Global Molecular Spectroscopy Market By Product Type (Mass Spectroscopy, Infrared Spectroscopy, Nuclear Magnetic Resonance (NMR) Spectroscopy, Color Measurement Spectroscopy and Others), By Application (Pharmaceuticals, Research Institutes, Food & Beverages Testing, Biotech and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 174537

- Number of Pages: 287

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

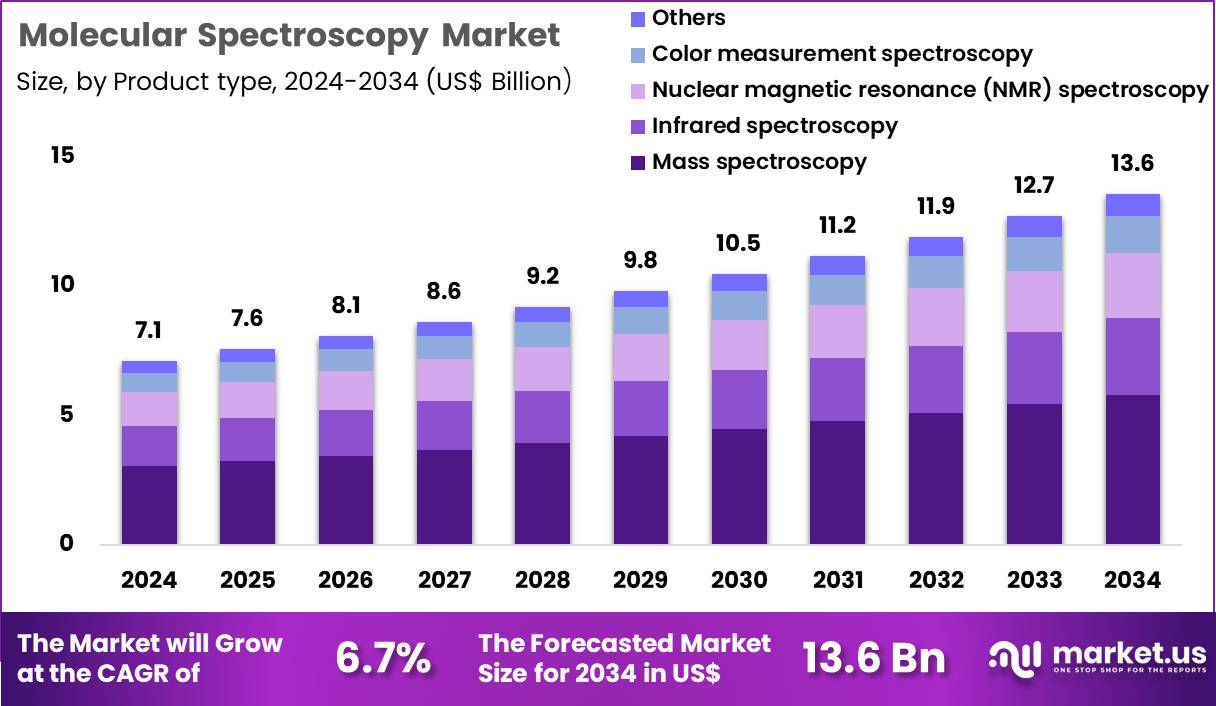

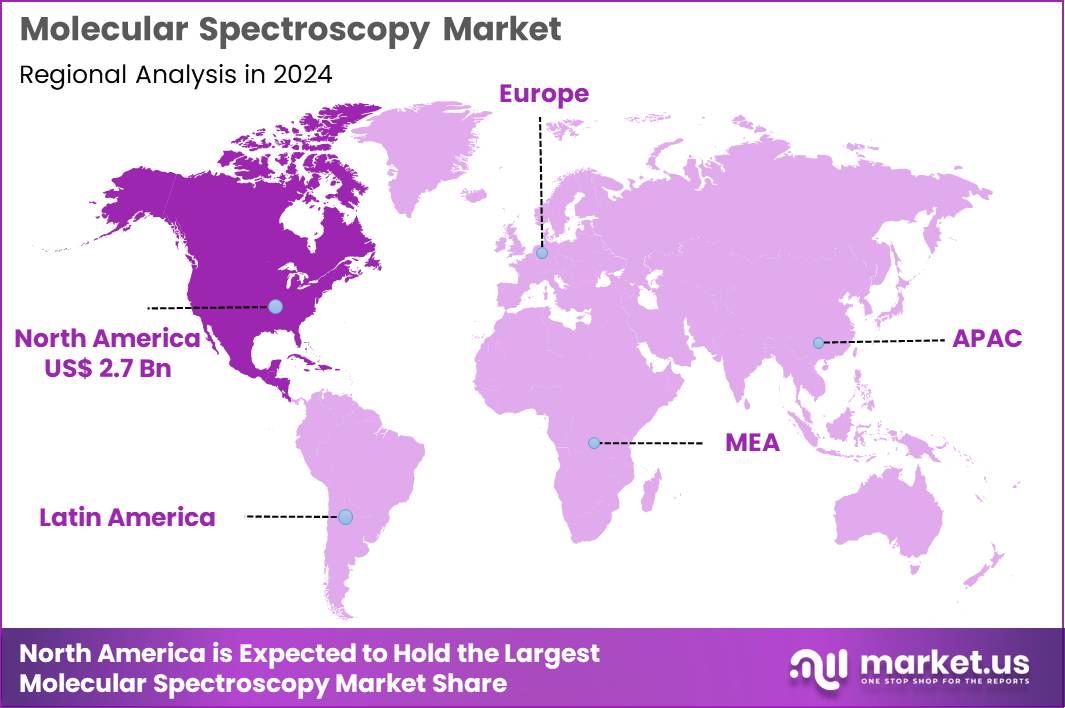

Global Molecular Spectroscopy Market size is expected to be worth around US$ 13.6 Billion by 2034 from US$ 7.1 Billion in 2024, growing at a CAGR of 6.7% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 38.5% share with a revenue of US$ 2.7 Billion.

Increasing complexity in pharmaceutical development and quality assurance drives demand for molecular spectroscopy techniques that deliver precise structural elucidation and quantitative analysis of chemical entities.

Analytical laboratories increasingly employ Fourier-transform infrared spectroscopy to identify functional groups in active pharmaceutical ingredients, ensuring batch-to-batch consistency during scale-up. These instruments support Raman spectroscopy applications in polymorph screening, distinguishing crystalline forms that influence drug solubility and bioavailability.

Spectroscopists utilize ultraviolet-visible spectroscopy for concentration determination in dissolution testing, verifying release profiles of oral solid dosage forms. Nuclear magnetic resonance spectroscopy enables detailed characterization of small-molecule impurities and excipient interactions, supporting regulatory submissions with comprehensive spectral data.

Mass spectrometry coupled with infrared or Raman detection facilitates identification of degradation products in stability studies, guiding formulation optimization. In March 2024, LGM Pharma announced a substantial expansion of its analytical and manufacturing capabilities as part of a broader growth strategy.

The company committed more than USD 2 million to scale its Analytical Testing Services by approximately 50 percent, positioning the unit as a standalone offering. Alongside this investment, LGM Pharma added suppository manufacturing to its CDMO services, broadening support across the drug product development lifecycle.

Manufacturers pursue opportunities to integrate chemometric tools with molecular spectroscopy platforms, enabling rapid multivariate analysis of complex mixtures in process analytical technology applications. Developers advance portable Raman and near-infrared spectrometers that support at-line monitoring of blending uniformity and coating thickness in tablet manufacturing.

These innovations facilitate real-time release testing, accelerating batch approval while maintaining compliance with current good manufacturing practices. Opportunities emerge in hyperspectral imaging systems that combine spatial and spectral information, enhancing counterfeit detection and content uniformity assessment in solid dosage forms.

Companies invest in high-resolution mass spectrometry interfaces that improve sensitivity for trace-level impurity profiling in biologics and generics. Firms explore vibrational circular dichroism for chiral molecule characterization, supporting development of enantiomerically pure therapeutics with superior efficacy profiles.

Key Takeaways

- In 2024, the market generated a revenue of US$ 7.1 Billion, with a CAGR of 6.7%, and is expected to reach US$ 13.6 Billion by the year 2034.

- The product type segment is divided into mass spectroscopy, infrared spectroscopy, nuclear magnetic resonance (NMR) spectroscopy, color measurement spectroscopy and others, with mass spectroscopy taking the lead with a market share of 42.7%.

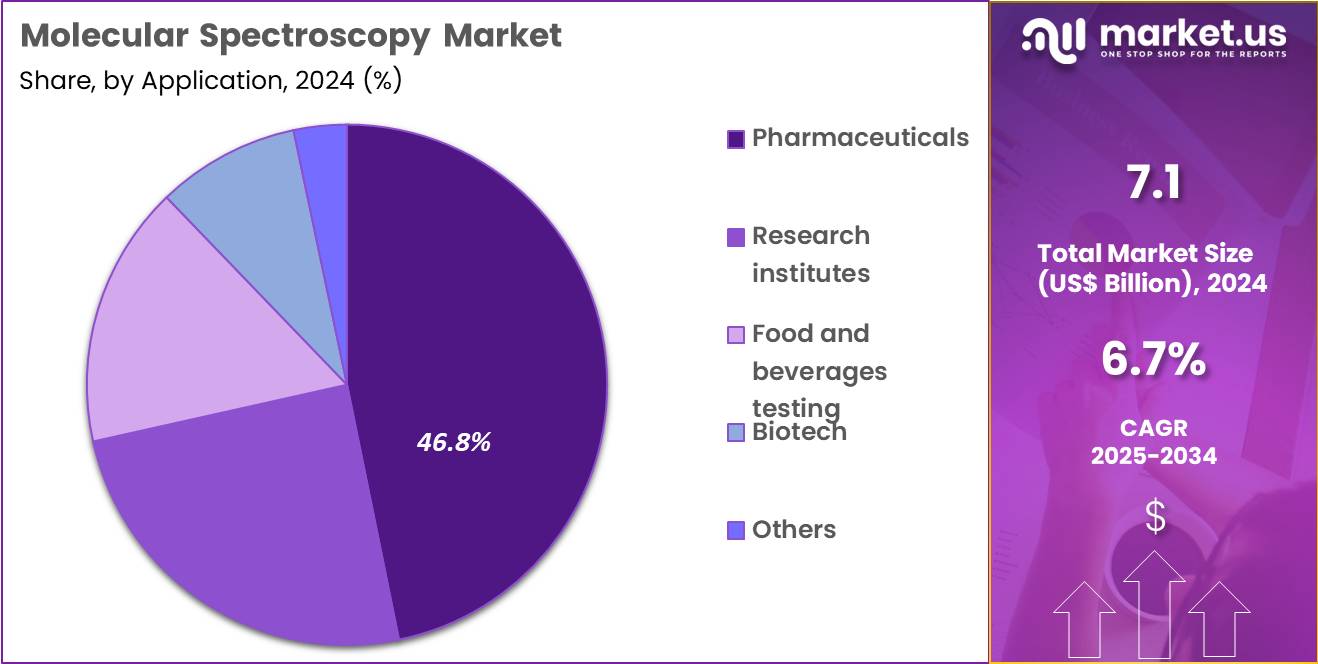

- The application segment is segregated into pharmaceuticals, research institutes, food & beverages testing, biotech and others, with the pharmaceuticals segment leading the market, holding a revenue share of 46.8%.

- North America led the market by securing a market share of 38.5%.

Product Type Analysis

Mass spectroscopy accounted for 42.7% of growth within the product type category and represents the most technologically critical segment in the Molecular Spectroscopy market. Pharmaceutical and life science laboratories increasingly rely on mass spectroscopy for precise molecular identification. High sensitivity and accuracy support trace-level compound detection. Drug discovery pipelines depend on mass spectroscopy for metabolite profiling and impurity analysis.

Advances in ionization techniques improve analytical performance. Coupling with chromatography systems expands application scope. Laboratories value rapid data generation and reproducibility. Regulatory expectations emphasize robust analytical validation, strengthening adoption. Automation integration improves throughput in high-volume labs.

Miniaturization trends increase deployment flexibility. Clinical research applications expand usage beyond traditional analysis. Academic collaborations drive continuous method development. Software advancements enhance data interpretation efficiency. Environmental and forensic testing contribute additional demand.

Investment in advanced instrumentation supports replacement cycles. Mass spectroscopy supports both qualitative and quantitative workflows. Training programs emphasize mass spectroscopy expertise. Pharmaceutical quality control relies heavily on this technology. Emerging markets increase laboratory infrastructure investments. The segment is projected to remain dominant due to analytical precision and broad applicability.

Application Analysis

Pharmaceuticals represented 46.8% of growth within the application category and stand as the primary demand driver of the Molecular Spectroscopy market. Drug development requires extensive molecular characterization at every stage. Spectroscopy techniques support compound identification, stability testing, and formulation analysis. Regulatory compliance increases demand for validated analytical methods. Pharmaceutical manufacturing emphasizes quality control and batch consistency.

Research and development spending remains strong across global pharma companies. Spectroscopy supports bioequivalence and impurity profiling studies. Personalized medicine trends increase analytical complexity. Clinical trial material testing increases instrument utilization. Spectroscopy assists in raw material verification and contamination detection. Lifecycle management activities increase repeat testing needs. High-value drug pipelines justify investment in advanced instruments.

Outsourcing trends increase service-based spectroscopy demand. Continuous manufacturing adoption requires real-time analytical monitoring. Regulatory audits emphasize traceability and data integrity. Pharmaceutical laboratories upgrade systems to meet evolving standards.

Combination therapies increase formulation analysis workload. Global expansion of pharmaceutical production supports regional instrument demand. Skilled analyst availability supports technology adoption. The segment is anticipated to remain dominant due to regulatory intensity and sustained R&D activity.

Key Market Segments

By Product Type

- Mass Spectroscopy

- Infrared Spectroscopy

- Nuclear Magnetic Resonance (NMR) Spectroscopy

- Color Measurement Spectroscopy

- Others

By Application

- Pharmaceuticals

- Research Institutes

- Food & Beverages Testing

- Biotech

- Others

Drivers

Rising demand for pharmaceutical R&D applications is driving the market

The molecular spectroscopy market is significantly driven by the rising demand for pharmaceutical R&D applications, where techniques like Raman and infrared spectroscopy are essential for drug discovery, quality control, and formulation analysis. Pharmaceutical companies rely on these tools to ensure molecular structure verification and impurity detection, enabling compliance with stringent quality standards.

Regulatory agencies emphasize the role of spectroscopy in accelerating drug development processes, supporting market growth through standardized validation methods. Key players invest in high-resolution systems to meet the needs of expanding R&D budgets in biopharma. Clinical research integrates spectroscopy for real-time monitoring of chemical reactions and biomolecular interactions.

Global trends in personalized medicine align with spectroscopy’s capability to analyze complex biological samples. Academic institutions contribute by validating spectroscopic techniques in preclinical studies. Patient care benefits indirectly from faster drug approvals facilitated by advanced analytical tools.

Economic factors, including the high cost of failed drug trials, further justify investment in spectroscopy. The U.S. Department of Energy allocated $31 million in 2024 to support 42 research projects, several of which involve molecular spectroscopy for advanced materials and pharmaceutical analysis.

Restraints

Technical complexity and skill requirements are restraining the market

The molecular spectroscopy market is restrained by the technical complexity and skill requirements, which demand specialized training for operators to handle sophisticated instruments like NMR and mass spectrometers accurately. Manufacturers face challenges in designing user-friendly systems, as complex setups increase error rates in non-expert hands. Regulatory compliance for instrument calibration adds to operational burdens, deterring adoption in smaller labs.

Healthcare and pharma sectors in developing regions struggle with limited trained personnel, reducing market penetration. Clinical applications require precise data interpretation, leading to inconsistencies without expert oversight. Global disparities in education infrastructure exacerbate skill gaps for spectroscopy use.

Academic analyses highlight the impact on research productivity due to training needs. Patient diagnostics are indirectly affected by delayed or inaccurate results from unskilled operation. Economic models project slower growth without simplified interfaces and automated features. These factors collectively hinder broader deployment and efficiency in molecular analysis.

Opportunities

Growth in environmental monitoring applications is creating growth opportunities

The molecular spectroscopy market presents growth opportunities through the expansion in environmental monitoring applications, where techniques like UV-Vis and FTIR are crucial for detecting pollutants and analyzing water quality. Developers can innovate portable spectrometers to address the needs of field-based environmental assessments. Regulatory frameworks for environmental protection encourage investment in spectroscopy for compliance testing.

Healthcare sectors benefit from monitoring airborne toxins that impact public health. Pharmaceutical firms can extend spectroscopy to green chemistry for sustainable drug production. Clinical research explores spectroscopy in toxicology for broader indications. Global adoption in emerging markets aligns with environmental policy development.

Academic collaborations refine methods for real-time pollutant detection. Patient health improves with better environmental data enabling preventive measures. The U.S. Environmental Protection Agency funded over $50 million in 2023 for research grants, including projects utilizing molecular spectroscopy for air and water analysis.

Impact of Macroeconomic / Geopolitical Factors

Global economic expansions drive heightened investments in pharmaceutical and environmental testing, bolstering the molecular spectroscopy market through greater adoption of infrared and Raman systems for precise material analysis. Leaders in the industry pursue opportunities from steady industrial recoveries, which supports robust demand for spectroscopy tools in quality control processes across sectors.

Nevertheless, fluctuating exchange rates amid economic uncertainties increase operational overheads, pushing equipment providers to adjust strategies in variable demand environments. Political standoffs between trading giants strain access to rare earth elements essential for spectrometer components, creating bottlenecks in global distribution channels.

Enterprises adapt by exploring alternative material sources from aligned partners, which streamlines workflows and minimizes exposure to regional conflicts. Present US tariffs on imported scientific instruments from dominant manufacturers abroad add layers of expense, testing pricing models for companies serving North American clients.

Regional players counter this by prioritizing in-house advancements, which cultivates expertise and aligns with evolving regulatory landscapes. Sophisticated integrations of AI for real-time spectral data interpretation continually elevate the market’s capabilities, ensuring adaptive success and expanded applications in diverse industries.

Latest Trends

Adoption of portable and handheld spectroscopy devices is a recent trend

In 2024, the molecular spectroscopy market has exhibited a prominent trend toward the adoption of portable and handheld devices, which enable on-site analysis for applications in food safety and forensic science. Manufacturers are focusing on miniaturized systems with wireless connectivity to improve field usability. Healthcare professionals are adopting these for point-of-care diagnostics in remote settings.

Regulatory approvals highlight the trend’s emphasis on mobility without sacrificing accuracy. Clinical implementations benefit from devices allowing rapid sample testing. Academic studies evaluate portable performance in real-world scenarios for evidence-based adoption. Global distribution expands access to advanced analysis in non-lab environments.

Patient diagnostics gain from faster results with handheld tools. Ethical protocols ensure data security in mobile applications. Thermo Fisher Scientific reported a 5% growth in portable analyzer sales in their 2024 annual report, reflecting the trend in molecular spectroscopy.

Regional Analysis

North America is leading the Molecular Spectroscopy Market

North America accounted for 38.5% of the overall market in 2024, and the Molecular Spectroscopy market grew as pharmaceutical quality control, clinical research, and materials science laboratories increased demand for precise molecular analysis. Drug developers relied on advanced spectroscopic techniques to characterize complex formulations, biologics, and impurities in compliance-driven workflows.

Academic institutions expanded analytical capabilities to support translational research and structural biology studies. Environmental and chemical safety testing also increased instrument utilization across public and private laboratories.

The U.S. National Institutes of Health reported total research funding of USD 47.5 billion in fiscal year 2023, reflecting sustained investment that directly supports advanced analytical instrumentation adoption. Software-driven automation improved data accuracy and throughput. Instrument upgrades focused on sensitivity and reproducibility strengthened laboratory confidence. These combined factors supported steady market expansion across North America in 2024.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to witness strong growth during the forecast period as the Molecular Spectroscopy market benefits from rapid expansion of pharmaceutical manufacturing, academic research, and industrial testing capacity. Governments continue prioritizing scientific infrastructure to support innovation in chemistry, biotechnology, and materials engineering.

Contract research organizations expand analytical services to meet global regulatory expectations. Food safety, environmental monitoring, and semiconductor manufacturing further drive demand for high-precision molecular analysis tools. Universities increase investment in spectroscopy-based research to strengthen global collaboration.

The National Bureau of Statistics of China reported R&D expenditure exceeding USD 440 billion in 2022, underscoring the region’s expanding analytical research base. Local instrument production improves affordability and access. These dynamics position Asia Pacific for sustained and accelerated growth in the coming years.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Molecular Spectroscopy market drive growth by advancing high-resolution, application-specific instruments that support pharmaceuticals, chemicals, food safety, and materials science analysis. Companies expand demand by embedding automation, AI-assisted interpretation, and software analytics that shorten analysis cycles and improve data reliability for regulated environments.

Commercial strategies emphasize long-term relationships with research institutes and industrial laboratories through service contracts, upgrades, and workflow-driven solutions. Innovation priorities focus on portable systems, multi-technique platforms, and sensitivity improvements that widen use cases beyond centralized labs.

Market expansion targets regions increasing R&D spending and regulatory testing requirements across life sciences and manufacturing. Bruker operates as a leading participant by leveraging its broad spectroscopy portfolio, strong scientific heritage, and global customer base to deliver precision analytical solutions across research and industrial markets.

Top Key Players

- Thermo Fisher Scientific

- Agilent Technologies

- PerkinElmer, Inc.

- Shimadzu Corporation

- Bruker Corporation

- Waters Corporation

- JEOL Ltd.

- HORIBA, Ltd.

- Rigaku Corporation

- Analytik Jena AG

Recent Developments

- In March 2025, during PittCon 2025, BrightSpec announced the debut of its expanded BrightSpec MRR product suite, representing a significant step forward for molecular rotational resonance spectroscopy. The new portfolio is intended to simplify and accelerate the identification and characterization of complex molecular structures, enabling analytical chemists to achieve higher confidence in structural analysis across research and industrial applications.

- In March 2025, CRAIC Technologies revealed the introduction of its new 5D Spectral Surface Mapping solution aimed at strengthening analytical performance in microscopy and materials science. The technology combines spatial, spectral, and intensity data to provide deeper surface insights, supporting researchers and industry users who require advanced microspectroscopy for detailed material characterization.

Report Scope

Report Features Description Market Value (2024) US$ 7.1 Billion Forecast Revenue (2034) US$ 13.6 Billion CAGR (2025-2034) 6.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Mass Spectroscopy, Infrared Spectroscopy, Nuclear Magnetic Resonance (NMR) Spectroscopy, Color Measurement Spectroscopy and Others), By Application (Pharmaceuticals, Research Institutes, Food & Beverages Testing, Biotech and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Thermo Fisher Scientific, Agilent Technologies, PerkinElmer, Inc., Shimadzu Corporation, Bruker Corporation, Waters Corporation, JEOL Ltd., HORIBA, Ltd., Rigaku Corporation, Analytik Jena AG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Molecular Spectroscopy MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Molecular Spectroscopy MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Thermo Fisher Scientific

- Agilent Technologies

- PerkinElmer, Inc.

- Shimadzu Corporation

- Bruker Corporation

- Waters Corporation

- JEOL Ltd.

- HORIBA, Ltd.

- Rigaku Corporation

- Analytik Jena AG