Global Motorcycle Helmet Market By Product Type (Full Face, Open Face, Half Face), By End-User (Rider, Passenger), By Distribution Channel (Online, Offline), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 16450

- Number of Pages: 250

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

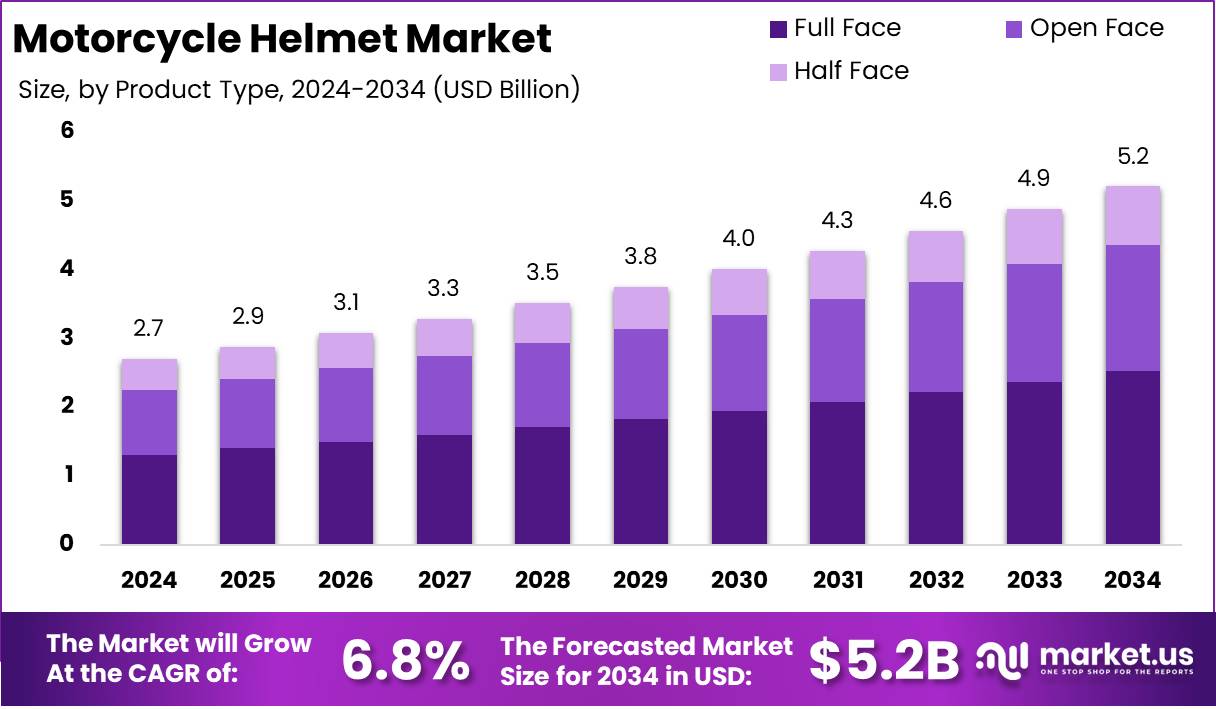

The Global Motorcycle Helmet Market size is expected to be worth around USD 5.2 Billion by 2034 from USD 2.7 Billion in 2024, growing at a CAGR of 6.8% during the forecast period from 2025 to 2034.

A motorcycle helmet is a protective headgear specifically designed to reduce the risk of severe head injuries during motorcycle accidents. Engineered with a durable outer shell and impact-absorbing inner liner, it safeguards the rider by dispersing impact forces and minimizing skull and brain trauma.

Motorcycle helmets are available in various designs, including full-face, open-face, modular, and half helmets, each offering distinct levels of protection and comfort. In addition to safety, modern helmets are increasingly incorporating features such as Bluetooth connectivity, ventilation systems, visors with UV protection, and integrated communication tools to enhance the overall riding experience.

The motorcycle helmet market refers to the global industry engaged in the design, manufacture, distribution, and sale of helmets intended for motorcycle riders and passengers. This market encompasses a wide range of products classified by type, material, certification standards, and end-use segments such as on-road and off-road riding.

It is closely tied to motorcycle sales trends, government regulations on rider safety, and consumer preferences for innovative and feature-rich helmets. With a growing emphasis on safety compliance and advanced materials, the market has evolved to include high-performance and technologically integrated helmets catering to both premium and mass-market segments across developed and emerging economies.

The growth of the motorcycle helmet market is primarily driven by increasing awareness about road safety and the rising incidence of motorcycle accidents. Governments worldwide have implemented stringent safety regulations mandating the use of helmets, further fueling product demand.

Rising global two-wheeler ownership, especially in densely populated countries such as India, Indonesia, and Vietnam, continues to sustain robust demand for motorcycle helmets. Urban commuters increasingly seek helmets that balance safety, comfort, and convenience, prompting manufacturers to offer lightweight, ventilated, and stylish models.

In parallel, the growth of online retail channels has enhanced product accessibility and consumer reach, contributing to rising sales volumes. Demand is also being reinforced by increased participation in motorsports and off-road biking, which has driven sales of specialized, high-end helmet variants.

Significant opportunities exist in the integration of smart technologies within helmets, such as heads-up displays (HUD), GPS navigation, voice control, and real-time traffic updates. These innovations address the evolving needs of tech-savvy riders and are reshaping the competitive landscape.

According to Legally Weird, the motorcycle helmet market is driven by strong safety metrics helmets reduce head injury risk by 69%, decrease death risk by 42%, and prevent fatal injuries by 37% among riders and 41% among passengers.

These compelling safety statistics, coupled with replacement recommendations every 5–7 years regardless of visible damage, are accelerating product lifecycle turnover and recurring demand. As a result, manufacturers are capitalizing on this momentum by enhancing innovation and expanding product portfolios in regulated and emerging economies alike.

According to Bike Advice, motorcycle helmet usage is critical to rider safety, with helmets proving 30% more effective in preventing head injuries and fatalities. The motorcycle helmet market is gaining traction as non-helmeted riders are 40% more likely to face fatal outcomes in accidents, while motorcyclists are 32 times more vulnerable to death compared to car drivers. Additionally, post-accident hospital costs surge 3–4 times when helmets are not worn, reinforcing demand for safety gear.

Key Takeaways

- The global motorcycle helmet market is projected to reach USD 5.2 billion by 2034, up from USD 2.7 billion in 2024, expanding at a CAGR of 6.8% during the forecast period (2025–2034).

- Full Face helmets dominated the market by product type, accounting for more than 48.6% of the total market share in 2024, indicating strong consumer preference for enhanced safety and full-coverage protection.

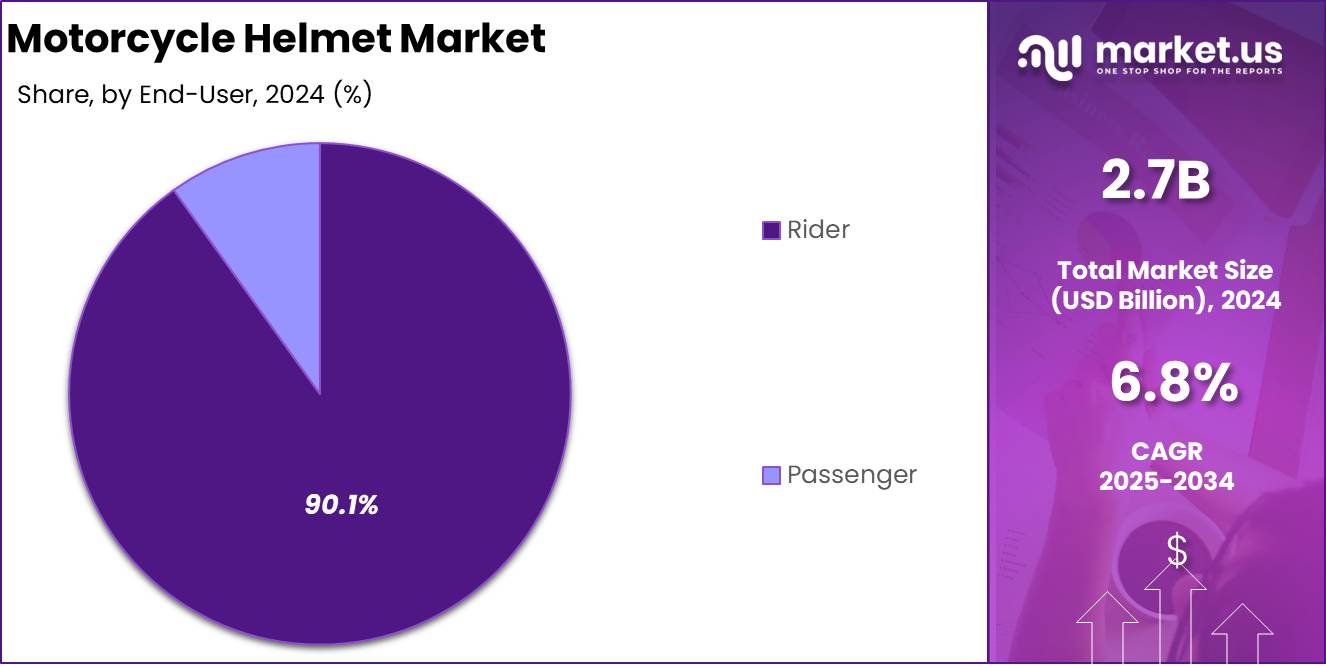

- The Rider segment led the end-user category with a commanding 90.1% share in 2024, highlighting the widespread adoption of helmets among individual motorcycle riders over commercial or passenger applications.

- Offline distribution channels held a dominant market position, capturing over 67.4% of the market in 2024, driven by consumer preference for in-person fittings and immediate product availability.

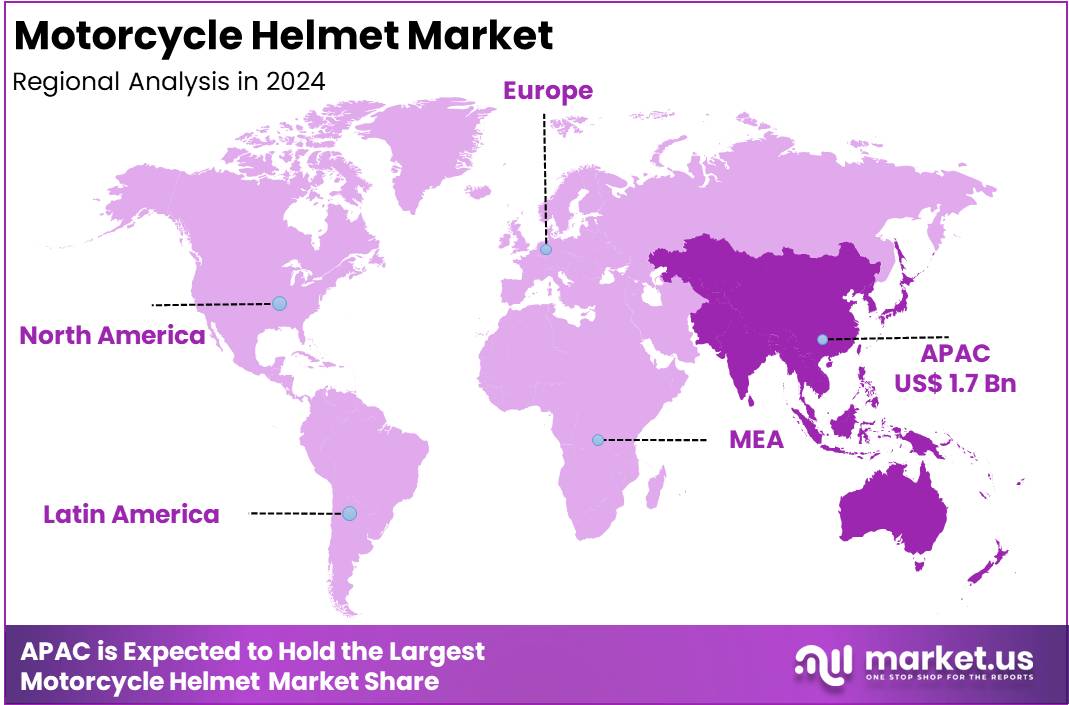

- Asia-Pacific emerged as the leading regional market, contributing a 64.2% share in 2024. The market value in this region is estimated to reach USD 1.7 billion, supported by high two-wheeler penetration, growing safety awareness, and favorable regulatory enforcement.

By Product Analysis

Full Face Dominated the Motorcycle Helmet Market, Capturing Over 48.6% Market Share

In 2024, Full Face held a dominant market position in the By Product Type segment of the Motorcycle Helmet Market, capturing more than 48.6% market share. This segment continues to be favored due to its comprehensive protection, offering enhanced safety for the entire face and jaw area, which is critical in high-impact collisions. The increasing awareness regarding road safety and the rising number of motorcycle accidents have led to a growing preference for full-face helmets.

Additionally, stringent government regulations mandating the use of certified helmets are further supporting demand. The premium appeal of full-face helmets, often designed with advanced ventilation, anti-fog visors, and integrated communication systems, is also contributing to their widespread adoption, particularly among urban and touring riders.

In 2024, the Open Face segment maintained a significant share in the Motorcycle Helmet Market by product type. Open-face helmets, also referred to as three-quarter helmets, are widely preferred due to their comfortable fit, lightweight structure, and enhanced field of vision.

These helmets are particularly popular among urban commuters and scooter riders who generally operate at lower speeds and prioritize ventilation and ease of use over full facial protection. Their cost-effectiveness, in comparison to full-face models, also contributes to their popularity among price-sensitive consumers, especially in developing markets.

In 2024, the Half Face segment represented a moderate share of the Motorcycle Helmet Market by product type. Characterized by minimal coverage typically protecting only the top and sides of the head—these helmets are the lightest and least restrictive among all helmet types.

Their popularity is most notable among casual or short-distance riders, particularly in areas with relaxed helmet regulations or lower-speed traffic environments. Their affordability and straightforward usability make them a common choice in rural and semi-urban areas.

By End-User Analysis

Rider Dominated the Motorcycle Helmet Market, Capturing Over 90.1% Market Share

In 2024, Rider held a dominant market position in the By End-User segment of the Motorcycle Helmet Market, capturing more than a 90.1% share. This overwhelming dominance can be attributed to the rider being the primary user of two-wheelers, leading to a significantly higher demand for helmets compared to passengers.

As riders are directly exposed to road risks, helmet usage among them is often mandated by law in both urban and rural regions. Government regulations and strict enforcement policies across countries such as India, China, the U.S., and several European nations have reinforced the need for riders to wear helmets at all times while operating motorcycles.

Furthermore, rising awareness about head injury prevention, coupled with the growing adoption of premium and safety-certified helmets by daily commuters, delivery personnel, and professional bikers, is driving this segment forward.

Manufacturers are also targeting riders with innovations in full-face, modular, and smart helmets, featuring advanced safety, communication, and comfort functionalities. As motorcycle usage continues to increase, particularly in densely populated and developing economies, the rider segment is expected to maintain its dominant share in the foreseeable future.

In 2024, the Passenger segment represented an emerging share of the Motorcycle Helmet Market by end-user. While considerably smaller compared to the rider segment, this category is gradually gaining momentum due to enhanced road safety campaigns and evolving regulatory frameworks encouraging helmet use for pillion riders.

In various countries, authorities have begun enforcing passenger helmet mandates, particularly in urban centers where two-wheeler accidents are more frequent. However, the level of adoption remains uneven, especially across rural and semi-urban regions where awareness and enforcement are limited.

Passenger helmets are frequently viewed as non-essential, leading to lower purchase frequency and minimal product differentiation. Socio-cultural perceptions and weak enforcement mechanisms further hinder widespread usage in many developing regions. Despite these challenges, ongoing public awareness initiatives and government-led safety programs are expected to gradually improve compliance.

The future growth of this segment will depend largely on improved product accessibility, cost-effective offerings, and sustained awareness campaigns promoting equal safety measures for all motorcycle occupants.

By Distribution Channel Analysis

Offline Dominated the Motorcycle Helmet Market, Capturing Over 67.4% Market Share

In 2024, Offline held a dominant market position in the By Distribution Channel segment of the Motorcycle Helmet Market, capturing more than a 67.4% share. This dominance is attributed to the strong presence of physical retail stores, dealership outlets, and automotive accessory shops that allow consumers to physically assess the quality, fit, and comfort of helmets before purchasing.

For many buyers, especially in developing countries, in-store purchase remains the preferred option due to the availability of real-time product trials, direct consultation with sales personnel, and instant product delivery.

The offline segment continues to thrive in both urban and rural markets, supported by a vast network of local helmet vendors and authorized dealers. Traditional buying behavior, coupled with trust in physical shopping experiences, reinforces this channel’s dominance.

Moreover, the presence of branded retail chains and showroom tie-ups with two-wheeler manufacturers further enhances visibility and accessibility. Despite the growing popularity of digital platforms, the offline channel remains the cornerstone of helmet sales, particularly in regions with limited internet penetration or digital literacy.

In 2024, the Online segment emerged as a steadily growing channel in the Motorcycle Helmet Market by distribution channel. The expansion of this segment is primarily driven by the increasing reach of e-commerce platforms, widespread smartphone adoption, and the growing consumer preference for digital shopping experiences.

Online platforms offer access to a broad range of helmet brands, models, and pricing tiers, along with customer feedback and competitive discounts, making them an attractive option for tech-savvy and convenience-seeking buyers. Added benefits such as promotional offers and doorstep delivery continue to boost online sales momentum.

This segment is particularly popular among younger demographics and consumers residing in urban areas, where digital infrastructure and internet accessibility are stronger. To leverage this trend, helmet manufacturers and distributors are investing in direct-to-consumer websites and collaborating with major online marketplaces.

Although the online channel currently trails behind offline in terms of total sales volume, its share is projected to grow consistently. This growth will be supported by enhanced logistics networks, seamless digital payment systems, and the integration of advanced technologies like virtual try-on tools, which improve the overall customer experience and encourage repeat purchases.

Key Market Segments

By Product Type

- Full Face

- Open Face

- Half Face

By End-User

- Rider

- Passenger

By Distribution Channel

- Online

- Offline

Driver

Rising Road Safety Regulations Mandating Helmet Use

The primary growth driver for the global motorcycle helmet market in 2024 is the tightening of road safety regulations across developing and developed nations. Governments are increasingly enforcing mandatory helmet laws for both riders and pillion passengers, backed by penalties and enforcement mechanisms. This shift is driven by rising road traffic fatalities, especially in two-wheeler-dominated countries, where motorcycles are widely used for personal and commercial transportation.

The World Health Organization estimates that motorcyclists account for nearly 28% of all road traffic deaths globally, a figure that has alarmed policymakers. As a result, regulatory frameworks are becoming more stringent, creating a steady demand for certified, high-quality helmets that meet specific safety standards.

These legislative mandates have stimulated market growth by expanding the consumer base beyond voluntary users to include all motorcycle riders. Additionally, authorities are actively launching awareness campaigns to educate citizens about helmet safety and compliance. This has resulted in a behavioral shift, where helmets are increasingly perceived not only as legal necessities but also as essential personal safety equipment.

The introduction of safety certifications and the inclusion of safety gear checks during traffic stops have further reinforced the urgency of helmet usage. The regulatory emphasis on safety has thus created a reliable and recurring demand stream, propelling the market forward.

Restraint

Consumer Reluctance Due to Discomfort and Heat Build-Up

A key restraint hindering the growth of the motorcycle helmet market is the persistent consumer discomfort associated with wearing helmets for extended durations, particularly in hot and humid climates. Despite the proven safety benefits, many users in regions such as Southeast Asia, Africa, and parts of Latin America express reluctance to wear helmets due to the heat build-up inside the helmet, poor ventilation, and the sense of confinement. These concerns are especially significant in tropical regions where high temperatures and humidity prevail year-round, making helmet usage physically taxing and unattractive to daily commuters.

This discomfort has a direct impact on compliance, particularly among rural and semi-urban populations where awareness may be lower, and enforcement may be inconsistent. Even in urban areas, some riders choose not to wear helmets on shorter trips or avoid full-face helmets in favor of less protective alternatives, undermining both safety and market penetration.

While manufacturers are attempting to innovate with lightweight materials and improved ventilation systems, the challenge remains substantial. These user experience issues not only hinder potential market growth but also increase the burden on policymakers to enforce usage, especially when public resistance is fueled by discomfort. Addressing this barrier will be critical for sustaining long-term growth in helmet adoption rates.

Opportunity

Integration of Smart Technologies in Helmet Design

The growing integration of smart technologies into motorcycle helmets presents a substantial opportunity to transform the product from a passive safety device into an active part of the rider’s digital ecosystem. Advanced helmets now come equipped with features such as Bluetooth connectivity, voice control, built-in GPS navigation, heads-up displays (HUDs), and even emergency crash detection systems.

These value-added functionalities significantly enhance the rider experience, enabling hands-free communication, real-time navigation, and improved situational awareness, all while promoting safety.

This innovation is aligned with the broader trend of consumer preference shifting toward multifunctional and technologically advanced products. As smart mobility gains prominence and connected devices become ubiquitous, riders are increasingly drawn to helmets that offer more than just protection. The rising adoption of electric two-wheelers and urban micro-mobility solutions also supports this opportunity, as tech-savvy consumers seek helmets that integrate with mobile apps and wearable ecosystems.

Furthermore, the willingness of premium customers to pay higher prices for smart helmets allows manufacturers to target new revenue streams and higher profit margins. The convergence of safety and technology not only expands the scope of helmet applications but also redefines the product’s role in enhancing both rider safety and convenience, thereby accelerating market growth.

Trends

Surge in Demand for Lightweight, Aerodynamic Helmet Designs

An emerging trend influencing the global motorcycle helmet market in 2024 is the growing demand for lightweight, aerodynamic helmet designs tailored for performance and comfort. Modern consumers, especially young urban riders and sports motorcyclists, are increasingly prioritizing helmets that offer reduced drag, enhanced airflow, and lighter build without compromising on safety standards.

This trend has been fueled by lifestyle shifts toward high-speed riding, long-distance commuting, and participation in motorsports, where helmet weight and shape directly affect rider endurance and comfort.

Advancements in materials science, such as the use of carbon fiber composites, polycarbonate blends, and advanced foam linings, have enabled manufacturers to meet these evolving consumer expectations. These materials not only reduce helmet weight but also offer higher impact resistance and structural integrity.

Additionally, the integration of aerodynamic fins, improved visor sealing, and optimized air vent placements enhances rider experience, particularly at higher speeds. As motorcycle usage expands across urban and semi-urban settings, and users seek a balance between safety, aesthetics, and functionality, the demand for sleek, ergonomic helmets is expected to rise. This trend is reshaping product development strategies, compelling manufacturers to innovate continuously in terms of design, material choice, and performance efficiency, thus contributing significantly to market expansion.

Regional Analysis

Asia-Pacific Leads the Global Motorcycle Helmet Market with Largest Market Share of 64.2% in 2024

The global motorcycle helmet market exhibits strong regional disparities, with Asia-Pacific emerging as the dominant region, holding the largest market share of 64.2% in 2024. The market valuation in this region is estimated to reach USD 1.7 billion during the same year, driven primarily by the high population density, expanding two-wheeler ownership, and increasing government regulations mandating helmet usage.

Countries such as India, China, Indonesia, and Vietnam contribute significantly to this dominance due to their large consumer base and rapidly growing middle class. The demand is further reinforced by rising road safety awareness, urbanization, and the adoption of electric two-wheelers across emerging economies in the region.

In North America, the motorcycle helmet market is characterized by moderate growth, underpinned by a strong preference for recreational and touring motorcycles. The presence of well-established road safety standards and increased adoption of technologically advanced helmets are contributing to regional demand. Urbanization trends, coupled with a growing youth population engaged in motorcycling for leisure, are supporting steady market performance across the United States and Canada.

Europe represents a mature market, driven by stringent road safety regulations, especially in Western European countries. The enforcement of mandatory helmet laws across EU member states and a cultural inclination towards motorbike commuting in urban centers have played a crucial role in sustaining market stability. Additionally, the demand is supported by a shift towards sustainable transport options and the growing use of scooters and motorbikes in congested metropolitan regions.

The Middle East & Africa region is witnessing gradual growth in motorcycle helmet adoption. The rising use of motorcycles as a cost-effective mode of transport, particularly in sub-Saharan Africa, and the increasing emphasis on road safety in urban areas are encouraging market expansion. However, market penetration remains relatively low due to economic disparities and limited enforcement of helmet regulations in several countries.

Latin America shows a developing outlook, with rising urban mobility trends and growing two-wheeler usage across countries like Brazil, Colombia, and Argentina. The market is gradually expanding, supported by awareness campaigns and improvements in road infrastructure. Nonetheless, the growth pace remains slower compared to Asia-Pacific, due to moderate per capita income levels and inconsistent implementation of safety mandates.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

The global motorcycle helmet market in 2024 continues to be shaped by a competitive landscape dominated by both legacy manufacturers and innovation-driven entrants. Leading players such as Bell Powersports, Inc., Shoei Co., Ltd., and Arai Helmet, Ltd. have maintained their strong market presence through continuous product enhancements, premium safety technologies, and a loyal customer base in North America, Europe, and parts of Asia.

Their emphasis on advanced impact protection, lightweight materials, and aerodynamic designs has set industry benchmarks, particularly in the full-face and racing helmet segments. Additionally, these companies benefit from brand recognition and a history of compliance with evolving safety regulations like ECE 22.06 and DOT standards, which enhances their positioning in both developed and emerging economies.

Simultaneously, brands such as HJC Helmets Co., Ltd., AGV S.p.A., and Nolan Group S.p.A. are expanding their market share through strategic product diversification and competitive pricing. Their focus on modular helmets, Bluetooth integration, and ventilation advancements aligns with changing consumer preferences for comfort and connectivity. Kido Sport Co., Ltd., LS2 Helmets China, and Shark Helmets S.A.S. represent strong contenders in the mid-price segment, offering robust value-for-money propositions, especially in Asia-Pacific and Latin America.

Meanwhile, Icon Motosports, Inc. and Nexxpro, Lda. cater to niche markets with stylish, urban-centric designs and limited-edition collections, appealing to younger demographics. Schuberth GmbH, known for its engineering excellence and presence in premium touring helmets, continues to lead in noise reduction and ergonomic comfort. Overall, the market remains highly fragmented but driven by technological advancements, product innovation, and brand positioning strategies across multiple price tiers.

Top Key Players in the Market

- Bell Powersports, Inc.

- Shoei Co., Ltd.

- Arai Helmet, Ltd.

- HJC Helmets Co., Ltd.

- AGV S.p.A.

- Nolan Group S.p.A.

- Kido Sport Co., Ltd.

- LS2 Helmets China

- Shark Helmets S.A.S.

- Icon Motosports, Inc.

- Nexxpro, Lda.

- Schuberth GmbH

Recent Developments

- In 2024, Reise Moto introduced Acerbis and Nexx helmets to Indian riders at India Bike Week (IBW). The company, already known for its premium tyres and riding gear, showcased these international helmet brands to enhance its growing product portfolio. Alongside the new helmets, Reise Moto also presented its own collection of jackets, gloves, and pants, aiming to offer complete riding solutions tailored to Indian conditions.

- In 2024, Steelbird Hi-tech India Ltd revealed its plan to invest ₹250 crore in a new manufacturing facility in Hosur, Tamil Nadu. This expansion is part of the company’s strategy to boost production capacity and meet the growing demand for branded helmets in India. Steelbird supplies helmets to major two-wheeler companies such as Hero, Honda, Yamaha, and Royal Enfield.

- In 2024, GoPro, Inc. announced its decision to acquire Forcite Helmet Systems, a company known for integrating smart features into helmets. The acquisition supports GoPro’s goal of bringing advanced technology to the helmet market, starting with motorcycling and expanding into other categories. The move marks GoPro’s entry into the safety tech space with a focus on improving rider experience.

Report Scope

Report Features Description Market Value (2024) USD 2.7 Bn Forecast Revenue (2034) USD 5.2 Bn CAGR (2025-2034) 6.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Full Face, Open Face, Half Face), By End-User (Rider, Passenger), By Distribution Channel (Online, Offline) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Bell Powersports, Inc., Shoei Co., Ltd., Arai Helmet, Ltd., HJC Helmets Co., Ltd., AGV S.p.A., Nolan Group S.p.A., Kido Sport Co., Ltd., LS2 Helmets China, Shark Helmets S.A.S., Icon Motosports, Inc., Nexxpro, Lda., Schuberth GmbH Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Bell Powersports, Inc.

- Shoei Co., Ltd.

- Arai Helmet, Ltd.

- HJC Helmets Co., Ltd.

- AGV S.p.A.

- Nolan Group S.p.A.

- Kido Sport Co., Ltd.

- LS2 Helmets China

- Shark Helmets S.A.S.

- Icon Motosports, Inc.

- Nexxpro, Lda.

- Schuberth GmbH