mHealth Apps Market By Type (Medical Apps- Remote Monitoring Services, Diagnostic Services, Treatment Services; Fitness Apps, Wellness & Nutrition Apps), By Usage (Women's Health- Fitness & Nutrition, Menstrual Health, Pregnancy Tracking & Postpartum Care, Disease Management, Menopause, Others; Chronic Disease Management- Obesity Management, Mental Health Management, Diabetes Management, Blood Pressure and ECG Monitoring, Cancer Management, Others; Personal Health Record, Medication Management, Others), By Platform (Android, iOS, Others), By End-User (Patients, Healthcare Providers, Healthcare Payer, Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152596

- Number of Pages: 254

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

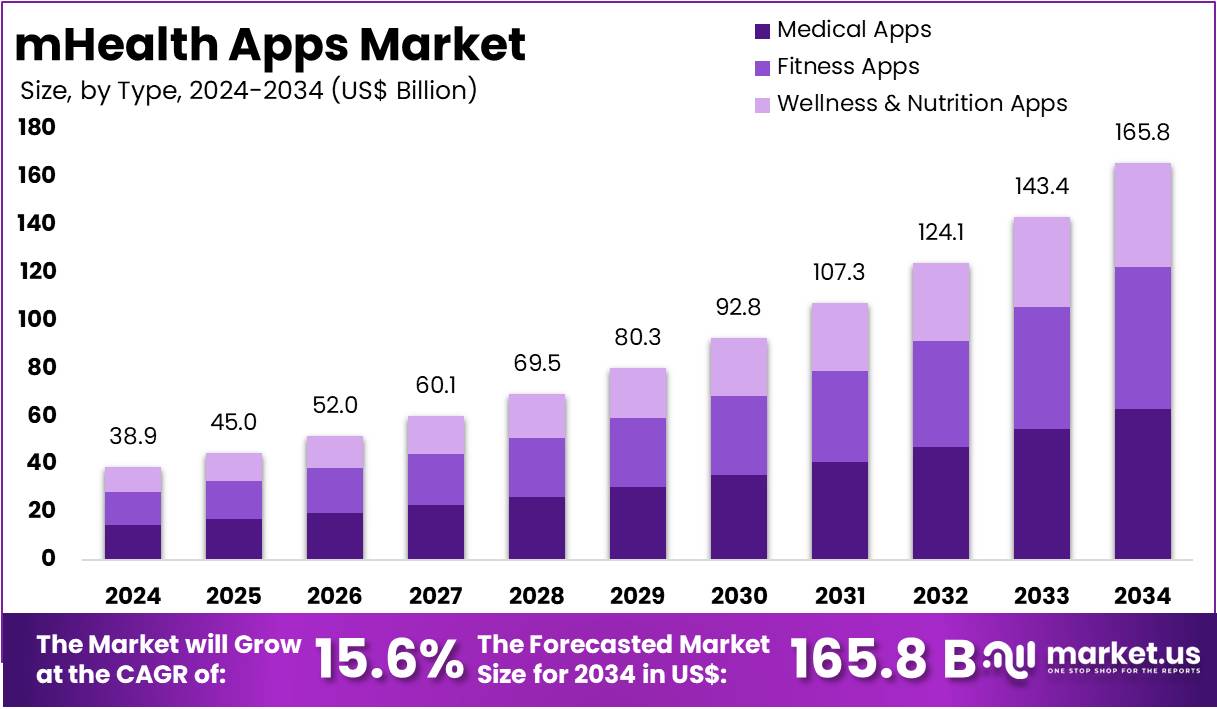

The mHealth Apps Market size is forecasted to be valued at US$ 165.8 billion by 2034 from US$ 38.9 billion in 2024, growing at a CAGR of 15.6% during the forecast period 2025 to 2034.

The mHealth apps market has been rapidly evolving, driven by the increasing penetration of smartphones, rising health awareness, and the growing adoption of digital healthcare solutions. With the advancement in mobile technology, mHealth apps are now playing a crucial role in healthcare management by providing users with tools for fitness tracking, mental health management, chronic disease monitoring, and personalized healthcare recommendations. The growing demand for these apps is attributed to the convenience they offer, enabling individuals to monitor their health and wellness remotely at any time, thus reducing the dependency on in-person consultations and visits to healthcare facilities.

The increasing prevalence of chronic conditions like diabetes, hypertension, and obesity has further propelled the demand for mobile health applications. These apps allow users to track their symptoms, medication adherence, and lifestyle factors, which is particularly beneficial for people managing long-term health conditions. For example, diabetes management apps provide personalized blood glucose monitoring and offer users recommendations on managing their condition through dietary and lifestyle adjustments, helping to prevent complications and reduce healthcare costs.

The latest International Diabetes Federation (IDF) Diabetes Atlas for 2025 reports that 11.1% of the global adult population, or one in nine people aged 20-79, are living with diabetes. Alarmingly, over 40% of them remain unaware of their condition. By 2050, it is projected that 1 in 8 adults, approximately 853 million people, will be affected by diabetes, marking an increase of 46%. Furthermore, these apps empower users to take a proactive role in managing their health, leading to better overall health outcomes and reducing the burden on healthcare systems.

The rise in telemedicine, particularly accelerated by the COVID-19 pandemic, has also contributed significantly to the growth of the mHealth apps market. During the pandemic, there was an increased reliance on virtual consultations and remote monitoring, which allowed healthcare providers to continue patient care while adhering to social distancing measures. Post-pandemic, there has been a notable shift in patient behavior, with individuals now taking a more proactive role in their healthcare.

The average number of consultations per user per year has risen from 2.0 in 2019 to 3.2 in 2023. Female consultations increased from 1.9 to 2.8, while male consultations saw a rise from 2.0 to 3.5 consultations per 100 users annually. mHealth apps facilitated these services by enabling remote consultations, health tracking, and even mental health support, thus ensuring that essential healthcare services remained accessible. This shift in healthcare delivery models has further cemented the value of mHealth apps in modern healthcare systems.

Advancements in artificial intelligence (AI) and machine learning (ML) have enabled mHealth apps to become even more personalized and efficient. By incorporating AI algorithms, these apps can analyze user data to provide real-time insights, detect patterns, and offer tailored health recommendations. For instance, AI-powered fitness apps can analyze an individual’s exercise habits and provide feedback on improving performance or avoiding injury. Similarly, AI-driven mental health apps can monitor mood changes and offer customized therapeutic exercises, making mental health management more accessible and effective.

Key Takeaways

- In 2024, the market for mHealth apps generated a revenue of US$ 38.9 billion, with a CAGR of 15.6%, and is expected to reach US$ 165.8 billion by the year 2034.

- By type, Medical Apps dominated the market with 38.2% share in 2024.

- Based on usage segment, chronic disease management held the largest share of 34.0% share in 2024.

- iOS platform captured the maximum revenue share of 41.5% in 2024.

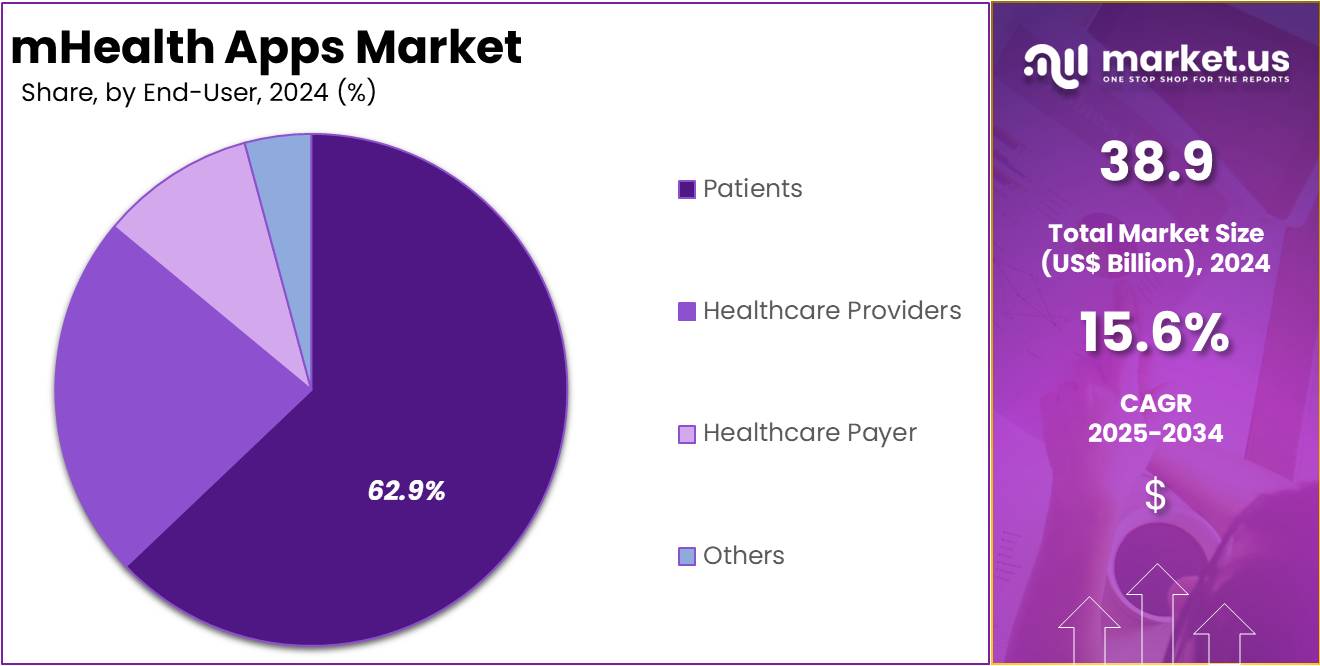

- By end-user, Patients segment was the dominant, holding a market share of 62.9% in 2024.

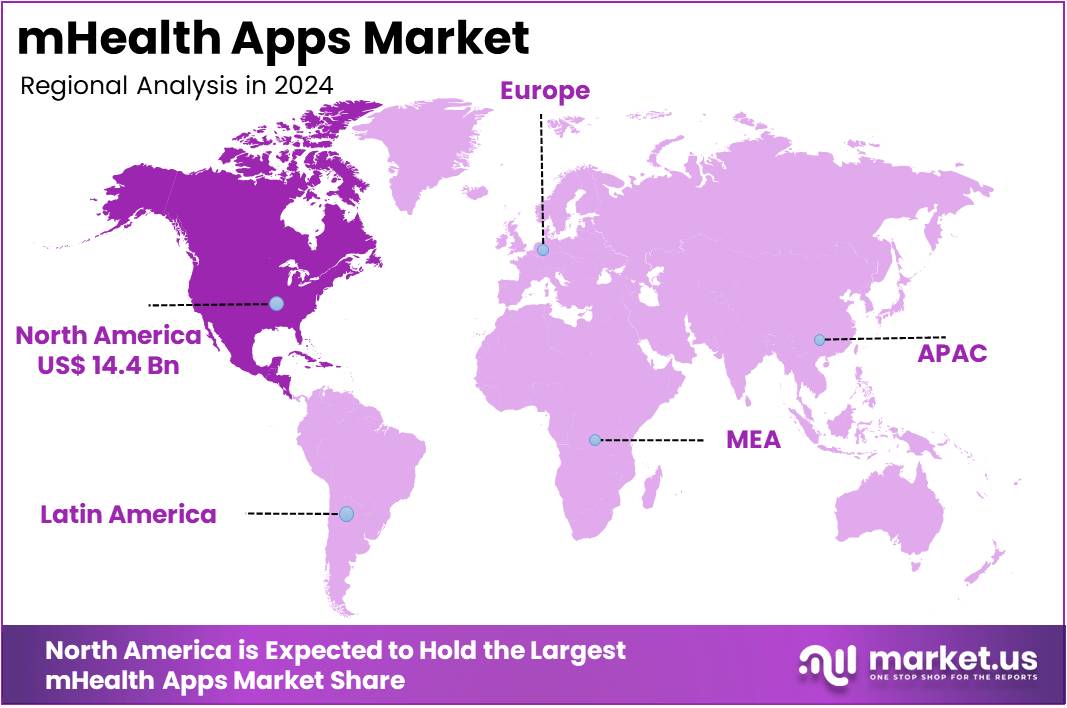

- North America held the largest share of 37.0% in 2024 in the global market.

Type Analysis

The medical apps segment has become the largest and most rapidly growing category within the mHealth apps market holding 38.2% share in 2024. This growth is driven by the increasing prevalence of chronic diseases, technological advancements, and the growing demand for accessible healthcare solutions. Medical apps cover a wide array of functionalities, including chronic disease management, medication adherence, remote patient monitoring, and telemedicine, which all contribute to the segment’s significant market share.

A key factor driving the growth of the medical apps segment is the rising consumer preference for self-care and prevention. Health-conscious consumers are turning to medical apps to monitor their well-being and prevent diseases before they occur. Another significant factor propelling the medical apps market is the growing integration of wearable technology with mobile health applications.

Wearable devices such as smartwatches and fitness trackers have become mainstream, with people increasingly using them to track everything from heart rate and sleep patterns to physical activity levels. In May 2025, a study by researchers at the University of Tsukuba found that using a gamified sleep-tracking app led to improvements in sleep quality and reductions in body mass index (BMI) among users.

Usage Analysis

Chronic disease management has emerged as the most significant application of mHealth apps with 34.0% share in 2024, driven by the increasing prevalence of conditions such as diabetes, hypertension, cardiovascular diseases, and cancer among others. These conditions necessitate continuous monitoring and management, areas where mHealth apps have proven to be particularly effective.

An example is the BOOST Thyroid app, developed for individuals with Hashimoto’s disease. This app allows users to track symptoms, medication adherence, and lab results, providing a comprehensive view of their health status. Studies have shown that users of the BOOST Thyroid app experienced fewer doctor visits, reduced anxiety, and better symptom management, highlighting the app’s effectiveness in managing chronic conditions. Another example is the AHOMKA platform, developed by the School of Engineering in Ghana, which showed positive results in facilitating communication between patients at high risk for heart attacks or strokes and their healthcare providers.

The widespread adoption of mHealth apps for chronic disease management is also evident in the growing number of such applications available. For instance, a 2022 study identified 42 apps dedicated to managing chronic diseases, including diabetes, hypertension, and general noncommunicable diseases. These apps often include features like symptom tracking, medication reminders, and educational resources, all aimed at empowering users to take control of their health.

Platform Analysis

The iOS platform holds a dominant position with 41.5% share in the mHealth apps market in 2024, primarily due to its seamless integration with Apple’s ecosystem, high user engagement, and the strong preference for iOS among healthcare professionals and tech-savvy consumers. One of the key factors contributing to iOS’s leadership in the market is its deep integration with Apple’s HealthKit and Apple Watch, creating a unified and comprehensive health management system. iOS users can easily track various health metrics such as heart rate, sleep patterns, and physical activity, all within a single, cohesive ecosystem. This integration provides a user-friendly experience, making iOS the preferred platform for health app developers.

Moreover, the iOS platform benefits from the premium nature of Apple devices, which are widely adopted by healthcare professionals. The combination of iPhones, iPads, and the Apple Watch creates a robust platform for mHealth apps, making them ideal for both personal and clinical use. With features like automatic syncing across devices, users can seamlessly transition between their phone, tablet, or wearable device, all while maintaining access to their health data. This cross-device functionality has contributed to the popularity of iOS-based health apps, as users can access their data and health metrics at any time, from anywhere.

Additionally, iOS’s strict app review process ensures that health apps meet high standards of security and performance. This is especially critical in the healthcare industry, where user trust and data protection are of paramount importance. Apple’s focus on security, encryption, and privacy protection makes iOS a preferred choice for both developers and users who are concerned about the confidentiality of their health data. Health app developers are encouraged by this secure environment to create apps that users can trust, further cementing iOS’s dominance in the space.

Global Number of iPhone Users (2020-2024)

Year Number of iPhone users (Bn) 2024 1.40 2023 1.36 2022 1.26 2021 1.23 2020 1.04 End-User Analysis

The mHealth apps market witnessed significant growth, with patients emerging as the largest and most active end-user segment accounting for 62.9% share in 2024. This trend is driven by the increasing adoption of smartphones, greater health awareness, and the growing need for accessible healthcare solutions. Patients utilize mHealth apps for a variety of purposes, including managing chronic conditions, tracking fitness and wellness metrics, adhering to medication schedules, and accessing telehealth services.

In the United States, a significant portion of patients uses mobile health applications and digital devices to manage their health, reflecting a global trend of patients taking an active role in their healthcare through digital tools. In the country, more than 60% of patients use mobile health applications and other digital devices to manage their health. This shift towards patient-centric healthcare is further supported by the development of platforms that facilitate patient engagement and self-management.

Key Market Segments

By Type

- Medical Apps

- Remote Monitoring Services

- Diagnostic Services

- Treatment Services

- Fitness Apps

- Wellness & Nutrition Apps

By Usage

- Women’s Health

- Fitness & Nutrition

- Menstrual Health

- Pregnancy Tracking & Postpartum Care

- Disease Management

- Menopause

- Others

- Chronic Disease Management

- Obesity Management

- Mental Health Management

- Diabetes Management

- Blood Pressure and ECG Monitoring

- Cancer Management

- Others

- Personal Health Record

- Medication Management

- Others

By Platform

- Android

- iOS

- Others

By End-User

- Patients

- Healthcare Providers

- Healthcare Payer

- Others

Drivers

Growing Adoption of Mobile Health Applications

The growing adoption of mobile health applications is significantly transforming healthcare delivery, empowering patients to take a proactive role in managing their health. This shift is driven by several factors, including increased smartphone penetration, the rise of chronic diseases, and advancements in mobile technology.

As of 2024, there were nearly 4.88 billion smartphone users worldwide, representing about 60.42% of the global population. This widespread accessibility enables individuals to utilize mHealth apps for various purposes, such as tracking physical activity, monitoring vital signs, managing chronic conditions, and accessing telehealth services. In the United States alone, approximately 84 million people use healthcare apps, with 30% relying heavily on these apps for managing their health.

Weight loss apps are also becoming increasingly popular, with over 70 million Americans affected by obesity and 99 million overweight. These apps, which focus on exercise, nutrition, and weight tracking, play a vital role in promoting healthier lifestyles.

Few examples of key health apps

Health App Name Key Features Apple Health Apple Health gathers health data from iPhones, Apple Watches, and other devices, providing medication reminders and organizing health records. MyFitnessPal MyFitnessPal offers a comprehensive database of food items with nutritional information, alongside a fitness tracking section. Fitbit The Fitbit fitness tracker is equipped with sensors to monitor heart rate, electrodermal activity, temperature, sleep patterns, and menstrual cycles. BetterMe BetterMe positions itself as a healthy lifestyle program focused on overall well-being, avoiding extreme weight loss approaches. Noom Noom, a weight management company, has expanded into behavior change programs aimed at managing both chronic and non-chronic health conditions. Lose It! Lose It! helps users track their food and water intake to achieve diet goals and facilitate weight loss. WeightWatchers WeightWatchers, a popular weight loss program, converts nutritional data into a points-based system to monitor calorie consumption. Restraints

Data Privacy and Security Concerns

As mHealth applications continue to gain popularity for managing personal health data, significant concerns have arisen regarding data privacy and security. These concerns stem from various factors, including inadequate data protection measures, excessive data sharing, and non-compliance with privacy regulations.

One of the primary issues is the lack of robust data protection mechanisms within many mHealth apps. Studies have found that a considerable number of these applications do not encrypt sensitive health data, leaving it vulnerable to unauthorized access. For instance, an analysis of Android mHealth apps revealed that many transmit data in clear text and store it on third-party servers without adequate security measures, exposing users to potential data breaches.

Another significant concern is the excessive collection and sharing of personal health data. Many mHealth apps collect a wide range of sensitive information, such as users’ health conditions, medication usage, and lifestyle habits. This data is often shared with third parties, including advertisers and data brokers, without users’ informed consent. For example, analysis by Dutch internet security firm Surfshark has found 80% of fitness apps share user data with third parties.

Furthermore, the absence of consistent regulatory oversight contributes to these privacy challenges. While regulations like the General Data Protection Regulation (GDPR) in the European Union and the Health Insurance Portability and Accountability Act (HIPAA) in the United States set standards for data protection, many mHealth apps operate in jurisdictions with limited or no enforcement of such regulations. This regulatory gap allows some apps to operate without adhering to necessary privacy standards, increasing the risk of data misuse. In terms of security, 2024 saw 14 major data breaches involving more than 1 million healthcare records, including the largest breach in healthcare history, which affected an estimated 190 million individuals.

Opportunities

Integration with Wearables

The integration of wearable devices with mHealth applications presents a significant opportunity to enhance healthcare delivery by enabling continuous, real-time health monitoring. Wearables such as smartwatches and fitness trackers can capture various health metrics, including heart rate, blood oxygen levels, and sleep patterns, and transmit this data to mHealth apps for analysis and feedback. This seamless integration allows healthcare providers to monitor patients remotely, facilitating early detection of potential health issues and timely interventions. According to recent surveys, approximately 40% of adults are using health apps, while 35% are using wearables, with most utilizing these technologies at least once a day.

For instance, a study involving 1,070 diabetes patients demonstrated that the use of mHealth app, in conjunction with wearable devices, led to improvements in health behaviors, such as increased physical activity and better dietary choices. These behavioral changes resulted in reduced blood glucose levels and fewer hospital visits, highlighting the effectiveness of wearable-integrated mHealth solutions in managing chronic conditions.

The potential of wearable-integrated mHealth apps extends beyond individual health management. These technologies can be incorporated into electronic health record (EHR) systems, allowing healthcare providers to access real-time patient data and make informed clinical decisions. For example, a system developed to monitor post-surgical symptoms in older adults utilized data from a consumer smartwatch, integrating it into the EHR system to enhance care management and improve outcomes.

Impact of Macroeconomic / Geopolitical Factors

Economic conditions, such as inflation and digital healthcare spending, directly impact consumer spending power and, consequently, the affordability of health-related technologies. For instance, government healthcare spending plays a crucial role; increased funding can lead to the development and promotion of digital health initiatives, thereby boosting mHealth app adoption. India’s digital economy is expected to grow by 2.8% annually and could reach $1 trillion by 2027-28. The country’s focus on AI initiatives is further supported by the IndiaAI mission, which will see its value increase to Rs 20,000 crore (US$ 2.3 mn) by 2025 from Rs 10,000 crore (US$ 1.2 mn).

Geopolitical factors also affect the mHealth app market. Healthcare institutions are becoming prime targets for cyberattacks, including ransomware, as adversaries exploit vulnerabilities in critical infrastructure. The report notes that 54% of large organizations identify supply chain vulnerabilities as a significant barrier to achieving cyber resilience, with healthcare systems particularly at risk due to their reliance on numerous third-party vendors and connected medical devices. A single compromised connection can jeopardize entire care delivery systems, potentially endangering patient safety.

Public-sector healthcare organizations are especially vulnerable, with 38% perceiving their resilience as inadequate compared to only 10% of medium-to-large private-sector organizations. This disparity is alarming, considering the essential services provided by public health institutions. Additionally, the ongoing staffing crisis, with a 33% increase in workforce shortages since 2024, further compounds these challenges, as nearly two-thirds of organizations report lacking essential cyber talent. Therefore, geopolitical factors are reshaping the cybersecurity landscape for digital health technologies.

Latest Trends

Growing Focus on Mental Health

The growing focus on mental health has led to a significant surge in the development and adoption of mHealth applications. These digital tools are increasingly utilized for managing conditions such as anxiety, depression, and stress, offering users accessible and personalized support. The COVID-19 pandemic played a pivotal role in accelerating this trend, as individuals sought remote solutions to address mental health challenges amid social distancing measures.

The effectiveness of mHealth apps is underscored by their widespread use and positive user feedback. For instance, a study evaluating user engagement with a real-time, text-based digital mental health support app found that users reported high satisfaction levels, indicating the potential of such platforms in providing effective mental health support.

According to a study by NCBI, the availability of mental health apps has significantly increased, with estimates suggesting that between 10,000 and 20,000 such apps are currently available to consumers. One way to assess engagement is by measuring user retention, which indicates how many users continue using an app over a set period. The data shows that about 4% of users who download a mental health app remain active after 15 days, with only 3% continuing after 30 days.

Furthermore, another study found that 41% of people had used a mental health app in the past year, although the use of prescription apps was much lower, at just 1.5% of mental health app users. The most commonly used categories of these apps include mindfulness, mood tracking, and relaxation. Users tend to cite the perceived helpfulness, enjoyment, and convenience of these apps as the main reasons for continued usage.

On the other hand, non-users often cite concerns such as distrust, a lack of perceived need, and issues related to data security as barriers to adoption. Overall, it is evident that mental health apps are widely used across the general population, regardless of sociodemographic factors.

Regional Analysis

North America is leading the mHealth Apps Market

North America remains the largest regional market for mHealth applications, driven by factors such as advanced healthcare infrastructure, widespread smartphone adoption, and supportive government initiatives. The United States, in particular, stands as a leader, with a large percentage of the population utilizing mobile health apps to manage various health concerns, including chronic diseases, mental health, and fitness.

The Americas have seen a dramatic rise in obesity, with Class II obesity rates increasing by more than 100%, from 63 million to 136 million, according to the 2025 World Obesity Atlas data. In addition, the country’s healthcare system has increasingly adopted digital health technologies, with mHealth apps playing a critical role in patient monitoring, telemedicine, and the management of health conditions such as diabetes and hypertension. This adoption is reinforced by the growing focus on patient-centered care, which encourages the use of digital tools for better health outcomes.

Around 14.7% of U.S. adults have diabetes. Furthermore, North America benefits from a robust ecosystem of technology companies, healthcare providers, and regulatory bodies that ensure mHealth applications are secure, efficient, and meet healthcare standards. The region’s regulatory frameworks also foster innovation by providing guidelines that protect patient data and ensure that digital health solutions are reliable. Moreover, the aging population in North America is driving demand for mHealth apps, particularly for chronic disease management and remote patient monitoring, where these technologies play a vital role in improving healthcare accessibility and reducing healthcare costs.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is the fastest-growing region for mHealth apps market, with significant growth driven by increased smartphone and internet penetration, an expanding middle class, and rising awareness of health and wellness. Countries like China, India, and various Southeast Asian countries are at the forefront of this growth, as large populations seek more accessible healthcare solutions.

Digital health solutions, particularly mHealth apps, have gained traction as a way to bridge the gap between traditional healthcare infrastructure and the growing demand for healthcare services. The increasing prevalence of chronic diseases, combined with the need for cost-effective healthcare, is further fueling the demand for mobile health applications.

Additionally, the integration of wearable devices and AI into mHealth apps is making them more efficient and user-friendly, enabling continuous monitoring of health metrics such as heart rate, blood pressure, and glucose levels. In June 2025, Ant Group, an affiliate of Alibaba, announced plans to launch a new AI-based healthcare app. This move reflects China’s growing investment in AI-driven health applications, with the company focusing on leveraging large language models to create consumer-centric healthcare solutions.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The competitive landscape of the mHealth apps market is rapidly evolving, with numerous players vying for a share of the growing demand for mobile health solutions. Leading global tech companies, such as Apple, Google, and Samsung, are at the forefront of the mHealth revolution, integrating health and fitness tracking features into their widely used devices.

Apple’s Health app, for example, offers a comprehensive platform for managing personal health data by integrating information from multiple sources, including wearables like the Apple Watch. Google Fit, similarly, allows users to track their physical activity and wellness metrics across Android devices and integrates data from other wearables, creating a seamless experience for users. These companies are capitalizing on their established ecosystems to provide users with intuitive health management tools, solidifying their dominance in the market.

Top Key Players in the mHealth Apps Market

- Apple Inc.

- Google Inc.

- AirStrip Technologies, Inc.

- Samsung Electronics Co. Ltd.

- Veradigm LLC

- Qualcomm Technologies, Inc.

- AT&T

- Orange

- Teladoc Health, Inc.

- Omada Health

- Jawbone Health Hub

- Pfizer Inc.

- Johnson & Johnson Services, Inc.

- Novartis AG

- AstraZeneca

- Abbott

- Sanofi

Recent Developments

- In July 2025, Samsung Electronics made strides in the healthcare space by acquiring Xealth, a platform that integrates digital health tools and care programs, further advancing their goal of creating a connected care platform. This acquisition complements Samsung’s leadership in wearable technology and its aim to provide holistic care for preventive health.

- In May 2025, Omada Health, a company specializing in chronic care management, is aiming for a valuation of approximately $1.1 billion as it prepares for its initial public offering (IPO) on the Nasdaq Global Market, with the ticker symbol OMDA.

- In February 2025, Apple introduced the Apple Health Study, designed to explore how technology, including the iPhone, Apple Watch, and AirPods, can enhance physical health, mental well-being, and overall wellness. Accessible through the Research app, the study aims to investigate connections between different health aspects, such as the impact of mental health on heart rate and how sleep affects exercise. This research is being conducted in partnership with Brigham and Women’s Hospital, a prominent research institution and a key teaching affiliate of Harvard Medical School.

Report Scope

Report Features Description Market Value (2024) US$ 38.9 billion Forecast Revenue (2034) US$ 165.8 billion CAGR (2025-2034) 15.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Medical Apps- Remote Monitoring Services, Diagnostic Services, Treatment Services; Fitness Apps, Wellness & Nutrition Apps), By Usage (Women’s Health- Fitness & Nutrition, Menstrual Health, Pregnancy Tracking & Postpartum Care, Disease Management, Menopause, Others; Chronic Disease Management- Obesity Management, Mental Health Management, Diabetes Management, Blood Pressure and ECG Monitoring, Cancer Management, Others; Personal Health Record, Medication Management, Others), By Platform (Android, iOS, Others), By End-User (Patients, Healthcare Providers, Healthcare Payer, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Apple Inc., Google Inc., AirStrip Technologies, Inc., Samsung Electronics Co. Ltd., Veradigm LLC, Qualcomm Technologies, Inc., AT&T, Orange, Teladoc Health, Inc., Omada Health, Jawbone Health Hub, Pfizer Inc., Johnson & Johnson Services, Inc., Novartis AG, AstraZeneca, Abbott, Sanofi Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Apple Inc.

- Google Inc.

- AirStrip Technologies, Inc.

- Samsung Electronics Co. Ltd.

- Veradigm LLC

- Qualcomm Technologies, Inc.

- AT&T

- Orange

- Teladoc Health, Inc.

- Omada Health

- Jawbone Health Hub

- Pfizer Inc.

- Johnson & Johnson Services, Inc.

- Novartis AG

- AstraZeneca

- Abbott

- Sanofi