Fundus Cameras Market By Product (Mydriatic Fundus Cameras, Non- Mydriatic Fundus Cameras, Hybrid Fundus Cameras and ROP fundus cameras), Modality (Portable and Tabletop), End-use (Hospitals, Ophthalmology Clinics, Ophthalmic & Optometrist Offices and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 21929

- Number of Pages: 283

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

The Fundus Cameras Market Size is expected to be worth around US$ 717.1 million by 2034 from US$ 374.9 million in 2024, growing at a CAGR of 6.7% during the forecast period 2025 to 2034.

Fundus cameras are specialized medical devices used to capture detailed images of the retina, optic disc, and blood vessels, aiding in the diagnosis and management of eye diseases like diabetic retinopathy, glaucoma, and macular degeneration. These cameras are categorized into mydriatic (requiring pupil dilation), non-mydriatic (no dilation needed), and hybrid models.

Technological advancements, such as AI integration and high-resolution imaging, have enhanced their diagnostic capabilities. Widely used in ophthalmology clinics and hospitals, fundus cameras are essential for early detection and monitoring of retinal conditions. The fundus cameras market is experiencing significant growth, driven by the increasing prevalence of eye diseases such as diabetic retinopathy, glaucoma, and age-related macular degeneration.

Fundus cameras are essential diagnostic tools used to capture detailed images of the retina, aiding in early detection and management of ocular conditions. Technological advancements, such as the integration of AI and high-resolution imaging, are enhancing diagnostic accuracy and efficiency.

Key Takeaways

- In 2024, the market for Fundus Cameras generated a revenue of US$ 374.9 million, with a CAGR of 6.7%, and is expected to reach US$ 717.1 million by the year 2033.

- The product type segment is divided into Mydriatic fundus cameras, Non- mydriatic fundus cameras, Hybrid fundus cameras and ROP fundus cameras, with Non- mydriatic fundus cameras taking the lead in 2023 with a market share of 34.8%.

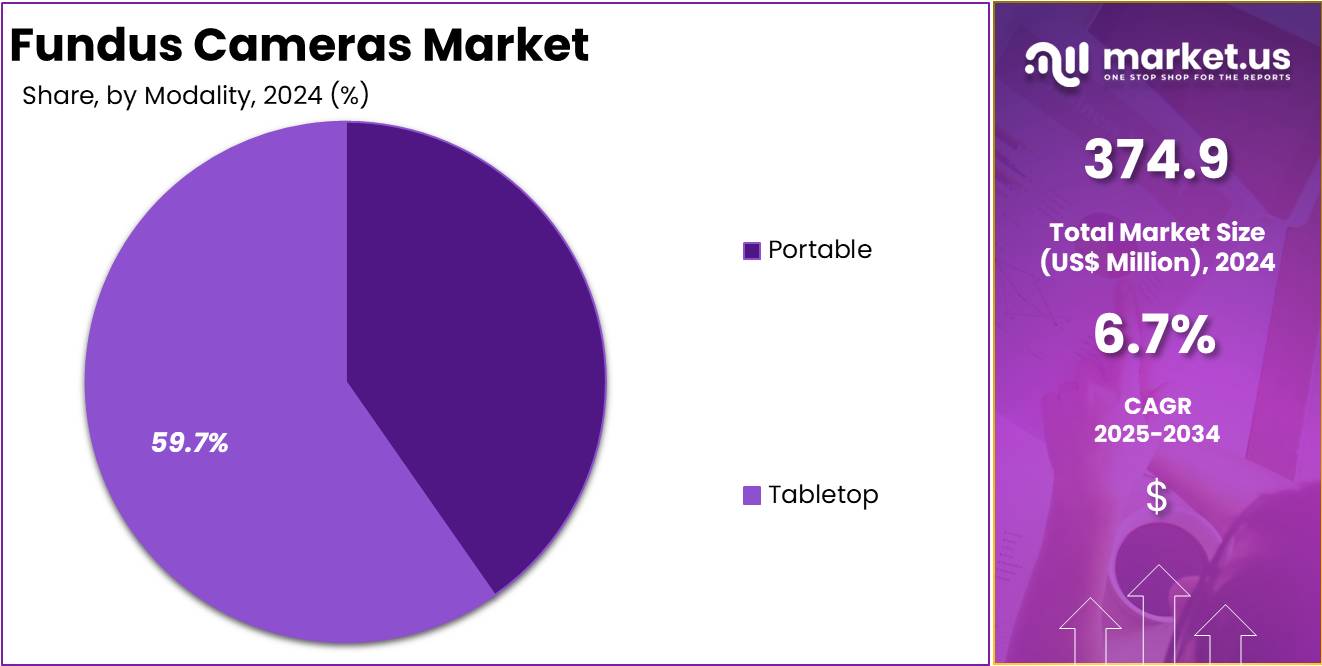

- By Modality, the market is bifurcated into Portable and Tabletop, with tabletop leading the market with 59.7% of market share.

- Furthermore, concerning the end-use segment, the market is segregated into Hospitals, Ophthalmology Clinics, Ophthalmic & Optometrist Offices and Others. The Hospitals sector stands out as the dominant player, holding the largest revenue share of 36.9% in the Fundus Cameras market.

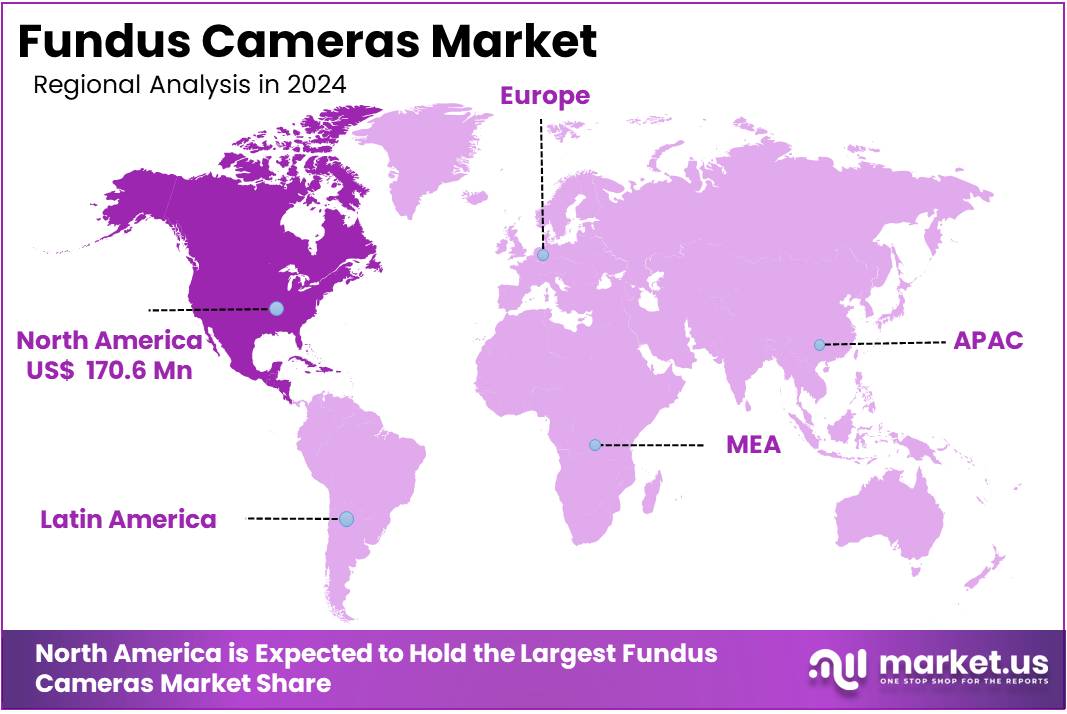

- North America led the market by securing a market share of 45.5% in 2023.

Product Analysis

The fundus cameras market is segmented into mydriatic, non-mydriatic, hybrid, and ROP fundus cameras, with non-mydriatic fundus cameras emerging as the dominant segment with 34.8% of market share in 2023. These cameras are widely preferred due to their ability to capture high-quality retinal images without requiring pupil dilation, offering greater patient comfort and efficiency in clinical settings. Their increasing adoption in hospitals, ophthalmology clinics, and telemedicine applications has significantly boosted market growth.

Mydriatic fundus cameras, while offering high-resolution imaging, require pupil dilation, making them less suitable for rapid diagnostics. Hybrid fundus cameras, which combine mydriatic and non-mydriatic features, are gaining traction in advanced ophthalmology centers. ROP fundus cameras, specifically designed for neonatal retinal screening, are becoming more relevant due to rising concerns about retinopathy of prematurity in premature infants.

Modality Analysis

The fundus cameras market is segmented by modality into portable and tabletop fundus cameras. The tabletop fundus cameras dominated the market with 59.7% market share due to their widespread use in hospitals, specialized eye clinics, and research institutions. These cameras offer high-resolution imaging, advanced diagnostic capabilities, and integration with AI-based retinal screening systems, making them the preferred choice for detailed retinal examinations and disease monitoring.

Their stability and precision provide superior image quality, which is essential for detecting diabetic retinopathy, glaucoma, and age-related macular degeneration (AMD). Portable fundus cameras, however, are gaining popularity due to their compact size, ease of use, and applicability in telemedicine and remote healthcare settings.

End-user Analysis

Hospitals dominated the market with 36.9% market share because it serves as primary centers for diagnosing and managing complex retinal diseases, making them the largest users of advanced fundus imaging technologies. With the increasing prevalence of diabetic retinopathy, glaucoma, and macular degeneration, hospitals invest heavily in high-resolution, AI-integrated fundus cameras to enhance early detection and treatment planning. Their access to specialized ophthalmologists, research facilities, and government funding further strengthens their dominance.

Key Market Segments

By Product

- Mydriatic fundus cameras

- Non- mydriatic fundus cameras

- Hybrid fundus cameras

- ROP fundus cameras

By Modality

- Portable

- Tabletop

By End-user

- Hospitals

- Ophthalmology Clinics

- Ophthalmic & Optometrist Offices

- Others

Drivers

Rising Prevalence of Diabetic Retinopathy & Other Retinal Disorders

The global prevalence of diabetic retinopathy, glaucoma, and age-related macular degeneration (AMD) is driving demand for fundus cameras. These conditions are leading causes of blindness, with diabetic retinopathy at the forefront. The diabetic population, projected to reach 700 million by 2045, and an aging global population are increasing incidences of AMD and glaucoma. Fundus cameras are essential for early detection and monitoring, enabling timely interventions that prevent vision loss.

Governments and healthcare organizations are emphasizing the importance of regular eye screenings, which boosts the demand for fundus cameras. These screenings are crucial for detecting retinal disorders early, facilitating better management and treatment outcomes. The growing awareness and institutional support are significantly propelling the adoption of fundus cameras worldwide.

According to a 2021 CDC report, approximately 9.6 million people in the U.S. were living with diabetic retinopathy across all age groups, including 1.84 million with vision-threatening conditions. The prevalence of diabetic retinopathy was lowest among individuals under 25 years old at 13.0% and highest among those aged 65-79 at 28.4%. Moreover, of those over 40, 8.94 million had diabetic retinopathy, with 1.71 million facing severe vision threats.

Restraints

High Cost of Advanced Fundus Cameras

The high cost of advanced fundus cameras significantly restricts their market accessibility, particularly for smaller clinics in low- and middle-income regions. These high-end devices, which boast features like high-resolution imaging and wide-field capabilities, often range from tens to hundreds of thousands of dollars. Their expense is a considerable hurdle, compounded by additional costs for maintenance and training, limiting their adoption in financially constrained settings.

Despite the potential long-term benefits of early diagnosis and treatment of eye conditions, the initial investment in fundus cameras poses a substantial barrier. This financial burden slows market growth, especially among smaller healthcare providers in less affluent areas. A standard table-mounted fundus camera, for example, costs around $10,000 but lacks portability, which could be a disadvantage in various clinical scenarios.

On the more affordable end, handheld fundus cameras provide some relief in terms of cost and mobility. Devices like the Remidio Non-Mydriatic Fundus On Phone and Volk Pictor Plus are priced around £4600 ($5800) and £4400 ($5500), respectively. While these are cheaper than their table-mounted counterparts, they still represent a significant investment for many healthcare facilities, impacting their widespread adoption.

Opportunities

Integration of AI for Automated Retinal Screening

The integration of artificial intelligence (AI) into fundus cameras presents a significant opportunity for market growth. AI-powered systems can analyze retinal images in real-time, detecting abnormalities such as diabetic retinopathy, glaucoma, and AMD with high accuracy. This automation reduces the reliance on specialist interpretation, making retinal screening more accessible in underserved areas.

AI also enhances efficiency by enabling mass screenings and reducing diagnostic errors. Companies are increasingly investing in AI-driven solutions, creating a competitive edge. This technological advancement not only improves patient outcomes but also aligns with the growing trend of telemedicine, offering a scalable solution for global eye care challenges.

Impact of Macroeconomic / Geopolitical Factors

The fundus cameras market is influenced by various macroeconomic and geopolitical factors. Economic growth in emerging markets, such as India and China, is driving healthcare investments, increasing access to advanced diagnostic tools like fundus cameras. However, economic downturns or inflation can limit healthcare budgets, reducing the adoption of high-cost devices. Geopolitical tensions and trade restrictions can disrupt supply chains, affecting the production and distribution of fundus cameras. For instance, tariffs on medical devices or semiconductor shortages can increase costs and delay availability.

Government policies and funding for healthcare infrastructure, particularly in developing regions, play a crucial role. Initiatives to combat diabetes and eye diseases boost demand, while austerity measures can hinder market growth. Additionally, currency fluctuations impact the affordability of imported devices, particularly in low-income countries. Overall, while macroeconomic growth and supportive policies present opportunities, economic instability and geopolitical risks pose challenges to the fundus cameras market.

Trends

Rising Adoption of Teleophthalmology and Remote Screening

The fundus cameras market is witnessing a significant trend with the rising adoption of teleophthalmology and remote screening. This shift is driven by the increasing need for accessible and efficient eye care, especially in underserved and rural areas. Fundus cameras, particularly portable and non-mydriatic models, are integral to teleophthalmology, enabling the capture of high-quality retinal images that can be transmitted to specialists for remote diagnosis.

Advancements in cloud-based platforms and AI-powered image analysis further enhance the efficiency of remote screening, making it a scalable solution for mass screenings. Governments and healthcare providers are increasingly investing in teleophthalmology infrastructure, creating growth opportunities for fundus camera manufacturers. This trend aligns with the broader digital transformation in healthcare, positioning teleophthalmology as a key driver of market expansion in the coming years.

Regional Analysis

North America is leading the Fundus Cameras Market

North America is the leading region in the fundus cameras market with a 45.5% market share in 2023, driven by advanced healthcare infrastructure, high prevalence of eye diseases, and strong adoption of innovative technologies. The U.S. accounts for the largest share, fueled by the rising incidence of diabetic retinopathy, glaucoma, and age-related macular degeneration (AMD), particularly among the aging population.

Increasing awareness of early diagnosis and preventive eye care further boosts demand for fundus cameras. The region is also at the forefront of technological advancements, with widespread adoption of AI-integrated, portable, and non-mydriatic fundus cameras. These devices enable efficient and accurate retinal screenings, aligning with the growing trend of teleophthalmology and remote diagnostics.

Government initiatives, favorable reimbursement policies, and significant investments in healthcare R&D further support market growth. Key players like Topcon Corporation, Canon Inc., and Carl Zeiss Meditec AG have a strong presence, driving innovation and competition. Overall, North America’s robust healthcare ecosystem and focus on cutting-edge solutions position it as a dominant and rapidly evolving market for fundus cameras.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Fundus Cameras market features prominent players such as Carl Zeiss Meditec AG, Kowa Company, Ltd., Optomed Plc, Optovue Incorporated, Topcon Corporation, Clarity Medical Systems, Inc., Canon Inc., Epipole Ltd, Revenio Group Corporation (Centervue SPA), and Clarity Medical Systems, Inc. These companies are noted for their innovative approaches in ophthalmic diagnostics, emphasizing the development of advanced imaging technologies and enhancing diagnostic accuracy through digital solutions.

Carl Zeiss Meditec AG is a leading figure in the ophthalmic device sector, offering cutting-edge fundus cameras like the CLARUS 500. This device is celebrated for its ultra-widefield imaging capabilities. Carl Zeiss is dedicated to integrating artificial intelligence and digital enhancements to improve the precision of retinal screenings. This strategy addresses the increasing demand for accurate and efficient diagnostic procedures in eye care.

Kowa Company, Ltd. is renowned for its non-mydriatic fundus cameras, including the VK-2 and VK-3 series. These cameras are prized for their portability and high-resolution imaging, making them ideal for use in various healthcare settings. Kowa focuses on affordability and user-friendliness, which makes its products highly sought after in both developed and emerging markets, thereby supporting broader access to advanced ophthalmic care.

Top Key Players in the Fundus Cameras Market

- Carl Zeiss Meditec AG

- Kowa Company, Ltd.

- Optomed Plc

- Optovue Incorporated

- Topcon Corporation

- Clarity Medical Systems, Inc.

- Canon Inc.

- Epipole Ltd

- Revenio Group Corporation (Centervue SPA)

- Clarity Medical Systems, Inc.

- Other Prominent Players

Recent Developments

- In October 2024: Visionix unveiled the VX 610 at Vision Expo West. This innovative nonmydriatic automated fundus camera eliminates the need for pupil dilation by using cross-polarized light. It features automatic alignment, focus, and image capture capabilities, housed within a compact, tablet-operated design that supports telehealth applications. It’s tailored for retinal screenings, particularly for conditions like diabetic retinopathy.

- In May 2024: Optomed USA, Inc. launched the Optomed Aurora AEYE. This handheld, AI-powered fundus camera enables primary care providers to perform immediate eye screenings for diabetic retinopathy, including its milder forms, directly at the point of care. This facilitates early detection and timely referral to eye care specialists.

- In May 2024: Remidio Inc. announced its milestone of deploying the 1000th FOP-NM handheld fundus camera in the U.S. Introduced in 2019, these portable, non-mydriatic cameras have significantly advanced diabetic retinopathy screening. Their ease of use and ability to operate without dilation have led to their broad adoption, enhancing retinal care accessibility.

- In October 2022: Samsung launched an initiative to screen 150,000 people in India for eye diseases by the end of 2023 using the EYELIKE Fundus Camera. This project is part of the Galaxy Upcycling initiative, which repurposes older Galaxy devices, thereby reducing electronic waste while increasing eye care access in underserved areas.

Report Scope

Report Features Description Market Value (2024) US$ 374.9 million Forecast Revenue (2034) US$ 717.1 million CAGR (2025-2034) 6.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Mydriatic fundus cameras, Non- mydriatic fundus cameras, Hybrid fundus cameras and ROP fundus cameras), Modality (Portable and Tabletop), End-use (Hospitals, Ophthalmology Clinics, Ophthalmic & Optometrist Offices and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Carl Zeiss Meditec AG, Kowa Company, Ltd., Optomed Plc, Optovue Incorporated, Topcon Corporation, Clarity Medical Systems, Inc., Canon Inc., Epipole Ltd, Revenio Group Corporation (Centervue SPA), Clarity Medical Systems, Inc., and Other Prominent Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Carl Zeiss Meditec AG

- Kowa Company, Ltd.

- Optomed Plc

- Optovue Incorporated

- Topcon Corporation

- Clarity Medical Systems, Inc.

- Canon Inc.

- Epipole Ltd

- Revenio Group Corporation (Centervue SPA)

- Clarity Medical Systems, Inc.

- Other Prominent Players