Global Methoxypropyl Acetate Market Size, Share, And Business Benefits By Product Type (Industrial Grade, Pharmaceutical Grade), By Application (Coatings, Inks, Cleaners, Pharmaceuticals), By End-User (Automotive, Electronics, Pharmaceuticals, Paints and Coatings), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 163818

- Number of Pages: 210

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

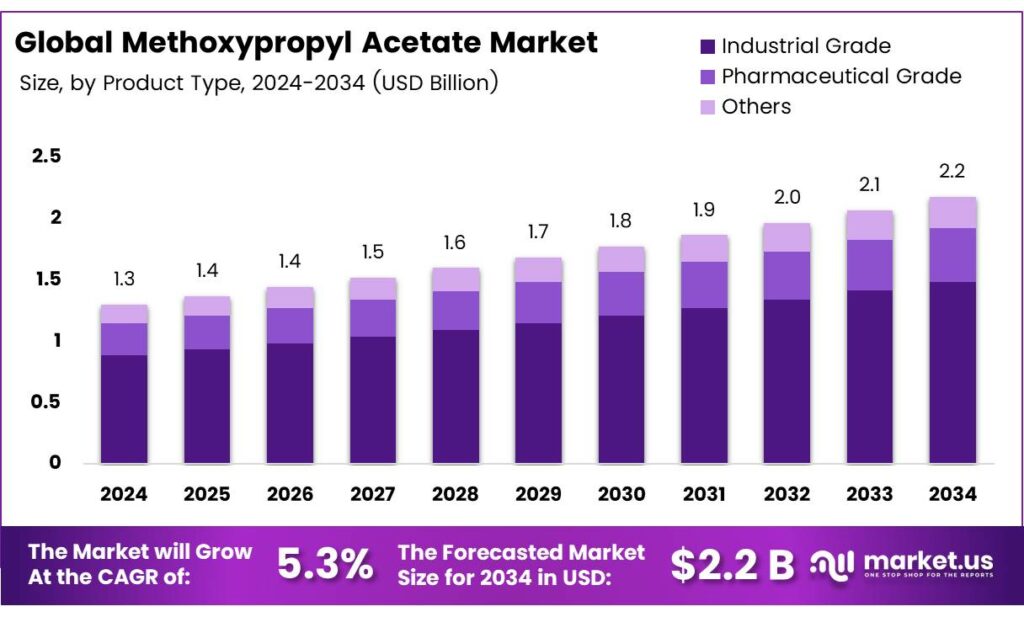

The Global Methoxypropyl Acetate Market size is expected to be worth around USD 2.2 billion by 2034, from USD 1.3 billion in 2024, growing at a CAGR of 5.3% during the forecast period from 2025 to 2034.

Methoxy propyl acetate (PMA), also known as 1-methoxy-2-acetoxypropane or propylene glycol monomethyl ether-1,2-acetate, is a clear, medium-volatility liquid solvent with the formula C₆H₁₂O₃. It exhibits limited miscibility with water and possesses a mild odour. PMA is synthesised by reacting ethylene or propylene oxide with alcohol to form glycol monoethers, which are subsequently esterified with acetic acid.

- Global production is estimated at 300,000 to 500,000 tonnes annually. PMA is typically distributed in 200 kg drums and requires storage in a cool, dry, well-ventilated area. For transportation, it is classified under packing group III and hazard class 3, reflecting its flammability. It has a specific gravity of 0.965 and a flash point of 42°C.

The solvent demonstrates strong solvency for a wide range of resins and dyes, making it valuable in furniture polishes, wood stains, printing dye solutions and pastes, leather and textile colouring processes, and ball-point pen inks. Its versatility extends to use as a coalescent in coatings, particularly those containing polyisocyanates, and as a binder for core sands in foundries.

Due to its excellent solvency for a wide variety of resins and dyes, methoxypropyl acetate serves as an effective solvent, flow improver, and coalescent in coatings. It is especially well-suited for formulations containing polyisocyanates. In such applications, the peroxide content must be kept to an absolute minimum to prevent discolouration of the finished product. To ensure stability and colour consistency, we stabilise our PMA with 2,6-di-t-butyl-p-cresol (BHT).

Key Takeaways

- The Global Methoxypropyl Acetate Market is projected to grow from USD 1.3 billion in 2024 to USD 2.2 billion by 2034 at a CAGR of 5.3%.

- Industrial Grade dominated by the Product Type segment in 2024 with 68.3% share due to cost-efficiency and high performance in large-scale production.

- Coatings led by the Application segment in 2024, with a 39.5% share, valued for improving flow, adhesion, and high-gloss finishes in paints.

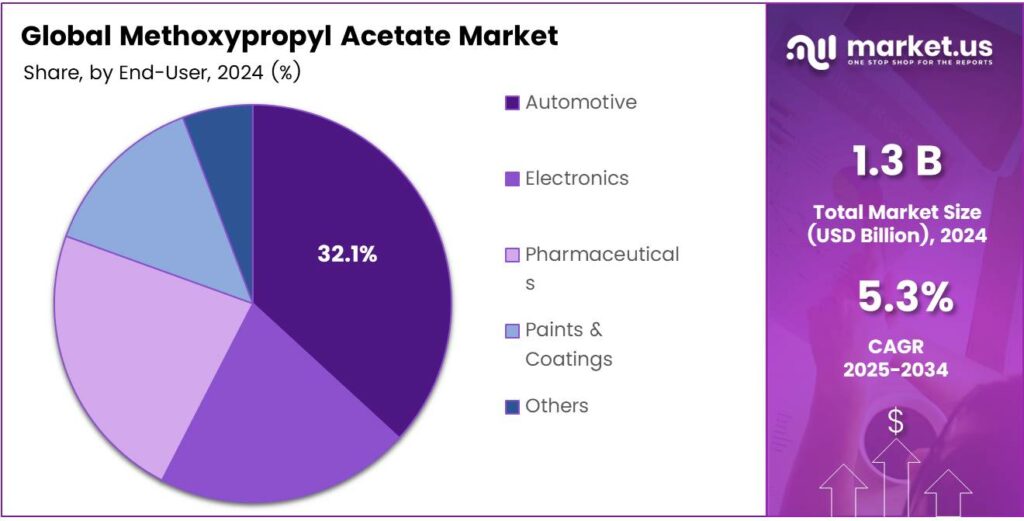

- The Automotive sector held the top position in the end-user segment in 2024 with a 32.1% share, driven by demand for durable, weather-resistant finishes.

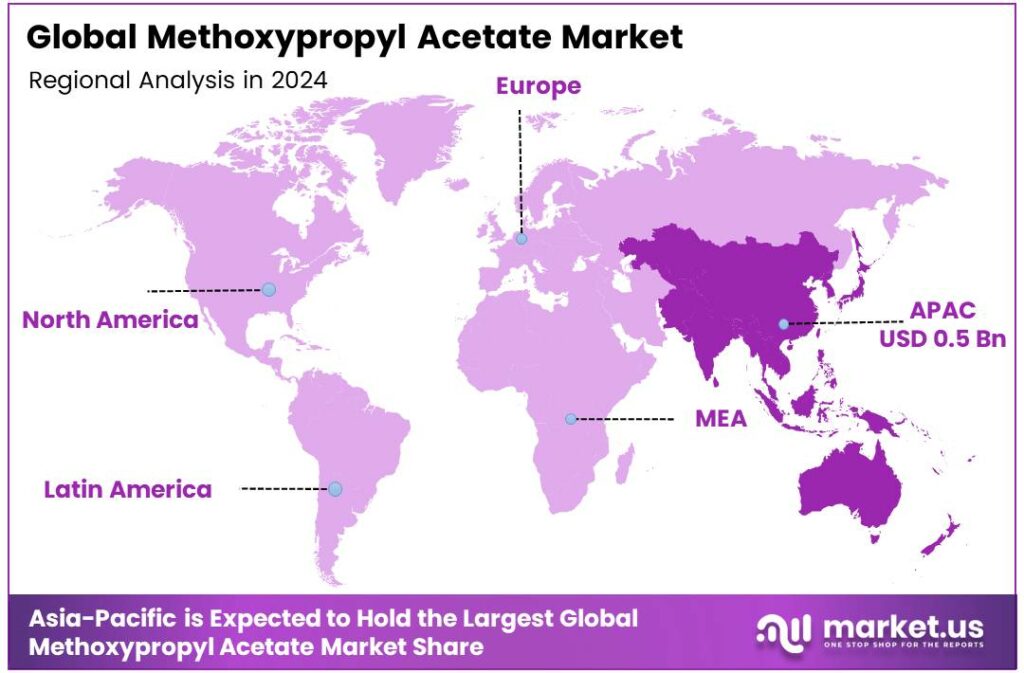

- Asia-Pacific dominated the market in 2024 with a 45.3% share (USD 0.5 billion), fueled by growth in coatings, electronics, and automotive industries in China, Japan, South Korea, and India.

By Product Type

Industrial Grade dominates with 68.3% due to its versatility in manufacturing processes.

In 2024, Industrial Grade held a dominant market position in the By Product Type Analysis segment of the Methoxypropyl Acetate Market, with a 68.3% share. This grade excels in industrial applications, offering robust solvency for resins and dyes. Manufacturers prefer it for cost-efficiency and high performance in large-scale production. Its stability ensures consistent results, driving widespread adoption across sectors like coatings and inks.

Pharmaceutical Grade captures a notable portion of the market, emphasizing purity for medical formulations. It supports drug delivery systems, ensuring safety and efficacy. Formulators choose it for its low impurity levels, which meet stringent regulatory standards. This grade enhances solubility in pharmaceutical processes, fostering innovation in healthcare products.

Others include specialized variants tailored for niche uses, such as research and custom blends. These options provide flexibility for emerging applications. Users select them to address specific solubility needs, supporting diverse industrial experiments. This segment grows steadily, complementing mainstream grades with innovative solutions.

By Application

Coatings lead with 39.5% owing to their essential role in protective finishes.

In 2024, Coatings held a dominant market position in the By Application Analysis segment of the Methoxypropyl Acetate Market, with a 39.5% share. It acts as a key solvent and coalescent, improving flow in paint formulations. Industries rely on it for durable, high-gloss finishes on surfaces. This application boosts adhesion and reduces defects, making it indispensable in construction and manufacturing.

Inks utilize Methoxypropyl Acetate for vibrant, quick-drying prints. It dissolves dyes effectively, ensuring sharp images in packaging and publishing. Printers value its low volatility, which prevents smudging. This application expands with digital printing demands, enhancing color stability and efficiency in production lines.

Cleaners leverage their solvency to remove residues in electronics and machinery. It dissolves tough greases without damaging surfaces, promoting safety. Facilities adopt it for eco-friendly cleaning, reducing waste. This segment thrives in maintenance tasks, supporting hygiene in industrial environments.

By End-User

Automotive commands 32.1% through its critical use in vehicle coatings.

In 2024, Automotive held a dominant market position in the By End-User Analysis segment of the Methoxypropyl Acetate Market, with a 32.1% share. It enhances paint adhesion on car bodies, ensuring weather resistance. Automakers integrate it for glossy, durable finishes that withstand harsh conditions. This end-user drives demand via efficient assembly lines and aesthetic upgrades.

Electronics employs it as a cleaning agent for circuit boards. It removes fluxes precisely, preventing corrosion. Tech firms appreciate its low residue, maintaining device reliability. This application supports miniaturization trends, aiding high-performance gadgets in consumer markets.

Pharmaceuticals incorporate it in drug coatings for controlled release. It dissolves polymers effectively, improving bioavailability. Producers select it for compliance with health standards, fostering patient safety. This sector innovates with it, expanding therapeutic options in medicine.

Key Market Segments

By Product Type

- Industrial Grade

- Pharmaceutical Grade

- Others

By Application

- Coatings

- Inks

- Cleaners

- Pharmaceuticals

- Others

By End-User

- Automotive

- Electronics

- Pharmaceuticals

- Paints and Coatings

- Others

Emerging Trends

Shift Toward Low-VOC and Recycled Solvents in Electronics Manufacturing

A major emerging trend shaping the Methoxypropyl Acetate (MPA) market is the rapid transition toward low-volatile organic compound (VOC) and recycled solvents, driven by both regulatory reforms and sustainability goals in electronics and coatings industries. MPA, commonly used as a solvent in coatings and semiconductor photoresists, is seeing growing substitution of high-VOC formulations with low-emission, recyclable alternatives.

- The European Union’s Directive 2004/42/EC limits VOC emissions in paints and varnishes to ≤420 g/L depending on product type, pushing formulators to rely more on eco-friendly solvents like MPA that offer high solvency power with lower environmental impact. In the United States, the South Coast Air Quality Management District restricts VOC content in architectural coatings to as low as 120 g/L for several categories.

This has led to strong adoption of low-VOC solvent systems in paints, adhesives, and electronics cleaning formulations. Parallelly, the semiconductor industry, a major consumer of MPA as PGMEA, is integrating circular-use solvent recovery. TSMC’s 2024 Sustainability Report highlighted over 85% recycling of organic solvents, including propylene glycol ethers, within its advanced fabs.

Drivers

Chipmaking & Electronics Expansion Is Pulling More Methoxypropyl Acetate

The clearest tailwind for methoxypropyl acetate is the world’s push to build many more semiconductor fabs and to assemble more electronics locally. Governments are underwriting this shift with big numbers. In the U.S., the CHIPS and Science Act set aside about USD 52 billion for domestic semiconductor capacity and R&D; the Commerce Department (NIST) reports tens of billions already moving through awards.

- In Japan, policy support is equally visible. USD 4.86 billion in additional subsidies was pledged in 2024 to help TSMC build a second fab in Kumamoto, on top of earlier support. India is also stepping in with a USD 10 billion incentive scheme and is now progressing to a commercial-scale fab targeting 50,000 wafers/month, signaling real downstream demand for lithography materials and high-purity solvents.

IDC tracked a rebound in global smartphones 8% shipment growth, even with longer replacement cycles, which keeps pressure on foundry output and advanced packaging, both heavy solvent users. TSMC reports 97% global waste recycling and very high VOC reduction, showing large chipmakers still consume significant volumes of process chemicals like PGMEA while pushing circularity and abatement.

Restraints

Regulatory & Safety Hurdles Limit Methoxypropyl Acetate Growth

One significant restraint facing the use of Methoxypropyl Acetate (MPA) lies in its stringent safety and regulatory requirements, which raise both complexity and cost for manufacturers and users. MPA is classified under the European CLP regulation as a Dangerous Substance — it is labelled as flammable, Flammable liquid and vapour, toxic if swallowed or inhaled, may cause respiratory irritation (H335), and can damage unborn children.

This classification means firms using it must invest in robust safety controls, specialised ventilation, protective equipment, and detailed documentation, all of which increase operating expense and complicate smaller-scale deployment.

As regulations tighten around solvent use, especially volatile organic compounds (VOCs) and toxic air contaminants, users must substitute processes, extend safety training, and often comply with local emissions permits or worker-exposure assessments. These hurdles slow the pace at which new end-use sectors adopt MPA, especially where low-cost alternatives are available.

Opportunity

Surging Semiconductor Production Fuels Methoxypropyl Acetate Demand

The booming expansion of semiconductor manufacturing has emerged as a powerful growth engine for solvents like methoxypropyl acetate (MPA). As fabs proliferate globally, the need for high-purity solvents in photoresist formulation, edge-bead removal, and wafer cleaning is climbing steadily.

- For instance, the CHIPS and Science Act (United States) commits roughly USD 52.7 billion to domestic semiconductor production, research, and workforce development. Another dimension of this growth is the rising complexity of semiconductor devices and processes.

The number of process steps increases, and each step demands ultra-clean solvents. Countries and companies are responding by investing in these steps: The Ministry of Economy, Trade and Industry (METI) in Japan offers subsidies covering up to one-third of the capital cost when manufacturing targeted devices, materials, or equipment.

Regional Analysis

Asia-Pacific leads with a 45.3% share and a USD 0.5 Billion market value.

In 2024, Asia-Pacific dominates the global Methoxypropyl Acetate (MPA) market, capturing a 45.3% share, valued at approximately USD 0.5 billion. This regional leadership is primarily driven by the rapid expansion of the coatings, electronics, and automotive sectors in countries such as China, Japan, South Korea, and India.

Methoxypropyl acetate is widely utilized as a solvent in high-performance coatings, inks, and photoresist formulations used in semiconductor and display manufacturing industries that are witnessing accelerated investment across the region. China remains the largest contributor, supported by the government’s strong push toward domestic semiconductor manufacturing and sustainable coatings production.

The Made in China 2025 initiative and the 14th Five-Year Plan for Green Manufacturing have encouraged the adoption of low-VOC solvents like MPA in industrial paints and automotive coatings. Similarly, Japan and South Korea are witnessing increasing consumption from electronics manufacturers, particularly due to the ongoing transition toward advanced chip fabrication and display technologies.

The region benefits from competitive raw material availability, cost-effective manufacturing capabilities, and the presence of leading chemical producers such as Mitsubishi Chemical, Lotte Chemical, and LG Chem. Asia-Pacific is expected to maintain its dominance in the Methoxypropyl Acetate market, reinforcing its role as the center of global production and consumption in the coming decade.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Dow Chemical Company leverages extensive manufacturing capabilities and a robust supply chain to serve diverse sectors like paints, coatings, and industrial cleaners. Their strong market position is reinforced by continuous investment in production technology and a commitment to developing high-purity, reliable grades of Methoxypropyl Acetate. Strategic global distribution ensures consistent availability.

Eastman Chemical Company is a major and highly innovative player in the Methoxypropyl Acetate market, renowned for its high-performance solvents. The company’s strength lies in its advanced production processes and focus on developing sustainable and safer chemical alternatives. Eastman effectively serves demanding applications in the coatings, printing inks, and chemical processing industries.

BASF SE’s involvement in the Methoxypropyl Acetate market is underpinned by its vast integrated production network (Verbund) and strong R&D focus. The company provides high-quality solvents to a broad customer base in the coatings, adhesives, and printing sectors. BASF’s commitment to sustainability and product stewardship aligns with evolving environmental regulations, enhancing its market appeal.

Top Key Players in the Market

- Dow Chemical Company

- Eastman Chemical Company

- BASF SE

- Shell Chemicals

- INEOS Group Holdings S.A.

- Arkema Group

- Mitsubishi Chemical Corporation

- LG Chem Ltd.

- SABIC

- ExxonMobil Chemical Company

- Huntsman Corporation

Recent Developments

- In 2024, New alkoxylation capacity expansion in the U.S. and Europe is expected to meet demand for oxygenated solvents like PMA. Investments maintain current carbon emissions via efficient technologies, backed by customer supply agreements.

- In 2024, Acetyls technology operates the world’s only coal gasification/carbonylation process for methyl acetate/acetic anhydride; it supports downstream PMA production. Kingsport methanolysis facility on track for 2.5x recycled content growth, aiding sustainable solvents.

Report Scope

Report Features Description Market Value (2024) USD 1.3 Billion Forecast Revenue (2034) USD 2.2 Billion CAGR (2025-2034) 5.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Industrial Grade, Pharmaceutical Grade, Others), By Application (Coatings, Inks, Cleaners, Pharmaceuticals, Others), By End-User (Automotive, Electronics, Pharmaceuticals, Paints and Coatings, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Dow Chemical Company, Eastman Chemical Company, BASF SE, Shell Chemicals, INEOS Group Holdings S.A., Arkema Group, Mitsubishi Chemical Corporation, LG Chem Ltd., SABIC, ExxonMobil Chemical Company, Huntsman Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Methoxypropyl Acetate MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample

Methoxypropyl Acetate MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Dow Chemical Company

- Eastman Chemical Company

- BASF SE

- Shell Chemicals

- INEOS Group Holdings S.A.

- Arkema Group

- Mitsubishi Chemical Corporation

- LG Chem Ltd.

- SABIC

- ExxonMobil Chemical Company

- Huntsman Corporation