Menstrual Health Apps Market By Platform (Android and iOS), By Application (Period Cycle Tracking, Fertility & Ovulation Management, and Menstrual Health Management), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153007

- Number of Pages: 301

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

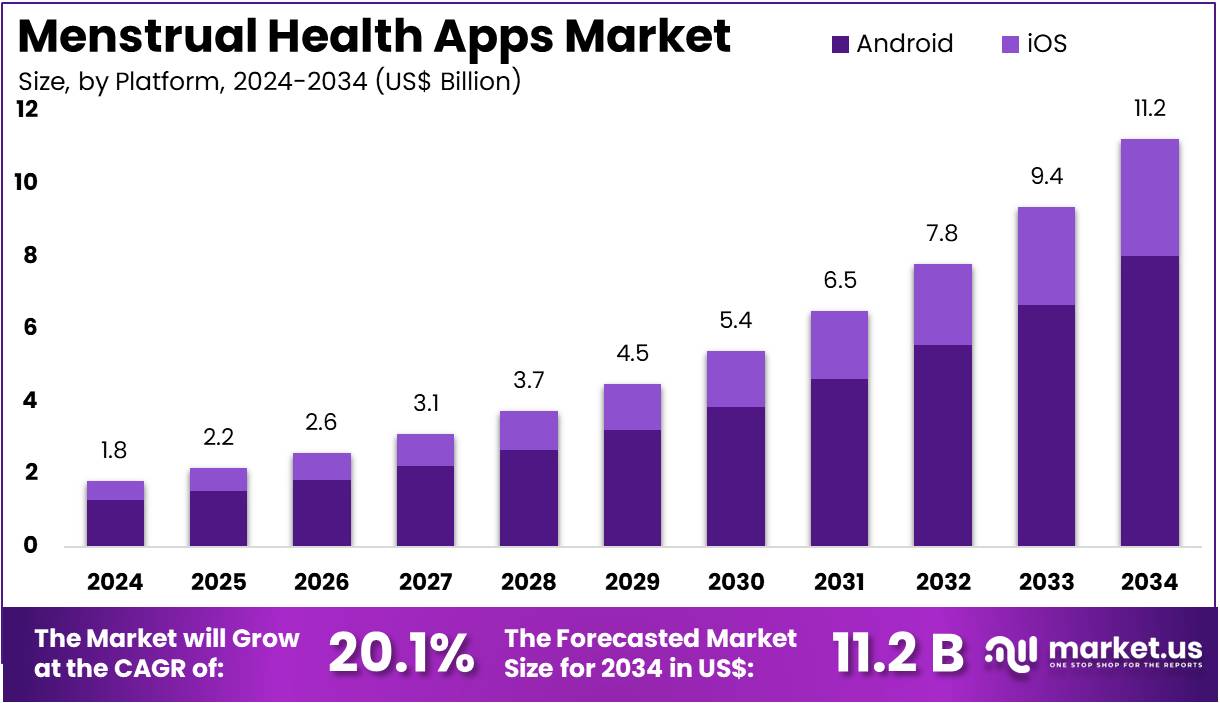

The Menstrual Health Apps Market size is expected to be worth around US$ 11.2 billion by 2034 from US$ 1.8 billion in 2024, growing at a CAGR of 20.1% during the forecast period 2025 to 2034.

Rising awareness about menstrual health and the increasing focus on women’s wellness are driving the growth of the menstrual health apps market. These apps have become essential tools for women to track their menstrual cycles, monitor symptoms, and manage related health concerns, such as irregular periods, pain, and fertility.

Growing access to smartphones and increased digital health literacy have made these apps more accessible to a wider audience, enhancing their adoption. Women increasingly seek personalized healthcare experiences, and menstrual health apps provide features like symptom tracking, menstrual predictions, and mood monitoring, empowering users with valuable insights into their reproductive health.

Additionally, the rise of telemedicine and virtual healthcare has created opportunities for integrating these apps with medical consultations, providing a seamless approach to managing menstrual and reproductive health. In January 2025, the Big Family 360 Foundation launched the HerPride app, a platform designed to support women by helping them track their periods, order sanitary products, and engage with a community. This launch highlights a key trend of expanding the functionalities of menstrual health apps to address not just cycle tracking but also overall well-being, social support, and access to products.

The market is also witnessing growing demand for apps that provide educational content on menstrual hygiene, reproductive health, and related topics. As the focus on women’s health intensifies and the market continues to innovate, menstrual health apps are poised to play a pivotal role in enhancing the health management of women worldwide. These apps offer not only convenience but also the potential for better health outcomes, as they help women stay informed and in control of their menstrual health.

Key Takeaways

- In 2024, the market for menstrual health apps generated a revenue of US$ 1.8 billion, with a CAGR of 20.1%, and is expected to reach US$ 11.2 billion by the year 2034.

- The platform segment is divided into android and ios, with android taking the lead in 2023 with a market share of 71.3%.

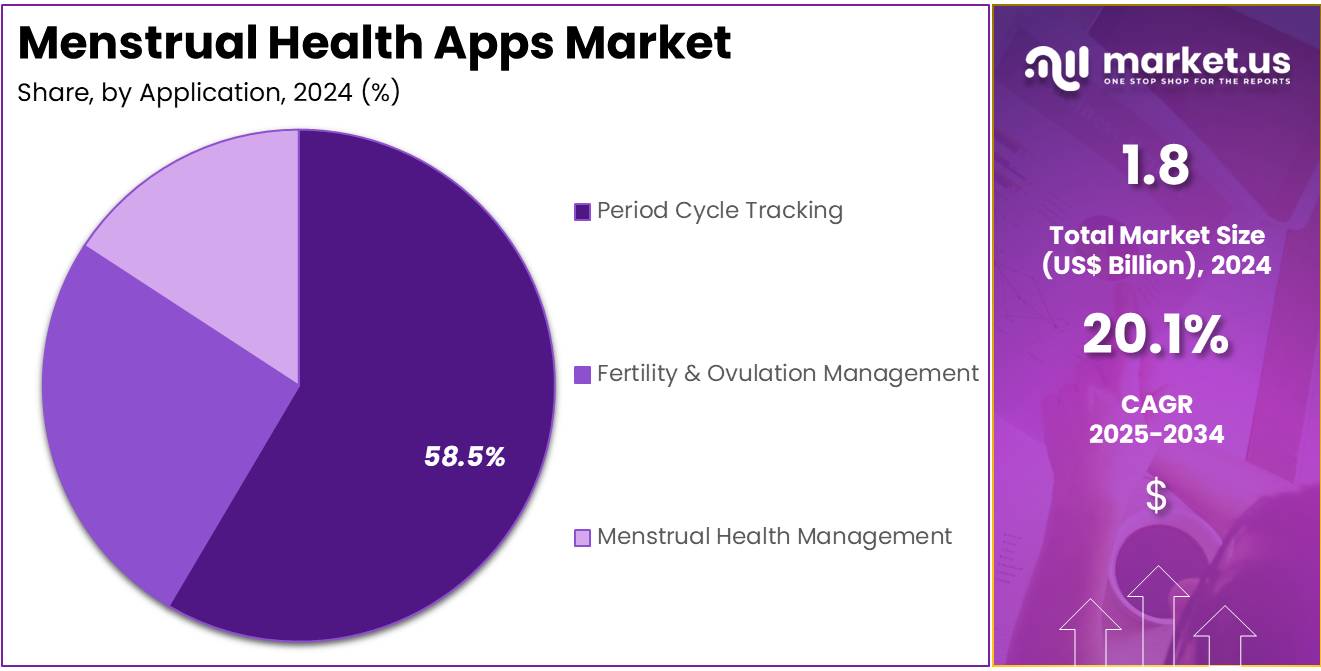

- Considering application, the market is divided into period cycle tracking, fertility & ovulation management, and menstrual health management. Among these, period cycle tracking held a significant share of 58.5%.

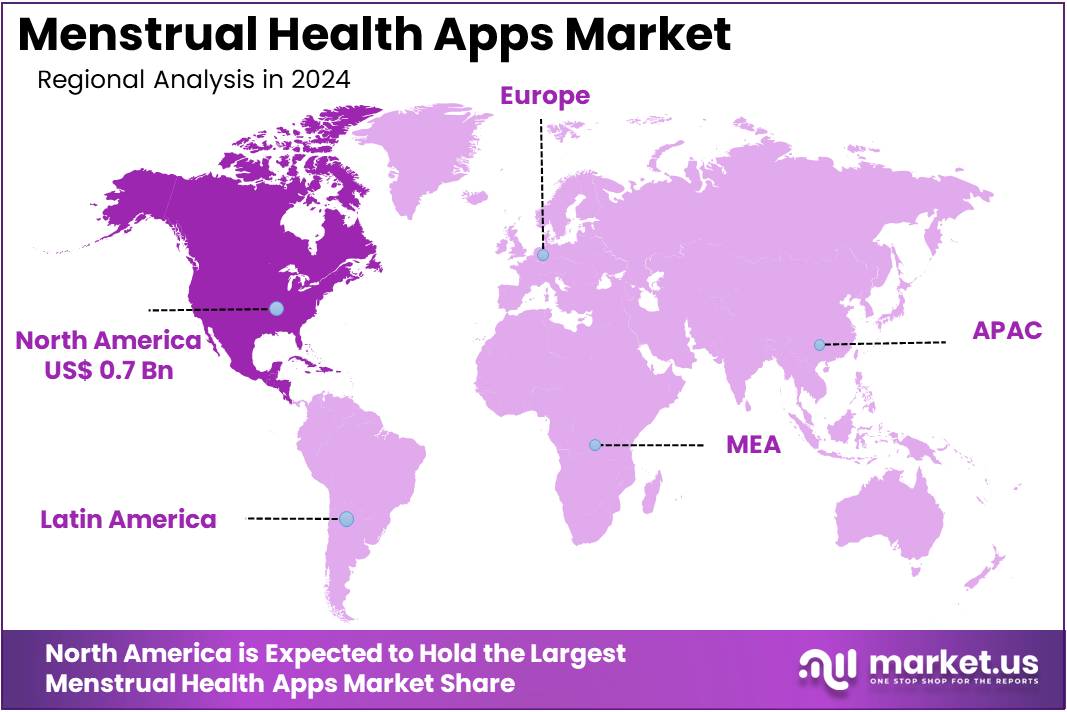

- North America led the market by securing a market share of 39.4% in 2023.

Platform Analysis

The Android platform holds a dominant share of 71.3% in the menstrual health apps market. This segment’s growth is expected to continue due to the widespread adoption of Android devices across different demographics and regions. Android is the most popular mobile operating system globally, especially in emerging markets where affordability and accessibility are key factors driving the market.

The increasing number of Android-based smartphones, combined with the growing interest in menstrual health, is anticipated to further increase the reach of Android-based menstrual health apps. These apps offer a range of functionalities such as period tracking, fertility monitoring, and menstrual health management, making them highly sought after.

Moreover, the flexibility of the Android ecosystem allows for easy customization and integration of third-party services, which enhances the user experience. The availability of these apps in multiple languages and regions is expected to make Android the preferred platform for menstrual health applications worldwide. As more women seek solutions to manage their menstrual health, the Android platform is projected to continue dominating the market for menstrual health apps.

Application Analysis

Period cycle tracking holds the largest share of 58.5% in the menstrual health apps market. This growth is expected to be driven by the increasing awareness among women about the benefits of tracking their menstrual cycles for better health management. Apps that allow women to monitor their periods, symptoms, and overall reproductive health are projected to see continued demand as users seek to optimize their menstrual health. The rise in personalized health and wellness tracking, along with the growing preference for digital tools for health management, is likely to further contribute to this segment’s growth.

Period cycle tracking apps are anticipated to expand in popularity as women become more informed about their menstrual cycles and the role they play in overall well-being. These apps often provide insights into irregularities, potential health issues, and hormonal fluctuations, helping users manage their health more proactively. Additionally, the growing integration of period tracking with fertility and ovulation management features is expected to drive further adoption. As more healthcare providers recommend period tracking for both reproductive health and symptom management, this segment is likely to experience significant growth in the coming years.

Key Market Segments

By Platform

- Android

- iOS

By Application

- Period cycle tracking

- Fertility & ovulation management

- Menstrual health management

Drivers

Increasing Smartphone Penetration and Digital Health Adoption is Driving the Market

The surging global penetration of smartphones and a growing societal acceptance of digital health solutions are significant drivers propelling the menstrual health apps market. As more individuals, particularly women, gain access to smartphones and reliable internet connectivity, the foundational platform for these applications becomes ubiquitous. This widespread availability of personal devices, coupled with a rising comfort level in using apps for various aspects of health management, creates a fertile ground for the adoption of menstrual health tracking tools.

For instance, data from BankMyCell in January 2025 indicated that the number of smartphone users worldwide reached 4.88 billion in 2024, with 60.42% of the global population owning a smartphone. Furthermore, the GSMA’s Mobile Gender Gap Report 2024 (published March 2025) highlighted that mobile internet adoption among women in low- and middle-income countries narrowed for the first time in three years, with 120 million women adopting mobile internet in 2023. This increased digital literacy and access empowers more individuals to utilize apps for tracking cycles, predicting ovulation, monitoring symptoms, and gaining insights into their reproductive health, thereby driving substantial growth in the market for these applications.

Restraints

Privacy Concerns and Data Security Risks are Restraining the Market

Significant privacy concerns and the persistent risk of data security breaches pose a considerable restraint on the growth of the menstrual health apps market. These applications often collect highly sensitive personal health information, including menstrual cycle dates, fertility windows, mood changes, and sexual activity, making users vulnerable to data misuse, unauthorized access, or sale of information to third parties.

High-profile data breaches in the broader healthcare sector have heightened public awareness and anxiety regarding the security of digital health data. For example, the U.S. Department of Health and Human Services (HHS) Office for Civil Rights (OCR) continuously reports healthcare data breaches. The HIPAA Journal, reporting in March 2025, noted that 2024 was the worst-ever year in terms of breached healthcare records, with over 276 million breached records, including a single incident affecting an estimated 190 million individuals.

While these statistics encompass the broader healthcare sector, they underscore the pervasive threat of data breaches that erode user trust in all health-related applications, including those focused on menstrual health. The lack of clear, consistent global regulations specifically governing the privacy of non-HIPAA-covered consumer health apps further exacerbates these concerns, making users hesitant to fully trust and rely on these platforms, thereby restraining market expansion.

Opportunities

Integration with Wearable Devices and Personalized Health Insights is Creating Growth Opportunities

The accelerating integration of menstrual health applications with wearable devices and the capability to provide increasingly personalized health insights are creating significant growth opportunities in the market. Wearable technology, such as smartwatches and fitness trackers, can passively collect physiological data like heart rate variability, body temperature, and sleep patterns.

When integrated with menstrual health apps, this data can offer more accurate cycle predictions, identify ovulation patterns with greater precision, and provide a holistic view of a user’s health in relation to their menstrual cycle. This enhances the utility and value proposition of these apps, moving beyond simple tracking to predictive analytics and comprehensive well-being management. A June 2025 report discussing the women’s health tracking app market highlighted that 40% of users already integrate these apps with fitness devices like smartwatches and fitness trackers, signifying a strong user demand for this connectivity.

Furthermore, advancements in artificial intelligence (AI) enable apps to analyze this combined data to offer highly personalized insights, alerts, and educational content, addressing individual health needs more effectively. This synergistic relationship between apps and wearables, driven by the demand for more precise and personalized health monitoring, is significantly expanding the market’s appeal and functionality.

Impact of Macroeconomic / Geopolitical Factors

Global economic stability, particularly as it influences disposable income and digital infrastructure investment, impacts the menstrual health apps market by affecting consumer access and the cost of app development. In periods of economic prosperity, individuals are more likely to own smartphones and pay for premium app features or subscriptions, boosting market revenue.

Conversely, economic downturns can reduce discretionary spending, potentially leading users to opt for free versions or discontinue app usage. Furthermore, the development, maintenance, and hosting of these apps require significant investment in cloud services, data storage, and cybersecurity, all influenced by global economic conditions and inflation.

For example, a September 2024 review of digital health funding trends noted that while overall digital health investment declined in 2023, it saw a rebound in Q1 2024, indicating a recovery in investor confidence. This highlights how investor capital, crucial for app innovation and scaling, is sensitive to macroeconomic factors.

Geopolitical stability also affects the availability and affordability of digital infrastructure, particularly in emerging markets where internet penetration and smartphone access are still developing. A stable geopolitical environment fosters greater investment in the digital infrastructure necessary for widespread app adoption, ultimately contributing to the market’s overall growth and accessibility.

Evolving US trade policies, particularly those related to technology imports and data governance, are shaping the menstrual health apps market by influencing the operational costs for app developers and the regulatory environment for data handling. While the primary product is software, the underlying infrastructure, such as cloud servers and data analytics tools, often relies on globally sourced hardware and services.

Tariffs on these technology inputs can increase development and hosting costs for app companies, potentially leading to higher subscription fees for users or reduced investment in new features. US trade policies are increasingly intertwined with national data privacy and security regulations, like HIPAA for covered entities and state-level privacy laws for consumer health data.

While menstrual health apps are often not directly governed by HIPAA unless affiliated with a covered entity, growing regulatory scrutiny on consumer health data practices globally, including in the US, compels app developers to implement robust data protection measures. This push for stronger data governance, though potentially increasing compliance costs, fosters greater user trust and ensures the market develops on a foundation of secure and ethical data handling.

Latest Trends

Focus on Reproductive Health Beyond Cycle Tracking and Symptom Management is a Recent Trend

A prominent recent trend significantly impacting the menstrual health apps market in 2024 and continuing into 2025 is the expanding focus of these applications beyond basic period tracking and symptom logging to encompass broader reproductive health and life stages. Many apps are now incorporating features related to fertility awareness for conception, pregnancy tracking with fetal development information, and support for menopause management, including symptom tracking and educational resources. This evolution positions these apps as comprehensive reproductive health companions throughout a woman’s life journey, rather than just simple cycle calendars.

For instance, in 2024, Flo Health launched a major update with enhanced AI-powered fertility tracking features, which the company stated increased user engagement by 25%. Similarly, Clue introduced a new menopause tracking feature in 2024, reportedly leading to a 15% increase in users in their 40s and 50s. This shift reflects a growing demand for holistic digital support that addresses the diverse and evolving health needs of women, providing continuous and relevant insights across different reproductive phases. This broader utility enhances user retention and attracts new demographics, driving innovation and growth in the menstrual health apps market.

Regional Analysis

North America is leading the Menstrual Health Apps Market

North America dominated the market with the highest revenue share of 39.4% owing to the widespread adoption of smartphones and an increasing emphasis on personal health tracking and reproductive wellness among women. In the United States, 83% of people aged 3 and older used the internet in some fashion in 2023, which is an increase from 80% in 2021, according to data from the National Telecommunications and Information Administration (NTIA), part of the U.S. Department of Commerce.

Furthermore, 72% of people lived in households with both fixed and mobile internet connections in 2023, up from 69% in 2021, as also reported by the NTIA. This pervasive digital connectivity, largely facilitated by smartphones, provides a robust foundation for the proliferation of health-focused applications. In Canada, digital health adoption continues to expand, with government initiatives supporting broader access to health information and services through digital platforms. This high smartphone penetration provides a ready user base for health-focused applications.

Women are increasingly seeking convenient and discreet ways to monitor their menstrual cycles, track fertility, and manage symptoms, leading to a surge in downloads and active usage of these applications. While specific revenue figures for individual menstrual health applications from publicly traded companies are not typically disclosed in their general investor reports, the overall trend in digital health engagement supports this growth.

The integration of period tracking features into broader health platforms like Apple Health and Google Fit further normalizes and promotes the use of digital tools for reproductive health management, contributing to the market’s expansion as users seek comprehensive and personalized insights into their well-being.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to increasing smartphone penetration, a growing female population, rising awareness of reproductive health issues, and supportive government initiatives promoting digital health. As of March 2024, the total number of telephone subscribers in India stood at 1,199.28 million, representing a substantial base for mobile application adoption, as reported by the Telecom Regulatory Authority of India (TRAI). This figure continued its growth trend, reaching 1,200.80 million subscribers by March 2025.

Wireless data subscribers in India also increased significantly, reaching 913.34 million by March 2024, further expanding to 939.51 million by March 2025, according to TRAI’s performance indicators. The Indian government’s “Digital India” initiative and the push for broadband connectivity, including widespread 5G rollout, are providing a robust digital infrastructure.

For instance, 5G service in India, launched in October 2022, had more than 438,000 sites covering over 700 districts by March 2024, as noted in the TRAI Annual Report 2023-24. These developments mean that more women are likely to access and utilize mobile-based health applications to track their cycles, manage fertility, and gain insights into their overall reproductive well-being, driving continued expansion in this segment.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the menstrual health app market employ various strategies to drive growth and enhance user engagement. They focus on integrating advanced technologies such as artificial intelligence and machine learning to offer personalized cycle predictions and symptom tracking. Expanding their service offerings to include fertility, pregnancy, and menopause management allows these companies to cater to a broader user base.

Strategic partnerships with healthcare providers and institutions help in enhancing the credibility and reach of their platforms. Investing in user education through informative content and community support fosters trust and long-term user retention. Additionally, prioritizing data privacy and implementing features like anonymous modes address user concerns and comply with regulatory standards. Geographical expansion, particularly in emerging markets, further contributes to their growth trajectory.

One prominent player, Flo Health Inc., stands out in the femtech industry. Founded in 2015, Flo is a leading female health app with over 380 million downloads worldwide. The app offers personalized menstrual, fertility, pregnancy, and menopause tracking, supported by a team of over 120 medical experts. Flo emphasizes user privacy with features like Anonymous Mode and achieved unicorn status in 2024 with a valuation exceeding US$1 billion after raising US$230 million. The company’s commitment to innovation and user-centric design has solidified its position as a market leader.

Top Key Players in the Menstrual Health Apps Market

- Simple Design. Ltd

- Procter & Gamble

- Ovia Health

- MagicGirl

- Glow, Inc

- Flo Health Inc

- Comma

- Biowink GmbH

Recent Developments

- In March 2025, Comma, a women’s health startup, successfully raised US$2 million in seed funding to develop Sara, an app designed to help women monitor their menstrual cycles and enhance reproductive healthcare with a secure platform.

- In July 2024, Flo Health, a leading women’s health app globally, raised more than US$200 million in Series C funding from General Atlantic. The funds will be used to expand the app’s capabilities, particularly in providing symptom analysis for women undergoing perimenopause and menopause, while also advancing its mission to improve health education worldwide.

Report Scope

Report Features Description Market Value (2024) US$ 1.8 billion Forecast Revenue (2034) US$ 11.2 billion CAGR (2025-2034) 20.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Platform (Android and iOS), By Application (Period Cycle Tracking, Fertility & Ovulation Management, and Menstrual Health Management) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Simple Design. Ltd, Procter & Gamble, Ovia Health, MagicGirl, Glow, Inc, Flo Health Inc, Comma, Biowink GmbH. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Menstrual Health Apps MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Menstrual Health Apps MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Simple Design. Ltd

- Procter & Gamble

- Ovia Health

- MagicGirl

- Glow, Inc

- Flo Health Inc

- Comma

- Biowink GmbH