Next Generation Sequencing Market Analysis By Product Type (Consumables, Platform), By Technology (Targeted Sequencing & Resequencing, WGS, Whole Exome Sequencing, Others), By Application (Oncology, Consumer Genomics, Clinical Investigation, Reproductive Health, HLA Typing/Immune System Monitoring, Metagenomics, Epidemiology & Drug Development, Agrigenomics & Forensics), By Workflow (Sequencing, NGS Data Analysis, Pre-Sequencing), By End-user (Academic Research, Clinical Research, Hospitals & Clinics, Pharma & Biotech Entities, Other Users), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 40038

- Number of Pages: 206

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

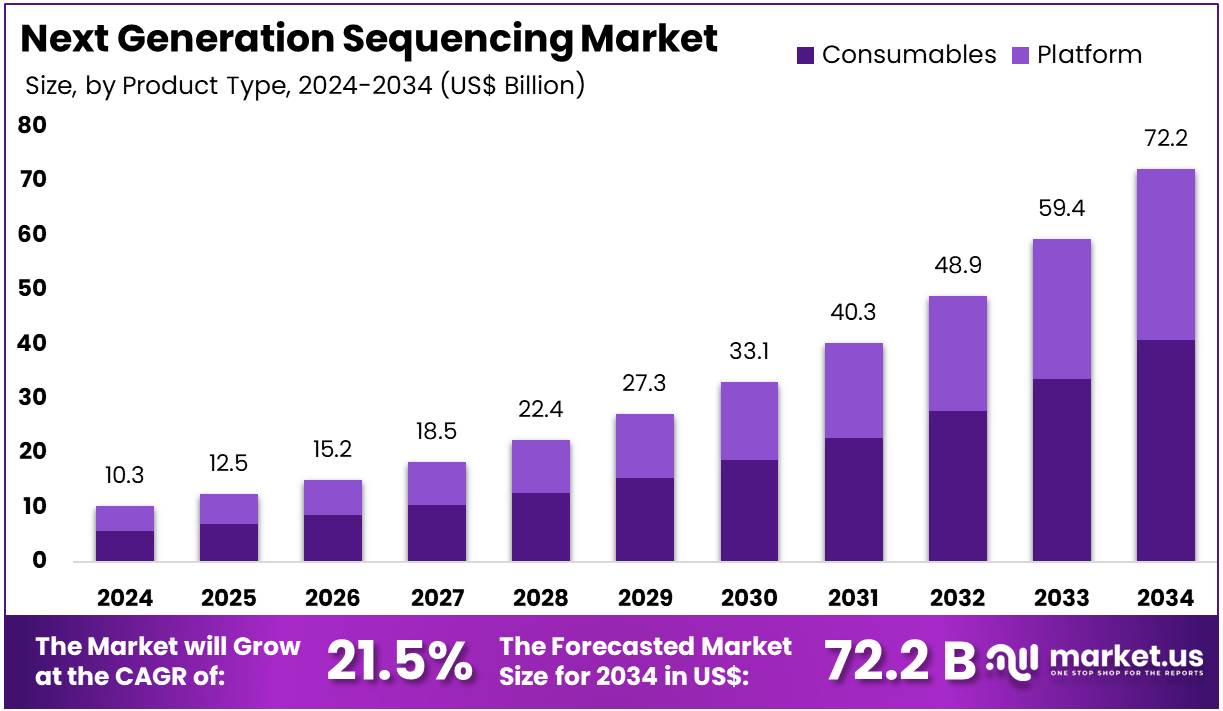

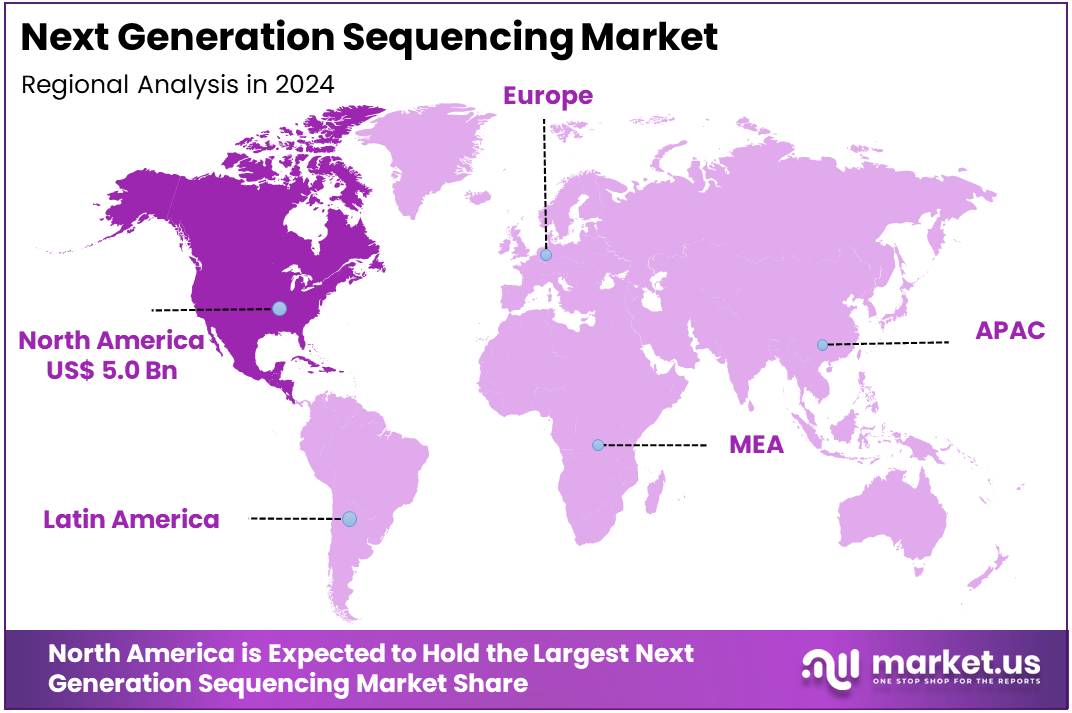

The Next Generation Sequencing Market size is expected to be worth around US$ 72.2 billion by 2034 from US$ 10.3 billion in 2024, growing at a CAGR of 21.5% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 48.7% share and holds US$ 5 Billion market value for the year.

Increasing adoption of precision medicine is a primary driver for the next-generation sequencing (NGS) market. NGS technology enables clinicians and researchers to analyze an individual’s unique genetic makeup, allowing for highly personalized diagnostics and treatment plans. This is particularly critical in oncology, where the American Cancer Society reported that over 2 million new cancer cases were expected in the US in 2024, underscoring the demand for advanced tools that can identify specific genetic mutations to guide targeted therapies. NGS applications in oncology, rare diseases, and reproductive health are transforming patient care by providing rapid and accurate genetic insights that traditional methods cannot match.

Growing opportunities are emerging from advancements in sequencing technologies, particularly the development of long-read sequencing and the integration of AI for data analysis. Long-read sequencing, as highlighted by the November 2023 collaboration between Yourgene Health and PacBio, enhances the precision and scalability of genomic studies by efficiently selecting long DNA fragments.

AI and machine learning are revolutionizing the vast amount of data generated by NGS, improving variant calling accuracy and streamlining workflows. The November 2023 funding initiative by MedGenome and PacBio for genome assembly research, and Integrated DNA Technologies’ introduction of a new product line in September 2023 to improve workflow efficiency, demonstrate the industry’s focus on technological innovation to make sequencing more accessible and accurate.

The market is also witnessing a strong trend toward expanding NGS applications beyond traditional research into a broader range of clinical diagnostics and consumer genomics. Non-invasive prenatal testing (NIPT), which uses NGS to screen for fetal abnormalities, is a rapidly growing application.

Similarly, the use of NGS in liquid biopsies for cancer monitoring provides a non-invasive way to track a tumor’s genetic landscape in real time. These trends are democratizing genomic data, bringing it into mainstream healthcare and direct-to-consumer services. The continuous technological developments and strategic partnerships are making NGS an increasingly essential tool for diagnostics, personalized medicine, and large-scale genomic research initiatives.

Key Takeaways

- In 2024, the market generated a revenue of US$ 10.3 billion, with a CAGR of 21.5%, and is expected to reach US$ 72.2 billion by the year 2034.

- The product type segment is divided into consumables and platform, with consumables taking the lead in 2023 with a market share of 56.7%.

- Considering technology, the market is divided into targeted sequencing & resequencing, WGS, whole exome sequencing, and others. Among these, targeted sequencing & resequencing held a significant share of 38.5%.

- Furthermore, concerning the application segment, the oncology sector stands out as the dominant player, holding the largest revenue share of 35.5% in the market.

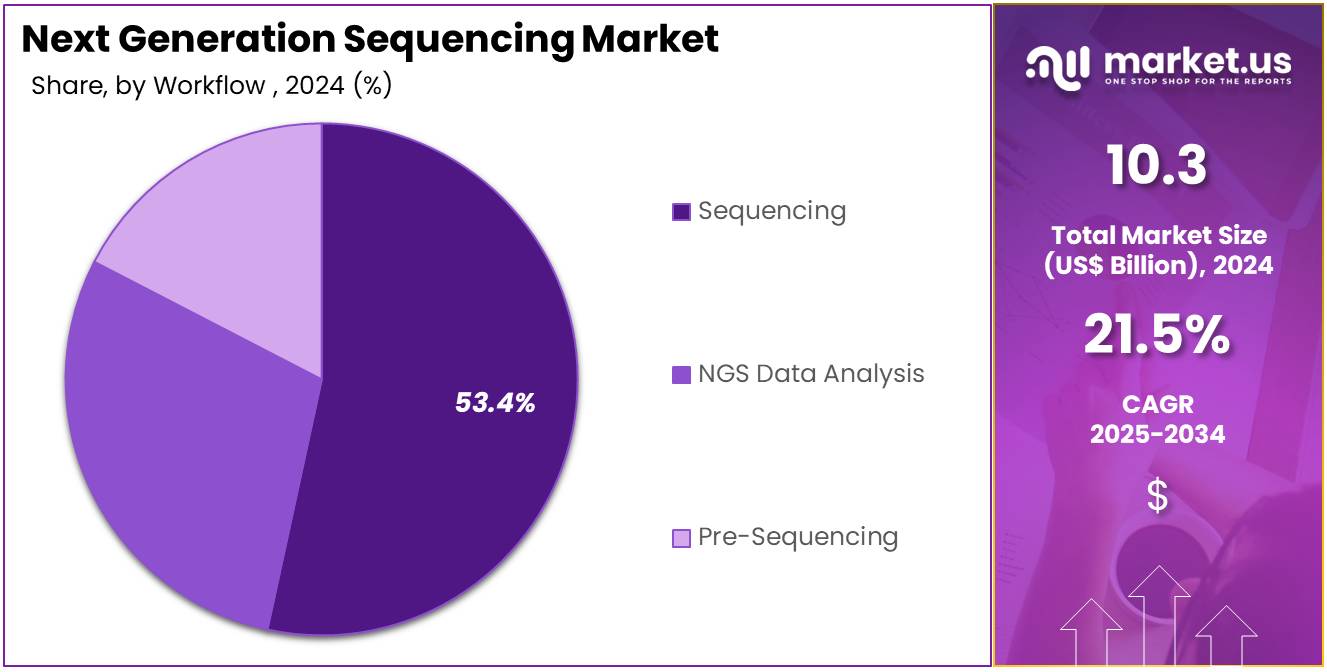

- The workflow segment is segregated into sequencing, NGS data analysis, and pre-sequencing, with the sequencing segment leading the market, holding a revenue share of 53.4%.

- Considering end-user, the market is divided into academic research, clinical research, hospitals & clinics, pharma & biotech entities, and other users. Among these, academic research held a significant share of 38.8%.

- North America led the market by securing a market share of 48.7% in 2023.

Product Type Analysis

Consumables dominate the product type segment with a 56.7% share. This growth is primarily driven by the increasing adoption of next-generation sequencing (NGS) technologies across research and clinical applications. Consumables, such as reagents, kits, and sequencer cartridges, are essential for the execution of NGS and make up a significant portion of the overall market. As NGS technologies continue to evolve, the need for high-quality consumables will rise, driving their market share.

The growing emphasis on personalized medicine, where NGS is widely used for genetic testing and diagnostics, is expected to further boost the demand for consumables. Additionally, advancements in sequencing technology, such as improved accuracy and faster sequencing speeds, are expected to increase the use of consumables in both clinical and research environments. The rise of genomic data-driven healthcare will contribute to the continued growth of consumables in the NGS market.

Technology Analysis

Targeted sequencing & resequencing lead the technology segment with a 38.5% share. The growth of this segment is driven by the increasing demand for precision medicine and the ability to identify specific genetic variations associated with diseases. Targeted sequencing allows for a focused approach to sequencing particular genes or regions of interest, making it more cost-effective and faster than whole-genome sequencing (WGS). This is particularly valuable in oncology and other genetic disorders where specific mutations play a critical role in disease progression.

The growing use of targeted therapies, where drug treatments are tailored to an individual’s genetic profile, is expected to drive demand for targeted sequencing. Furthermore, advancements in sequencing technology that improve the speed, accuracy, and affordability of targeted sequencing are anticipated to contribute to the continued growth of this segment.

Application Analysis

Oncology is the largest application segment in the NGS market, holding a 37.5% share. The application of NGS in oncology has significantly increased due to its ability to identify genetic mutations, characterize tumors, and inform personalized treatment plans. NGS is used extensively for cancer genomics research, enabling the discovery of new biomarkers and the development of targeted therapies.

The increasing focus on precision oncology, where treatments are customized based on a patient’s genetic makeup, is driving the demand for NGS in oncology. Additionally, the growing number of clinical trials focused on genomic-based therapies is likely to fuel further growth in this application. As the understanding of the genetic basis of cancer expands, NGS technologies are expected to become an integral part of cancer diagnostics, treatment planning, and monitoring, contributing to the overall growth of the market.

Workflow Analysis

Sequencing is the dominant workflow segment with a 53.4% share. This segment’s growth is driven by the widespread use of sequencing technologies in both research and clinical applications. Sequencing is the core process of NGS, and its increasing adoption in genomic research, diagnostics, and drug discovery is expected to propel this segment’s growth. The demand for sequencing is expected to grow as NGS technologies become more advanced, allowing for faster and more accurate sequencing of DNA and RNA.

Additionally, the increasing use of sequencing for applications such as whole-genome sequencing, exome sequencing, and transcriptome analysis will continue to drive growth. As sequencing becomes more accessible and affordable, it is anticipated to play a critical role in both academic and clinical settings, especially in personalized medicine and genetic testing.

End-User Analysis

Academic research is the largest end-user segment with a 38.8% share. The demand for NGS technologies in academic research is expected to continue to grow as the understanding of genomics and personalized medicine advances. Academic institutions are key players in driving innovation in sequencing technologies and applying these techniques to a wide range of biological and medical research.

NGS is extensively used in academic research for gene expression profiling, disease mechanism studies, and genetic variant analysis. The increasing number of research projects focused on human genetics, cancer genomics, and personalized medicine is expected to contribute to the continued growth of the NGS market. As research institutions and universities adopt NGS for more diverse and complex applications, the academic research segment is likely to maintain its dominance in the market.

Key Market Segments

By Product Type

- Consumables

- Sample Preparation

- Target Enrichment

- Others

- Platform

- Sequencing

- Data Analysis

By Technology

- Targeted Sequencing & Resequencing

- DNA-based

- RNA-based

- WGS

- Whole Exome Sequencing

- Others

By Application

- Oncology

- Diagnostics and Screening

- Oncology Screening

- Companion Diagnostics

- Other Diagnostics

- Research Studies

- Diagnostics and Screening

- Consumer Genomics

- Clinical Investigation

- Infectious Diseases

- Inherited Diseases

- Idiopathic Diseases

- Non-Communicable/Other Diseases

- Reproductive Health

- NIPT

- Aneuploidy

- Microdeletions

- PGT

- Newborn Genetic Screening

- Single Gene Analysis

- NIPT

- HLA Typing/Immune System Monitoring

- Metagenomics, Epidemiology & Drug Development

- Agrigenomics & Forensics

By Workflow

- Sequencing

- NGS Data Analysis

- Pre-Sequencing

- NGS Library Preparation Kits

- Semi-automated Library Preparation

- Automated Library Preparation

By End-user

- Academic Research

- Clinical Research

- Hospitals & Clinics

- Pharma & Biotech Entities

- Other Users

Drivers

The decreasing cost of sequencing is driving the market

The rapid and significant decline in the cost of Next Generation Sequencing (NGS) is a major driver of market growth. When the Human Genome Project was completed, sequencing a single human genome cost billions of dollars. Today, technological advancements have brought this cost down dramatically, making the technology far more accessible for research, clinical diagnostics, and drug discovery.

A key milestone was announced in early 2024 with the launch of new high-throughput sequencing systems that promised to bring the cost of sequencing a whole human genome below US$200. This drastic reduction in cost opens up new applications that were previously not economically feasible.

For example, it enables large-scale population studies to identify genetic markers for complex diseases and facilitates the routine use of genomic profiling in cancer care. As the cost per genome continues to fall, it democratizes access to genetic information, allowing a broader range of institutions-from small clinical laboratories to individual researchers-to adopt NGS technologies, thereby fueling market expansion.

Restraints

The complexity of data analysis and management is restraining the market

One of the most significant restraints on the Next Generation Sequencing market is the immense complexity and volume of data generated, which creates major challenges for analysis and management. A single human genome sequence can produce hundreds of gigabytes of raw data, and analyzing this information requires sophisticated bioinformatics tools and highly skilled professionals. The sheer scale of the data necessitates robust and costly IT infrastructure for storage and processing. Furthermore, the interpretation of this data to derive meaningful clinical insights is a major bottleneck.

The shortage of qualified bioinformatics specialists who can accurately interpret complex genetic variants and their clinical significance is a major hurdle. In 2024, the amount of data generated by sequencing technologies was projected to surpass the data volumes of social media giants like YouTube and Twitter. This data deluge, combined with the lack of standardized analysis pipelines and the high cost of data storage and management, poses a significant technical and financial challenge for many potential users, thereby limiting the broader adoption of NGS technologies.

Opportunities

The expansion of companion diagnostics is creating growth opportunities

The growing field of companion diagnostics represents a major opportunity for the Next Generation Sequencing market. Companion diagnostics are tests used to identify which patients are most likely to respond to a particular drug therapy, based on their genetic makeup. This approach is a cornerstone of precision medicine, particularly in oncology, where NGS is used to profile tumors for specific genetic mutations that can be targeted with a drug. The US Food and Drug Administration (FDA) has continued to approve new companion diagnostics in recent years.

In 2022, the FDA approved a liquid biopsy test that uses NGS technology to identify patients with non-small cell lung cancer who are candidates for treatment with a specific targeted therapy. This trend is accelerating, as more drug therapies are being developed in conjunction with a companion diagnostic. The increasing number of FDA approvals for both new cancer drugs and their associated NGS-based diagnostic tests is creating a clear and expanding pathway for the clinical adoption of NGS, moving the technology from a research tool to a standard of care in personalized medicine.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly impact the next-generation sequencing (NGS) market, challenging biotechnology leaders to balance budget constraints with technological progress. Ongoing global inflation has reduced research funding, forcing labs to delay the purchase of high-throughput sequencing platforms. Economic slowdowns in emerging regions, like Latin America, limit investment in bioinformatics systems, which are critical for analyzing genetic variants. Additionally, geopolitical tensions, such as US-China trade disputes, have disrupted supply chains and raised costs for essential reagents and components used in sequencing technologies.

Cybersecurity threats also pose risks to data sharing, particularly in international collaborations. Regulatory delays and inconsistencies in biosecurity protocols further slow the development of clinical-grade sequencing applications. The rising prevalence of rare genetic disorders, which affect 1 in 10 individuals globally, is fueling demand for more advanced diagnostic tools. In response, companies are forming strategic partnerships in neutral regions like Switzerland and diversifying supply chains to foster innovation in precision medicine.

US tariffs and recent legislative actions are reshaping the NGS market landscape. Recent tariff increases have driven up the costs of sequencing equipment and library preparation kits, putting pressure on suppliers’ profitability. As research institutions face higher import costs, many are delaying the expansion of their sequencing systems, creating bottlenecks in large-scale genomics projects.

Retaliatory measures from China have further disrupted global workflows, causing shortages in academic research pipelines. As a result, procurement teams are focusing more on managing tariff impacts rather than optimizing algorithms, which affects the progress of multi-omics platforms.

However, government initiatives like the BIOSECURE Act are promoting local manufacturing in the US by restricting federal funding for certain foreign biotech services and equipment. This has encouraged companies to invest in domestic talent and develop resilient, tariff-resistant supply chains. By seeking waivers for specific sectors, the industry is turning these challenges into opportunities for long-term growth, driving innovation in high-precision sequencing solutions.

Latest Trends

The rise of population-scale genomic initiatives is a recent trend

A recent and prominent trend in the Next Generation Sequencing market is the proliferation of large-scale, government-backed genomic initiatives aimed at sequencing the genomes of entire populations. These projects, such as the All of Us Research Program in the US and the Genome UK program, are designed to build vast databases of genomic and health information. Their goal is to accelerate biomedical research, improve public health, and advance precision medicine by providing researchers with an unprecedented volume of diverse genetic data.

For example, the All of Us Research Program has reached a major milestone by sequencing more than 100,000 whole genomes as of 2022. This trend is leading to significant public and private funding for NGS technologies, as governments and research institutions recognize the long-term value of these datasets. The focus on population-scale genomics not only drives demand for high-throughput sequencing instruments and services but also fosters innovation in bioinformatics and data analysis to manage and interpret the massive amounts of information being generated.

Regional Analysis

North America is leading the Next Generation Sequencing Market

In 2024, North America held a 48.7% share of the global Next Generation Sequencing market, driven by strong federal support for genomic infrastructure and the growth of precision oncology, in response to the increasing prevalence of chronic diseases. Biopharmaceutical companies accelerated the use of high-throughput platforms to identify new biomarkers, which helped shorten drug development timelines and improve targeted treatments for cancers like lung and breast cancer.

The FDA’s expanded approvals for NGS companion diagnostics facilitated smoother clinical integration and increased confidence in automated variant calling for routine tumor profiling. Academic consortia, supported by collaborative grants, improved bioinformatics pipelines to manage large datasets, enabling large-scale multi-omics studies that uncover genetic risks in diverse populations. Following the pandemic, the need for genomic surveillance grew, with hospitals upgrading sequencing labs to improve outbreak preparedness.

Cost reductions in library preparation kits made NGS more economically viable, encouraging mid-sized research institutions to outsource complex analyses. Additionally, venture funding boosted advancements in single-cell resolution tools, filling gaps in spatial transcriptomics for neuroscience research. These factors have strengthened North America’s leadership in transformative DNA analysis technologies. The National Human Genome Research Institute’s budget rose from US$ 636.5 million in fiscal year 2022 to US$ 660.5 million in fiscal year 2023, continuing to support progress in sequencing technologies and data interpretation.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Looking ahead, analysts predict significant growth for the Asia Pacific Next Generation Sequencing market, driven by national strategies focused on achieving biotech self-reliance to address hereditary diseases in large populations. Governments are investing in centralized sequencing hubs, providing research institutes with automated workflows to conduct large-scale exome analyses for endemic conditions. Pharmaceutical companies are collaborating with local labs to create customized pharmacogenomics panels, which are expected to lead to faster approval of medications tailored to specific ethnic groups.

Innovation centers in Shenzhen and Tokyo are advancing long-read technologies, enabling academic teams to explore structural variants in agricultural genomics. Regional collaborations are also investing in cloud-based platforms to share genetic variants, helping clinicians refine neonatal screening protocols across borders. Local companies plan to deploy portable sequencers for field-based epidemiology, addressing infectious disease threats in tropical regions.

Collaborative efforts are incorporating AI to map tumor heterogeneity and guide immunotherapy decisions in oncology. These efforts position the region as a key player in providing equitable genomic insights. In 2023, China’s National Natural Science Foundation allocated 31.8 billion yuan to support foundational research, including genomics and sequencing projects.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Prominent firms in the genomics sequencing sector propel expansion by unveiling high-throughput platforms that slash costs and amplify accuracy for applications spanning oncology to infectious disease tracking. They execute calculated acquisitions to absorb innovative long-read and single-cell technologies, thereby diversifying their portfolios and outpacing competitors. Businesses cultivate robust partnerships with pharmaceutical leaders and academic labs to jointly engineer bespoke assays, streamlining regulatory pathways and hastening commercialization.

Executives steer hefty R&D allocations toward AI-enhanced bioinformatics suites, empowering users with rapid variant detection and predictive modeling. They penetrate fast-growing territories like Asia-Pacific and Latin America, adapting protocols to regional data sovereignty rules and infrastructure variances. In addition, they deploy bundled reagent and service subscriptions to cement client dependencies and cultivate reliable revenue pipelines.

Illumina, Inc., founded in 1998 and headquartered in San Diego, California, pioneers DNA sequencing and array technologies that accelerate breakthroughs in life sciences, oncology, and reproductive health worldwide. The company deploys core platforms like NovaSeq and NextSeq, complemented by library preparation kits and analytics software, to facilitate seamless genomic workflows.

Illumina directs vigorous R&D initiatives to broaden access in clinical diagnostics and population studies, emphasizing precision and scalability. CEO Francis deSouza orchestrates a global team focused on integrity-driven innovation and cross-sector collaborations. The firm engages with health networks across more than 150 countries to embed sequencing into everyday care practices. Illumina bolsters its dominance by prioritizing user-centric enhancements and adaptive solutions amid shifting market dynamics.

Top Key Players in the Next Generation Sequencing Market

- Thermo Fisher Scientific, Inc

- QIAGEN

- PierianDx

- Oxford Nanopore Technologies

- Illumina

- Genomatix GmbH

- Hoffman-La Roche Ltd

- Eurofins GATC Biotech GmbH

- Bio-Rad Laboratories, Inc.

- BGI

Recent Developments

- In December 2023: Oxford Nanopore, in collaboration with Tecan, rolled out the beta version of TurBOT, a cutting-edge benchtop instrument designed to streamline the process of basecalling, data analysis, and library preparation. By enabling efficient handling of multiple samples in a single unit, this advancement enhances the scalability of genomic sequencing workflows, contributing to the broader adoption of Next Generation Sequencing (NGS) technologies.

- In December 2023: Illumina expanded its reach in global genomics by partnering with a prominent African organization. This collaboration focuses on enhancing genomic capabilities in the region, particularly for tackling infectious diseases, and is expected to increase the deployment of NGS platforms, broadening their use in medical research and diagnostics.

- In December 2023: Illumina formed a partnership with a leading Chinese firm to locally manufacture sequencing instruments. This initiative will improve the accessibility and affordability of advanced sequencing tools in China, expanding the adoption of NGS technologies and supporting the country’s growing life sciences sector.

Report Scope

Report Features Description Market Value (2024) US$ 10.3 billion Forecast Revenue (2034) US$ 72.2 billion CAGR (2025-2034) 21.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Consumables (Sample Preparation, Target Enrichment, and Others), and Platform (Sequencing, Data Analysis)), By Technology (Targeted Sequencing & Resequencing (DNA-based, and RNA-based), WGS, Whole Exome Sequencing, and Others), By Application (Oncology (Diagnostics and Screening (Oncology Screening, Companion Diagnostics, and Other Diagnostics), and Research Studies), Consumer Genomics, Clinical Investigation (Infectious Diseases, Inherited Diseases, Idiopathic Diseases, Non-Communicable/Other Diseases), Reproductive Health (NIPT (Aneuploidy, and Microdeletions), PGT, Newborn Genetic Screening, Single Gene Analysis), HLA Typing/Immune System Monitoring, Metagenomics, Epidemiology & Drug Development, Agrigenomics & Forensics), By Workflow (Sequencing, NGS Data Analysis, Pre-Sequencing (NGS Library Preparation Kits, Semi-automated Library Preparation, and Automated Library Preparation)), By End-user (Academic Research, Clinical Research, Hospitals & Clinics, Pharma & Biotech Entities, and Other Users) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Thermo Fisher Scientific, Inc, QIAGEN, PierianDx, Oxford Nanopore Technologies, Illumina, Genomatix GmbH, F. Hoffman-La Roche Ltd, Eurofins GATC Biotech GmbH, Bio-Rad Laboratories, Inc., BGI. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Next Generation Sequencing MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample

Next Generation Sequencing MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Illumina, Inc.

- Hoffman-La Roche

- QIAGEN

- Thermo Fisher Scientific Inc.

- Bio-Rad Laboratories, Inc.

- Oxford Nanopore Technologies

- PierianDx Inc.

- Genomatix GmbH

- DNASTAR, Inc.

- Perkin Elme Inc.

- Eurofins GATC Biotech GmbH

- BGI

- Precigen Inc.

- Macrogen Inc.

- Pillar Biosciences Inc.

- Agilent Technologies Inc.

- Other key players