Global Monoisopropylamine Market Size, Share, And Business Benefits By Grade (Industrial Grade, Pharmaceutical Grade, Others), By End-User (Agriculture, Pharmaceuticals, Chemicals, Water Treatment, Others), By Region, and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: October 2025

- Report ID: 163469

- Number of Pages: 338

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

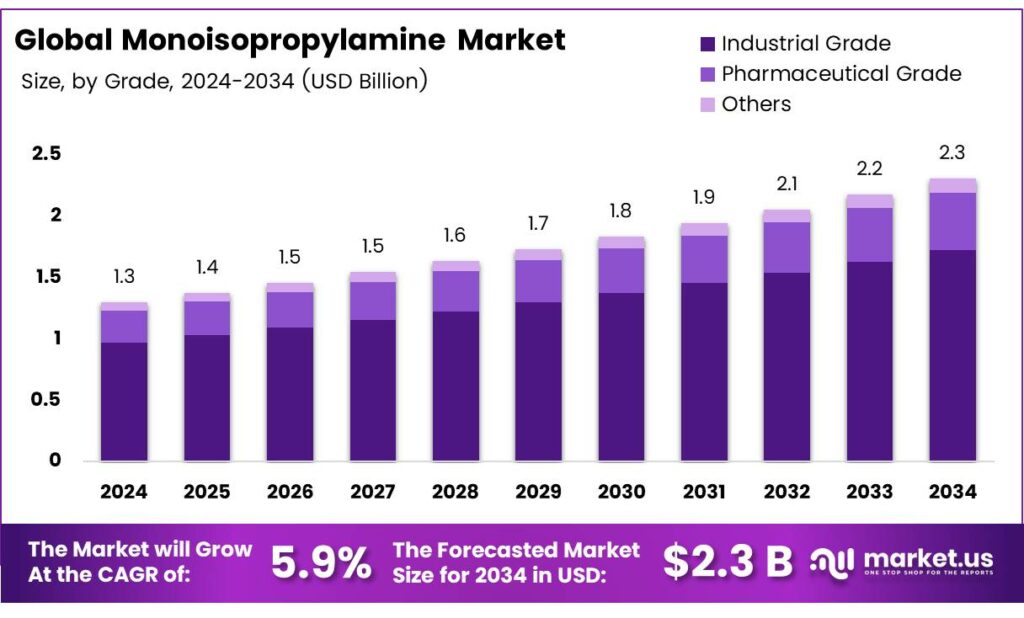

The Global Monoisopropylamine Market size is expected to be worth around USD 2.3 Billion by 2034, from USD 1.3 Billion in 2024, growing at a CAGR of 5.9% during the forecast period from 2025 to 2034.

Monoisopropylamine (MIPA) is a clear, colorless, and hygroscopic liquid with a strong ammonia-like odor. It is a highly flammable primary aliphatic amine, with a low flash point below -30°C and a boiling point of 32–34°C. Fully miscible with water, it is less dense than water but produces vapors that are heavier than air. Its chemical formula is (CH₃)₂CHNH₂, and it is classified as an alkylamine. When it combusts, it releases toxic oxides of nitrogen.

MIPA serves as a versatile intermediate in organic synthesis and is widely used across multiple industries. It is a key component in the production of agrochemicals, including herbicides such as bentazon, glyphosate (Roundup), imazapyr, and triazines (ametryn, atrazine, desmetryn, prometryn, pramitol, dipropetryn, and propazine), as well as the nematicide fenamiphos and the fungicide iprodione. Additionally, it is employed in the synthesis of insecticides, pharmaceuticals, surfactants, rubber chemicals, and coating materials.

Beyond active ingredients, MIPA functions as a regulating agent for plastics and an additive in the petroleum industry. It is also used as a chemical initiator in the preparation of chlorguanide, an antiprotozoal drug effective against asexual blood forms of susceptible Plasmodium strains. Its reactivity and solubility make it an essential building block in diverse chemical manufacturing processes.

Key Takeaways

- The Global Monoisopropylamine Market is projected to reach USD 2.3 billion by 2034, from USD 1.3 billion in 2024, at a CAGR of 5.9% during 2025–2034.

- Industrial grade dominates with a 74.9% share due to versatile applications and cost efficiency.

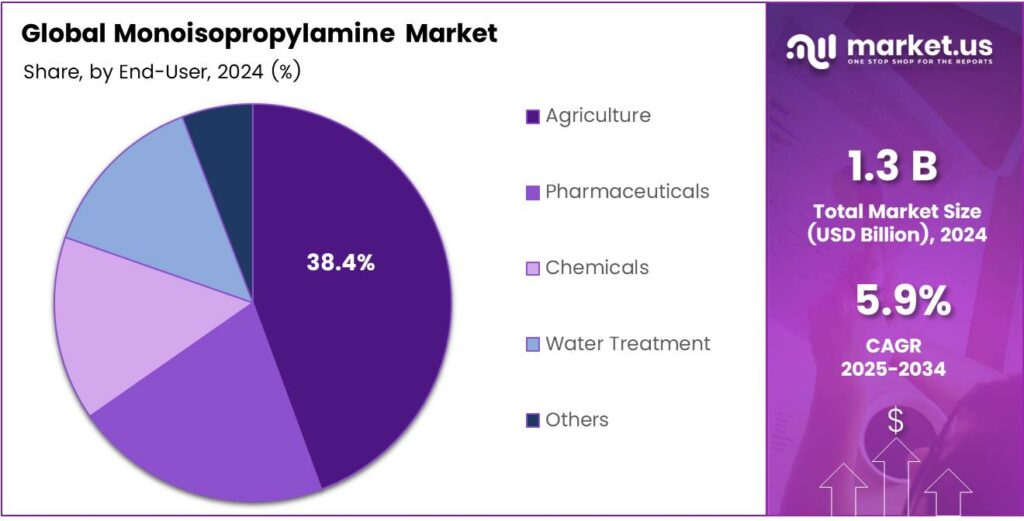

- The Agriculture segment leads with 38.4% share, driven by rising crop protection needs.

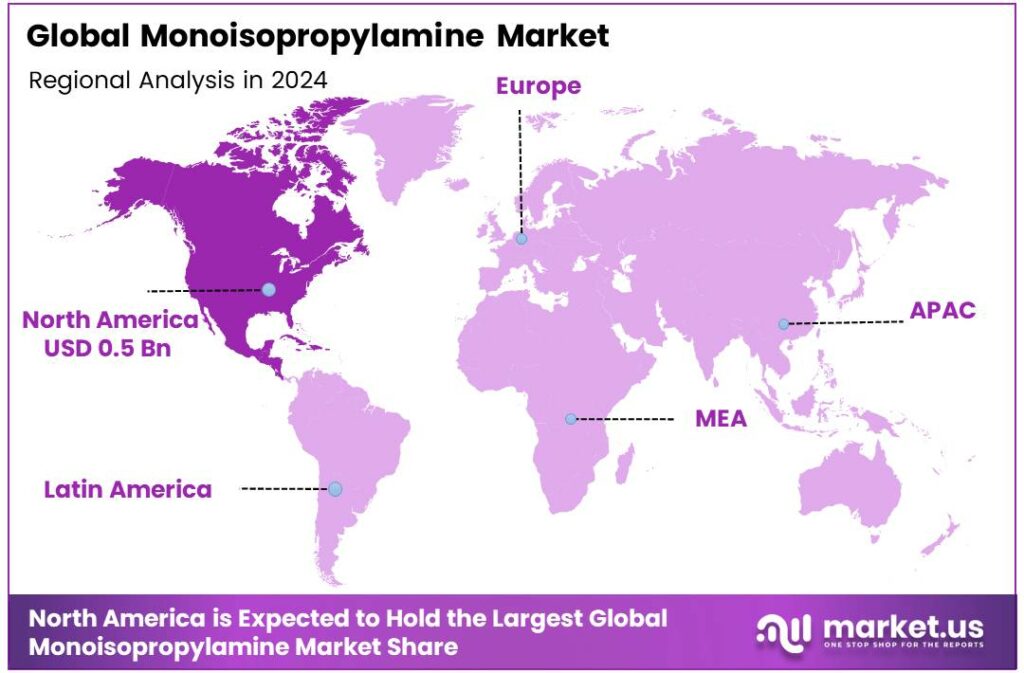

- North America held a 42.8% market share in 2024, valued at around USD 0.5 billion.

By Grade

Industrial Grade dominates with 74.9% due to its versatile applications and cost efficiency.

In 2024, Industrial Grade held a dominant market position in the By Grade Analysis segment of the Monoisopropylamine Market, with a 74.9% share. This grade excels in bulk production processes. Manufacturers prefer it for its reliability and affordability. It supports diverse industrial needs effectively. Thus, it leads the segment strongly.

Pharmaceutical Grade secures a notable position in the By Grade Analysis segment. It meets stringent purity standards for drug formulation. Companies rely on it for safe, high-quality outputs. Demand grows as health regulations tighten. Consequently, it gains steady traction in specialized markets.

Others form a smaller yet essential part in the By Grade Analysis segment. This category includes specialized variants for niche uses. It caters to emerging innovations and custom requirements. While not dominant, it contributes to overall diversity. Hence, it sustains a gradual market presence.

By End-User

Agriculture dominates with 38.4% due to rising demand for crop protection solutions.

In 2024, Agriculture held a dominant market position in the By End-User Analysis segment of the Monoisopropylamine Market, with a 38.4% share. Farmers use it extensively in pesticide synthesis. It enhances herbicide efficacy for better yields. Global food needs drive its adoption. Therefore, it commands the largest portion.

Pharmaceuticals play a key role in the By End-User Analysis segment. Monoisopropylamine aids in drug intermediate production. It ensures precise chemical reactions for effective medicines. As healthcare expands, this sector boosts consumption. Thus, it fosters consistent growth and innovation.

Chemicals represent a vital area in the By End-User Analysis segment. It serves as a building block for surfactants and additives. Industries leverage it for enhanced product performance. Demand rises with manufacturing expansions. Accordingly, it maintains robust market involvement.

Key Market Segments

By Grade

- Industrial Grade

- Pharmaceutical Grade

- Others

By End-User

- Agriculture

- Pharmaceuticals

- Chemicals

- Water Treatment

- Others

Emerging Trends

Low-VOC shift boosts MIPA in waterborne systems

A clear emerging trend for monoisopropylamine (MIPA) is its wider use as a neutralizer and building block in waterborne, low-VOC coatings and related corrosion-inhibitor chemistries. Governments are tightening solvent rules, pushing formulators toward amine-neutralized emulsions where MIPA helps set pH and stability.

- In the EU, Directive 2004/42/EC caps VOCs for many sub-categories; water-borne binding primers moved to 30 g/L, while one-pack performance coatings are limited to 140 g/L (water-borne) and 500 g/L (solvent-borne). These hard numbers have nudged manufacturers to replace solvent with water and use alkanolamines like MIPA to achieve target pH (typically 8.5–9.3 in latex paints) without odor issues seen with ammonia.

In the United States, the EPA’s architectural coatings rule established nationwide category limits and targeted about a 20% cut in VOC emissions versus a 1990 baseline, another regulatory pull for waterborne systems and amine neutralizers. Regional rules such as Southern California’s Rule 1113 further reinforce low-VOC ceilings in practice.

Drivers

Low-VOC rules and steady agro volumes lift MIPA

A powerful demand driver for monoisopropylamine (MIPA) is the worldwide shift to low-VOC, water-borne coatings, plus persistently large pesticide volumes where amine salts remain formulation workhorses. Regulators keep tightening solvent ceilings, pushing formulators toward water systems that need amine neutralizers like MIPA to set pH and stabilize latex.

- In the European Union, Directive 2004/42/EC sets numerical VOC caps for decorative coatings; common water-borne categories carry limits as low as 30–140 g/L, which has materially reduced solvent allowance in everyday paints. In the United States, the EPA’s national AIM coatings rule (40 CFR Part 59) establishes nationwide category definitions and compliance procedures for VOC content, creating a federal floor that sustains water-borne adoption across states.

Restraints

Handling and regulatory burden limit the usage of MIPA

A significant restraint on the use of Monoisopropylamine (MIPA) stems from its inherent hazard profile and the increasing regulatory pressures on amine chemicals. MIPA is classified under the EU’s CLP regulation as H225 (Highly flammable liquid and vapour), H311 (Toxic in contact with skin), H314 (Causes severe skin burns and eye damage), and H332 (Harmful if inhaled).

- This means that any industrial use must include stringent handling, storage, transport, disposal, and worker-protection measures — all of which raise operational cost and complexity. For example, the safety data sheet for MIPA shows its flash point is as low as –26 °C (closed cup) and auto-ignition temperature is around 355 °C (as per Eastman technical data).

These physical-chemical traits mean facilities must invest in explosion-proof equipment, ventilation, inerting, or strict process controls — and even then worker exposure remains a risk: inhalation may irritate the respiratory tract; skin/eye contact may lead to burns; and vapour contact can cause serious harm.

Opportunity

Herbicide-salt demand is the clearest growth engine

Monoisopropylamine (MIPA) rides on a simple, durable driver: farmers’ steady shift toward herbicide programs that rely on amine-salt formulations. Authoritative technical notes confirm that the isopropylamine salt is the most commonly used glyphosate salt in formulated products—directly linking MIPA consumption to the world’s dominant weed-control chemistry.

- The scale behind that chemistry is large and still growing. Global agricultural pesticide use reached 3.70 million tonnes (active ingredients), up 4% year-over-year and 13% over a decade, according to FAO’s official statistics. Herbicides make up the biggest share of pesticide use in many markets, India’s Parliamentary Research Service reports herbicides at 44% of the domestic pesticide market by category.

Rising herbicide intensity translates into more amine salts—and therefore more pull for MIPA as a neutralizing amine in salt formulations and adjuvant systems. Policy and cropping trends reinforce this demand. In the United States, more than 90% of soybean, corn, and cotton acres are planted with genetically engineered seeds, with a high prevalence of herbicide-tolerant (HT) traits.

Regional Analysis

North America leads with a 42.8% share and a USD 0.5 Billion market value.

In 2024, North America held a dominant 42.8% share, valued at around USD 0.5 billion, in the global monoisopropylamine (MIPA) market. The region’s leadership stems from its advanced agrochemical manufacturing base, strong industrial coatings sector, and consistent demand from pharmaceutical and water-treatment applications.

MIPA’s wide use in synthesizing herbicide salts, surfactants, corrosion inhibitors, and rubber-processing chemicals has made it a vital intermediate across multiple U.S. and Canadian industries. The United States, in particular, remains the central hub for herbicide production, where isopropylamine salt formulations of glyphosate and other weed-control agents dominate agricultural usage.

The U.S. Department of Agriculture (USDA) continues to promote efficient herbicide usage through precision-farming programs, while the Environmental Protection Agency (EPA) monitors and approves safer amine-based formulations for crop protection. These government frameworks strengthen confidence in domestic chemical production and sustain downstream demand for MIPA.

The expanding use of MIPA in personal care formulations and specialty surfactants also contributes to steady growth in the United States and Canada. Collectively, strong agrochemical output, diverse end-use industries, and environmental compliance policies ensure that North America will maintain its commanding role in the global monoisopropylamine market over the coming decade.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

BASF SE is a pivotal player in the monoisopropylamine (MIPA) market. Its strength lies in a robust, integrated production infrastructure and a vast global distribution network. The company leverages its extensive R&D capabilities to ensure high-purity MIPA, catering to diverse sectors like agrochemicals, pharmaceuticals, and rubber processing. BASF’s strong technical customer support and commitment to sustainable practices solidify its competitive edge.

The Dow Chemical Company is a dominant force in the MIPA market, underpinned by its massive scale of operations and advanced manufacturing technologies. Dow’s integrated supply chain and strong presence in the Americas and Asia-Pacific ensure reliable product availability. Its focus on innovation drives the development of high-quality MIPA, primarily used in herbicides, pesticides, and chemical intermediates.

Eastman Chemical Company is a significant and innovative competitor in the monoisopropylamine market. Renowned for its specialty chemicals portfolio, Eastman provides high-purity MIPA critical for the production of herbicides, dyes, and pharmaceuticals. The company differentiates itself through a strong emphasis on technology-driven solutions and customer-specific applications.

Top Key Players in the Market

- BASF SE

- Dow Chemical Company

- Eastman Chemical Company

- Alkyl Amines Chemicals Ltd.

- Air Products and Chemicals, Inc.

- Zhejiang Jianye Chemical Co., Ltd.

- Shandong IRO Amine Industry Co., Ltd.

Recent Developments

- In 2025, BASF’s Intermediates division announced that it would convert its entire European amines portfolio to 100% renewable electricity at its production sites in Ludwigshafen (Germany) and Antwerp. The announcement states an expected reduction of 188,000 tons CO₂-equivalent annually.

- In 2025, Eastman’s product page clearly lists Monoisopropylamine (MIPA) (synonym: isopropylamine, 2-aminopropane) with application notes: herbicide intermediates (2,4-D, atrazine, glyphosate), home & industrial care intermediates. Eastman also lists Monoisopropylamine 70% (MIPA-70%) aqueous solution product page.

Report Scope

Report Features Description Market Value (2024) USD 1.3 Billion Forecast Revenue (2034) USD 2.3 Billion CAGR (2025-2034) 5.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Grade (Industrial Grade, Pharmaceutical Grade, Others), By End-User (Agriculture, Pharmaceuticals, Chemicals, Water Treatment, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BASF SE, Dow Chemical Company, Eastman Chemical Company, Alkyl Amines Chemicals Ltd., Air Products and Chemicals, Inc., Zhejiang Jianye Chemical Co., Ltd., Shandong IRO Amine Industry Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Monoisopropylamine MarketPublished date: October 2025add_shopping_cartBuy Now get_appDownload Sample

Monoisopropylamine MarketPublished date: October 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- BASF SE

- Dow Chemical Company

- Eastman Chemical Company

- Alkyl Amines Chemicals Ltd.

- Air Products and Chemicals, Inc.

- Zhejiang Jianye Chemical Co., Ltd.

- Shandong IRO Amine Industry Co., Ltd.