Global Nipah Virus (NiV) Infection Testing Market By Test Type (RT-PCR based kits and ELISA kits), By Sample Type (Blood, Throat & nasal swab, Urine and Others), By End-User (Hospitals, Diagnostic centres, Research laboratories, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 168187

- Number of Pages: 332

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

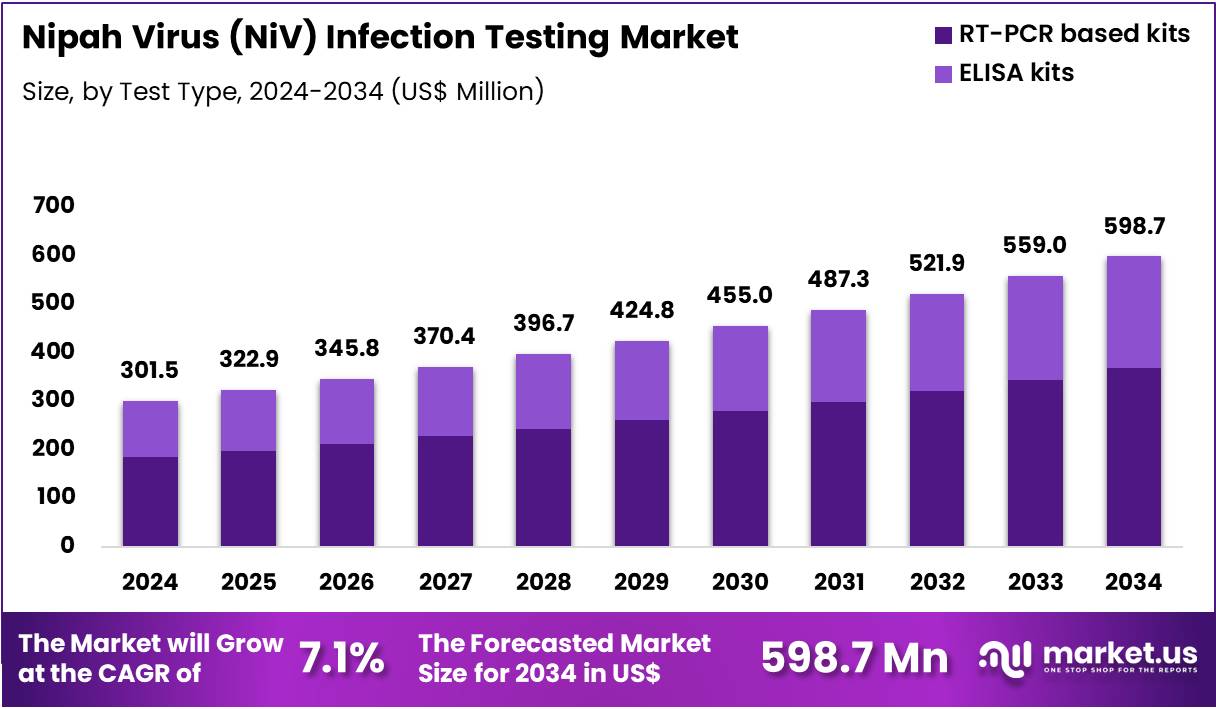

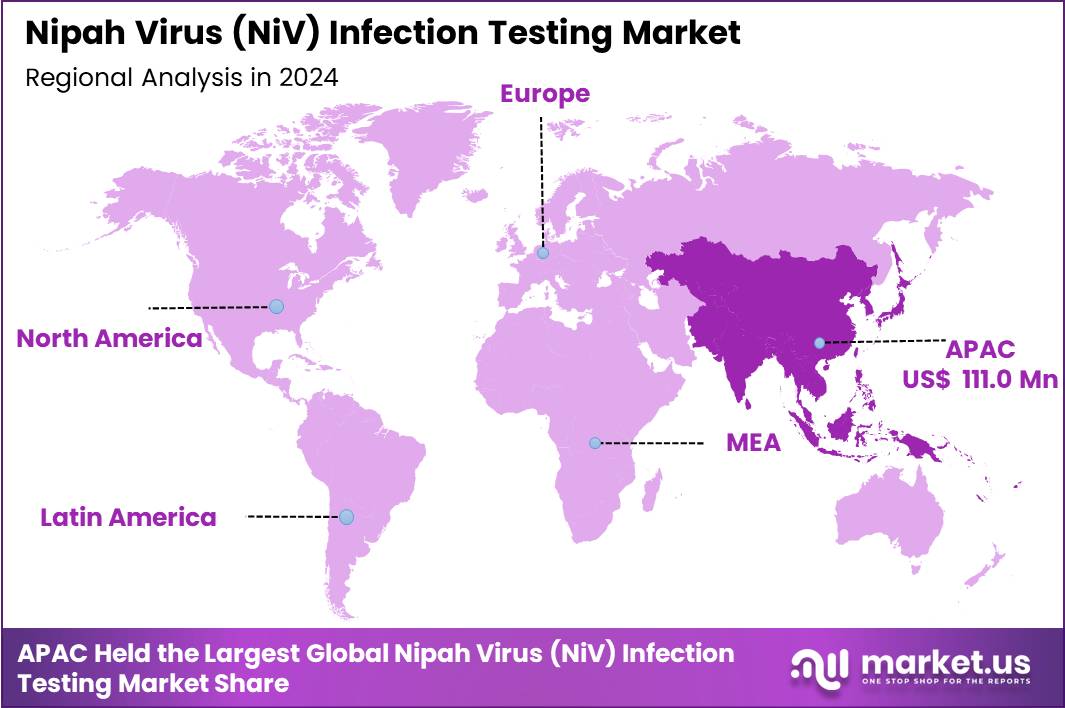

The Global Nipah Virus (NiV) Infection Testing Market is expected to reach US$ 598.7 Million by 2034, rising from US$ 301.5 Million in 2024, expanding at a CAGR of 7.1% from 2025 to 2034. In 2024, Asia Pacific led the market, achieving over 36.8% share with a revenue of US$ 111.0 Million.

Nipah virus, classified as a high-priority pathogen by the World Health Organization (WHO), continues to drive global investment in outbreak preparedness, early detection systems, and advanced molecular diagnostics.

Testing remains central to NiV surveillance because of the virus’s high fatality rates, which have reached 40–75% in past outbreaks documented in Bangladesh, India, Malaysia, and the Philippines. Most healthcare systems rely on molecular and immunoassay tools to identify acute and past infections, enabling rapid containment during spillover events.

RT-PCR testing remains the reference standard for diagnosing acute infections due to its ability to detect viral RNA early in the symptomatic phase. ELISA-based assays are commonly used for serological surveillance, contact tracing, and post-outbreak epidemiological studies.

With improved biosafety protocols, governments and reference laboratories increasingly deploy mobile RT-PCR units, rapid sample transport protocols, and high-throughput molecular platforms to accelerate outbreak response. Companies manufacturing viral RNA purification kits, real-time PCR reagents, and validated primer/probe sets have expanded production capacity during recent NiV events, particularly in South Asia.

The market also benefits from expanding research into viral evolution, spillover ecology, and zoonotic surveillance programs supported by the CDC, WHO, and national health ministries. Development of point-of-care molecular tools and recombinant antigen-based ELISA kits is gaining momentum as countries invest in decentralized rapid diagnostic capacity. As global interest in emerging infectious diseases continues, Nipah virus testing markets grow alongside broader investments in pathogen genomics, field diagnostics, and outbreak-ready laboratory networks.

The rising emphasis on strengthening public health infrastructure, improving biosurveillance in wildlife and livestock populations, and expanding advanced diagnostic capabilities ensures sustained growth for NiV testing platforms over the next decade.

Key Takeaways

- In 2024, the market generated a revenue of US$ 301.5 Million, with a CAGR of 7.1%, and is expected to reach US$ 598.7 Million by the year 2034.

- The Test Type segment comprises RT-PCR based kits and ELISA kits, with RT-PCR holding the majority share in 2024 of 61.4%.

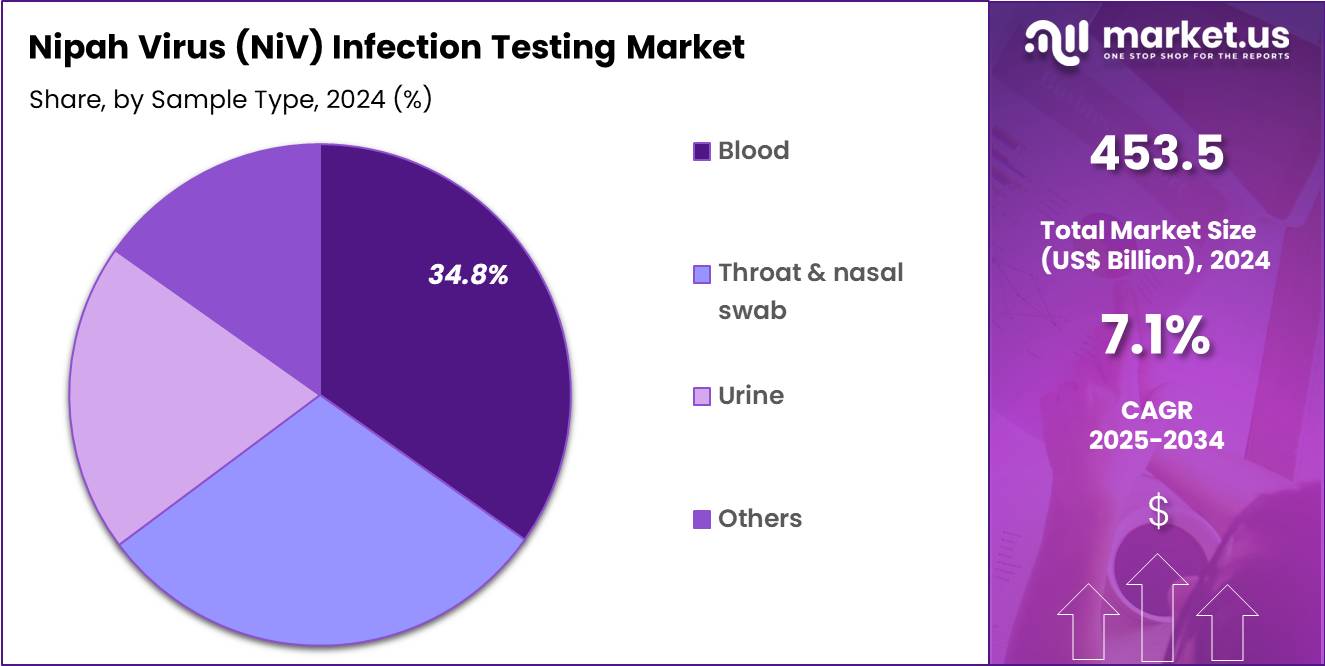

- The Sample Type segment includes Blood, Throat & Nasal Swab, Urine, and Others, with Blood samples dominating with 34.8% market share due to laboratory compatibility with both RNA and serology detection workflows.

- The End-User segment includes Hospitals, Diagnostic Centres, Research Laboratories, and Others, with Hospitals accounting for the largest share of 53.9% in 2024.

- Asia Pacific led the market by securing a market share of 36.8% in 2024.

Test Type Analysis

RT-PCR based kits represent the largest share of NiV infection testing with 61.4% due to their role as the gold-standard diagnostic method recommended by WHO and national public health authorities. Their ability to detect viral RNA during the early symptomatic stage supports timely isolation and treatment decisions. RT-PCR assays using validated primer-probe sets targeting the N, G, and L genes are widely used in national reference labs, including those operated by the Indian Council of Medical Research and the CDC.

High fatality rates associated with NiV heighten dependence on molecular detection, particularly during seasonal spillover events linked to bat-human or intermediate host transmissions. The global adoption of thermocyclers, viral RNA extraction kits, and emergency response protocols further strengthens RT-PCR market dominance.

In December 2022, the ICMR-National Institute of Virology (NIV Pune) confirmed the rollout of its newly developed ELISA-based IgM and IgG antibody detection kits for Nipah virus, enabling serosurveillance and retrospective diagnosis during outbreak investigations across high-risk regions.

ELISA kits hold a substantial share due to their importance in immune response assessment, serosurveillance, and epidemiological studies. IgM-capture ELISA assays support confirmation of recent infections, while IgG ELISA plays a major role in long-term surveillance programs studying viral exposure in human communities and wildlife reservoirs.

During outbreaks, ELISA assays are used for contact tracing and retrospective diagnosis when RT-PCR may no longer detect viral RNA. Manufacturers developing recombinant NiV antigens and high-specificity monoclonal-antibody-based ELISAs continue to expand capabilities, supporting this segment’s increasing relevance.

Sample Type Analysis

Blood samples hold the largest share of 34.8% due to their use across molecular and serological diagnostic workflows. Blood is required for both IgM/IgG ELISA validation and high-sensitivity RT-PCR, particularly in cases where viral presence in respiratory secretions declines. Blood-based detection has been heavily utilized during NiV outbreaks in Kerala (India) and in Bangladesh, where suspected cases are screened immediately after symptom onset.

Throat and nasal swabs form the second largest category because respiratory secretions provide high viral loads during the acute stage. These samples are preferred during early diagnosis and are compatible with rapid RT-PCR deployment in field settings. WHO outbreak reports highlight a strong use of swab samples during community-level surveillance and screening of symptomatic contacts.

Urine samples contribute to a smaller but important share, as NiV has been detected in urine during several outbreaks, enabling complementary testing when blood collection is difficult. Researchers conducting environmental surveillance and experimental pathogenesis studies also rely on urine-based detection

In January 2025, a rapid-response mobile laboratory system showcased at IDWeek demonstrated a “van-to-village” diagnostic workflow for Nipah RT-PCR testing, enabling real-time pathogen confirmation in remote areas and representing a major innovation for decentralized outbreak management.

End-User Analysis

Hospitals account for the largest market share of 53.9% in 2024 because they act as primary centers for outbreak detection, patient triage, and acute NiV case management. Most initial diagnoses during outbreaks occur in emergency departments or infectious disease units equipped with high-containment laboratories or sample-transfer networks.

Diagnostic centres form the second-largest segment due to increased use of accredited laboratories for confirmatory molecular testing. During outbreaks, national networks mobilize commercial labs to manage high sample volumes, reducing turnaround time and improving access to regional diagnostics.

Research laboratories represent a strong, growing segment driven by NiV’s classification as a WHO R&D Blueprint priority pathogen. These labs support viral genomics, host-pathogen studies, vaccine evaluation, and development of new diagnostic platforms. University BSL-3 facilities in the US, Australia, India, and Singapore contribute significantly to this segment.

Key Market Segments

By Test Type

- RT-PCR based kits

- ELISA kits

By Sample Type

- Blood

- Throat & nasal swab

- Urine

- Others

By End-User

- Hospitals

- Diagnostic centres

- Research laboratories

- Others

Drivers

Rising incidence of zoonotic spillover and recurrent outbreaks in South Asia

The driver is strengthened by documented Nipah virus outbreaks in Bangladesh and India, where annual surveillance reports from respective health ministries highlight repeated spillover events linked to fruit bat populations. Increased human-bat interface due to deforestation, date-palm sap contamination, and habitat disruption elevates the need for rapid diagnostic testing.

WHO’s classification of NiV as a priority pathogen accelerates global investment in molecular and serological testing infrastructure. Countries with high-density populations increasingly deploy RT-PCR platforms and ELISA surveillance kits to detect asymptomatic or mild cases that might otherwise be missed, thereby preventing widespread infection. Government-backed rapid response systems, laboratory upskilling programs, and expansion of BSL-3/BSL-4 laboratories strengthen the demand for NiV diagnostic tools.

Restraints

High biosafety requirements and limited laboratory capacity

Testing for NiV requires strict biosafety protocols because of its high fatality rate and potential for human-to-human transmission. Only specialized BSL-3 or BSL-4 laboratories are permitted to handle live viral samples, limiting widespread adoption of advanced diagnostics. Regions with limited laboratory capacity face delays in sample transportation, risking deterioration of RNA integrity and impacting diagnostic accuracy.

Maintenance of biosafety infrastructure, supply chain coordination, and trained workforce availability remain major challenges. During past outbreaks in Kerala and Bangladesh, reliance on central laboratories led to logistical delays in confirmatory testing, highlighting a structural constraint on market expansion.

Opportunities

Growth of mobile, field-ready molecular diagnostic platforms

There is a growing opportunity for decentralized molecular testing technologies, including portable RT-PCR platforms, CRISPR-based detection systems, and isothermal amplification assays. These decentralized tools reduce reliance on high-containment laboratories and support real-time diagnosis in outbreak zones.

International health agencies and regional governments invest heavily in mobile PCR units, solar-powered diagnostic vans, and rapid RNA-extraction devices that allow frontline workers to confirm cases within hours. Manufacturers are developing simplified RNA-extraction systems compatible with field conditions, enabling high sensitivity without complex lab equipment. Expansion of these technologies can transform NiV surveillance and clinical management in rural and high-risk areas.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic factors influence the NiV testing market through government healthcare spending, emergency preparedness budgets, and investments in infectious disease infrastructure. During economic slowdowns, countries often redirect funding toward essential public health capabilities, benefiting high-risk pathogen testing. Geopolitical factors, including global travel patterns and cross-border trade, shape surveillance strategies as countries tighten entry screening protocols during outbreaks.

Restrictions on high-containment laboratory reagent exports, international shipping delays, and disruptions in logistics chains during global crises can limit access to RNA extraction kits, enzymes, and ELISA reagents. Public health emergencies such as COVID-19 have demonstrated the importance of maintaining resilient diagnostic supply chains, prompting many nations to localize the production of PCR consumables and serology kits, thereby strengthening long-term capacity for NiV testing.

Latest Trends

Growing adoption of multiplex molecular assays for simultaneous detection of NiV and other viral encephalitides

A notable trend is the increase in adoption of multiplex panels capable of detecting Nipah virus alongside other neurological pathogens such as Japanese encephalitis virus, Hendra virus, and measles virus. These panels reduce testing time, support differential diagnosis, and improve decision-making in hospitals treating severe acute encephalitis syndrome (AES) cases.

Advances in next-generation sequencing (NGS) and metagenomic diagnostics further support the transition from single-target assays to broader pathogen detection platforms. Several academic labs have reported accelerated sequencing timelines during recent NiV outbreaks, enabling rapid genomic surveillance and variant characterisation.

In August 2022, Meridian Bioscience issued a press release introducing specialized raw materials including recombinant antigens and assay-grade reagents — designed to support global diagnostic developers working on Nipah virus detection, reinforcing supply chain capacity for WHO-priority pathogen testing.

Regional Analysis

Asia Pacific Leads the Nipah Virus (NiV) Infection Testing Market

Asia Pacific accounts for the largest share of the market of 36.8% due to historically documented outbreaks in Bangladesh, India, and Malaysia. Governments in these countries have established extensive surveillance systems and designated regional laboratories to perform confirmatory RT-PCR and ELISA testing. India’s health ministry, for example, regularly deploys mobile units and emergency laboratory teams during suspected NiV events in Kerala.

High population density and seasonal spillover patterns strengthen the region’s testing demand. Investments in healthcare infrastructure, expansion of BSL-3 laboratories, and rapid training of virology units reinforce Asia Pacific’s dominance.

In September 2021, Molbio Diagnostics announced that its TrueNat Nipah test received emergency-use approval from Indian authorities, marking the first portable, rapid RT-PCR platform cleared in India for Nipah virus detection. The development enabled on-site molecular confirmation during outbreaks in Kerala, significantly reducing turnaround time in remote districts.

North America Shows Steady Growth

North America demonstrates strong growth driven by advanced research laboratories, high biosafety infrastructure, and substantial investment in countermeasure development against priority pathogens. The US CDC, NIH, and BARDA support ongoing development of NiV vaccines, therapies, and laboratory assays.

Academic institutions operate BSL-4 labs conducting preclinical studies involving NiV strains, increasing demand for molecular testing reagents, viral culture kits, and reference standards. The region also invests in wildlife surveillance and bat-ecology monitoring projects to evaluate zoonotic risks.

Europe Expands Research and Surveillance Capacity

Europe continues to strengthen its capabilities in emerging infectious disease surveillance, focusing on early detection and preparedness. Government-funded virology institutes in the UK, Germany, and the Netherlands use NiV molecular assays for research studies, vaccine trials, and host-pathogen assessments. High awareness of zoonotic disease risks and integration of NiV testing into broader biosurveillance programs drive market participation.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the market include Thermo Fisher Scientific, Roche Diagnostics, Abbott Laboratories, QIAGEN, Bio-Rad Laboratories, Siemens Healthineers, Cepheid, MyBioSource, Krishgen Biosystems, Liferiver Bio-Technology Co., Ltd., Creative Diagnostics, Molbio Diagnostics Pvt. Ltd. and Other key players.

Thermo Fisher supports NiV testing through high-performance RT-PCR master mixes, viral RNA extraction kits, and real-time PCR platforms widely used in BSL-3 laboratories. Its reagents enable rapid, sensitive detection essential for outbreak response, surveillance, and confirmatory diagnostics. Roche contributes to NiV diagnostics through its automated real-time PCR instruments, high-throughput RNA extraction systems, and serology workflow components.

Its platforms are frequently used in national reference labs conducting NiV confirmation, genomic monitoring, and differential diagnosis during outbreak investigations. Abbott supports NiV diagnostic workflows by providing ELISA-based immunoassay kits, recombinant antigen solutions, and laboratory automation systems used for serosurveillance and IgM/IgG detection. Its global diagnostic portfolio strengthens outbreak preparedness and supports research programs studying paramyxovirus antibody responses.

Top Key Players

- Thermo Fisher Scientific

- Roche Diagnostics

- Abbott Laboratories

- QIAGEN

- Bio‑Rad Laboratories

- Siemens Healthineers

- Cepheid

- MyBioSource, Inc.

- Krishgen Biosystems

- Liferiver Bio‑Technology Co., Ltd.

- Creative Diagnostics

- Molbio Diagnostics Pvt. Ltd.

- Other key players

Recent Developments

- In April 2024, the Australian Centre for Disease Preparedness released new genomic sequencing data and improved reference panels for Nipah virus, allowing laboratories worldwide to optimize PCR primer-probe designs and advance assay sensitivity.

- In August 2024, Bangladesh’s Directorate General of Health Services launched mobile molecular diagnostic units equipped with field-ready RT-PCR systems for rapid Nipah virus detection in rural spillover hotspots, strengthening community-level surveillance during the seasonal risk window.

- In October 2024, Abbott expanded its availability of recombinant antigen components used in Nipah ELISA development, supporting broader research and validation of serological assays as part of global preparedness initiatives.

Report Scope

Report Features Description Market Value (2024) US$ 301.5 Million Forecast Revenue (2034) US$ 598.7 Million CAGR (2025-2034) 7.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Test Type (RT-PCR based kits and ELISA kits), By Sample Type (Blood, Throat & nasal swab, Urine and Others), By End-User (Hospitals, Diagnostic centres, Research laboratories, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Thermo Fisher Scientific, QIAGEN, Merck KGaA, Takara Bio Inc., Promega Corporation, altona Diagnostics GmbH, Zymo Research Corporation, Roche Diagnostics, Bio-Rad Laboratories, Agilent Technologies, Abbott Laboratories, Seegene Inc., and Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Nipah Virus (NiV) Infection Testing MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Nipah Virus (NiV) Infection Testing MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Thermo Fisher Scientific

- Roche Diagnostics

- Abbott Laboratories

- QIAGEN

- Bio‑Rad Laboratories

- Siemens Healthineers

- Cepheid

- MyBioSource, Inc.

- Krishgen Biosystems

- Liferiver Bio‑Technology Co., Ltd.

- Creative Diagnostics

- Molbio Diagnostics Pvt. Ltd.

- Other key players