Global Mobile AI Market By Technology Node (7 nm, 10 nm, 20-28 nm, Others (12 nm and 14 nm)), By Application (Smartphones, Cameras, Drones, Automobile, Robotics, AR/VR, Others (smart boards, Laptops, PCs)), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: March 2024

- Report ID: 116465

- Number of Pages: 349

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

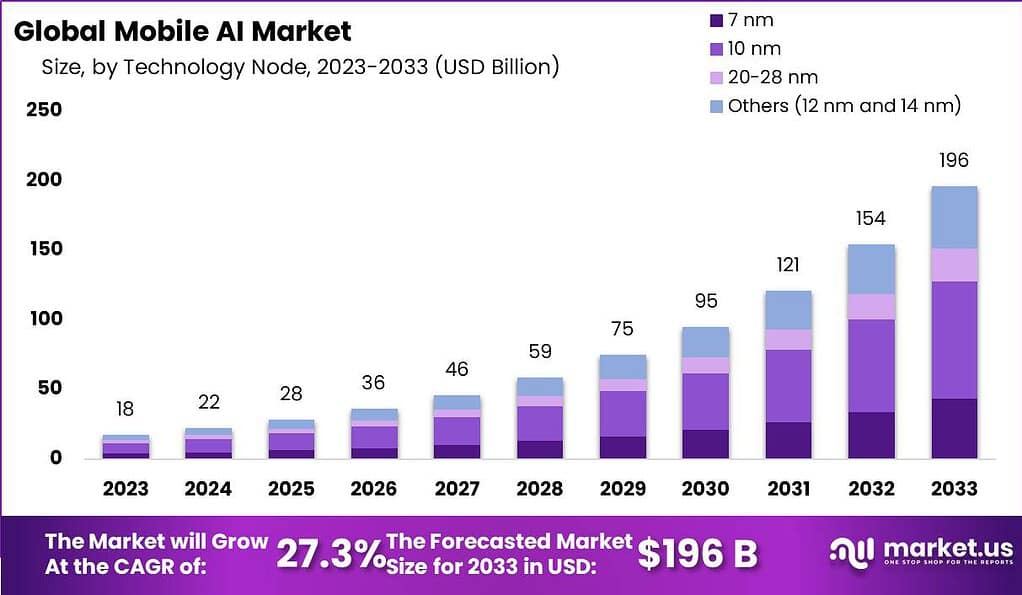

The Global Mobile AI Market size is expected to be worth around USD 196 Billion by 2033, from USD 18 Billion in 2023, growing at a CAGR of 27.3% during the forecast period from 2024 to 2033.

Mobile AI refers to the integration of artificial intelligence (AI) capabilities into mobile devices such as smartphones, tablets, and wearable gadgets. It enables these devices to perform intelligent tasks and provide personalized experiences to users. Mobile AI utilizes machine learning algorithms, natural language processing, and computer vision to enhance various functionalities and applications on mobile devices.

The mobile AI market is experiencing rapid growth as AI technology becomes more accessible and powerful. With the increasing computational power and improved efficiency of mobile processors, AI functionalities can now be embedded directly into mobile devices. This opens up a wide range of possibilities, including voice assistants, image recognition, augmented reality, and personalized recommendations.

One of the key drivers of the mobile AI market is the demand for intelligent virtual assistants like Siri, Google Assistant, and Amazon Alexa. These assistants leverage AI algorithms to understand natural language queries, provide relevant information, and perform tasks through voice commands. The convenience and hands-free nature of voice interactions have contributed to their widespread adoption and integration into mobile devices.

Another significant aspect of the mobile AI market is image recognition and computer vision. AI-powered camera functionalities enable mobile devices to recognize objects, scenes, and faces, and provide real-time augmented reality experiences. This has revolutionized industries such as gaming, e-commerce, and social media, offering users immersive and interactive visual experiences.

According to a recent survey, the usage of AI-enabled virtual assistants like Siri, Google Assistant, or Alexa on smartphones saw a significant increase in 2023, with 62% of mobile users reporting their utilization. This trend reflects the growing reliance on virtual assistants for voice-based interactions and accessing information on mobile devices.

The mobile gaming industry experienced a notable shift in 2023, with major game developers embracing AI technologies. AI-powered game mechanics, personalized gameplay, and real-time analytics became prevalent, enhancing the gaming experience for users and offering more immersive and dynamic gameplay.

In the industrial sector, mobile AI solutions for predictive maintenance and remote monitoring saw a substantial 27% growth in 2023 compared to the previous year. These solutions leverage AI algorithms to analyze data from sensors and equipment, enabling proactive maintenance and reducing downtime in industrial operations.

The adoption of AI-powered mobile banking applications also witnessed a significant 35% increase in 2023. This surge can be attributed to the growing demand for personalized financial services and the integration of advanced security features, ensuring secure and convenient mobile banking experiences for users.

Furthermore, the integration of AI in mobile e-commerce platforms proved to be highly beneficial in 2023. A market report indicated a 15% increase in customer engagement and conversion rates due to AI-driven features such as personalized product recommendations, chatbots for customer support, and optimized search functionalities.

Looking ahead, it is projected that around 90% of new mobile applications will incorporate some form of AI technology. This includes various AI capabilities such as natural language processing, computer vision, and predictive analytics. These AI-powered features will enhance app functionality, provide personalized experiences, and streamline processes for users across different industries.

Key Takeaway

- The Mobile AI Market is projected to witness robust growth, with an estimated worth of around USD 196 billion by 2033, indicating a strong CAGR of 27.3% from 2024 to 2033.

- In 2023, the 10nm technology node segment dominated the market, capturing over 43% share, owing to its optimal balance between performance, power efficiency, and cost.

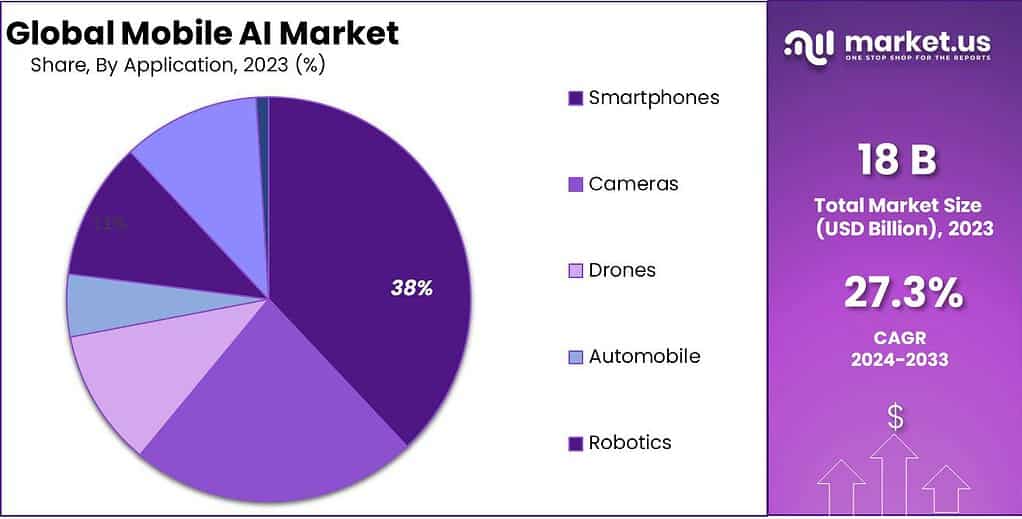

- The smartphone segment held a dominant position in 2023, capturing over 38% market share. Smartphones serve as the primary platform for deploying AI technologies due to their ubiquity and evolving capabilities.

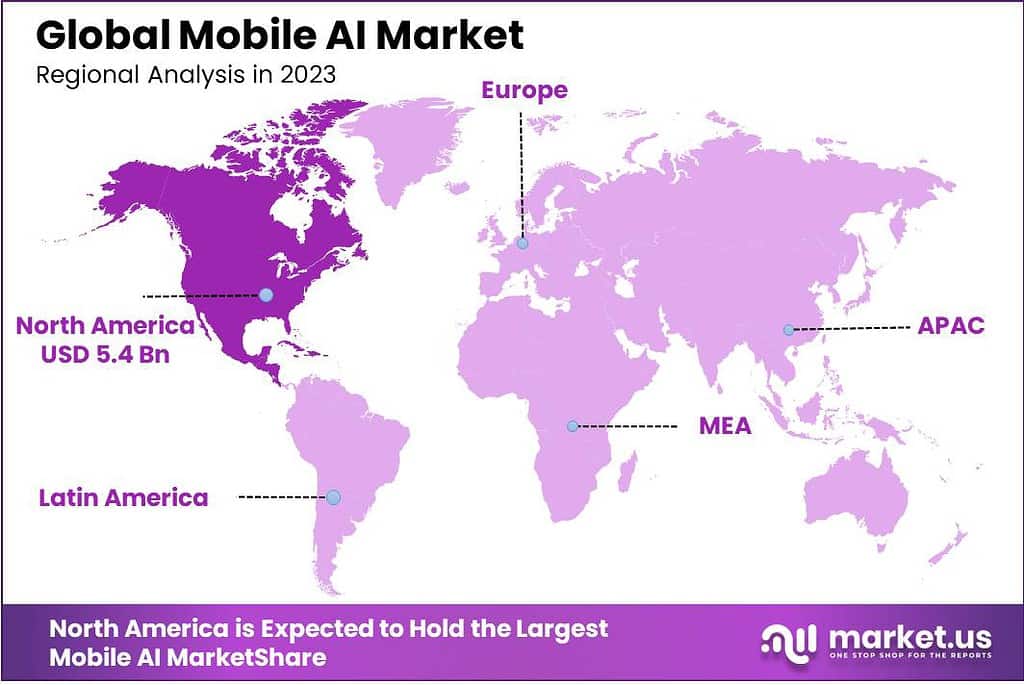

- In 2023, North America held a dominant market position in the mobile AI market, capturing more than a 31% share.

- The demand for Mobile AI in North America was valued at USD 5.4 billion in 2023 and is anticipated to grow significantly in the forecast period.

- The Artificial Intelligence Market size is expected to be worth around USD 2,745 billion by 2032, from USD 177 Billion in 2023, growing at a CAGR of 36.8% during the forecast period from 2024 to 2033.

- AI is expected to boost the United States GDP by a significant 21% by 2030.

- A large 64% of businesses believe AI will make them more productive overall.

- Every month, about 3.1 billion searches are done through voice assistants, and 24% of young Americans (18-29) had a smart speaker in 2023.

- In 2023, it was estimated that more than 80% of smartphones shipped worldwide came with AI capabilities, including facial recognition and voice assistants.

By Technology Node Analysis

In 2023, the 10nm technology node segment held a dominant position in the mobile AI market, capturing more than a 43% share. This prominence can be attributed to the optimal balance the 10nm node provides between performance, power efficiency, and cost.

Devices manufactured using 10nm technology offer significant improvements in speed and energy consumption over their predecessors, making them highly suitable for the latest generation of mobile AI applications. The reduced power consumption is particularly crucial for mobile devices, as it extends battery life while delivering enhanced AI capabilities, such as real-time voice translation, image recognition, and augmented reality experiences.

The leading status of the 10nm segment also stems from its widespread adoption by major semiconductor and smartphone manufacturers. These entities have invested heavily in 10nm technology to leverage its advantages in creating more powerful and efficient mobile processors.

As a result, a substantial portion of high-end smartphones and other AI-powered mobile devices launched in the market during this period were built on 10nm chips. This widespread adoption not only underscores the technological superiority of the 10nm node but also reflects the industry’s confidence in its ability to meet the growing demands for advanced mobile AI applications.

By Application Analysis

In 2023, the smartphone segment held a dominant market position within the mobile AI market, capturing more than a 38% share. This leading position is primarily due to the ubiquitous nature of smartphones and their integral role in our daily lives.

As the central hub for communication, entertainment, and personal productivity, smartphones have become the primary platform for deploying and experiencing AI technologies. Manufacturers have continuously integrated advanced AI capabilities into smartphones, including voice assistants, camera enhancements, user behavior predictions, and security features, driving consumer demand and adoption rates.

The proliferation of AI in smartphones is also facilitated by the increasing processing power of mobile devices, enabling them to handle complex AI algorithms locally on the device. This local processing capability allows for real-time applications such as speech recognition, language translation, and augmented reality, all without the need for constant cloud connectivity.

Such advancements have significantly improved the user experience, making smartphones even more indispensable to consumers. Moreover, the introduction of AI has opened new avenues for mobile app developers, creating a vibrant ecosystem of AI-powered applications and services that further drive the smartphone segment’s growth.

Key Market Segments

By Technology Node

- 7 nm

- 10 nm

- 20-28 nm

- Others (12 nm and 14 nm)

By Application

- Smartphones

- Cameras

- Drones

- Automobile

- Robotics

- AR/VR

- Others (smart boards, Laptops, PCs)

Driver

Growing Demand for AI-Capable Processors in Mobile Devices

The growth of the mobile artificial intelligence (AI) market can be attributed significantly to the increasing demand for AI-capable processors in mobile devices. These processors enhance the capabilities of mobile devices, enabling advanced features such as voice recognition, image processing, and on-device decision-making.

This demand is fueled by the consumer’s growing expectation for smarter, more intuitive user experiences in smartphones, tablets, and other portable electronics. The integration of AI processors in mobile devices not only improves performance but also ensures efficiency in power consumption, thereby extending battery life. As a result, manufacturers are increasingly incorporating AI processors into their designs, driving the expansion of the mobile AI market.

Restraint

Limited Number of AI Experts

A significant restraint facing the mobile AI market is the limited number of AI experts. The development and integration of AI technologies require specialized knowledge and skills that are currently in short supply. This scarcity of AI talent hampers the ability of companies to innovate and implement AI solutions at a pace that matches market demand.

The complexity of AI systems, coupled with the need for continuous learning and adaptation to new algorithms and data sets, exacerbates the challenge. Consequently, the shortage of skilled AI professionals acts as a bottleneck, slowing down the growth and development of the mobile AI market.

Opportunity

Growing Demand for Edge Computing in IoT

The mobile AI market is poised to benefit from the growing demand for edge computing in the Internet of Things (IoT). Edge computing involves processing data near the source of data generation (i.e., at the edge of the network), which reduces latency, conserves bandwidth, and enhances privacy. As IoT devices proliferate, the need for real-time processing and AI-driven decision-making at the edge is becoming increasingly critical.

Mobile devices, equipped with AI capabilities, are ideally positioned to serve as edge computing nodes, processing data locally and facilitating immediate responses. This convergence of mobile AI and edge computing represents a significant opportunity for market growth, enabling new applications and services in various sectors, including healthcare, smart cities, and industrial automation.

Challenge

Unreliability of AI Algorithms in Mobile Apps

A challenge confronting the mobile AI market is the unreliability of AI algorithms in mobile applications. Despite advances in AI technology, the performance of AI algorithms can vary significantly based on the data they are trained on, leading to inconsistencies in user experience.

Moreover, the limited processing power and storage available on mobile devices can constrain the complexity of AI models that can be deployed, potentially affecting their accuracy and reliability. These factors contribute to a level of unpredictability in AI-driven applications, which can erode user trust and adoption. Addressing this challenge requires ongoing research and development to optimize AI algorithms for mobile environments and to ensure that they deliver consistent, reliable performance

Regional Analysis

In 2023, North America held a dominant market position in the mobile AI market, capturing more than a 31% share. The demand for Mobile AI in North America was valued at USD 5.4 billion in 2023 and is anticipated to grow significantly in the forecast period.

This leadership can be attributed to several key factors that underscore the region’s pioneering role in technological advancements and digital transformation. First and foremost, North America, particularly the United States, is home to some of the world’s leading technology firms, including giants in software, semiconductors, and consumer electronics.

These companies are at the forefront of integrating AI into mobile devices, propelling innovations in user interface, personalized services, and enhanced device capabilities. The region’s strong emphasis on research and development, supported by substantial investments from both the public and private sectors, further cements its status as a hub for technological innovation.

Additionally, the high adoption rate of smartphones and mobile services among consumers in North America contributes significantly to its leading position in the mobile AI market. The demand for AI-powered applications and services, such as voice recognition, camera enhancements, and real-time translation, is growing among consumers seeking more intelligent and personalized user experiences.

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

In the rapidly evolving mobile AI market, key players are instrumental in shaping the trajectory of technology and innovation. These entities, ranging from established technology giants to emerging startups, are at the forefront of integrating artificial intelligence into mobile devices, thereby enhancing user experiences and expanding the capabilities of smartphones and tablets. A detailed analysis of these key players reveals a competitive landscape characterized by strategic partnerships, continuous research and development, and a focus on consumer needs.

Top Market Leaders

- Qualcomm Inc

- NVIDIA

- Intel Corporation

- IBM Corporation

- Microsoft Corporation

- Apple Inc

- Huawei (Hisilicon)

- GoogleLLC

- Mediatek

- Samsung

- Other key players

Recent Developments

- In August 2023, Microsoft teamed up with Epic, a company known for its healthcare software, to enhance the use of generative AI in healthcare. This collaboration aims to tackle the most urgent challenges in the healthcare industry by leveraging AI technology.

- Earlier, in February 2023, Microsoft introduced a new version of Bing Chat that is powered by AI. This updated version became available on mobile apps for both Android and iOS devices, offering users a more advanced and intelligent search experience on the go.

- In another significant partnership in July 2023, Qualcomm and Meta came together to work on bringing AI applications directly onto devices through the use of Llama 2 technology. This effort focuses on enhancing the capability and efficiency of AI applications without needing to constantly connect to the internet, making AI more accessible and faster for users.

- In February 2023, Qualcomm unveiled a new video conferencing solution powered by artificial intelligence (AI). This innovation is designed to make video conferencing more interactive and engaging, enhancing the overall experience for users.

- Also in February 2023, Telefónica, Ericsson, and Qualcomm joined forces to launch Spain’s first commercial mobile 5G mmWave network. This collaboration marks a significant step forward in mobile technology, promising faster speeds and paving the way for new advancements in mobile AI.

- In May 2023, IBM took a step further in integrating AI into everyday business tools by embedding its Watson technology into SAP® solutions. This integration aims to provide new AI-driven insights, seeking to significantly improve user experiences across various industries.

Report Scope

Report Features Description Market Value (2023) USD 18 Bn Forecast Revenue (2033) USD 196 Bn CAGR (2024-2033) 27.3% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Technology Node (7 nm, 10 nm, 20-28 nm, Others (12 nm and 14 nm)), By Application (Smartphones, Cameras, Drones, Automobile, Robotics, AR/VR, Others (smart boards, Laptops, PCs)) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Qualcomm Inc, NVIDIA, Intel Corporation, IBM Corporation, Microsoft Corporation, Apple Inc, Huawei (Hisilicon), GoogleLLC, Mediatek, Samsung, Other key players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is Mobile AI?Mobile AI refers to artificial intelligence technologies and applications that are specifically designed and optimized for mobile devices such as smartphones, tablets, and wearables. These AI capabilities enable mobile devices to perform various tasks such as image recognition, natural language processing, voice recognition, and more, directly on the device without needing constant internet connectivity.

How big is Mobile AI Market?The Global Mobile AI Market size is expected to be worth around USD 196 Billion by 2033, from USD 18 Billion in 2023, growing at a CAGR of 27.3% during the forecast period from 2024 to 2033.

Which application segment accounted for the largest mobile artificial intelligence (AI) market share?In 2023, the smartphone segment held a dominant market position within the mobile AI market, capturing more than a 38% share.

Who are the key players in the mobile artificial intelligence market?Some key players operating in the mobile artificial intelligence market include Qualcomm Inc, NVIDIA, Intel Corporation, IBM Corporation, Microsoft Corporation, Apple Inc, Huawei (Hisilicon), GoogleLLC, Mediatek, Samsung, Other key players

Which region has the biggest share in Mobile Artificial Intelligence Market?In 2023, North America held a dominant market position in the mobile AI market, capturing more than a 31% share.

-

-

- Qualcomm Inc

- NVIDIA

- Intel Corporation

- IBM Corporation

- Microsoft Corporation

- Apple Inc

- Huawei (Hisilicon)

- GoogleLLC

- Mediatek

- Samsung

- Other key players