Global Nuclear Medicine Equipment Market By Product Type (SPECT, Planar scintigraphy systems and PET), By Application (Cardiology, Oncology, Neurology and General imaging), By End-user (Hospital, Diagnostic imaging centers and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2026

- Report ID: 176789

- Number of Pages: 390

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

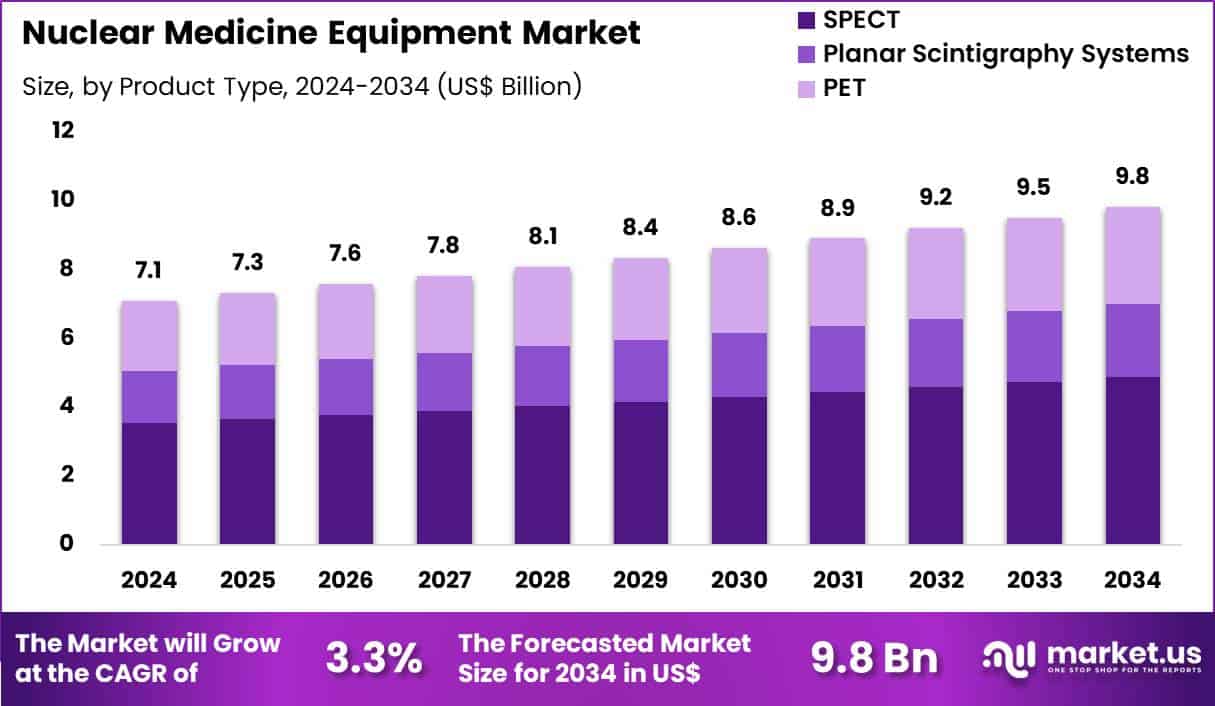

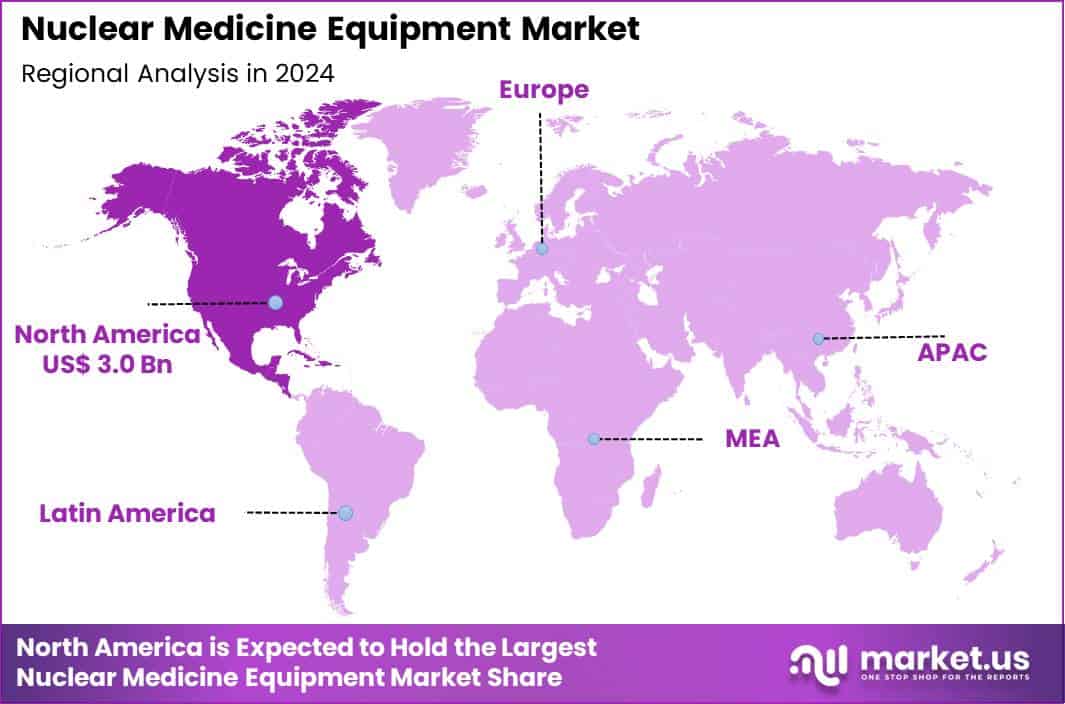

Global Nuclear Medicine Equipment Market size is expected to be worth around US$ 9.8 Billion by 2034 from US$ 7.1 Billion in 2024, growing at a CAGR of 3.3% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 42.2% share with a revenue of US$ 3.0 Billion.

Increasing prevalence of chronic diseases such as cancer and cardiovascular disorders propels the nuclear medicine equipment market as clinicians demand advanced imaging systems that deliver precise molecular and functional diagnostics. Nuclear medicine specialists increasingly utilize positron emission tomography scanners to detect metabolic changes in tumors, enabling early staging of breast, lung, and lymphoma cancers for tailored treatment plans.

These devices support myocardial perfusion imaging with single-photon emission computed tomography, assessing coronary artery disease by visualizing blood flow deficits during stress tests. Radiologists apply gamma cameras for bone scintigraphy, identifying metastatic spread in prostate and breast cancer patients through radiotracer uptake patterns.

Hybrid PET/CT systems facilitate comprehensive evaluations in neurology, mapping amyloid deposits in Alzheimer’s disease to guide therapeutic decisions. Theranostic applications integrate diagnostic imaging with targeted radionuclide therapy, where equipment like SPECT/CT monitors iodine-131 distribution in thyroid cancer ablation.

Manufacturers pursue opportunities to develop AI-enhanced reconstruction algorithms that improve image resolution and reduce scan times, expanding applications in pediatric oncology where lower radiation doses remain critical.

Developers advance portable gamma probes for intraoperative sentinel lymph node mapping, broadening utility in breast and melanoma surgeries with real-time guidance. These innovations facilitate hybrid modalities combining nuclear imaging with MRI, enhancing soft-tissue contrast for brain tumor delineation and epilepsy focus localization.

Opportunities emerge in sustainable tracer production systems that minimize isotope waste while supporting high-volume cardiac and oncologic scans. Companies invest in cloud-based data platforms for collaborative image analysis, accelerating research into novel radiopharmaceuticals. Recent trends emphasize personalized dosimetry tools that optimize therapeutic radionuclide doses, positioning nuclear medicine equipment as essential for value-based care in oncology and cardiology.

Key Takeaways

- In 2024, the market generated a revenue of US$ 7.1 Billion, with a CAGR of 3.3%, and is expected to reach US$ 9.8 Billion by the year 2034.

- The product type segment is divided into SPECT, planar scintigraphy systems and PET, with SPECT taking the lead with a market share of 49.8%.

- Considering application, the market is divided into cardiology, oncology, neurology and general imaging. Among these, cardiology held a significant share of 41.2%.

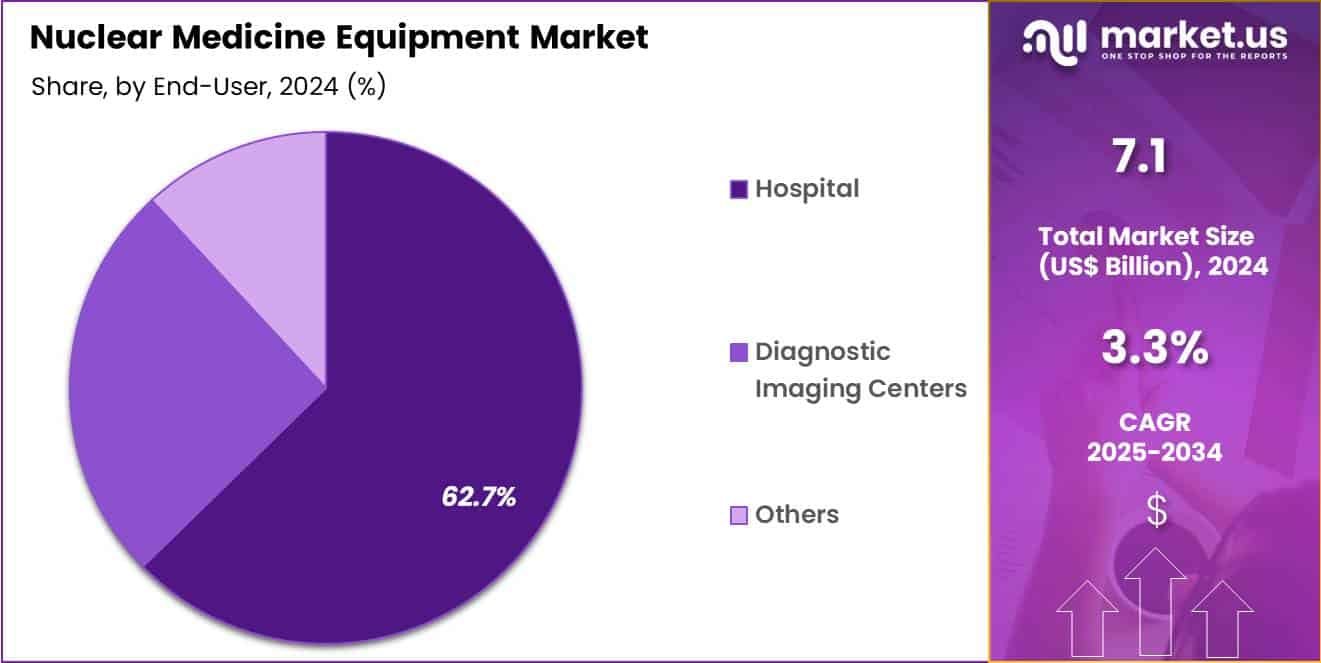

- Furthermore, concerning the end-user segment, the market is segregated into hospital, diagnostic imaging centers and others. The hospital sector stands out as the dominant player, holding the largest revenue share of 62.7% in the market.

- North America led the market by securing a market share of 42.2%.

Product Type Analysis

SPECT contributed 49.8% of growth within product type and led the nuclear medicine equipment market due to its strong clinical adoption, cost efficiency, and broad diagnostic applicability. Hospitals rely on SPECT systems for functional imaging across cardiology, oncology, and neurology because they support high patient throughput and established radiotracer protocols.

The modality integrates well with existing nuclear medicine infrastructure, which encourages upgrades rather than complete technology shifts. Widespread physician familiarity and long-standing clinical validation reinforce routine utilization across healthcare settings.

Growth strengthens as manufacturers enhance detector sensitivity and image reconstruction software, improving diagnostic accuracy. Hybrid SPECT systems expand clinical utility and workflow efficiency. Emerging markets favor SPECT due to lower acquisition and operating costs compared to PET.

Reimbursement stability further supports sustained demand. The segment is expected to remain dominant as healthcare providers continue to prioritize accessible and reliable functional imaging solutions.

Application Analysis

Cardiology generated 41.2% of growth within application and emerged as the leading segment due to the high prevalence of cardiovascular disease and the central role of nuclear imaging in cardiac assessment. SPECT myocardial perfusion imaging supports diagnosis of coronary artery disease, risk stratification, and treatment planning.

Clinicians depend on functional cardiac imaging to evaluate ischemia and myocardial viability with high clinical confidence. Increasing demand for non-invasive cardiac diagnostics strengthens utilization across hospitals.

Growth accelerates as aging populations drive higher cardiac care volumes. Preventive cardiology programs emphasize early detection of perfusion abnormalities. Integration of nuclear imaging into cardiac care pathways increases repeat testing. Technological advancements reduce scan time and improve patient comfort. The segment is projected to maintain leadership as cardiovascular disease management continues to rely on advanced functional imaging.

End-User Analysis

Hospitals accounted for 62.7% of growth within end-user and dominated the nuclear medicine equipment market due to their comprehensive diagnostic capabilities and high patient inflow. Hospitals manage complex cardiac, oncological, and neurological cases that require integrated imaging services and specialized expertise.

Availability of radiopharmacy facilities and multidisciplinary teams strengthens hospital-based adoption. Capital investment capacity supports procurement and upgrade of advanced nuclear medicine systems. Growth continues as hospitals expand specialized service lines and invest in diagnostic infrastructure.

Accreditation requirements and clinical guidelines reinforce routine imaging utilization. Teaching hospitals further drive demand through research and training activities. Referral concentration favors hospital settings for advanced nuclear diagnostics. The segment is anticipated to remain the primary growth driver as hospitals continue to anchor nuclear medicine service delivery.

Key Market Segments

By Product Type

- SPECT

- Planar scintigraphy systems

- PET

By Application

- Cardiology

- Oncology

- Neurology

- General imaging

By End-user

- Hospital

- Diagnostic imaging centers

- Others

Drivers

Increasing prevalence of cancer is driving the market.

The escalating global burden of cancer has considerably boosted the need for nuclear medicine equipment to facilitate precise tumor localization and therapy monitoring in clinical oncology. Advanced diagnostic modalities enable clinicians to assess disease progression and treatment efficacy with greater accuracy.

Healthcare systems are increasingly incorporating these technologies to address the rising caseload of malignancies across populations. According to the American Cancer Society, 2,001,140 new cancer cases were projected to occur in the United States in 2024. This projection illustrates the substantial diagnostic challenge and the role of molecular imaging in managing patient care pathways.

Nuclear medicine equipment supports targeted radiopharmaceutical applications for both imaging and therapeutic interventions. Governmental cancer initiatives emphasize the deployment of innovative tools to enhance survival metrics.

Principal vendors are aligning product developments with this heightened clinical imperative. This driver interconnects with broader health trends involving lifestyle and environmental contributors to oncological risks. Altogether, the cancer escalation fortifies market progression in specialized diagnostic infrastructures.

Restraints

High cost of nuclear medicine equipment is restraining the market.

The considerable expense associated with nuclear medicine systems, encompassing hybrid scanners and radiotracer generators, curtails their implementation in facilities facing fiscal restrictions. Intricate fabrication processes for detector arrays and software suites amplify overall acquisition outlays.

Modest-scale medical centers frequently confront hurdles in rationalizing expenditures against utilization forecasts. Certification mandates for radiation containment elevate supplementary charges in deployment phases. Within communal health frameworks, resource distributions lean toward fundamental provisions rather than sophisticated apparatuses.

Operators might postpone modernizations owing to the notable initial and upkeep disbursements entailed. This restraint influences dissemination, notably in emerging territories with scant allocations. Sector endeavors to engineer economical prototypes strive to counteract these impediments stepwise. Notwithstanding functional merits, fiscal elements obstruct inclusive rollout. Ameliorating procurement via incentives proves vital to surmounting this market encumbrance.

Opportunities

Growth in imaging segment revenues is creating growth opportunities.

The affirmative fiscal outcomes in imaging divisions among foremost producers denote prospects for augmented employment of nuclear medicine equipment in therapeutic environments. Augmented allocations to radiological divisions bolster the amalgamation of progressive techniques for exact ailment appraisal.

Siemens Healthineers documented imaging segment adjusted revenues of 13.2 billion dollars in fiscal year 2024, marking a 5 percent rise from 12.7 billion dollars in 2023. This augmentation signifies persistent requisition extending to molecular visualization in oncological and cardiological domains.

Cooperative enterprises with care consortia expedite the positioning of amalgamated imaging resolutions in prolific hubs. The extensive operational foundation in progressed economies heightens vistas for apparatus augmentations. Modifications in analytical compensation fortify structural evolutions.

Paramount entities are embarking on territorial proliferations to exploit financial rebounds. This prospect synchronizes with undertakings to exalt criteria in minimally intrusive examinations. Directed methodologies can engender conspicuous headways in particularized realms.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic trends shape the nuclear medicine equipment market through capital availability, public healthcare investment, and long range planning by hospitals and imaging providers. Inflation and higher interest rates increase financing burdens for cyclotrons, PET, and SPECT systems, which slows purchasing and site expansion decisions.

Geopolitical tensions complicate access to critical isotopes, detectors, and high precision components, adding supply uncertainty and operational risk. Current US tariffs on imported equipment, electronics, and shielding materials raise total system costs, which pressures margins and lengthens procurement approvals. These factors strain smaller facilities and limit near term upgrades in budget constrained regions.

On the positive side, trade pressure drives localization of assembly, service infrastructure, and isotope production partnerships. Growing clinical reliance on nuclear medicine for oncology and cardiology sustains strong utilization. With strategic sourcing, technology upgrades, and service led value propositions, the market remains set for stable and confident growth.

Latest Trends

Acquisition of molecular imaging manufacturing networks is a recent trend in the market.

In 2024, the procurement of specialized production infrastructures has bolstered supply chain robustness for radiopharmaceutical distribution in nuclear medicine applications. These acquisitions encompass established facilities and expert personnel to expedite tracer availability.

Siemens Healthineers finalized the purchase of Advanced Accelerator Applications Molecular Imaging from Novartis in December 2024. This transaction incorporates a European manufacturing and distribution framework serving multiple nations. Enterprises are concentrating on amalgamating acquired assets to amplify operational synergies.

Therapeutic expansions benefit from assured isotope procurement, mitigating shortage vulnerabilities. The inclination underscores strategic imperatives for vertical consolidation in the sector. Supervisory endorsements in 2024 for such mergers have quickened their realization. Sector coalitions hone capabilities for augmented tracer portfolios. These evolutions aspire to fortify capacities in confronting escalating requisites for precision diagnostics.

Regional Analysis

North America is leading the Nuclear Medicine Equipment Market

North America holds a 42.2% share of the global Nuclear Medicine Equipment market, showcasing substantial progress in 2024 due to widespread integration of digital PET detectors and time-of-flight capabilities that improve lesion detectability in busy clinical environments.

Renowned suppliers including Canon Medical Systems and Mediso Medical Imaging Systems have deployed updated gamma cameras and dosimetry software, facilitating precise quantification in thyroid uptake studies and bone scintigraphy for metastatic evaluations.

The area’s emphasis on outpatient imaging centers has accelerated equipment upgrades to support same-day protocols for myocardial perfusion assessments, catering to cardiovascular disease burdens. Policies from the Food and Drug Administration have expedited clearances for software enhancements that incorporate artificial intelligence for artifact reduction, boosting diagnostic confidence.

A notable increase in Alzheimer’s evaluations has prompted investments in amyloid PET scanners, aligning with biomarker-driven neurology practices. Associations connecting healthcare providers with vendors have established training curricula for hybrid imaging, ensuring optimal utilization in multidisciplinary teams.

Moreover, efforts to standardize radiotracer handling have minimized downtime, enhancing operational efficiencies in high-volume facilities. Voximetry Incorporated secured a $2 million grant from the US National Cancer Institute in 2024 to advance SPECT/CT imaging technology.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Experts anticipate considerable enhancement in the radionuclide diagnostics landscape across Asia Pacific over the forecast period, because authorities bolster isotope supply chains to sustain expanding oncology centers in urban hubs. Organizations in India and Thailand engineer modular SPECT units that adapt to variable power grids, while professionals in Vietnam standardize protocols for hepatic tumor localizations amid liver disease spikes.

Institutions in Cambodia acquire compact PET scanners that enable decentralized screenings, tackling accessibility barriers for rural stroke patients. Supporters in Laos finance accreditation schemes that certify operators in tracer kinetics, raising proficiency in endocrine disorder mappings. Managers in Brunei implement procurement tenders favoring energy-efficient models, conserving resources during prolonged cardiac exams.

Physicians in Bhutan incorporate cloud-based reconstructions to expedite data sharing, refining interpretations for infectious disease outbreaks. Companies in Fiji customize collimators for pediatric applications, accommodating smaller anatomies in congenital anomaly detections. Chinese hospitals completed 16 installations of the uEXPLORER PET/CT system by September 2023, reflecting rapid adoption of advanced scanning technologies.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key competitors in the nuclear medicine equipment market pursue growth by advancing imaging performance, integrating hybrid systems, and enhancing software tools that improve diagnostic clarity and procedural efficiency for clinical teams. They deepen customer relationships through service agreements, training programs, and flexible financing options that reduce acquisition barriers for hospitals and imaging centers.

Strategic partnerships with healthcare providers and research institutions help them align product development with emerging clinical workflows and evidence needs. Expanding sales coverage in Europe, North America, and high-growth regions such as Asia Pacific diversifies revenue exposure and taps rising healthcare infrastructure investments.

GE HealthCare exemplifies a global leader with a broad portfolio of nuclear imaging and therapy systems, robust service network, and coordinated commercial organization that supports large healthcare customers. The company supports expansion through disciplined investment in R&D, targeted alliances, and a customer-centric approach that connects technological innovation with end-user priorities.

Top Key Players

- GE Healthcare

- Siemens Healthineers

- Philips Healthcare

- Canon Medical Systems

- United Imaging Healthcare

- Bracco Imaging

- Bayer

- Lantheus Holdings

- Curium Pharma

- Eckert and Ziegler

Recent Developments

- In 2025, Siemens Healthineers reported full-year adjusted revenue of US$ 15.149 billion from its Imaging segment, which encompasses molecular imaging and nuclear medicine technologies. The company attributed this performance largely to accelerated uptake of its molecular imaging portfolio, with hybrid PET/CT and PET/MR systems seeing particularly strong demand across the Americas and EMEA markets.

- In 2025, GE HealthCare stated that its Imaging division generated US$ 2.349 billion in revenue during the third quarter, supported by sales of advanced SPECT/CT and PET/CT systems. Financial disclosures noted that increased adoption of digital PET/CT platforms, including the Omni Legend, drove growth in the US, while heightened demand for radiopharmaceuticals contributed to a 14% revenue rise in the Pharmaceutical Diagnostics segment.

Report Scope

Report Features Description Market Value (2024) US$ 7.1 Billion Forecast Revenue (2034) US$ 9.8 Billion CAGR (2025-2034) 3.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (SPECT, Planar scintigraphy systems and PET), By Application (Cardiology, Oncology, Neurology and General imaging), By End-user (Hospital, Diagnostic imaging centers and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape GE Healthcare, Siemens Healthineers, Philips Healthcare, Canon Medical Systems, United Imaging Healthcare, Bracco Imaging, Bayer, Lantheus Holdings, Curium Pharma, Eckert and Ziegler Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Nuclear Medicine Equipment MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample

Nuclear Medicine Equipment MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- GE Healthcare

- Siemens Healthineers

- Philips Healthcare

- Canon Medical Systems

- United Imaging Healthcare

- Bracco Imaging

- Bayer

- Lantheus Holdings

- Curium Pharma

- Eckert and Ziegler