Global Mining Equipment Market Size, Share, Growth Analysis By Equipment Type (Underground Mining Equipment, Surface Mining Equipment, Crushing, Pulverizing & Screening, Drills & Breakers, Others), By Application (Coal Mining, Gas & Oil Extraction, Metal Mining, Non-Metal Mining), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 19825

- Number of Pages: 289

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

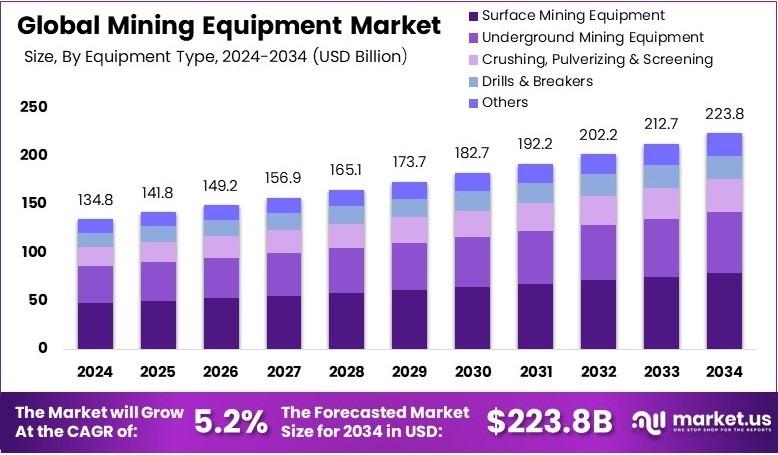

The Global Mining Equipment Market size is expected to be worth around USD 223.8 Billion by 2034, from USD 134.8 Billion in 2024, growing at a CAGR of 5.2% during the forecast period from 2025 to 2034.

Mining equipment refers to machines and tools used in the extraction of minerals from the earth. These devices help break rock, transport ore, and process raw materials. They include drills, excavators, loaders, and trucks. The equipment improves efficiency, safety, and productivity in mining operations across diverse environments.

The mining equipment market encompasses the sale and purchase of machinery used in mining activities. It involves various stakeholders, including manufacturers, suppliers, and service providers. The market is driven by industrial demand, technological advancements, and safety improvements. Global trends and economic factors influence market growth and competitive landscapes, and expansion.

The mining equipment market is experiencing significant growth, driven by the escalating demand for minerals essential in manufacturing electric vehicle (EV) batteries. In 2022, despite a substantial 180% production increase since 2017, lithium’s demand exceeded its supply, mirroring similar trends in cobalt and nickel markets where 60% of the lithium, 30% of the cobalt, and 10% of the nickel demands are for EV batteries.

Furthermore, various nations are adopting strategic measures to bolster their mineral production capacities to meet these demands. For instance, Russia has set ambitious targets to achieve an annual lithium carbonate output of 60,000 metric tons by 2030.

Similarly, India’s JSW Group plans to establish a copper smelter by 2028-2029 with a capacity of 500,000 metric tons to support its EV and battery production sectors. These initiatives signify a robust growth trajectory for the mining equipment sector, highlighting its critical role in advancing global industrial capacities.

Additionally, the global digital transformation is intensifying the need for minerals, with digital devices and ICT networks consuming between 6% and 12% of global electricity. However, the environmental costs disproportionately affect developing countries, which enjoy fewer benefits from these technological advancements. This scenario underscores the necessity for more sustainable mining practices and technologies that can mitigate environmental impacts while enhancing local economic benefits.

In this context, government regulations and strategic investments are crucial in shaping the competitive landscape of the mining equipment market. Enhanced regulations promote sustainable practices, while investments in technology lead to innovations in mining equipment. These developments not only increase market competitiveness but also ensure a balance between economic growth and environmental stewardship.

Key Takeaways

- Mining Equipment Market was valued at USD 134.8 Billion in 2024 and is projected to reach USD 223.8 Billion by 2034, with a CAGR of 5.2%.

- In 2024, Surface Mining Equipment led the equipment type segment with 38.4%, driven by increasing demand for open-pit mining operations.

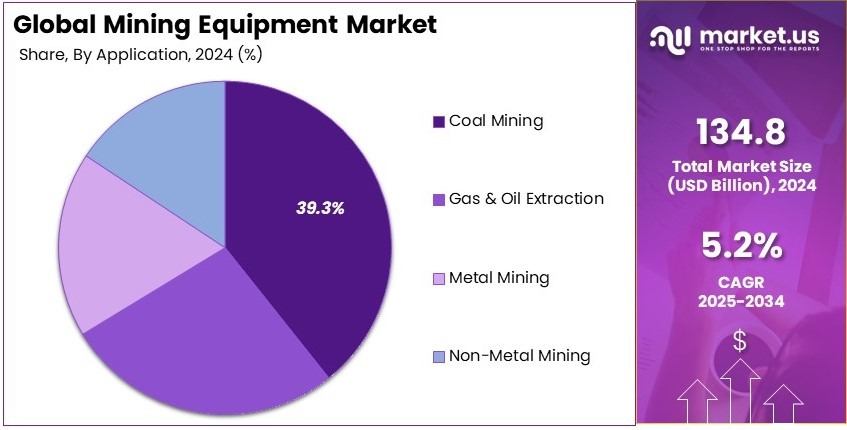

- In 2024, Coal Mining dominated the application segment with 39.3%, reflecting continued reliance on coal in industrial and energy sectors.

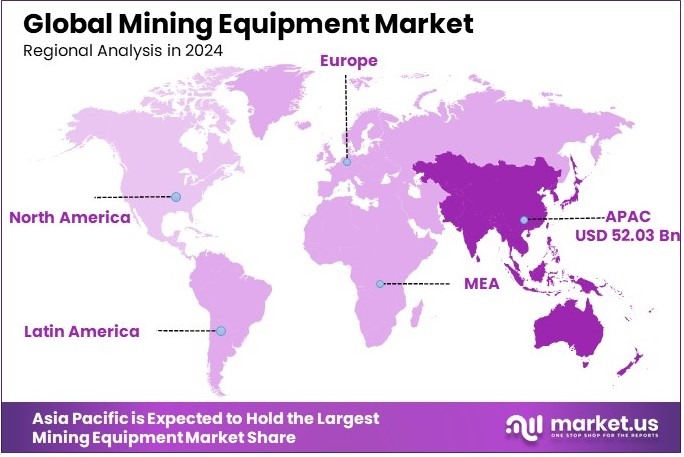

- In 2024, Asia Pacific held the largest market share at 38.6%, with a market value of USD 52.03 Billion, supported by expanding mining activities in China, India, and Australia.

Type Analysis

Surface Mining Equipment dominates with 38.4% due to its extensive application in extracting minerals from the earth’s surface.

Surface Mining Equipment, as a major segment within the mining equipment market, has demonstrated robust growth, accounting for 38.4% of the market share in 2024. This dominance can be attributed to its efficiency and cost-effectiveness in accessing minerals, compared to underground mining methods. Surface mining includes several sub-technologies such as open-pit mining, quarrying, and strip mining, each contributing significantly to the extraction of a wide range of minerals.

Underground Mining Equipment is crucial for accessing deeper mineral deposits. This sub-segment is vital for extracting materials that cannot be reached through surface mining techniques, thereby playing a key role in the overall growth of the mining equipment sector.

Crushing, Pulverizing & Screening Equipment is essential for the processing of mined materials into marketable products. This equipment simplifies the handling and processing of large amounts of earth and rock, contributing to the efficiency and cost-effectiveness of mining operations.

Drills & Breakers are integral for breaking down hard surfaces and drilling deep into the earth to reach valuable mineral deposits. Their effectiveness in facilitating access to deeper layers enhances the operational capabilities of mining projects.

Other Mining Equipments include various tools and devices essential for specific mining operations, aiding in everything from material transport to safety measures in mining environments.

Application Analysis

Coal Mining dominates with 39.3% due to high global energy demands.

Coal Mining has remained a significant sub-segment within the mining sector, with a substantial 39.3% market share in 2024, driven by its critical role in meeting global energy demands and industrial requirements. Despite growing environmental concerns and the shift towards renewable energy, coal continues to be a major energy source worldwide, particularly in developing economies where it supports industrial growth and energy security.

Gas & Oil Extraction is another crucial application, focusing on the extraction of oil and natural gas which are key to the energy sector. This segment’s performance is pivotal to the global energy supply chain, impacting everything from transportation to electricity generation.

Metal Mining involves the extraction of metallic minerals such as iron, copper, and gold, essential for various industrial applications. This segment is vital for supplying raw materials to the manufacturing and construction industries, driving its importance within the mining sector.

Non-Metal Mining explores the extraction of non-metallic minerals such as diamonds, rubies, and other precious stones, catering to the jewelry industry and industrial applications like abrasives. The growth in this segment reflects the diverse applications of non-metallic minerals.

Key Market Segments

By Equipment Type

- Underground Mining Equipment

- Surface Mining Equipment

- Crushing, Pulverizing & Screening

- Drills & Breakers

- Others

By Application

- Coal Mining

- Gas & Oil Extraction

- Metal Mining

- Non-Metal Mining

Driving Factors

Growing Mineral Demand and Digital Shifts Drive Market Growth

The mining equipment market is being propelled by rising demand for critical minerals. These minerals, such as lithium and cobalt, are essential for electric vehicle batteries. As more automakers shift to electric vehicles, the need for mineral extraction has intensified. This pushes mining companies to invest in better, more efficient equipment.

In addition, emerging economies like India and Brazil are expanding their surface and underground mining operations. These countries are rich in mineral resources and are boosting their production capacities. With that, new equipment purchases are increasing.

Meanwhile, digital transformation is shaping the sector. Governments in several regions are promoting mining digitalization, encouraging the adoption of smart equipment and automated technologies.

Lastly, advances in autonomous and teleoperated machines are making mines safer and more productive. These machines reduce human involvement in hazardous areas while improving operational control. For example, mines in Australia now use driverless trucks and remote-operated drills. These shifts, driven by sustainability goals and safety needs, support the long-term growth of the mining equipment market.

Restraining Factors

High Costs and Regulations Restrain Market Growth

The mining equipment market faces several challenges that slow its growth. A key barrier is the high cost of advanced machinery. New technologies often require large upfront investments, making them hard to afford for small and medium mining companies.

In addition, operational costs such as fuel, maintenance, and spare parts remain high. This creates a burden on budgets and slows equipment upgrades. Environmental regulations add another layer of complexity. Many governments enforce strict rules on emissions and land usage. These rules often require extra spending on compliant technologies or processes. As an example, companies operating in Europe must meet tighter emission limits, which can delay new investments.

Labor is another concern. Operating high-tech machines needs skilled workers. However, there is a shortage of trained personnel in many regions. This gap limits the adoption of digital and automated systems.

On top of these issues, fluctuations in commodity prices make future returns uncertain. When prices fall, mining operations tend to cut spending, including equipment procurement. This creates a cycle of cautious investment. Together, these factors act as roadblocks for market expansion, especially for new entrants and smaller players trying to adopt modern equipment and practices.

Growth Opportunities

Sustainability and Smart Technologies Provide Opportunities

The mining equipment market is seeing new opportunities with a shift toward smart and green mining solutions. One major trend is the use of IoT and AI for predictive maintenance. These tools help detect equipment issues before they lead to breakdowns. As a result, downtime is reduced, and operations become more efficient. Many companies are now investing in these technologies to save time and money.

Energy efficiency is another area creating growth. There is increasing demand for machines that consume less power and release fewer emissions. For instance, electric-powered drills and loaders are being tested in mines across Canada and Sweden. These tools support low-carbon goals and appeal to environmentally conscious investors.

Also, the development of hybrid and fully electric mining vehicles offers cleaner alternatives to diesel models. This shift is in line with broader global efforts to reduce carbon footprints.

Finally, growing investments in sustainable mining practices are opening new market avenues. Governments and private firms are funding projects that align with green standards. Together, these developments provide equipment manufacturers a chance to innovate and lead the transition.

Emerging Trends

Digital Tools and Automation Are Latest Trending Factor

The mining equipment market is being reshaped by key technology trends. One such trend is the use of 3D printing for spare parts. This allows mining sites in remote areas to produce parts on demand, reducing wait times and shipping costs. For example, a mine in Chile can now print a broken gear within hours instead of waiting weeks.

Another trend is the increasing use of drones and UAVs. These are now commonly used for mapping and monitoring mining sites. They offer fast and accurate data collection, improving planning and safety.

In parallel, the adoption of blockchain is gaining attention. This technology helps improve supply chain transparency by recording every step of the equipment lifecycle. It also prevents counterfeiting and ensures accountability.

Lastly, digital twins are being used to simulate mining operations. These virtual models help test equipment and processes before real-world implementation. As a result, risks are reduced, and efficiency increases. For example, a digital twin of a mine in South Africa helped optimize drilling schedules and saved significant costs. These trends highlight how digital transformation is becoming central to mining operations.

Regional Analysis

Asia Pacific Dominates with 38.6% Market Share

Asia Pacific leads the Mining Equipment Market with a 38.6% share, translating to USD 52.03 billion. This commanding presence is driven by the region’s extensive mining activities, especially in countries like China, Australia, and India.

The region’s dominance is supported by vast natural resources, increasing industrial activities, and growing technological adoption in mining operations. Governments in Asia Pacific are also promoting mining sector reforms, which include incentives for adopting environmentally friendly and more efficient mining technologies.

Looking ahead, Asia Pacific is expected to maintain or even increase its influence in the global Mining Equipment Market. Continued urbanization and industrial development, coupled with investments in mining technology, are likely to drive further growth. This makes Asia Pacific a crucial area for market stakeholders to watch and engage with in the coming years.

Regional Mentions:

- North America: North America holds a significant position in the Mining Equipment Market, characterized by advanced mining technologies and extensive mineral resources. The region’s focus on sustainable mining practices and safety standards supports its stable market growth.

- Europe: Europe maintains a steady presence in the Mining Equipment Market, driven by stringent environmental regulations and a focus on automation in mining processes. European countries are leaders in providing cutting-edge mining equipment that enhances efficiency and safety.

- Middle East & Africa: The Middle East and Africa are increasingly investing in mining infrastructure, particularly in resource-rich countries like South Africa and Saudi Arabia. The region’s growth is spurred by the exploration of new mining sites and the modernization of existing operations.

- Latin America: Latin America is experiencing growth in the Mining Equipment Market, fueled by rich deposits of precious metals and minerals. The region is enhancing its mining capabilities through investments in better equipment and technology, aiming to boost productivity and environmental sustainability.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

The global mining equipment market is dominated by a few major players known for their strong brand presence, wide product portfolio, and global distribution networks. The top four key players in this market include Caterpillar Inc., Komatsu Ltd., Sandvik AB, and Hitachi Ltd. These companies contribute significantly to market revenue and innovation.

Caterpillar Inc. holds a leading position due to its strong legacy, diversified machinery range, and aftersales service. The company benefits from a vast global footprint and consistent investment in automation and digital mining solutions. It focuses on innovation in autonomous haulage systems and fuel efficiency.

Komatsu Ltd. is a strong competitor with a global presence and competitive pricing. The company’s strength lies in its advanced technology integration, such as autonomous vehicles and electric drive systems. Komatsu’s focus on partnerships and joint ventures enhances its market access and R&D capabilities.

Sandvik AB stands out for its focus on underground mining equipment and cutting-edge rock drilling tools. It is known for innovation in electric and battery-powered machinery, aligning with the global push toward sustainable mining operations. Sandvik’s specialization in high-performance, safety-enhancing equipment supports its premium market positioning.

Hitachi Ltd. is known for its large-scale hydraulic excavators and efficient electric mining trucks. The company leverages its strength in construction and industrial technologies to deliver reliable and high-capacity machines. Strategic collaborations and investments in automation have strengthened its presence in both surface and underground mining segments.

These four companies are setting industry standards through technological innovation, product reliability, and strategic expansion. Their continuous investment in automation, electrification, and sustainable solutions reflects the broader trends driving the mining equipment market. Competitive advantage is maintained through global scale, service networks, and alignment with customer needs for productivity and safety.

Major Companies in the Market

- Terex Corporation

- Komatsu Ltd.

- Hitachi Ltd.

- CNH Industrial N.V

- Caterpillar

- John Deere & Company

- Sandvik AB

- Atlas Copco AB

- Liebherr-International AG

- Xuzhou Construction Machinery Group Co., Ltd.

- Doosan Corporation

- Zoomlion Heavy Industry Science & Technology Development Co. Ltd

- AB Volvo

- Metso Corporation

Recent Developments

- Peabody and Anglo American: On November 2024, Peabody announced an agreement to acquire steelmaking coal assets from Anglo American. This strategic move aims to accelerate Peabody’s portfolio shift towards seaborne metallurgical coal. The transaction is expected to close by mid-2025, pending customary closing conditions.

- Orla Mining and Musselwhite Mine: On November 2024, Orla Mining announced the acquisition of the Musselwhite Mine in Ontario, Canada, for $810 million, with an additional $40 million in contingent consideration. This acquisition is projected to more than double Orla’s gold production and strengthen its North American operations. The transaction was finalized on February 2025.

Report Scope

Report Features Description Market Value (2024) USD 134.8 Billion Forecast Revenue (2034) USD 223.8 Billion CAGR (2025-2034) 5.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Equipment Type (Underground Mining Equipment, Surface Mining Equipment, Crushing, Pulverizing & Screening, Drills & Breakers, Others), By Application (Coal Mining, Gas & Oil Extraction, Metal Mining, Non-Metal Mining) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Terex Corporation, Komatsu Ltd., Hitachi Ltd., CNH Industrial N.V, Caterpillar, John Deere & Company, Sandvik AB, Atlas Copco AB, Liebherr-International AG, Xuzhou Construction Machinery Group Co., Ltd., Doosan Corporation, Zoomlion Heavy Industry Science & Technology Development Co. Ltd, AB Volvo, Metso Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Terex Corporation

- Komatsu Ltd.

- Hitachi Ltd.

- CNH Industrial N.V

- Caterpillar

- John Deere & Company

- Sandvik AB

- Atlas Copco AB

- Liebherr-International AG

- Xuzhou Construction Machinery Group Co., Ltd.

- Doosan Corporation

- Zoomlion Heavy Industry Science & Technology Development Co. Ltd

- AB Volvo

- Metso Corporation