Global Sequencing Consumables Market By Product (Kits (Target Enrichment, RNA Library Preparation, DNA Library Preparation, Purification & Quality Control, Library Quantification, and Others), Reagents (Sequencing, Sample Prep, Library Preparation & Amplification), Accessories (Plates, Collection Tubes, and Others)), By Technology (3rd Generation, 2nd Generation, and 1st Generation), By Application (Cancer Diagnostics, Reproductive Health Diagnostics, Pharmacogenomics, Infectious Disease Diagnostics, Agrigenomics, and Others), By End-use (Hospitals & Laboratories, Academic Research Institutes, Pharmaceutical & Biotechnology Companies, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 147408

- Number of Pages: 239

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

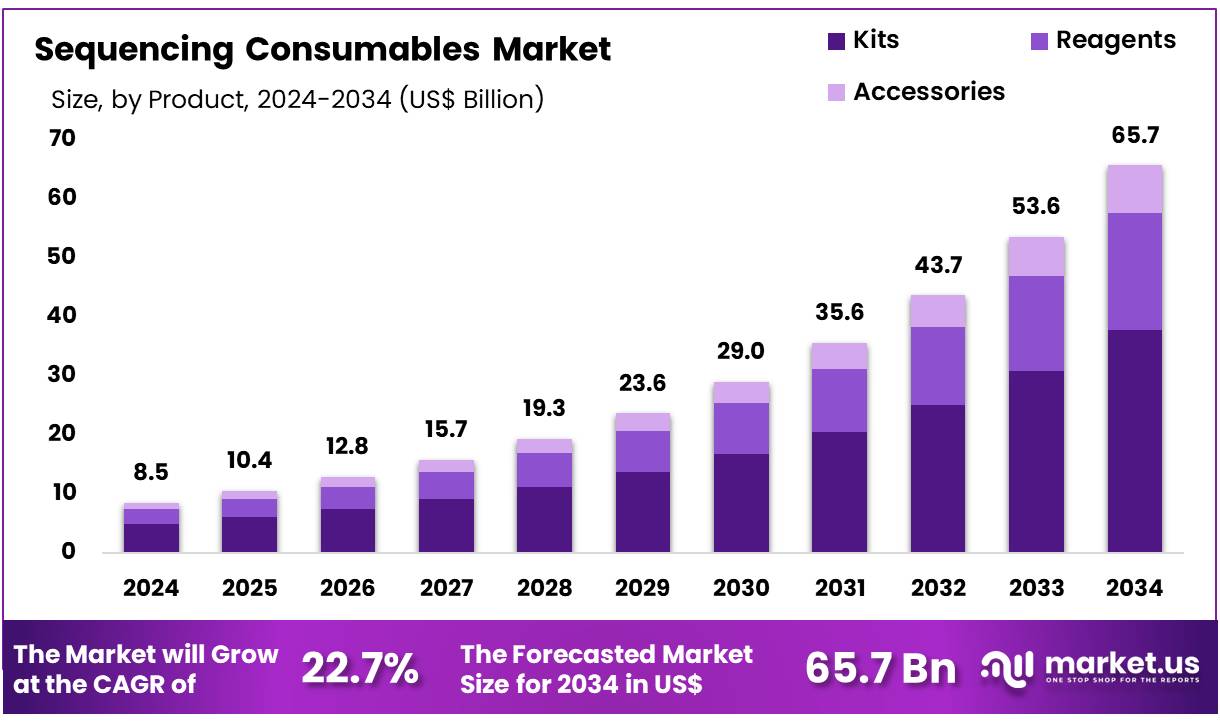

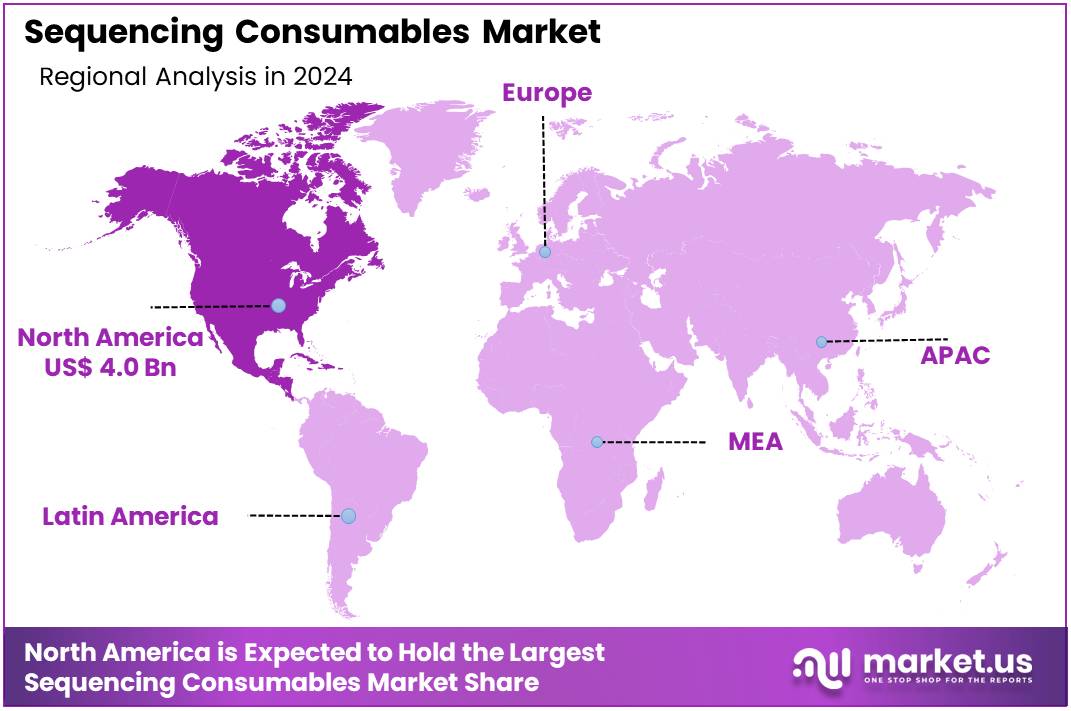

Global Sequencing Consumables Market size is expected to be worth around US$ 65.7 billion by 2034 from US$ 8.5 billion in 2024, growing at a CAGR of 22.7% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 47.3% share with a revenue of US$ 4.0 Billion.

Increasing advancements in genomic research and the growing demand for personalized medicine are driving the rapid growth of the sequencing consumables market. Sequencing consumables, including reagents, kits, and primers, play a crucial role in next-generation sequencing (NGS) applications, which are essential for applications in genomics, diagnostics, drug development, and precision medicine.

The rising demand for high-throughput sequencing technologies in research and clinical settings fuels the need for quality consumables to maintain accuracy and efficiency in genetic analysis. In October 2023, the National Human Genome Research Institute (NHGRI) launched funding initiatives to promote genomic medicine research, further accelerating the development of sequencing technologies.

These grants, including those for Small Business Innovation Research (SBIR) programs, are designed to support multi-disciplinary consortia and investigator-led projects. Such funding initiatives offer significant opportunities for developing new sequencing consumables and driving innovation in genomic medicine.

The growing applications of sequencing in cancer genomics, infectious diseases, rare genetic disorders, and drug development continue to push the boundaries of sequencing technology, ensuring a steady demand for consumables. As research expands, the sequencing consumables market presents new opportunities for innovation and product development, particularly in genomic medicine and disease diagnostics.

Key Takeaways

- In 2024, the market for sequencing consumables generated a revenue of US$ 8.5 billion, with a CAGR of 22.7%, and is expected to reach US$ 65.7 billion by the year 2033.

- The product segment is divided into kits, reagents, and accessories, with kits taking the lead in 2024 with a market share of 57.6%.

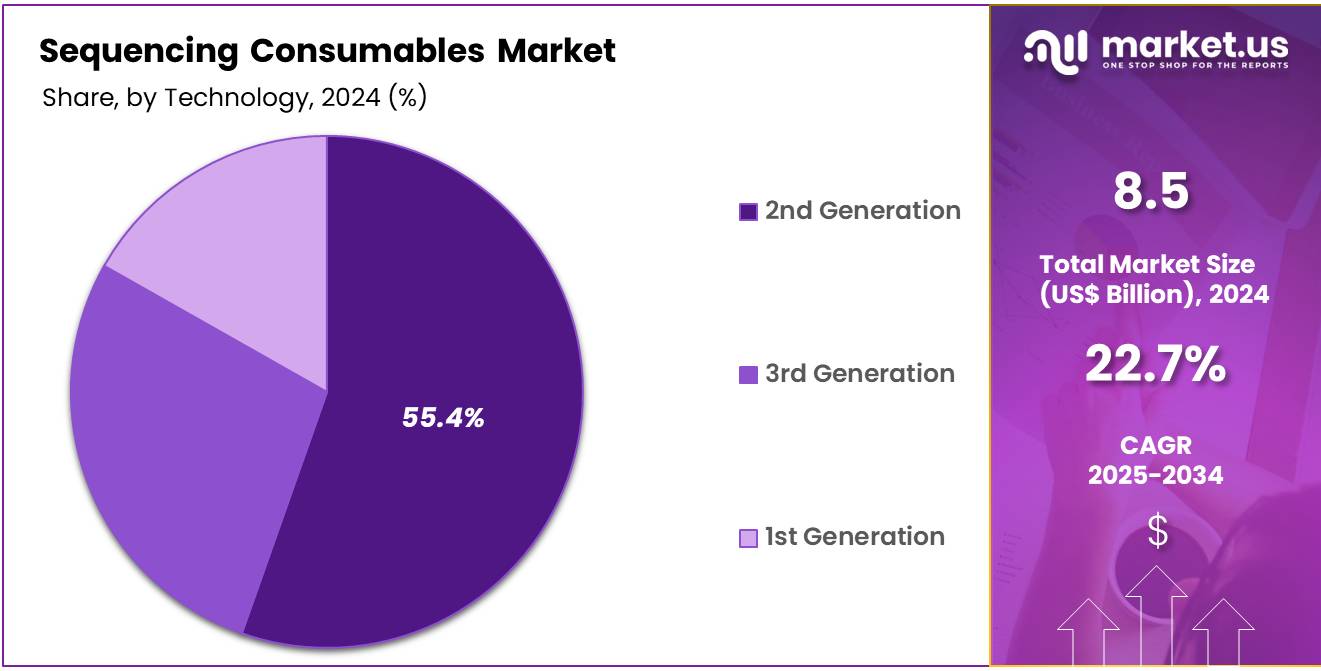

- Considering technology, the market is divided into 3rd generation, 2nd generation, and 1st generation. Among these, 2nd generation held a significant share of 55.4%.

- Furthermore, concerning the application segment, the market is segregated into cancer diagnostics, reproductive health diagnostics, pharmacogenomics, infectious disease diagnostics, agrigenomics, and others. The cancer diagnostics sector stands out as the dominant player, holding the largest revenue share of 54.9% in the sequencing consumables market.

- The end-use segment is segregated into hospitals & laboratories, academic research institutes, pharmaceutical & biotechnology companies, and others, with the hospitals & laboratories segment leading the market, holding a revenue share of 59.8%.

- North America led the market by securing a market share of 47.3% in 2024.

Product Analysis

The kits segment led in 2024, claiming a market share of 57.6% owing to the increasing demand for high-throughput sequencing and the need for efficient sample preparation. Kits are anticipated to be crucial in streamlining workflows, offering an all-in-one solution that simplifies the sequencing process.

With advances in genomic research, the development of more precise and specialized kits tailored to different sequencing technologies will likely drive their adoption. Moreover, as personalized medicine and genetic testing become more prevalent, the use of sequencing kits for clinical applications is projected to increase, further supporting the growth of this segment.

Technology Analysis

The 2nd generation held a significant share of 55.4% due to its balance of affordability, accuracy, and scalability. 2nd generation sequencing technologies, also known as next-generation sequencing (NGS), are widely used for large-scale genomic studies, such as whole-genome sequencing and RNA sequencing.

The continuous advancements in NGS technology, combined with decreasing sequencing costs, will likely drive demand for consumables associated with 2nd generation sequencing. This segment is expected to remain dominant in academic, clinical, and commercial applications due to its established performance and reliability in generating high-quality sequencing data.

Application Analysis

The cancer diagnostics segment had a tremendous growth rate, with a revenue share of 54.9% as genetic testing plays an increasingly crucial role in detecting and treating cancer. With the rise in personalized medicine, sequencing technologies are expected to become more integrated into routine cancer diagnostics.

Genetic profiling of tumors enables the identification of specific mutations that guide targeted therapy, making sequencing consumables vital in cancer care. As the global burden of cancer increases and more treatments are tailored to individual genetic profiles, the demand for sequencing consumables in cancer diagnostics is likely to rise, expanding the segment further.

End-Use Analysis

The hospitals & laboratories segment grew at a substantial rate, generating a revenue portion of 59.8% due to the increasing adoption of sequencing technologies for clinical diagnostics and research applications. Hospitals and diagnostic laboratories are anticipated to be the primary users of sequencing consumables as they integrate advanced genomic testing into clinical practice.

This growth is driven by the need for precision medicine, which relies on genomic data for accurate diagnosis and treatment planning. Additionally, as sequencing becomes more accessible and cost-effective, hospitals and laboratories are projected to increase their utilization of sequencing technologies, thus contributing to the growth of this segment in the market.

Key Market Segments

Product

- Kits

- Target Enrichment

- RNA Library Preparation

- DNA Library Preparation

- Purification & Quality Control

- Library Quantification

- Others

- Reagents

- Sequencing

- Sample Prep

- Library Preparation & Amplification

- Accessories

- Plates

- Collection Tubes

- Others

Technology

- 3rd Generation

- 2nd Generation

- 1st Generation

Application

- Cancer Diagnostics

- Reproductive Health Diagnostics

- Pharmacogenomics

- Infectious Disease Diagnostics

- Agrigenomics

- Others

End-use

- Hospitals & Laboratories

- Academic Research Institutes

- Pharmaceutical & Biotechnology Companies

- Others

Drivers

Expanding Use in Clinical Diagnostics is driving the market

The increasing integration of sequencing technologies, particularly next-generation sequencing (NGS), into clinical settings significantly fuels demand for the necessary reagents and kits. Clinicians increasingly utilize genomic information for diagnosing genetic disorders, assessing cancer risk, and guiding personalized treatment strategies. Regulatory bodies are recognizing the value of these tools, leading to more approvals for diagnostic tests.

For instance, the US Food and Drug Administration (FDA) maintains a growing list of cleared or approved companion diagnostic devices, including numerous nucleic acid-based tests approved or updated between 2022 and 2024 for various conditions like cancer and genetic diseases.

Furthermore, major investments support this trend; in late 2024, the US National Institutes of Health (NIH) announced US$27 million in funding over five years to establish a network focused on integrating genomics into learning health systems, aiming to improve how genomic information translates into patient care. This clinical shift inherently requires a consistent and growing supply of high-quality materials for sample preparation, sequencing runs, and analysis.

Restraints

Complexity and Data Interpretation Costs are restraining the market

While the cost per genome has decreased over time, the overall expense and complexity associated with implementing and running sequencing workflows present a significant barrier for some institutions. The initial investment in high-throughput sequencing instruments remains substantial. Beyond the hardware, analyzing and interpreting the vast amounts of generated data requires sophisticated bioinformatics infrastructure and specialized expertise, adding considerable ongoing operational costs.

Although specific consumable prices fluctuate, the total cost of ownership, including data management and interpretation, can be prohibitive, particularly for smaller clinical laboratories or research groups with limited budgets. This challenge can slow the adoption rate, especially in resource-constrained settings, thereby limiting the potential expansion of reagent and kit consumption despite the technology’s clear advantages. Successfully navigating the data analysis bottleneck is crucial for broader market penetration.

Opportunities

Personalized Medicine Initiatives are creating growth opportunities

The global push towards personalized medicine presents a major growth avenue for sequencing consumables. Tailoring treatments based on an individual’s genetic makeup requires detailed genomic information, directly driving the need for sequencing.

As researchers identify more links between genetic variations and disease susceptibility or drug response, the demand for companion diagnostics surges. The FDA’s approval list reflects this, showing numerous companion diagnostics, including NGS-based tests like FoundationOne CDx and specific assays like Abbott RealTime IDH1/IDH2, cleared or approved through 2023 to guide targeted therapies, primarily in oncology.

This trend extends globally, with healthcare systems worldwide exploring ways to incorporate genomic data into routine care, necessitating a greater volume and variety of sequencing kits and reagents to support these precision health programs.

Impact of Macroeconomic / Geopolitical Factors

Global macroeconomic conditions and geopolitical tensions exert significant influence on the market for genomic analysis supplies. Inflationary pressures observed globally can increase the manufacturing costs of reagents and plastics, potentially leading to higher prices for end-users and impacting laboratory budgets.

Supply chain vulnerabilities, exacerbated by international conflicts or trade disputes, pose risks to the consistent availability of critical components and raw materials sourced internationally, potentially causing delays or shortages. Fluctuations in government research funding across different nations can also affect demand, as academic research remains a major consumer segment.

Conversely, heightened global focus on pandemic preparedness and genomic surveillance, often spurred by geopolitical health concerns, can drive increased investment and demand. Furthermore, national strategic initiatives, like efforts in the US and EU to bolster domestic biomanufacturing, may reshape supply chains over time, fostering regional resilience even amidst global uncertainty. Strategic collaborations and diversification efforts by suppliers help mitigate these risks, ensuring continued innovation and supply stability.

Current US tariff policies, particularly Section 301 tariffs targeting China, introduce significant cost and logistical complexities for the supply of sequencing materials. These tariffs, initially ranging up to 25% on billions of dollars worth of goods, saw targeted increases announced in 2024; for example, tariffs on certain medical supplies like syringes and needles rose to 50%, while semiconductor tariffs are scheduled to reach 50% by 2025. Such duties imposed on imported chemicals, specialized plastics, or electronic components used in instruments can directly increase manufacturing costs for suppliers.

This pressure is notable given the reliance on global sources. The US imported US$6 billion in pharmaceutical products from China in 2023, a sector potentially facing new tariffs, and relies heavily on imports for many active pharmaceutical ingredients and medical device components. Reports indicate related cost hikes, like an 18.4% increase for semiconductor components between 2022 and 2024. This ultimately can translate to higher prices for labs, potentially constraining consumable budgets.

Furthermore, tariffs disrupt established supply chains, forcing companies to seek alternative sourcing or invest in domestic production, incurring transition costs. However, these trade dynamics may also accelerate the strengthening of domestic manufacturing capabilities, aligning with strategic goals for supply chain resilience. Companies actively navigate this landscape by diversifying suppliers and optimizing logistics, adapting robustly to maintain market access and mitigate cost impacts.

Latest Trends

The Rise of Long-Read Technologies is a key recent trend

A notable recent trend involves the increasing adoption and technological advancement of long-read sequencing platforms offered by companies like Pacific Biosciences and Oxford Nanopore Technologies. These technologies provide advantages for specific applications, such as de novo genome assembly, structural variant detection, and epigenetic analysis, complementing traditional short-read approaches.

Key players reported significant activity in this area during the 2022-2024 period. For example, Pacific Biosciences reported shipping 173 Revio systems by the end of fiscal year 2023, contributing to a substantial increase in their instrument revenue to US$120.5 million for the year.

Similarly, Oxford Nanopore highlighted strong underlying revenue growth driven by increased utilization of their high-throughput PromethION platform in 2024 preliminary reports. This growing interest necessitates the development and purchase of specific consumables optimized for these long-read platforms.

Regional Analysis

North America is leading the Sequencing Consumables Market

North America dominated the market with the highest revenue share of 47.3% owing to increased investment in genomics research and expanded clinical applications. This growth is supported by initiatives like the U.S. National Institutes of Health (NIH) continued funding for large-scale sequencing projects, including contributions to the Human Pangenome Project, which requires substantial volumes of reagents and kits.

Furthermore, the integration of sequencing into routine clinical diagnostics, particularly in oncology and infectious disease surveillance, significantly increased demand for sequencing materials. For instance, the Centers for Disease Control and Prevention (CDC) utilized sequencing extensively for monitoring pathogen evolution, processing over 270,000 SARS-CoV-2 sequences in 2022 alone, demonstrating a high throughput necessitating consistent consumable supply.

Academic and research institutions across the United States and Canada also expanded their sequencing capabilities and projects during this period. This surge in both research and clinical applications across diverse fields directly fueled the need for a steady supply of various sequencing reagents, library preparation kits, and flow cells throughout 2024.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR in the coming years. Governments across the region are prioritizing precision medicine and large-scale genomics initiatives, which will likely accelerate the adoption of sequencing technologies. For example, China’s national genomics plan is anticipated to involve significant investment in infrastructure and research, driving considerable demand for related materials.

India’s Genome India Project, aiming to sequence the genomes of a large population cohort, is expected to consume a vast quantity of sequencing reagents and kits as it progresses. Similarly, countries like South Korea and Japan are projected to continue increasing their investments in genomics research and clinical sequencing applications.

The expanding healthcare infrastructure and rising awareness regarding personalized medicine in emerging economies within Asia Pacific further suggest an increasing need for sequencing technologies and, consequently, their essential consumables in the coming years. This regional push towards comprehensive genomic profiling indicates a strong trajectory for market expansion.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the sequencing consumables market drive growth through strategic investments in research and development, expanding their product portfolios, and enhancing global distribution networks. They focus on developing advanced reagents, kits, and bioinformatics tools to improve the accuracy, efficiency, and scalability of sequencing technologies.

Collaborations with academic institutions, research organizations, and healthcare providers facilitate the integration of new technologies and broaden market access. Additionally, targeting emerging markets with increasing research activities and healthcare infrastructure presents significant growth opportunities.

Thermo Fisher Scientific, headquartered in Waltham, Massachusetts, is a global leader in laboratory instruments, reagents, and consumables. The company offers a comprehensive range of sequencing consumables, including library preparation kits, reagents, and bioinformatics solutions, to support next-generation sequencing applications. Thermo Fisher Scientific operates in over 50 countries, serving customers in academia, healthcare, and industry sectors, and continues to expand its presence through strategic acquisitions and product innovations.

Top Key Players

- Takara Bio Inc

- QIAGEN

- Millipore Sigma

- Illumina

- Hoffmann-La Roche Ltd

- Eurofins Genomics

- Biostate AI

- Agilent Technologies

Recent Developments

- In July 2024, Biostate AI, a healthcare company utilizing artificial intelligence, unveiled two new services: OmicsWeb Copilot, designed for RNA sequencing data analysis, and whole RNA sequencing, aimed at advancing genomics research.

- In August 2024, Illumina revealed plans to establish a new Capability Center in Bengaluru, India, as part of its strategy to expand its technical workforce and support a growing global customer base. This investment reflects Illumina’s commitment to enhancing its global operations.

Report Scope

Report Features Description Market Value (2024) US$ 8.5 billion Forecast Revenue (2034) US$ 65.7 billion CAGR (2025-2034) 22.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Kits (Target Enrichment, RNA Library Preparation, DNA Library Preparation, Purification & Quality Control, Library Quantification, and Others), Reagents (Sequencing, Sample Prep, Library Preparation & Amplification), Accessories (Plates, Collection Tubes, and Others)), By Technology (3rd Generation, 2nd Generation, and 1st Generation), By Application (Cancer Diagnostics, Reproductive Health Diagnostics, Pharmacogenomics, Infectious Disease Diagnostics, Agrigenomics, and Others), By End-use (Hospitals & Laboratories, Academic Research Institutes, Pharmaceutical & Biotechnology Companies, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Takara Bio Inc, QIAGEN, Millipore Sigma, Illumina, Hoffmann-La Roche Ltd, Eurofins Genomics, Biostate AI, and Agilent Technologies. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Sequencing Consumables MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Sequencing Consumables MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Takara Bio Inc

- QIAGEN

- Millipore Sigma

- Illumina

- Hoffmann-La Roche Ltd

- Eurofins Genomics

- Biostate AI

- Agilent Technologies