Global Cogeneration Device Market Size, Share Analysis Report By Type (Gas-Internal Combustion, Gas-Engine, Gas-Battery, Others), By Fuel Type (Natural Gas, Biomass, Coal, Others), By Capacity (Up to 30 MW, 31 MW to 60 MW, 61 MW to 100 MW, Above 100 MW), By End-use (Industrial, Commercial, Residential) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: March 2025

- Report ID: 143962

- Number of Pages: 389

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

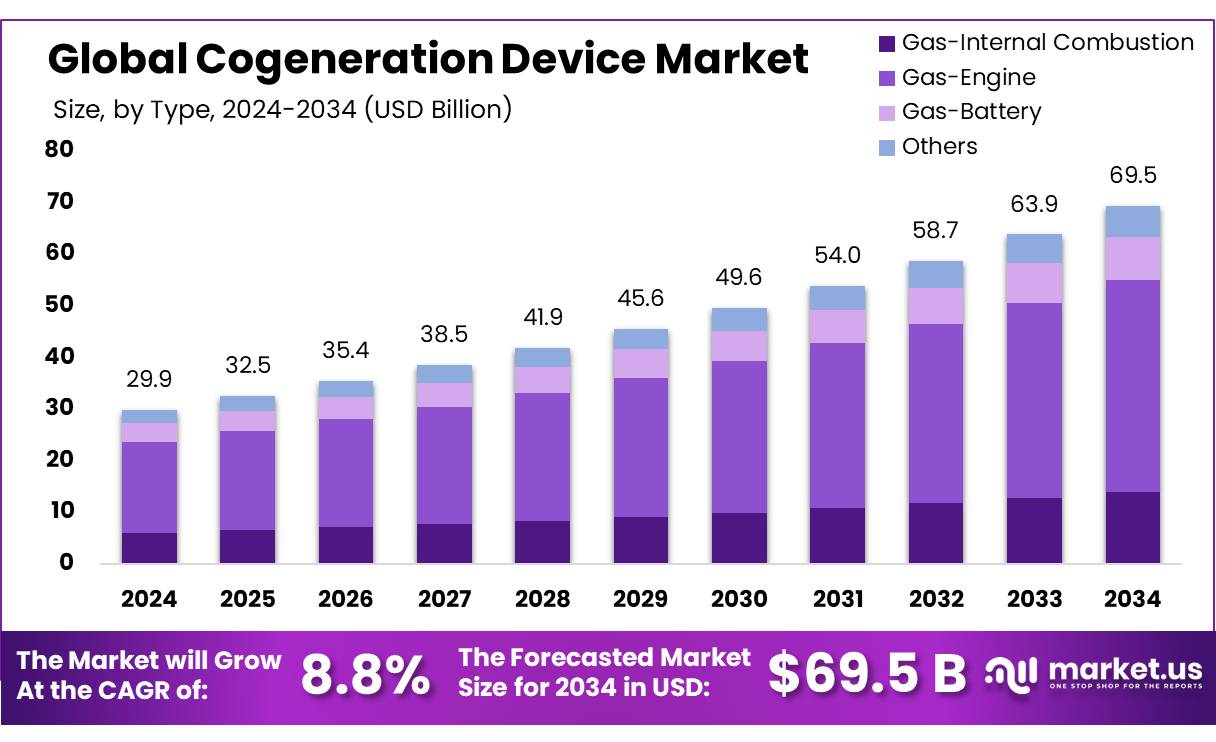

The Global Cogeneration Device Market size is expected to be worth around USD 69.5 Bn by 2034, from USD 29.9 Bn in 2024, growing at a CAGR of 8.8% during the forecast period from 2025 to 2034.

Cogeneration devices, also known as combined heat and power (CHP) systems, are technologies that simultaneously generate electricity and useful heat from the same energy source. These devices are increasingly being utilized across various sectors to optimize energy efficiency and reduce operational costs.

In cogeneration systems, a single fuel source such as natural gas, coal, or biomass, powers a generator to produce both electricity and thermal energy, which can be used for heating purposes or industrial processes. This dual-purpose system provides significant energy savings, decreases energy waste, and contributes to the reduction of greenhouse gas emissions.

The global cogeneration market is driven by several factors, particularly the increasing demand for energy efficiency and sustainability across industries. According to the International Energy Agency (IEA), cogeneration systems can achieve efficiency levels of up to 80%, compared to the 30–40% efficiency of traditional energy production methods. In industries such as food and beverage manufacturing, significant energy is required for production processes such as cooking, drying, and refrigeration. The ability to produce both heat and power from a single source of fuel allows these industries to reduce energy costs by up to 30%, as reported by the U.S. Department of Energy.

Additionally, the rising demand for energy security and reliability is pushing industries toward adopting cogeneration systems. Countries like Germany, the United States, and Japan have been key adopters of these systems. In Germany, the government has implemented a highly supportive framework for CHP systems under the Combined Heat and Power Act (KWKG), offering incentives for both small-scale and large-scale systems. As a result, Germany has one of the largest CHP markets in Europe, with more than 20,000 CHP units in operation, contributing approximately 14% of the country’s electricity.

The food industry, which represents a major portion of industrial energy consumption, is also increasingly adopting cogeneration solutions. According to the Food and Agriculture Organization (FAO), food processing accounts for nearly 30% of industrial energy consumption worldwide. The adoption of cogeneration systems within this sector can provide substantial cost savings and energy efficiency improvements. Companies such as Nestlé and PepsiCo have implemented these technologies in their manufacturing plants, significantly reducing their carbon footprints and enhancing operational efficiency.

The future growth opportunities in the cogeneration market are robust, fueled by global sustainability initiatives and advancements in technology. Governments worldwide are offering financial incentives to promote the use of clean and efficient technologies. The European Union’s Green Deal, for example, aims to achieve net-zero carbon emissions by 2050, creating a conducive environment for the growth of cogeneration devices. Moreover, technological advancements, such as the development of smaller, more cost-effective CHP systems, are opening new opportunities in the residential and commercial sectors.

Key Takeaways

- Cogeneration Device Market size is expected to be worth around USD 69.5 Bn by 2034, from USD 29.9 Bn in 2024, growing at a CAGR of 8.8%.

- Gas-Engine cogeneration devices firmly established themselves at the forefront of the market, securing a substantial 59.20% share.

- Natural Gas held a dominant market position in the cogeneration device sector, capturing more than a 61.20% share.

- Above 100 MW held a dominant market position, capturing more than a 39.40% share.

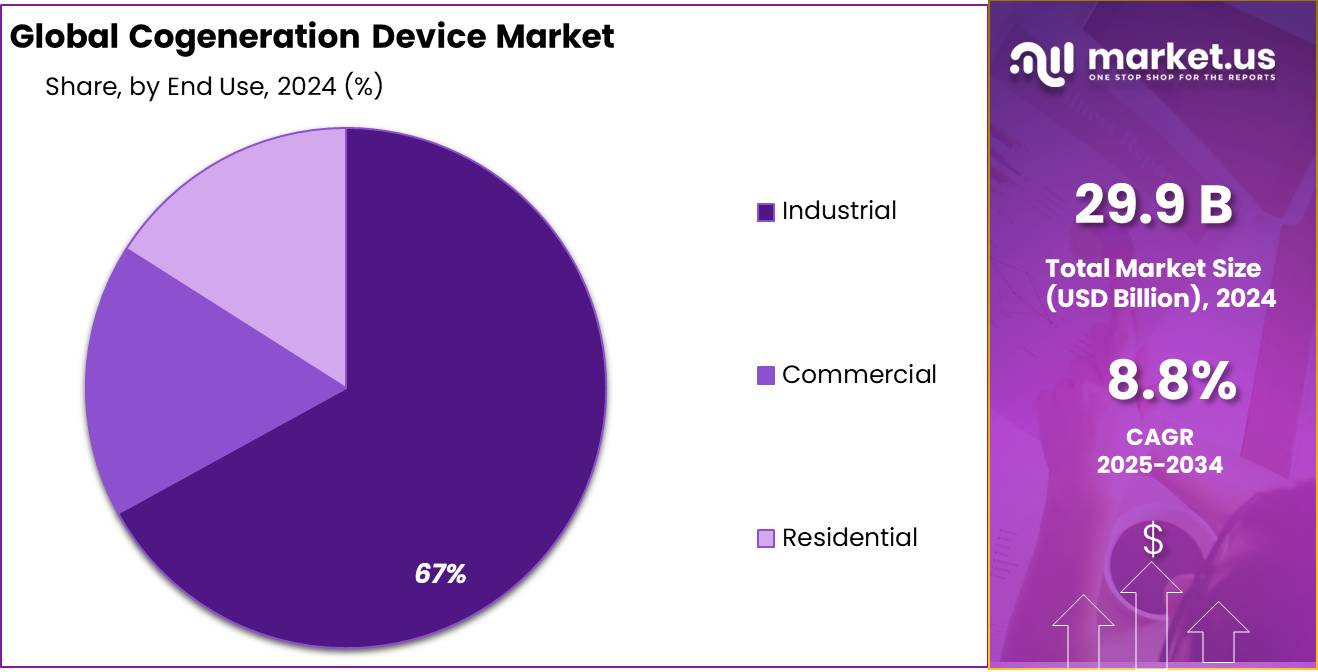

- Industrial segment held a dominant position in the cogeneration device market, capturing more than a 67.20% share.

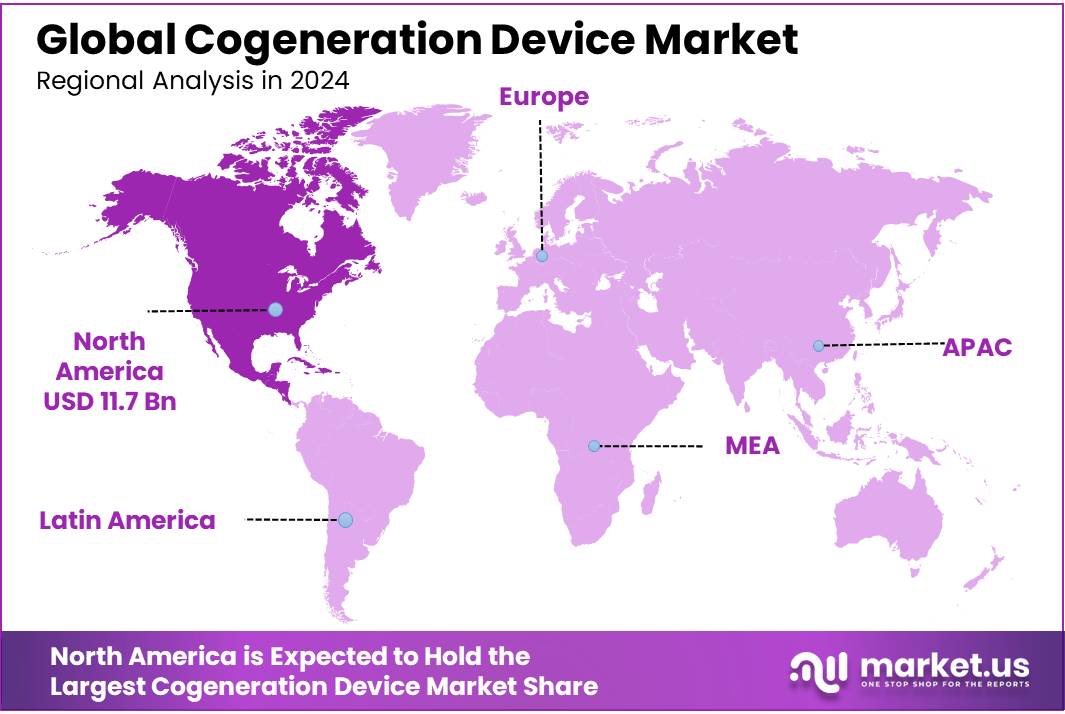

- North America emerged as a dominating region in 2024, capturing a significant 39.20% market share, valued at approximately USD 11.7 billion.

By Type

Gas-Engine Cogeneration Devices Lead with Over 59% Market Share

In 2024, Gas-Engine cogeneration devices firmly established themselves at the forefront of the market, securing a substantial 59.20% share. This segment’s dominance is attributed to its efficiency in simultaneously generating electricity and useful heat from a single fuel source, which is typically natural gas. Gas engines are highly favored in various applications, ranging from industrial to residential settings, due to their reliability and the relatively low operational costs compared to other cogeneration technologies.

They are particularly prevalent in areas with developed gas infrastructure, which facilitates easier access and integration. The trend towards sustainable energy solutions and the need for efficient energy systems have further bolstered the market penetration of gas-engine cogeneration units, making them a preferred choice for energy managers and facility operators aiming to reduce carbon footprints while ensuring energy security.

By Fuel Type

Natural Gas Takes the Lead in Cogeneration with a 61.2% Market Share

In 2024, Natural Gas held a dominant market position in the cogeneration device sector, capturing more than a 61.20% share. This substantial market share is largely due to the wide availability and cost efficiency of natural gas as a fuel source. Natural gas cogeneration systems are renowned for their high efficiency in converting fuel to energy, which significantly reduces the operational costs and environmental impact compared to other fuels like coal or oil.

These systems are particularly advantageous for large-scale industrial plants, commercial buildings, and residential complexes seeking to lower their energy expenses and enhance their sustainability profiles. The preference for natural gas in cogeneration is also driven by its relatively lower emissions of carbon dioxide and other harmful pollutants, aligning with global trends toward cleaner energy production and stricter environmental regulations.

By Capacity

Above 100 MW Cogeneration Units Command a 39.4% Market Share

In 2024, cogeneration devices with a capacity of Above 100 MW held a dominant market position, capturing more than a 39.40% share. This segment’s strong presence is attributed to the growing demand for high-capacity, efficient energy solutions in industrial and large-scale energy settings. These high-capacity cogeneration systems are particularly valued for their ability to provide stable and reliable power and heat over extended periods, which is essential for operations in heavy industries and large commercial complexes.

The adoption of these systems is driven by their cost-effectiveness in large-scale applications, where they significantly reduce energy costs and enhance operational efficiency. Moreover, the shift towards sustainable energy practices has seen a push for larger cogeneration units that can maximize energy output while minimizing environmental impact, making the Above 100 MW category a preferred choice for energy-intensive industries.

By End-use

Industrial Sector Dominates Cogeneration Market with a 67.2% Share

In 2024, the Industrial segment held a dominant position in the cogeneration device market, capturing more than a 67.20% share. This notable market share reflects the critical role cogeneration systems play in industrial applications, where they provide both power and thermal energy from a single fuel source. Industries such as manufacturing, chemicals, and paper significantly benefit from these systems due to their ability to enhance energy efficiency and reduce waste by utilizing the heat produced during electricity generation.

The industrial sector’s preference for cogeneration technology is also motivated by the ongoing push for sustainable and energy-efficient production processes. These systems not only help reduce operational costs by lowering energy consumption but also align with environmental goals by decreasing greenhouse gas emissions. As industries continue to focus on improving energy efficiency and reducing environmental impact, the adoption of cogeneration systems in the industrial sector is expected to remain strong.

Key Market Segments

By Type

- Gas-Internal Combustion

- Gas-Engine

- Gas-Battery

- Others

By Fuel Type

- Natural Gas

- Biomass

- Coal

- Others

By Capacity

- Up to 30 MW

- 31 MW to 60 MW

- 61 MW to 100 MW

- Above 100 MW

By End-use

- Industrial

- Commercial

- Residential

Drivers

Government Incentives Boost Cogeneration Device Adoption

One of the major driving factors for the adoption of cogeneration devices, especially in the industrial sector, is the support from government initiatives. These incentives are designed to promote the use of energy-efficient technologies to meet both environmental targets and enhance economic efficiency.

For example, in the United States, the Department of Energy (DOE) has been actively promoting the use of cogeneration technology through various grants and tax incentives. The DOE’s Combined Heat and Power (CHP) Deployment Program aims to increase the technology’s efficiency from about 45% to 80% by encouraging the installation of new systems and upgrading existing ones. This initiative is particularly appealing to food processing industries, which require significant amounts of heat and power to maintain operations and are thus ideal candidates for cogeneration systems.

Furthermore, the European Union has implemented stringent directives to cut greenhouse gas emissions, promoting cogeneration as a viable solution. The EU’s cogeneration directive recognizes high-efficiency CHP systems as key to achieving these goals. According to a report by the International Energy Agency (IEA), these policy frameworks have led to an increase in cogeneration installations across various industries, including food manufacturing, which is reported to have adopted these systems to reduce their energy costs and carbon footprint significantly.

In addition to policy support, financial incentives such as feed-in tariffs and tax credits make cogeneration systems more attractive. In Germany, for instance, the government provides financial support through the KfW Development Bank for the installation of CHP units. This has spurred a notable increase in adoption rates within the food industry, which is often at the forefront of energy innovation due to the high costs associated with thermal and electrical energy production.

Restraints

High Initial Investment Hinders Cogeneration Adoption

One significant barrier to the widespread adoption of cogeneration devices, particularly in the food industry, is the high initial cost associated with deploying these systems. The capital expenditure for cogeneration technology can be prohibitively expensive, especially for small to medium-sized enterprises (SMEs) within the food sector that operate on tight margins.

Cogeneration systems involve complex installations that include not only the primary equipment but also extensive modifications to existing energy infrastructures, such as electrical and heating systems. For example, according to the U.S. Environmental Protection Agency (EPA), the upfront cost of installing a standard 5 MW cogeneration unit can exceed $20 million. This cost barrier can be a significant deterrent for food processing plants, which typically require substantial returns on investment within a short period to justify such capital-intensive projects.

Additionally, the variability in fuel prices adds another layer of financial uncertainty. While cogeneration systems predominantly use natural gas due to its lower emissions and cost-effectiveness, fluctuations in natural gas prices can impact the overall savings and payback period of these systems. This volatility makes financial planning challenging, particularly for industries like food processing where profit margins are already under pressure.

Despite these financial hurdles, there are government-led initiatives aimed at mitigating these impacts through financial aids and incentives. For instance, the Energy Efficiency and Conservation Block Grant Program, administered by the U.S. Department of Energy, offers grants to industries looking to upgrade their energy systems to more efficient solutions, including cogeneration. However, the availability of such programs can vary significantly by region and may not always fully cover the high upfront costs associated with cogeneration systems, limiting their adoption among budget-conscious businesses.

Opportunity

Sustainability Goals Drive Cogeneration Opportunities in the Food Industry

A major growth opportunity for cogeneration devices lies in the global push towards sustainability, particularly within the food industry. This sector is increasingly driven by the need to reduce carbon emissions and improve energy efficiency, aligning with broader environmental objectives and compliance with regulatory standards.

According to the Food and Agriculture Organization of the United Nations (FAO), the food sector accounts for around 30% of the world’s total energy consumption and contributes to over 20% of global greenhouse gas emissions. Cogeneration, or combined heat and power (CHP) systems, offer a solution by providing both thermal and electrical energy from a single fuel source, achieving energy efficiencies of up to 80%. This is significantly higher than the separate production of electricity and heat, which can be around 40-50% efficient.

In regions like the European Union, where the Green Deal aims for carbon neutrality by 2050, cogeneration is identified as a key technology. The EU promotes CHP through various funding mechanisms, such as the Cohesion Fund and the European Regional Development Fund, which support infrastructure improvements and energy efficiency projects in member states. These initiatives make it financially viable for food producers, particularly in high-energy use sectors like dairy, brewing, and meat processing, to adopt cogeneration systems.

Moreover, the reliability of cogeneration systems in providing constant energy supply enhances production processes in the food industry, which often require precise temperature controls and uninterrupted power for refrigeration and processing. This reliability, combined with the environmental and economic benefits, positions cogeneration as an attractive investment for food industry leaders aiming to meet their sustainability goals while also reducing operational costs.

Trends

Decentralization of Energy Sources Fuels Cogeneration Trends

A prominent trend in the cogeneration device market is the shift towards decentralized energy generation. This movement is gaining momentum particularly in the food industry, where energy supply reliability, cost reduction, and sustainability are crucial. Decentralized cogeneration systems allow food processing facilities to produce their own energy onsite, which significantly reduces the loss associated with transmitting electricity over long distances and provides greater control over energy costs.

The adoption of decentralized cogeneration systems is supported by advancements in digital technologies that enable smarter energy management. For instance, modern cogeneration units can be integrated with smart grids and IoT (Internet of Things) devices to optimize energy production and consumption based on real-time data. This integration enhances operational efficiency and further reduces energy costs, making it an attractive option for energy-intensive sectors like food processing.

Government initiatives also play a critical role in this trend. In Germany, for example, the government’s Energy Concept 2050 targets a reduction in greenhouse gas emissions by 80-95% compared to 1990 levels, promoting the adoption of technologies such as cogeneration through regulatory support and financial incentives. This policy framework encourages food manufacturers to invest in cogeneration systems as part of their sustainability strategies.

Moreover, global food corporations are committing to aggressive carbon reduction targets, aligning with international agreements like the Paris Agreement. Companies like Nestlé and Unilever have pledged to achieve net-zero emissions by 2050, driving the demand for efficient and renewable energy solutions like cogeneration.

Regional Analysis

In the cogeneration device market, North America emerged as a dominating region in 2024, capturing a significant 39.20% market share, valued at approximately USD 11.7 billion. This substantial market presence is supported by a robust industrial base, stringent environmental regulations, and a growing emphasis on energy efficiency across the United States and Canada.

The region’s leadership in the cogeneration market is largely driven by the advanced regulatory frameworks that incentivize the adoption of energy-efficient technologies. For example, the United States has implemented various policies and incentives, such as the Investment Tax Credit (ITC), which provides tax benefits for the installation of cogeneration systems.

North America’s focus on sustainable energy solutions is further evidenced by the integration of renewable energy sources with cogeneration systems, particularly in areas with substantial biomass resources and natural gas infrastructure. The U.S. Environmental Protection Agency (EPA) actively promotes cogeneration through the Combined Heat and Power Partnership program, which assists in optimizing the energy efficiency and environmental quality of CHP systems across the country.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Clarke Energy is a prominent player in the cogeneration device market, specializing in the engineering, installation, and maintenance of gas-fueled cogeneration systems. Known for their efficiency and reliability, Clarke Energy’s solutions are tailored to meet the specific needs of their customers, ranging from small-scale applications to large industrial projects. Their expertise in integrating renewable biogas systems into existing energy infrastructures has solidified their position as a leader in sustainable energy solutions.

General Electric is a global giant in the energy sector, with its cogeneration systems widely acclaimed for their high efficiency and advanced technology. GE’s cogeneration devices are designed to deliver reliable and cost-effective power and heat solutions to a diverse range of industries, including healthcare, manufacturing, and utilities. Their focus on innovation and sustainability in energy generation ensures their continuing influence in the cogeneration market.

Mitsubishi Heavy Industries Ltd is renowned for its engineering excellence in the power generation sector, including cogeneration. Their cogeneration systems are highly efficient, utilizing cutting-edge technology to provide both thermal energy and electricity across various sectors. Mitsubishi’s commitment to R&D in energy solutions aligns with global efforts to enhance energy efficiency and reduce environmental impact.

Top Key Players

- Clarke Energy

- GE

- SIEMENS

- Mitsubishi heavy industries Ltd

- 2G Energy AG

- Siemens

- Robert BOSCH Gmbh

- Kawasaki heavy industries Ltd

- A.B. HOLDING S.P.A.

- Tecogen, Inc.

- Alfa Laval

- Yanmar

- Kawasaki Heavy Industries

- ALSTOM

- Caterpillar

Recent Developments

In 2024, General Electric (GE) continued to assert its position in the cogeneration equipment market, leveraging its robust technological capabilities and extensive global presence.

Clarke Energy’s approach to the market is characterized by a commitment to robust after-sales support and a deep understanding of various gas applications and engineering challenges.

Report Scope

Report Features Description Market Value (2024) USD 29.9 Bn Forecast Revenue (2034) USD 69.5 Bn CAGR (2025-2034) 8.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Gas-Internal Combustion, Gas-Engine, Gas-Battery, Others), By Fuel Type (Natural Gas, Biomass, Coal, Others), By Capacity (Up to 30 MW, 31 MW to 60 MW, 61 MW to 100 MW, Above 100 MW), By End-use (Industrial, Commercial, Residential) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Clarke Energy, GE, SIEMENS, Mitsubishi heavy industries Ltd, 2G Energy AG, Siemens, Robert BOSCH Gmbh, Kawasaki heavy industries Ltd, A.B. HOLDING S.P.A., Tecogen, Inc., Alfa Laval, Yanmar, Kawasaki Heavy Industries, ALSTOM, Caterpillar Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Cogeneration Device MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Cogeneration Device MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Clarke Energy

- GE

- SIEMENS

- Mitsubishi heavy industries Ltd

- 2G Energy AG

- Siemens

- Robert BOSCH Gmbh

- Kawasaki heavy industries Ltd

- A.B. HOLDING S.P.A.

- Tecogen, Inc.

- Alfa Laval

- Yanmar

- Kawasaki Heavy Industries

- ALSTOM

- Caterpillar