Global Non Invasive Blood Glucose Monitoring System Market By Technology (Spectroscopy, Optical Sensors, Electromagnetic Field-Based Sensors, Biosensors, Thermal Sensors, Ultrasonic Sensors, and Others), By Modality (Non wearable and Wearable), By End-User (Hospitals, Homecare, and Clinics), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 117875

- Number of Pages: 388

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

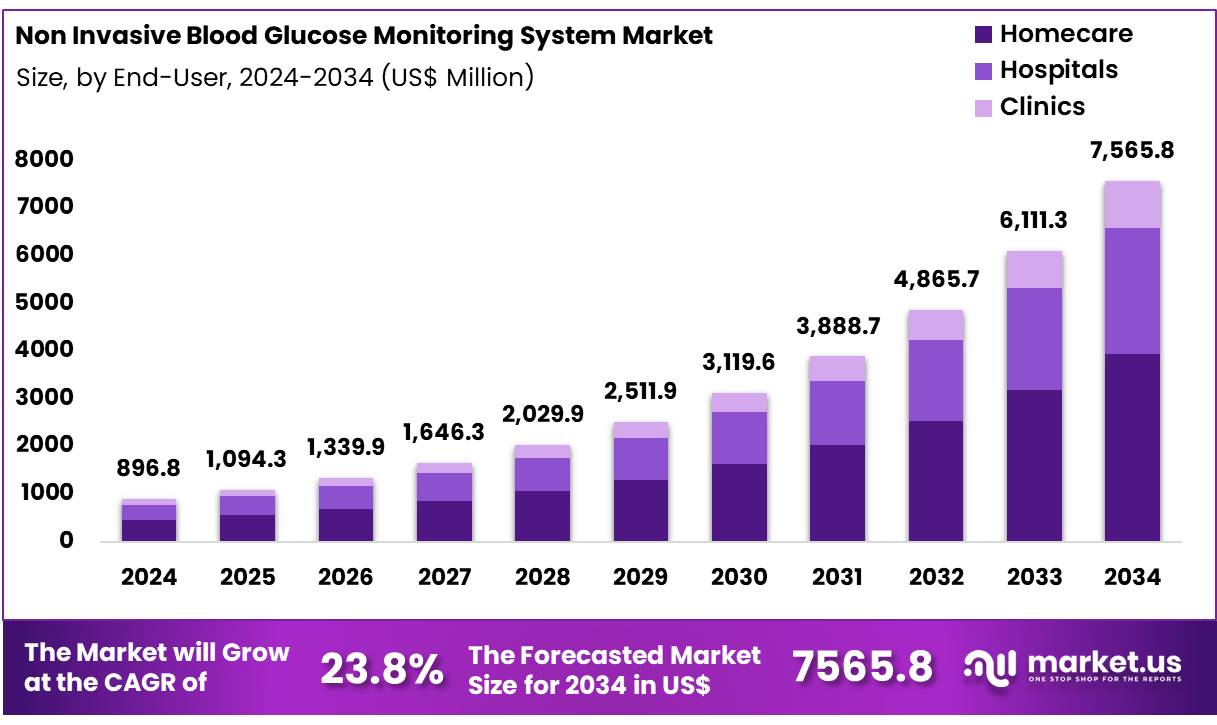

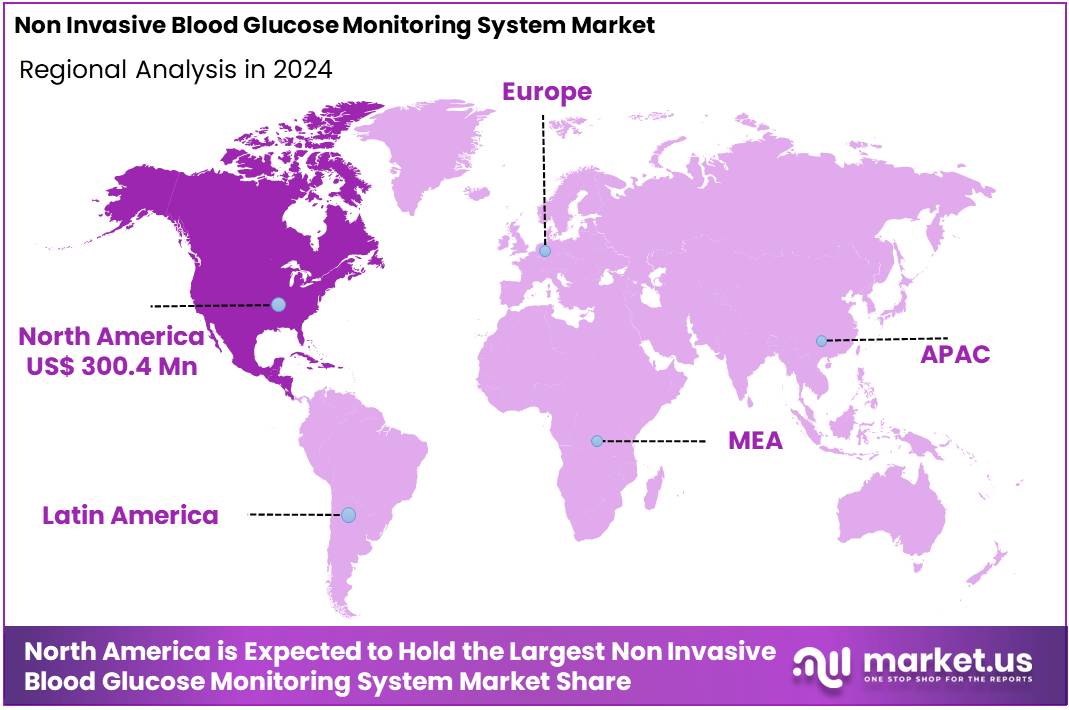

Global Non-Invasive Blood Glucose Monitoring System Market was valued at US$ 896.8 Million in 2024 and is expected to grow at a CAGR of 23.8% from 2024 to 2034. In 2024, North America led the market, achieving over 33.5% share with a revenue of US$ 300.4 Million.

Non Invasive Blood Glucose Monitoring System Market, Global Analysis, 2020-2024 (US$ Million)

Global 2020 2021 2022 2023 2024 CAGR Revenue 567.5 598.5 661.4 737.5 896.8 23.8% A non-invasive blood glucose monitoring system is an advanced solution designed to measure blood glucose levels without the need for blood samples, offering a more comfortable and convenient alternative to traditional invasive methods. Leveraging cutting-edge technologies such as optical sensors, electromagnetic fields, spectroscopy, ultrasound, and thermal sensors, these systems provide accurate glucose readings through the skin or other tissues.

Available as wearable devices (e.g., smartwatches, patches) or portable handheld devices, they deliver real-time or on-demand monitoring, enhancing diabetes management. Key advantages include eliminating the discomfort associated with finger pricks and promoting user adherence through ease of use. These systems are particularly well-suited for frequent monitoring, driving improved patient outcomes.

However, current challenges include addressing accuracy concerns relative to invasive methods and managing the higher costs of these technologies. As innovations continue, non-invasive glucose monitoring is poised to play a transformative role in the healthcare market, delivering improved patient experiences and outcomes. The development and launch of new products tailored to the needs of individuals is significantly propelling the market growth.

- For instance, in February 2024, Know Labs introduced the KnowU, a wearable, non-invasive continuous glucose monitor designed for seamless glucose tracking.

Key Takeaways

- The global non-invasive blood glucose monitoring system market was valued at USD 896.8 million in 2024 and is anticipated to register substantial growth of USD 7565.8 million by 2034, with 23.8% CAGR.

- In 2024, the spectroscopy segment took the lead in the global market, securing 20.7% of the total revenue share.

- The homecare segment took the lead in the global market, securing 56.2% of the total revenue share.

- North America maintained its leading position in the global market with a share of over 33.5% of the total revenue.

Technology Analysis

Based on technology the market is fragmented into spectroscopy, optical sensors, electromagnetic field-based sensors, biosensors, thermal sensors, ultrasonic sensors, and others. Amongst these, spectroscopy segment dominated the global non-invasive blood glucose monitoring system market capturing a significant market share of 20.7% in 2024. Spectroscopy method utilizes light-based techniques to measure glucose levels without requiring a blood sample.

By analyzing how different wavelengths of light interact with glucose molecules, spectroscopy provides a non-invasive, painless alternative to traditional glucose monitoring methods like finger-prick tests. Near-infrared (NIR) and mid-infrared (MIR) spectroscopy, as well as Raman spectroscopy, are among the common techniques being explored for their potential to accurately measure glucose levels through the skin or other tissues.

The growing interest in spectroscopy-based monitoring systems is driven by the demand for more comfortable and convenient glucose monitoring solutions for diabetic patients. Companies developing these technologies aim to enhance accuracy, reduce patient burden, and offer continuous glucose monitoring without invasive procedures, which could revolutionize diabetes care and improve patient outcomes. This segment is expected to gain significant traction as innovations continue to evolve.

Non Invasive Blood Glucose Monitoring System Market, Technology Analysis, 2020-2024 (US$ Million)

Technology 2020 2021 2022 2023 2024 Spectroscopy 122.0 127.5 139.5 154.1 185.6 Optical Sensors 101.0 108.3 121.7 137.9 170.4 Electromagnetic Field-Based Sensors 91.4 97.0 107.8 120.9 148.0 Biosensors 84.0 87.4 95.2 104.7 125.6 Thermal Sensors 72.6 77.2 86.0 96.6 118.4 Ultrasonic Sensors 41.4 44.3 49.6 56.0 69.1 Others 55.1 56.9 61.5 67.1 79.8 Modality Analysis

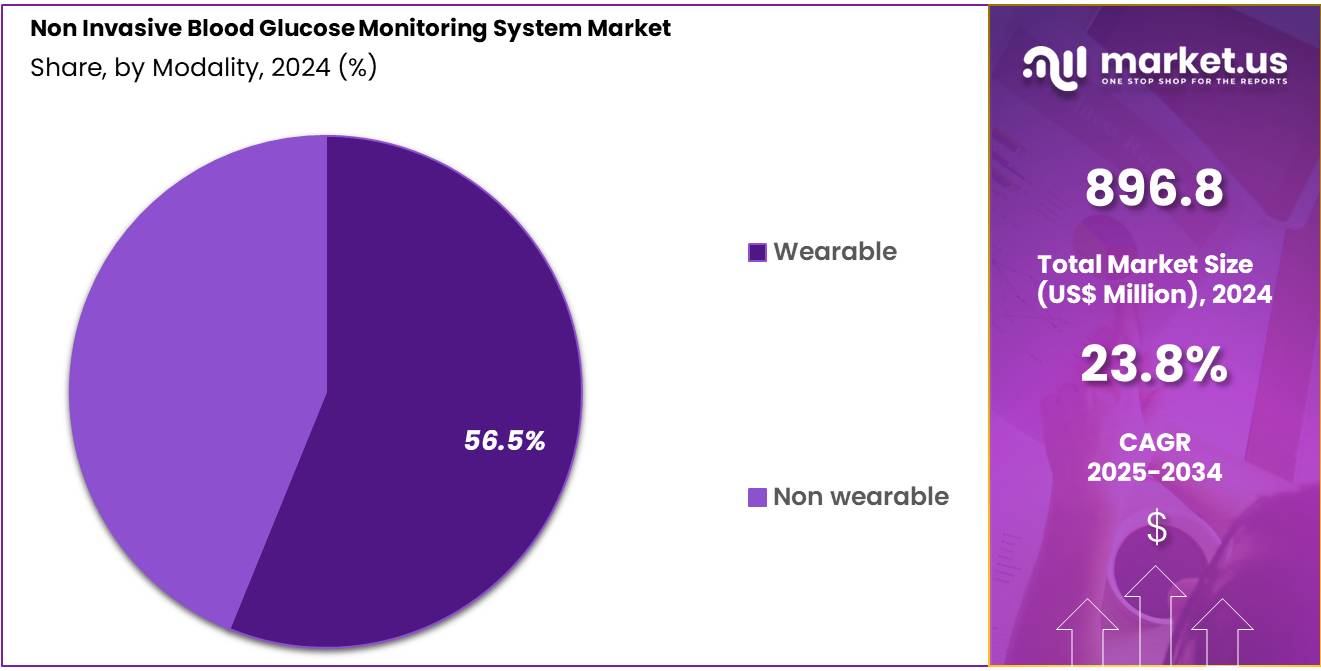

The market is fragmented by modality into non wearable and wearable. Wearable dominated the global non-invasive blood glucose monitoring system market capturing a significant market share of 56.5% in 2024. Wearable devices, such as smartwatches and fitness bands equipped with glucose monitoring capabilities, provide a non-invasive approach that enhances user comfort and compliance. The integration of advanced sensor technologies, including optical and biosensors, enables these devices to deliver accurate glucose readings without invasive procedures.

Additionally, the growing emphasis on health and wellness, along with the rise of telehealth and remote patient monitoring, further supports the adoption of wearable glucose monitoring solutions. As technology advances and patient awareness increases, the wearable segment is set to play a pivotal role in transforming diabetes management and improving overall patient outcomes.

- Products like D- Pocket and D- Sensors are the few examples of wearable non-invasive blood glucose monitoring system developed by DiaMonTech AG.

Non Invasive Blood Glucose Monitoring System Market, Modality Analysis, 2020-2024 (US$ Million)

Modality 2020 2021 2022 2023 2024 Non-wearable 0.3 0.3 0.3 0.3 0.4 Wearable 0.3 0.3 0.4 0.4 0.5 End-User Analysis

The market is fragmented by end-user into hospitals, homecare, and clinics. Homecare dominated the global non-invasive blood glucose monitoring system market capturing a significant market share of 52.0% in 2024. The increasing prevalence of diabetes and the growing preference for convenient, user-friendly monitoring solutions is the primary factor propelling the growth of the segment.

Patients are increasingly seeking ways to manage their glucose levels at home, avoiding the discomfort and inconvenience associated with traditional blood sampling methods. Non-invasive systems offer a pain-free alternative, allowing users to monitor their glucose levels easily and accurately.

- Cost-effectiveness studies suggest that home-based diabetes management is significantly less expensive than hospital care, with reductions in costs estimated around 32%.

Non Invasive Blood Glucose Monitoring System Market, End-User Analysis, 2020-2024 (US$ Million)

End-User 2020 2021 2022 2023 2024 Hospitals 208.9 219.1 240.7 267.0 322.9 Homecare 288.3 305.8 339.9 381.3 466.4 Clinics 70.4 73.6 80.7 89.2 107.6

Key Segments Analysis

By Technology

- Spectroscopy

- Optical Sensors

- Electromagnetic Field-Based Sensors

- Biosensors

- Thermal Sensors

- Ultrasonic Sensors

- Others

By Modality

- Non wearable

- Wearable

By End-User

- Hospitals

- Homecare

- Clinics

Market Dynamics

Increasing Prevalence of Diabetes

Changing lifestyles and unhealthy dietary habits have contributed significantly to the rising prevalence of diabetes. In today’s fast-paced world, many individuals have limited time for cooking and often rely on convenient, packaged, and processed foods. These foods are often high in refined sugars, unhealthy fats, and calories, and lack essential nutrients.

Additionally, they tend to have high sodium content, which can contribute to hypertension and other risk factors for diabetes. These rising rates of patients with diabetes highlight the urgent need for effective diabetes management solutions, including advanced technologies like continuous glucose monitors, to address the growing health challenge posed by this chronic condition.

- For instance, approximately 537 million adults (20-79 years) were living with diabetes in 2021. The total number of people living with diabetes is projected to rise to 643 million by 2030 and 783 million by 2045. Further, 3 in 4 adults with diabetes live in low- and middle-income countries. According to the International Diabetes Federation (IDF), the global prevalence rate of diabetes stands at 6.1%, ranking it among the top 10 causes of death and disability worldwide. At the super-region level, North Africa and the Middle East have the highest prevalence rate at 9.3%, with projections indicating a rise to 16.8% by 2050. Similarly, in Latin America and the Caribbean, the diabetes rate is expected to increase to 11.3% in the coming years.

Market Restraints

Patient Skepticism toward Non-Invasive Technologies

Patient skepticism remains a significant barrier to the widespread adoption of non-invasive blood glucose monitoring systems. Although non-invasive methods offer clear benefits, such as eliminating the need for frequent finger pricks and providing a more comfortable experience, many patients remain hesitant to switch from traditional invasive techniques.

This skepticism often stems from concerns about the accuracy and reliability of newer, non-invasive devices, especially when compared to the proven performance of conventional methods like fingerstick glucose tests and continuous glucose monitors (CGMs) that require skin penetration. Furthermore, a lack of awareness and education about the capabilities of newer non-invasive glucose monitors exacerbates this issue.

While the technology has progressed, there is a communication gap in educating patients on the benefits and accuracy improvements of these devices. Many patients continue to rely on traditional methods simply because they are more familiar and trusted, even if non-invasive alternatives could offer them more convenience and comfort. Additionally, older patients, who represent a significant portion of the diabetes population, may be less inclined to adopt new technologies due to unfamiliarity or a lack of confidence in their use.

- Low level of wearable use (17.49%) among the US older adults was found during a study published by Health Informatics Journal, in November 2021.

Market Opportunities

Enhanced Market Growth through Increased Regulatory Approvals

The non-invasive blood glucose monitoring market is experiencing significant growth opportunities through increased regulatory approvals, which are essential for introducing innovative technologies to healthcare markets worldwide. Such approvals not only validate the safety and efficacy of new devices but also broaden their accessibility to patients and healthcare providers, driving market expansion and technological adoption.

These agencies assess medical devices to ensure they meet stringent safety and performance criteria before granting approval for commercial use. Once approved, these technologies can reach a broader patient base, offering more individuals access to convenient and less painful glucose monitoring options.

- For example, in March 2024, the FDA approved the Dexcom Stelo Glucose Biosensor System, a landmark event as it marked the first over-the-counter (OTC) continuous glucose monitor (CGM) cleared for the general population aged 18 and older who do not use insulin. This system is designed for individuals managing their diabetes with oral medications and those without diabetes who wish to monitor how their lifestyle affects their blood sugar levels. This approval is particularly noteworthy because it expands the use of CGM systems beyond the traditional prescription model, making it available directly to consumers without the need for a doctor’s prescription.

Impact of macroeconomic factors / Geopolitical factors

Macroeconomic and geopolitical factors play a significant role in shaping the non-invasive blood glucose monitoring system market. Economic conditions, such as GDP growth and healthcare spending, influence the adoption of advanced healthcare technologies, with higher disposable incomes leading to increased demand for innovative diabetic care solutions like NIBGM systems.

During economic downturns, however, consumers and healthcare providers may prioritize cost-effective options, potentially slowing market growth. Geopolitical factors, including international trade relations, regulatory policies, and political stability, can affect the availability of materials, manufacturing, and distribution channels for these systems. Trade barriers or tariffs may increase production costs, impacting affordability and accessibility.

Latest Trends

The non-invasive blood glucose monitoring system market is experiencing notable trends driven by technological advancements and increasing diabetes prevalence. One key trend is the rise of wearable devices, such as smartwatches and patches, that continuously monitor glucose levels without the need for traditional blood samples. This trend is fuelled by advancements in sensors, biosensors, and optical technologies, allowing for more accurate, real-time readings.

Additionally, there is growing interest in non-invasive monitoring solutions due to the increasing demand for pain-free and convenient alternatives to finger-prick tests. Moreover, the integration of artificial intelligence (AI) and machine learning (ML) with NIBGM devices is enhancing predictive analytics, helping users manage glucose levels more effectively.

The expanding adoption of these systems is further supported by rising health awareness, the aging population, and increasing healthcare expenditures. As a result, the NIBGM market is seeing rapid innovation and increasing investment, positioning it for significant growth.

Regional Analysis

The North America non-invasive blood glucose monitoring system market is experiencing growth due to the rising number of diabetes patients in the region. As the prevalence of diabetes continues to increase, there is a growing demand for non-invasive blood glucose monitoring systems that offer convenience and improved patient compliance. These non-invasive monitoring systems eliminate the need for traditional finger-prick testing, providing a more comfortable and less intrusive method for diabetes management.

- For instance, according to the 2022 data published by the American Diabetes Association (ADA), it was reported that more than 10 million Americans are treated with insulin and receive positive results from a continuous glucose monitoring (CGM) system. The penetration is likely to increase in the country in the coming years owing to the growing prevalence of diabetes along with an increasing shift of preference among the patient population toward CGMs for monitoring diabetes.

Non-Invasive Blood Glucose Monitoring System Market, Regional Analysis, 2020-2024 (US$ Million)

Region 2020 2021 2022 2023 2024 North America 194.7 204.1 224.2 248.5 300.4 Europe 136.8 144.8 160.7 179.9 219.7 Asia Pacific 145.3 155.6 174.6 197.6 243.9

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global non-invasive glucose monitoring systems market is highly competitive, with several major players leading innovation and driving growth. Key companies such as Medtronic plc, Abbott, Inc., and Insulet Corporation are at the forefront, offering cutting-edge non-invasive glucose monitoring technologies.

The non-invasive glucose monitoring systems market is also witnessing growth, fuelled by advancements in product development, new product launches, and regulatory approvals. Technological innovations and the introduction of more user-friendly devices are broadening treatment options for diabetes patients. Furthermore, regulatory approvals for new devices are improving market accessibility, supporting increased adoption and overall market expansion.

Medtronic plc is a global leader in medical technology, offering a wide range of innovative products and therapies. Headquartered in Dublin, Ireland, Medtronic operates in over 150 countries, providing solutions in areas such as cardiovascular, diabetes, neurological, and orthopedic care. The company’s mission is to alleviate pain, restore health, and extend life through its advanced medical devices, therapies, and services, focusing on improving patient outcomes and enhancing healthcare efficiency.

In addition, Abbott is a multinational healthcare company headquartered in Abbott Park, Illinois. Specializing in diagnostics, medical devices, nutrition, and branded generic pharmaceuticals, Abbott develops a broad range of products to improve the health and well-being of people worldwide.

Top Key Players

- Medtronic plc

- Abbott

- Insulet Corporation

- Dexcom, Inc.

- Apple

- Know Labs

- DiaMonTech AG

- LifePlus

Recent Developments

- In February 2024, Know Labs introduced the KnowU device, a wearable and non-invasive continuous glucose monitor. This innovative device features machine learning capabilities and onboard computing power, utilizing a compact, advanced sensor that measures glucose levels through spectroscopy.

- In August 2024, Medtronic plc announced the U.S. Food and Drug Administration (FDA) approval for its Simplera™ continuous glucose monitor (CGM).

- In February 2024, Know Labs, Inc. announced it has entered into a funding agreement for an investment of up to US$12 million, of which it has executed a US$4 million close with Lind Global Fund II LP, an investment entity managed by The Lind Partners, a New York-based institutional fund manager.

Report Scope

Report Features Description Market Value (2024) US$ 896.8 Million Forecast Revenue (2034) US$ 7565.8 Million CAGR (2025-2034) 23.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Technology (Spectroscopy, Optical Sensors, Electromagnetic Field-Based Sensors, Biosensors, Thermal Sensors, Ultrasonic Sensors, and Others), By Modality (Non wearable and Wearable), By End-User (Hospitals, Homecare, and Clinics) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Medtronic plc, Abbott, Insulet Corporation, Dexcom, Inc., Apple, Know Labs, DiaMonTech AG, and LifePlus Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Non Invasive Blood Glucose Monitoring System MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Non Invasive Blood Glucose Monitoring System MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Abbott Laboratories

- Medtronic plc

- Hoffmann-La Roche Ltd.

- Ascensia Diabetes Care

- Dexcom, Inc.

- Sanofi

- Novo Nordisk

- Insulet Corporation

- Ypsomed Holdings

- Glysens Incorporated

- Other Key Players