Global Mining Logistics Market Size, Share, Growth Analysis By Type (Transportation Service, Warehousing & Storage Service, Value-added Service), By Application (Coal, Iron Ore, Metals, Gold, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jun 2025

- Report ID: 151449

- Number of Pages: 198

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

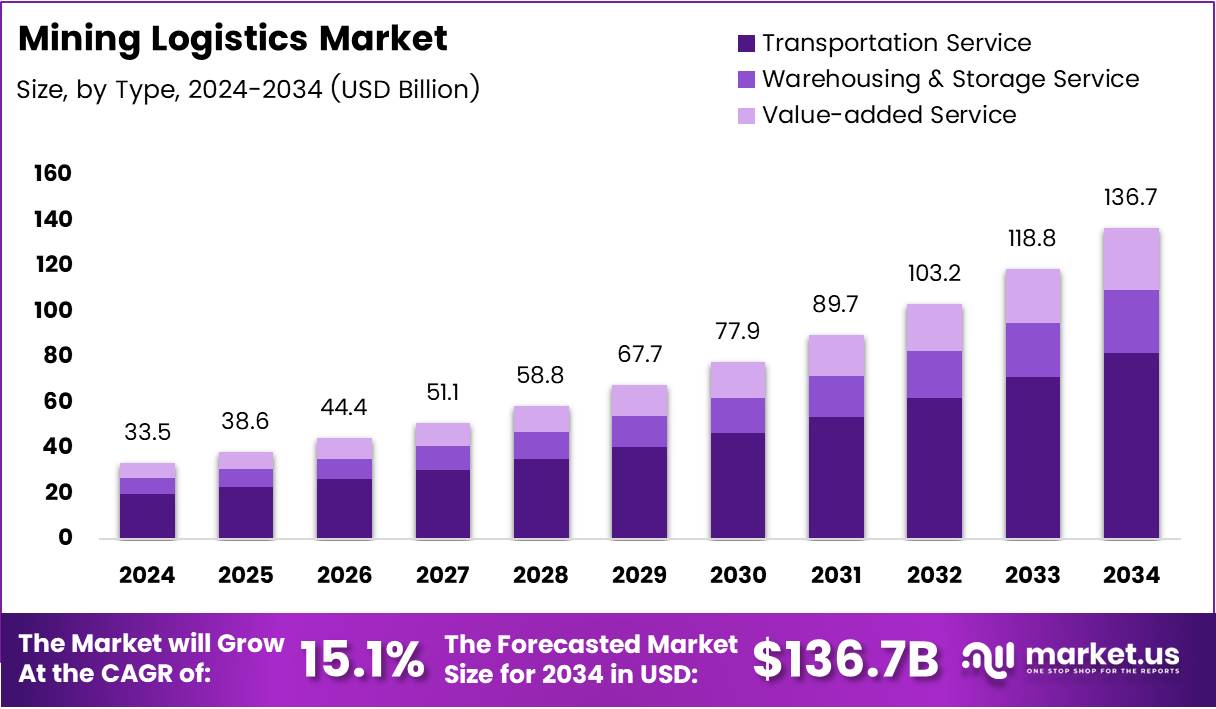

The Global Mining Logistics Market size is expected to be worth around USD 136.7 Billion by 2034, from USD 33.5 Billion in 2024, growing at a CAGR of 15.1% during the forecast period from 2025 to 2034.

The Mining Logistics Market plays a crucial role in the movement of raw materials such as coal, metals, and minerals from mining sites to processing facilities, and finally to distribution centers. Logistics in the mining industry is essential for improving efficiency and reducing operational costs. Efficient transportation systems and supply chain management help in addressing the growing global demand for minerals and energy products.

The growth prospects of the Mining Logistics Market are particularly strong due to increased demand for commodities like coal and iron ore. According to the Head of the Statistics Indonesia (BPS), the mining industry is set to grow by 13.47%, with coal and lignite mining projected to increase by 9.41%. This growth is driven by rising demand for coal from abroad, as well as a significant rise in coal prices, which creates substantial opportunities for logistics companies to expand their services.

Mining logistics is a critical aspect for mining companies to streamline operations and minimize production costs. However, according to a study by the International Council on Mining and Metals, logistics costs can range from 10% to 40% of the total cost of production, highlighting a significant area for cost-saving innovations. As a result, companies are increasingly adopting new technologies such as automation, data analytics, and real-time monitoring systems to optimize transportation and inventory management.

Government investment and regulations are shaping the Mining Logistics Market’s future. Governments across the globe are implementing policies to improve infrastructure and facilitate the smooth transport of raw materials.

These initiatives, often aimed at strengthening trade routes and reducing logistical bottlenecks, create a favorable environment for market expansion. Furthermore, the growing push toward sustainability is encouraging companies to adopt more eco-friendly transportation options, such as electric trucks and alternative fuels, in their logistics operations.

The opportunities within the Mining Logistics Market are vast. With the increasing shift toward automation and digitalization, mining companies are poised to benefit from more efficient supply chains. Additionally, advancements in infrastructure and global trade agreements are expected to reduce logistics delays and improve cost-effectiveness. As the industry evolves, companies that invest in innovative technologies and sustainable logistics practices will be well-positioned to lead the market.

Key Takeaways

- The global Mining Logistics Market size is projected to reach USD 136.7 Billion by 2034, growing at a CAGR of 15.1% from 2025 to 2034.

- In 2024, Transportation Service led the market with a 62.1% share in the By Type Analysis segment.

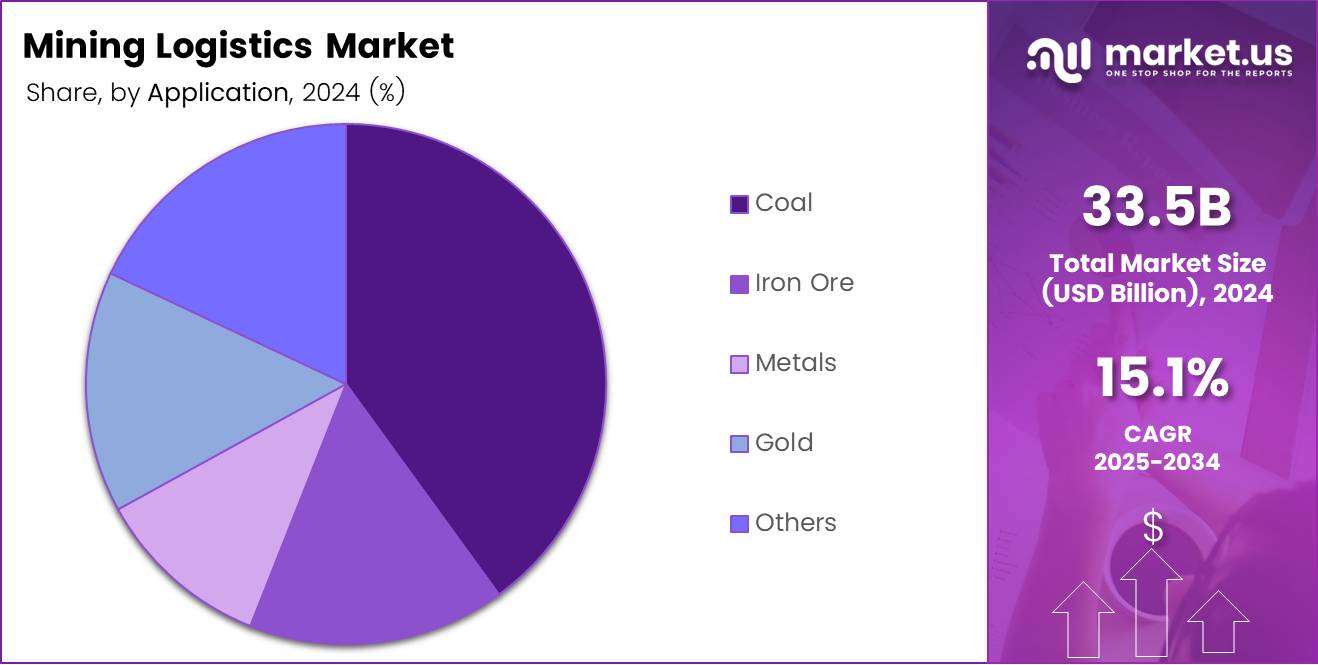

- Coal dominated the By Application Analysis segment in 2024, holding a significant market share.

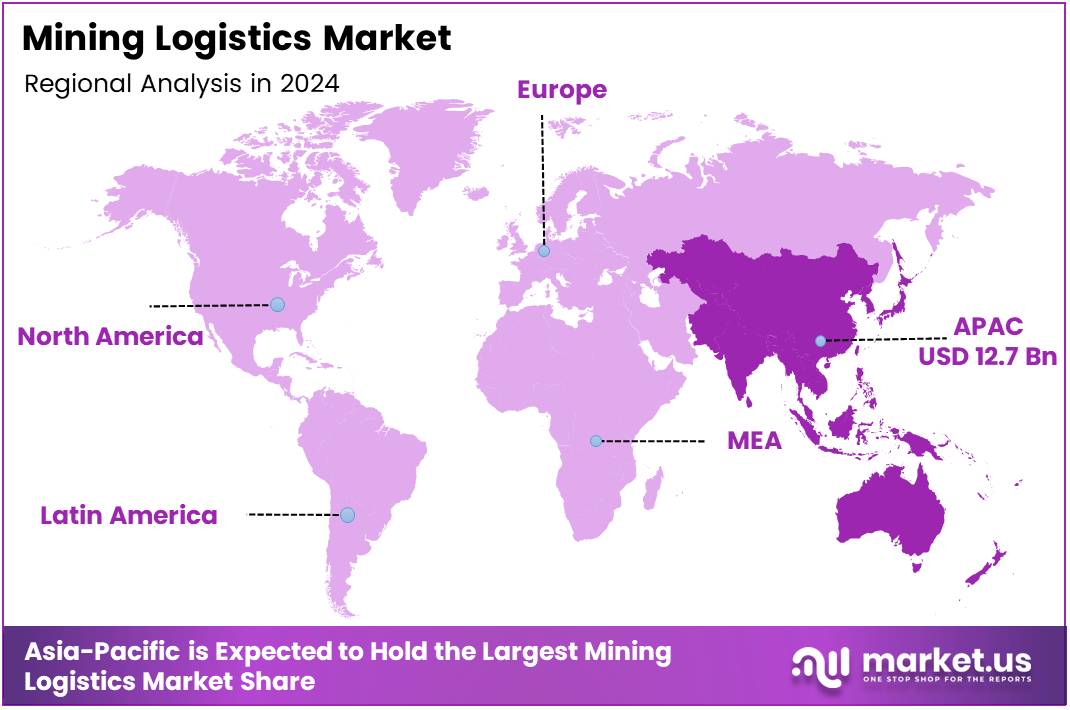

- Asia Pacific holds the largest market share in mining logistics with 37.5%, valued at USD 12.7 Billion in 2024.

- The growth in Asia Pacific is fueled by rapid industrialization and increasing mining activities in countries like China and India.

Type Analysis

Transportation Service dominates with 62.1% share, driven by its essential role in moving raw materials efficiently

In 2024, Transportation Service held a dominant market position in the By Type Analysis segment of the Mining Logistics Market, with a 62.1% share. This segment’s growth is driven by the increasing demand for efficient transportation solutions to move raw materials from mining sites to processing plants and ports. Transportation services are crucial for ensuring the timely delivery of mining materials, contributing to the segment’s leading position.

Warehousing & Storage Service accounted for a significant portion of the market, leveraging its critical role in handling and storing mining materials before and after transportation. It helps ensure that materials are well-preserved, minimizing wastage and loss.

Value-added Service has gained prominence due to the growing need for additional services such as inventory management, sorting, and packaging. This service enhances the overall logistics efficiency, but it has a smaller share compared to transportation and warehousing services.

Application Analysis

Coal holds the largest share, driving the Mining Logistics Market due to its vital role in the global energy sector.

In 2024, Coal held a dominant market position in the By Application Analysis segment of the Mining Logistics Market, capturing a major share. As one of the most sought-after resources in the mining sector, coal logistics involves extensive transportation networks, making it the largest contributor in this category.

Iron Ore follows closely, driven by the consistent demand from the steel manufacturing industry. Mining logistics for iron ore requires precise and large-scale transport solutions to meet global market demands.

Metals and Gold also represent key application areas, each benefiting from advanced logistics to ensure smooth global distribution. Metals, especially in construction and manufacturing industries, require large-scale transportation, while gold mining logistics is focused on securing high-value shipments.

The Others category encompasses various other minerals and materials with smaller logistics needs but still plays an essential role in the mining market’s broader logistics framework.

Key Market Segments

By Type

- Transportation Service

- Warehousing & Storage Service

- Value-added Service

By Application

- Coal

- Iron Ore

- Metals

- Gold

- Others

Drivers

Increasing Demand for Efficient Mining Logistics Drives Market Growth

The mining logistics market is experiencing growth due to the increasing demand for efficient and cost-effective mining operations. As the global demand for minerals rises, mining companies are under pressure to reduce costs and improve operational efficiency. Logistics systems play a crucial role in meeting these demands, driving the adoption of more streamlined, optimized processes that lower operational expenses.

Advancements in automation and technology in logistics systems are another key driver. Technologies such as artificial intelligence (AI), robotics, and automated tracking systems are helping to streamline operations, reduce human error, and increase the speed and accuracy of logistics services. These advancements not only improve the efficiency of mining operations but also ensure greater safety in challenging environments.

Additionally, growing infrastructure development in mining regions is contributing to the growth of the market. As mining activities expand in remote areas, there is a need for better infrastructure to support the transportation and storage of raw materials. Investment in roads, railways, and ports enhances the logistics capabilities in these regions, driving market expansion.

Finally, the rising demand for sustainable and eco-friendly logistics solutions is also impacting the mining logistics market. Environmental concerns are pushing mining companies to adopt greener practices, such as using electric vehicles and optimizing routes to reduce carbon emissions, driving the demand for sustainable logistics solutions.

Restraints

Challenges and Regulatory Hurdles Restrain Mining Logistics Market Growth

One of the primary challenges in the mining logistics market is the high initial investment costs required for advanced logistics technologies. Mining companies must invest heavily in technologies such as automation, AI, and digital tracking systems, which can be a barrier for smaller operators or those in regions with limited capital availability.

Regulatory challenges and compliance requirements further complicate logistics operations. The mining industry is subject to strict regulations concerning safety, environmental standards, and transportation. Ensuring compliance with these regulations often requires additional time and resources, creating logistical bottlenecks that hinder overall efficiency.

The limited availability of skilled labor for modern logistics operations is another restraint. Mining logistics companies need workers who are trained in advanced technologies and automation, but there is a shortage of skilled personnel in many regions, slowing down the adoption of cutting-edge logistics systems.

Volatile fuel prices also pose a significant challenge for mining logistics. Fuel is a major operational cost, and fluctuations in prices can make it difficult for mining companies to maintain stable logistics budgets. This price volatility creates uncertainty and can negatively impact profitability, particularly for transportation-heavy mining operations.

Growth Factors

Growth Opportunities in Mining Logistics Market Drive Future Potential

The expansion of mining operations in emerging markets presents significant growth opportunities for the mining logistics market. As countries in Africa, Asia, and Latin America continue to increase their mining activities, the demand for efficient logistics solutions to transport materials rises. These regions are expected to become major hubs for mining logistics services.

The integration of artificial intelligence and machine learning into logistics operations offers significant growth potential. AI and machine learning can optimize routes, predict maintenance needs, and improve inventory management, leading to faster and more cost-effective logistics services.

Blockchain technology adoption in the mining logistics sector is another promising opportunity. Blockchain can enhance supply chain transparency, providing real-time tracking and ensuring the authenticity and quality of the materials being transported. This increased transparency can help reduce fraud and improve overall supply chain efficiency.

Strategic partnerships with third-party logistics providers also present opportunities for growth. By collaborating with established logistics providers, mining companies can optimize their supply chain operations, reduce costs, and improve service levels. These partnerships allow companies to leverage the expertise of third-party providers, which can lead to more efficient logistics solutions.

Emerging Trends

Trends Shaping the Future of Mining Logistics Market

One of the key trends in the mining logistics market is the increased focus on real-time data analytics for operational efficiency. Mining companies are utilizing data analytics to monitor supply chains, track shipments, and predict maintenance needs. This helps companies make faster decisions, reduce delays, and improve overall logistics efficiency.

Another trend is the shift towards electric vehicles in mining logistics to reduce environmental impact. As governments and businesses increasingly prioritize sustainability, electric vehicles are becoming more common in mining logistics fleets. This trend not only helps reduce carbon emissions but also aligns with global sustainability goals.

The growing use of drones and autonomous vehicles in mining logistics is also transforming the industry. Drones are being used to monitor mine sites and transport materials, while autonomous vehicles are improving the efficiency of transportation by reducing the need for human drivers. This technology allows for faster and safer operations in challenging environments.

Lastly, the rising adoption of digital platforms for logistics and supply chain management is reshaping the industry. Companies are increasingly turning to digital platforms to track shipments, communicate with suppliers, and manage inventory. These platforms enhance visibility across the entire supply chain and improve the overall coordination of logistics operations.

Regional Analysis

Asia Pacific Dominates the Mining Logistics Market with a Market Share of 37.5%, Valued at USD 12.7 Billion

Asia Pacific holds the dominant share in the mining logistics market with 37.5% of the total market, valued at USD 12.7 Billion. The region’s growth is primarily driven by rapid industrialization and increasing mining activities in countries like China and India. Infrastructure developments, coupled with the rising demand for efficient mining operations, continue to fuel the market.

North America Mining Logistics Market Trends

North America is a significant player in the mining logistics market, benefitting from a well-established logistics infrastructure. The region’s advanced technology adoption and strong mining industry contribute to its steady market share. Regulatory frameworks around sustainable practices and government initiatives also play a key role in the growth of the mining logistics market.

Europe Mining Logistics Market Trends

Europe’s mining logistics market is expanding, driven by the demand for high-quality and sustainable logistics solutions. The region is focusing on automating logistics operations and integrating digital technologies. Additionally, investments in green logistics and sustainability efforts by European governments are expected to propel the market growth in the coming years.

Middle East and Africa Mining Logistics Market Trends

In the Middle East and Africa, the mining logistics market is witnessing gradual growth. The presence of abundant natural resources and increasing demand for minerals, particularly in Africa, are key drivers. However, logistical challenges and infrastructure gaps in certain regions may limit market expansion, although investments in infrastructure are slowly addressing these concerns.

Latin America Mining Logistics Market Trends

Latin America holds a promising growth trajectory in the mining logistics market, particularly driven by its rich reserves of minerals like copper and lithium. The market is poised for further expansion due to increasing foreign investments and government efforts to improve regional infrastructure. However, political and economic instability in certain countries could pose challenges to growth.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Mining Logistics Company Insights

In 2024, Vale stands as a dominant player in the global mining logistics market, leveraging its extensive experience in transporting and managing the logistics of iron ore and other key commodities. The company’s global network plays a crucial role in facilitating efficient mining supply chains, particularly in South America and Asia.

Bis Industries, known for its integrated logistics services, continues to provide specialized solutions tailored to the mining sector. With a strong presence in Australia, Bis Industries focuses on transport and site services, helping clients optimize logistics operations in the challenging terrains of mining environments.

ATG Australian Transit Group offers comprehensive logistics solutions that include transportation, warehousing, and site services specifically designed for the mining industry. Their expertise in handling bulk goods across remote mining areas strengthens their position in the market, especially in the Australian region.

Blue Water Shipping has carved out a niche in handling complex logistics projects for the mining sector. With a focus on international freight forwarding, Blue Water Shipping plays a vital role in supporting the movement of heavy mining equipment and raw materials across borders, facilitating seamless operations in key mining regions worldwide.

These companies, along with others, are shaping the mining logistics landscape by providing tailored solutions to optimize operational efficiency and reduce costs across the value chain. Their ability to manage large-scale, complex logistics requirements is critical in supporting the continued growth of the mining industry globally.

Top Key Players in the Market

- Vale

- Bis Industries

- ATG Australian Transit Group

- Blue Water Shipping

- PLS Logistics

- Linfox Pty Ltd.

- Tranz Logistics

- Centurion

- A.P. Moller – Maersk

- TIBA

Recent Developments

- In June 2025, Titan Mining’s subsidiary secured $15 million in funding from EXIM Bank to support its efforts in the development of critical minerals, aimed at bolstering the company’s mining operations and ensuring a sustainable supply of essential resources.

- In April 2025, Himadri Speciality Chemical acquired a strategic stake in a mining logistics firm, expanding its footprint in the logistics sector to enhance supply chain efficiencies and drive growth in its mining-related business activities.

- In March 2025, Adani Group launched India’s first hydrogen-powered truck for mining logistics, marking a significant step toward sustainability and green energy in the mining sector, reducing emissions and promoting environmentally-friendly transportation solutions.

Report Scope

Report Features Description Market Value (2024) USD 33.5 Billion Forecast Revenue (2034) USD 136.7 Billion CAGR (2025-2034) 15.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Transportation Service, Warehousing & Storage Service, Value-added Service), By Application (Coal, Iron Ore, Metals, Gold, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Vale, Bis Industries, ATG Australian Transit Group, Blue Water Shipping, PLS Logistics, Linfox Pty Ltd., Tranz Logistics, Centurion, A.P. Moller – Maersk, TIBA Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Vale

- Bis Industries

- ATG Australian Transit Group

- Blue Water Shipping

- PLS Logistics

- Linfox Pty Ltd.

- Tranz Logistics

- Centurion

- A.P. Moller - Maersk

- TIBA