Global Microcatheter Market By Product (Aspiration Microcatheter, Diagnostic Microcatheter, Delivery Microcatheter, Steerable Microcatheter) By Product Design (Single Lumen Microcatheter, Dual Lumen Microcatheter), By Application (Cardiology, Urology, Neurology, Oncology, Peripheral Vascular, Other Applications) By End-User (Hospitals & Clinics, Ambulatory Surgical Centers) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Feb 2024

- Report ID: 15289

- Number of Pages: 297

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

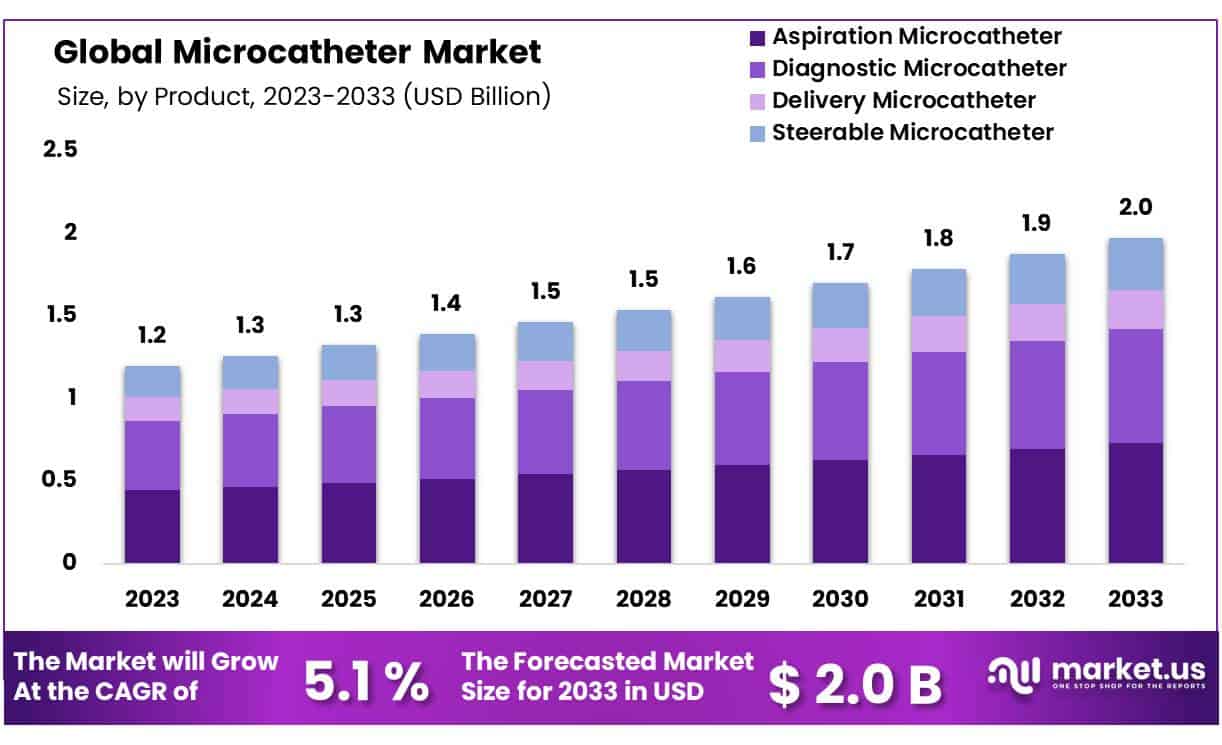

The Global Microcatheter Market size is expected to be worth around USD 2.0 Billion by 2033 from USD 1.2 Billion in 2023, growing at a CAGR of 5.1% during the forecast period from 2024 to 2033.

The market is expected to be driven by the rising number of minimally invasive procedures and the increasing prevalence of chronic diseases such as cancer, neurovascular disorders, cardiovascular disease, and other disorders.

The market is also growing due to technologically advanced products being adopted and government initiatives. The microcatheters are hollow, small tubes that can be inserted into blood vessels to perform various interventions. They are designed to deliver different interventional devices to blood vessels. They are used in many diagnostic and therapeutic procedures.

Market growth is being driven by the rising incidence of chronic diseases due to unhealthy lifestyle choices. The main risk factors for conditions such as heart disease and cancer are obesity, cigarette smoking, and overweight. The World Health Organization (WHO) estimates that 41 million people are killed each year from chronic diseases, accounting for 71% of all deaths globally. The majority of chronic diseases are caused by cardiovascular disease, which accounts for 17.9 million people each year. Next, neurovascular disorders, most commonly strokes, account for 7.0 million. The market is being driven by an increase in patients with neurovascular and cardiovascular disorders.

Key Takeaways

- Market Size: Microcatheter Market size is expected to be worth around USD 2.0 Billion by 2033 from USD 1.2 Billion in 2023.

- Market Growth: The market growing at a CAGR of 5.1% during the forecast period from 2024 to 2033.

- Product Analysis: With a 37% share in 2023, aspiration microcatheter were the dominant market.

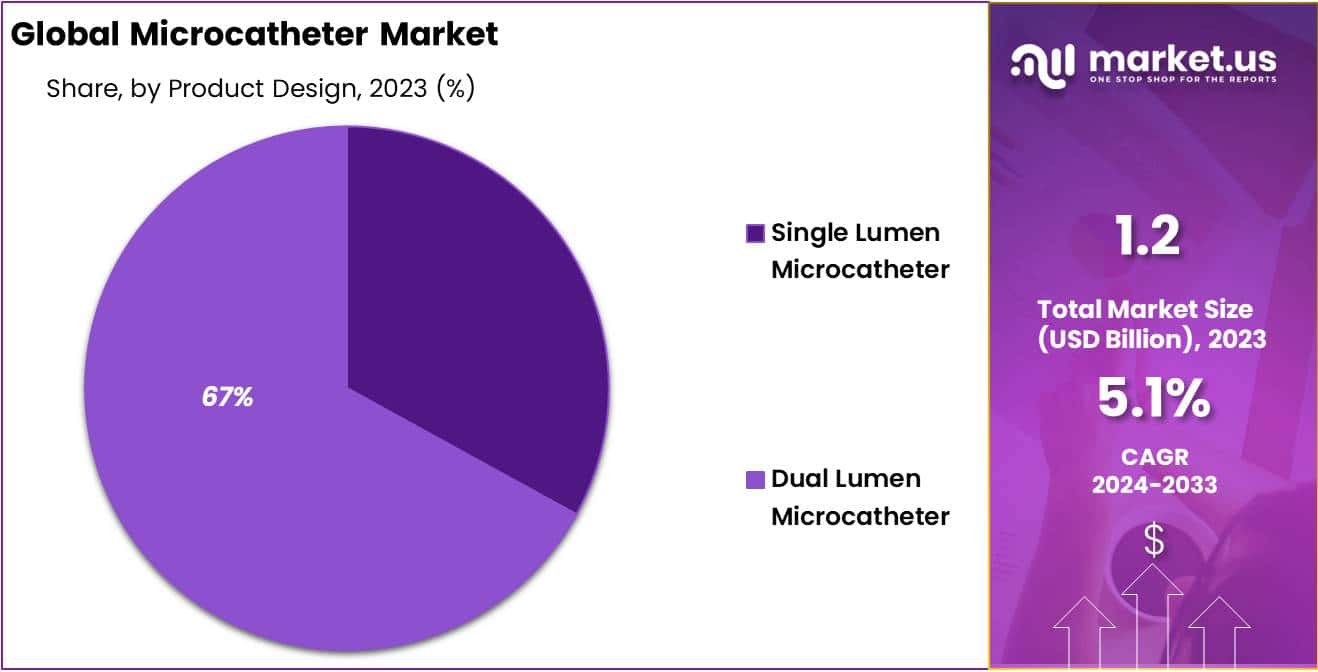

- Product Design Analysis: Single-lumen or dual-lumen. With a 67% share in 2023.

- Application Analysis: The cardiology segment dominated 31% market share in 2023.

- End-Use Analysis: Hospitals & Clinics dominate the Microcatheter Market with 63% market share.

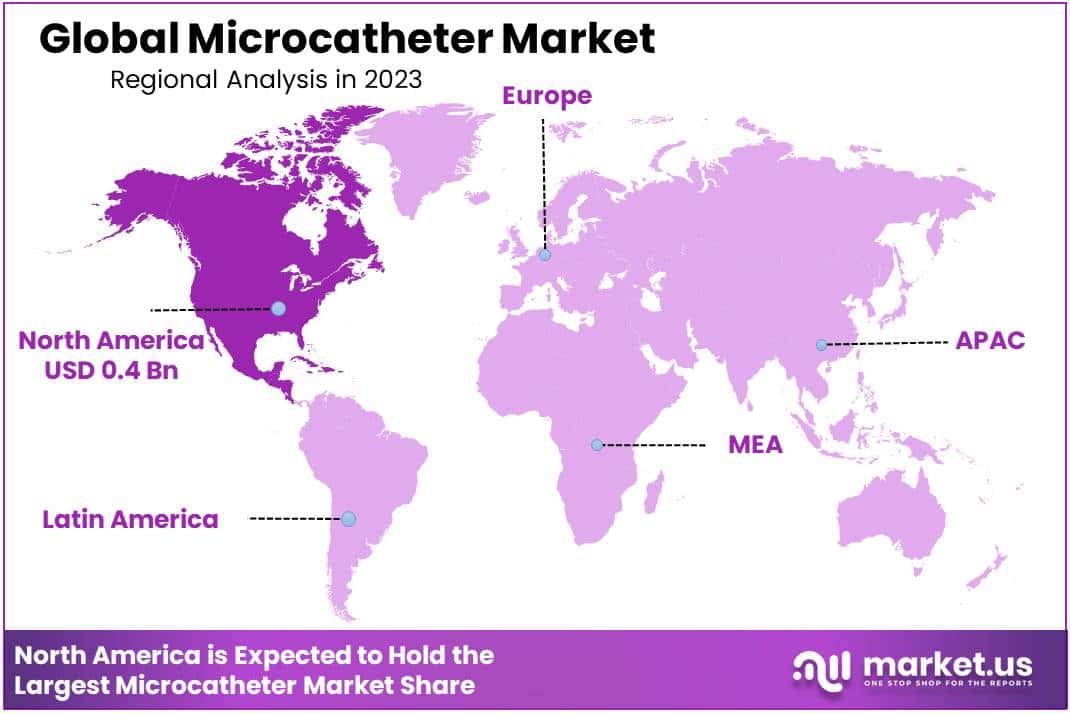

- Regional Analysis: North America was the dominant market, with 34% of the share in 2023.

Product Analysis

The market can be segmented by product into delivery microcatheter (aspiration microcatheter), diagnostic microcatheter (diagnostic microcatheter), and steerable microcatheter. With a 37% share in 2023, aspiration microcatheter were the dominant market. This market is driven by the growing demand for the treatment of aneurysms and acute strokes.

These catheters can also be used to quickly reanalyze, stop blood flow completely, and prevent distal embolism from occurring during interventions. It is also widely used to remove thrombus and debris from blocked vessels. These factors will likely increase demand for aspiration microcatheters over the forecast period.

The Steerable Microcatheter is forecast to grow at the highest CAGR over the forecast period. This microcatheter is an alternative to standard microcatheters. Conventional microcatheters are fixed-shaped and cannot be modified. They can also be used with a guidewire to navigate complex vessel anatomy.

A steerable microcatheter allows for faster target vessel selection and shorter procedure times. The device’s tip shape and angle can be adjusted while it is in a patient by using the dial on the handgrip. Market growth is expected to be driven by the growing use of steerable microcatheters in the treatment of various peripheral and cardiovascular disorders.

Product Design Analysis

The market can be divided into two types based on their product design: single lumen or dual-lumen. With a 67% share in 2023, the dual lumen segment of the microcatheter market was dominant. It is expected to see the most rapid growth during the estimated period.

The dual lumen microcatheter has many advantages, including easy access to the procedure site. You can also administer multiple analgesics or drug infusions simultaneously, rather than having to do so at different times. It acts as a two-microcatheter and is highly preferred for interventional cardiology procedures. The segment growth is expected to be fueled by the dual-lumen microcatheter’s benefits.

Due to increasing rates of chronic diseases, such as neurovascular and cardiovascular disorders, the dual lumen microcatheter is seeing increased adoption in emerging countries. According to an American Heart Association journal article, stroke is one of the most common causes of death in China.

According to The Lancet’s 2018 report, India’s prevalence of heart disease and stroke has increased by more than 50% since 1990. Patients with chronic illnesses require multiple central venous accesses because they need long-term intravenous therapy. These factors will increase the demand for dual-lumen microcatheters during the estimated period.

Application Analysis

The market can be divided by application into neurology, cardiology, peripheral blood, oncology, and urology as well as otolaryngology and ophthalmology. With a 31% share in 2023, the cardiology segment was the dominant market. This is because cardiovascular diseases (CVD), have been the cause of death in the world over the past 30 years.

The WHO estimates that 17.9 mn deaths occurred each year in 2016 worldwide. It is predicted that CVD will cause more than 3.5 million deaths by 2030. CVDs are mainly caused by sedentary lifestyles, such as obesity, high blood pressure, smoking, and low physical activity. The segment’s growth is expected to be boosted by the rising incidence of cardiovascular disease in the future.

The forecast period will see the greatest growth in the neurovascular segment. According to the WHO, cerebrovascular stroke was the second leading cause of death and the third leading cause of disability in 2016.

Ischemic stroke accounts for 60 to 80% of all strokes. Stroke is most commonly caused by hypertension, smoking, and diabetes. Microcatheters are in high demand because of the increasing number and complexity of neurosurgical procedures.

End-User Analysis

Hospitals & Clinics dominate the Microcatheter Market with 63% market share, acting as primary care providers and centers of specialized treatment, heavily relying on microcatheters for various interventional procedures such as minimally invasive surgeries, diagnostic imaging exams and targeted drug deliveries. Microcatheters’ flexible design makes them great tools to use in navigating intricate vascular pathways precisely while providing minimally invasive surgical solutions, diagnostic imaging assessments and targeted drug delivery services.

Hospitals & Clinics use microcatheters across a range of medical disciplines, from cardiology, neurology, and radiology, where these devices aid procedures like angioplasty, embolization and arterial stenting. Such robust utilization showcases microcatheter’s indispensable role in modern healthcare settings; with patient outcomes, procedural efficiency and cost-effectiveness being key factors that drive market expansion. With Hospitals & Clinics maintaining their dominance of this market segment and ongoing technological advances fuelling interventional medicine’s growth trajectory.

Key Market Segments

Product

- Aspiration Microcatheter

- Diagnostic Microcatheter

- Delivery Microcatheter

- Steerable Microcatheter

Product Design

- Single Lumen Microcatheter

- Dual Lumen Microcatheter

Application

End-User

- Hospitals & Clinics

- Ambulatory Surgical Centers

Driver

Global Increase in Cardiovascular Disorders

The rising global incidence of cardiovascular disorders such as coronary artery and peripheral arterial diseases has become one of the major forces driving microcatheter sales worldwide. Interventional cardiology procedures may utilise microcatheters extensively; thus increasing microcatheter consumption. As chronic cardiovascular illnesses impact an increasing proportion of elderly populations globally, their burden increases accordingly and in turn the demand for interventional cardiology procedures using microcatheters grows as well.

In recent years, countries like the U.S. have seen a rise in chronic disorders. According to the American Heart Association’s Heart Disease and Stroke Statistics 2019, 121.5 million Americans are suffering from cardiovascular disease. Every year, 805,000 Americans experience a heart attack.

Technological Advancements in Minimally Invasive Surgeries

Technological advancements have led to the creation of microcatheters with enhanced materials, design, and navigation capabilities allowing physicians greater precision and safety when accessing complex anatomical regions with minimally invasive procedures. With healthcare providers increasing opting for minimally invasive procedures due to benefits like reduced patient trauma, shorter recovery times, and lower healthcare costs; demand for microcatheters continues to skyrocket.

Restraint

Shifting towards Ambulatory Surgical Centers (ASCs)

Recent trends indicate a growing shift towards performing interventional procedures that entail microcatheters at Ambulatory Surgical Centers (ASCs) rather than hospitals, driven by factors like cost-efficiency and technological progress allowing more outpatient procedures than ever. ASCs often prioritize minimally invasive methods aligning with an emerging outpatient healthcare trend while increasing demand for microcatheters among these settings.

Rising Adoption of Microcatheters in Neurovascular Interventions

There has been an upward trend towards using microcatheters as neurovascular interventions for conditions such as stroke, cerebral aneurysms and arteriovenous malformations. Technological advancements such as improved navigation capabilities have greatly enhanced microcatheter design to allow precise navigation through intricate cerebral vasculature with greater accuracy and safety – as demand for minimally invasive therapies for neurovascular disorders grows, so too should their adoption rate within this field.

Restriction

Strict Regulatory Requirements

The microcatheter market can be challenged by stringent regulatory requirements set by regulatory bodies like FDA and European Medicines Agency (EMA). Approvals processes for new microcatheters can take time and money; preclinical and clinical testing procedures need to show safety and efficacy before final approval is given by these organizations; delays or refusal can impact market entry for manufacturers as product launches occur and revenues generated are cut into.

Limited Reimbursement Policies

Restrictive reimbursement policies associated with procedures using microcatheters can impede market expansion. Reimbursement rates differ by region and payer; not all procedures may receive adequate reimbursement rates, deterring healthcare providers from adopting microcatheter-based interventions in settings where reimbursement does not cover associated costs; uncertainty can also impact purchasing decisions by healthcare facilities thereby diminishing demand in the market.

Opportunity

Expanding Applications in Emerging Markets

Emerging markets represent immense opportunities for microcatheter manufacturers, driven by factors like expanding healthcare infrastructure, rising disposable income levels and chronic diseases that occur more commonly there. Furthermore, as minimally invasive procedures become more popular and access to healthcare improves in these regions there will be an upsurge in demand for microcatheters across various medical specialties such as cardiology, neurology and oncology; manufacturers can capitalize on these opportunities by expanding into these regions while adapting products specifically to suit these regions’ specific requirements.

Technological Innovation and Product Development

Market players have ample opportunities for differentiation of offerings and capture of market share by engaging in ongoing technological innovations and product development efforts. Investment in research and development to enhance microcatheters’ performance, safety, and navigational capabilities may result in advanced products which meet unfulfilled clinical needs.

Strategic partnerships and collaborations with healthcare institutions and research organizations can play an integral role in developing innovative microcatheter solutions, and commercializing them to market. By staying abreast of technological advancements, companies can seize growth opportunities while maintaining an edge over competition within their market.

Market Dynamics

Microcatheters are most frequently used for their ability to reach the most complex veins. Microcatheters allow for the best possible access to even the most intricate network of veins. The market is expected to grow due to the increasing adoption of minimally invasive procedures and technological advancements.

Market growth is also expected to be fueled by the increasing number of programs and initiatives being implemented by different countries. In 2016, the WHO launched “Global Hearts”, a new initiative to combat strokes and heart attacks. The Cancer Prevention and Control Research Network is an international program that aims to reduce and control the global burden of cancer.

The CDC’s Division of Cancer Prevention funds this initiative in conjunction with the Control and the National Cancer Institute. This program focuses on reducing the incidence of cancer in underserved communities. It collaborates with state, local, and national partners to lower cancer risk and death, as well as improve screening.

The Bee Foundation (TBF), a non-profit organization, aims to raise awareness and reduce the number of cerebrovascular stroke deaths through innovative research. The microcatheter market will grow if there is greater awareness about the treatment and government initiatives to prevent related disorders.

According to the CDC, approximately 795,000 Americans suffer from cerebrovascular stroke each year. According to the Stroke Report 2017, approximately 400,000 Canadians were living with long-term stroke disability. This number is expected to increase by a third in the next 20 years. Market growth is expected to be boosted by a high rate of chronic diseases.

In addition, there are more chronic diseases in developing and developed countries. This has prompted the development of new products. Swift NINJA by Merit Medical, for example, is the first U.S. FDA-approved Steerable Microcatheter. It offers an alternative to standard microcatheters in complex vessel anatomy. The device allows doctors to adjust the tip’s shape and angle while it is in the patient’s body.

A peripheral microcatheter and neurovascular microcatheter are also options for treating strokes and other urological conditions. The market players are constantly trying to introduce technologically advanced products.

Regional Analysis

North America was the dominant market, with 34% of the share in 2023. This is due to the existence of established healthcare facilities in the region, increased government initiatives, awareness campaigns concerning chronic disorders, and a higher incidence of stroke and heart disease in the region. The regional market is also growing due to rising demand for minimally invasive procedures, and the availability of technologically advanced products.

Asia Pacific is projected to grow at the highest rate of CAGR over the forecast period. This is due to an increasingly aging population, increased stress levels in countries like Japan, rising incidence of chronic diseases, large populations, improved quality of diagnosis, and increasing patient affordability. These factors have resulted in significant growth in Asia Pacific interventional procedures.

Market growth is expected to be aided by the high growth potential in developing countries like India, Japan, and China.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Players Analysis

Market leaders are focused on the launch and advancement of medical devices, as well as technological advances, and their growth strategies. Medtronic’s Phenom 21 Microcatheter was launched in April 2019 to deliver all sizes of vasculature equipment. This device removes blood clots in obstructed vessels and restores blood flow to patients with large vessel obstruction. These advancements will likely boost market growth during the forecast period. The market leader in microcatheter sales is:

Key Market Players

- Medtronic Plc

- Teleflex Inc.

- Terumo Corporation

- Boston Scientific Corporation

- Merit Medical System

- Penumbra Inc.

- Stryker Corporation

- Other Key Players

Recent Developments

- April 2023: Medtronic Plc, Received FDA clearance for theHurricane™ PTA Microcatheter, designed for crossing chronic total occlusions in peripheral arteries.

- July 2023: Terumo Corporation Received CE marking for theSeQure™ Steerable Microcatheter, designed for navigating challenging vascular anatomies.

- August 2023: Teleflex Inc. Partnered with a leading medical device manufacturer to developnext-generation microcatheters with advanced functionalities.

- October 2023: Merit Medical System Introduced theTiger Paw™ Microcatheter, designed for superior vessel tracking and control during embolization procedures.

Report Scope

Report Features Description Market Value (2023) USD 1.2 Billion Forecast Revenue (2033) USD 2.0 Billion CAGR (2024-2033) 5.1% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product-(Aspiration Microcatheter, Diagnostic Microcatheter, Delivery Microcatheter, Steerable Microcatheter) By Product Design-(Single Lumen Microcatheter, Dual Lumen Microcatheter), By Application-(Cardiology, Urology, Neurology, Oncology, Peripheral Vascular, Other Applications) By End-User-(Hospitals & Clinics, Ambulatory Surgical Centers) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape Medtronic Plc, Teleflex Inc., Terumo Corporation, Boston Scientific Corporation, Merit Medical System, Penumbra Inc., Stryker Corporation, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is a microcatheter?A microcatheter is a thin, flexible catheter used in minimally invasive medical procedures to access and navigate small or intricate blood vessels within the body. It is typically inserted through a larger guiding catheter and is used for delivering therapeutic agents, imaging contrast agents, or devices to specific target sites within the vasculature.

How big is the Microcatheter Market?The global Microcatheter Market size was estimated at USD 1.2 Billion in 2023 and is expected to reach USD 2.0 Billion in 2033.

What is the Microcatheter Market growth?The global Microcatheter Market is expected to grow at a compound annual growth rate of 5.1%. From 2024 To 2033

Who are the key companies/players in the Microcatheter Market?Some of the key players in the Microcatheter Markets are Medtronic Plc, Teleflex Inc., Terumo Corporation, Boston Scientific Corporation, Merit Medical System, Penumbra Inc., Stryker Corporation, Other Key Players.

What are the key applications of microcatheters?Microcatheters find widespread use in various medical specialties, including interventional cardiology, neurology, oncology, and peripheral vascular interventions. They are employed in procedures such as angioplasty, embolization, stenting, thrombectomy, drug delivery, and diagnostic angiography.

What factors are driving the growth of the microcatheter market?The growth of the microcatheter market is primarily driven by factors such as the increasing prevalence of cardiovascular diseases, advancements in minimally invasive surgeries, expanding applications in emerging markets, and technological innovations improving the performance and efficacy of microcatheters.

How does the regulatory landscape impact the microcatheter market?The microcatheter market is subject to stringent regulatory requirements imposed by regulatory bodies such as the FDA and the European Medicines Agency (EMA). Compliance with these regulations is essential for market entry, and delays or failures in obtaining regulatory approvals can hinder product launches and market growth.

-

-

- Medtronic Plc

- Teleflex Inc.

- Terumo Corporation

- Boston Scientific Corporation

- Merit Medical System

- Penumbra Inc.

- Stryker Corporation

- Other Key Players