Global Motor Lamination Market Size, Share, And Business Benefits By Technology (Welding, Bonding, Stamping), By Material (Nickel Alloys, Cold-Rolled lamination Steel, Cobalt Alloys, Silicon Steel), By Electric Vehicle Type (Battery Electric Vehicles, Hybrid Electric Vehicles, Plug-in Hybrid Electric Vehicles, Others), By Application (Electrical Stators and Rotors, Magnetic Coils, Transformers), By End-use (Automotive, Electronics, Manufacturing, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: January 2025

- Report ID: 137734

- Number of Pages: 385

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Business Benefits of the Motor Lamination Market

- By Technology Analysis

- By Material Analysis

- By Electric Vehicle Type Analysis

- By Application Analysis

- By End-Use Analysis

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunity

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

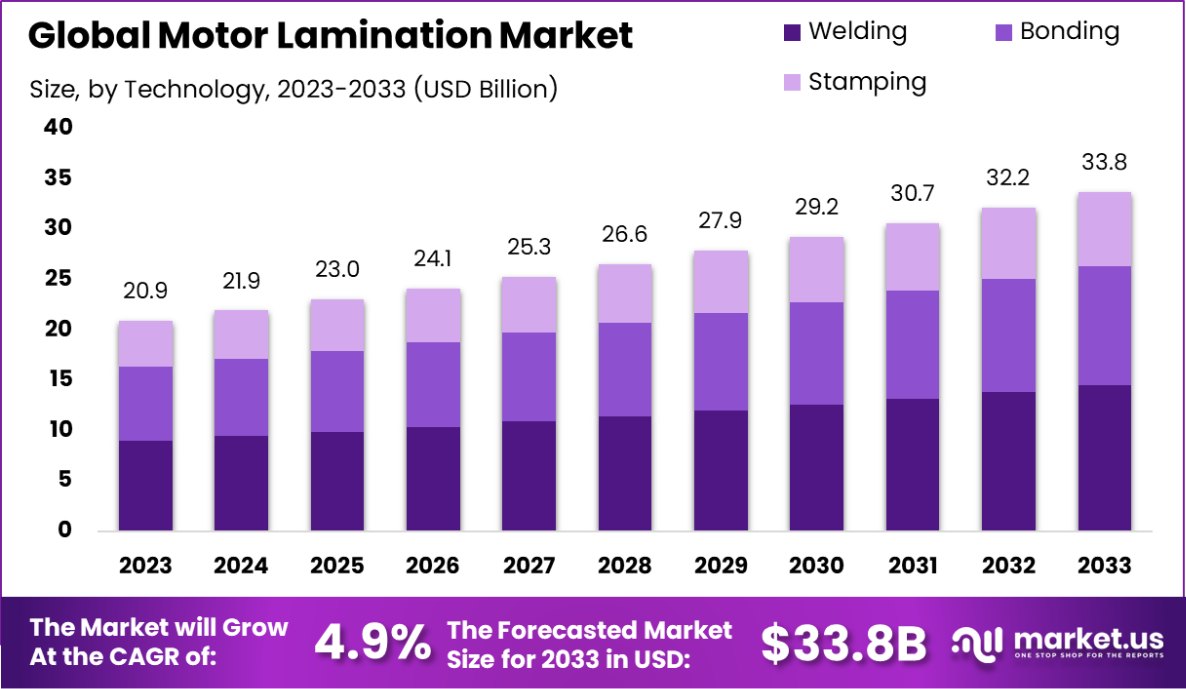

The Global Motor Lamination Market is expected to be worth around USD 33.8 Billion by 2033, up from USD 20.9 Billion in 2023, and grow at a CAGR of 4.9% from 2024 to 2033.

Motor laminations, typically crafted from thin silicon steel sheets, are essential in minimizing energy losses in electric motors by reducing eddy currents. The industrial landscape for motor laminations is experiencing a transformation, driven by the increasing adoption of electric vehicles (EVs) and the expansion of renewable energy sectors.

The U.S. Department of Energy (DOE) has been actively involved in research and development to enhance the efficiency and performance of electric motors, including advancements in motor lamination materials and designs.

A key factor propelling the motor lamination market is the global shift towards energy-efficient solutions. Electric motors account for a substantial portion of industrial energy consumption, prompting initiatives to improve their efficiency. The DOE’s Vehicle Technologies Office has been focusing on electric motor thermal management, which includes optimizing lamination materials to enhance thermal conductivity and reduce losses.

Emerging trends in the market include the development of advanced lamination materials with superior magnetic properties and reduced thickness, aiming to decrease core losses and improve motor performance. Research by the National Renewable Energy Laboratory (NREL) has highlighted the importance of thermal management in motor laminations, emphasizing the need for materials with better thermal properties to handle increased power densities in modern electric motors.

Future growth opportunities in the motor lamination market are closely tied to technological advancements and policy support for energy efficiency. The DOE’s targets for electric motors include a tenfold increase in power density and a 53% cost reduction by 2025 compared to 2015 levels. Achieving these goals will likely involve innovations in lamination materials and manufacturing processes.

According to Eenewseurope, companies like DeepDrive are pioneering innovative approaches by integrating in-wheel and central drive motors that reduce the use of critical materials, including magnets, copper, and laminated steel, by 50%. These breakthroughs offer material cost savings of €200 and system cost savings exceeding €1,000, enhancing the economic feasibility of EV production.

Protean in the UK is accelerating pilot line production for its in-wheel motor technology, while REE Automotive has secured $45 million in funding and partnered with Indian manufacturer Motherson to scale production.

This ecosystem evolution promises a 20% efficiency improvement and a cost reduction of over €1 billion, enabling EVs to achieve ranges above 800km. For consumers, these developments narrow the price gap between internal combustion engine vehicles and EVs, potentially halving it.

DeepDrive’s collaborations with BMW, Audi, Volvo, and Tier One supplier Continental highlight the market’s alignment with global automotive leaders. These advancements not only support cost-efficient, scalable manufacturing processes but also position motor lamination technologies as a cornerstone for high-volume EV production.

Key Takeaways

- The Global Motor Lamination Market is expected to be worth around USD 33.8 Billion by 2033, up from USD 20.9 Billion in 2023, and grow at a CAGR of 4.9% from 2024 to 2033.

- Welding technology holds a significant 43.2% share in the Motor Lamination Market.

- Cold-Rolled Lamination Steel is preferred, accounting for 46.4% of materials used.

- Battery Electric Vehicles (BEVs) dominate, comprising 58.1% of the electric vehicle type segment.

- Electrical stators and rotors are the main applications, capturing 59.1% of the market.

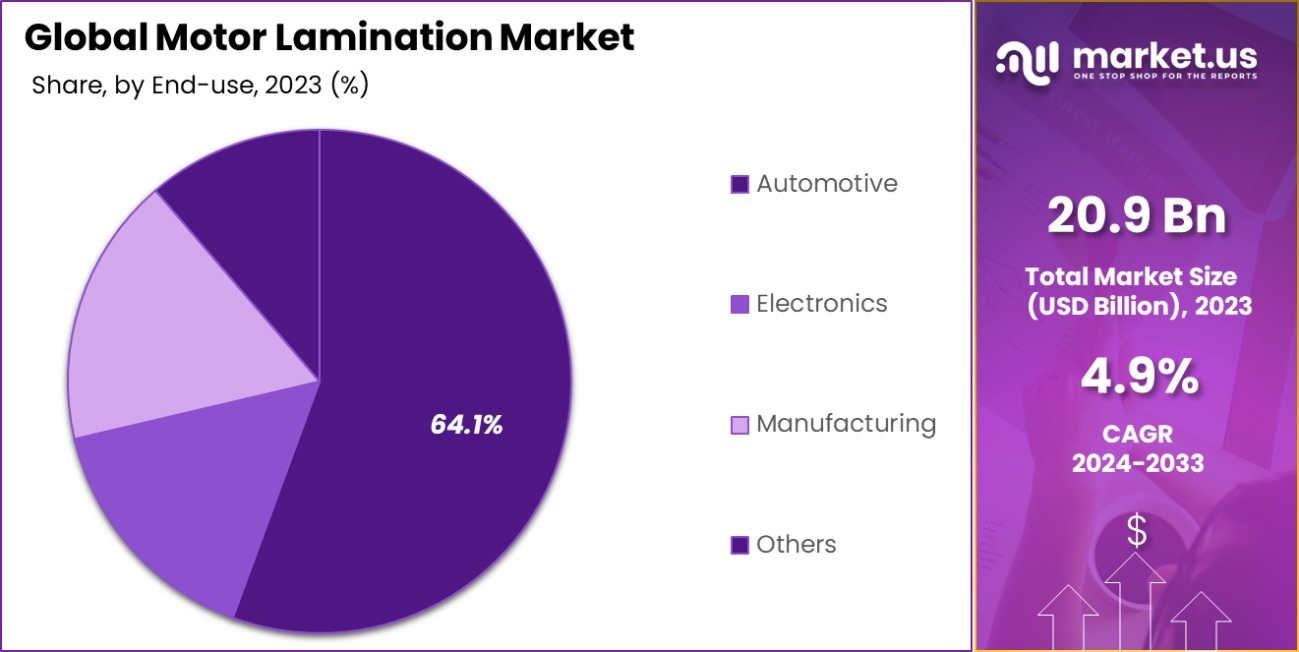

- The automotive sector is the largest end-user, with a substantial 64.1% market share.

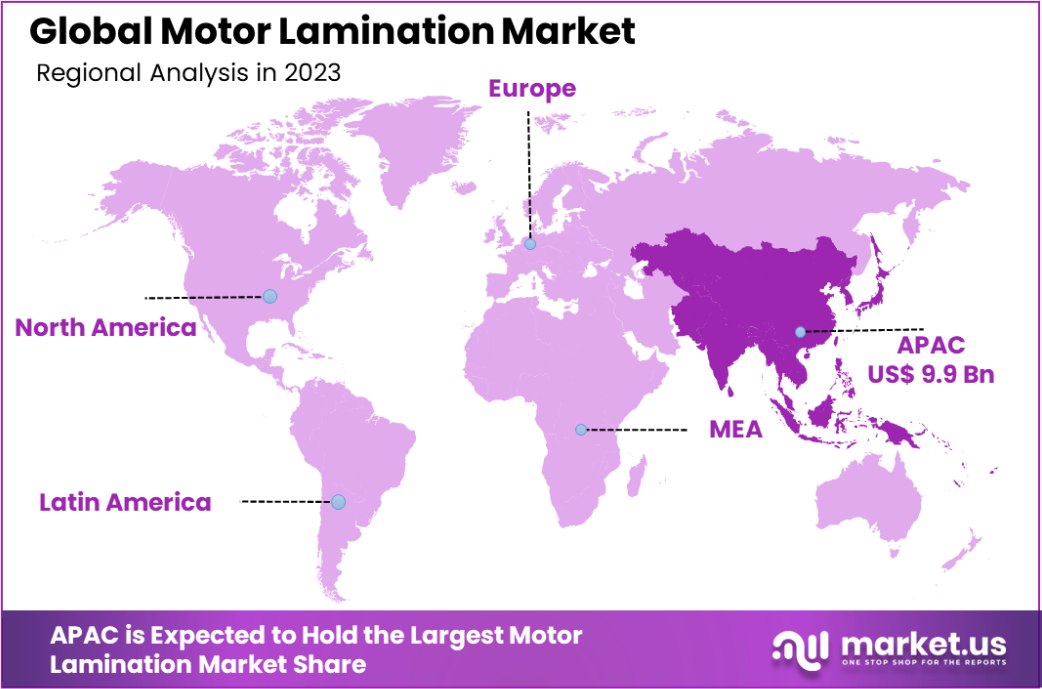

- Asia-Pacific Leads Motor Lamination Market with 47.7% Share, USD 9.9 Billion.

Business Benefits of the Motor Lamination Market

Motor laminations, typically made from silicon steel, are essential in reducing energy losses in electric motors by minimizing eddy currents and hysteresis losses. The U.S. Department of Energy (DOE) estimates that developing cost-effective soft magnetic materials with increased resistivity can reduce core losses in electric motors and generators by approximately 37%.

Implementing advanced motor lamination materials can lead to significant energy savings. The DOE projects potential annual energy savings of over 2,100 gigawatt-hours (GWh) in the industrial sector, equating to 0.37% of the total energy consumed by industrial motors.

In non-industrial motors, the anticipated savings are about 9,700 GWh per year, representing 1.27% of their total energy consumption. Collectively, these improvements could account for a 0.44% reduction in total U.S. electricity consumption.

Beyond energy efficiency, enhancing motor laminations contributes to economic benefits by lowering operational costs and reducing smart greenhouse gas emissions. The DOE notes that when combined with other efficiency improvements in electric motor technologies, these enhancements will contribute to the development of a new generation of electric motors and generators, improving the global competitive advantage of the U.S. industry.

By Technology Analysis

Welding dominates the Motor Lamination Market with a 43.2% share.

In 2023, Welding held a dominant market position in the By Technology segment of the Motor Lamination Market, capturing a 43.2% share. This dominance is attributed to its cost-effectiveness, precision, and widespread adoption in electric motor manufacturing, particularly in the automotive and industrial sectors. The rising demand for EV motors further accelerates the growth of welding technology.

Bonding accounted for 29.7% of the By Technology segment in the Motor Lamination Market. Its advantages, such as enhanced motor efficiency and noise reduction, have driven its adoption, especially in high-performance electric motors. Bonding technology is witnessing growing traction in industries prioritizing low-noise, lightweight solutions, such as aerospace and high-end automotive applications.

Stamping constituted 27.1% of the By Technology segment in the Motor Lamination Market. Known for its efficiency in mass production, stamping remains a preferred choice for manufacturers focusing on standard motor designs. Its growth is supported by advancements in stamping technologies, including precision die-cutting and automation, catering to high-volume production requirements in consumer electronics and industrial motors.

By Material Analysis

Cold-rolled lamination Steel is preferred, holding a 46.4% market share.

In 2023, Cold-Rolled Lamination Steel held a dominant market position in the By Material segment of the Motor Lamination Market, capturing a 46.4% share. Its high magnetic permeability, cost efficiency, and extensive use in electric motors drive its dominance. Increasing adoption of energy-efficient motors and their compatibility with advanced manufacturing processes boosts its market growth.

Silicon Steel accounted for 31.2% of the By Material segment in the Motor Lamination Market. Renowned for its superior electrical conductivity and reduced energy losses, silicon steel is a preferred choice for high-performance motors. Its rising demand for renewable energy and industrial applications further reinforces its market presence.

Nickel Alloys constituted 12.5% of the By Material segment in the Motor Lamination Market. Known for their excellent thermal and corrosion resistance, nickel alloys find application in motors operating under extreme conditions, such as aerospace and marine industries. The segment benefits from growing demand for specialized, durable motors.

Cobalt Alloys held 9.9% of the by-material segment in the Motor Lamination Market. Valued for their high magnetic properties and temperature resistance, cobalt alloys are crucial for high-end applications in aerospace, defense, and advanced robotics. Technological advancements and demand for premium-grade motors are driving this segment’s growth.

By Electric Vehicle Type Analysis

Battery Electric Vehicles lead, capturing 58.1% of the market.

In 2023, Battery Electric Vehicles (BEVs) held a dominant market position in the By Electric Vehicle Type segment of the Motor Lamination Market, capturing a 58.1% share. This leadership stems from the global shift toward zero-emission vehicles, government incentives, and advancements in battery technologies. BEVs are increasingly favored for their efficiency and sustainability in urban and long-range transportation.

Hybrid Electric Vehicles (HEVs) accounted for 24.6% of the Electric Vehicle Type segment in the Motor Lamination Market. Combining traditional engines with electric motors, HEVs appeal to consumers seeking fuel efficiency and reduced emissions. Their market growth is supported by demand in regions with less developed charging infrastructure.

Plug-in Hybrid Electric Vehicles (PHEVs) constituted 17.3% of the Electric Vehicle Type segment in the Motor Lamination Market. Offering flexibility between electric and fuel-powered driving, PHEVs attract environmentally conscious consumers seeking extended driving ranges. Growth in this segment is bolstered by increasing adoption in developed markets with expanding charging networks.

By Application Analysis

Electrical stators and rotors are the main applications at 59.1%.

In 2023, Electrical Stators and Rotors held a dominant market position in the By Application segment of the Motor Lamination Market, capturing a 59.1% share. Their extensive use in electric motors for automotive, industrial, and consumer applications drives this dominance. The rise of electric vehicles and industrial automation significantly boosts the demand for high-performance stators and rotors.

Magnetic Coils accounted for 25.4% of the By Application segment in the Motor Lamination Market. Magnetic coils are essential for energy conversion and efficient operation in motors and generators. Growing investments in renewable energy and electrification projects propel the adoption of magnetic coils in both residential and industrial applications.

Transformers constituted 15.5% of the By Application segment in the Motor Lamination Market. Transformers play a critical role in electrical power distribution and transmission systems. Increasing demand for energy-efficient power infrastructure and renewable energy integration supports the growth of this segment globally.

By End-Use Analysis

The automotive sector is the largest end-user, with a 64.1% share.

In 2023, Automotive held a dominant market position in the By End-Use segment of the Motor Lamination Market, capturing a 64.1% share. The rapid adoption of electric vehicles (EVs), increasing production of fuel-efficient cars, and stringent emission regulations globally drive demand for motor laminations, particularly in electric and hybrid vehicle powertrains.

Electronics accounted for 21.8% of the By End-Use segment in the Motor Lamination Market. With the surge in smart devices, home appliances, and consumer electronics, the demand for compact, energy-efficient motors is rising. Miniaturized motor laminations cater to the growing need for performance and efficiency in electronics.

Manufacturing constituted 14.1% of the By End-Use segment in the Motor Lamination Market. Industrial automation, robotics, and heavy machinery applications rely on robust motors, driving the adoption of motor laminations. The ongoing trend of factory digitization and increased investments in advanced manufacturing systems further propel this segment’s growth.

Key Market Segments

By Technology

- Welding

- Bonding

- Stamping

By Material

- Nickel Alloys

- Cold-Rolled lamination Steel

- Cobalt Alloys

- Silicon Steel

By Electric Vehicle Type

- Battery Electric Vehicles

- Hybrid Electric Vehicles

- Plug-in Hybrid Electric Vehicles

- Others

By Application

- Electrical Stators and Rotors

- Magnetic Coils

- Transformers

By End-use

- Automotive

- Electronics

- Manufacturing

- Others

Driving Factors

Rising Adoption of Electric Vehicles Boosts Market Growth

The increasing adoption of electric vehicles (EVs) globally is fueling the growth of the motor lamination market. EVs require efficient electric motors for optimal performance, and motor laminations are essential for reducing energy losses in these motors.

Governments worldwide are encouraging EV adoption through incentives, fueling this demand. Additionally, consumer preferences for sustainable and eco-friendly transportation solutions are increasing, further accelerating EV adoption. This trend creates a growing need for high-quality motor laminations to ensure energy efficiency and performance in electric motors.

Technological Advancements in Motor Efficiency Drive Demand

Continuous advancements in motor technologies are enhancing efficiency and performance across industries. High-performance motors with advanced laminations are gaining popularity as they minimize energy losses and maximize operational efficiency.

Industries such as automotive, industrial machinery, and renewable energy are increasingly integrating advanced motors into their systems. Additionally, research and development initiatives by manufacturers aim to create innovative lamination designs tailored for specific applications. These advancements play a crucial role in expanding the use of motor laminations across diverse sectors.

Expansion of Industrial Automation Enhances Market Potential

The growing adoption of industrial automation is creating significant demand for efficient electric motors and components. Automated systems rely heavily on electric motors for precision and reliability, making motor laminations an indispensable part of these systems.

Industries like manufacturing, logistics, and robotics are increasingly integrating automation to improve productivity and operational efficiency. This shift is driving the demand for motor laminations designed to meet the performance requirements of advanced automated equipment, further propelling market growth across industrial applications.

Restraining Factors

High Costs of Raw Materials Impact Market Growth

The motor lamination market faces challenges from the rising costs of raw materials like electrical steel and silicon steel. These materials are essential for manufacturing high-quality laminations but are subject to price fluctuations influenced by global supply chain disruptions and resource availability.

Such cost variations increase production expenses, affecting manufacturers’ profit margins and, in some cases, leading to higher prices for end-users. Smaller manufacturers, in particular, may struggle to maintain competitive pricing, potentially limiting market expansion across various sectors.

Complex Manufacturing Processes Reduce Production Scalability

The intricate processes involved in producing motor laminations can slow down production scalability. Precision is critical during lamination manufacturing to ensure the components meet performance and energy efficiency requirements. Achieving this precision requires advanced machinery and skilled labor, which increases production time and costs.

For manufacturers seeking to scale operations quickly to meet rising demand, these complexities act as a hurdle, potentially delaying project timelines and reducing the market’s overall growth potential in various industrial applications.

Competition from Alternatives Challenges Market Development

The growing adoption of alternative technologies, such as brushless motors and permanent magnet motors, is impacting the demand for traditional motor laminations. These alternatives often offer higher efficiency and reliability, attracting industries looking for advanced motor solutions.

Additionally, ongoing innovations in non-laminated motor designs pose a competitive threat. As industries explore these alternatives, traditional motor lamination manufacturers may face challenges in retaining market share and adapting to the changing preferences of various end-users in diverse applications.

Growth Opportunity

Expanding Renewable Energy Sector Drives New Opportunities

The rapid growth of renewable energy sources, like wind and solar power, is creating fresh opportunities in the motor lamination market. Wind turbines and solar tracking systems rely on electric motors to operate efficiently, and high-quality laminations are essential for these motors to perform optimally.

Governments and industries are investing heavily in renewable energy projects, increasing demand for efficient motor components. This trend provides a promising avenue for manufacturers to develop and supply specialized laminations tailored to meet the needs of renewable energy applications.

Growing Focus on Energy Efficiency Across Industries

Industries worldwide are prioritizing energy efficiency to reduce operational costs and meet sustainability goals. This shift opens doors for the motor lamination market, as energy-efficient motors require advanced laminations to minimize energy losses.

Sectors like manufacturing, automotive, and logistics are upgrading to motors with improved performance and lower energy consumption. Manufacturers have an opportunity to innovate and cater to these demands by offering customized lamination solutions designed to enhance motor efficiency, making this a key area for growth in the market.

Rising Adoption of Industrial Robots Fuels Market Demand

The increasing use of industrial robots in manufacturing and automation offers a promising growth opportunity for the motor lamination market. These robots rely on precise and efficient motors to deliver reliable performance in complex tasks.

With industries embracing automation to enhance productivity, the need for high-performance motor laminations is on the rise. Manufacturers can tap into this demand by developing advanced lamination designs tailored for robotic applications, creating a strong growth potential in sectors such as automotive, electronics, and logistics.

Latest Trends

Use of High-Performance Materials Enhancing Efficiency

Manufacturers are increasingly adopting advanced materials, such as silicon steel and amorphous alloys, to produce high-performance motor laminations. These materials offer improved magnetic properties, reducing energy losses and enhancing overall motor efficiency.

Industries such as automotive, renewable energy, and industrial machinery are driving this trend by demanding motors that deliver optimal performance with lower power consumption. The focus on material innovation is encouraging the development of superior laminations tailored for specific applications, shaping the future of the motor lamination market across diverse sectors.

Growing Adoption of Laser Cutting for Precision

Laser-cutting technology is becoming a preferred method for manufacturing motor laminations due to its precision and efficiency. This technique allows manufacturers to create complex designs with minimal material waste and higher accuracy.

The adoption of laser cutting is particularly prominent in producing laminations for electric vehicles, industrial machinery, and renewable energy systems, where precision is critical. This trend is driving advancements in production processes, enabling manufacturers to meet the evolving demands of end-users with high-quality and precisely engineered motor laminations.

Rising Integration of Automation in Manufacturing Processes

Automation in motor lamination production is gaining traction, helping manufacturers improve efficiency and reduce production time. Automated systems, such as robotic assembly lines and AI-driven quality control, streamline the manufacturing process while maintaining high precision.

This trend is particularly relevant in meeting the growing demand for laminations in electric vehicles and industrial applications. By leveraging automation, manufacturers can achieve faster production cycles, maintain consistent quality, and respond to market needs more effectively, contributing to the evolution of the motor lamination industry.

Regional Analysis

Asia-Pacific Dominates Motor Lamination Market with 47.7% Share, Valued at USD 9.9 Billion.

The motor lamination market exhibits diverse regional dynamics, with Asia-Pacific leading as the dominant region, accounting for 47.7% of the market share and a valuation of USD 9.9 billion. This growth is driven by rapid industrialization, the expansion of automotive manufacturing hubs in countries like China, India, and Japan, and the increasing adoption of electric vehicles.

North America follows as a key market, supported by advancements in renewable energy projects and strong demand for energy-efficient motors, particularly in the United States and Canada. In Europe, the market benefits from stringent energy efficiency regulations and robust investments in electric mobility, particularly in Germany, France, and the United Kingdom.

The Middle East & Africa region showcases steady growth potential, propelled by investments in industrial automation and the development of infrastructure projects, particularly in countries like the UAE and Saudi Arabia. Latin America, driven by Brazil and Mexico, sees growth in sectors such as manufacturing and energy, encouraging the adoption of advanced motor technologies.

With Asia-Pacific at the forefront, these regional variations highlight the market’s global appeal and the increasing focus on energy-efficient and high-performance motor solutions tailored to meet regional demands and industry-specific requirements.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global motor lamination market in 2023 is shaped by key players driving innovation, efficiency, and sustainability in motor technologies. ABB and General Electric remain influential, leveraging their extensive expertise in automation and energy-efficient solutions to cater to industrial and renewable energy sectors. Nidec Corporation and Mitsubishi Electric are at the forefront, particularly excelling in the automotive and electric vehicle segments, with advanced lamination technologies designed for high-performance motors.

Emerson Electric and Eaton continue to strengthen their market presence through strategic investments in industrial automation and energy management systems. Companies like Honeywell and Rockwell Automation focus on integrating smart technologies, and enhancing the functionality of motor laminations in critical applications such as aerospace, defense, and manufacturing.

EuroGroup S.P.A and Lamination Specialties Incorporated are pivotal in developing specialized laminations for diverse industries, maintaining strong footholds in Europe and North America, respectively. Polaris Laser Laminations, LLC and Precision Micro Ltd are enhancing production capabilities by adopting laser cutting and micro-engineering technologies for high-precision laminations.

Hyundai Rotem Co and Pitti Laminations Ltd. are expanding their portfolios to address emerging needs in transportation and power generation. R. Bourgeois and LCS Company focus on niche markets, emphasizing custom designs and solutions.

Top Key Players in the Market

- ABB

- Eaton

- Emerson Electric

- Eurogroup S.P.A

- General Electric

- Honeywell

- Hyundai Rotem Co

- Lake Air Companies

- Lamination Specialties Incorporated

- LCS Company

- Littelfuse

- Mitsubishi Electric

- Nidec Corporation

- Parker Hannifin

- Partzsch Elektromotoren E.K.

- Pitti Laminations Ltd.

- Polaris Laser Laminations, LLC.

- Precision Micro Ltd

- R. Bourgeois

- Rockwell Automation

Recent Developments

- In 2023, Emerson Electric enhanced its motor lamination sector by integrating advanced diagnostic technologies to address motor issues like bearing failures and insulation breakdowns, reinforcing its commitment to innovation and efficiency in industrial motor applications.

- In 2023, Eurogroup S.P.A. focused on enhancing its electrical systems services for various environments, continuing to innovate through significant investments in research and training to meet global customer needs efficiently.

Report Scope

Report Features Description Market Value (2023) USD 20.9 Billion Forecast Revenue (2033) USD 33.8 Billion CAGR (2024-2033) 4.9% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Technology (Welding, Bonding, Stamping), By Material (Nickel Alloys, Cold-Rolled lamination Steel, Cobalt Alloys, Silicon Steel), By Electric Vehicle Type (Battery Electric Vehicles, Hybrid Electric Vehicles, Plug-in Hybrid Electric Vehicles, Others), By Application (Electrical Stators and Rotors, Magnetic Coils, Transformers), By End-use (Automotive, Electronics, Manufacturing, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape ABB, Eaton, Emerson Electric, Eurogroup S.P.A, General Electric, Honeywell, Hyundai Rotem Co, Lake Air Companies, Lamination Specialties Incorporated, LCS Company, Littelfuse, Mitsubishi Electric, Nidec Corporation, Parker Hannifin, Partzsch Elektromotoren E.K., Pitti Laminations Ltd., Polaris Laser Laminations, LLC., Precision Micro Ltd, R. Bourgeois, Rockwell Automation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Motor Lamination MarketPublished date: January 2025add_shopping_cartBuy Now get_appDownload Sample

Motor Lamination MarketPublished date: January 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ABB

- Eaton

- Emerson Electric

- Eurogroup S.P.A

- General Electric

- Honeywell

- Hyundai Rotem Co

- Lake Air Companies

- Lamination Specialties Incorporated

- LCS Company

- Littelfuse

- Mitsubishi Electric

- Nidec Corporation

- Parker Hannifin

- Partzsch Elektromotoren E.K.

- Pitti Laminations Ltd.

- Polaris Laser Laminations, LLC.

- Precision Micro Ltd

- R. Bourgeois

- Rockwell Automation