Global Meat Alternatives Market Size, Share, Statistics Analysis Report By Source (Soy-based, Wheat-based, Mycoprotein, Pea-based, Others), By Category (Refrigerated, Shelf Stable, Frozen), By Form (Solid, Liquid), By Product Type (Tofu-based, Tempeh-based, TVP-based, Seitan-based, Quorn-based, Others), By Distribution Channel (Food Service Channels, Supermarkets/Hypermarkets, Specialty Stores, Online Retail Channels, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: March 2025

- Report ID: 142025

- Number of Pages: 289

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

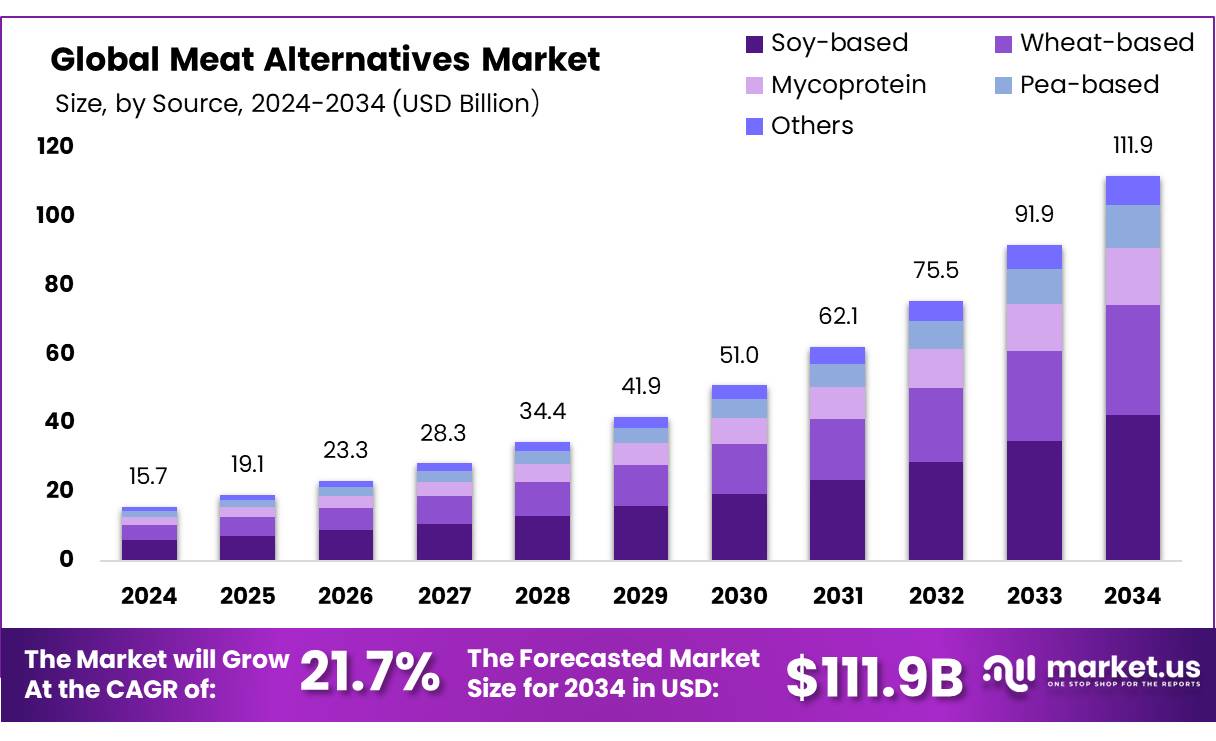

The Global Meat Alternatives Market size is expected to be worth around USD 111.9 Bn by 2034, from USD 15.7 Bn in 2024, growing at a CAGR of 21.7% during the forecast period from 2025 to 2034.

The meat alternatives industry, commonly known as plant-based meats, offers products designed to emulate the flavor, texture, and nutritional benefits of traditional animal meat, utilizing plant sources like soy, peas, and legumes. This sector is experiencing a surge in popularity, fueled by heightened consumer consciousness about health, environmental issues, and animal welfare.

There is considerable growth in this sector, driven by advancements in food technology and flavor enhancement. Leading corporations and emerging startups are pouring resources into research and development to refine the quality and diversity of plant-based offerings. Data from the Plant Based Foods Association and The Good Food Institute show a 29% increase in sales over two years, with the market now valued at $5 billion annually in the U.S.

Companies like Beyond Meat, Impossible Foods, and Quorn Foods are at the forefront, innovating to improve the sensory experience of plant-based meats. Major retailers such as Walmart and Tesco are also increasing their selections of plant-based products, underscoring the industry’s expansion.

Furthermore, government support globally is boosting this shift towards plant-based eating. The European Union, for example, is backing the ‘Smart Protein Project’ to create sustainable protein alternatives, while various U.S. states are adopting policies that encourage plant-based agricultural practices.

Key Takeaways

- Meat Alternatives Market size is expected to be worth around USD 111.9 Bn by 2034, from USD 15.7 Bn in 2024, growing at a CAGR of 21.7%.

- Soy-based meat alternatives held a dominant position in the market, capturing more than a 38.4% share.

- Meat alternatives held a dominant market position, capturing more than a 47.5% share.

- Solid meat alternatives held a dominant market position, capturing more than a 63.3% share.

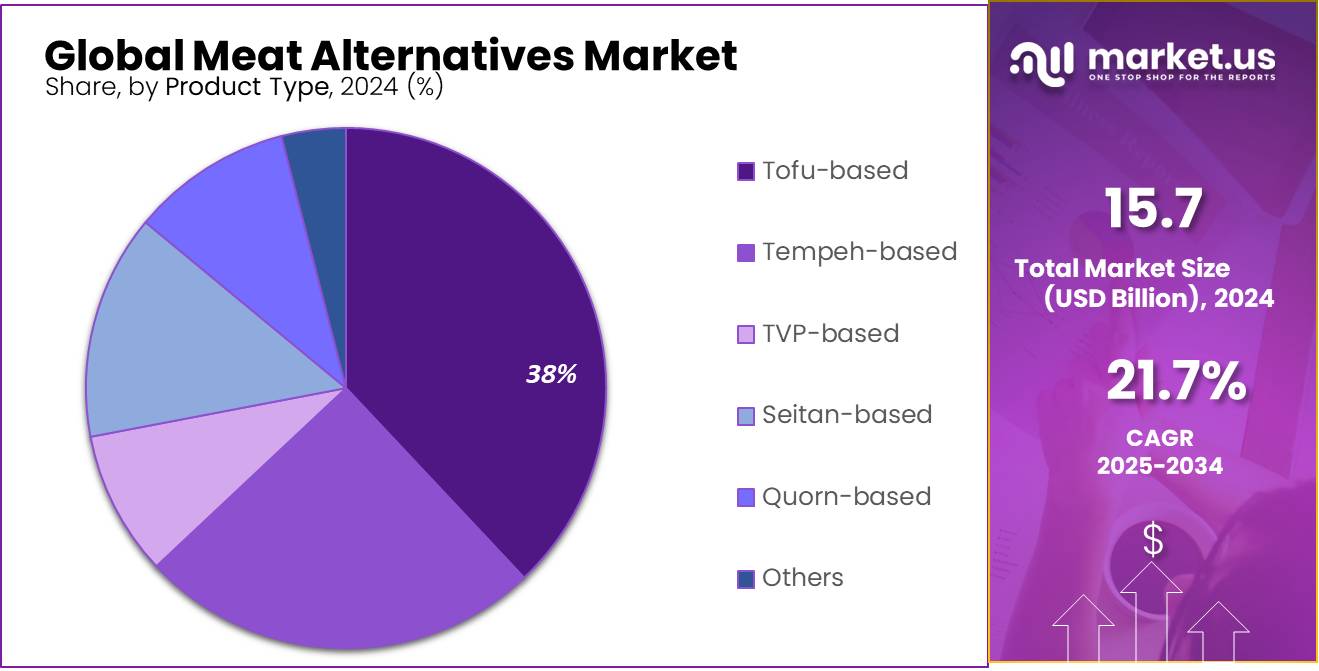

- Tofu-based meat alternatives held a dominant market position, capturing more than a 38.2% share.

- Supermarkets and hypermarkets held a dominant market position in the distribution of meat alternatives, capturing more than a 43.2% share.

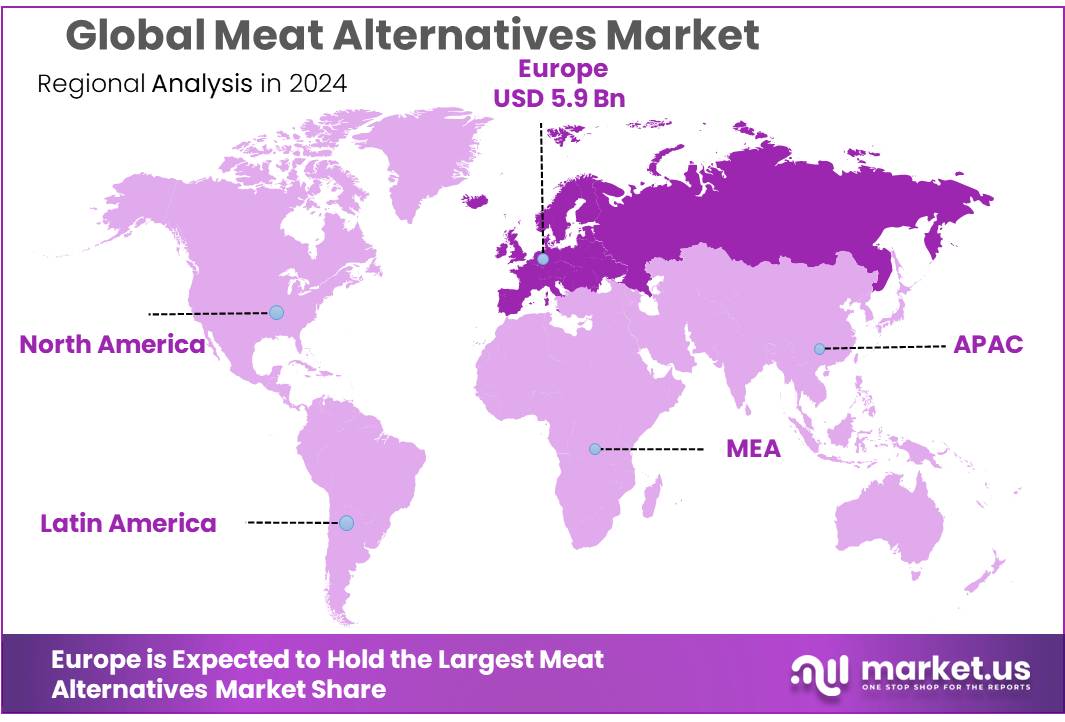

- Europe is a significant and rapidly growing segment of the global food industry. In 2025, the market is valued at approximately USD 5.9 billion and holds a dominant share of 38.2%

By Source

In 2024, Soy-based meat alternatives held a dominant position in the market, capturing more than a 38.4% share. This significant market presence can be attributed to soy’s established reputation as a versatile and highly nutritious plant-based protein source. Soy-based products have successfully penetrated various consumer segments due to their ability to effectively mimic the texture and flavor of meat, making them a preferred choice for both vegetarians and meat-eaters looking to reduce their meat consumption.

As consumer awareness regarding health and environmental benefits continues to rise, the demand for soy-based alternatives has shown robust growth. These products have been particularly popular in regions with a strong vegetarian culture as well as among millennials and Gen Z consumers who are increasingly adopting plant-based diets. The versatility of soy allows for a wide range of products, including tofu, tempeh, and soy-based sausages, burgers, and ground meat, which cater to diverse culinary preferences and dietary requirements.

By Category

In 2024, the refrigerated category of meat alternatives held a dominant market position, capturing more than a 47.5% share. This segment’s strength lies in its ability to offer fresh-tasting, high-quality products that appeal to consumers seeking alternatives closest to traditional meat in terms of flavor and texture. Refrigerated meat alternatives include a variety of products such as burgers, sausages, and ground meat substitutes that require cold storage to maintain their freshness and nutritional value.

The preference for refrigerated meat alternatives is particularly strong among consumers who prioritize the taste and culinary experience of meat-like products without the environmental and ethical concerns associated with animal farming. The refrigerated segment benefits from its positioning as a premium option within the broader plant-based food market, often associated with being more natural and less processed compared to frozen alternatives.

By Form

In 2024, solid meat alternatives held a dominant market position, capturing more than a 63.3% share. This form of meat alternative, which includes products such as burgers, sausages, nuggets, and steaks, has been favored for its convenience and familiar eating experience. These solid forms are especially popular in both retail and food service sectors due to their ease of preparation and ability to mimic traditional meat products in texture and flavor.

The success of solid meat alternatives can also be attributed to their wide availability and the growing variety of options that cater to different taste preferences and dietary needs. As consumers increasingly seek out plant-based foods that don’t compromise on taste or texture, manufacturers have responded by improving product formulations and expanding their offerings.

By Product Type

In 2024, tofu-based meat alternatives held a dominant market position, capturing more than a 38.2% share. This segment’s popularity stems from tofu’s longstanding reputation as a versatile and healthful protein source. Tofu-based products are particularly favored for their ability to absorb flavors, making them a preferred choice for consumers who enjoy experimenting with different cuisines and flavors. These products range from tofu burgers and sausages to tofu-based deli slices, catering to a variety of dietary preferences and meal options.

Tofu’s appeal also lies in its health benefits, including being a rich source of protein, low in calories, and containing beneficial phytonutrients. It is a staple in vegetarian and vegan diets but is also gaining traction among a broader audience looking to reduce meat consumption due to health, ethical, or environmental reasons.

By Distribution Channel

In 2024, supermarkets and hypermarkets held a dominant market position in the distribution of meat alternatives, capturing more than a 43.2% share. This channel’s success can be attributed to its extensive reach and the convenience it offers to consumers. Supermarkets and hypermarkets have been pivotal in making meat alternatives accessible to a broad audience by providing a wide variety of options under one roof, ranging from tofu-based products to innovative plant-based blends that mimic traditional meat textures and flavors.

These outlets have effectively catered to the growing consumer demand for plant-based products by allocating more shelf space to meat alternatives and positioning them alongside traditional meat products. This strategy not only appeals to dedicated vegetarians and vegans but also to flexitarians looking to reduce their meat consumption without drastically altering their shopping habits.

Key Market Segments

By Source

- Soy-based

- Wheat-based

- Mycoprotein

- Pea-based

- Others

By Category

- Refrigerated

- Shelf Stable

- Frozen

By Form

- Solid

- Liquid

By Product Type

- Tofu-based

- Tempeh-based

- TVP-based

- Seitan-based

- Quorn-based

- Others

By Distribution Channel

- Food Service Channels

- Supermarkets/Hypermarkets

- Specialty Stores

- Online Retail Channels

- Others

Drivers

Rising Health Awareness and Dietary Shifts

One of the primary driving factors for the growth of the meat alternatives market is the increasing consumer awareness regarding health and dietary habits. According to the World Health Organization (WHO), reducing meat consumption can decrease the risk of chronic diseases such as heart disease, stroke, and certain cancers. This health-driven shift is prompting more consumers to turn to meat alternatives as a way to maintain a balanced diet while reducing meat intake.

For instance, a study by the American Dietetic Association suggests that plant-based diets, which often include meat alternatives like tofu and tempeh, are associated with lower levels of cholesterol and blood pressure, contributing to better overall heart health. These findings have been echoed in various health advisories and are increasingly being promoted by health practitioners and dieticians.

Additionally, government initiatives are playing a significant role in encouraging this shift. For example, the United States Department of Agriculture (USDA) has updated its dietary guidelines to recommend increasing the consumption of plant-based foods. The USDA promotes these foods as essential components of dietary patterns that can prevent chronic diseases and support healthful eating.

This shift is also supported by environmental considerations. The Food and Agriculture Organization of the United Nations (FAO) reports that livestock farming is one of the major contributors to environmental issues like deforestation and greenhouse gas emissions. By choosing meat alternatives, consumers are also making choices that are better for the environment, aligning personal health benefits with broader ecological impacts.

The synergy between governmental health recommendations, recognized health benefits, and environmental sustainability is compelling consumers to adopt meat alternatives at an increasing rate, significantly driving market growth in this sector.

Restraints

Consumer Preferences and Taste Perceptions

One significant restraining factor in the meat alternatives market is consumer preference and the perception of taste. Despite advancements in food technology, many consumers remain skeptical about the taste and texture of meat alternatives compared to traditional meat products. According to a survey by the International Food Information Council (IFIC), approximately 38% of consumers are hesitant to buy meat alternatives because they believe these products do not adequately replicate the taste and satisfaction of animal meat.

This challenge is particularly pronounced in markets where meat consumption is a cultural norm and where dietary habits are deeply ingrained. For example, in regions such as the United States and many parts of Europe, meat is a central part of traditional cuisine, making the shift to meat alternatives more difficult. The IFIC also notes that taste is one of the top three factors that influence food purchases, alongside price and healthfulness, which underscores the importance of sensory attributes in consumer decision-making.

Furthermore, government initiatives that could potentially promote the adoption of meat alternatives are often limited by strong lobbying from the meat industry, which perceives plant-based products as a threat to their market share. This has slowed the implementation of policies that could support the broader acceptance and integration of meat alternatives in national diets.

To address these issues, companies in the meat alternatives sector are investing heavily in research and development to improve the flavor profiles and textural properties of their products. However, overcoming deep-seated consumer preferences and expanding market reach remains a significant challenge that could restrain market growth in the near term.

Opportunity

Expanding Market in Emerging Economies

A significant growth opportunity for the meat alternatives sector lies in expanding its reach into emerging economies. According to the Food and Agriculture Organization of the United Nations (FAO), the rising middle class in countries like India, China, and Brazil is showing a growing interest in healthier and sustainable food choices. This demographic shift presents a prime opportunity for meat alternative producers to introduce their products to new consumer bases that are increasingly health-conscious and environmentally aware.

The FAO report indicates that urbanization is a key driver behind this shift, as urban consumers have more access to global food trends and are more receptive to new dietary concepts, including plant-based diets. In China, for instance, government initiatives aimed at reducing meat consumption by 50% to mitigate environmental damage and improve public health are beginning to influence consumer behaviors. Similarly, in Brazil, where meat has traditionally dominated diets, there is a growing trend towards plant-based eating driven by health concerns and ethical considerations regarding animal welfare.

The potential for growth in these markets is further supported by the increasing incidence of lifestyle diseases such as diabetes and heart disease, which are linked to high meat consumption. As public health campaigns and local governments continue to promote dietary changes as a means to combat these health issues, the demand for meat alternatives is expected to rise.

For companies in the meat alternatives industry, the challenge lies in adapting products to meet local tastes and preferences while maintaining affordability. Investments in local production facilities, partnerships with local distributors, and targeted marketing strategies that highlight the health and environmental benefits of meat alternatives can help tap into these emerging markets effectively.

Trends

The Rise of Whole Food Plant-Based Alternatives

A notable trend in the meat alternatives market is the increasing consumer preference for whole food plant-based alternatives. This trend is driven by a growing skepticism among consumers towards highly processed foods, which has led to a demand for simpler, more natural ingredient lists. According to a report by the Plant Based Foods Association (PBFA), there is a significant shift towards products that use whole ingredients like beans, seeds, whole grains, and vegetables, which are perceived as cleaner and healthier options compared to processed meat alternatives.

This shift is particularly evident in the success of products that are marketed as being free from artificial additives and GMOs. The PBFA notes that sales of these whole food-based meat alternatives have seen a rise of over 20% in the past year alone, indicating a robust growth trajectory. This trend is further bolstered by a series of new product launches that cater to this demand, offering not only burgers and sausages but also whole-cut alternatives like steaks and fillets made from whole plant ingredients.

Government health initiatives across various countries are supporting this trend by promoting the health benefits of whole food plant-based diets. For example, dietary guidelines issued by the United States Department of Agriculture (USDA) increasingly emphasize the importance of including more plant-based foods, which aligns with the rising consumer interest in less processed alternatives.

To capitalize on this trend, companies in the meat alternatives sector are investing in innovation and research to develop products that can meet this demand for authenticity and transparency in ingredients. The focus is on creating products that deliver on taste and texture without relying heavily on artificial components, thereby aligning with the consumer push towards healthier, more sustainable eating habits.

Regional Analysis

The meat alternatives market in Europe is a significant and rapidly growing segment of the global food industry. In 2025, the market is valued at approximately USD 5.9 billion and holds a dominant share of 38.2% of the global meat alternatives market. This growth is driven by increasing consumer demand for plant-based, lab-grown, and other meat substitutes due to rising health consciousness, environmental concerns, and a shift towards more sustainable eating practices.

Europe’s robust market for meat alternatives is also influenced by increasing consumer awareness regarding the environmental impact of traditional meat production, including its carbon footprint and water usage. A key driver for this market in Europe is the growing trend of veganism and vegetarianism, particularly in countries like the UK, Germany, and the Netherlands. These countries not only have a high number of people adopting plant-based diets but are also seeing a strong presence of leading meat alternative brands like Beyond Meat and Oatly.

Additionally, Europe’s regulatory environment supports the growth of plant-based food products. The European Union has made significant strides in promoting plant-based foods as part of its Green Deal and Farm to Fork strategy, which aims to reduce the environmental impact of food production. This, in turn, has spurred innovation and investment in the meat alternatives sector.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Amy’s Kitchen is renowned for its organic, non-GMO, and vegetarian-friendly offerings. Established in 1987, the company has grown significantly, offering a variety of meat-free alternatives, including burgers and sausages, that cater to health-conscious consumers. Amy’s Kitchen focuses on sustainable practices and providing family-friendly vegetarian meals, which positions it strongly within the growing meat alternatives sector.

Archer Daniels Midland Company (ADM) is a global leader in food processing and ingredients. With a vast portfolio that includes soy proteins and meat substitutes, ADM supports the meat alternatives market through its innovative approach to new textures and flavors. This company’s extensive reach in the supply chain enhances its ability to influence and adapt to the evolving demands of plant-based food consumers.

Beyond Meat, Inc. is a trailblazer in the meat alternatives industry, known for its revolutionary plant-based burgers, sausages, and ground meat products. Founded in 2009, Beyond Meat has rapidly expanded its distribution worldwide, appealing to both vegetarians and meat-eaters looking to reduce meat consumption. The company’s commitment to improving the sustainability of food systems continues to attract significant consumer and investor interest.

Impossible Foods Inc. is renowned for its scientific approach to food innovation, particularly its use of heme to replicate the taste and texture of meat. Launched in 2011, the company’s flagship product, the Impossible Burger, has seen widespread adoption in restaurants and supermarkets globally. Their aggressive research and development efforts continue to push the boundaries of what’s possible in plant-based food technology.

Top Key Players

- Amy’s Kitchen

- Archer Daniels Midland Company

- Beyond Meat, Inc.

- CAULDRON FOODS

- GARDEN PROTEIN INTERNATIONAL, INC

- IMPOSSIBLE FOODS INC.

- Kellogg Company

- Maple Leaf Foods

- MEATLESS B.V.

- MGP Ingredients, Inc.

- MorningStar Farms

- Pinnacle Foods

- SONIC BIOCHEM EXTRACTIONS LTD.

- Tofurky Field Roast

- VBites

Recent Developments

ADM is primarily engaged in the agriculture and food processing industries, focusing on products and services related to food ingredients, animal feed, and renewable fuels like bioethanol.

Beyond Meat aims to address the growing consumer demand for sustainable and healthier food options through innovative products like burgers, sausages, and ground meat made from plant ingredients.

Report Scope

Report Features Description Market Value (2024) USD 15.7 Bn Forecast Revenue (2034) USD 111.9 Bn CAGR (2025-2034) 21.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Soy-based, Wheat-based, Mycoprotein, Pea-based, Others), By Category (Refrigerated, Shelf Stable, Frozen), By Form (Solid, Liquid), By Product Type (Tofu-based, Tempeh-based, TVP-based, Seitan-based, Quorn-based, Others), By Distribution Channel (Food Service Channels, Supermarkets/Hypermarkets, Specialty Stores, Online Retail Channels, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Amy’s Kitchen, Archer Daniels Midland Company, Beyond Meat, Inc., CAULDRON FOODS, GARDEN PROTEIN INTERNATIONAL, INC, IMPOSSIBLE FOODS INC., Kellogg Company, Maple Leaf Foods, MEATLESS B.V., MGP Ingredients, Inc., MorningStar Farms, Pinnacle Foods, SONIC BIOCHEM EXTRACTIONS LTD., Tofurky Field Roast, VBites Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Amy's Kitchen

- Archer Daniels Midland Company

- Beyond Meat, Inc.

- CAULDRON FOODS

- GARDEN PROTEIN INTERNATIONAL, INC

- IMPOSSIBLE FOODS INC.

- Kellogg Company

- Maple Leaf Foods

- MEATLESS B.V.

- MGP Ingredients, Inc.

- MorningStar Farms

- Pinnacle Foods

- SONIC BIOCHEM EXTRACTIONS LTD.

- Tofurky Field Roast

- VBites