Global Medical Oxygen Concentrators Market By Type (Portable and Stationary), By Technology (Pulse Dose and Continuous Flow), By Indication (Asthma, Chronic Obstructive Pulmonary Disease (COPD), Sleep Apnea, and Others), By End-user (Hospitals & Clinics, Homecare Settings, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Aug 2024

- Report ID: 104222

- Number of Pages: 280

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

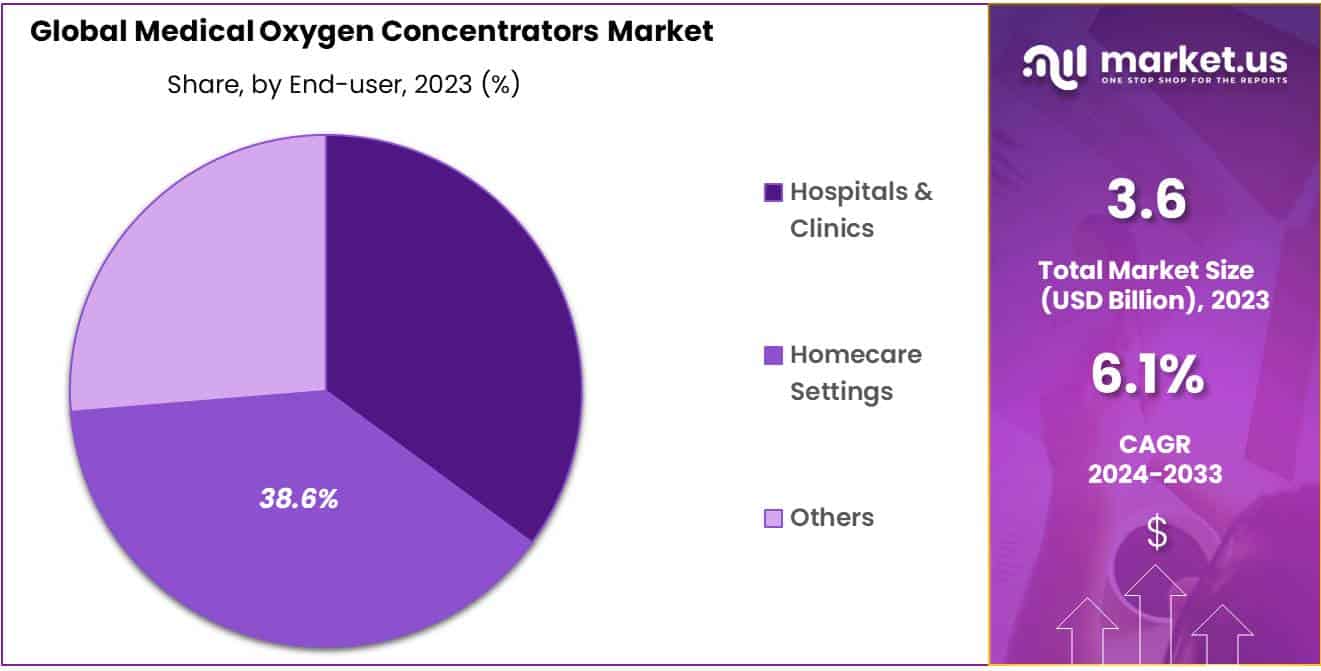

The Medical Oxygen Concentrators Market size is expected to be worth around USD 6.5 billion by 2033 from USD 3.6 billion in 2023, growing at a CAGR of 6.1% during the forecast period 2024 to 2033.

Medical practitioners mostly use oxygen concentrators for treating patients and for diagnostic tests. In the home care settings, medical oxygen equipment like concentrators or compressed oxygen cylinders are used by elderly patients with mobility disability and those who need a constant oxygen supply. Oxygen therapy is widely utilized in treating respiratory illnesses because of the advantages that it offers in acute and extended patient management. The market for medical oxygen concentrators is expanding because of the favorable government policies and campaigns to make the devices more accessible.

The market is also growing because of the increasing geriatric population, who has a high prevalence of respiratory ailments such as chronic obstructive pulmonary disease, pulmonary fibrosis, and sleep apnea. According to the data published in the World Health Organization report in October 2022, the global population is aging at a much faster pace than it did in the past. Between the years 2015 and 2050, the percentage of the world’s geriatric population (over 60 years) is anticipated to nearly double, reaching from 12% to 22%.

Key Takeaways

- Market Size: The Medical Oxygen Concentrators Market size is expected to be worth around USD 6.5 billion by 2033 from USD 3.6 billion in 2023.

- Market Growth: The market growing at a CAGR of 6.1% during the forecast period 2024 to 2033.

- Type Analysis: The type segment is divided into portable and stationary, with portable taking the lead in 2023 with a market share of 55.6%.

- Technology Analysis: Considering technology, the market is divided into pulse dose and continuous flow. Among these, continuous flow held a significant share of 31.2%.

- Indication Analysis: Furthermore, concerning the indication segment, the market is segregated into asthma, chronic obstructive pulmonary disease (COPD), sleep apnea, and others. The chronic obstructive pulmonary disease (COPD) sector stands out as the dominant player, holding the largest revenue share of 31.2% in the medical oxygen concentrators market.

- End-user Analysis: The end-user segment is segregated into hospitals & clinics, homecare settings, and others, with the homecare settings segment leading the market, holding a revenue share of 38.6%.

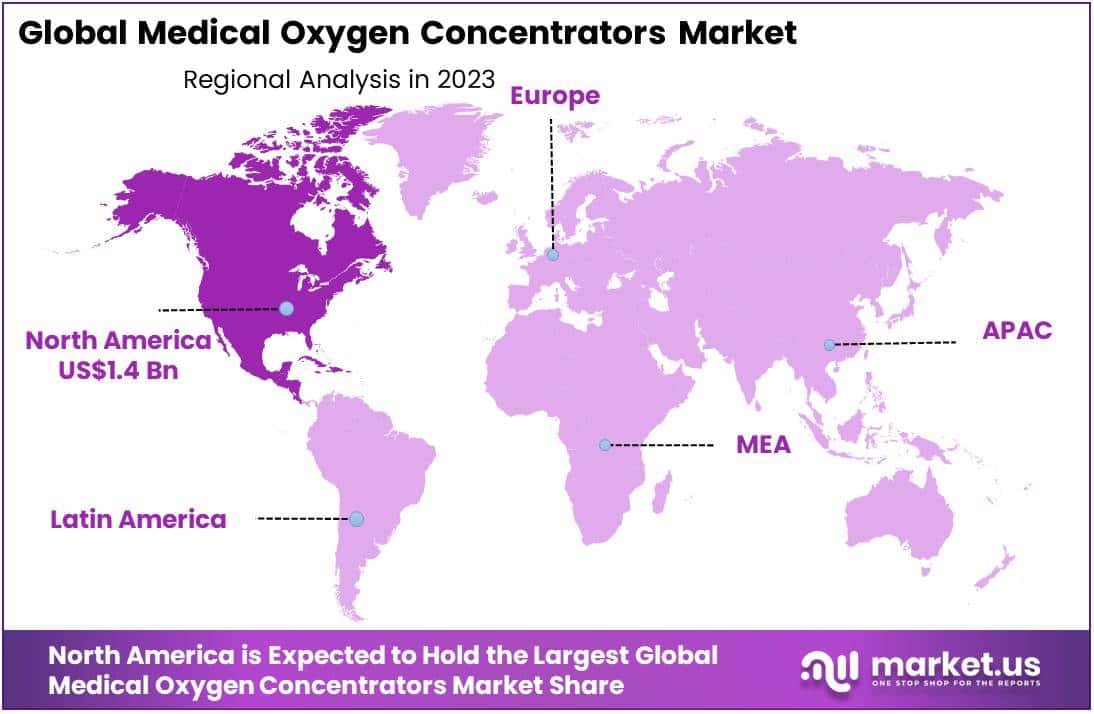

- Regional Analysis: North America led the market by securing a market share of 40.2% in 2023.

By Type Analysis

The portable segment led in 2023, claiming a market share of 55.6% owing to the rise in trend of using lightweight and compact devices for enhanced mobility of patients. Due to the improvement in technology, lighter and more efficient portable concentrators can be hand-carried or worn. This has opened up a market of active patients who need oxygen therapy but at the same time wish to continue with their daily activities. Moreover, portable oxygen concentrators are being required in scenarios of emergency response, and also in areas where medical care is restricted.

These factors are propelling the growth of this segment. On December 31, 2021, Inogen stated that about 80% of long-term oxygen treatment users in the United States used ambulatory oxygen, with the other 20% being classified as stationary.

By Technology Analysis

The continuous flow held a significant share of 61.2% due to the constant and reliable supply of oxygen it provides. This technology is most helpful in dealing with patients with severe respiratory disorders who need a steady supply of oxygen. Continuous flow concentrators are also preferred by healthcare professionals because of their simplicity and minimal maintainence requirment.

Also, the enhancement in the continuous flow technology has resulted in increased oxygen purity and efficiency, thus increasing its usage. This is anticipated to fuel the segment’s growth in the near future.

By Indication Analysis

The chronic obstructive pulmonary disease (COPD) segment had a tremendous growth rate, with a revenue share of 31.2% owing to the growing occurrence of this disease globally. Trials have shown that patients with COPD should use long-term oxygen therapy. This leads to a high demand for medical oxygen concentrators.

Moreover, factors such as the rise in geriatric population and surge in tobacco smoking habits are causing an upsurge in the number of patients suffering from COPD. This, in turn, fuels the need for medical oxygen concentrators.

By End-user Analysis

The homecare settings segment grew at a substantial rate, generating a revenue portion of 38.6% due to the growing popularity of homecare for elderly people owing to its feasibility. People suffering from various chronic respiratory diseases are increasingly preferring home care settings to get oxygen therapy, and hence, the need for lightweight and small medical oxygen concentrators is rising.

Market growth is also increasing due to the availability, accessibility, and affordability of home care settings.

Key Market Segments

By Type

- Portable

- Stationary

By Technology

- Pulse Dose

- Continuous Flow

By Indication

- Asthma

- Chronic Obstructive Pulmonary Disease

- COPD

- Sleep Apnea

- Others

By End-user

- Hospitals & Clinics

- Homecare Settings

- Others

Drivers

Increasing Incidence of Chronic Respiratory Ailments

With the growing number of patients with respiratory diseases, there is a constant demand for efficient oxygen delivery systems. Medical oxygen concentrators are portable and relatively less costly. They are used for long-term oxygen therapy, making them quite popular with patients and healthcare facilities. The high occurrence of respiratory ailments among elderly people is a key driver of the market.

Additionally, the growing awareness of the importance of oxygen therapy in managing chronic respiratory conditions contributes to the increasing adoption of medical oxygen concentrators.

- According to the data updated by the Institute for Health Metrics and Evaluation in April 2023, the chronic respiratory ailment is the third primary cause of death throughout the world, killing 1.3 million people. On a global scale, it is estimated that 1 out of 20 people suffer from chronic respiratory diseases.

Restraints

High Cost of Medical Oxygen Concentrators

The high costs lead to restricted access to medical oxygen concentrators in areas with poor health facilities and among low-income to mid-income patients. Also, the cost of replacement filters and other consumables cannot be ignored as they are considered additional costs. Furthermore, the regular need for maintenance and calibration can be a burden for some users. These factors are likely to impede the market during the forecast period.

Opportunities

Growing Demand for Portable and Compact Devices

Advances in technology have enabled the development of small and efficient concentrators that can be used on the go. This has opened up new possibilities for patients who require oxygen therapy but have active lifestyles. Emergency use of portable oxygen concentrators is also feasible for situations where access to a medical facility is strictly limited.

The market for medical oxygen concentrators is also fueled by the increase in home healthcare and telemedicine services. By offering compact and portable devices, manufacturers can tap into this growing market and expand their customer base.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors exert a significant influence on the medical oxygen concentrators market, shaping its growth trajectory and dynamics. Factors affecting the use of medical oxygen concentrators include rising healthcare expenditure, aging population, and home healthcare. Market forces such as trade wars and tariffs are also determining factors since they result in disruption of the supply chain and higher costs.

But in the same context, government strategies and involvement of healthcare facilities prove to be beneficial as they contribute to the growth of the market. Furthermore, the outbreak of the COVID-19 pandemic boosted the need for medical oxygen concentrators.

Latest Trends

The Trend of Homecare Therapy is on the Rise

The growing demand for homecare therapy is expected to propel the market during the forecast period. Chronic respiratory disease patients are beginning to prefer home-based oxygen therapy because of its flexibility, comfort, and affordability. Oxygen therapy at home is convenient for patients. They can be treated in their homes which cuts the cost of hospitalization.

This trend is driven by the increasing number of patients requiring long-term oxygen therapy, as well as the patient’s increasing demand for mobility. This trend of home care is expected to continue growing and create lucrative prospects for market growth.

- As per the data updated by the Centers for Disease Control and Prevention in November 2023, close to 3 million patients opted for homecare therapy in the US. A substantial portion of them required oxygen therapy.

Regional Analysis

North America is leading the medical oxygen concentrators market

North America dominated the market with the highest revenue share of 40.2% owing to the growing incidence of respiratory diseases including COPD, asthma, and sleep apnea. Other factors that are driving the market include development in respiratory technology such as portable and compact devices. Moreover, the government’s efforts to enhance patients’ awareness and develop healthcare facilities also contribute to market development. This along with the advanced medical infrastructure is anticipated to propel the market in this region in the years to come.

- In March 2023, a congressman of the US presented the SOAR (Supplemental Oxygen Access Reform) Act to change and improve access to additional oxygen for Medicare beneficiaries. Such policies have led to an increase in the adoption of oxygen concentrators in this region.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to the increased population, particularly in countries such as India and China. The advancements in technology and increasing adoption of portable oxygen concentrators are expected to fuel the market expansion in this region. Additionally, the rapid rise in the geriatric population in this region opens up lucrative avenues for market growth.

- In July 2022, the United Nations Economic and Social Commission for Asia-Pacific declared that 630 million individuals were 60 years of age or older, making up about 60% of the global senior population. By 2050, it is projected to increase to almost 1.3 billion in the region.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The major players in the medical oxygen concentrators market are actively engaged in the expansion and introduction of innovative products, as well as applying strategic initiatives aimed at enhancing their competitive positioning.

For instance, in April 2022, ARYA BioMed Corp released the ARYA Portable Oxygen Concentrators in the US. These portable concentrators from ARYA are incredibly lightweight and have a reliable battery-powered system with quick charging.

Top Key Players in Medical Oxygen Concentrators Market

- Respironics

- React Health

- O2 Concepts

- Nidek Medical Products, Inc.

- Inogen, Inc.

- DeVilbiss Healthcare

- Caire Medical

- Other Key Players

Recent Developments

- Philips Respironics (January 2024): Philips Respironics announced it would discontinue sales of its portable and stationary oxygen concentrators, including popular models like SimplyGo and SimplyGo Mini, effective January 25, 2024. The company plans to focus on consumables and accessories following this strategic shift.

- Caire Medical (January 2023): global pioneer of oxygen therapy, acquired MGC Diagnostics Holdings, a company located in St. Paul, Minnesota. This acquisition was intended to strengthen CAIRE’s commitment to diagnostic technologies, enhancing its adeptness in serving patients at all phases of pulmonary disease development.

- React Health (February 2023): global leader specializing in the manufacturing and distribution of medical devices that help with the treatment of sleep-disordered breathing and provide oxygen therapy, successfully acquired Invacare’s Respiratory line. This acquisition is aimed at enabling React Health to strengthen its market position and expand its product portfolio.

- Inogen, Inc. (August 2023): Inogen released a new portable oxygen concentrator, the Rove 6, into the U.S. market, focusing on advanced and innovative features to meet the needs of users requiring respiratory support at home.

Report Scope

Report Features Description Market Value (2023) USD 3.6 billion Forecast Revenue (2033) USD 6.5 billion CAGR (2024-2033) 6.1% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Portable and Stationary), By Technology (Pulse Dose and Continuous Flow), By Indication (Asthma, Chronic Obstructive Pulmonary Disease (COPD), Sleep Apnea, and Others), By End-user (Hospitals & Clinics, Homecare Settings, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Respironics, React Health, O2 Concepts, Nidek Medical Products, Inc., Inogen, Inc., DeVilbiss Healthcare, Caire Medical, and Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Medical Oxygen Concentrators MarketPublished date: Aug 2024add_shopping_cartBuy Now get_appDownload Sample

Medical Oxygen Concentrators MarketPublished date: Aug 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Respironics

- React Health

- O2 Concepts

- Nidek Medical Products, Inc.

- Inogen, Inc.

- DeVilbiss Healthcare

- Caire Medical

- Other Key Players