North America Household Appliances Market Size, Share, Growth Analysis By Product (Major Appliances, Small Appliances), By Distribution Channel (Electronic Stores, Hypermarkets & Supermarkets, Exclusive Brand Outlets, Online, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: May 2025

- Report ID: 150229

- Number of Pages: 234

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Size & Drivers

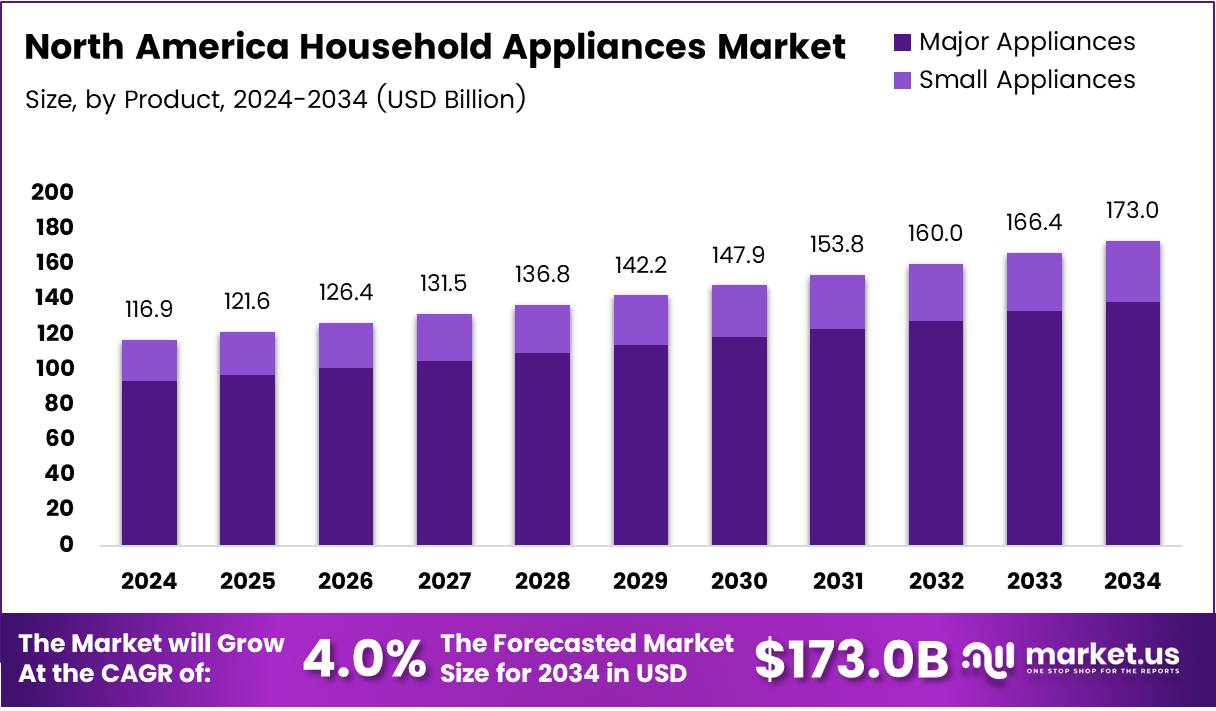

The North America Household Appliances Market size is expected to be worth around USD 116.9 Billion by 2034, from USD 116.9 Billion in 2024, growing at a CAGR of 4.0% during the forecast period from 2025 to 2034. Key driving factors include the increasing demand for energy-efficient appliances, rising disposable incomes, and the growing trend of smart home technology adoption, which are all contributing to market expansion.

Key Takeaways

- North America Household Appliances Market is expected to reach USD 116.9 Billion by 2034, growing at a CAGR of 4% from 2025 to 2034.

- Major Appliances dominated the By Product Analysis segment in 2024, holding a 84.6% share.

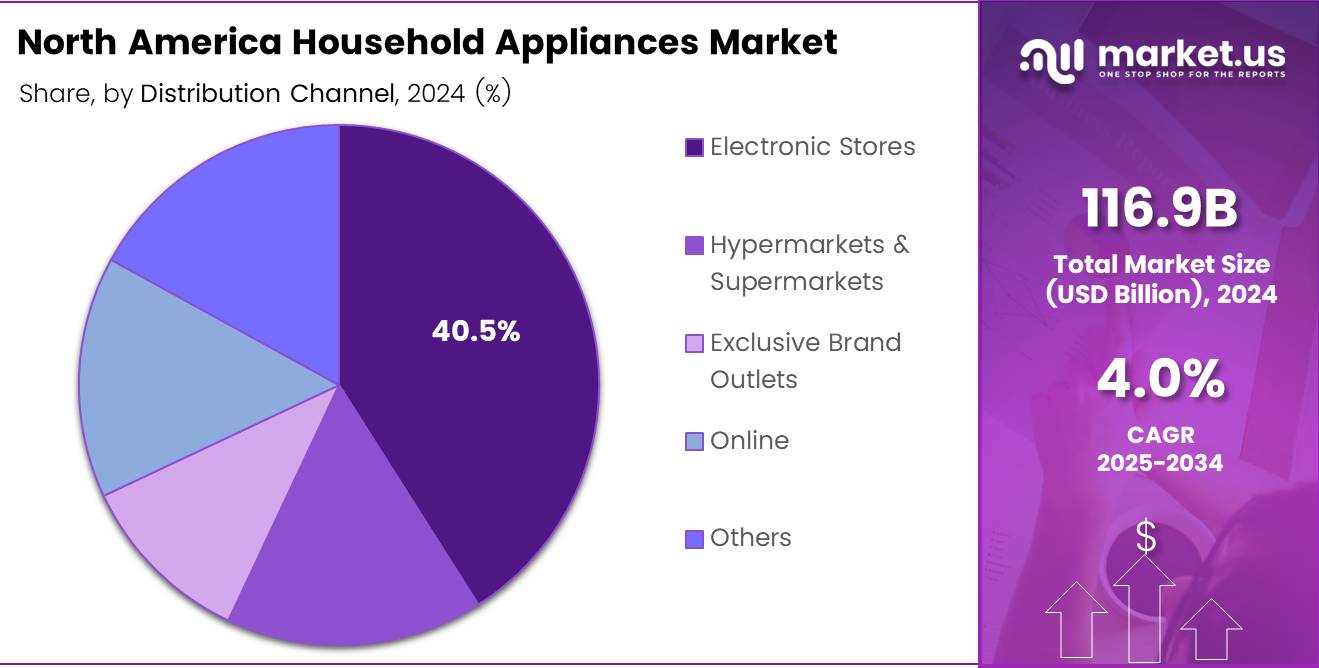

- Electronic Stores led the By Distribution Channel Analysis segment in 2024, capturing a 40.5% market share.

Report Overview

In 2024, the North American household appliances market is witnessing steady growth due to rising consumer demand for energy-efficient and smart home appliances. The increasing focus on sustainability and technological advancements is driving the adoption of appliances with enhanced performance and reduced environmental impact. This trend is expected to continue, with a growing preference for connected devices, such as smart refrigerators and washing machines.

The market is benefiting from favorable government investments and regulations aimed at enhancing appliance efficiency. According to renewableenergyworld, a June 2024 YouGov poll found that 60% of Americans support tougher appliance efficiency standards.

This growing consumer awareness is leading manufacturers to prioritize energy-saving innovations. Government regulations, like energy efficiency mandates and incentives for eco-friendly products, are further fueling demand for high-efficiency household appliances across the region.

Moreover, the market’s growth is further accelerated by innovations in design and functionality. Consumers are increasingly opting for appliances that not only provide better performance but also integrate seamlessly with their smart home ecosystems.

With the expansion of the Internet of Things (IoT) technology, smart appliances are becoming more accessible and cost-effective, opening up significant growth opportunities in the North American market. These innovations, coupled with the desire for convenience and energy savings, are positioning household appliances as essential elements in modern households.

Investment in the sector continues to increase, driven by both large and small manufacturers. Companies are focusing on upgrading existing products and launching new models that cater to the evolving needs of consumers.

Furthermore, consumer spending on home appliances is rising, which is expected to provide a steady revenue stream for key players. With these factors in play, the North American household appliances market is poised for substantial growth, fueled by innovation, regulatory support, and rising consumer awareness of sustainability.

Product Analysis

In 2024, Major Appliances held a dominant market position in the By Product Analysis segment of the North America Household Appliances Market, with a 84.6% share. Major appliances such as refrigerators, washing machines, and air conditioners continue to drive the market due to their necessity in every household.

The steady demand for these appliances, bolstered by technological advancements and enhanced energy efficiency, has positioned major appliances as the key market segment. Their substantial market share reflects consumer preference for durable and high-performance household items.

Small Appliances, while also significant, hold a smaller share of the market. In 2024, small appliances are growing at a moderate pace, with increased demand for items such as vacuum cleaners, coffee makers, and toasters. However, they are not as integral to household needs as major appliances.

Despite this, innovations such as cordless and smart devices are expected to push growth, especially in urban areas where space-saving and multifunctional designs are prioritized. The share of small appliances remains considerable but is far less than that of major appliances, with a much smaller impact on overall market performance.

Distribution Channel Analysis

In 2024, Electronic Stores held a dominant market position in the By Distribution Channel Analysis segment of the North America Household Appliances Market, with a 40.5% share.

Electronic stores have proven to be the most preferred outlet for consumers purchasing household appliances, driven by the ability to physically interact with the products and receive immediate product demonstrations. This direct engagement enhances consumer confidence and bolsters purchasing decisions, keeping electronic stores as the top channel for appliance sales.

Hypermarkets & Supermarkets are the next most popular distribution channel, benefiting from their wide-ranging consumer base and convenience. While their market share is smaller than that of electronic stores, they remain a strong player due to their accessible locations and broader product availability.

Exclusive Brand Outlets also contribute to the distribution mix, although they are more niche in nature and target specific customer demographics, offering premium products and brand loyalty incentives. Meanwhile, online retail continues to rise, offering the convenience of door-to-door delivery, while Other channels maintain a marginal presence in the broader market landscape.

Key Market Segments

By Product

- Major Appliances

- Water Heater

- Dishwasher

- Refrigerator

- Cooktop, Cooking Range, Microwave, and Oven

- Vacuum Cleaner

- Washing Machine and Dryers

- Air Conditioner

- Small Appliances

- Coffee Makers

- Toasters

- Juicers, Blenders, and Food Processors

- Hair Dryers

- Irons

- Deep Fryers

- Space Heaters

- Electric Trimmers and Shavers

- Air Purifiers

- Humidifiers & Dehumidifiers

- Rice Cookers & Steamers

- Air Fryers

By Distribution Channel

- Electronic Stores

- Hypermarkets & Supermarkets

- Exclusive Brand Outlets

- Online

- Others

Drivers

Increasing Demand for Energy-Efficient and Eco-Friendly Appliances Drives Market Growth

The North American household appliances market is experiencing growth due to the increasing demand for energy-efficient and eco-friendly products. Consumers are more conscious of their environmental impact, leading them to prefer appliances that reduce energy consumption. These appliances not only help lower utility bills but also contribute to sustainability efforts, further boosting their demand.

Rising disposable income and improving standards of living have also played a significant role in driving market growth. As more people can afford advanced appliances, the market for high-quality products is expanding. With better economic conditions, households are upgrading their appliances to improve comfort and convenience.

Technological advancements in smart home appliances are another key driver. Consumers are increasingly adopting smart technologies that offer enhanced functionality, such as remote control and automation, contributing to the demand for innovative household appliances.

Restraints

High Initial Cost and Supply Chain Disruptions Restrain Market Growth

Despite strong demand, there are several restraints affecting the North American household appliances market. The high initial cost of advanced appliances can limit their adoption, particularly among price-sensitive consumers. While these products offer long-term savings, the upfront investment is often a deterrent.

Additionally, supply chain disruptions and raw material shortages have created challenges for manufacturers. The availability of essential components and materials has been inconsistent, leading to delays in production and an increase in product prices. These supply chain issues are impacting the overall availability and affordability of household appliances in the market.

Growth Factors

Growth in Smart Kitchen Appliances and AI Integration Creates Opportunities

The North American household appliances market is poised for growth opportunities, particularly with the increasing demand for smart kitchen appliances. Consumers are looking for appliances that offer more convenience, such as smart refrigerators and ovens that optimize energy use and offer better functionality.

The adoption of AI and IoT technologies in home appliances is also opening new possibilities. AI-powered appliances can learn user preferences and offer enhanced personalization, improving the overall user experience. Furthermore, the market for replacing aging appliances presents an opportunity, as consumers seek more modern, efficient, and connected solutions.

Emerging Trends

Rising Popularity of Connected Home Ecosystems and Multi-Functional Appliances

Several trends are shaping the North American household appliances market. The rising popularity of connected home ecosystems is influencing consumer choices. More homeowners are integrating their appliances into smart home systems, creating seamless and efficient living environments.

There is also a surge in demand for multi-functional and space-saving appliances, especially in urban areas where space is limited. Appliances that offer multiple functions in one device are becoming more popular, reducing the need for additional equipment.

Additionally, there is a growing focus on sustainability and circular economy practices in appliance manufacturing. Consumers and manufacturers alike are prioritizing products designed for longer life cycles and recyclability, promoting environmental responsibility in the market.

Key North America Household Appliances Company Insights

In 2024, Dyson Limited continues to dominate the North American household appliances market with its innovative product offerings, particularly in vacuum cleaners, air purifiers, and hand dryers. Dyson’s focus on high-performance and energy-efficient appliances makes it a leading player in the premium segment.

Robert Bosch GmbH holds a strong market position, leveraging its advanced engineering expertise in kitchen appliances, including dishwashers and refrigerators. Bosch’s commitment to quality and technology-driven products has allowed it to maintain a robust presence in the region.

Breville Group Limited excels in the kitchen appliance segment, offering a variety of high-quality products such as coffee machines, blenders, and toaster ovens. Breville’s success lies in its combination of modern design, functionality, and innovation, catering to the needs of the North American consumer.

LG Electronics Inc. remains a prominent player, with its wide range of home appliances like refrigerators, washing machines, and air conditioners. LG’s market leadership is driven by its reputation for cutting-edge technology and integration with smart home ecosystems, positioning it as a key competitor in the smart appliance category.

Top Key Players in the Market

- Dyson Limited

- Robert Bosch GmbH

- Breville Group Limited

- LG Electronics Inc.

- De’Longhi S.p.A.

- Haier Smart Home Co., Ltd.

- Panasonic Corporation

- Whirlpool Corporation

- Miele

- Sharp Corporation

- Electrolux AB

- Koninklijke Philips N.V.

- Samsung Electronics Co. Ltd.

- SEB Groupe (Groupe SEB)

- Midea Group

Recent Developments

- In June 2025, BSH Home Appliances announced an $11 million expansion in North Carolina, aimed at enhancing its manufacturing capabilities and increasing its footprint in the North American market. This investment is expected to strengthen the company’s production and distribution networks in the region.

- In December 2024, Haier Smart Home revealed plans to complete the acquisition of Kwikot, a leading South African water heating manufacturer. The acquisition is expected to improve Haier’s product offerings and expand its market presence in Africa, particularly in the water heating sector.

- In June 2024, Whirlpool’s potential deal with Bosch could significantly boost Bosch’s India appliances business by expanding its product portfolio and market share. The move is expected to enhance Bosch’s competitive edge in India’s rapidly growing home appliance market.

Report Scope

Report Features Description Market Value (2024) USD 116.9 Billion Forecast Revenue (2034) USD 116.9 Billion CAGR (2025-2034) 4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Major Appliances, Small Appliances), By Distribution Channel (Electronic Stores, Hypermarkets & Supermarkets, Exclusive Brand Outlets, Online, Others) Competitive Landscape Dyson Limited, Robert Bosch GmbH, Breville Group Limited, LG Electronics Inc., De’Longhi S.p.A., Haier Smart Home Co., Ltd., Panasonic Corporation, Whirlpool Corporation, Miele, Sharp Corporation, Electrolux AB, Koninklijke Philips N.V., Samsung Electronics Co. Ltd., SEB Groupe (Groupe SEB), Midea Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  North America Household Appliances MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample

North America Household Appliances MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Dyson Limited

- Robert Bosch GmbH

- Breville Group Limited

- LG Electronics Inc.

- De'Longhi S.p.A.

- Haier Smart Home Co., Ltd.

- Panasonic Corporation

- Whirlpool Corporation

- Miele

- Sharp Corporation

- Electrolux AB

- Koninklijke Philips N.V.

- Samsung Electronics Co. Ltd.

- SEB Groupe (Groupe SEB)

- Midea Group