Pulmonary Arterial Hypertension Market By Product Type (Branded and Generics), By Route of Administration (Oral, Intravenous/ Subcutaneous, and Inhalational), By Drug Class (Endothelin Receptor Antagonists (ERAs), SGC Stimulators, Prostacyclin and Prostacyclin Analogs, and PDE-5 Inhibitors), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 142618

- Number of Pages: 227

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

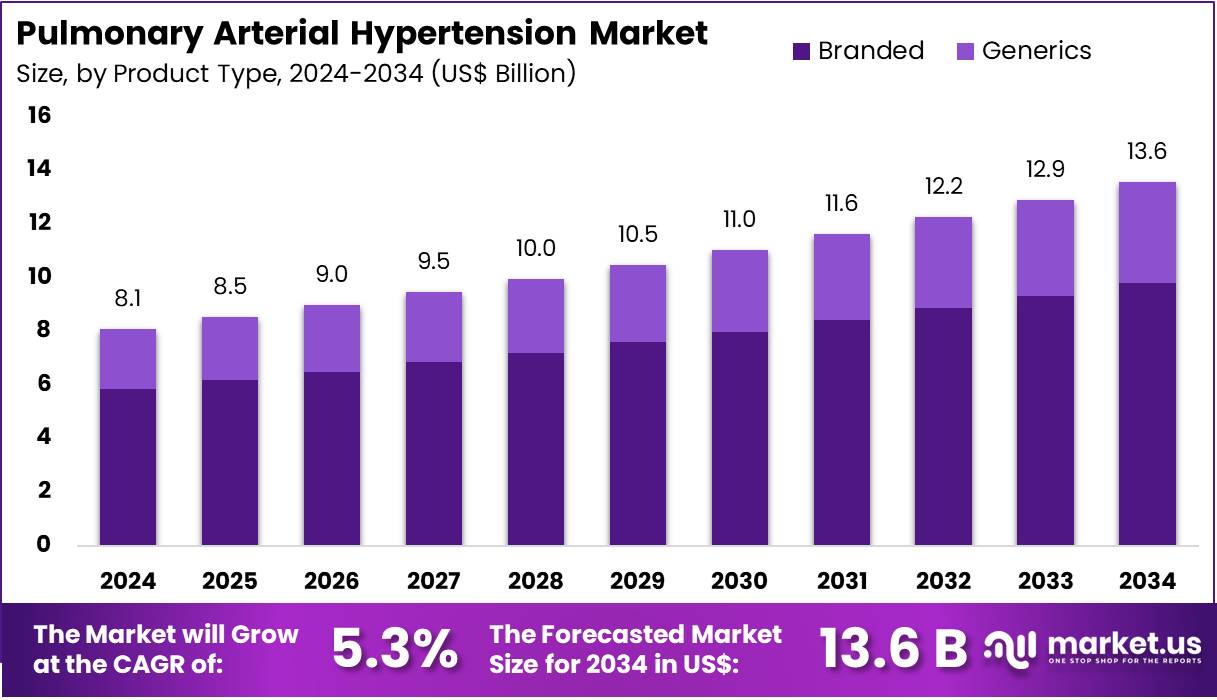

The Pulmonary Arterial Hypertension Market Size is expected to be worth around US$ 13.6 billion by 2034 from US$ 8.1 billion in 2024, growing at a CAGR of 5.3% during the forecast period 2025 to 2034.

The rising prevalence of pulmonary arterial hypertension (PAH) is driving growth in the PAH market. PAH is a serious condition that leads to high blood pressure in the arteries of the lungs, resulting in heart failure and reduced quality of life. Increasing awareness about the condition has boosted demand for improved diagnostic methods and effective treatment options. Early detection and targeted therapies are essential for managing PAH effectively. This demand continues to encourage pharmaceutical companies to develop innovative solutions that improve patient outcomes.

The introduction of combination therapies and advancements in personalized medicine have expanded treatment options for PAH patients. These approaches offer improved efficacy by addressing the condition from multiple pathways. Drug delivery innovations, such as inhaled therapies, are enhancing treatment adherence and clinical outcomes. In April 2023, Mochida Pharmaceutical Co., Ltd. launched its Treprost inhalation solution, providing a novel treatment option for PAH patients. Such developments reflect the growing focus on non-invasive therapies that improve patient convenience.

Ongoing research into the molecular mechanisms of PAH is unlocking new insights, driving innovation in treatment strategies. This research has revealed potential targets for next-generation therapies. Increasing clinical trials and rising investments in PAH research further support market growth. As healthcare providers focus on early intervention and improved therapies, the PAH market is poised for steady expansion. Companies investing in innovative treatments are well-positioned to capitalize on these emerging opportunities in the evolving PAH landscape.

Key Takeaways

- In 2024, the market for pulmonary arterial hypertension generated a revenue of US$ 8.1 billion, with a CAGR of 5.3%, and is expected to reach US$ 13.6 billion by the year 2033.

- The product type segment is divided into branded and generics, with branded taking the lead in 2024 with a market share of 72.3%.

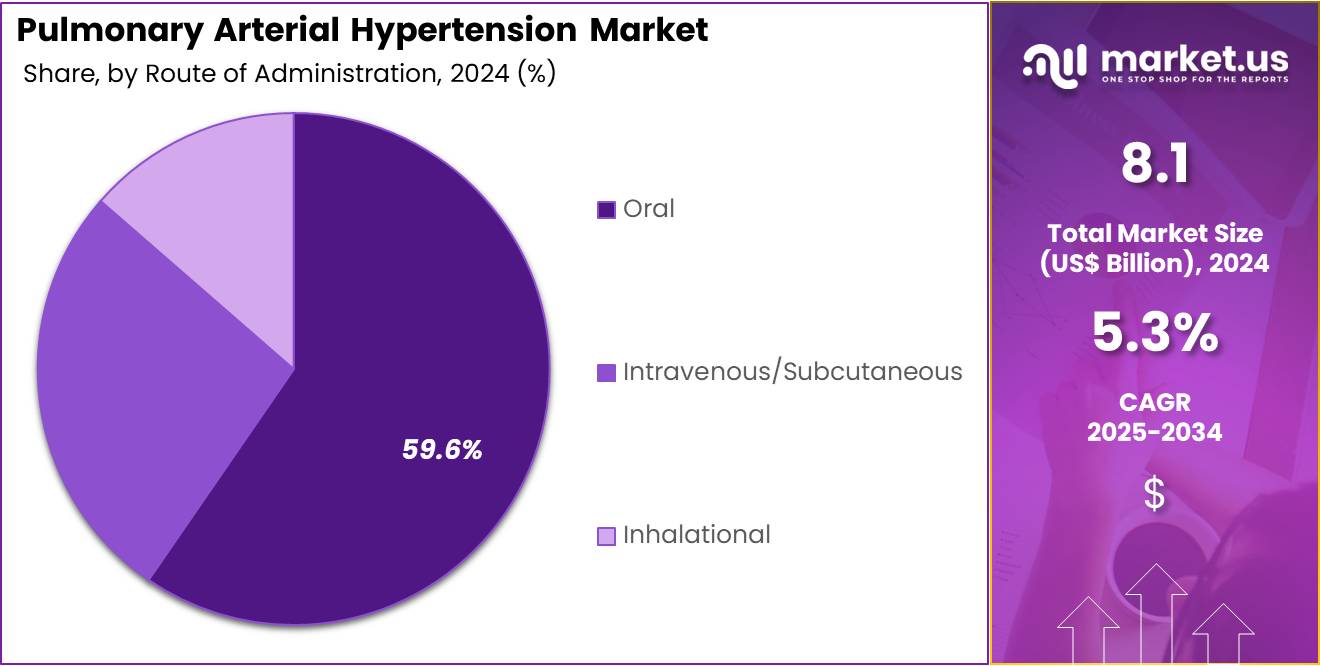

- Considering route of administration, the market is divided into oral, intravenous/ subcutaneous, and inhalational. Among these, oral held a significant share of 59.6%.

- Furthermore, concerning the drug class segment, the market is segregated into endothelin receptor antagonists, SGC stimulators, prostacyclin and prostacyclin analogs, and PDE-5 inhibitors. The prostacyclin and prostacyclin analogs sector stands out as the dominant player, holding the largest revenue share of 52.4% in the pulmonary arterial hypertension market.

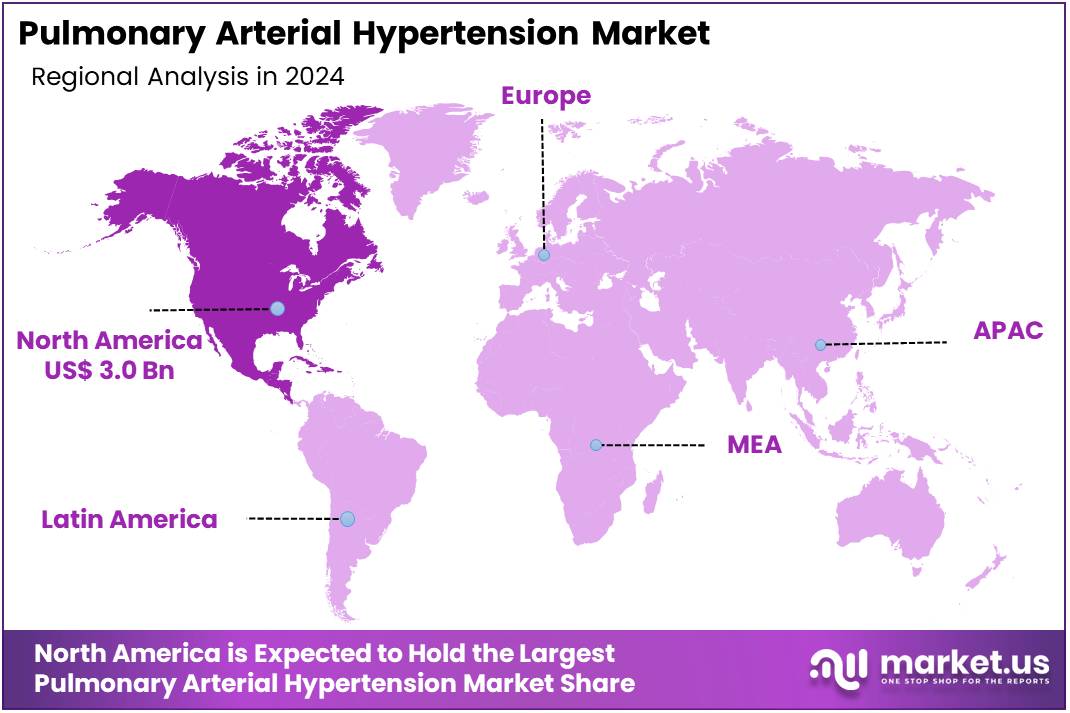

- North America led the market by securing a market share of 37.2% in 2024.

Product Type Analysis

The branded segment led in 2024, claiming a market share of 72.3% owing to the increasing demand for advanced and effective therapies for managing this chronic condition. Branded medications are anticipated to remain the preferred choice in the market, as they often offer innovative treatment options backed by extensive clinical evidence and approval by regulatory bodies. The rising prevalence of pulmonary arterial hypertension, coupled with the growing focus on improving treatment outcomes, is likely to drive the demand for branded drugs.

Additionally, the ability of branded drugs to address specific needs in managing the disease, such as improving exercise capacity and reducing symptoms, is expected to fuel this segment’s growth. The continued advancement of research and development in the field is projected to further expand the branded segment as new therapies are introduced.

Route of Administration Analysis

The oral held a significant share of 59.6% due to the growing preference for convenient and non-invasive treatment options. Oral medications are expected to become increasingly popular as they offer ease of administration, improving patient compliance, especially for long-term treatments. The increasing availability of oral therapies with proven efficacy in managing pulmonary arterial hypertension is likely to drive demand for this route of administration.

As the treatment landscape for pulmonary arterial hypertension evolves, oral medications are anticipated to play a more central role due to their convenience compared to intravenous, subcutaneous, or inhalational alternatives. The growing patient preference for oral therapies is projected to further accelerate the adoption of oral drugs in the treatment of pulmonary arterial hypertension.

Drug Class Analysis

The prostacyclin and prostacyclin analogs segment had a tremendous growth rate, with a revenue share of 52.4% owing to their effectiveness in improving pulmonary artery pressure and exercise capacity in patients with pulmonary arterial hypertension. Prostacyclin and its analogs are anticipated to remain a cornerstone in the treatment of pulmonary arterial hypertension, particularly for patients with more advanced stages of the disease. The ability of prostacyclin analogs to dilate blood vessels and reduce resistance in the pulmonary artery is likely to drive their sustained use.

As more clinical data supporting the safety and efficacy of prostacyclin analogs becomes available, their adoption is expected to grow. Additionally, the development of new, longer-acting prostacyclin analogs and improvements in their delivery methods are projected to further expand this segment within the market, offering enhanced patient outcomes and convenience.

Key Market Segments

By Product Type

- Branded

- Generics

By Route of Administration

- Oral

- Intravenous/ subcutaneous

- Inhalational

By Drug Class

- Endothelin Receptor Antagonists (ERAs)

- SGC Stimulators

- Prostacyclin and Prostacyclin Analogs

- PDE-5 Inhibitors

Drivers

Increasing Prevalence of Pulmonary Arterial Hypertension is Driving the Market

The rising incidence of pulmonary arterial hypertension (PAH) significantly propels the market for its treatments. In the United States, PAH affects approximately 40,000 individuals, highlighting a substantial patient population requiring medical intervention. This growing prevalence necessitates the development and availability of effective therapies, thereby driving market growth.

Pharmaceutical companies are actively investing in research and development to address this demand, leading to the introduction of novel treatment options. For instance, Merck’s therapy, Winrevair, has demonstrated a significant reduction in the risk of death among PAH patients, underscoring the advancements in treatment efficacy.

Additionally, increased awareness and improved diagnostic capabilities have contributed to earlier detection, leading to better patient outcomes. Research institutions and healthcare organizations are collaborating to enhance therapeutic options and expand access to life-saving drugs. As awareness and diagnosis rates of PAH increase, the demand for effective treatments is expected to rise, further fueling market expansion.

Restraints

High Treatment Costs are Restraining the Market

Despite advancements in therapy, the high cost of PAH treatments poses a significant barrier to patient access and market growth. For example, Merck’s Winrevair is priced at approximately US$ 238,000 annually, making it financially burdensome for many patients. Such steep costs can limit the affordability and accessibility of these essential medications, particularly for uninsured or underinsured individuals.

Even in developed countries, high out-of-pocket expenses may deter patients from seeking or adhering to prescribed treatments. The financial burden also affects healthcare systems, as governments and insurers struggle to cover the rising costs of innovative therapies. Limited reimbursement policies in certain regions further exacerbate the affordability challenge, leading to disparities in treatment access.

This financial strain not only affects patient outcomes but also hampers overall market growth, as potential users are unable to afford necessary therapies. Addressing these cost challenges through policy changes, expanded insurance coverage, and pharmaceutical pricing strategies is crucial to ensuring broader accessibility and equitable healthcare delivery.

Opportunities

Technological Advancements are Creating Growth Opportunities

Continuous technological advancements in drug development and delivery systems present significant growth opportunities in the PAH market. Innovations such as targeted therapies and improved drug formulations enhance treatment efficacy and patient compliance. For instance, Merck’s Winrevair has shown a significant reduction in the risk of death for PAH patients, reflecting the potential of advanced therapeutic approaches.

Additionally, the integration of digital health technologies enables better disease monitoring and management, further improving patient outcomes. AI-driven diagnostics and wearable devices are being developed to track disease progression and optimize treatment plans. Advancements in gene therapy and regenerative medicine also hold promise for future breakthroughs in PAH treatment.

These technological strides not only improve the quality of care but also expand the market by attracting a broader patient base seeking effective and convenient treatment options. Increased investment in research and development will likely accelerate innovation, bringing forth more targeted and efficient therapies for PAH patients.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly influence the PAH market. Economic downturns can constrain healthcare budgets, limiting investments in advanced therapies and affecting patients’ ability to afford high-cost treatments like Winrevair, priced at approximately US$238,000 annually. Conversely, economic growth facilitates increased healthcare spending, promoting the adoption of innovative treatments.

Geopolitical tensions may disrupt global supply chains, affecting the availability of essential medications and hindering timely patient access. Supply shortages in key pharmaceutical ingredients can delay production, leading to treatment gaps for patients relying on PAH therapies. However, stable geopolitical environments encourage international collaborations, fostering research and development in PAH treatments.

Government policies prioritizing healthcare innovation and funding can accelerate market growth, while restrictive regulations may impede it. Additionally, global health initiatives focusing on rare diseases enhance awareness and integration of PAH treatments into standard care protocols. Overall, economic stability, supportive healthcare policies, and technological advancements create a positive outlook for expanding access to PAH therapies and improving patient outcomes.

Trends

Regulatory Approvals are a Recent Trend in the Market

A notable recent trend in the PAH market is the acceleration of regulatory approvals for new therapies. For example, the UK’s Medicines and Healthcare products Regulatory Agency approved Merck’s therapy, Winrevair, for treating PAH, following earlier approvals in the US and European Union. Such expedited approvals facilitate faster patient access to innovative treatments and reflect a growing recognition of the need for effective PAH therapies.

This trend encourages pharmaceutical companies to invest in PAH research and development, anticipating a smoother and quicker path to market for their products. Regulatory agencies are also introducing fast-track designations and priority reviews to accelerate the approval process for promising treatments. These policies are essential in addressing unmet medical needs and providing patients with life-saving medications sooner.

As more drugs gain regulatory approval, competition in the PAH market is expected to increase, potentially leading to better pricing and wider accessibility. The trend toward faster regulatory processes is shaping a more dynamic and responsive market, ultimately benefiting both patients and healthcare providers.

Regional Analysis

North America is leading the Pulmonary arterial hypertension Market

North America dominated the market with the highest revenue share of 37.2% owing to several key factors. A significant contributor was the rising incidence of PAH in the region. According to a systematic review, the prevalence of PAH in North America ranged from 0.4 to 1.4 per 100,000 persons, with an incidence of 0.5 to 1.0 cases per 100,000 person-years. This increasing prevalence heightened the demand for advanced therapeutic options.

In response, pharmaceutical companies intensified their research and development efforts. For instance, Merck’s drug, Winrevair, received approval from the US Food and Drug Administration (FDA) and demonstrated significant efficacy in reducing the risk of death among PAH patients. Such advancements underscore the growing integration of innovative therapies in PAH treatment protocols, further propelling market growth.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is projected to experience the fastest compound annual growth rate (CAGR) in the pulmonary arterial hypertension (PAH) market. This growth is driven by the rising prevalence of PAH in the region. For instance, Japan reports an estimated PAH prevalence of 3.2 per 100,000 individuals, with 70-100 new cases diagnosed each year. The improving healthcare infrastructure across Asia Pacific is enhancing access to advanced PAH therapies. Additionally, increasing healthcare expenditures are expected to support the adoption of innovative treatment solutions.

Government initiatives promoting early disease detection and treatment are further driving PAH market growth in Asia Pacific. Collaborations between local healthcare providers and international pharmaceutical firms are introducing cutting-edge therapies to the region. Countries such as China and India are seeing a surge in clinical trials and precision medicine advancements. This growing focus on innovative treatments is anticipated to boost demand for PAH therapies, contributing to the region’s expanding market share.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the pulmonary arterial hypertension (PAH) market focus on research and development, strategic partnerships, and product diversification to fuel growth. Companies invest in novel therapeutic approaches, including targeted therapies and combination treatments, to improve patient outcomes. They collaborate with healthcare providers and research institutions to enhance treatment efficacy and expedite product approvals. Expanding into emerging markets and increasing patient awareness through educational initiatives also help strengthen their market presence.

Furthermore, the integration of digital health technologies and personalized medicine is driving innovation and expanding treatment options for PAH patients. United Therapeutics Corporation is a prominent player in the PAH market, headquartered in Silver Spring, Maryland. The company specializes in developing innovative therapies for pulmonary and cardiovascular diseases.

United Therapeutics offers a range of treatments for PAH, including both oral and inhaled therapies designed to improve patients’ quality of life. The company emphasizes continuous investment in R&D and partnerships with medical institutions to accelerate the development of next-generation therapies. United Therapeutics’ global presence and commitment to advancing treatments make it a leading player in the pulmonary arterial hypertension market.

Top Key Players in the Pulmonary arterial hypertension Market

- Viatris Inc

- United Therapeutics Corporation

- Keros Therapeutics

- Johnson & Johnson

- Janssen Pharmaceutical Companies

- GlaxoSmithKline

- Gilead Sciences, Inc

- Bayer

Recent Developments

- In August 2023: Keros Therapeutics hosted a conference to showcase promising outcomes from its Phase 2 clinical trial of KER-012, focusing on the drug’s potential to treat pulmonary arterial hypertension (PAH).

- In May 2023: Janssen Pharmaceutical Companies filed a new drug application with the U.S. FDA, seeking approval for a combination therapy consisting of tadalafil 40mg and macitentan 10mg to treat pulmonary arterial hypertension.

Report Scope

Report Features Description Market Value (2024) US$ 8.1 billion Forecast Revenue (2034) US$ 13.6 billion CAGR (2025-2034) 5.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Branded and Generics), By Route of Administration (Oral, Intravenous/ Subcutaneous, and Inhalational), By Drug Class (Endothelin Receptor Antagonists (ERAs), SGC Stimulators, Prostacyclin and Prostacyclin Analogs, and PDE-5 Inhibitors) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Viatris Inc, United Therapeutics Corporation, Keros Therapeutics , Johnson & Johnson, Janssen Pharmaceutical Companies, GlaxoSmithKline, Gilead Sciences, Inc, and Bayer Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Pulmonary Arterial Hypertension MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Pulmonary Arterial Hypertension MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Viatris Inc

- United Therapeutics Corporation

- Keros Therapeutics

- Johnson & Johnson

- Janssen Pharmaceutical Companies

- GlaxoSmithKline

- Gilead Sciences, Inc

- Bayer