Global Medical Thermometer Market By Device Type [Mercury-Free (Infrared Radiation Thermometer, Digital Thermometer and Others) Mercury-based] By Patient Demographic (Pediatric and Adults) By Point of Measurement (Oral, Ear, Forehead and Others) By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: July 2024

- Report ID: 22284

- Number of Pages: 267

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

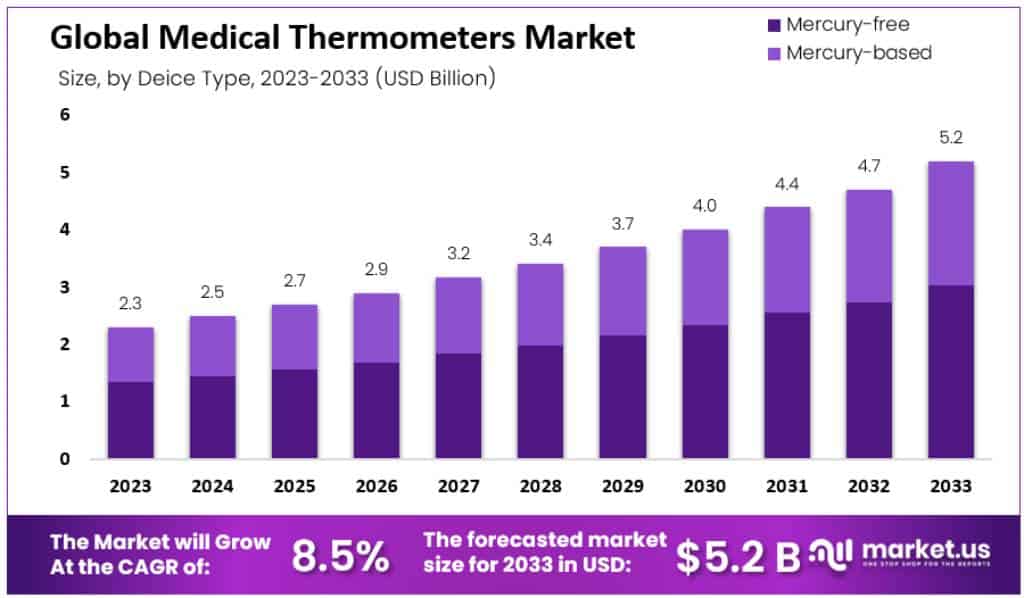

The Global Medical Thermometer Market size is expected to be worth around USD 5.2 Billion by 2033, from USD 2.3 Billion in 2023, growing at a CAGR of 8.5% during the forecast period from 2024 to 2033.

A medical thermometer, also known as a clinical thermometer, is a device used for measuring a human’s or animal’s body temperature. These thermometers are essential tools in healthcare settings, as they provide valuable insights into a patient’s health status.

Rising healthcare expenditures, disposable income, and public knowledge of self-health care management are all expected to contribute to market expansion. People nowadays prefer to acquire innovative items rather than visit medical practitioners regularly to be informed about their health concerns. The medical thermometer market is predicted to grow as a result of these factors.

Key Takeaways

- Market Size: The Global Medical Thermometer Market is projected to reach approximately USD 5.2 Billion by 2033, up from USD 2.3 Billion in 2023.

- Market Growth: This market is expected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2024 and 2033.

- Device Type Analysis: In 2023, the Mercury-Free segment accounted for over 58.2% of the medical thermometer market, driven by the demand for safer, non-toxic alternatives.

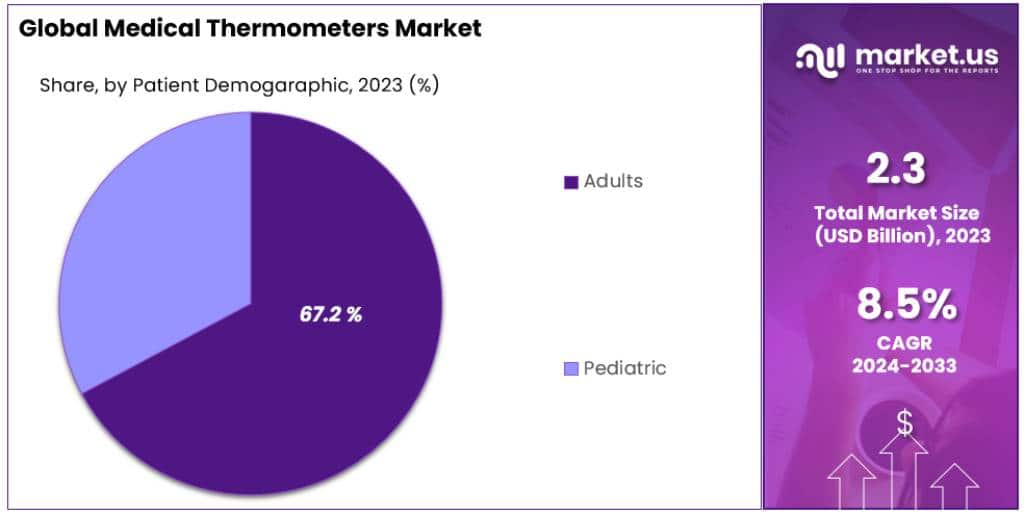

- Patient Demographic Analysis: The adult demographic held a dominant position in the medical thermometer market, with over 67.2% market share, in 2023.

- Point of Measurement Analysis: The adult demographic held a dominant position in the medical thermometer market, with over 67.2% market share, in 2023.

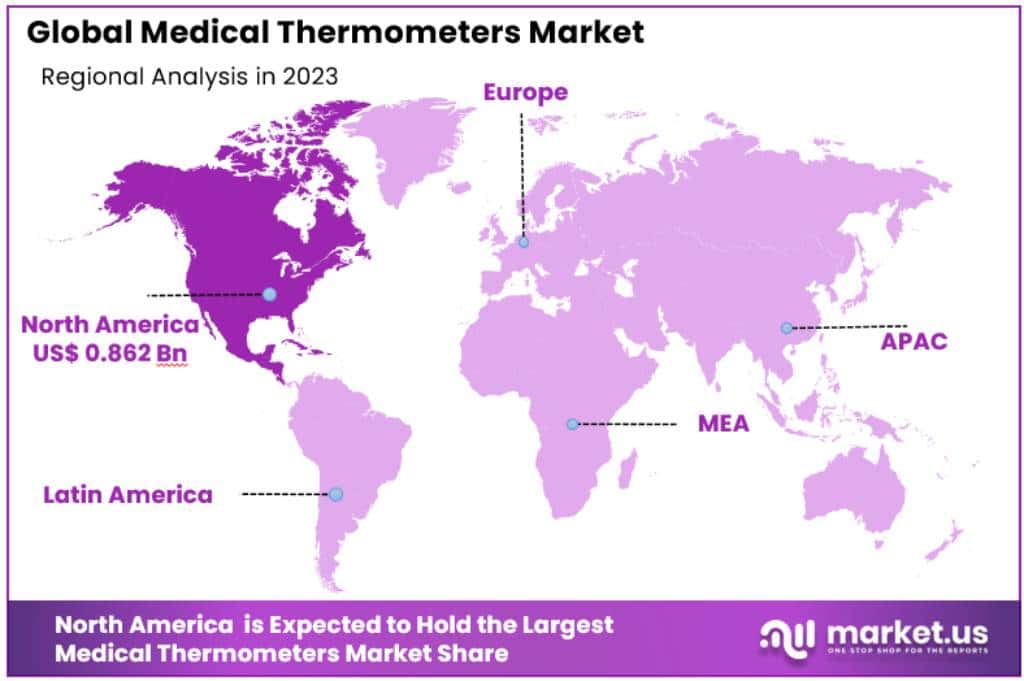

- Regional Analysis: North America, with a 37.5% share amounting to USD 0.862 billion in 2023

Device Type Analysis

In 2023, the Mercury-Free segment of the medical thermometer market held a dominant position, capturing more than a 58.2% share. This segment’s significant market presence is attributed to the increasing preference for safer, non-toxic alternatives in medical devices.

Mercury-Free Thermometers

- Infrared Radiation Thermometers: This sub-segment has gained substantial traction, particularly for its non-invasive and hygienic features. Infrared thermometers, which measure temperature without skin contact, have become increasingly popular in various settings, including hospitals, clinics, and even homes. Their rapid and accurate temperature readings, essential during health emergencies, have further solidified their market position.

- Digital Thermometers: These devices are recognized for their precise and consistent temperature readings. Digital thermometers are user-friendly, with features such as easy-to-read displays and quick measurement times. They are widely used in both clinical and home settings, catering to a broad consumer base. The continual enhancements in digital technology, such as improved battery life and additional functionalities, have made them a preferred choice for many users.

Mercury-Based Thermometers

Despite the growing concerns over mercury’s environmental and health impacts, mercury-based thermometers still maintain a presence in the market. Known for their accuracy, these thermometers are used in specific applications where precision is paramount. However, the segment is experiencing a decline due to the global shift towards mercury-free options and stringent regulations limiting the use of mercury in medical instruments.

Patient Demographic Analysis

In 2023, the adult demographic in the medical thermometer market held a dominant position, capturing more than a 67.2% share. This substantial market share reflects the broad usage of thermometers among adults for personal health monitoring and in various healthcare settings.

Adult Segment

The adult segment’s dominance can be attributed to several factors. Firstly, the growing awareness of health and wellness among adults has led to an increased use of medical thermometers for regular monitoring. This is particularly evident in the context of managing chronic conditions or during flu seasons. Secondly, the prevalence of chronic illnesses, which often require regular temperature monitoring, is higher in adults. This demographic’s reliance on accurate and easy-to-use thermometers has stimulated demand in this segment.

Additionally, the adult segment benefits from a wide range of thermometer options catering to different needs and preferences, from traditional mercury-based thermometers to advanced digital and infrared models. The diversity in product offerings has enabled this segment to maintain a significant market share.

Pediatric Segment

The pediatric segment, while smaller in comparison, is nonetheless crucial in the medical thermometer market. Children’s need for specific thermometer types, such as gentle, non-invasive models, drives innovation and specialization within this segment. Pediatric thermometers often feature designs that are more appealing to children, such as fun shapes or colors, and are tailored to provide quick and accurate readings with minimal discomfort.

Moreover, the sensitivity of a child’s health and the need for precise temperature measurements in diagnosing and monitoring illnesses in children underpin the steady demand in this segment. Safety features, such as non-toxic materials and flexible tips, are especially valued in pediatric thermometers.

Point of Measurement Analysis

In 2023, the oral segment of the medical thermometer market held a dominant position, capturing more than a 62.8% share. This prominence can be attributed to the widespread acceptance and reliability of oral thermometers in both clinical and home settings.

Oral Segment

Oral thermometers have long been a standard tool for temperature measurement due to their accuracy and ease of use. They are particularly favored in adult populations and are commonly used in medical facilities worldwide. The familiarity and trust in oral thermometers, coupled with their cost-effectiveness, have helped sustain their market dominance. Additionally, advancements in digital oral thermometers, offering features like faster read times and memory functions, have further cemented their position in the market.

Ear Segment

The ear (tympanic) thermometer segment, though smaller, is notable for its convenience and speed. Ear thermometers provide quick readings, making them ideal for use with children and in fast-paced clinical environments. The increasing preference for non-invasive and quick temperature measurement solutions has boosted the demand for ear thermometers. However, their accuracy can be influenced by factors like earwax or improper positioning, which slightly limits their market reach compared to oral thermometers.

Forehead Segment

Forehead (temporal artery) thermometers have gained popularity due to their non-contact nature, which is vital for infection control. Their ease of use, particularly in pediatric and geriatric care, makes them a valuable tool in both hospitals and homes. While they are generally more expensive than oral or ear thermometers, the demand for hygienic and non-intrusive temperature measurement methods has been driving their market growth.

Others

This segment includes various other types of thermometers, such as axillary (underarm) and rectal thermometers. While these methods are less commonly used due to factors like discomfort and the need for closer contact, they still hold relevance in specific scenarios where oral, ear, or forehead measurements are not feasible or recommended.

Key Market Segments

Based On the Device Type

- Mercury-free

- Infrared Radiation Thermometer

- Digital Thermometers

- Others

- Mercury-based

Based On Patient Demographic

- Pediatric

- Adults

Based On the Point of Measurement

- Oral

- Ear

- Forehead

- Others

Drivers

- Rising Demand for Non-Contact Thermometers: Non-contact, or infrared thermometers, have seen a surge in demand, especially highlighted during the COVID-19 pandemic. Their quick, non-invasive nature has made them indispensable in healthcare and public settings. This trend has been a key driver in market growth.

- Increased Focus on Personal Healthcare: A heightened awareness of personal health, particularly during the pandemic, has led to more individuals monitoring their health at home. Medical thermometers, as a primary tool for health monitoring, have thus seen increased demand.

- Growing Prevalence of Infectious Diseases: The spread of diseases like COVID-19 has emphasized the need for reliable fever detection. According to Healthline (June 2021), about 78% of 24,420 adults with COVID-19 experienced fever. This need for accurate temperature measurement has spurred thermometer sales.

- Expanding Geriatric Population: The aging global population, more prone to health issues requiring temperature monitoring, has also contributed to market growth.

Opportunities

- Technological Advancements: Innovations in thermometer technology, such as faster response times and connectivity, have broadened the market. For instance, in October 2021, Telli Health launched a contactless connected 4G digital wall-mounted infrared thermometer.

- Increasing Healthcare Expenditure: As global healthcare spending rises, so does the demand for essential medical devices like thermometers.

Challenges

- Market Competition and Price Sensitivity: The competitive nature of the market and the need for affordable yet quality thermometers pose a challenge, potentially limiting growth in higher-end segments.

- Alternative Temperature Measurement Methods: The availability of different temperature measurement methods, such as disposable strips or tympanic thermometers, can limit the growth of traditional thermometer markets.

Trends

- Dominance of the Digital Segment: Digital thermometers, known for their accuracy and ease of use, are expected to hold a major market share. WHO data from 2020 shows a high incidence of diseases like malaria, where fever is a primary symptom, further driving demand for digital thermometers.

- Increasing Adoption of Smart and Connected Thermometers: With the rise of IoT, smart thermometers with features like smartphone integration are becoming more popular. These devices offer real-time data and historical trends, appealing to those managing their health proactively.

- Global Medical Thermometer Key Trends: The global market is adapting to increasing demand for multifunctional, non-contact clinical electronic thermometers. Local manufacturers have gained opportunities due to supply chain disruptions during the pandemic. For example, Kinsa, Inc. distributed smart thermometers to track COVID-19 hotspots in the U.S.

Regional Analysis

North America’s Market Dominance

In the medical thermometer market, North America, with a 37.5% share amounting to USD 0.862 billion in 2023, is expected to maintain its lead during the forecast period. The region’s market strength is bolstered by key factors including the presence of major industry players, a high rate of infectious diseases, advancing research and development, technological innovation, and an increasing emphasis on self-healthcare management.

The United States is at the forefront in this region, propelled by its strong healthcare policies, a significant patient count, and a well-developed healthcare infrastructure. For instance, CDC data from April 2020 indicates around 15.5 million Americans sought physician consultations for infectious and parasitic diseases.

Additionally, MedAlertHelp’s 2022 data suggests that 5-20% of Americans contract influenza annually, and the 2019-2020 flu season led to 35 million cases, 380,000 hospitalizations, and 20,000 deaths. This high incidence of infectious diseases and the subsequent increase in healthcare visits significantly drive the demand for medical thermometers in North America.

Innovative product developments are also a key growth driver in this region. February 2022 saw Calera launch a wearable thermometer featuring a miniaturized sensor and AI algorithm. Moreover, October 2020 marked GreenTEG’s launch of Core medical and Masimo’s release of the Radius T continuous Thermometer in the United States. Such innovations are anticipated to further fuel market growth in North America.

Asia-Pacific’s Projected Growth

The Asia-Pacific medical thermometer market is expected to witness significant growth from 2023 to 2030. This growth is driven by a massive population base, increasing disposable incomes, and a rise in cases of viral diseases such as COVID-19, influenza, and tuberculosis (TB). Particularly in India, TB remains a major health concern, with the WHO reporting 2,690,000 cases in 2018, of which 1,990,000 were notified. Such high incidences of infectious diseases are projected to boost medical thermometer sales in the region.

Additionally, advancements in clinical development frameworks in developing economies like India, China, and Japan are anticipated to contribute substantially to market growth.

Europe’s Market Contribution

Europe is poised to hold a sizeable portion of the global medical thermometer market through the forecast period. The region’s growth is primarily due to the prevalence of infectious diseases, the presence of major market participants, and rising healthcare expenses. Key countries contributing to this growth include Germany, the UK, and France. The market in Europe is also expected to benefit from the increasing popularity of digital thermometers, the rise of telemedicine, and the demand for non-contact thermometers.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

The global medical thermometer market is characterized by a moderate level of competition, with a blend of both international and local players. Key companies in the market include Baxter (Hillrom Holdings Inc.), Cardinal Health, 3M, McKesson Corporation, Mediaid, Inc., Innovo Medical, Microlife Corporation, American Diagnostic Corporation, Exergen Corporation, Kinsa Inc., Braun Healthcare, Panasonic Corporation, OMRON Corporation, Citizen Watch Co. Ltd. (Citizen Systems Japan Co. Ltd.), Paul Hartmann AG. (Thermoval), DeLonghi SpA (Braun GmbH), Halma Plc. (Rudolf Riester GmbH), Beurer GmbH, Opto Circuits (India) Ltd., Rycom Electron Technology Limited, Tecnimed Srl., and Easytem Co. Ltd.

These key players are vigorously investing in research and development to innovate and develop technologically advanced products, thereby gaining a competitive edge in the market. For instance, Microlife Corporation broadened its product range in November 2019 by launching new blood pressure monitors, thermometers, nebulizers, scales, and breast pumps. Such expansions help companies to diversify and strengthen their product portfolios. Exergen Corporation introduced the Exergen Temporal Artery Thermometer (TAT-5000) in March 2016, a non-invasive medical thermometer renowned for its easy and accurate temperature measurement capabilities, suitable for all patient types, including infants and children.

Mergers, acquisitions, and partnerships are also strategic approaches employed by these companies to enhance their manufacturing capabilities, product diversity, and market presence. A notable instance of this strategy is Hill-Rom’s acquisition of Breathe Technologies, Inc. in August 2019, which allowed them to integrate wearable non-invasive ventilation technology into their respiratory care products. Cardinal Health’s acquisition of Medtronic’s deep vein thrombosis, nutritional insufficiency, and patient care business in July 2017 is another example. This acquisition not only expanded Cardinal Health’s product offerings but also included several well-established brands, enhancing their market footprint.

Market Key Players

- Baxter (Hillrom Holdings Inc.)

- Cardinal Health

- 3M

- McKesson Corporation

- Mediaid, Inc.

- Innovo Medical

- Microlife Corporation

- American Diagnostic Corporation

- Exergen Corporation

- Kinsa Inc.

- Braun Healthcare

- Panasonic Corporation

- OMRON Corporation

- Citizen Watch Co. Ltd. (Citizen Systems Japan Co. Ltd.)

- Paul Hartmann AG. (Thermoval)

- DeLonghi SpA (Braun GmbH)

- Halma Plc. (Rudolf Riester GmbH)

- Beurer GmbH

- Opto Circuits (India) Ltd.

- Rycom Electron Technology Limited

- Tecnimed Srl.

- Easytem Co. Ltd.

- Other Key Players

Recent Developments

Increasing Adoption of Digital Thermometers

- November 2023: A study in the Journal of Clinical Medicine revealed that digital thermometers work faster and are more accurate than old-style glass mercury thermometers. This might make more healthcare providers choose digital thermometers.

- October 2023: Top medical thermometer companies introduced new digital thermometers. These have modern features like Bluetooth, memory for past readings, and alerts for high temperatures.

Growing Demand for Non-invasive Thermometers

- November 2023: The World Health Organization (WHO) now recommends using non-invasive thermometers, like those for the ear and forehead, in medical settings to reduce infection risks. This could increase their use in healthcare.

- September 2023: A big hospital group in the U.S. decided to switch to using ear thermometers for checking patients’ temperatures.

Technological Advancements

- November 2023: Researchers at a top university introduced a new thermometer that uses AI to read infrared scans and figure out body temperature. This could change how temperature is measured.

- August 2023: A healthcare company launched new one-time-use temperature strips. They aim to be more precise and user-friendly than traditional glass mercury thermometers.

Regulatory Updates

- November 2023: The European Union announced that by 2025, all medical thermometers must have CE marking. This will likely impact the thermometer market in Europe.

- October 2023: The FDA in the U.S. warned about possible risks with some digital thermometers, likely leading to closer monitoring of these products.

Mergers and Acquisitions

- November 2023: Two leading digital thermometer makers merged, potentially leading to more product innovation in this field.

- September 2023: A private equity firm bought a big part of a company that’s developing a new non-invasive thermometer, which could speed up its introduction to the market.

Report Scope

Report Features Description Market Value (2023) USD 2.3 Billion Forecast Revenue (2033) USD 5.2 Billion CAGR (2023-2032) 8.5% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Device Type [Mercury-Free (Infrared Radiation Thermometer, Digital Thermometer and Others) Mercury-based] By Patient Demographic (Pediatric and Adults) By Point of Measurement (Oral, Ear, Forehead and Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Baxter (Hillrom Holdings Inc.), Cardinal Health, 3M, McKesson Corporation, Mediaid, Inc., Innovo Medical, Microlife Corporation, American Diagnostic Corporation, Exergen Corporation, Kinsa Inc., Braun Healthcare, Panasonic Corporation, OMRON Corporation, Citizen Watch Co. Ltd. (Citizen Systems Japan Co. Ltd.), Paul Hartmann AG. (Thermoval), DeLonghi SpA (Braun GmbH), Halma Plc. (Rudolf Riester GmbH), Beurer GmbH, Opto Circuits (India) Ltd., Rycom Electron Technology Limited, Tecnimed Srl., Easytem Co. Ltd. and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What factors are driving the growth of the medical thermometer market?The market growth is primarily driven by rising incidences of infectious diseases, increasing healthcare expenditure, advancements in thermometer technology, and the growing demand for non-contact thermometers due to their convenience and safety.

How big is the Medical Thermometer Market?The global Medical Thermometer Market size was estimated at USD 2.3 Billion in 2023 and is expected to reach USD 5.2 Billion in 2033.

What is the Medical Thermometer Market growth?The global Medical Thermometer Market is expected to grow at a compound annual growth rate of 8.5%. From 2024 To 2033

Who are the key companies/players in the Medical Thermometer Market?Some of the key players in the Medical Thermometer Markets are Baxter (Hillrom Holdings Inc.), Cardinal Health, 3M, McKesson Corporation, Mediaid, Inc., Innovo Medical, Microlife Corporation, American Diagnostic Corporation, Exergen Corporation, Kinsa Inc., Braun Healthcare, Panasonic Corporation, OMRON Corporation, Citizen Watch Co. Ltd. (Citizen Systems Japan Co. Ltd.), Paul Hartmann AG. (Thermoval), DeLonghi SpA (Braun GmbH), Halma Plc. (Rudolf Riester GmbH), Beurer GmbH, Opto Circuits (India) Ltd., Rycom Electron Technology Limited, Tecnimed Srl., Easytem Co. Ltd. and Other Key Players.

How has the COVID-19 pandemic impacted the medical thermometer market?The COVID-19 pandemic significantly boosted the demand for medical thermometers, particularly non-contact infrared thermometers, due to their use in screening for fever, a common symptom of the virus. This led to a temporary surge in market demand and production.

What technological advancements are influencing the medical thermometer market?Technological advancements include the development of smart thermometers that connect to mobile apps, providing real-time data and tracking. Non-contact infrared thermometers have also seen improvements in accuracy and response time.

What are the challenges faced by the medical thermometer market?Challenges include the risk of contamination in reusable thermometers, competition from low-cost manufacturers, and the need for strict regulatory compliance. Additionally, the market faces challenges in terms of product differentiation and innovation.

Medical Thermometer MarketPublished date: July 2024add_shopping_cartBuy Now get_appDownload Sample

Medical Thermometer MarketPublished date: July 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Baxter (Hillrom Holdings Inc.)

- Cardinal Health

- 3M

- McKesson Corporation

- Mediaid, Inc.

- Innovo Medical

- Microlife Corporation

- American Diagnostic Corporation

- Exergen Corporation

- Kinsa Inc.

- Braun Healthcare

- Panasonic Corporation

- OMRON Corporation

- Citizen Watch Co. Ltd. (Citizen Systems Japan Co. Ltd.)

- Paul Hartmann AG. (Thermoval)

- DeLonghi SpA (Braun GmbH)

- Halma Plc. (Rudolf Riester GmbH)

- Beurer GmbH

- Opto Circuits (India) Ltd.

- Rycom Electron Technology Limited

- Tecnimed Srl.

- Easytem Co. Ltd.

- Other Key Players