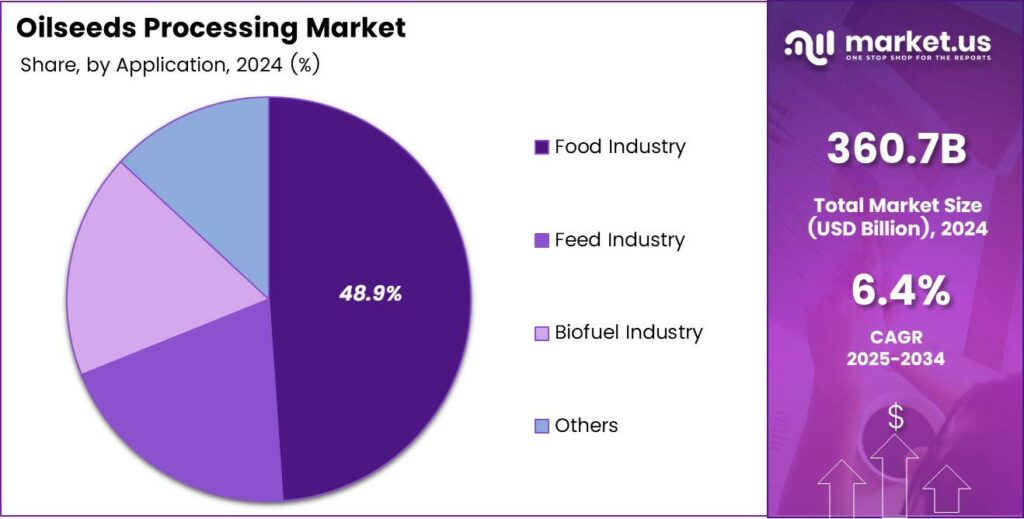

- The Food Industry is the largest application segment, holding a market share of 48.9% driven by rising edible oil consumption.

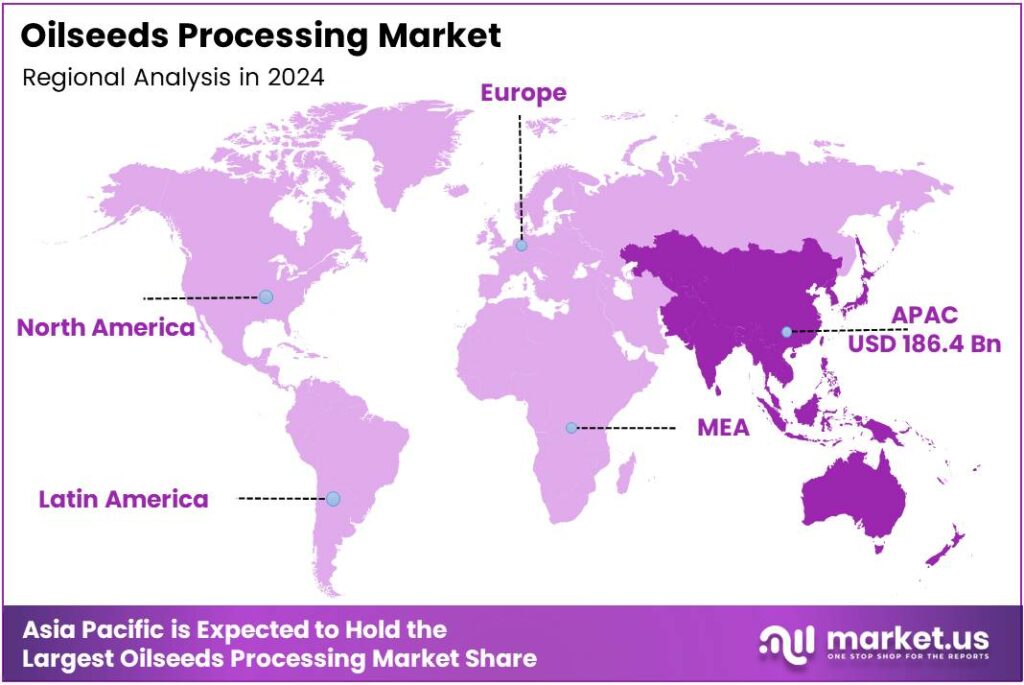

- Asia Pacific is the leading regional market, capturing a 51.7% share and reaching a market value of USD 186.4 billion.

By Type Analysis

Soybean Processing dominates with 54.2% due to its wide cultivation base, strong demand for edible oil, and high protein meal usage.

In 2025, Soybean Processing held a dominant market position in the By Type Analysis segment of the Oilseeds Processing Market, with a 54.2% share. It benefits from efficient crushing infrastructure, stable farmer supply, and strong demand from food and feed sectors. Moreover, soybean oil’s versatility supports consistent industrial and household consumption.

Rapeseed and Canola Processing play a vital role due to their balanced oil profile and growing preference in premium edible oils. Additionally, its lower saturated fat content supports demand in health-focused food applications, while stable yields encourage steady processing investments.

Sunflower Seed Processing continues to expand as consumers prefer light-tasting oils with clean-label appeal. Furthermore, sunflower oil’s usage in snacks and packaged foods supports consistent processing volumes across emerging and developed markets.

Palm Kernel Processing remains important for industrial fats and specialty food ingredients. However, sustainability concerns and sourcing regulations influence processing growth, encouraging gradual efficiency improvements rather than rapid capacity expansion.

By Process Type Analysis

Solvent Extraction dominates with 61.8% due to its higher oil recovery efficiency and suitability for large-scale processing.

In 2025, Solvent Extraction held a dominant market position in the By Process Type Analysis segment of the Oilseeds Processing Market, with a 61.8% share. This method enables maximum oil yield, making it cost-effective for high-volume processors and supporting consistent output for food and industrial uses.

Mechanical pressing remains relevant for small to mid-scale processors due to its simpler operation and lower capital needs. Additionally, it supports demand for minimally processed oils in certain regional and specialty markets. Hydraulic Pressing is used in limited applications where gentle extraction is required.

Although slower, it helps preserve oil quality, making it suitable for specific premium or traditional oilseed processing needs. Enzyme-Assisted Extraction is gaining attention for improving yield and sustainability. However, its adoption remains gradual due to higher process complexity and the need for technical expertise.

By Application Analysis

Food Industry dominates with 48.9% driven by rising edible oil consumption and processed food demand.

In 2025, the Food Industry held a dominant market position in the By Application Analysis segment of the Oilseeds Processing Market, with a 48.9% share. Growing urbanization, packaged food consumption, and consistent household demand support stable oilseed processing volumes.

Feed Industry represents a critical application, utilizing oilseed meals as protein-rich animal nutrition inputs. Moreover, the livestock and poultry sector growth ensures steady demand for processed oilseed by-products. The Biofuel Industry continues to use oilseeds as feedstock for biodiesel production.

Although policy-driven, this application supports diversification of oilseed processing revenue streams. Others include cosmetics, oleochemicals, and industrial uses that consume smaller volumes. Nevertheless, these applications add value by supporting niche demand and specialty product development.

Key Market Segments

By Type

- Soybean Processing

- Rapeseed and Canola Processing

- Sunflower Seed Processing

- Palm Kernel Processing

- Cottonseed Processing

- Others

By Process Type

- Solvent Extraction

- Mechanical Pressing

- Hydraulic Pressing

- Enzyme-Assisted Extraction

By Application

- Food Industry

- Feed Industry

- Biofuel Industry

- Others

Emerging Trends

Technology Adoption Shapes Modern Oilseed Processing

One key trend in the oilseeds processing market is the adoption of advanced processing technologies. Enzyme-assisted extraction, energy-efficient presses, and solvent recovery systems help improve oil yield and reduce operating costs. Sustainability-focused processing is another important trend.

- Companies are investing in water recycling, waste utilization, and lower-emission operations to meet environmental standards and customer expectations. FEDIOL members report processing 40.6 million tons of oilseeds, representing 86% of the EU oilseed crush, so when documentation requirements tighten, a very large processing base must adapt quickly.

Digitalization is also gaining momentum. Process automation, real-time monitoring, and data analytics help improve efficiency, reduce downtime, and ensure consistent product quality across processing plants. Traceability and clean-label trends are influencing processing strategies. Food manufacturers and consumers increasingly demand transparency in sourcing and processing.

Drivers

Rising Demand for Edible Oils Drives Market Growth

The oilseeds processing market is mainly driven by the steady rise in global edible oil consumption. Growing populations, urban living, and changing food habits are increasing the daily use of soybean, sunflower, rapeseed, and palm oils. Processors are expanding, crushing, and refining capacity to meet food industry needs.

- Oilseed meals such as soybean meal and rapeseed meal are rich in protein and are widely used in poultry, dairy, and aquaculture feed. The International Grains Council has flagged global soybean consumption reaching a record 430 million tons (forecast), showing how quickly demand can absorb supply and keep processors active across regions.

Government support also plays an important role. Many countries promote domestic oilseed production to reduce edible oil imports. Minimum support prices, input subsidies, and investments in processing infrastructure encourage farmers and processors to increase output.

Restraints

Price Volatility and Supply Risks Limit Market Expansion

One major restraint in the oilseeds processing market is raw material price volatility. Oilseed prices depend heavily on weather conditions, crop yields, and global trade flows. Sudden price changes reduce profit margins for processors and increase operational risk.

- The FAO reported the Vegetable Oil Price Index averaging 164.6 points in December, and separate FAO reporting showed vegetable-oil prices rising 17.1% over the year—moves that can create sharp swings in working capital needs, hedging costs, and buyer contract behavior.

Supply uncertainty is another challenge. Many oilseeds are grown under rain-fed conditions, making production highly sensitive to climate change. Droughts, floods, and temperature shifts can disrupt consistent supply to processing plants. High energy and logistics costs also limit market growth. Oilseed crushing and refining require significant power and water usage.

Growth Factors

Value-Added Products Create Strong Growth Opportunities

The oilseeds processing market offers strong opportunities through value-added products. Demand for refined, fortified, and specialty edible oils is rising among health-conscious consumers. This encourages processors to invest in advanced refining and blending technologies.

Growth in plant-based food products creates another major opportunity. Oilseed derivatives such as soy protein, lecithin, and textured vegetable protein are widely used in meat alternatives and functional foods. This expands revenue beyond basic oil extraction.

Export opportunities are also increasing. Countries with strong processing capacity can export oils, meals, and by-products to regions facing supply shortages. Improved port infrastructure and trade agreements support this trend. Increasing use of oilseed by-products in bio-based chemicals, lubricants, and renewable materials opens new revenue streams.

Regional Analysis

Asia Pacific Dominates the Oilseeds Processing Market with a Market Share of 51.7%, Valued at USD 186.4 Billion

Asia Pacific leads the global oilseeds processing market, accounting for a dominant 51.7% share and reaching a market value of USD 186.4 billion. This leadership is supported by large-scale soybean, palm, and rapeseed processing activities, along with strong domestic consumption of edible oils. Rapid population growth, rising food demand, and expanding livestock feed usage continue to strengthen regional processing capacity.

North America represents a mature and well-structured oilseed processing market, driven by high soybean crushing volumes and advanced processing technologies. Strong demand from food manufacturing, biofuel production, and animal nutrition supports stable capacity utilization. The region benefits from efficient supply chains and consistent farm productivity.

Europe’s oilseed processing market is shaped by growing demand for sustainable edible oils and protein-rich animal feed. Rapeseed and sunflower seed processing play a central role due to regional crop preferences. Environmental regulations encourage efficient processing and by-product utilization. Increasing demand for non-GMO and traceable oilseed products also influences processing strategies.

Latin America shows steady growth in oilseed processing, supported by abundant soybean production and export-oriented crushing activities. The region plays an important role in supplying processed oils and meals to global markets. Expansion of agricultural land and improvements in logistics enhance processing efficiency. Demand from both domestic food sectors and international trade continues to support market development.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Archer Daniels Midland Company remains a bellwether for large-scale oilseed crushing and origination in 2024, with a footprint that helps balance supply swings between North and South America. Its strength is the ability to connect farm-gate sourcing with integrated processing and downstream food, feed, and industrial customers. ADM’s edge is operational flexibility, shifting crush mix and logistics routes when margins move.

Bunge Limited is viewed as a highly margin-sensitive, execution-led processor that performs best when it tightens procurement discipline and optimizes plant utilization across key soybean and softseed corridors. In 2024, its core advantage is the breadth of export and merchandising links that can unlock value beyond basic crushing. Bunge’s ability to manage basis risk and freight costs, since these can make or break quarterly performance.

Cargill continues to set the pace on scale, risk management, and customer coverage, especially where demand for edible oils, meal, and bio-based inputs stays resilient. Its processing strength is supported by deep logistics and trading capabilities, which can protect throughput even during volatile crop years. In 2024, the company’s integrated model keeps it competitive in both commodity and value-added segments.

Wilmar International Ltd is strategically positioned in Asia’s consumption-driven markets, where refining, specialty fats, and food manufacturing links create a steady pull for processed oils. Wilmar’s integrated “plantation-to-consumer” approach is a buffer against pure crush-margin volatility. Its regional diversification and downstream reach remain key to smoothing earnings across cycles.

Top Key Players in the Market

- Archer Daniels Midland Company

- Bunge Limited

- Cargill

- Wilmar International Ltd

- Richardson International Limited

- Louis Dreyfus Company (LDC)

- Ag Processing Inc (AGP)

- GrainCorp Limited

- Olam Agri

- COFCO International

Recent Developments

- In 2025, ADM announced a joint venture with Planters Cotton Oil Mill for cottonseed processing, contributing its Memphis facility. ADM exceeded the regenerative agriculture acreage goal a year early, including oilseeds. ADM formed a joint venture with PYCO Industries for cottonseed processing in Lubbock, Texas, contributing facilities.

- In 2025, Bunge reported Q3 2025 results with strong Soybean and Softseed Processing & Refining performance, driven by higher margins and Viterra integration. Viterra merger aligned reporting around oilseeds value chains, including Soybean, Softseed, and Other Oilseeds Processing & Refining.

Report Scope

Report Features Description Market Value (2024) USD 360.7 Billion Forecast Revenue (2034) USD 670.8 Billion CAGR (2025-2034) 6.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Soybean Processing, Rapeseed and Canola Processing, Sunflower Seed Processing, Palm Kernel Processing, Cottonseed Processing, Others), By Process Type (Solvent Extraction, Mechanical Pressing, Hydraulic Pressing, Enzyme-Assisted Extraction), By Application (Food Industry, Feed Industry, Biofuel Industry, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Archer Daniels Midland Company, Bunge Limited, Cargill, Wilmar International Ltd, Richardson International Limited, Louis Dreyfus Company (LDC), Ag Processing Inc (AGP), GrainCorp Limited, Olam Agri, COFCO International Customization Scope Customization for segments and region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Oilseeds Processing MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample

Oilseeds Processing MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Archer Daniels Midland Company

- Bunge Limited

- Cargill

- Wilmar International Ltd

- Richardson International Limited

- Louis Dreyfus Company (LDC)

- Ag Processing Inc (AGP)

- GrainCorp Limited

- Olam Agri

- COFCO International